Medicare Advantage: Take Another Look

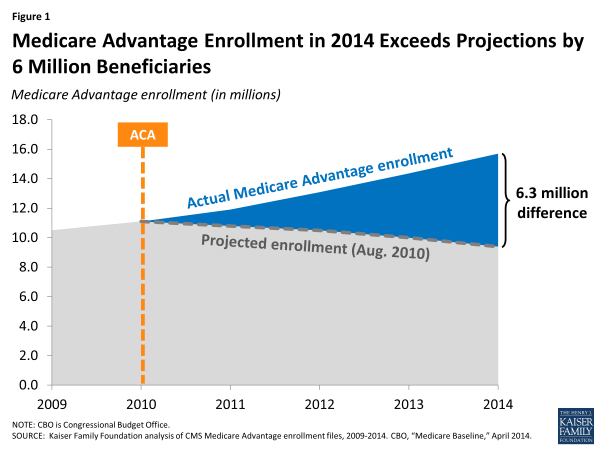

While health policy observers are mainly focused on the number of people enrolled in the new federal and state marketplaces, fewer are keeping a close eye on fairly big changes in the estimates and projections for enrollment in Medicare Advantage plans. The number of Medicare beneficiaries in Medicare private plans reached an all-time high this year of nearly 16 million beneficiaries, 6.3 million higher than the Congressional Budget Office (CBO) had projected in 2010 soon after the Affordable Care Act (ACA) was enacted (Figure 1). The CBO now projects Medicare Advantage enrollment will reach 22 million beneficiaries by 2020, more than double the number projected shortly after the ACA was enacted.

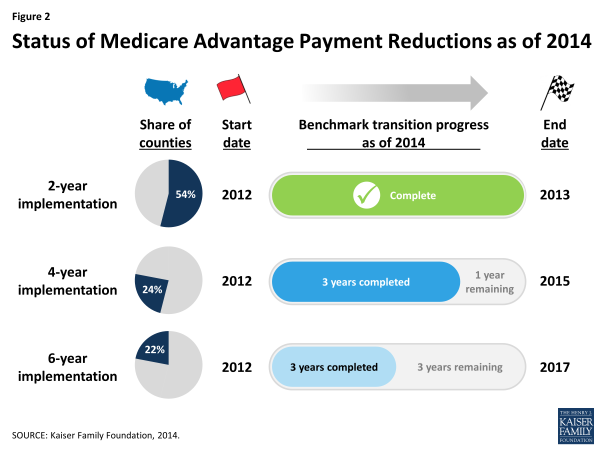

Medicare Advantage enrollment was expected to decrease in response to the reductions in payments to plans that were included in the ACA. The ACA payment reductions were adopted in response to concerns that Medicare was paying 14 percent more for beneficiaries in Medicare Advantage plans than it did for beneficiaries in traditional Medicare, on average. This contributed to higher Part B premiums for all beneficiaries and to Medicare’s fiscal challenges. The ACA froze payments to plans for 2011 and then phased in reductions between 2012 and 2017. The reductions were implemented by county on a 2-year, 4-year and 6-year schedule, with the longest phase in allowed for counties with relatively larger payment reductions. The phased-in approach aimed to give insurers more time to adjust to the reductions and to find ways to deliver services at a lower cost without negatively affecting the quality of patient care.

The payment reductions have now been fully implemented in more than half of all counties and will be fully implemented in about another quarter of counties next year (Figure 2). Since 2010, enrollment has increased by more than one third in the counties with a slower, 6-year phase in, and by even more in the other counties. Nationally, Medicare Advantage enrollment has increased by 41 percent since 2010.

When Congress debated the payment reductions in 2010, forecasters and analysts also projected that reductions would drive insurers to raise premiums, cut extra benefits and even pull out of the Medicare Advantage market as they did after the Balanced Budget Act of 1997. Thus far, however, the response by insurers to the ACA cuts has been more muted.

Beneficiaries today are able to choose among 18 Medicare Advantage plans, on average– a drop from prior years but still a fair amount of choice by most standards. Some Medicare Advantage plans terminated or consolidated coverage, but others are moving into new counties and expanding coverage, suggesting that at least some insurers are optimistic about their financial prospects.

The steady but unexpected rise in enrollment may be partly attributable to the quality bonus demonstration implemented by the Centers for Medicare and Medicaid Services between 2012 and 2014. The demonstration awarded bonuses to nearly all Medicare Advantage plans and boosted the size of the bonuses beyond what the ACA provided. The bonuses helped to offset more than one-quarter of the projected Medicare Advantage reductions in plan payments over these three years. Plans were required to use all bonus payments to provide extra benefits to enrollees, attracting more seniors to Medicare Advantage plans.

As Medicare Advantage enrollment increased, monthly premiums actually declined (from an average $44 per month in 2010 to $35 per month in 2014). Still, some evidence indicates that plans have made other adjustments to cut costs, for example, by increasing out-of-pocket limits, which could affect beneficiaries with relatively high health care expenses, and by narrowing their provider networks.

Plans may be looking for ways to tighten their belts and maintain profits, but the changes thus far do not seem to be scaring seniors away. CBO’s most recent projections show enrollment on track to increase steadily through 2023. Looking forward, it will be important for beneficiaries to monitor potential changes in their coverage, costs and provider networks, with the bonus demonstration ending and plans continuing to adjust to lower payments and changing market conditions. But, for now, as Mark Twain might have said, the reports of the demise of the Medicare Advantage program appear to be greatly exaggerated.