How Small Business Owners Get Health Insurance

As with any economic policy issue, there has been much discussion of how the Affordable Care Act (ACA) will affect small businesses. But, there’s been very little focus on how the health reform law will affect the owners of those businesses as people.

As our recently released Employer Health Benefits Survey shows, small businesses are much less likely than larger businesses to offer health benefits to their workers. Half of businesses with 3-9 workers and 73% of firms with 10-24 workers provide health insurance. That contrasts with 98% of firms with 200 or more workers that offer health coverage.

The workers in these firms that do not offer coverage must rely on employer-based insurance through a family member, buying insurance in the individual market (assuming they can afford the coverage and do not have a pre-existing health condition), or in many cases going uninsured.

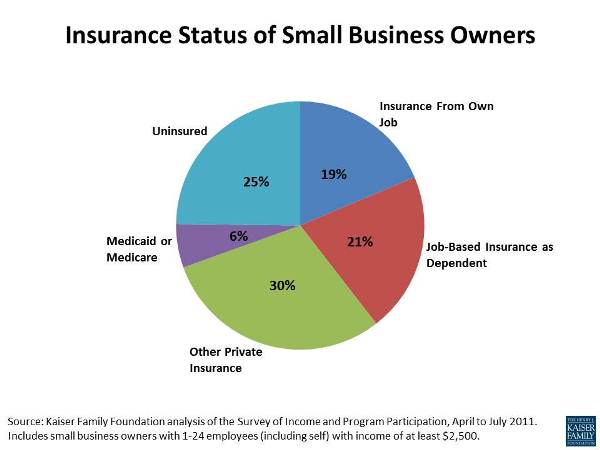

But what about the owners of these small businesses? They’re pretty much in the same boat. The following chart shows how small business owners with 1-24 employees now get insurance:

A few striking things emerge from this analysis:

- About one in four small business owners is uninsured, roughly the same as for non-elderly adults generally.

- Just 40% of small business owners get job-based insurance, either from their own job or through a family member. In contrast, almost six in ten non-elderly adults get their insurance through an employer.

- Small business owners rely heavily on the individual insurance market, with 30% of them buying “other private insurance” (the vast majority of which is coverage purchased in the individual market).

This suggests that the biggest effects the ACA will have on small business owners may not be changes in the rules for the small business insurance market, but rather the changes in the individual insurance market: guaranteed access to coverage and no premium surcharges for people with pre-existing health conditions, limits on how much premiums can vary by age, a requirement that all insurers cover a set of “essential” benefits, the creation of health insurance exchanges, the requirement to be insured, and tax credits to make premiums more affordable. In fact, an estimated 60% of small business owners now buying insurance in the individual market have incomes up to 400% of the poverty level and would be eligible for tax credits in exchanges or Medicaid, and 83% of owners who are now uninsured would be eligible for subsidized coverage (split about equally between tax credits and Medicaid).

It may be that we can gain more insight into the implications of policy issues like health reform for small business by focusing less on the businesses themselves and more on the people who own them.