The Affordable Care Act and Insurance Coverage in Rural Areas

Introduction

Almost 50 million people, or about 16 percent of the population of the United States, live in rural areas. These rural areas are defined as those outside of Metropolitan Statistical Areas (MSAs). MSAs are urban areas with more than 50,000 residents and surrounding suburbs. The populations of rural areas have different demographics, health needs and insurance coverage profiles than their urban counterparts, which means that Medicaid and Marketplace coverage reforms in the Affordable Care Act (ACA) may affect the two populations differently. In particular, rural populations tend to have high shares of low-to-moderate-income individuals, those who are in the target population for ACA coverage reforms. However, nearly two-thirds of uninsured people in rural areas live in a state that is not currently implementing the Medicaid expansion, meaning they are disproportionally affected by state decisions about ACA implementation. As a result, uninsured rural individuals may have fewer affordable coverage options moving forward. This brief examines these differences in populations and coverage patterns and assesses how ACA coverage reforms will affect rural and metropolitan areas in different ways.

The Challenge of Extending Health Insurance Coverage in Rural Areas

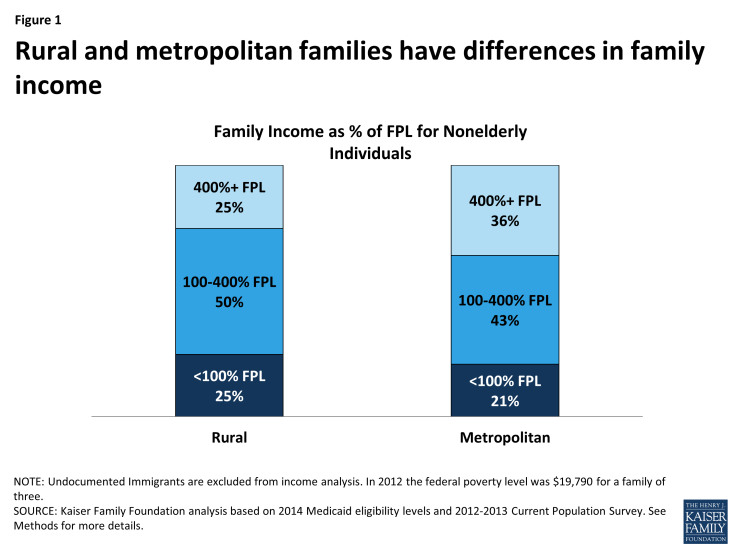

Compared to populations in metropolitan areas, the rural population has lower income (Figure 1). One-quarter of the nonelderly rural population has family income below the federal poverty level (FPL, about $19,790 for a family of 3 in 2014) compared to about one-fifth of the nonelderly population in metropolitan areas. Conversely, a greater share of the nonelderly population in metropolitan areas is in families with incomes over 400% FPL than rural families. Lower incomes make it difficult for people to afford coverage on their own, since health insurance coverage is expensive.

In addition, individuals in rural areas are less likely than their urban counterparts to have access to coverage through a job. The nonelderly population in rural areas is more likely than metropolitan counterparts to live in family without either a full-or part-time worker (17% versus 14%). Further, among workers, those in rural areas are more likely to work in blue collar jobs (jobs outside of managerial, business, and financial occupations) than workers in metropolitan areas (71% versus 63%). Blue-collar workers tend to earn less and have fewer overall benefits than white-collar workers.1Half of all rural workers work in “Low ESI industries,” or industries in which less than 80% of workers are covered by employer-sponsored insurance coverage.

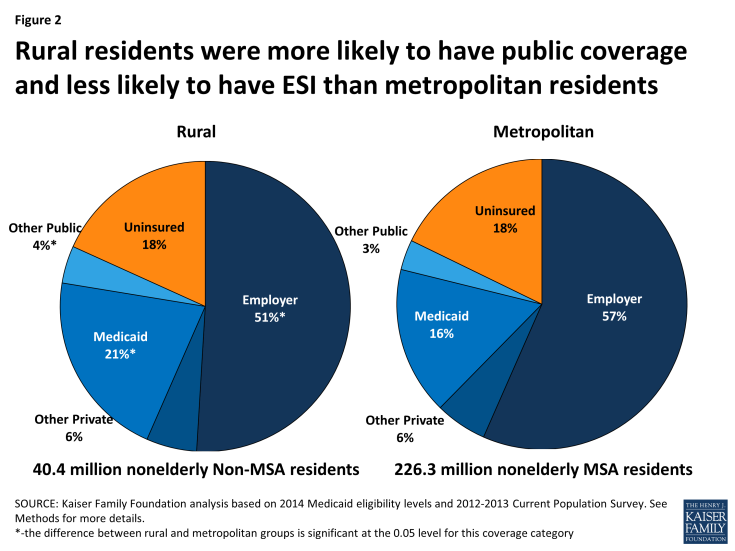

These differences in income and access to coverage through a job are reflected in different coverage patterns in rural and urban areas. Only slightly more than half (51%) of the rural population was enrolled in employer-sponsored coverage between 2012 and 2013 a significantly lower proportion than the 57% of the metropolitan population with employer coverage. However, before ACA implementation, the rural population was significantly more likely to be covered by Medicaid (21%) or other public insurance (4%) than the metropolitan population (16 and 3 percent, respectively). Because Medicaid made up some of the gap in employer-sponsored coverage in rural areas, the uninsured rate was similar across rural and metropolitan populations prior to the ACA (Figure 2).

Figure 2: Rural residents were more likely to have public coverage and less likely to have ESI than metropolitan residents

Like the uninsured population nationally, uninsured individuals in rural areas are likely to live in low-income working families, are primarily adults (who were historically ineligible for public coverage), and are generally unable to afford coverage on their own. Compared to their urban counterparts, however, rural uninsured may face particular challenges in accessing health care services when needed due to more limited supply of providers who can provide low-cost or charity care. Thus, there is a particular need to extend coverage in rural areas.

The Impact of ACA Coverage Expansions in Rural Areas

The ACA offers the opportunity to expand health coverage among the rural population through the expansion of Medicaid for people with incomes at or below 138% of poverty and the availability of premium tax credits for the purchase of private insurance through the Health Insurance Marketplaces for moderate income families (those with incomes between 100% and 400% of poverty). Among the rural uninsured population, about three in four are in the income range (and meet the immigration requirements) for these coverage provisions.

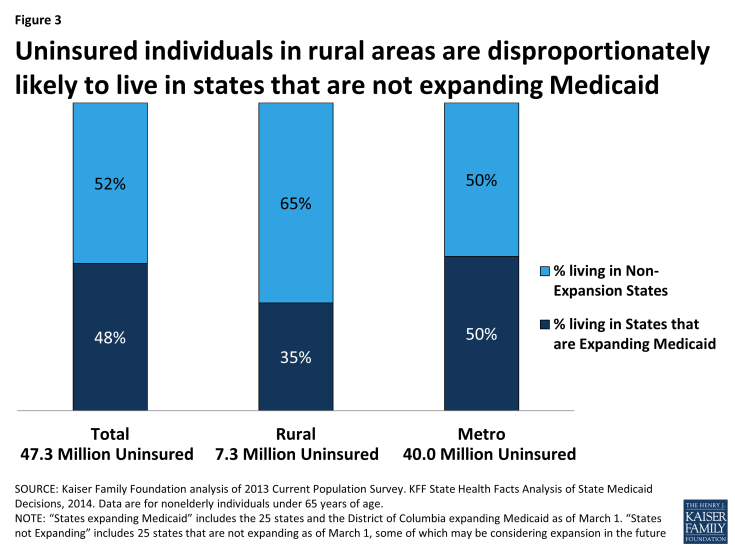

However, with the Supreme Court ruling in June 2012, the Medicaid expansion became essentially optional for states, and as of May 2014, 24 states were not implementing the Medicaid expansion. In states that do not expand Medicaid, some individuals with incomes between 100% FPL and 138% FPL will be eligible for premium tax credits in the Marketplace. However, many uninsured individuals under poverty will be left in a “coverage gap” in which their incomes are above Medicaid eligibility levels but below eligibility levels for tax credits.2 As a result, many will be left without an affordable insurance option. State decisions about expanding Medicaid have a disproportionate effect on coverage options for uninsured individuals in rural areas. Almost two-thirds of the rural uninsured population lives in states that are not expanding Medicaid at this time (Figure 3).

Figure 3: Uninsured individuals in rural areas are disproportionately likely to live in states that are not expanding Medicaid

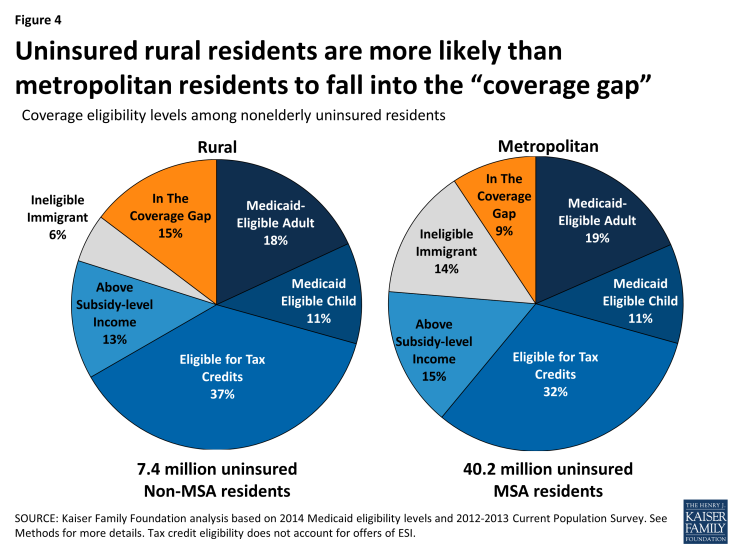

As a result of state decisions, rural individuals are much more likely than their urban counterparts to fall into the “coverage gap.” Among uninsured rural individuals, about 15% – over a million people – are estimated to fall into the coverage gap compared to 9% of the uninsured in metropolitan areas (Figure 4). About equal shares of rural and urban (30%) uninsured individuals may be eligible for Medicaid or CHIP, but a greater share (37%) of uninsured rural individuals than metropolitan uninsured (32%) are within the income range to be eligible for premium tax credits in the marketplaces than are metropolitan individuals.3 Immigration status for the uninsured is less a factor barring coverage in rural areas compared to metropolitan areas, with only 6% vs 14% ineligible due to immigration status. Adequate outreach and consumer assistance are key to reaching individuals who are eligible for coverage under the ACA, particularly in rural areas where resources to help with enrollment may require traveling long distances.

Figure 4: Uninsured rural residents are more likely than metropolitan residents to fall into the “coverage gap”

Conclusion

The rural population is poorer and less likely to be covered by employer-based insurance than the metropolitan population. Prior to the ACA, rural individuals were more likely to receive coverage through public insurance than metropolitan individuals. Many uninsured people in rural areas will be eligible for Medicaid coverage or tax credits to purchase coverage under the ACA. While the uninsured population in rural areas is less likely than their metropolitan counterparts to be ineligible for coverage due to their immigration status or incomes, they are more likely to fall into the “coverage gap” due to state decisions not to expand Medicaid coverage. People in rural areas may face particularly high barriers to accessing coverage, such as transportation barriers or limited provider availability and may also continue to face financial barriers to accessing needed care.

This Issue Brief was prepared by Vann Newkirk from the Kaiser Family Foundation and Anthony Damico, an independent consultant.

| Appendix: Methods |

| This analysis uses pooled data from the 2012 and 2013 Current Population Survey (CPS) Annual Social and Economic Supplement (ASEC). The CPS ASEC provides socioeconomic and demographic information for the United Sates population and specific subpopulations. Importantly, the CPS ASEC provides detailed data on families and households, which we use to determine income for ACA eligibility purposes (see below for more detail). We merge two years of data in order to increase the precision of our estimates.Medicaid and Marketplaces have different rules about household composition and income for eligibility. For this analysis, we calculate household membership and income for both Medicaid and Marketplace premium tax credits for each person individually, using the rules for each program. For more detail on how we construct Medicaid and Marketplace households and count income, see the detailed technical Appendix A available here.Immigrants who are undocumented are ineligible for Medicaid and Marketplace coverage. Since CPS data do not directly indicate whether an immigrant is lawfully present, we impute documentation status for each person in the sample. To do so, we draw on the methodology in the State Health Access Data Assistance Center (SHADAC) paper, “State Estimates of the Low-Income Uninsured Not Eligible for the ACA Medicaid Expansion.”4 This approach uses the Survey of Income and Program Participation (SIPP) to develop a model that predicts immigration status; it then applies the model to CPS, controlling to state-level estimates of total undocumented population from Department of Homeland Security. For more detail on the immigration imputation used in this analysis, see the technical Appendix B available here.As of January 2014, Medicaid financial eligibility for most nonelderly adults will be based on modified adjusted gross income (MAGI). To determine whether each individual is eligible for Medicaid, we use each state’s MAGI eligibility level that will be effective as of 2014.5 Some nonelderly adults with incomes above MAGI levels may be eligible for Medicaid through other pathways; however, we only assess eligibility through the MAGI pathway.6

An individual’s income is likely to fluctuate throughout the year, impacting his or her eligibility for Medicaid. Our estimates are based on annual income and thus represent a snapshot of the number of people in the coverage gap at a given point in time. Over the course of the year, a larger number of people are likely to move in and out of the coverage gap as their income fluctuates. Marketplace premium tax credit eligibility determination is most accurately established by modeling the employment status and likelihood of an ESI offer, since tax credit eligibility requires the absence of an affordable ESI offer. This analysis did not account for this “offer rate reduction” so the tax credit eligibility is overestimated by about 17% and likely to include about 2.7 million metro and rural area residents who will have affordable ESI offers. |