How Many Uninsured Are in the Coverage Gap and How Many Could be Eligible if All States Adopted the Medicaid Expansion?

Ten years after the implementation of the Affordable Care Act’s (ACA) coverage options, ten states have not adopted the Medicaid expansion, leaving 1.5 million uninsured people without an affordable coverage option. The unwinding of the Medicaid continuous enrollment provision along with ongoing financial struggles among rural hospitals has focused attention on the gaps in Medicaid coverage in non-expansion states, and availability of temporary enhanced federal funding for states that newly adopt expansion has sparked renewed expansion discussions in some of these states.

Two states (South Dakota and North Carolina) implemented Medicaid expansion in 2023, reducing the number of low-income uninsured people nationally without access to Medicaid. Expansion in those two states brings the count to 40 states and the District of Columbia that have adopted expansion, leaving ten states that have not adopted it. Using data from 2022, the most recent year available, this brief presents estimates of the number and characteristics of uninsured people in the ten non-expansion states who could be reached by Medicaid if their states adopted the Medicaid expansion. An overview of the methodology underlying the analysis can be found in the Data and Methods, and more detail is available in the Technical Appendices.

What is the coverage gap?

The coverage gap exists in states that have not adopted the ACA Medicaid expansion for adults who are not eligible for Medicaid coverage or subsidies in the Marketplace. The ACA expanded Medicaid to nonelderly adults with income up to 138% FPL ($20,782 annually for an individual in 2024) with enhanced federal matching funds (now at 90%). The Medicaid expansion established a uniform eligibility threshold across states for low-income parents and newly established Medicaid coverage for adults without dependent children. However, the expansion is effectively optional for states because of a 2012 Supreme Court ruling. As of February 2024, 40 states and DC have expanded Medicaid (Figure 1).

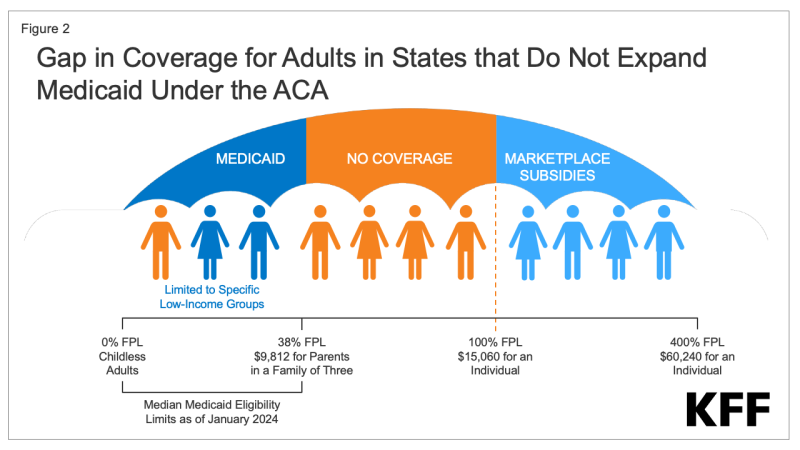

In the remaining ten states that have not adopted the Medicaid expansion, an estimated 1.5 million individuals fall into the coverage gap. Adults who fall into the coverage gap have incomes above their state’s eligibility for Medicaid but below poverty, making them ineligible for subsidies in the ACA Marketplaces (Figure 2). When enacted, the ACA did not anticipate that states would be permitted to forgo Medicaid expansion; as such, subsidies in the Marketplaces are not available for people with incomes below poverty.

Medicaid eligibility for adults in states that have not expanded their programs is very low. In these states, the median income limit for parents is just 38% FPL, or an annual income of $9,812 for a family of three in 2024, and in nearly all states not expanding (except Wisconsin through a waiver), childless adults remain ineligible regardless of their income (Figure 3). In Texas, the state with the lowest eligibility threshold, parents in a family of three with incomes above $4,131 annually, or just $344 per month, are not eligible for Medicaid. Because there is no pathway for coverage for childless adults, except in Wisconsin, more than three-quarters (79%) of people in the coverage gap fall into this group.

States that have not implemented the expansion have uninsured rates that are nearly double the rate of expansion states (14.1% compared to 7.5%). People without insurance coverage have worse access to care than people who are insured. One in five uninsured adults in 2022 went without needed medical care due to cost and uninsured people are less likely than those with insurance to receive preventive care and services for major health conditions and chronic diseases.

What are the characteristics of people in the coverage gap?

Nearly three-quarters of adults in the coverage gap are concentrated in three states in the South. Four in ten people in the coverage gap reside in Texas, which has very limited Medicaid eligibility, and consequently, a large uninsured population (Figure 4). An additional 19% of people in the coverage gap live in Florida and 12% live in Georgia. In total, 97% of those in the coverage gap live in the South. Seven of the 16 states in the South have not adopted the Medicaid expansion, and the region has more low-income, uninsured adults and higher uninsured rates compared to other regions.

People in the coverage gap are disproportionately people of color. Nationally, over six in ten (62%) people in the coverage gap are people of color, a share that is higher than for non-elderly adults generally in non-expansion states (53%) and for non-elderly adults nationwide (46%) (Figure 5). These differences in part explain persisting disparities in health insurance coverage by race/ethnicity.

Despite having low income, nearly six in ten people in the coverage gap are in a family with a worker, and over four in ten are working themselves (Figure 6). Adults who work may still have incomes below poverty because they work low-wage jobs. People with incomes below poverty often do not have access to employer based health insurance or if available, it is often unaffordable. The most common jobs among adults in the coverage gap are cashier, cook, waiter/waitress, construction laborer, maid/housecleaner, retail salesperson, and janitor. For parents in non-expansion states, even part-time work may make them ineligible for Medicaid.

Some people in the coverage gap have significant current health care needs. KFF analysis of the 2022 American Community Survey shows that more than one in six (17%) people in the coverage gap have a functional disability, meaning they have serious difficulty with hearing, vision, cognitive functioning, mobility, self-care, or independent living. Even with functional disabilities, many are not able to qualify for Medicaid through a disability pathway leaving them uninsured. Older adults, age 55-64, an age of increasing health needs, make up 18% of people in the coverage gap. Research has demonstrated that uninsured people in this age range may leave health needs untreated until they become eligible for Medicare at age 65.

How many uninsured could gain coverage if all states adopted the expansion?

If all states adopted the Medicaid expansion, approximately 2.9 million uninsured adults would become newly eligible for Medicaid. This number includes the 1.5 million adults in the coverage gap and an additional 1.4 million uninsured adults with incomes between 100% and 138% FPL, most of whom are currently eligible for Marketplace coverage but not enrolled (Figure 7 and Table 1). Most of the adults who are currently eligible for coverage in the Marketplace qualify for plans with zero premiums; however, even with no premiums, Medicaid could provide more comprehensive benefits and lower cost-sharing compared to Marketplace coverage. The potential number of people who could be reached by Medicaid expansion varies by state.

What is the outlook ahead?

A substantial body of research continues to point to largely positive effects from the Medicaid expansion. KFF reports published in 2020 and 2021 reviewed more than 600 studies and concluded that expansion is linked to gains in coverage, improvement in access and health, and economic benefits for states and providers. More recent studies generally find positive effects related to more specific outcomes such as improved access to care, treatment and outcomes for cancer, chronic conditions, sexual and reproductive health and behavioral health. Studies also point to evidence of reduced racial disparities in coverage and access, reduced mortality and improvements in economic impacts for providers (particularly rural hospitals) and economic stability for individuals.

The American Rescue Plan Act (ARPA) included a temporary fiscal incentive for states that newly implement Medicaid expansion. Under ARPA, states that newly adopt expansion are eligible for an additional five percentage point increase in the state’s traditional match rate (FMAP) for two years. This incentive does not apply to the expansion population; states are required to cover 10% of the cost of Medicaid expansion, with the federal government covering 90%.The traditional FMAP applies to most spending for all non-expansion groups (children, parents and people eligible based on age 65 plus or disability); Medicaid spending for non-expansion groups is much larger than spending for the expansion group. KFF analysis shows that all non-expansion states could see a net fiscal benefit over a two-year period if they adopted the expansion. For the two states that recently adopted the expansion, South Dakota and North Carolina, the estimated fiscal benefit is $60 million and $1.2 billion, respectively.

Renewed debates over Medicaid expansion could lead to additional states adopting the expansion. Legislative opposition to expansion may be softening in some states, driven by financial challenges facing rural hospitals as well as interest in taking advantage of the additional federal funding. If additional states were to expand Medicaid, it could help limit increases in the number of people who become uninsured because of the unwinding of the Medicaid continuous enrollment provision. In South Dakota and North Carolina, Medicaid enrollment dropped initially after the start of the unwinding, but began increasing again following implementation of Medicaid expansion in each state.