Paying a Visit to the Doctor: Current Financial Protections for Medicare Patients When Receiving Physician Services

Under current law, Medicare has several financial protections in place that are designed to safeguard Medicare beneficiaries—seniors and people with permanent disabilities—from unexpected and confusing charges when they seek care from doctors and other practitioners. These protections include the participating provider program, limitations on balance billing, and conditions on private contracting. This issue brief describes these three protections, explains why they were enacted, and examines the implications of modifying them for beneficiaries, providers, and the Medicare program.

Main Findings

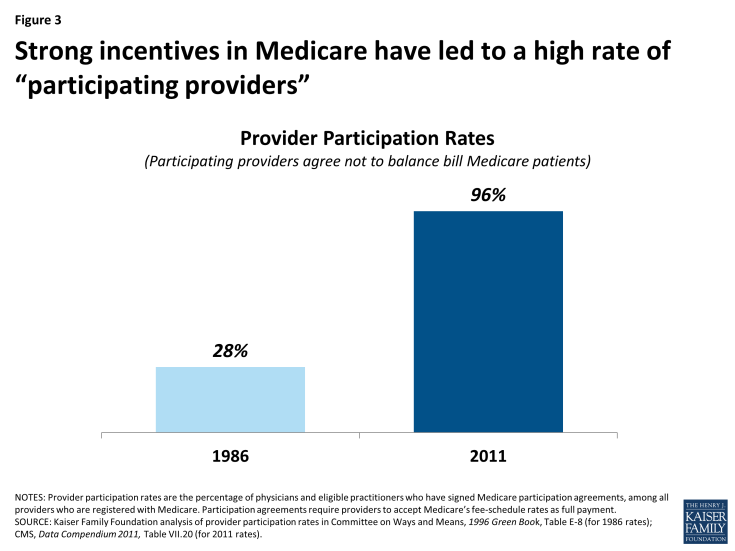

- The participating provider program was enacted in 1984 for two purposes: (1) to assist Medicare patients with identifying and choosing providers who charge Medicare-approved rates; and (2) to encourage providers to accept these rates. Given this program’s strong provider incentives, the number of participating providers grew rapidly across all states and today, the vast majority (96%) of eligible physicians and practitioners are “participating providers”—agreeing to charge Medicare’s standard fees when they see beneficiaries.

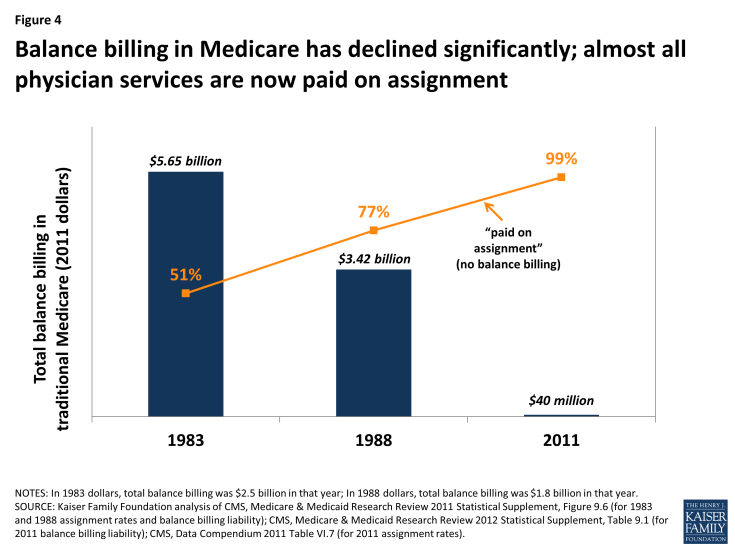

- The Congress instituted limitations on balance billing in 1989, in conjunction with implementation of the Medicare physician fee schedule. This financial protection limits the amount that “non-participating” providers may charge beneficiaries through balance billing—whereby beneficiaries are responsible for the portion of the provider’s charge that exceeds Medicare’s fee-schedule rate. Total out-of-pocket liability from balance billing has declined significantly over the past few decades dropping from $2.5 billion in 1983 ($5.65 billion in 2011 dollars) to $40 million in 2011.

- In 1997, the Congress codified several conditions for private contracting that apply to physicians and practitioners who “opt out” of Medicare and see beneficiaries only under individual private contracts. These restrictions were instituted to ensure that beneficiaries are aware of the financial ramifications of entering into these private contracts, and to safeguard patients and Medicare from fraud and abuse. In general, private contracting is relatively rare with only 1 percent of practicing physicians opting out of Medicare.

Background: Current Provider Options for Charging Medicare Patients

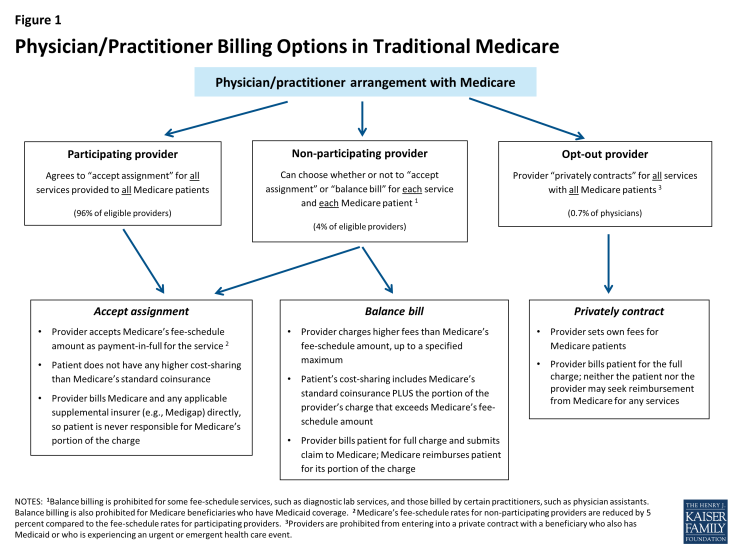

Under current law, physicians and practitioners have three options for how they will charge their patients in traditional Medicare. They may register with Medicare as (1) a participating provider, (2) a non-participating provider, or (3) an opt-out provider who privately contracts with each of his or her Medicare patients for payment (Figure 1). This issue brief describes these three options and then examines three current provisions in Medicare that provide financial protections for Medicare beneficiaries.

Participating providers: Physicians and practitioners who register with Medicare as participating providers agree to “accept assignment” for all of their Medicare patients. Accepting assignment entails two conditions: agreeing to accept Medicare’s fee-schedule amount as payment-in-full for a given service and collecting Medicare’s portion directly from Medicare, rather than the patient. Therefore, when Medicare patients see participating providers, they can be certain that these providers will not charge fees higher than Medicare’s published fee-schedule amount and that they will not face higher out-of-pocket liability than the maximum 20-percent coinsurance for most services. The vast majority (96%) of providers who provide Medicare-covered services are participating providers.

Non-participating providers: Non-participating providers do not agree to accept assignment for all of their Medicare patients; instead they may choose—on a service-by-service basis—to charge Medicare patients higher fees, up to a certain limit. When doing so, their Medicare patients are liable for higher cost sharing to cover the higher charges. This arrangement is called “balance billing” and means that the Medicare patient is financially responsible for the portion of the provider’s charge that is in excess of Medicare’s assigned rate, in addition to standard applicable coinsurance and deductibles for Medicare services. When non-participating providers do not accept assignment, they may not collect reimbursement from Medicare; rather, they bill the Medicare patient directly, typically up front at the time of service. Non-participating providers must submit claims to Medicare on behalf of their Medicare patients, but Medicare reimburses the patient, rather than the nonparticipating provider, for its portion of the covered charges. A small share (4%) of providers who provide Medicare-covered services are non-participating providers.

Opt-out providers, privately contracting: Physicians and practitioners who choose to enter into private contracts with their Medicare patients “opt-out” of the Medicare program entirely. These opt-out providers may charge Medicare patients any fee they choose. Medicare does not provide any reimbursement—either to the provider or the Medicare patient—for services provided by these providers under private contracts. Accordingly, Medicare patients are liable for the entire cost of any services they receive from physicians and practitioners who have opted out of Medicare. Several protections are in place to ensure that patients are clearly aware of their financial liabilities when seeing a provider under a private contract. An extremely small portion of physicians (less than 1% of physicians in clinical practice) have chosen to “opt-out” of the Medicare program, of whom 42 percent are psychiatrists.

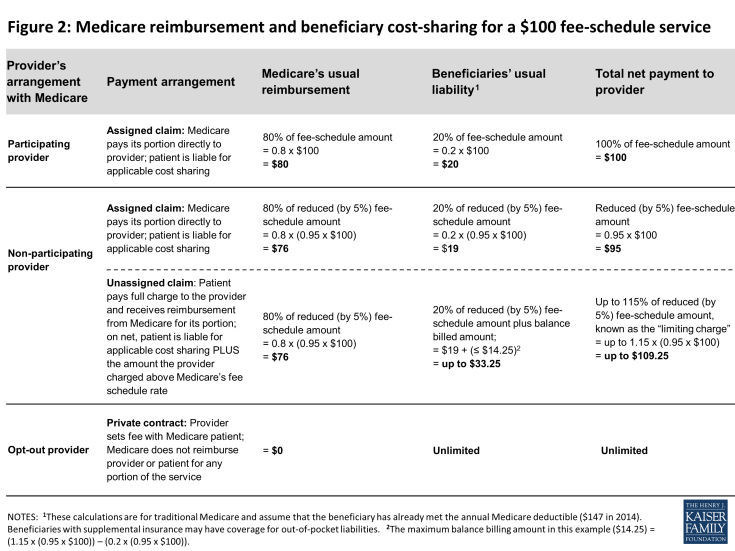

These provider options have direct implications on the charges and out-of-pocket liabilities that beneficiaries face when they receive physician services (Figure 2). They also play a major role in several financial protections in current law—namely, the physician participation program, limitations on balance billing, and conditions for private contracting—which help beneficiaries understand the financial implications of their provider choices and encourage providers to accept Medicare’s standard fees.

Medicare’s Participating Provider Program

Medicare’s participating provider program includes several incentives (both financial and nonfinancial) to encourage physicians and practitioners to “accept assignment” for all of their Medicare patients. When providers accept assignment, they agree to accept Medicare’s fee-schedule amount as payment-in-full for a given service and are allowed to bill Medicare directly for its portion of the reimbursement. Physicians and practitioners who agree to accept assignment on all services that they provide to Medicare patients are “participating providers” and are listed in Medicare provider directories. Beneficiaries who select a participating provider are assured that, after meeting the deductible, their coinsurance liability will not exceed 20 percent of the charge for the services they receive (Figure 2).

Congress established the participating provider program in the 1984 Deficit Reduction Act (DEFRA) to address two main concerns: confusion among beneficiaries about the fees they were being charged when they saw a doctor and escalating rates of balance billing from charges that exceeded Medicare’s established “usual, customary, and reasonable” rates for their area.1 At that time, aside from Medicaid-eligible beneficiaries, Medicare had no limits on the amount that physicians and practitioners could balance bill for their services. Surveys conducted by the Physician Payment Review Commission (PPRC), a congressional advisory body and predecessor of the Medicare Payment Advisory Commission (MedPAC), revealed that prior to the participating provider program, beneficiaries often did not know from one physician to the next whether they would face extra out-of-pocket charges due to balance billing and how much those amounts might be.2 By 1984, beneficiaries’ payment for balance billing reached 27 percent of total Medicare Part B out-of-pocket liability and was jeopardizing their access to affordable physician services.3

The establishment of the participating provider program in Medicare instituted multiple incentives to encourage providers to accept assignment for all their patients and become participating providers. For example, Medicare payment rates for participating providers are 5 percent higher than the rates paid to non-participating providers. Also, participating providers may collect Medicare’s reimbursement amount directly from Medicare, in contrast to non-participating providers who may not collect payment from Medicare and typically bill their Medicare patients upfront for their charges. (Non-participating providers must submit claims to Medicare so that their patients are reimbursed for Medicare’s portion of their charges.) Participating providers also gain the benefit of having electronic access to Medicare beneficiaries’ supplemental insurance status, such as their Medigap coverage. This information makes it considerably easier for providers to file claims to collect beneficiary coinsurance amounts, as well as easing the paperwork burden on patients. Additionally, Medicare helps beneficiaries in traditional Medicare seek and select participating providers by listing them by name with their contact information on Medicare’s consumer-focused website (www.Medicare.gov).

Given the strong incentives of the participation program, combined with limits on balance billing (discussed in the next section), it is not surprising that the share of physicians and practitioners electing to be participating providers has risen to high levels across the country. Overall, the rate of providers with participation agreements has grown to 96 percent in 2011, up considerably from about 30 percent in 1986, two years after the start of the participating provider program (Figure 3).4 As a result, across all states, most beneficiaries now encounter predictable expenses for Medicare-covered services, and are never responsible for Medicare’s portion of the fee (Appendix 1).

Medicare’s Balance Billing Limitations

Despite the incentives to become participating providers, a small share (4%) of physicians and practitioners who are registered with Medicare are non-participating providers. These providers can—on a service-by-service basis—charge patients in traditional Medicare higher fees than Medicare’s fee-schedule amount, up to a specified maximum. When charging higher fees, beneficiaries are responsible for the difference between Medicare’s approved amount and the providers’ total charge—essentially the balance of the bill remaining after accounting for Medicare’s reimbursement. This higher cost-sharing arrangement is called “balance billing” and means that the Medicare patient is financially liable for not only the applicable coinsurance and deductible, but also for any amount in which the provider’s charge exceeds Medicare’s assigned rate. Providers may not balance bill Medicare beneficiaries who also have Medicaid coverage.5

When non-participating providers balance bill, they bill the beneficiary directly, typically for the full charge of the service—including Medicare’s share, applicable coinsurance and deductible, and any balance billed amount. Non-participating providers are then required to submit a claim to Medicare, so that Medicare can process the claim and reimburse the patient for Medicare’s share of the charge. Two Medigap insurance policies, which beneficiaries may purchase to supplement their Medicare coverage, include coverage for balance billing.6 Balance billing is prohibited for Medicare-covered services in the Medicare Advantage program, except in the case of private fee-for-service plans.

In traditional Medicare, the maximum that non-participating providers may charge for a Medicare-covered service is 115 percent of the discounted fee-schedule amount. (Medicare’s fee-schedule rates for non-participating physicians are reduced by five percent.) Accordingly, non-participating providers may bill Medicare patients up to 9.25 percent more than participating providers (i.e., 1.15 x 0.95= 109.25). If the non-participating physician or practitioner balance bills the maximum amount permitted (not including any unmet deductible), total beneficiary liability for Medicare-covered services is about 33 percent of Medicare’s regular fee schedule amount (Figure 2).

Balance billing limitations were implemented in conjunction with the institution of Medicare’s physician fee-schedule in the Omnibus Budget Reconciliation Act of 1989. At the time, Medicare’s charge-based methodology for physician services gave rise to rapid spending growth and confusion among beneficiaries about what charges they would face for physician services.7 Moreover, high cost-sharing liabilities weighed disproportionately on beneficiaries who were sickest and used the most physician services. Despite physician reports that they took patient incomes into account when determining whether to charge higher-than Medicare rates, PPRC research did not find a relationship between beneficiary income and the probability that claims would be assigned.8

While the Congress constrained growth in provider fees through the implementation of the fee schedule, it also implemented maximum “limiting charges” to establish further certainty and predictability for patients on their expected costs for services. In trying to rein in Medicare fee-schedule payments, the Congress sought to protect beneficiaries from excess charges that providers could otherwise impose in response to restrictions on their fees.9

The continued desire to protect beneficiary spending during the implementation of the new physician fee schedule gave rise to the question of whether Congress might consider imposing even greater restrictions on balance billing or even mandate assignment (prohibiting balance billing) for all claims.10 Ultimately, the rationale in Congress for allowing limited balance billing was that it would provide for: (1) a “safety valve” for physicians who believed that the fee schedule did not adequately reflect the quality of services that they provided; (2) a means to correct any underpricing of resource costs in the fee schedule; and (3) necessary financial protections for beneficiaries, particularly in areas of the country where choice of physicians was limited.11

As limits on balance billing were implemented and incentives for physicians and practitioners to take assignment took hold, beneficiary liability for balance billing declined dramatically. CMS data show that in 2011, total balance billing amounted to $40 million, down significantly from $2.5 billion in 1983, (which equals $5.6 billion in 2011 dollars) (Figure 4). Concurrently, the rate of assigned claims to total covered charges climbed from 51% in 1983 to 99% in 2011.

Figure 4: Balance billing in Medicare has declined significantly; almost all physician services are now paid on assignment

Private Contracting Conditions for Providers who Opt Out of Medicare

A very small share of providers (less than 1 percent of physicians) have elected to “opt out” of Medicare and contract privately with all of their Medicare patients, individually.12 Their fees are not bound by Medicare’s physician fee schedule in any way, which means that these providers have no limits on the amounts they may charge beneficiaries for their services. Medicare does not reimburse either the provider or the patient for any services furnished by opt-out providers. Therefore, Medicare patients are financially responsible for the full charge of services provided by providers who have formally opted out of Medicare.13

Serving as beneficiary protections, several important conditions exist for providers who elect to contract privately with Medicare patients. One condition is that prior to providing any service to Medicare patients, physicians and practitioners must inform their Medicare patients that they have opted out of Medicare and provide their Medicare patients with a written document stating that Medicare will not reimburse either the provider or the patient for any services furnished by opt-out providers. Their Medicare patients must sign this document to signify their understanding of it and their right to seek care from a physician or other practitioner who has not opted-out of Medicare.

Providers opt-out by submitting a signed affidavit to Medicare agreeing to applicable terms and affirming that their contracts with patients include all the necessary information. Physicians or practitioners who opt out of Medicare must privately contract with all of their Medicare patients, not just some. Once a physician or practitioner opts out of Medicare, this status lasts for a two-year period and is automatically renewed unless the physician or practitioner actively cancels it.14 Providers may not enter into a private contract with a beneficiary who also has Medicaid benefits or who is experiencing an urgent or emergent health care event. 15

These conditions, which provide protections for both beneficiaries and the Medicare program, were included in the Balanced Budget Act of 1997 as part of the legislation that first codified physicians’ ability to privately contract with Medicare beneficiaries. Requiring opt-out providers to privately contract for all services they provide to Medicare patients (rather than being able to select by individual patients or services) was intended to prevent confusion among Medicare patients as to whether or not each visit would be covered under Medicare and how much they could expect to pay out-of-pocket. Similarly, requiring providers to opt out for a minimum period of time—two years—was intended to ensure that beneficiaries had consistent information to make knowledgeable choices when selecting their physicians. Both of these provisions also addressed Medicare’s duty to guard against fraudulent billing in an administratively feasibly manner. If, for example, physicians contracted with only some of their patients and/or services, Medicare would have to examine each contract for each submitted claim to discern which claims were eligible for Medicare reimbursement and which were not.

Previous Kaiser Family Foundation analysis shows that psychiatrists are disproportionately represented among the 0.7 percent of physicians (4,863) who have opted out of Medicare—comprising 42 percent of all physicians who have opted out (Figure 5).16 Another 1,775 clinical professionals with non-physician doctorate degrees (i.e. oral surgeon dentists, podiatrists, and optometrists) also have opted-out of the Medicare program.17 Dentists who are oral surgeons comprise the majority of this group (95%). Earlier research that examined opt-out providers through 2002 found similarly low numbers of providers opting out (2,839) as well as relatively higher opt-out rates among psychiatrists compared with other specialties.18

Some physician organizations attribute physician decisions to opt out of Medicare to frustration with Medicare’s fees and regulations.19 Others have noted a similar trend in physician refusal to work with any insurers—including commercial insurance plans—especially in prosperous communities. 20 In these cases, providers require patients to pay them directly out-of-pocket, leaving the patient to seek reimbursement, if any, from their insurer. For providers with patients who have the resources to make the payments, this billing method significantly reduces providers’ paperwork.

| Figure 5: Less than 1% of physicians in patient care have formally “opted out” of Medicare, with psychiatrists making up the largest share | |||||

| Specialty | Number of physicians in patient care, 20101 | Percent of physicians in specialty | Number of Medicare opt-out providers, 20132 | Percent of Medicare opt-out providers in specialty | Percent of total opt-out providers |

| Physicians | |||||

| Addiction Medicine | NA | — | 4 | — | 0.1% |

| Allergy/Immunology | 3,668 | 0.5% | 35 | 1.0% | 0.7% |

| Anesthesiology | 36,462 | 5.4% | 30 | 0.1% | 0.6% |

| Cardiovascular Disease/Cardiology | 19,637 | 2.9% | 29 | 0.1% | 0.6% |

| Colorectal Surgery/Proctology | NA | — | 1 | — | 0.0% |

| Dermatology | 10,101 | 1.5% | 96 | 1.0% | 2.0% |

| Emergency Medicine | 30,094 | 4.4% | 53 | 0.2% | 1.1% |

| Endocrinology | 4,502 | 0.7% | 32 | 0.7% | 0.7% |

| Family Medicine/General Practice | 97,779 | 14.4% | 702 | 0.7% | 14.4% |

| Gastroenterology | 11,550 | 1.7% | 20 | 0.2% | 0.4% |

| General Surgery | 21,896 | 3.2% | 41 | 0.2% | 0.8% |

| Geriatric Medicine | 3,367 | 0.5% | 5 | 0.1% | 0.1% |

| Hand Surgery | NA | — | 3 | — | 0.1% |

| Hematology/Oncology | 10,261 | 1.5% | 14 | 0.1% | 0.3% |

| Infectious Disease | 5,007 | 0.7% | 10 | 0.2% | 0.2% |

| Internal Medicine | 93,381 | 13.8% | 447 | 0.5% | 9.2% |

| Maxillofacial Surgery | NA | — | 245 | — | 5.0% |

| Nephrology | 7,020 | 1.0% | 2 | 0.0% | 0.0% |

| Neurology | 10,748 | 1.6% | 47 | 0.4% | 1.0% |

| Neurosurgery | 4,505 | 0.7% | 36 | 0.8% | 0.7% |

| Obstetrics/Gynecology | 36,978 | 5.5% | 375 | 1.0% | 7.7% |

| Ophthalmology | 16,598 | 2.4% | 30 | 0.2% | 0.6% |

| Orthopedic Surgery | 18,625 | 2.7% | 140 | 0.8% | 2.9% |

| Osteopathic Manipulative Medicine | NA | — | 49 | — | 1.0% |

| Otolaryngology | 8,636 | 1.3% | 35 | 0.4% | 0.7% |

| Pain Mgt/Interventional Pain Mgt | NA | — | 21 | — | 0.4% |

| Pathology | 11,231 | 1.7% | 2 | 0.0% | 0.0% |

| Pediatric Medicine | 55,686 | 8.2% | 52 | 0.1% | 1.1% |

| Physical Medicine And Rehab, Sports Medicine | 7,435 | 1.1% | 50 | 0.7% | 1.0% |

| Plastic And Reconstructive Surgery | 6,379 | 0.9% | 127 | 2.0% | 2.6% |

| Preventative Medicine | 4,060 | 0.6% | 24 | 0.6% | 0.5% |

| Psychiatry, Geriatric Psychiatry, Neuropsychiatry | 38,781 | 5.7% | 2,029 | 5.2% | 41.7% |

| Pulmonary Disease, Critical Care/Intensivists | 10,486 | 1.5% | 6 | 0.1% | 0.1% |

| Radiation Oncology | 4,032 | 0.6% | 1 | 0.0% | 0.0% |

| Radiology, Nuclear Medicine | 24,887 | 3.7% | 19 | 0.1% | 0.4% |

| Rheumatology | 4,069 | 0.6% | 12 | 0.3% | 0.2% |

| Thoracic Surgery | 4,222 | 0.6% | 4 | 0.1% | 0.1% |

| Urology | 9,180 | 1.4% | 29 | 0.3% | 0.6% |

| Vascular Surgery | 2,582 | 0.4% | 6 | 0.2% | 0.1% |

| Other, unspecified specialty*3 | 44,479 | 6.6% | NA | — | — |

| Total for all physician specialties | 678,324 | 100.0% | 4,863 | 0.7% | 100.00% |

| Non-physician clinicians with doctorate | |||||

| Chiropractic | NA | — | 5 | — | 0.3% |

| Optometry | NA | — | 52 | — | 2.9% |

| Oral Surgery (Dentist Only) | NA | — | 1,692 | — | 95.3% |

| Podiatry | NA | — | 26 | — | 1.5% |

| Total Non-physician clinicians with doctorate | 1,775 | 100.0% | |||

| NOTES: Physician counts include active physicians in patient care with an MD (Medical Doctor) or DO (Doctor of Osteopathic Medicine) degree. NA (not available) indicates that the specified specialty category is not supplied in the applicable data source. *Physicians in specialties with fewer than 2,500 total physicians are not categorized by specialty in AAMC analysis of AMA data (see Sources); 44,749 is the difference between the total number of physicians in patient care (678,324) and the number categorized by specialty (633,845). | |||||

| SOURCES: Kaiser Family Foundation analysis of: 1Physician counts from Association of American Medical Colleges (AAMC) 2012 Physician Specialty Data Book, using American Medical Association (AMA) Physician Masterfile (December 2010); 2Unpublished data from the Center for Medicare and Medicaid Services, September 2013; 3Physician counts from AAMC, 2011 State Physician Workforce Data Book, using AMA Physician Masterfile (December 31, 2010). | |||||

Concierge Practice Models

Some physicians are turning to concierge practice models (also called retainer-based care), in which they charge their patients annual membership fees and typically have smaller patient caseloads. Physicians in a concierge practice model do not necessarily need to opt-out of Medicare to see Medicare patients. However, if they do not opt-out of Medicare, these physicians are subject to Medicare’s balance billing rules, and therefore, cannot charge beneficiaries additional fees for services that are already covered by Medicare.21 For example, the annual fee for a concierge practice may not be used for the yearly wellness visit covered by Medicare, but it could be applied to items such as a newsletter and high-end waiting room furniture. More controversy exists about concierge practices applying annual fees paid by Medicare beneficiaries to enhanced appointment access and extra time with patients.22

While anecdotal reports suggest a significant migration of primary care physicians to concierge/retainer practices, particularly in areas around Washington D.C and other major east and west coast cities, reliable data on the number of these practices are lacking. In 2010, a report for MedPAC found listings for 756 concierge physicians, compared with 146 found by Government Accountability Office in 2005.23 Other news articles have reported larger numbers (4,400 in 2012) according to the American Association of Private Physicians.24

Implications of Proposals to Modify Incentives and Relax Certain Financial Protections—Pros and Cons

Proposals introduced by Rep. Tom Price, House Speaker Paul Ryan and others have sought to relax private contracting conditions either throughout the Medicare program or as a demonstration project that could be implemented by the Administration. For example, in 2015, two Bills introduced in the House with a companion Bill in the Senate25 include provisions to allow physicians and practitioners to engage in private contracting on a beneficiary-by-beneficiary basis, instead of requiring providers to opt-out of Medicare entirely. These Bills would also allow beneficiaries to seek Medicare reimbursement for the portion of the privately contracted fee that equals Medicare’s fee schedule amount, but no out-of-pocket limits would apply to the remaining portion of the provider’s charge. Similar changes are also proposed as a demonstration in the 2016 House Republican Plan, “A Better Way, our Vision for a Confident America.”26 An earlier House Bill also included a demonstration to allow non-participating providers to collect Medicare’s portion of their charge directly from Medicare.27

Pros: Support for Relaxing restrictions and increasing physician autonomy

Proponents of such proposals, including the American Medical Association, support relaxing restrictions on balance billing and private contracting for a number of reasons—perhaps the foremost is that they would allow physicians to charge Medicare beneficiaries higher rates and thereby get relief from fees that they say have failed to keep pace with the rising costs of running their practices.28 Proponents also assert that this ability could increase the overall number of providers willing to accept Medicare patients. This concern may be an issue in some geographic areas, though surveys and other data sources show that nationally, access to physicians among Medicare seniors is generally comparable to access among people age 55 to 64 with private insurance.29

Physician groups also state that proposals to relax constraints on balance billing and private contracting would give providers a sense of greater autonomy in how they relate to both their patients and the Medicare program and would allow physicians to charge higher fees to some patients based on their assessment of their patients’ ability to pay.30 Additionally, beneficiaries would be able to seek at least partial Medicare reimbursement for services they received under private contracts. Proposals that would allow non-participating providers to collect Medicare’s portion of their charge directly from Medicare would obviate the need to charge patients the full fee upfront. This circumstance could be helpful to those patients who do not want to wait for Medicare’s reimbursement, even if on net, they would incur higher out-of-pocket liability due to balance billing. Non-participating providers could also experience a more reliable payment from Medicare, compared with the challenges, in some cases, of collecting fees from Medicare patients for unassigned claims.

Cons: Concerns about Eroding Financial Protections

Other analysts have raised concerns about the effects of relaxing private contracting rules and balance billing restrictions.31 To the extent that such changes lead to increases in the number of non-participating and/or opt-out providers, they could exacerbate problems that lower-income beneficiaries face when seeking care. Beneficiaries without the ability to pay higher rates (who are also likely to be disproportionately sicker) could find a reduced pool of physicians willing to accept them. Also, for rarer physician specialties and in some geographic areas, such as rural parts of the country, patients may have little choice among physicians. If the limits on balance billing and private contracting were relaxed, beneficiaries in these situations could face the types of problems that existed prior to the imposition of limits on balance billing—high out-of-pocket costs and greater confusion and uncertainty about possible charges. Additionally, concerns have been raised about the accuracy and appropriateness of providers determining which Medicare patients in their caseload can afford higher fees, and by how much.

While proposals that allow beneficiaries and non-participating physicians to seek reimbursement from Medicare may, in the short term, reduce out-of-pocket liability for beneficiaries, they could also decrease the incentives for physicians and practitioners to become participating providers. In the long run, if significantly more providers balance billed their Medicare patients or opted-out of Medicare, this shift could alternatively increase beneficiary out-of-pocket spending.

From the perspective of the Medicare’s program integrity, Medicare would have significant difficulty tracking fraud and abuse if physicians were able to contract selectively for services with some but not all beneficiaries. Medicare would have to examine every physician-patient contract, on a claim-by-claim basis, to determine which claims could be reimbursed directly to the physician and which would be the full responsibility of the patient. Additionally, Medicare would need to examine these physicians’ billing practices to ensure that beneficiaries were not being charged inappropriately.

Conclusions

Balance billing limits, with incentives for physicians to accept assignment, have proven effective in limiting beneficiaries’ out-of-pocket liability for physician services. Today, a small share of Medicare beneficiaries experience balance billing just as only small share of provider claims in Medicare are paid unassigned—very different from the years before balance billing limits were instituted. Moreover, only about 1 percent of physicians provide services to beneficiaries on a private contracting basis. As the Congress has been considering changes to the way in which Medicare pays for physician service in the context of SGR repeal, some proposals have briefly surfaced to relax constraints on balance billing and private contracting.

On the one hand, these proposals could increase physician autonomy and provider willingness to treat Medicare patients, particularly among those providers who charge higher fees. On the other hand, such proposals could result in higher out-of-pocket liability, particularly in the longer term, which could affect beneficiary access to care. Additionally, relaxing these protections could foster less predictability in the fees beneficiaries encounter when seeing physicians and practitioners. Patients most at risk for experiencing a greater financial burden would be those with modest incomes and greater health care needs. Beneficiaries in geographic areas with limited choices of physicians might also be at higher risk if a growing number of providers choose to balance bill or require private contracts with their Medicare patients. The key is to strike a balance between assuring that providers receive fair payments from Medicare while also preserving financial protections that help beneficiaries face more predictable and affordable costs when they seek care.

Technical support in preparation of this brief was provided by Health Policy Alternatives, Inc.