2016 Employer Health Benefits Survey

Section Eleven: Retiree Health Benefits

Retiree health benefits are an important consideration for older workers making decisions about their retirement. Health benefits for retirees provide an important supplement to Medicare for retirees age 65 or older. Over time, the percentage of firms offering retiree coverage has decreased.

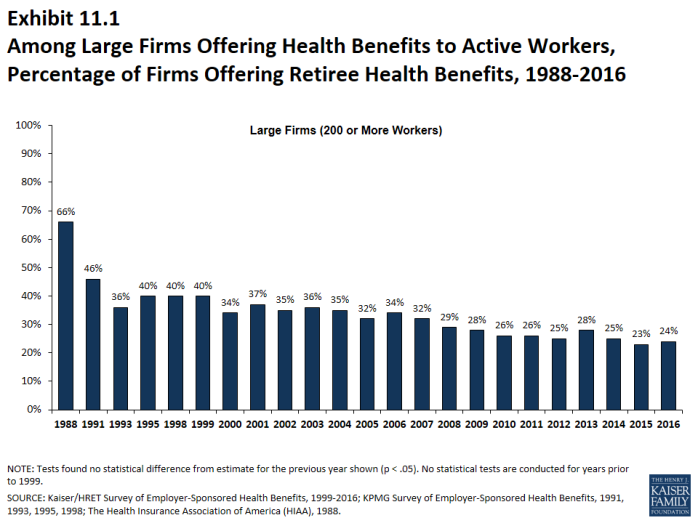

- Twenty-four percent of large firms (200 or more workers) that offer health benefits to their employees offer retiree coverage in 2016, similar to recent years. There has been a downward trend in the percentage of firms offering retirees coverage, from 34% in 2006 and 40% in 1999 (Exhibit 11.1).

- The offering of retiree health benefits varies considerably by firm characteristics.

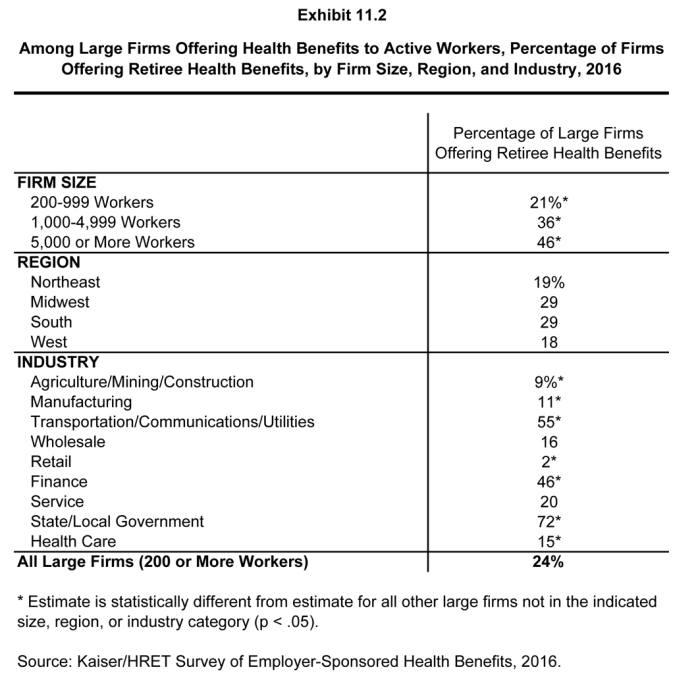

- Among large firms offering health benefits, the likelihood that a firm will offer retiree health benefits increases with size: from 21% of firms with 200-999 workers, to 36% of firms with 1,000-4,999 workers, to 46% of firms with 5,000 or more workers (Exhibit 11.2).

- The share of large firms offering retiree health benefits varies considerably by industry. State and local governments (72%), firms in transportation/utilities/communication (55%) and firms in finance (46%) have particularly high rates of offer while retail firms (2%) have a particularly low rate (Exhibit 11.2).

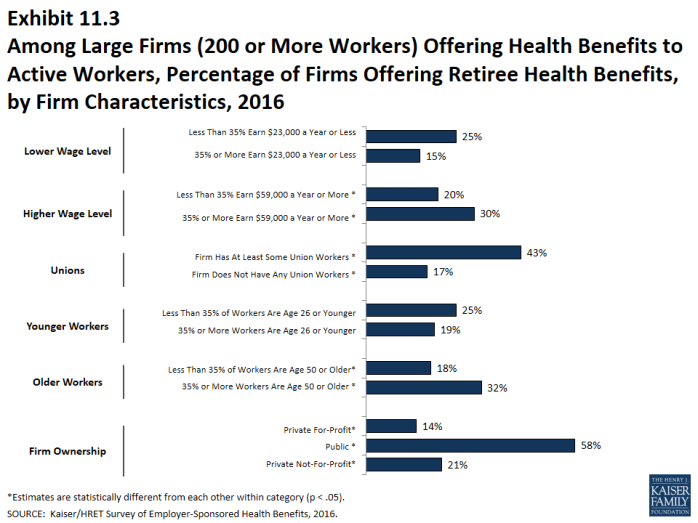

- Among large firms offering health benefits, those with a larger share of older workers (35% or more of workers are age 50 or older) are more likely to offer retiree health benefits than large firms with a smaller share of older workers (32% vs. 18%) (Exhibit 11.3).

- Among large firms offering health benefits, those with a larger share of higher-wage workers (35% or more earn at least $59,000 per year) are more likely to offer retiree health benefits than those with a smaller share of higher-wage workers (30% vs. 20%) (Exhibit 11.3).

- Among large firms offering health benefits, the share of public firms offering retiree benefits (58%) is higher than the shares of private for-profit firms (14%) or private not-for-profit firms (21%) offering retiree benefits (Exhibit 11.3).

- Large firms with at least some union workers are more likely to offer retiree health benefits than large firms without any union workers (43% vs. 17%) (Exhibit 11.3).

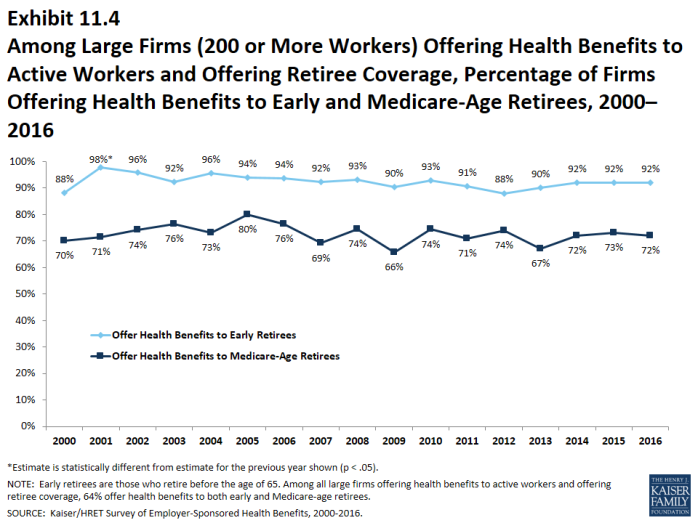

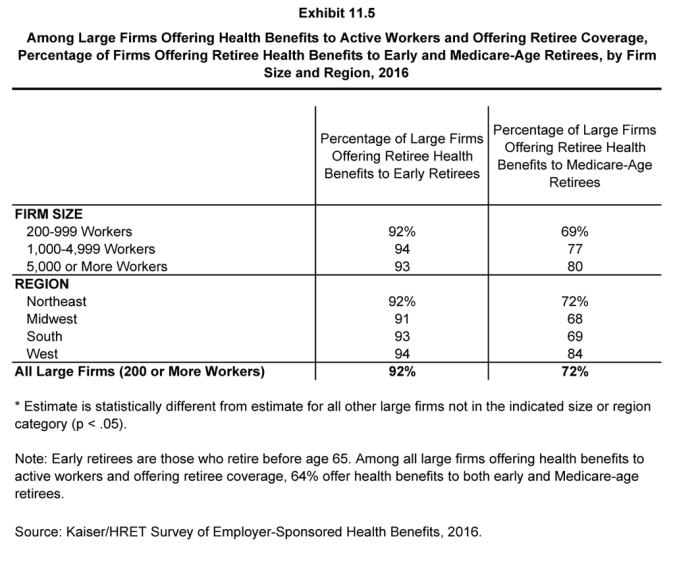

- Among all large firms offering retiree health benefits, most firms offer to early retirees under the age of 65 (92%). A lower percentage (72%) of large firms offering retiree health benefits offer to Medicare-age retirees. These percentages are similar to those in recent years (Exhibit 11.4).

- Among all large firms offering retiree health benefits, 64% offer health benefits to both early and Medicare-age retirees.

Private Exchanges and Public Exchanges

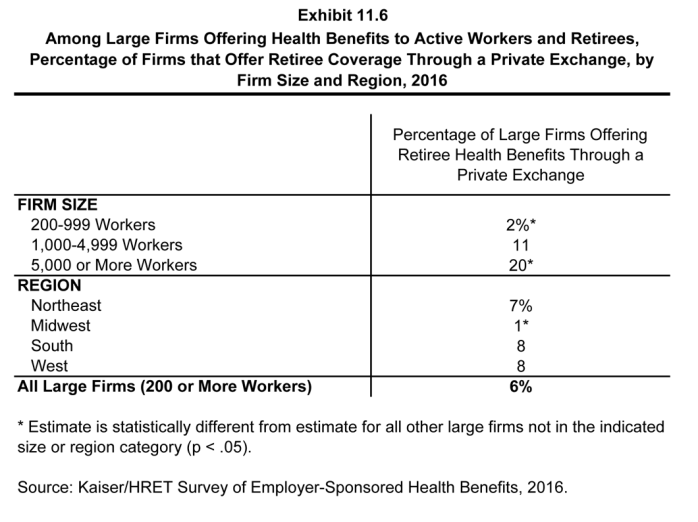

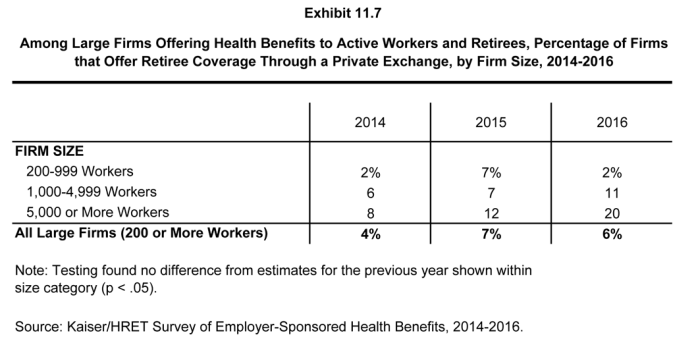

- Private exchanges have received considerable attention over the last several years. They are typically created by a consulting company, broker, or insurer, and are different than the public exchanges created under the Affordable Care Act (ACA). Private exchanges allow employees or retirees to choose from several health benefit options offered on the exchange. Six percent of large firms (200 or more workers) offering retiree health benefits report they offer benefits through a private exchange, similar to the percentage last year (7%) (Exhibit 11.7). For more information on the use of private exchanges for active employees, please see section 14.

- Since 2014, households with an income between 100% and 400% of the federal poverty level and without an offer of employer coverage may be eligible for subsidized health insurance on federal and state exchanges. Some current retirees may be eligible for premium tax credits for coverage provided through these marketplaces.

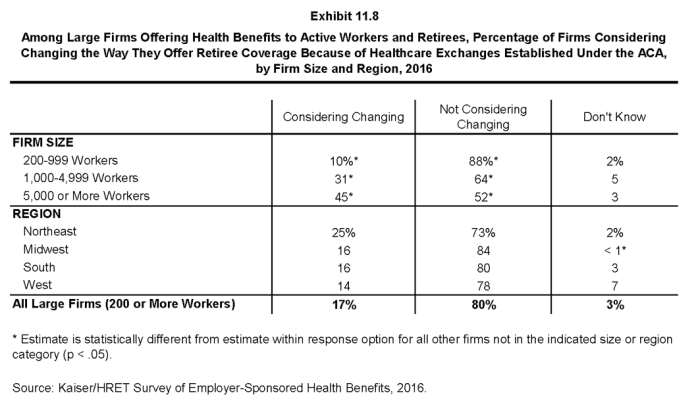

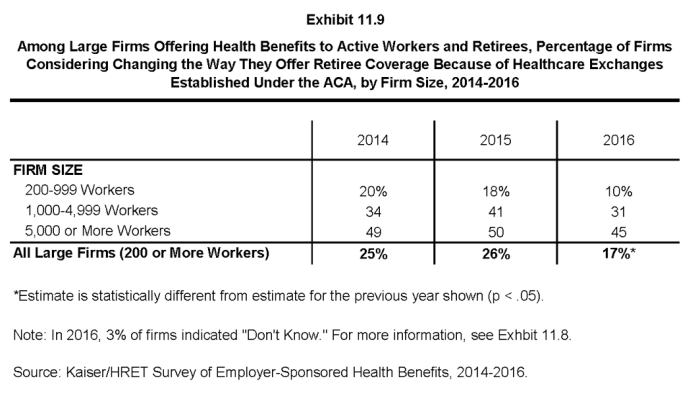

- Seventeen percent of large firms offering retiree health coverage report they are considering changes in the way they offer retiree health benefits because of the new marketplaces, lower than the percentage last year (26%) (Exhibit 11.9).

Section Ten: Plan Funding

Section Twelve: Health Risk Assessment, Biometrics Screening and Wellness Programs

x

Exhibit 11.1

x

Exhibit 11.2

x

Exhibit 11.3

x

Exhibit 11.4

x

Exhibit 11.7

x