Abortion Coverage in Marketplace Plans, 2015

In the negotiations leading to the passage of the Affordable Care Act (ACA), abortion coverage was one of the thorniest and most controversial of many controversial issues. Along with immigrant coverage, it was one of the final issues negotiated before the House vote. Initially, the House passed the Stupak-Pitts Amendment, which would have prohibited any plans in the Marketplaces from receiving federal subsidies if they covered abortion. The final law, however, included a compromise proposed by former Senator Ben Nelson of Nebraska which allows states to ban abortion coverage on their ACA Health Insurance Marketplace and requires plans that offer abortion coverage to segregate funds, assuring that no federal funds are used for abortion coverage. After the ACA was passed, President Obama also signed an executive order to emphasize that no federal funds can be used to pay for abortion beyond the Hyde limitations.

State Policies On Abortion Coverage in Marketplace Plans

In the years following the passage of the ACA, states and insurers have made different choices about abortion coverage and, as a result, the availability of abortion coverage varies considerably. In states that have not banned abortion coverage, plans sold on the Marketplace electing to include abortion coverage must segregate funds consumers pay for abortion coverage from those paid for all other care. By 2017, at least one Multi-State plan that excludes abortion coverage must be available in each Marketplace, so that consumers have an option to enroll in a plan that does not cover abortion.

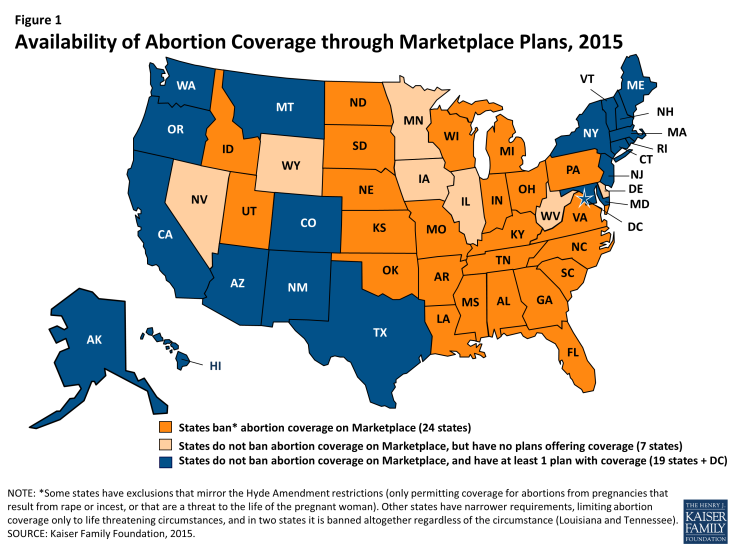

As of January 2015, 24 states1 have enacted laws banning qualified health plans available through the Marketplace from including abortion coverage to varying degrees. Some states have exclusions that mirror the Hyde Amendment restrictions (only permitting coverage for abortions from pregnancies that result from rape or incest, or that are a threat to the life of the pregnant woman). Others have even narrower requirements, limiting abortion coverage only to life threatening circumstances and prohibiting coverage in cases of rape or incest, and in some state it is banned altogether regardless of the circumstance (Louisiana and Tennessee).

Both sides of the abortion debate are unsatisfied with these rules and are carefully watching the law’s implementation. While it is clear that there is no abortion coverage available to women eligible for subsidies in the states that have barred it in the Marketplace, there has been a lot of attention about how difficult it is for consumers in the remaining states to determine whether plans include abortion coverage or not. This lack of transparency was the impetus for a U.S. General Accounting Office review of the availability of abortion coverage in 2014 Marketplace plans.

The report found that among the states without Marketplace abortion coverage bans, in five states (Connecticut, Hawaii, New Jersey, Rhode Island, and Vermont) there were no Multi-State plans offered, and all of the Marketplace plans in those states included abortion coverage. This meant that consumers in those states who wanted to secure a plan without abortion coverage did not have that option. While it is stipulated in the law that at least one Multi-State plan in each Marketplace is required to exclude abortion coverage, there is a transitional period to implement this policy (ending in 2017). In 2015, the Connecticut Marketplace now offers a Multi-State plan that excludes abortion coverage.

The GAO also identified eight states (Delaware, Illinois, Iowa, Minnesota, Nevada, New Hampshire, West Virginia, and Wyoming) that did not have laws barring abortion coverage, yet no Marketplace plans in these states included abortion coverage in 2014. In reviewing the 2015 plans, KFF found that 7 of these 8 states still do not have any Marketplace plans which include abortion coverage (Figure 1). Abortion coverage is available in New Hampshire in 2015, presumably because the number of Marketplace issuers increased from one to five from 2014 to 2015.

As a combined result of the state laws and insurance company choices, women in 31 states do not have access to insurance coverage of abortions through a Marketplace plan – the only place where consumers can receive tax subsidies to help pay for the cost of health insurance premiums

Impact of State Policies and Insurance Carrier Choices on Women’s Access to Coverage

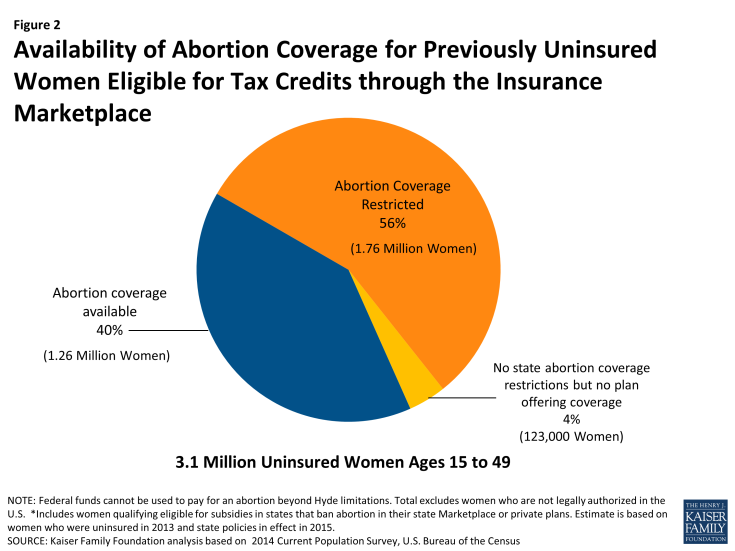

Among the estimated 3.1 million uninsured women of reproductive age who are income eligible for tax credits, 40% (1.26 million) have the option to enroll in a Marketplace plan that offers abortion coverage. Six in ten women (60%), however, do not have the option to obtain abortion coverage through their Marketplace – 56% (1.76 million) live in states that have banned abortion coverage available through Marketplace health plans and 4% (123,000) live in a state without a ban but that does not offer any plans that cover abortion (Figure 2). For women who seek abortions, the absence of this coverage can result in sizable out-of-pocket costs. A clinic-based abortion at 10 weeks’ gestation is estimated to cost between $400 and $550, whereas an abortion at 20-21 weeks’ gestation is estimated to cost $1,100-$1,650 or more.2

Figure 2: Availability of Abortion Coverage for Previously Uninsured Women Eligible for Tax Credits through the Insurance Marketplace

While the reasons why plans in these states have opted to exclude abortion coverage are not known, it is possible that the complexity of the requirements specific only to abortion coverage could be a deterrent to the plans. This was raised as a possible outcome during the pre-ACA abortion coverage debate. The Nelson Amendment included in the final law, requires plans to segregate funds used for abortion coverage, effectively collecting an additional fee for this coverage, and adding a layer of administrative work. Plans that choose to include abortion coverage are also subject to additional reporting standards and audit requirements. This might be the case in West Virginia, where the same insurance carrier that does not offer abortion coverage for individual policies is, however, including abortion coverage in the group policies sold to small firms through the small group marketplace plans, where the accounting rules and reporting requirements do not apply.

As the debate on abortion continues, both sides remain dissatisfied with how the law is being implemented with regard to abortion coverage. Given the polarized nature of the abortion debate in this country, the issue of access to abortion coverage will continue to be a focus of policy at both the state and national level, and increasingly shaped by choices made not just by states and federal policy makers but also by health insurers.