Medicare Advantage 2023 Spotlight: First Look

Issue Brief

Medicare Advantage 2023 Spotlight: First Look

Issue Brief

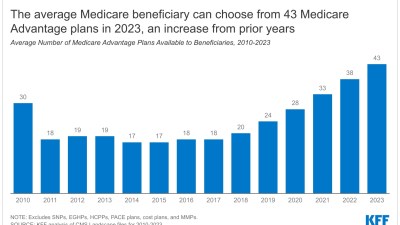

For 2023, the average Medicare beneficiary has access to 43 Medicare Advantage plans and can choose from plans offered by nine firms. Among the majority of Medicare Advantage plans that cover prescription drugs, 66 percent will charge no premium in addition to the monthly Medicare Part B premium. As in previous years, the vast majority of Medicare Advantage plans will offer supplemental benefits, including fitness, dental, vision, and hearing benefits. In addition, virtually all will also offer telehealth benefits in 2023.