Gaps in Coverage Among People With Pre-Existing Conditions

The American Health Care Act (AHCA), which has passed the House of Representatives, contains a controversial provision that would allow states to waive community rating in the individual insurance market. In this brief we estimate the number of people with pre-existing conditions who might be affected by such a policy.

How the State Waiver Provision Works

Under the provision, insurers in states with community rating waivers could vary premiums by health status for enrollees who have had a gap in insurance of 63 or more consecutive days in the last year. The higher (or lower) premiums due to health status would apply for an entire plan year (or the remainder of the year in case of people signing up during a special enrollment period), at which point enrollees would be eligible for a community-rated premium unrelated to their health.

States waiving community rating would be required to set up a mechanism to subsidize the cost of high-risk enrollees, such as a high-risk pool, or participate in a reinsurance arrangement that makes payments directly to insurers. States are not required to set up an alternative source of coverage for people who face higher premiums based on their health.

The bill makes $100 billion available to all states for a variety of purposes, including high-risk pools, reinsurance programs, and cost-sharing subsidies. An additional $15 billion is made available for a federal invisible risk-sharing program, which would be similar to a reinsurance arrangement. Another $15 billion is earmarked for spending on maternal and newborn care, mental health, and substance abuse services for the year 2020. The AHCA also allocates $8 billion over five years to states that implement community rating waivers; these resources can be used to help reduce premiums or pay out-of-pocket medical expenses for people rated based on their health status.

Premiums varied significantly based on health status in the individual market before the Affordable Care Act (ACA) prohibited that practice beginning in 2014. Insurers in nearly all states were also permitted to decline coverage to people with pre-existing conditions seeking individual market insurance. We estimate that 27% of non-elderly adults have a condition that would have led to a decline in coverage in the pre-ACA market. While insurers would have to offer insurance to everyone under the AHCA, people with declinable pre-existing conditions would likely face very large premium surcharges under an AHCA waiver, since insurers were unwilling to cover them at any price before the ACA.

How Many People Might be Affected by Community Rating Waivers?

The effect of a community rating waiver would depend crucially on how many people with pre-existing conditions have gaps in insurance that would leave them vulnerable to higher premiums.

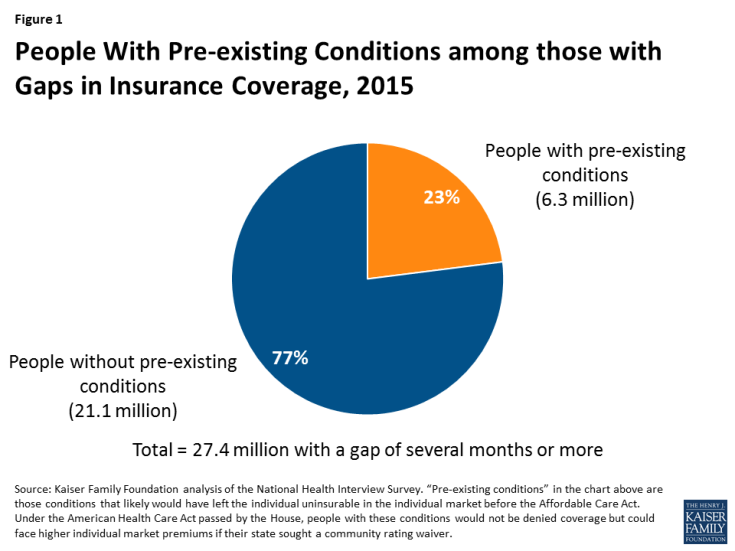

Using the most recent National Health Interview Survey (NHIS), we estimate that 27.4 million non-elderly adults nationally had a gap in coverage of at least several months in 2015. This includes 6.3 million people (or 23% of everyone with at least a several-month gap) who have a pre-existing condition that would have led to a denial of insurance in the pre-ACA individual market and would lead to a substantial premium surcharge under AHCA community rating waiver.1

Among the 21.1 million people who experienced a gap in coverage and did not have a declinable pre-existing condition, some also had pre-existing conditions (such as asthma, depression, or hypertension) that would not have resulted in an automatic denial by individual market health insurers pre-ACA but that nonetheless could also result in a premium surcharge.

In many cases, people uninsured for several months or more in a year have been without coverage for a long period of time. In other cases, people lose insurance and experience a gap as a result of loss of a job with health benefits or a decrease in income that makes coverage less affordable. Young people may have a gap in coverage as they turn 26 and are unable to stay on their parents’ insurance policies. Medicaid beneficiaries can also have a gap if their incomes rise and they are no longer eligible for the program.

Through expanded Medicaid eligibility and refundable tax credits that subsidized premium in insurance marketplaces, the ACA has substantially reduced coverage gaps. In 2013, before the major provisions of the ACA went into effect, 38.6 million people had a gap of several months, including 8.7 million with declinable pre-existing conditions.

Some people with a gap will ultimately regain coverage through an employer-based plan or Medicaid, and would not be subject to premium surcharges based on their health. However, anyone who has been uninsured for 63 days or more who tries to buy individual market insurance in a state with a community rating waiver would be subject to medical underwriting and potential premium surcharges based on their health.

Uncertainty Around the Estimate

There are a variety reasons why our estimates might understate or overstate number of people with pre-existing conditions who could be subject to premium surcharges under the AHCA.

People with health conditions would have a strong incentive under an AHCA waiver to maintain continuous coverage in order to avoid being charged premiums that could potentially price them out of the insurance market altogether. The question is how many would be able to do so, given the fact that the premium tax credits provided for in the AHCA would be 36% lower on average for marketplace enrollees than under the ACA and would grow more slowly over time. In 2013, before tax credits for individual insurance were available and the ACA’s Medicaid expansion took effect, the number of people with pre-existing conditions who experienced a gap in coverage was 41% higher. Among people with individual market insurance in 2015, we estimate that 3.8 million adults (representing 25% of all adult enrollees) had a pre-existing condition that would have led to a decline before the ACA. These individuals would not be subject to premium surcharges under AHCA community rating waivers, so long as they maintain continuous coverage. Because individual market subsidies would be significantly reduced under the AHCA, these individuals could face added challenges remaining continuously covered.

About 49% of people with pre-existing conditions who had a gap in coverage in 2015 had incomes at or below 138% of the poverty level, and some of them could be eligible for Medicaid (depending on whether their state has expanded eligibility under the ACA and what eligibility rules are in states that have not expanded). They would not face any coverage restrictions associated with their health status in Medicaid. However, under the AHCA enhanced federal funding for expanding Medicaid would be repealed, and federal matching funds would be capped. The Congressional Budget Office projects that 14 million fewer people would be enrolled in Medicaid by 2026. So, while some people we identify as having a coverage gap would be eligible for Medicaid under the AHCA, many more people currently enrolled in Medicaid would lose that coverage under the AHCA and be uninsured. They would be eligible for premium tax credits, but the AHCA’s subsidies do not scale by income so individual market insurance would likely be unaffordable for people who are poor, including those with pre-existing conditions.

There is also significant uncertainty surrounding how many states would seek to waive community rating under the AHCA. Some states might do so to roll back what they consider to be excessive regulation of the insurance market initiated by the ACA and preserved under the AHCA. Other states might come under pressure to implement waivers from insurers who believe the market would be unstable, given that the AHCA repeals the ACA’s individual mandate. What states decide to do may ultimately have the greatest effect on how many people with pre-existing conditions face potentially unaffordable insurance premiums.

Larry Levitt, Gary Claxton, Cynthia Cox, and Karen Pollitz are with the Kaiser Family Foundation. Anthony Damico is an independent consultant to the Kaiser Family Foundation.

Methods

To calculate nationwide prevalence rates of declinable health conditions, we reviewed the survey responses of nonelderly adults for all question items shown in Methods Table 1 using the CDC’s 2015 National Health Interview Survey (NHIS). Approximately 27% of 18-64 year olds, or 52 million nonelderly adults, reported having at least one of these declinable conditions in response to the 2015 survey. For more details on methods and a list of declinable conditions included in this analysis, see our earlier brief: Pre-existing Conditions and Medical Underwriting in the Individual Insurance Market Prior to the ACA.

The programming code, written using the statistical computing package R, is available upon request for people interested in replicating this approach for their own analysis.

Endnotes

Note that coverage gaps identified in NHIS do not match up precisely to the 63-day threshold in the AHCA. People who were uninsured at the time they were surveyed were asked if they had been uninsured for at least the prior six months, a longer period than the AHCA threshold. People who were insured at the time of the survey were asked if they had experienced any gaps in coverage totaling at least three months during the past year. These coverage gaps identified in NHIS may not have been consecutive months, but that would typically be the case.