2015 Employer Health Benefits Survey

Abstract

This annual survey of employers provides a detailed look at trends in employer-sponsored health coverage including premiums, employee contributions, cost-sharing provisions, and employer opinions. The 2015 survey included almost 2,000 interviews with non-federal public and private firms.

Annual premiums for employer-sponsored family health coverage reached $17,545 this year, up 4 percent from last year, with workers on average paying $4,955 towards the cost of their coverage, according to the Kaiser Family Foundation/Health Research & Education Trust 2015 Employer Health Benefits Survey. The 2015 survey includes information on the use of incentive for employer wellness programs, plan cost-sharing as well as firm offer rate. Survey results are released here in a variety of ways, including a full report with downloadable tables on a variety of topics, summary of findings, and an article published in the journal Health Affairs.

News Release

- A news release announcing the publication of the 2015 Employer Health Benefits Survey is available here.

Summary of Findings

- The Summary of Findings provides an overview of the 2015 survey results and is available under the Summary of Findings section.

Full Report

- The complete Employer Health Benefits Survey Report includes over 200 exhibits and is available under the Report section. The Report section contains 14 separate sections. Users can view each section separately or download the section exhibits from the bottom of the respective section page.

Health Affairs

- The peer-reviewed journal Health Affairs has published an article with key findings from the 2015 survey: Health Benefits in 2015: Stable Trends in the Employer Market.

Web Briefing

- Coming soon: On Tuesday September 22, 2015, the Kaiser Family Foundation and the Health Research & Educational Trust (HRET) held a reporters-only web briefing to release the 2015 Employer Health Benefits Survey.

Interactive Graphic

- This graphing tool allows users to look at changes in premiums and worker contributions for covered workers at different types of firms over time: Premiums and Worker Contributions Among Workers Covered by Employer-Sponsored Coverage, 1999-2015.

Key Exhibits – Chartpack

- Over twenty overview slides from the 2015 Employer Health Benefits Survey are available as a slideshow or PDF.

Additional Resources

- Standard errors for selected estimates are available in the Technical Supplement here.

- Employer Health Benefits Surveys from 1998-2014 are available here. Please note that historic survey reports have not been revised with methodological changes.

- Researchers may request for a public use dataset by going to Contact Us and choosing “TOPIC: Health Costs.”

Researchers at the Kaiser Family Foundation, NORC at the University of Chicago, and Health Research & Educational Trust designed and analyzed the survey.

Summary Of Findings

Employer-sponsored insurance covers over half of the non-elderly population, 147 million people in total.1 To provide current information about employer-sponsored health benefits, the Kaiser Family Foundation (Kaiser) and the Health Research & Educational Trust (HRET) conduct an annual survey of private and nonfederal public employers with three or more workers. This is the seventeenth Kaiser/HRET survey and reflects employer-sponsored health benefits in 2015.

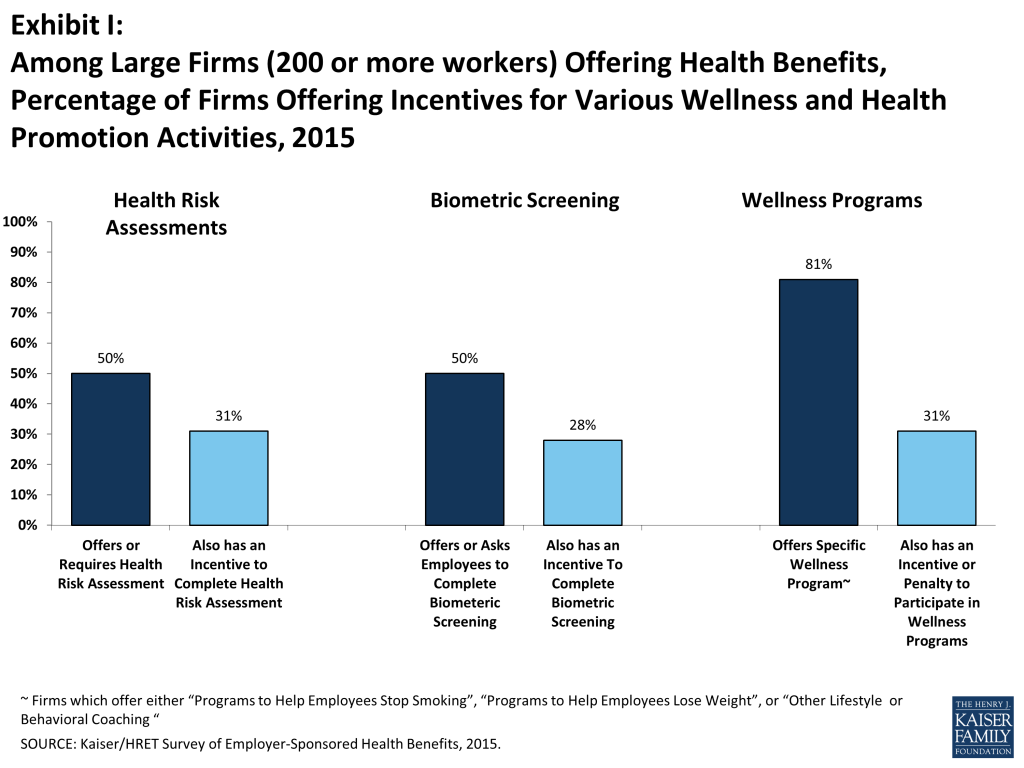

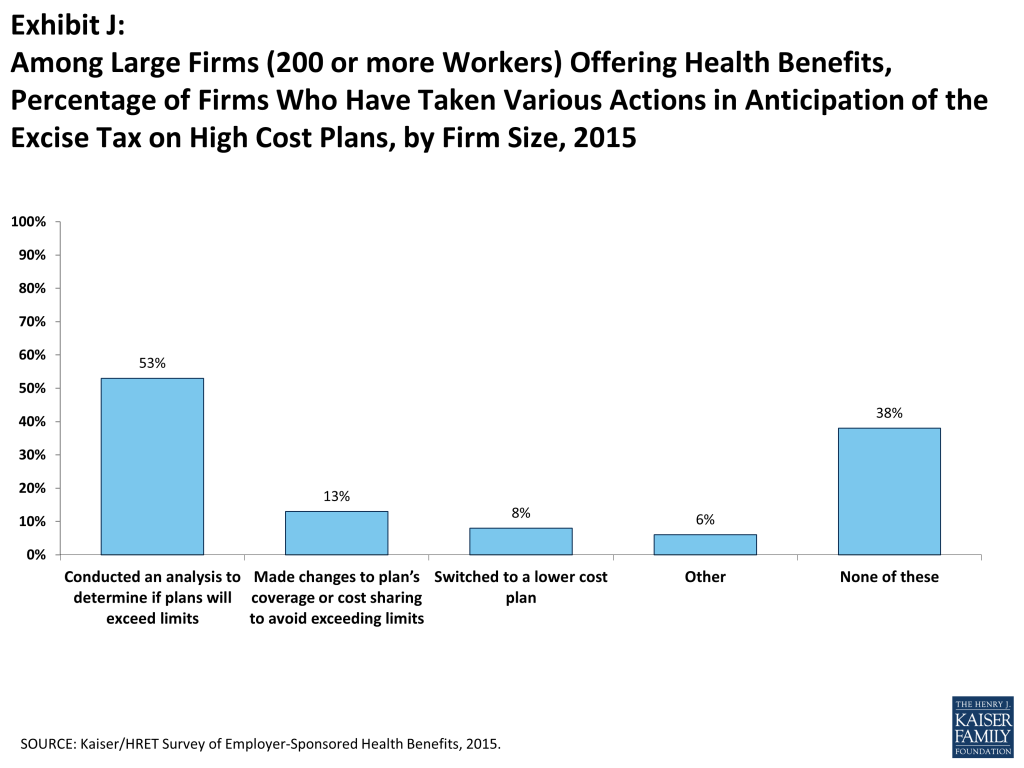

The key findings from the survey, conducted from January through June 2015, include a modest increase (4%) in the average premiums for both single and family coverage in the past year. The average annual single coverage premium is $6,251 and the average family coverage premium is $17,545. The percentage of firms that offer health benefits to at least some of their employees (57%) and the percentage of workers covered at those firms (63%) are statistically unchanged from 2014. Relatively small percentages of employers with 50 or more full-time equivalent employees reported switching full-time employees to part time status (4%), changing part-time workers to full-time workers (10%), reducing the number of full-time employees they intended to hire (5%) or increasing waiting periods (2%) in response to the employer shared responsibility provision which took effect for some firms this year. Employers continue to be interested in programs addressing the health and behaviors of their employees, such as health risk assessments, biometric screenings, and health promotion and wellness programs. Meaningful numbers of employers which offer one of these screening programs now offer incentives to employees who complete them; 31% of large firms offering health benefits provide an incentive to complete a health risk assessment and 28% provide an incentive to complete a biometric screening. A majority of large employers (200 or more workers) (53%) have analyzed their health benefits to see if they would be subject to the high-cost plan tax when it takes effect in 2018, with some already making changes to their benefit plans in response to the tax.

HEALTH INSURANCE PREMIUMS AND WORKER CONTRIBUTIONS

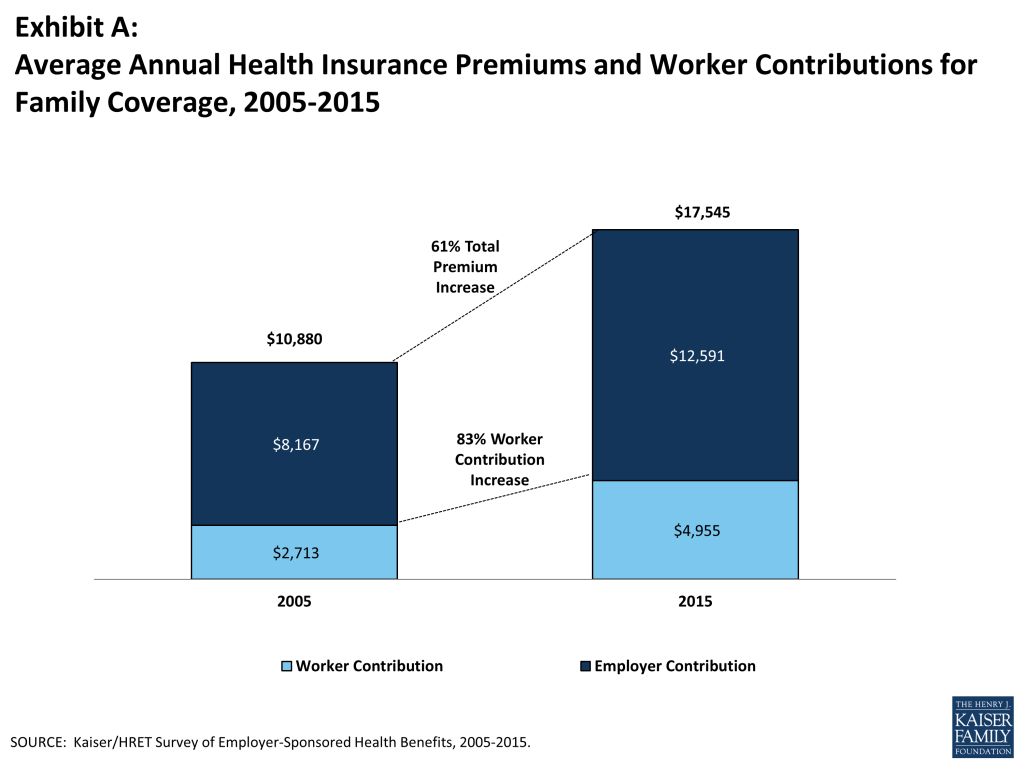

In 2015, the average annual premiums for employer-sponsored health insurance are $6,251 for single coverage and $17,545 for family coverage (Exhibit A). Each rose 4% over the 2014 average premiums. During the same period, workers’ wages increased 1.9% and inflation declined by 0.2%.2 Premiums for family coverage increased 27% during the last five years, the same rate they grew between 2005 and 2010 but significantly less than they did between 2000 to 2005 (69%) (Exhibit B).

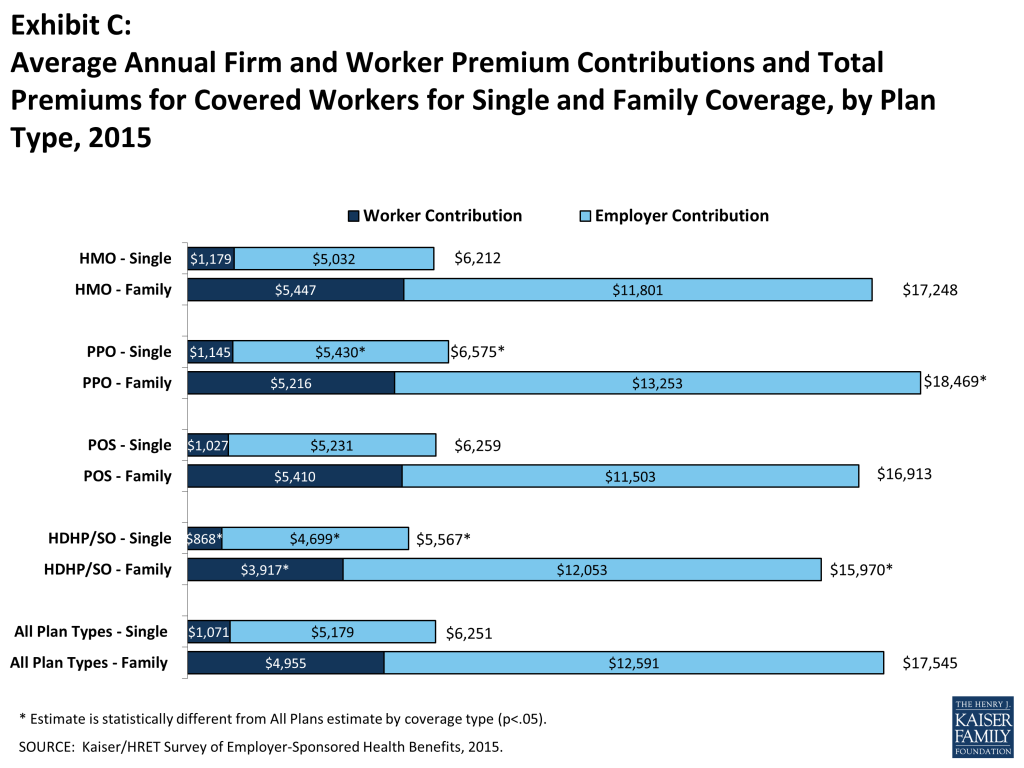

Average premiums for high-deductible health plans with a savings option (HDHP/SOs) are lower than the overall average for all plan types for both single and family coverage (Exhibit C), at $5,567 and $15,970, respectively. The average premium for family coverage is lower for covered workers in small firms (3-199 workers) than for workers in large firms (200 or more workers) ($16,625 vs. $17,938).

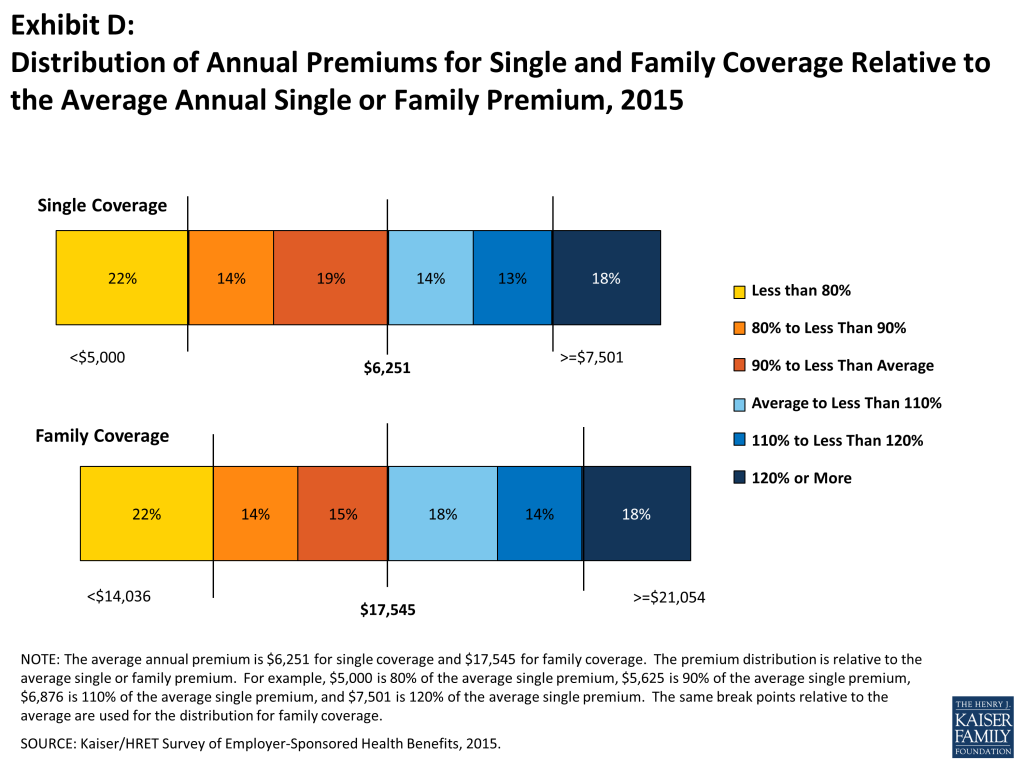

As a result of differences in benefits, cost sharing, covered populations, and geographical location, premiums vary significantly around the averages for both single and family coverage. Eighteen percent of covered workers are in plans with an annual total premium for family coverage of at least $21,054 (120% or more of the average family premium), and 22% of covered workers are in plans where the family premium is less than $14,036 (less than 80% of the average family premium). The distribution is similar around the average for single coverage premiums (Exhibit D).

Employers generally require that workers make a contribution towards the cost of the premium. Covered workers contribute on average 18% of the premium for single coverage and 29% of the premium for family coverage, the same percentages as 2014 and statistically similar to those reported in 2010. Workers in small firms contribute a lower average percentage for single coverage compared to workers in large firms (15% vs. 19%), but they contribute a higher average percentage for family coverage (36% vs. 26%). Workers in firms with a higher percentage of lower-wage workers (at least 35% of workers earn $23,000 a year or less) contribute higher percentages of the premium for family coverage (41% vs. 28%) than workers in firms with a smaller share of lower-wage workers.

As with total premiums, the share of the premium contributed by workers varies considerably. For single coverage, 61% of covered workers are in plans that require them to make a contribution of less than or equal to a quarter of the total premium, 2% are in plans that require more than half of the premium, and 16% are in plans that require no contribution at all. For family coverage, 44% of covered workers are in plans that require them to make a contribution of less than or equal to a quarter of the total premium and 15% are in plans that require more than half of the premium, while only 6% are in plans that require no contribution at all (Exhibit E). Employers use different strategies to structure their employer contributions; 45% of small employers offering health benefits indicated that they contribute the same dollar amount for family coverage as single coverage, 34% contributed a larger dollar amount for family than single coverage, and 18% used some other approach.

Looking at the dollar amounts that workers contribute, the average annual premium contributions in 2015 are $1,071 for single coverage and $4,955 for family coverage. Covered workers’ average dollar contribution to family coverage has increased 83% since 2005 and 24% since 2010 (Exhibit A). Workers in small firms have lower average contributions for single coverage than workers in large firms ($899 vs. $1,146), but higher average contributions for family coverage ($5,904 vs. $4,549). Workers in firms with a higher percentage of lower-wage workers have higher average contributions for family coverage ($6,382 vs. $4,829) than workers in firms with lower percentages of lower-wage workers.

PLAN ENROLLMENT

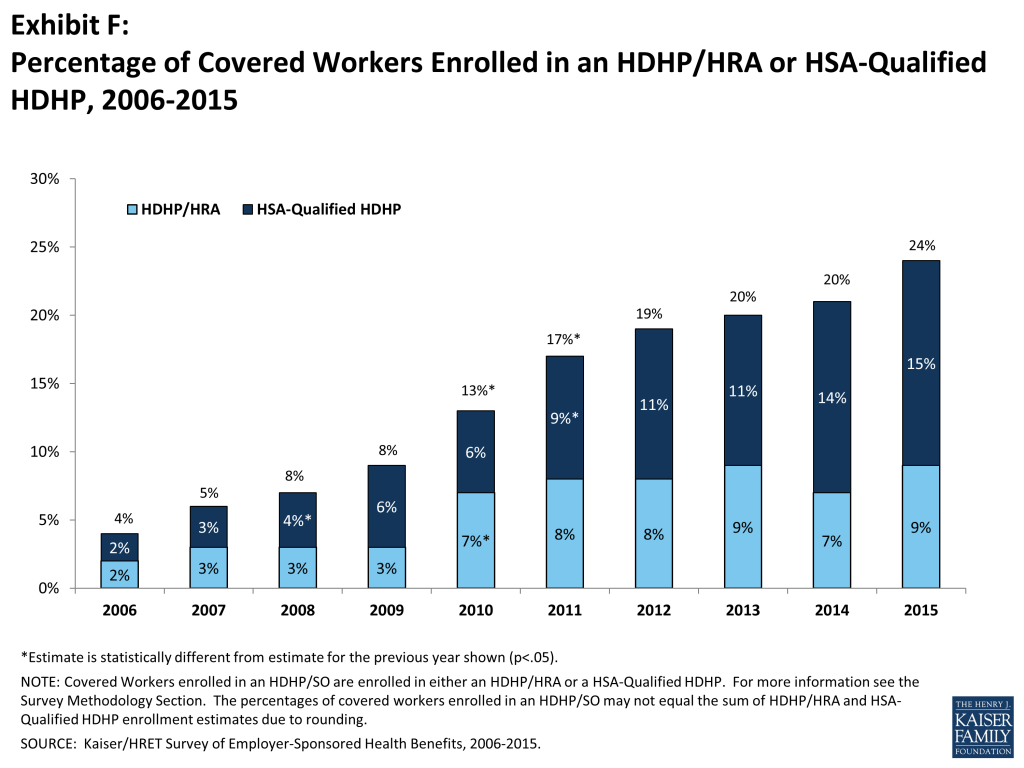

PPO plans remain the most common plan type, enrolling 52% of covered workers in 2015, although a smaller percentage than 2014. Twenty-four percent of covered workers are enrolled in a high-deductible plan with a savings options (HDHP/SO), 14% in an HMO, 10% in a POS plan, and 1% in a conventional (also known as an indemnity) plan (Exhibit F). Enrollment distribution varies by firm size; for example, PPOs are relatively more popular for covered workers at large firms than small firms (56% vs. 41%) and POS plans are relatively more popular among small firms than large firms (19% vs. 6%).

Almost a quarter (24%) of covered workers are enrolled in HDHP/SOs in 2015; enrollment in these plans has increased over time from 13% of covered workers in 2010. In 2015, 7% of firms offering health benefits offered a high-deductible health plan with a health reimbursement arrangement (HDHP/HRA), and 20% offered a health savings (HSA) qualified HDHP.

EMPLOYEE COST SHARING

Most covered workers face additional out-of-pocket costs when they use health care services. Eighty-one percent of covered workers have a general annual deductible for single coverage that must be met before most services are paid for by the plan. Even workers without a general annual deductible often face other types of cost sharing when they use services, such as copayments or coinsurance for office visits and hospitalizations.

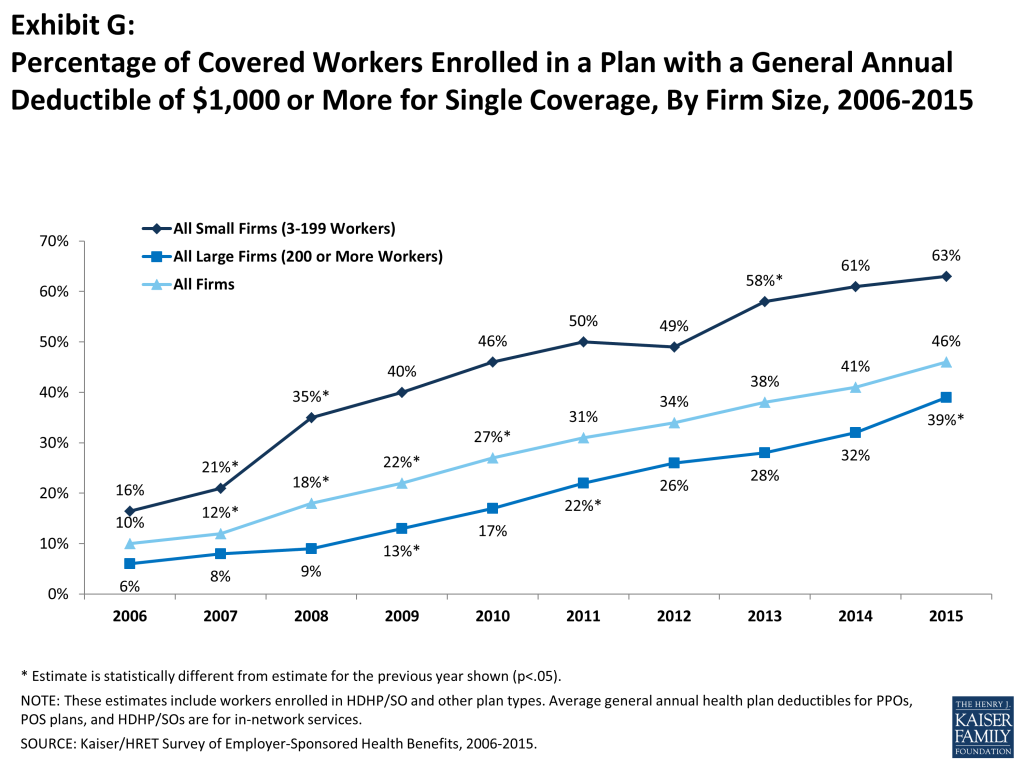

Among covered workers with a general annual deductible, the average deductible amount for single coverage is $1,318. The average annual deductible is similar to last year ($1,217), but has increased from $917 in 2010. Deductibles differ by firm size; for workers in plans with a deductible, the average deductible for single coverage is $1,836 in small firms, compared to $1,105 for workers in large firms. Sixty-three percent of covered workers in small firms are in a plan with a deductible of at least $1,000 for single coverage compared to 39% in large firms; a similar pattern exists for those in plans with a deductible of at least $2,000 (36% for small firms vs. 12% for large firms) (Exhibit G).

Looking at the increase in deductible amounts over time does not capture the full impact for workers because the share of covered workers in plans with a general annual deductible also has increased significantly, from 55% in 2006 to 70% in 2010 to 81% in 2015. If we look at the change in deductible amounts for all covered workers (assigning a zero value to workers in plans with no deductible), we can look at the impact of both trends together. Using this approach, the average deductible for all covered workers in 2015 is $1,077, up 67% from $646 in 2010 and 255% from $303 in 2006.

A large majority of workers also have to pay a portion of the cost of physician office visits. Almost 68% of covered workers pay a copayment (a fixed dollar amount) for office visits with a primary care or specialist physician, in addition to any general annual deductible their plan may have. Smaller shares of workers pay coinsurance (a percentage of the covered amount) for primary care office visits (23%) or specialty care visits (24%). For in-network office visits, covered workers with a copayment pay an average of $24 for primary care and $37 for specialty care. For covered workers with coinsurance, the average coinsurance for office visits is 18% for primary and 19% for specialty care. While the survey collects information only on in-network cost sharing, it is generally understood that out-of-network cost sharing is higher.

Virtually all (99%) covered workers are enrolled in a plan that covers some prescription drugs. Cost sharing for filling a prescription usually varies with the type of drug – for example, whether it is a generic, brand-name, or specialty drug – and whether the drug is considered preferred or not on the plan’s formulary. These factors result in each drug being assigned to a tier that represents a different level, or type, of cost sharing. Eighty-one percent of covered workers are in plans with three or more tiers of cost sharing. Twenty-three percent of covered workers are enrolled in a plan with four or more cost sharing tiers compared to 13% in 2010. Copayments are the most common form of cost sharing for tiers one through three. Among workers with plans with three or more tiers, the average copayments in these plans are $11 for first tier drugs, $31 for second tier drugs, $54 for third tier drugs, and $93 for fourth tier drugs. HDHP/SOs have a somewhat different cost sharing pattern for prescription drugs than other plan types; just 61% of covered workers are enrolled in a plan with three or more tiers of cost sharing, 12% are in plans that pay the full cost of prescriptions once the plan deductible is met, and 22% are in a plan with the same cost sharing for all prescription drugs.

Most covered workers with drug coverage are enrolled in a plan which covers specialty drugs such as biologics (94%). Large employers have used a variety of strategies for containing the cost of specialty drugs including utilization management programs (31%), step therapies where enrollees must first try alternatives (30%) and tight limits on the number of units administered at a single time (25%).

Twelve percent of covered workers enrolled in a plan with prescription drug coverage are enrolled in a plan with a separate annual drug deductible that applies only to prescription drugs. Among these workers, the average separate annual deductible for prescription drug coverage is $231. Five percent of covered workers are enrolled in a plan with an annual deductible for prescription drug coverage of $500 or more.

Most workers also face additional cost sharing for a hospital admission or an outpatient surgery episode. After any general annual deductible is met, 65% of covered workers have a coinsurance and 14% have a copayment for hospital admissions. Lower percentages have per day (per diem) payments (4%), a separate hospital deductible (2%), or both copayments and coinsurance (11%). The average coinsurance rate for hospital admissions is 19%. The average copayment is $308 per hospital admission, the average per diem charge is $281, and the average separate annual hospital deductible is $1,006. The cost sharing provisions for outpatient surgery are similar to those for hospital admissions, as most covered workers have either coinsurance (67%) or copayments (15%). For covered workers with cost sharing, for each outpatient surgery episode, the average coinsurance is 19% and the average copayment is $181.

Almost all (98%) covered workers are in plans with an out-of-pocket maximum for single coverage, significantly more than the 88% in 2013. While almost all workers have an out-of-pocket limit, the actual dollar limits differ considerably. For example, among covered workers in plans that have an out-of-pocket maximum for single coverage, 13% are in plans with an annual out-of-pocket maximum of $6,000 or more, and 9% are in plans with an out-of-pocket maximum of less than $1,500.

AVAILABILITY OF EMPLOYER-SPONSORED COVERAGE

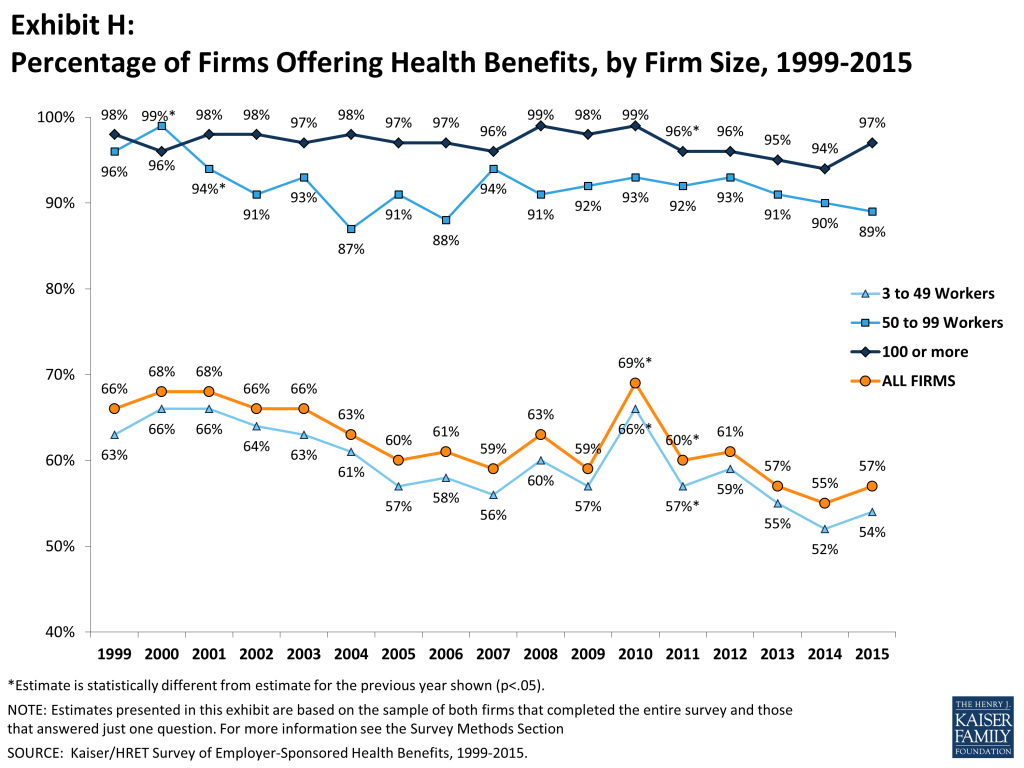

Fifty-seven percent of firms offer health benefits to their workers, statistically unchanged from 55% last year and 60% in 2005 (Exhibit H). The likelihood of offering health benefits differs significantly by size of firm, with only 47% of employers with 3 to 9 workers offering coverage, but virtually all employers with 1,000 or more workers offering coverage to at least some of their employees. Ninety percent of workers are in a firm that offers health benefits to at least some of its employees, similar to 2014 (90%).

Even in firms that offer health benefits, not all workers are covered. Some workers are not eligible to enroll as a result of waiting periods or minimum work-hour rules. Other workers do not enroll in coverage offered to them because of the cost of coverage or because they are covered through a spouse. Among firms that offer coverage, an average of 79% of workers are eligible for the health benefits offered by their employer. Of those eligible, 79% take up their employer’s coverage, resulting in 63% of workers in offering firms having coverage through their employer. Among both firms that offer and those that do not offer health benefits, 56% of workers are covered by health plans offered by their employer, similar to 2014 (55%).

Beginning in 2015, employers with at least 100 full-time equivalent employees (FTEs) must offer health benefits to their full-time workers that meet minimum standards for value and affordability or pay a penalty. The requirement applies to employers with 50 or more FTEs beginning in 2016. Of firms reporting at least 100 FTEs (or, if they did not know FTEs, of firms with at least 100 employees), 96% report that they offer one health plan that would meet these requirements, two percent did not and three percent reported “don’t know.” Five percent of these firms reported that this year they offered more comprehensive benefits to some workers who previously were only offered a limited benefit plan. Twenty-one percent reported that they extended eligibility to groups of workers not previously eligible because of the employer shared responsibility provision.

We asked firms reporting 50 or more FTEs (or, if they did not know how many FTEs, firms with at least 50 employees) about changes to their workforce in response to the employer requirement. Four percent reported that they changed some job classifications from full-time to part-time so employees would not be eligible for health benefits while 10% reported changing some job classifications from part-time to full-time so that they would become eligible. Four percent also reported reducing the number of full-time employees that they intended to hire because of the cost of health benefits.

RETIREE COVERAGE

Twenty-three percent of large firms that offer health benefits in 2015 also offer retiree health benefits, similar to the percentage in 2014 (25%). Among large firms that offer retiree health benefits, 92% offer health benefits to early retirees (workers retiring before age 65), 73% offer health benefits to Medicare-age retirees, and 2% offer a plan that covers only prescription drugs. Employers offering retiree benefits report interest in new ways of delivering them. Among large firms offering retiree benefits, seven percent offer them through a private exchange and 26% are considering changing the way they offer retiree coverage because of the new health insurance exchanges established by the ACA.

WELLNESS, HEALTH RISK ASSESSMENTS AND BIOMETRIC SCREENINGS

Health Risk Assessment. Employers continue to offer programs that encourage employees to identify health issues and to manage chronic conditions. A majority of larger employers now offer health screening programs including health risk assessments, which are questionnaires asking employees about lifestyle, stress or physical health, and in-person examinations such as biometric screenings. Some employers have incentive programs that reward or penalize employees for a range of activities including participating in wellness programs or meeting biometric outcomes.

Fifty percent of large employers offering health benefits provide employees with an opportunity or require employees to complete a health risk assessment. A health risk assessment includes questions about medical history, health status, and lifestyle, and is designed to identify the health risks of the person being assessed. Large firms are more likely than small firms to offer an opportunity or require employees to complete a health risk assessment (50% vs. 18%). Among firms with a health risk assessment, 62% of large firms report that they provide incentives to employees that complete the assessment. There is significant variation in the percentage of employees that complete a health risk assessment among firms; 27% of large firms with a health risk assessment report that more than three-quarters of employees complete the screening while 41% report that a quarter or less complete it.

Biometric Screening. Fifty percent of large firms and 13% of small firms offering health benefits ask or offer employee the opportunity to complete a biometric screening. Biometric screening is a health examination that measures an employee’s risk factors such as body weight, cholesterol, blood pressure, stress, and nutrition. Among large firms with biometric screening programs, 56% offer employees incentives to complete a biometric screening. Among firms with a biometric screening program and an incentive to complete it, 20% have a reward or penalty for meeting specified biometric outcomes such as achieving a target body mass index (BMI) or cholesterol level. The maximum financial value for meeting biometric outcomes ranges considerably across these firms: 16% have a maximum annual incentive of $150 or less and 28% have a maximum annual incentive of more than $1,000.

Wellness Programs. Many employers offer wellness or health promotion programs to improve their employees’ health. Eighty-one percent of large employers (200 or more workers) and 49% of small employers offer employees programs to help them stop smoking, lose weight, or make other lifestyle or behavioral changes. Of firms offering health benefits and a wellness program, 38% of large firms and 15% of small firms offer employees a financial incentive to participate in or complete a wellness program. Among large firms with an incentive to participate in or complete a wellness program, 27% of firms believe that incentives are “very effective” at encouraging employees to participate (Exhibit I).

Disease management programs. Disease management programs try to improve the health and reduce the costs for enrollees with chronic conditions. Thirty-two percent of small employers and 68% of large employers offer disease management programs. Among firms with disease management programs, eight percent of large firms and 24% of firms with 5,000 or more workers offer a financial incentive to employees who participate.

PROVIDER NETWORKS

High Performance or Tiered Networks. Seventeen percent of employers offering health benefits have high performance or tiered networks in their largest health plan. These programs identify providers that are more efficient or have higher quality care, and may provide financial or other incentives for enrollees to use the selected providers. Firms with 1,000-4,999 workers are more likely to have a largest plan that includes a high performance or tiered network (33%) than firms in other size categories.

Narrow Networks. Some employers limit their provider networks to reduce the cost of the plan. Nine percent of employers reported that their plan eliminated hospitals or a health system to reduce cost and 7% offer a plan considered a narrow network plan. These plans typically have a provider network more limited than the standard HMO network.

Telemedicine. Telemedicine includes exchanging heath information electronically, including through smart phones or webcasts in order to improve a patient’s health. The largest health plan at 27% of large firms (2oo or more workers) offering health benefits covers telemedicine.

OTHER TOPICS

Pre-Tax Premium Contributions. Thirty-seven percent of small firms and 90% of large firms have a plan under section 125 of the Internal Revenue Service Code (sometimes called a premium-only plan) to allow employees to use pre-tax dollars to pay for a share of health insurance premiums.

Flexible Spending Accounts. Seventeen percent of small firms and 74% of large firms offer employees the option of contributing to a flexible spending account (FSA). FSAs permit employees to make pre-tax contributions that may be used during the year to pay for eligible medical expenses. The Affordable Care Act put some additional limits on FSAs, including capping the amount that could be contributed in a year ($2,550 in 2015) and limits on the use of FSA dollars for non-prescribed over the counter medications and premiums.3 Three percent of firms not offering health benefits offered an FSA in 2015.

Waiting Periods and Enrollment. With exceptions for orientation periods and variable hour employees, the ACA limits waiting periods to no more than 90 days for all group health plans.4 The average waiting period for covered workers who face a waiting period decreased from 2.1 months in 2014 to 2 months in 2015. The provision of the Affordable Care Act requiring employers with 200 or more full-time employees to automatically enroll eligible new full-time employees in one of the firm’s health plans after any waiting period has not yet taken effect. In 2015, 13% of large employers (200 or more workers) and 42% of small employers automatically enroll eligible employees.

Self-Funding. Seventeen percent of covered workers at small firms and 83% of covered workers at large firms are enrolled in plans that are either partially or completely self-funded. Overall, 63% of covered workers are enrolled in a plan that is either partially or completely self-funded, 60% of whom are covered by additional insurance against high claims, sometimes known as stop loss coverage. The percentage of covered workers at both small and large firms in self-funded plans is similar to the percentage reported in 2010.

Private Exchanges. Private exchanges are arrangements created by consultants, brokers or insurers that allow employers to offer their employees a choice of different benefit options, often from different insurers. While these arrangements are fairly new, 17% of firms with more than 50 employees offering health benefits say they are considering offering benefits through a private exchange. Twenty-two percent of employers with 5,000 or more employees are considering this option. Enrollment to this point has been modest: 2% of covered workers in firms with more than 50 employees are enrolled in a private exchange.

Professional Employment Organization. Some firms provide for health and other benefits by entering into a co-employment relationship with a Professional Employer Organization (PEO). Under this arrangement, the firm manages the day-to-day responsibilities of employees but the PEO hires the employees and acts as the employer for insurance, benefits, and other administrative purposes. Five percent of employers offering health benefits with between 3 and 499 workers offer coverage through a PEO.

Grandfathered Health Plans. The ACA exempts “grandfathered” health plans from a number of its provisions, such as the requirements to cover preventive benefits without cost sharing or the new rules for small employers’ premiums ratings and benefits. An employer-sponsored health plan can be grandfathered if it covered a worker when the ACA became law (March 23, 2010) and if the plan has not made significant changes that reduce benefits or increase employee costs.5 Thirty-five percent of firms offering health benefits offer at least one grandfathered health plan in 2015. Twenty-five percent of covered workers are enrolled in a grandfathered health plan in 2015.

EXCISE TAX ON HIGH-COST HEALTH PLANS

Beginning in 2018, employer health plans will be will be subject to an excise tax of 40% on the amount by which their cost exceeds specified thresholds ($10,200 for single coverage and $27,000 for family coverage in 2018).6 The tax is calculated with respect to each employee based on the combinations of health benefits received by that employee, including the employer and employee share of health plan premiums (or premium equivalents for self-funded plans), FSA contributions, and employer contributions to health savings accounts and health reimbursement arrangement contributions. Fifty-three percent of large firms (200 or more workers) offering health benefits have conducted an analysis to determine if they will exceed the 2018 thresholds, with 19% of these firms saying that their largest health plan would exceed the 2018 threshold. A small percentage of large employers offering health benefits report that they already have made changes to their plans’ coverage or cost-sharing requirements (13%) or switched to a lower cost plan (8%) in response to the anticipated tax (Exhibit J).

CONCLUSION

The continuing implementation of the ACA has brought about a number of changes for employer-based coverage, ranging from benefits changes (such as the requirement to cover certain preventive care without cost sharing or have an out-of-pocket limit) to the requirement for larger employers to offer coverage to their full-time workers or face financial penalties. Even with these new requirements, most market fundamentals have stayed consistent with prior trends, suggesting that the implementation has not caused significant disruption for most market participants. Premiums for single and family coverage increased by 4% in 2015, continuing a fairly long period (2005 to 2015) where annual premium growth has averaged about 5%. The percentage of employers offering coverage (57%) is similar to recent years,7 as is the percentage of workers in offering firms covered by their own employer (63%). The offer and coverage rates have been declining very gradually since we have been doing the survey, with the current values generally below those we saw prior to 2005.

The stability we have seen over the last several years does not mean that no changes are occurring. Employers continue to focus on wellness and health promotion and extend their programs to assess health risk; here programs that collect personal health information and provide financial incentives for employees to undertake health programs or meet biometric targets have the potential to significantly alter how people with employer-based coverage interact with their health plan. Employers, particularly large employers, continue to show interest in private exchanges, although enrollment to date is not very large. If these exchanges succeed, they have the potential to move some of the decision-making about benefits away from employers, which could transform how employees and employers interact over benefits.

While the ACA has not transformed the market, changes are occurring and more are likely to come. Some employers report that they have modified job classifications in reaction to the employer requirement to offer benefits, with more reporting that they increased the number of jobs with full-time status than decreasing it. Additionally, five percent of large employers (200 or more workers) reported that they intend to reduce the number of full-time employees that they intend to hire because of the cost of providing health care benefits. Employers also are considering the potential impacts that the high-cost plan tax may have on their health benefits, with small percentages already taking action to lower plan costs. Over a longer period, the high-cost plan tax has the potential to cause significant changes in employer-sponsored coverage as employers and workers look for ways to keep cost increases to inflation far below the even moderate premium increases we have seen in recent years.

Whether the period of moderate premium growth will continue as the economy improves is one the biggest questions facing the employer market. Higher costs tend to follow improvements in economic growth,8 and recent increases in spending for health services will put upward pressure on premiums.9 At the same time, concerns about the high-cost plan tax will have employers and insurers looking for savings. These competing pressures may well lead to plan changes such as tighter networks, stricter management and higher cost sharing as employers and insurers struggle to contain these higher costs.

METHODOLOGY

The Kaiser Family Foundation/Health Research & Educational Trust 2015 Annual Employer Health Benefits Survey (Kaiser/HRET) reports findings from a telephone survey of 1,997 randomly selected public and private employers with three or more workers. Researchers at the Health Research & Educational Trust, NORC at the University of Chicago, and the Kaiser Family Foundation designed and analyzed the survey. National Research, LLC conducted the fieldwork between January and June 2015. In 2015, the overall response rate is 42%, which includes firms that offer and do not offer health benefits. Among firms that offer health benefits, the survey’s response rate is also 41%.

We asked all firms with which we made phone contact, even if the firm declined to participate in the survey: “Does your company offer a health insurance program as a benefit to any of your employees?” A total of 3,191 firms responded to this question (including the 1,997 who responded to the full survey and 1,194 who responded to this one question). Their responses are included in our estimates of the percentage of firms offering health coverage. The response rate for this question is 67%.

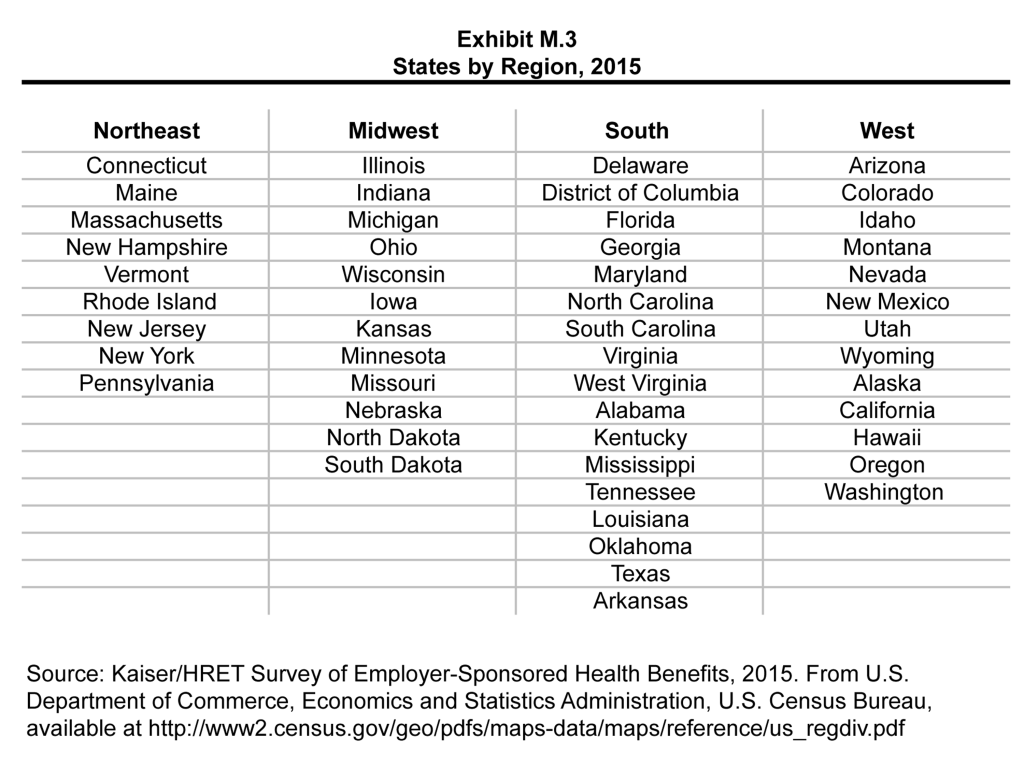

Since firms are selected randomly, it is possible to extrapolate from the sample to national, regional, industry, and firm size estimates using statistical weights. In calculating weights, we first determine the basic weight, then apply a nonresponse adjustment, and finally apply a post-stratification adjustment. We use the U.S. Census Bureau’s Statistics of U.S. Businesses as the basis for the stratification and the post-stratification adjustment for firms in the private sector, and we use the Census of Governments as the basis for post-stratification for firms in the public sector. Some numbers in the report’s exhibits do not sum up to totals because of rounding effects, and, in a few cases, numbers from distribution exhibits referenced in the text may not add due to rounding effects. Unless otherwise noted, differences referred to in the text and exhibits use the 0.05 confidence level as the threshold for significance.

For more information on the survey methodology, please visit the Methodology section at http://ehbs.kff.org/.

The Kaiser Family Foundation, a leader in health policy analysis, health journalism and communication, is dedicated to filling the need for trusted, independent information on the major health issues facing our nation and its people. The Foundation is a non-profit private operating foundation based in Menlo Park, California.

The Health Research & Educational Trust (HRET) is a private, not-for-profit organization involved in research, education, and demonstration programs addressing health management and policy issues. Founded in 1944, HRET, an affiliate of the American Hospital Association, collaborates with health care, government, academic, business, and community organizations across the United States to conduct research and disseminate findings that help shape the future of health care.

Report: Section One: Cost Of Health Insurance

The average annual premiums in 2015 are $6,251 for single coverage and $17,545 for family coverage. The average single and family premiums increased 4% in the last year. The average family premium has increased 61% since 2005 and 27% since 2010. The average family premium for workers in small firms (3-199 workers) ($16,625) is significantly lower than average family premiums for workers in larger firms (200 or more workers) ($17,938).

Premium Costs for Single and Family Coverage

- The average premium for single coverage in 2015 is $521 per month, or $6,251 per year. The average premium for family coverage is $1,462 per month or $17,545 per year 1.

- The average annual premiums for covered workers in HDHP/SOs are lower for single ($5,567) and family coverage ($15,970) than the overall average premiums for covered workers. The average premiums for covered workers enrolled in PPO plans are higher for single ($6,575) and family coverage ($18,469) than the overall plan average. Average annual premiums for HMOs and POS plans are similar to the overall average premiums for covered workers 1.

- The average annual premium for family coverage for covered workers in small firms (3-199 workers) ($16,625) is lower than the average premium for covered workers in large firms (200 or more workers) ($17,938) 2.

- Average single and family premiums for covered workers are higher in the Northeast ($6,631 and $19,074) and lower in the South ($6,052 and $16,985) than the average premiums for covered workers in all other regions 3.

- Average family premiums for covered workers employed in the retail industry ($15,801) are lower than the average premiums for covered workers in all other industries. The average family premium for covered workers employed in the health care industry is higher than the average premium for covered workers in all other industries ($19,200) 4.

- Covered workers in firms where 35% or more of the workers are age 26 or younger have lower average family premiums ($16,125) than covered workers in firms where a lower percentage of workers are age 26 or younger ($17,649) 6.

- Covered workers in firms with a large percentage of lower-wage workers (at least 35% of workers earn $23,000 per year or less) have lower average single and family premiums ($5,606 and $16,182) than covered workers in firms with a smaller percentage of lower-wage workers ($6,307 and $17,665). Covered workers in firms with a large percentage of higher-wage workers (at least 35% of workers earn $58,000 per year or more) have higher average family premiums ($18,130) than covered workers in firms with a smaller percentage of higher-wage workers ($16,923) 5 and 6.

- Covered workers in firms with some union workers have higher average premiums for single coverage and family coverage($6,508 and $18,305) than covered workers in firms without any union workers ($6,123 and $17,164).

The Distribution of Premiums

- There is considerable variation in premiums for both single and family coverage.

- Eighteen percent of covered workers are employed by firms that have a single coverage premium at least 20% higher than the average single premium, while 22% of covered workers are in firms that have a single premium less than 80% of the average single premium 7 and 8.

- For family coverage, 18% of covered workers are employed in a firm that has a family premium at least 20% higher than the average family premium, and another 22% of covered workers are in firms that have a family premium less than 80% of the average family premium 7 and 8.

- Six percent of covered workers enrolled in single coverage are in a plan with a premium of $9,000 a year or more, nearly 50% more expensive than the national average 9. Eight percent of covered workers enrolled in family coverage are in a plan with a premium of $24,000 a year or more 10.

Premium Changes Over Time

- The 2015 average single and family coverage premiums are four percent higher than the 2014 average premiums 11.

- The $17,545 average annual family premium in 2015 is 27% higher than the average family premium in 2010 and 61% higher than the average family premium in 2005 11. The 27% premium growth in the last five years (2010 to 2015) is significantly smaller than the 69% premium growth seen between 2000 and 2005 16.

- Premiums for both small and large firms have seen a similar increase since 2010 (25% for small and 28% for large). For small firms (3 to 199 workers), the average family premium rose from $13,250 in 2010 to $16,625 in 2015. For large firms (200 or more workers), the average family premium rose from $14,038 in 2010 to $17,938 in 2015 13.

- The rate of growth for small firms and large firms since 2005 has been similar. Since 2005, premiums for small firms (3 to 199 workers) have increased 57% ($16,625 in 2015 vs. $10,587 in 2005), and premiums for large firms have increased 63% ($17,938 in 2015 vs. $11,025 in 2005) 13.

- For large firms (200 or more workers), the average family premium for covered workers in firms that are fully insured has grown at a similar rate to premiums for workers in fully or partially self-funded firms from 2010 to 2015 (22% for fully insured plans and 29% for self-funded firms) 17.

- The average family premium for self-funded plans is higher in 2015 than in 2014 ($17,939 vs. $17,229) 17.

Report: Section Two: Health Benefits Offer Rates

While nearly all large firms (200 or more workers) offer health benefits to at least some employees, small firms are significantly less likely to do so. The percentage of all firms offering health benefits in 2015 (57%) is not statistically different from the percentage of firms that offered health benefits in 2005 when 60% of firms offered coverage to at least some employees. Firms not offering health benefits continue to cite “cost” as the most important reason they do not do so. Almost all firms that offer coverage offer coverage to dependents such as children and the spouses of eligible employees.

- In 2015, 57% of firms offer health benefits, not statistically different from the 55% who reported doing so in 2014 1.

- Ninety-eight percent of large firms (200 or more workers) offer health benefits to at least some of their workers 3. In contrast, only 56% of small firms (3 to 199 workers) offer health benefits in 2015. The percentage of both small and large firms offering health benefits to at least some of their workers is similar to last year 2.

- Since most firms in the country are small, variation in the overall offer rate is driven primarily by changes in the percentages of the smallest firms (3 to 9 workers) offering health benefits. For more information on the distribution of firms in the country, see the Survey Design and Methods Section and Exhibit M1.10

- Ninety-seven percent of firms with 100 or more employees offered health benefits to at least some of their employees in 2015. Eighty-nine percent of firms with between 50 and 99 workers offered benefits to at least some workers 5. The percentage of firms offering health benefits in each of these firm size categories is similar to last year.

- Over the 1999 to 2015 period, there has been a statistically significant decrease in the percentage of firms offering health benefits. This decline is due to changes in offer rates for small firms.

- Offer rates vary across different types of firms.

- Smaller firms are less likely to offer health insurance: 47% of firms with 3 to 9 workers offer coverage, compared to 63% of firms with 10 to 24 workers, 82% of firms with 25 to 49 workers, and 92% of firms with 50 to 199 employees 3.

- Offer rates throughout different firm size categories in 2015 remained similar to those reported in 2014 2.

- Firms with fewer lower-wage workers (less than 35% of workers earn $23,000 or less annually) are significantly more likely to offer health insurance than firms with many lower-wage workers (55% vs. 28%) 4. The offer rate for firms with many lower-wage workers is not significantly different from the 33% reported in 2014.

- We observe a similar pattern among firms with many higher-wage workers (35% or more of workers earn $58,000 or more annually) being more likely to offer coverage to employees (70% versus 45%) 4.

- The age of the workforce correlates with the probability of a firm offering health benefits. Firms where 35% or more of their workers are age 26 or younger are less likely to offer health benefits than firms where less than 35% of workers are age 26 or younger (25% and 55%, respectively) 4. The percentage of firms with many younger workers that offer health benefits is similar to the 30% reported in 2014.

Part-Time and Temporary Workers

- Among firms offering health benefits, relatively few offer benefits to their part-time and temporary workers.

- The Affordable Care Act defines part-time workers as those who on average work fewer than 30 hours per week. The employer shared responsibility provision of the Affordable Care Act requires that large firms offer full-time employees a minimum standard of coverage or be assessed a penalty11 . Beginning this year, we modified the survey to explicitly ask employers whether they offered benefits to employees working fewer than 30 hours. Our previous question did not include a definition of “part-time”. For this reason, historical data on part-time offer rates are shown but we did not test whether the differences between 2014 and 2015 were significant. Many employers may work with multiple definitions of part-time; one for their compliance with legal requirements and another for internal policies and programs.

- In 2015, 19% of all firms that offer health benefits offer them to part-time workers 6. Firms with 200 or more workers are more likely to offer health benefits to part-time employees than firms with 3 to 199 workers (35% vs. 18%) 9.

- Among firms offering health benefits to at least some employees, relatively few report that they stopped offering benefits to part-time workers in the last year (2%) 7.

- A small percentage (3%) of firms offering health benefits offer them to temporary workers 8. More large firms (200 or more workers) offering health benefits elect to offer temporary workers coverage than small firms (11% vs. 3%) 10.

Spouses, Dependents and Domestic Partner Benefits

- The vast majority of firms offering health benefits offer benefits to spouses and dependents, such as children. In 2015, 98% of small firms (3 to 199 workers) and 100% of large firms offering health benefits offer coverage to spouses. Similarly, 96% of small firms and 100% of large firms offering health benefits cover other dependents, such as children. Two percent of small firms offering health benefits do not offer coverage to any dependents 11.

- This year we asked employers whether same-sex and opposite-sex domestic partners were allowed to enroll in a firm’s coverage. While definitions may vary, employers often define domestic partners as an unmarried couple who have lived together for a specified period of time. Firms may define domestic partners separately from any legal requirements a state may have, and also, employers may have a different policy in different parts of the country. Employers were asked these questions during the survey’s fielding period from January 2015 to the beginning of June 2015. Some employers may elect to change their policies for offering same-sex and opposite-sex domestic partner benefits following recent judicial decisions.

- In 2015, 28% of firms offering health benefits offered coverage to unmarried opposite-sex partners, similar to the 39% who did so in 2014. In 2015, 42% of firms offering benefits covered same-sex domestic partners, similar to the 39% who did so last year 13.

- The rates at which firms have offered domestic partner benefits have increased over a longer period of time. For example, in 2015, 39% of firms offering health benefits offered coverage to same-sex domestic partners, a significant increase from the 21% that did so in 2009 13.

- When we ask employers if they offer health benefits to opposite or same-sex domestic partners, many firms report that they have not encountered this issue. At many small firms (3 to 199 workers), the firm may not have formal human resource policies on domestic partners simply because none of the firm’s employees have asked to cover a domestic partner. Regarding health benefits for opposite-sex domestic partners, 30% of firms report in 2015 that they have not encountered this need or that the question was not applicable. The vast majority of firms in the United States are small businesses; 61% of firms have between 3 and 9 employees and 98% have between 3 and 199 employees (Exhibit M.1). Therefore, statistics about the percentage of firms that offer domestic partner benefits are largely determined by small businesses. More small firms (31%) compared to large firms (3%) indicate that they have not encountered this need or that the question was not applicable 12. Regarding health benefits for same-sex domestic partners, 32% of firms report that they have not encountered the need or that the question was not applicable. More small firms (32%) than large firms (5%) report that they have not encountered the issue of offering benefits to same-sex domestic partners 12.

Firms Not Offering Health Benefits

- The survey asks firms that do not offer health benefits if they have offered insurance or shopped for insurance in the recent past, and about their most important reasons for not offering coverage. Because such a small percentage of large firms report not offering health benefits, we present responses for small non-offering firms (3 to 199 workers) only.

- The cost of health insurance remains the primary reason cited by firms for not offering health benefits. Among small firms (3-199 workers) not offering health benefits, 41% cite high cost as “the most important reason” for not doing so, followed by “employees are generally covered under another plan” (26%) 14. Relatively few employers indicate that they did not offer because they believe that employees will get a better deal on the health insurance exchanges (4%).

- Many non-offering small firms have either offered health benefits in the past five years, or shopped for alternative coverage options recently.

- Twenty-five percent of non-offering small firms (3 to 199 workers) have offered health benefits in the past five years, while 27% have shopped for coverage in the past year 15. The 25% of non-offering small firms which have offered coverage in the past five years is similar to the 18% reported last year.

- Among non-offering small firms (3 to 199 workers), 17% report that they provide funds to their employees to purchase health insurance through the individual, also known as the non-group, market, such as on an individual health insurance marketplace 16. The percentage of small firms (3 to 199 workers) offering funds to purchase non-group coverage is significantly higher than last year (7%). The IRS has issued guidance limiting the circumstances in which employers can contribute to an employee’s non-group plan going forward12 . Thirty-five percent of small firms that do not offer health benefits but provide employees funds to purchase coverage on the non-group market reported that they started providing funds in the last year.

- Small firms (3 to 199 workers) not offering health insurance gave a variety of estimates regarding the amount they believe the firm could afford to pay for health insurance for an employee with single coverage. Thirty-five percent reported that they could pay less than $100 per month; 14% reported that they could pay $400 or more per month 17. Alternatively, 23% of small firms not offering health benefits believed that their employees could afford less than $100 a month for single coverage. Twelve percent of firms not offering health benefits believed that their employees could afford more than $400 or more per month 18.

- Small firms (3 to 199 workers) not offering health benefits were asked to estimate the percentage of their employees who had coverage from another source. Employees could have a variety of other coverage options including a spouse’s plan, a public plan such as Medicaid, coverage through the health insurance exchanges or another employer’s plan. Fifty-eight percent of small employers estimated that three quarters or more of their employees were covered by another source of coverage 19.

SHOP Exchanges

The Small Business Health Options Program (SHOP) is federal or state sponsored exchanges in which employers may offer and contribute to health insurance provided to their employees. In 2015, firms with 50 or fewer full-time equivalents are eligible to participate in a SHOP exchange. Some employers are eligible for tax credits when purchasing coverage on the exchanges.

- Seventeen percent of firms with 3 to 5o full-time equivalents who do not offer health benefits said they considered purchasing coverage on a SHOP exchange 20.

- Among non-offering firms with 5o or fewer full-time equivalents that chose not to purchase coverage on a SHOP exchange, 64% reported they did not do so because the plans were too expensive 21.

Report: Section Three: Employee Coverage, Eligibility, And Participation

Employers are the principal source of health insurance in the United States, providing health benefits for about 147 million non-elderly people in America.13 Most workers are offered health coverage at work, and the majority of workers who are offered coverage take it. Workers may not be covered by their own employer for several reasons: their employer may not offer coverage, they may be ineligible for the benefits offered by their firm, they may elect to receive coverage through their spouse’s employer, or they may refuse coverage from their firm. Before eligible employees may enroll, almost three-quarters (74%) of covered workers face a waiting period, although the average length of waiting periods for covered workers with waiting periods has decreased in each of the last two years.

- Among firms offering health benefits, 63% percent of workers are covered by health benefits through their own employer 2.

- When considering both firms that offer health benefits and those that do not, 56% of workers are covered under their employer’s plan 1.

- The coverage rates at both offering and non-offering firms has decreased over time for workers at small firms (3 to 199 workers) from 50% in 2005 to 45% in 2015. The coverage rate for large firms is statically unchanged from 66% in 2005 to 63% in 2015 1.

Eligibility

- Not all employees are eligible for the health benefits offered by their firm, and not all eligible employees “take up” (i.e., elect to participate in) the offer of coverage. The share of workers covered in a firm is a product of both the percentage of workers who are eligible for the firm’s health insurance and the percentage that choose to take up the benefit. The percentage of workers eligible for health benefits at offering firms in 2015 is similar to last year for both small firms (3 to 199 workers) and large firms 6.

- Seventy-nine percent of workers in firms offering health benefits are eligible for the coverage offered by their employer 2.

- Eligibility varies considerably by wage level. Employees in firms with a lower proportion of low-wage workers (less than 35% of workers earn $23,000 or less annually) are more likely to be eligible for health benefits than employees in firms with a higher proportion of low-wage workers (81% vs. 65%). We observe a similar pattern among firms with many high-wage workers (35% or more of workers earn $58,000 or more annually) (89% vs. 72%) 3.

- Eligibility also varies by the age of the workforce. Those in firms with fewer younger workers (less than 35% of workers are age 26 or younger) are more likely to be eligible for health benefits than those in firms with many younger workers (82% vs. 54%) 3.

Take-up Rate

- Employees who are offered health benefits generally elect to take up the coverage. In 2015, 79% of eligible workers take up coverage when it is offered to them, similar to 80% last year 6.14

- The likelihood of a worker accepting a firm’s offer of coverage also varies with the workforce’s wage level. Eligible employees in firms with a lower proportion of low-wage workers are more likely to take up coverage (80%) than eligible employees in firms with a higher proportion of low-wage workers (35% or more of workers earn $23,000 or less annually) (71%). Similar patterns exist in firms with a larger proportion of higher-wage workers, with workers in these firms being more likely to take up coverage than those in firms with a smaller share of high-wage workers (82% vs. 76%) 4.

- Ninety percent of workers at public employers who offer health benefits take up coverage. 4.

Coverage

- The percentage of workers at firms offering health benefits that are covered by their firms’ health plan in 2015 is 63%. The coverage rate at firms offering health benefits is similar to last year for both small firms (3 to 199 workers) and large firms 6.

- There is significant variation by industry in the coverage rate among workers in firms offering health benefits. For example, only 34% of workers in retail firms offering health benefits are covered by the health benefits offered by their firm, compared to 77% of workers in finance, and 79% of workers in the transportation/communications/utilities industry category 2.

- Among workers in firms offering health benefits, those in firms with fewer low-wage workers (less than 35% of workers earn $23,000 or less annually) are more likely to be covered by their own firm than workers in firms with many low-wage workers (65% vs. 46%). A comparable pattern exists in firms with a larger proportion of high-wage workers (35% or more earn $58,000 or more annually) offering health benefits (73% vs. 55%) 5.

- Among workers in firms offering health benefits, those in firms with fewer younger workers (less than 35% of workers are age 26 or younger) are more likely to be covered by their own firm than those in firms with many younger workers (66% vs.39%) 5.

- Five percent of large firms (200 or more workers) and less than 1% of small firms indicated that they started offering a more comprehensive benefit plan in 2015 to some workers who were previously only eligible for a limited benefit plan 7.

Waiting Periods

- Waiting periods are a specified length of time after beginning employment before employees are eligible to enroll in health benefits. With some exceptions, the Affordable Care Act requires that waiting periods cannot exceed 90 days.15 For example, employers are permitted to have orientation periods before the waiting period begins which, in effect, means an employee is not eligible for coverage 3 months after hire. If an employee is eligible to enroll on the 1st of the month, after three months of employment, this survey “rounds-up” and considers the firm’s waiting period four months. For these reasons, some employers still have waiting periods exceeding the 90 day maximum.

- The percentage of covered workers who face a waiting period is similar to last year 10.

- Seventy-four percent of covered workers face a waiting period before coverage is available. Covered workers in small firms (3 to 199 workers) are more likely than those in large firms to have a waiting period (81% vs. 71%) 8.

- The average waiting period among covered workers who face a waiting period is 2 months 8. While 22% of covered workers face a waiting period of 3 months or more, workers in small firms (3 to 199 workers) generally have longer waiting periods than workers in large firms 9.

Auto Enrollment

The Affordable Care Act requires that employers with 200 or more workers automatically enroll eligible full-time workers in their health benefits after any waiting periods. The implementation of this provision has been delayed by the Department of Labor rules.16

- In 2015, 13% of large employers (200 or more workers) indicated that they automatically enrolled employees after any waiting periods are met 11.

- Small employers (3 to 199 workers) were more likely than large firms to automatically enroll eligible employees after any waiting periods (42% vs. 13%) 11.

Single Coverage Enrollment

- Covered workers in small firms (3 to 99 workers) are more likely to be enrolled in single coverage than covered workers in large firms (54% vs. 44%) 12.

Report: Section Four: Types Of Plans Offered

Most firms that offer health benefits offer only one type of health plan (83%) (see text box). Large firms (200 or more workers) are more likely to offer more than one type of health plan than small firms. Employers are most likely to offer their workers a PPO or HDHP/SO plan and are least likely to offer a conventional plan (sometimes known as indemnity insurance).

- Eighty-three percent of firms offering health benefits in 2015 offer only one type of health plan. Large firms (200 or more workers) are more likely to offer more than one plan type than small firms (3 to 199 workers) (48% vs. 16%) 1.

- In addition to looking at the percentage of firms that offer multiple plan types, the percentage of covered workers at firms that offer multiple plan types can also be analyzed. Over half (55%) of covered workers are employed in a firm that offers more than one health plan type. Sixty-eight percent of covered workers in large firms are employed by a firm that offers more than one plan type, compared to 24% in small firms 2.

- Nearly three quarters (72%) of covered workers in firms offering health benefits work in firms that offer one or more PPO plans; 51% work in firms that offer one or more HDHP/SOs; 32% work in firms that offer one or more HMO plans; 16% work in firms that offer one or more POS plans; and 2% work in firms that offer one or more conventional plans 4.17

- Among firms offering only one type of health plan, large firms are more likely to offer PPO plans than small firms (73% vs. 43%), while small firms are more likely to offer HMO (10%) and POS (19%) plans than large firms (2% and 5%, respectively) 5.

- Among firms offering only one type of health plan, 23% of covered workers are in firms that only offer an HDHP/SO 5.

The survey collects information on a firm’s plan with the largest enrollment in each of the plan types. While we know the number of plan types a firm has, we do not know the total number of plans a firm offers workers. In addition, firms may offer different types of plans to different workers. For example, some workers might be offered one type of plan at one location, while workers at another location are offered a different type of plan.

HMO is health maintenance organization.

PPO is preferred provider organization.

POS is point-of-service plan.

HDHP/SO is high-deductible health plan with a savings option such as an HRA or HSA.

Report: Section Five: Market Shares Of Health Plans

Enrollment remains highest in PPO plans, covering just over half of covered workers, followed by HDHP/SOs, HMO plans, POS plans, and conventional plans. Enrollment distribution varies by firm size: for example, PPOs are relatively more popular for covered workers at large firms (200 or more workers) than small firms (56% vs. 41%) and POS plans are relatively more popular among small firms than large firms (19% vs. 6%). While enrollment in HDHP/SO plans (24%) is statistically unchanged from 2014 (20%), it has increased from 13% in 2010. Enrollment in PPOs declined significantly from 58% in 2014 to 52% in 2015.

- Fifty-two percent of covered workers are enrolled in PPOs, followed by HDHP/SOs (24%), HMOs (14%), POS plans (10%), and conventional plans (1%) 1. More workers are enrolled in HDHP/SO plans than in HMOs in both small firms (3 to 199 workers) and large firms 2.

- The percentage of covered workers enrolled in HDHP/SOs in both large firms (200 or more workers) and small firms is similar to last year. Enrollment in HDHP/SOs increased significantly from 2009 to 2012 1.

- Enrollment in HDHP/SOs is higher for covered workers employed at firms with many low-wage workers (at least 35% of workers earn $23,000 per year or less) than firms with fewer low-wage workers. Enrollment in HDHP/SOs is similar between large firms (200 or more workers) and small firms 2.

- Enrollment in HMOs is similar to 2014, but declined significantly from 3 years ago (16% in 2012) and 5 years ago (20% in 2009). PPO enrollment declined to just 52% after many years of growth or steady enrollment.

- Plan enrollment patterns vary by firm size. Workers in large firms (200 or more workers) are more likely than workers in small firms to enroll in PPOs (56% vs. 41%). Workers in small firms are more likely than workers in large firms to enroll in POS plans (19% vs. 6%) 2.

- Plan enrollment patterns also differ across regions.

- HMO enrollment is significantly higher in the West (23%) and significantly lower in the South (10%) and Midwest (7%) 3.

- Workers in the South (58%) are more likely to be enrolled in PPOs than workers in other regions; workers in the West (44%) are less likely to be enrolled in a PPO 3.

- Enrollment in HDHP/SOs is higher among workers in the Midwest (30%) than in all other regions 3.

- Plan enrollment patterns differ by industry as well.

- Covered workers in the state/local government industry (10%) and health care (18%) are significantly less likely to be enrolled in an HDHP/SO plan than covered workers in other industries 3.

Report: Section Six: Worker And Employer Contributions For Premiums

Premium contributions by covered workers average 18% for single coverage and 29% for family coverage.18 The average monthly worker contributions are $89 for single coverage ($1,071 annually) and $413 for family coverage ($4,955 annually). On average, covered workers contribute the same percentage of the premium in 2015 as they did in 2014 for both single and family coverage. There continue to be important differences by firm size and other firm characteristics: covered workers in small firms (3-199 workers) contribute a lower percentage of the premium for single coverage (15% vs. 19%) but a much higher percentage of the premium for family coverage than covered workers in large firms (200 or more employees) (36% vs. 26%).

- In 2015, covered workers on average contribute 18% of the premium for single coverage and 29% of the premium for family coverage, the same percentages reported in both 2014 and 2013 1. These contributions have remained stable since 2010 for both single and family coverage.

- On average, workers with single coverage contribute $89 per month ($1,071 annually), and workers with family coverage contribute $413 per month ($4,955 annually) towards their health insurance premiums. Both are similar to the amounts reported in 2014 2, 3, and 4.

- The average worker contribution in HDHP/SOs is lower than the overall average worker contributions for single coverage ($868 vs. $1,071) and family coverage ($3,917 vs. $4,955) 5.

- In addition to differences between plan types, there are differences in worker contributions by type of firm. As in previous years, workers in small firms (3-199 workers) contribute a lower amount annually for single coverage than workers in large firms (200 or more workers) ($899 vs. $1,146). In contrast, workers in small firms with family coverage contribute significantly more annually than workers in large firms ($5,904 vs. $4,549) 8.

- The average family contribution for covered workers enrolled in small firms is less than the average family contribution at large firms within each plan type 10.

- The average worker contribution for single coverage is similar to last year for both small firms (3-199 workers) and large firms 6 and 7.

Variation in Worker Contributions to the Premium

- There is a great deal of variation in worker contributions to premiums.

- Twenty-nine percent of covered workers contribute $1,500 or more annually (140% or more of the average worker contribution) for single coverage, while 15% of covered workers have an annual worker contribution of less than $643 (less than 60% of the average worker contribution) 15.

- For family coverage, 21% of covered workers contribute $6,936 or more annually (140% or more of the average worker contribution), while 20% of covered workers have an annual worker contribution of less than $2,973 (less than 60% of the average worker contribution) 15.

- The majority of covered workers are employed by a firm that contributes at least half of the premium for single and family coverage.

- Sixteen percent of covered workers with single coverage and 6% of covered workers with family coverage work for a firm that pays 100% of the premium 16.

- Covered workers in small firms (3-199 workers) are more likely to work for a firm that pays 100% of the premium for single coverage than workers in large firms (200 or more workers). Thirty-five percent of covered workers in small firms have an employer that pays the full premium for single coverage, compared to 7% of covered workers in large firms 17. For family coverage, 16% of covered workers in small firms have an employer that pays the full premium, compared to 1% of covered workers in large firms 18.

- Three percent of covered workers in small firms (3-199 workers) and 2% of covered workers in large firms (200 or more workers) contribute more than 50% of the premium for single coverage 17. For family coverage, 32% of covered workers in small firms work in a firm where they must contribute more than 50% of the premium, compared to 8% of covered workers in large firms 18.

Differences by Firm Characteristics

- The percentage of the premium paid by covered workers varies by several firm characteristics.

- For family coverage, covered workers in firms with many lower-wage workers (35% or more earn $23,000 or less annually) contribute a greater percentage of the premium than those in firms with fewer lower-wage workers (41% vs. 28%) 21. Covered workers in firms with many higher-wage workers (35% or more earn $58,000 or more a year) contribute less on average than those in firms with a lower proportion of higher-wage workers (26% vs. 33%).

- Twenty-nine percent of covered workers at firms with many lower-wage workers pay more than 50% of the premium for family coverage, in contrast to 14% at firms with fewer lower-wage workers 19.

- Looking at dollar amounts, covered workers in firms with many lower-wage workers (35% or more earn $23,000 or less annually) on average contribute $6,382 for family coverage versus $4,829 for covered workers in firms with fewer lower-wage workers 13.

- Covered workers with family coverage in firms that have at least some union workers contribute a significantly lower percentage of the premium than those in firms without any unionized workers (23% vs. 32%) 21.

- For workers with family coverage in large firms (200 or more workers), the average percentage contribution for workers in firms that are partially or completely self-funded is lower than the average percentage contributions for workers in firms that are fully insured (25% vs. 32%) 21. 19

- Covered workers in private for profit firms contribute a significantly higher percentage of the premium for single coverage (19%) than do workers in private not-for-profit firms (16%) and public organizations such as state or local governments (12%) 20.

Contribution Approaches

- Among firms offering health benefits with fewer than 20 employees, 12% contribute different dollar amounts toward premiums for different employees 26. Employers may contribute different amounts to different employees based on a variety of reasons, including workers’ age, smoking status, seniority, job title or location.

- Among small firms (3-199 workers) offering health benefits, 45% indicate that they contribute the same dollar amount for single coverage as family coverage. In contrast, over a third (35%) of small firms report that they contribute a higher dollar amount for workers enrolled in family coverage than in single coverage 27.

Changes over Time

- The amount that workers contribute to single coverage premiums has increased 76% since 2005 and 19% since 2010. Covered workers’ contributions to family coverage have increased 83% since 2005 and 24% since 2010. Over the last five years, the average worker contributions for single and family coverage have risen at a similar rate.

- Over the last ten years, the average employer contribution to both single coverage and family coverage premiums has risen faster than the average employee contribution.

- Over the last ten years, the average worker contribution for family coverage has risen at a similar rate for large firms (200 or more workers) and small firms (83% and 86% respectively).

- The average worker contribution for family coverage has risen at a similar rate for firms with many lower-wage workers (35% or more earn $23,000 or less annually) and those with fewer lower-wage workers over the past ten years (86% and 80%, respectively).

Report: Section Seven: Employee Cost Sharing

In addition to any required premium contributions, most covered workers face cost sharing for the medical services they use. Cost sharing for medical services can take a variety of forms, including deductibles (an amount that must be paid before most services are covered by the plan), copayments (fixed dollar amounts), and/or coinsurance (a percentage of the charge for services). The type and level of cost sharing often vary by the type of plan in which the worker is enrolled. Cost sharing may also vary by the type of service, such as office visits, hospitalizations, or prescription drugs.

The cost-sharing amounts reported here are for covered workers using services provided in-network by participating providers. Plan enrollees receiving services from providers that do not participate in plan networks often face higher cost sharing and may be responsible for charges that exceed plan allowable amounts. The framework of this survey does not allow us to capture all of the complex cost-sharing requirements in modern plans, particularly for ancillary services (such as durable medical equipment or physical therapy) or cost-sharing arrangements that vary across different settings (such as tiered networks). Therefore, we do not collect information on all plan provisions and limits that affect enrollee out-of-pocket liability.

General Annual Deductibles For Workers in Plans with Deductibles

- A general annual deductible is an amount that must be paid by enrollees before most services are covered by their health plan. Non-grandfathered health plans are required to cover some services such as preventive care without cost sharing. Some plans require enrollees to meet a service-specific deductible such as on prescription drugs or hospital admissions in lieu of or in addition to a general deductible.

- Eighty-one percent of covered workers are enrolled in a plan with a general annual deductible for single coverage, similar to 80% in 2014. Since 2010, the percentage of covered workers with a general annual deductible for single coverage has increased from 70% to 81% 2.

- The percentage of covered workers enrolled in a plan for single coverage without a general annual deductible is similar for small firms (3-199 workers) and large firms (18% and 19%) 1.

- The likelihood of having a deductible varies by plan type. Workers in HMOs are less likely to have a general annual deductible for single coverage than workers in other plan types. Fifty-eight percent of workers in HMOs do not have a general annual deductible for single coverage, compared to 28% of workers in POS plans and 15% of workers in PPOs 1. The percentage of workers enrolled in HMO plans with a general annual deductible for single coverage has increased from 28% in 2010 to 42% in 2015 2.

- Workers in firms with many lower-wage workers (35% or more earning $23,000 or less annually) have higher average general annual deductibles for single coverage than workers in firms with fewer such workers ($1,667 vs. $1,288) 3.

- Workers without a general annual deductible often have other forms of cost sharing for medical services. For workers without a general annual deductible with single coverage, 77% in HMOs, 80% in PPOs, and 75% in POS plans are in plans that require cost sharing for hospital admissions. The percentages are similar for family coverage 4.

- The dollar amounts of general annual deductibles vary greatly by plan type and firm size.

- The average annual deductible for single coverage for covered workers in a plan with a deductible is $1,318. However, average deductibles vary considerably by plan type. The average annual deductibles for single coverage among covered workers with a deductible are $1,025 for HMOs, $958 for PPOs, $1,230 for POS plans, and $2,099 for HDHP/SOs 5.

- Deductibles for single coverage generally are higher for covered workers in small firms (3-199 workers) than for covered workers in large firms (200 or more workers) across plan types. For example, for covered workers in PPOs with a general annual deductible, the average deductible amount for single coverage in small firms is more than twice as large as the average deductible amount in large firms ($1,516 vs. $775). Overall, for covered workers in plans with a general annual deductible, the average deductible amount for single coverage in small firms (3-199 workers) is higher than the average deductible amount in large firms ($1,836 vs. $1,105) 5.

- The average general annual deductible for single coverage for covered workers in plans with a deductible has increased significantly over time. The average deductible for covered workers with a deductible is similar to last year, but significantly higher than $917 in 2010 7.

- There is considerable variation in the dollar values of general annual deductibles for workers at different firms. For example, 27% of covered workers enrolled in a PPO plan with a general annual deductible for single coverage have a deductible of less than $500 while 11% have a deductible of $2,000 or more 11.

- For family coverage, the majority of workers with general annual deductibles have an aggregate deductible, meaning all family members’ out-of-pocket expenses count toward meeting the deductible amount. Among those with a general annual deductible for family coverage, the percentage of covered workers with an average aggregate general annual deductible is 56% for workers in HMOs, 62% for workers in PPOs, 77% for workers in POS plans and 82% for workers in HDHP/SOs 13.