Data Note: Medicare Advantage Enrollment, by Firm, 2015

–

Updated county-level data showing market share by firm for 2016 is available here.

In recent weeks, a number of potential mergers and acquisitions between large firms that offer health insurance have been reported in the press, including the July 3, 2015 announcement of a merger between Aetna and Humana. These mergers could affect consumers in the individual market, enrollees in the new federal and state Marketplaces, employees with employer-sponsored insurance, as well as people covered by public programs such as Medicare. Nearly 17 million Medicare beneficiaries – almost one-third of the total Medicare population – are enrolled in private Medicare plans, known as Medicare Advantage plans, raising questions about the potential impact of these mergers on Medicare enrollees.

This Data Note examines the Medicare Advantage market share of large firms that have reportedly engaged in merger and acquisition discussions: Aetna, Anthem, Cigna, Humana, and UnitedHealthcare. Table 1 shows the Medicare Advantage market shares of these five firms nationally and by state. Table 2 highlights the counties in which the Aetna-Humana merger could have a relatively large impact on Medicare Advantage enrollees based on the combined market share of these two firms. Table 3 shows the market share of these five firms in the 50 counties with the largest number of Medicare Advantage enrollees. This Data Note uses Medicare Advantage enrollment data released by the Centers for Medicare and Medicaid Services in March 2015.

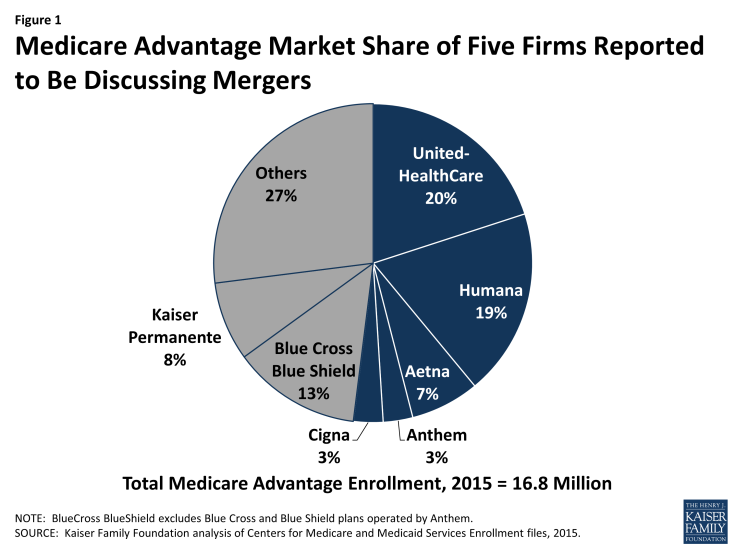

Table 1 shows the market share of the five large firms, nationally and by state, that have reportedly been engaged in merger and acquisition discussions. Together, these five firms comprise more than half (52%) of the Medicare Advantage market (Figure 1).

If the announced deal between Aetna and Humana proceeds, the consolidated firm would provide coverage to more than one-quarter (26%) of all Medicare Advantage enrollees nationwide, making it the leading Medicare Advantage insurer, ahead of UnitedHealthcare, which has 20 percent of all Medicare Advantage enrollees.

Mergers between insurers would play out differently across the country because Medicare Advantage market share by firm varies greatly across states and counties. In some counties and states, locally-owned firms play a larger role in the Medicare Advantage market than national firms, while other states are dominated by the large, national firms.

- Based on current enrollment numbers, the combined market share of Aetna and Humana would include at least half of all Medicare Advantage enrollees in 10 states and at least two-thirds of all enrollees in five states (KS, LA, MS, VA, and WV), unless they divest some Medicare Advantage plans in response to regulatory (antitrust) issues. By itself, Humana has more than half of the Medicare Advantage market in five states (KY, LA, MS, VA, and WV), including two states (MS and WV) in which it has more than two-thirds of all Medicare Advantage enrollees. Aetna has at least one-quarter of all enrollees in eight states (AK, DE, IA, KS, ME, MO, NE, and NJ).

- UnitedHealthcare currently has more than half of the market in four states (NE, NH, VT, and WY), including two states (VT and WY) in which it has more than two-thirds of the market. UnitedHealthcare has more than one-quarter of all enrollees in 19 other states and the District of Columbia. Anthem more than one-fifth of the market (23%) in Ohio. Cigna has more than one-third of the market (38%) in Delaware and about one-fifth of the market in three other states (TN, AL, and MD).

In seven states (CT, ME, MA, MT, NM, ND and SD), the firm with the most Medicare Advantage enrollees is a locally operated firm and thus mergers among the large, national firms would likely have a smaller impact in these states.

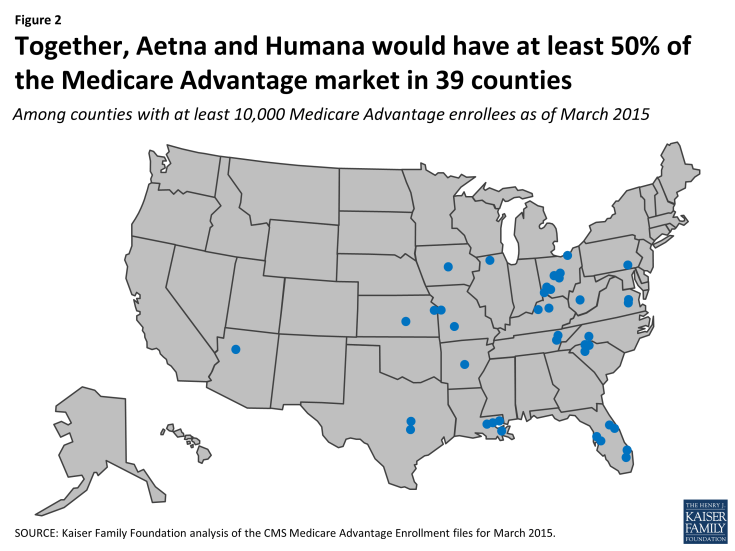

Table 2 and Figure 2 drill down to the county level to show the counties in which Humana and Aetna currently account for at least 50 percent of the Medicare Advantage market.

Figure 2: Together, Aetna and Humana would have at least 50% of the Medicare Advantage market in 39 counties

Among the 335 counties nationwide with at least 10,000 Medicare Advantage enrollees:

- Humana currently provides coverage to at least half of all Medicare Advantage enrollees in 21 counties, and at least two-thirds of all Medicare Advantage enrollees in six counties;

- Aetna currently provides coverage to more than half of all Medicare Advantage enrollees in two counties: Polk County, Iowa which includes Des Moines and Sedgwick County, Kansas which includes Wichita; and

- Together, Aetna and Humana currently cover at least half of all Medicare Advantage enrollees in 39 counties, and at least 75 percent of all Medicare Advantage enrollees in nine counties (Benton, AR; Polk County, IA; Winnebago County, IL; Johnson County, KS; Sedgwick County, KS; Livingston County, LA; Jackson County, MO; Anderson County, SC; and Kanawha County, WV).

Table 3 shows the Medicare Advantage market shares of the five large, national firms in 50 counties with the largest number of Medicare Advantage enrollees. Together, these 50 counties account for about one-third (34%) of all Medicare Advantage enrollees nationwide.

- Humana has more enrollees than any other firm in 11 counties, while UnitedHealthcare has more enrollees than any other firm in 10 of the 50 counties. Anthem has a larger market share than any other firm in three counties. Cigna has the most Medicare Advantage enrollees in one of the 50 counties – Philadelphia County, PA.

- Humana has at least half of all Medicare Advantage enrollees in three counties in Florida (Broward County, Palm Beach County, and Volusia County). UnitedHealthcare has at least half of all Medicare Advantage enrollees in six counties, three of which are in Texas (Pima County, AZ; Clark County, NV; Bexar County, TX; Dallas County, TX; Tarrant County, TX; and Milwaukee County, WI). Anthem has more than half of all Medicare Advantage enrollees in Suffolk County, NY.

- Together, Aetna and Humana have more than half of all Medicare Advantage enrollees in six counties (Broward County, FL; Hillsborough County, FL; Palm Beach County, FL; Pasco County, FL; Volusia County, FL; and Franklin County, OH). In three of these six counties (Broward County, FL; Palm Beach County, FL; and Volusia County, FL), Humana already has at least half of all Medicare Advantage enrollees.

While the large, national firms have a substantial presence in many counties with a relatively large number of Medicare Advantage enrollees, none of these five large, national firms have the largest Medicare Advantage market share in 25 of the 50 counties.

Gretchen Jacobson and Tricia Neuman are with the Kaiser Family Foundation; and Anthony Damico is an independent consultant.

| Table 1: Medicare Advantage Market Share of the Five Firms Reported to be Discussing Mergers, by State, 2015 | |||||||

| State | Total Medicare Advantage Enrollment | Percent of Enrollees in Firm’s Plans | |||||

| Aetna | Anthem | Cigna | Humana | United-Healthcare | All Others | ||

| Total U.S. | 16,761,673 | 7% | 3% | 3% | 19% | 20% | 48% |

| Alabama | 238,091 | 0% | 0% | 22% | 20% | 16% | 43% |

| Alaska | 56 | 55% | 0% | 0% | 0% | 45% | 0% |

| Arizona | 425,454 | 1% | 4% | 10% | 14% | 37% | 34% |

| Arkansas | 114,326 | 6% | 0% | 2% | 38% | 29% | 25% |

| California | 2,127,666 | 1% | 4% | 0% | 3% | 16% | 76% |

| Colorado | 281,467 | 1% | 0% | 0% | 14% | 39% | 46% |

| Connecticut | 157,692 | 20% | 3% | 0% | 0% | 31% | 46% |

| Delaware | 13,841 | 40% | 0% | 38% | 8% | 12% | 2% |

| District of Columbia | 11,033 | 7% | 0% | 9% | 0% | 28% | 56% |

| Florida | 1,570,845 | 6% | 2% | 3% | 37% | 22% | 30% |

| Georgia | 460,670 | 9% | 1% | 4% | 22% | 49% | 15% |

| Hawaii | 110,465 | 0% | 0% | 0% | 10% | 19% | 71% |

| Idaho | 87,837 | 0% | 0% | 0% | 10% | 13% | 77% |

| Illinois | 371,007 | 11% | 0% | 5% | 26% | 39% | 19% |

| Indiana | 264,104 | 3% | 14% | 1% | 35% | 25% | 21% |

| Iowa | 81,541 | 40% | 0% | 0% | 24% | 24% | 12% |

| Kansas | 61,600 | 42% | 0% | 0% | 48% | 8% | 1% |

| Kentucky | 212,948 | 2% | 17% | 0% | 60% | 16% | 5% |

| Louisiana | 232,445 | 1% | 0% | 0% | 65% | 1% | 33% |

| Maine | 66,307 | 26% | 2% | 0% | 7% | 13% | 52% |

| Maryland | 76,375 | 10% | 0% | 19% | 2% | 13% | 56% |

| Massachusetts | 233,084 | 1% | 0% | 0% | 0% | 18% | 81% |

| Michigan | 595,239 | 1% | 0% | 0% | 10% | 1% | 88% |

| Minnesota | 480,474 | 0% | 0% | 0% | 7% | 0% | 93% |

| Mississippi | 76,776 | 1% | 0% | 11% | 66% | 1% | 22% |

| Missouri | 311,364 | 30% | 2% | 0% | 22% | 31% | 15% |

| Montana | 34,758 | 0% | 0% | 0% | 20% | 4% | 76% |

| Nebraska | 34,982 | 30% | 0% | 0% | 16% | 51% | 3% |

| Nevada | 146,094 | 4% | 4% | 0% | 33% | 45% | 14% |

| New Hampshire | 17,295 | 3% | 12% | 0% | 17% | 55% | 14% |

| New Jersey | 222,846 | 25% | 3% | 0% | 0% | 44% | 27% |

| New Mexico | 113,807 | 1% | 2% | 0% | 13% | 19% | 65% |

| New York | 1,212,239 | 5% | 10% | 0% | 1% | 18% | 67% |

| North Carolina | 512,924 | 8% | 0% | 1% | 31% | 34% | 26% |

| North Dakota | 17,878 | 0% | 0% | 0% | 9% | 1% | 90% |

| Ohio | 811,503 | 21% | 23% | 0% | 29% | 8% | 19% |

| Oklahoma | 111,013 | 3% | 0% | 0% | 29% | 29% | 40% |

| Oregon | 323,765 | 0% | 0% | 0% | 1% | 12% | 87% |

| Pennsylvania | 1,001,864 | 22% | 0% | 6% | 4% | 3% | 65% |

| Puerto Rico | 552,888 | 0% | 0% | 0% | 9% | 0% | 91% |

| Rhode Island | 71,009 | 0% | 0% | 0% | 0% | 28% | 72% |

| South Carolina | 209,812 | 2% | 0% | 4% | 45% | 45% | 4% |

| South Dakota | 26,400 | 7% | 0% | 0% | 21% | 1% | 71% |

| Tennessee | 412,042 | 1% | 1% | 22% | 31% | 18% | 27% |

| Texas | 1,098,678 | 12% | 3% | 10% | 24% | 33% | 18% |

| Utah | 113,034 | 8% | 0% | 0% | 7% | 45% | 40% |

| Vermont | 8,984 | 8% | 0% | 0% | 0% | 80% | 12% |

| Virginia | 206,427 | 4% | 3% | 0% | 62% | 18% | 13% |

| Washington | 348,467 | 0% | 0% | 0% | 9% | 25% | 65% |

| West Virginia | 99,454 | 14% | 0% | 0% | 71% | 2% | 13% |

| Wisconsin | 388,732 | 0% | 1% | 0% | 19% | 33% | 47% |

| Wyoming | 2,071 | 11% | 0% | 0% | 4% | 72% | 12% |

|

SOURCE: Kaiser Family Foundation analysis of CMS Medicare Advantage enrollment files for March 2015. |

|||||||

| Table 2: Market Shares of Aetna and Humana in Counties in Which the Combined Enrollment of Aetna and Humana Includes At Least Half of the Medicare Advantage Market (Among counties with at least 10,000 Medicare Advantage enrollees as of March 2015) |

|||||

| State | County | Total Medicare Advantage Enrollment | Percent of Enrollees in Firm’s Plans | ||

| Aetna | Humana | Aetna-Humana Combined |

|||

| Arkansas | Benton | 11,447 | 56% | 20% | 76% |

| Arizona | Mohave | 15,339 | 54% | 1% | 55% |

| Florida | Broward | 151,997 | 55% | 9% | 64% |

| Florida | Flagler | 12,004 | 50% | 3% | 53% |

| Florida | Hillsborough | 94,334 | 48% | 6% | 53% |

| Florida | Palm Beach | 106,636 | 62% | 7% | 69% |

| Florida | Pasco | 60,336 | 47% | 2% | 50% |

| Florida | Volusia | 58,661 | 55% | 1% | 56% |

| Iowa | Polk | 12,103 | 22% | 55% | 77% |

| Illinois | Winnebago | 15,413 | 35% | 41% | 76% |

| Kansas | Johnson | 22,473 | 40% | 45% | 86% |

| Kansas | Sedgwick | 14,426 | 40% | 57% | 98% |

| Kentucky | Fayette | 13,038 | 69% | 2% | 72% |

| Kentucky | Jefferson | 39,769 | 56% | 3% | 58% |

| Louisiana | East Baton Rouge | 29,042 | 71% | 1% | 73% |

| Louisiana | Jefferson | 44,677 | 59% | 1% | 60% |

| Louisiana | Livingston | 10,020 | 78% | 0% | 78% |

| Louisiana | St. Tammany | 21,344 | 61% | 3% | 63% |

| Missouri | Greene | 22,276 | 25% | 36% | 61% |

| Missouri | Jackson | 40,693 | 45% | 35% | 80% |

| North Carolina | Gaston | 13,517 | 39% | 12% | 51% |

| Ohio | Butler | 23,968 | 31% | 23% | 54% |

| Ohio | Clark | 13,177 | 19% | 45% | 64% |

| Ohio | Clermont | 14,573 | 35% | 17% | 53% |

| Ohio | Delaware | 10,438 | 35% | 31% | 66% |

| Ohio | Franklin | 70,369 | 35% | 22% | 57% |

| Ohio | Hamilton | 50,269 | 36% | 19% | 55% |

| Ohio | Lorain | 18,927 | 30% | 27% | 57% |

| Pennsylvania | Lancaster | 36,445 | 9% | 47% | 56% |

| South Carolina | Anderson | 12,271 | 77% | 1% | 78% |

| South Carolina | Greenville | 25,729 | 63% | 1% | 64% |

| South Carolina | Spartanburg | 20,307 | 56% | 0% | 56% |

| Tennessee | Blount | 11,226 | 68% | 1% | 69% |

| Tennessee | Knox | 32,821 | 71% | 0% | 71% |

| Texas | Travis | 28,423 | 52% | 12% | 64% |

| Texas | Williamson | 16,731 | 41% | 13% | 54% |

| Virginia | Chesterfield | 10,201 | 58% | 5% | 63% |

| Virginia | Henrico | 10,226 | 60% | 4% | 64% |

| West Virginia | Kanawha | 13,620 | 64% | 18% | 82% |

|

SOURCE: Kaiser Family Foundation analysis of the CMS Medicare Advantage enrollment files for March 2015.

|

|||||

| Table 3: Medicare Advantage Market Share of the Five Firms in the 50 Counties with the Most Medicare Advantage Enrollees, 2015 | ||||||||

| State | County | Total Medicare Advantage Enrollment | Percent of Enrollees in Firm’s Plans | |||||

| Aetna | Anthem | Cigna | Humana | United-Healthcare | All Others | |||

| Arizona | Maricopa | 251,368 | 1% | 2% | 16% | 13% | 30% | 38% |

| Arizona | Pima | 87,014 | 1% | 12% | 0% | 8% | 53% | 26% |

| California | Alameda | 91,850 | 0% | 0% | 0% | 3% | 6% | 90% |

| California | Contra Costa | 80,756 | 0% | 0% | 0% | 8% | 3% | 89% |

| California | Los Angeles | 579,072 | 1% | 6% | 0% | 1% | 15% | 77% |

| California | Orange | 209,338 | 1% | 7% | 0% | 2% | 21% | 69% |

| California | Riverside | 166,613 | 3% | 2% | 0% | 7% | 19% | 70% |

| California | Sacramento | 101,377 | 0% | 0% | 0% | 1% | 14% | 84% |

| California | San Bernardino | 134,393 | 3% | 4% | 0% | 3% | 19% | 71% |

| California | San Diego | 195,134 | 2% | 2% | 0% | 2% | 32% | 62% |

| California | Santa Clara | 93,191 | 1% | 4% | 0% | 1% | 8% | 86% |

| Florida | Broward | 151,997 | 9% | 0% | 0% | 55% | 13% | 23% |

| Florida | Hillsborough | 94,334 | 6% | 1% | 0% | 48% | 20% | 25% |

| Florida | Miami-Dade | 260,533 | 7% | 7% | 17% | 28% | 24% | 17% |

| Florida | Orange | 69,567 | 1% | 1% | 0% | 39% | 14% | 45% |

| Florida | Palm Beach | 106,636 | 7% | 0% | 0% | 62% | 17% | 14% |

| Florida | Pasco | 60,336 | 2% | 0% | 0% | 47% | 18% | 32% |

| Florida | Pinellas | 101,445 | 4% | 1% | 0% | 39% | 25% | 32% |

| Florida | Polk | 62,279 | 9% | 6% | 0% | 33% | 25% | 27% |

| Florida | Volusia | 58,661 | 1% | 0% | 0% | 55% | 14% | 30% |

| Hawaii | Honolulu | 78,819 | 0% | 0% | 0% | 9% | 22% | 69% |

| Illinois | Cook | 132,940 | 4% | 0% | 11% | 32% | 29% | 24% |

| Massachusetts | Middlesex | 54,970 | 0% | 0% | 0% | 0% | 18% | 81% |

| Michigan | Oakland | 67,658 | 1% | 0% | 0% | 8% | 1% | 90% |

| Michigan | Wayne | 98,745 | 1% | 0% | 0% | 8% | 0% | 91% |

| Minnesota | Hennepin | 95,706 | 0% | 0% | 0% | 5% | 0% | 94% |

| Missouri | St. Louis | 67,505 | 27% | 2% | 0% | 4% | 35% | 32% |

| Nevada | Clark | 112,875 | 5% | 5% | 0% | 38% | 51% | 1% |

| New Mexico | Bernalillo | 54,649 | 0% | 2% | 0% | 6% | 9% | 82% |

| New York | Bronx | 99,732 | 2% | 8% | 0% | 0% | 11% | 79% |

| New York | Erie | 104,339 | 2% | 0% | 0% | 0% | 4% | 94% |

| New York | Kings | 136,552 | 4% | 9% | 0% | 0% | 18% | 69% |

| New York | Monroe | 89,841 | 7% | 0% | 0% | 0% | 10% | 84% |

| New York | Nassau | 57,586 | 4% | 35% | 0% | 1% | 13% | 47% |

| New York | New York | 89,688 | 3% | 8% | 0% | 0% | 23% | 65% |

| New York | Queens | 139,785 | 4% | 14% | 0% | 0% | 26% | 56% |

| New York | Suffolk | 55,316 | 4% | 55% | 0% | 1% | 14% | 27% |

| Ohio | Cuyahoga | 89,639 | 18% | 33% | 0% | 23% | 12% | 14% |

| Ohio | Franklin | 70,369 | 22% | 10% | 0% | 35% | 9% | 24% |

| Oregon | Multnomah | 63,484 | 0% | 0% | 0% | 2% | 14% | 84% |

| Pennsylvania | Allegheny | 154,168 | 17% | 0% | 0% | 1% | 1% | 81% |

| Pennsylvania | Philadelphia | 105,432 | 11% | 0% | 41% | 2% | 1% | 45% |

| Pennsylvania | Westmoreland | 55,381 | 24% | 0% | 0% | 1% | 0% | 75% |

| Texas | Bexar | 104,465 | 10% | 4% | 3% | 27% | 50% | 7% |

| Texas | Dallas | 86,485 | 12% | 0% | 3% | 15% | 54% | 15% |

| Texas | El Paso | 54,977 | 6% | 12% | 5% | 21% | 36% | 20% |

| Texas | Harris | 181,054 | 10% | 8% | 17% | 9% | 14% | 42% |

| Texas | Tarrant | 92,344 | 8% | 4% | 2% | 9% | 65% | 12% |

| Washington | King | 96,623 | 1% | 1% | 0% | 7% | 30% | 62% |

| Wisconsin | Milwaukee | 59,870 | 0% | 2% | 0% | 14% | 73% | 11% |

|

SOURCE: Kaiser Family Foundation analysis of CMS Medicare Advantage enrollment files for March 2015. |

||||||||