Early Insights from Commonwealth Coordinated Care: Virginia’s Demonstration to Integrate Care and Align Financing for Dual Eligible Beneficiaries

Executive Summary

Virginia is among the early states to launch a 3-year capitated financial alignment demonstration to integrate Medicare and Medicaid payments and care for beneficiaries who are dually eligible for Medicare and Medicaid. This report describes the early implementation of Virginia’s capitated demonstration, Commonwealth Coordinated Care (CCC). Findings are based on interviews conducted with a diverse group of state leaders, including representatives from state agencies; medical, behavioral health, and social services providers; consumer advocates; and health plans, involved in the design and early implementation of the CCC program. The report also includes data on enrollment in CCC to provide context for the qualitative findings.

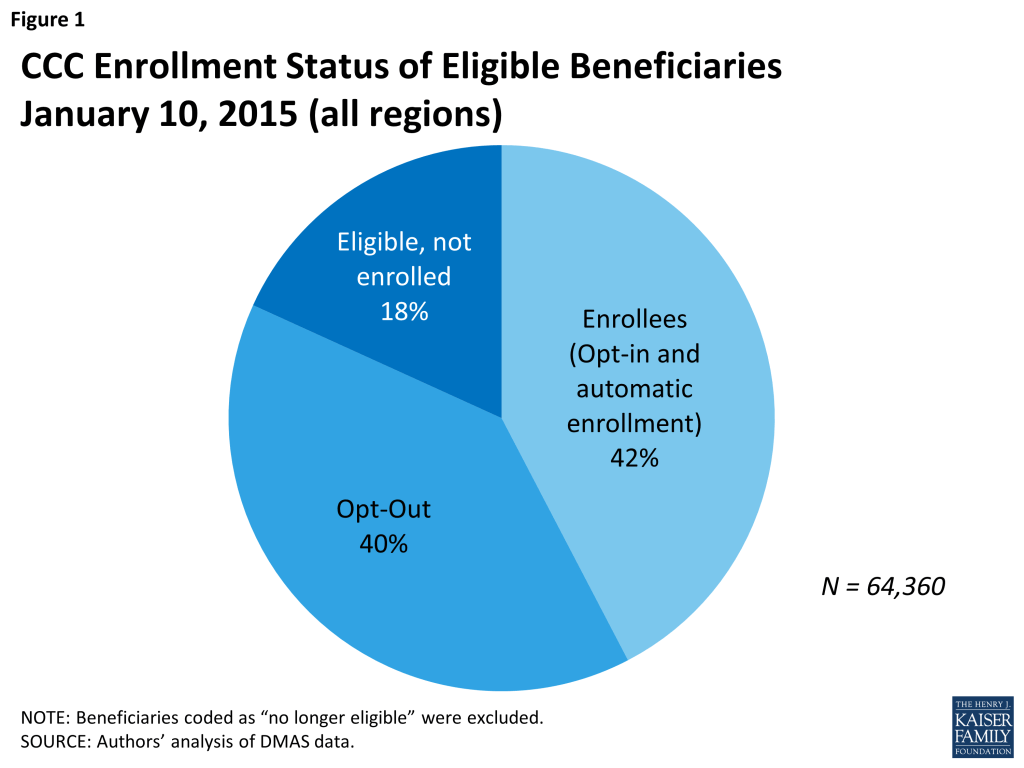

CCC launched in April 2014, and as of January 10, 2015, had enrolled 27,333 beneficiaries, about 42 percent of the population estimated to be eligible for the program, most of whom (84 percent) were automatically assigned to a health plan and enrolled in the program, and the remainder (16 percent) voluntarily enrolled on their own. About 40 percent of all eligible beneficiaries across the state have opted out of the program, with the remaining 18 percent not yet enrolled.

The Virginia demonstration includes the following features:

- focuses on a comprehensive population of adult dually eligible beneficiaries, including seniors, people with physical disabilities, and people with behavioral health needs;

- includes beneficiaries residing within five regions of the state;

- allows beneficiaries to opt out of the demonstration for both their Medicare and Medicaid benefits;

- covers both community-based and institutional long-term services and supports (LTSS), including Medicaid home and community-based waiver services for seniors and people with physical disabilities;

- requires a minimum medical loss ratio for health plans and offers financial incentives for health plans to provide home and community-based services; and

- sets aside funds for an early state-specific evaluation.

Beneficiaries, the state, plans, and providers faced several challenges during the early implementation stage of the demonstration, such as:

- with an ambitious timeline for implementation, particularly because Virginia did not receive an earlier design contract and was among the first states to implement its demonstration, program development was occurring even as enrollment started: provider contracts were still being negotiated, systems for data exchange were being refined, and features such as integrated care teams or behavioral health homes were under development;

- confusion among beneficiaries and providers about the program and its benefits and policies;

- limited capacity to match beneficiaries to their Medicare providers during initial health plan auto-assignment, which has the potential to result in disrupted care arrangements;

- lack of extensive experience in working with LTSS managed care plans prior to program implementation, relative to other states;

- unanticipated difficulties with maintaining continuity of care for enrollees who switched plans or left the program; and

- lower initial enrollment than anticipated due to beneficiaries opting out of CCC.

Strengths of the implementation process included:

- frequent communication and promotion of “a culture of cooperation” between the state and other stakeholders;

- limits on the number of health plans, which helped to simplify plan choice for consumers and plan and provider contract negotiations, administration, and monitoring;

- contract requirements for provider inclusion and prompt payment, which helped encourage provider participation; and

- early collection, analysis, and public reporting of data, including data on the reasons that beneficiaries did not enroll or disenrolled from the CCC program, kept stakeholder informed and helped identify problems and improve program operations quickly.

As one of the first capitated dual eligible financial alignment demonstrations to be implemented in the country, Virginia’s early experience may help other states prepare and implement their programs. Stakeholders noted that the longer-term viability of the CCC program will depend on attracting and keeping beneficiaries enrolled; some stakeholders recommended restricting beneficiaries from opting-out or switching plans, while others expressed concern about limited choices for beneficiaries. They noted that plans’ decisions about the breadth of their networks as well as providers’ decisions about whether to join networks and beneficiaries’ desires to continue using their current providers will all play a role in ensuring program viability. Additionally, stakeholders noted that examinations of the frequency with which the appeals process is used and the outcomes of appeals will be instructive. Stakeholders generally were eager to move beyond CCC program start-up issues. As many noted, the post-transition period will be an important time to understand how the new program is affecting beneficiaries and what the longer-term impacts might be.

It is important to note that this case study provides a very early look at the program. More data collection and analysis will help answer questions about the long-term financial viability of the demonstration, whether and how savings are achieved, the extent to which service coordination, health outcomes, and quality improve, and the program’s impact on beneficiaries’ health and wellbeing. Consequently, it will be important to assess Virginia’s and other states’ demonstrations over time as more information becomes available.

Issue Brief

Introduction

Commonwealth Coordinated Care (CCC) is a new program designed to coordinate the delivery of primary, preventive, acute, behavioral, and long-term services and supports for Virginians who are dually eligible for Medicaid and Medicare. Virginia is one of 12 states that have agreements with the Centers for Medicare and Medicaid Services (CMS) to sponsor a Financial and Administrative Alignment Demonstration for Dual Eligible Beneficiaries (see Box 1). The CCC program is one of the first to be implemented. It was introduced in March 2014 and beneficiaries first enrolled in plans effective in April. The program will continue through December 31, 2017.

Box 1: The Duals Demos: Financial and Administrative Alignment Demonstrations

Based on authority in the Affordable Care Act, CMS is testing capitated and managed fee-for-service financial alignment models and seeking to improve care and control costs for beneficiaries dually eligible for Medicare and Medicaid. The demonstrations seek to maintain or decrease health care costs while maintaining or improving health outcomes for this vulnerable population of seniors and non-elderly people with significant disabilities. The three-year demonstrations, implemented beginning in July 2013, are introducing changes in the care delivery systems through which beneficiaries receive medical and long-term care services. The demonstrations also are changing the financing arrangements among CMS, the states, and providers. As of February 2015, CMS had finalized memoranda of understanding (MOUs) with 11 states to implement demonstrations. California, Illinois, Massachusetts, Michigan, New York, Ohio, South Carolina, Texas, and Virginia are testing a capitated financial alignment model. Colorado and Washington are testing a managed fee-for-service (FFS) financial alignment model. Minnesota is testing the integration of administrative functions without financial alignment. As of February 2015, nine states had begun enrolling beneficiaries in their programs.See Kaiser Commission on Medicaid and the Uninsured, State Demonstration Proposals to Integrate Care and Align Financing and/or Administration for Dual Eligible Beneficiaries (February 2015), available at: https://www.kff.org/medicaid/fact-sheet/state-demonstration-proposals-to-integrate-care-and-align-financing-for-dual-eligible-beneficiaries/

Initially, an estimated 78,600 beneficiaries were eligible for the CCC program, which operates in five regions of the state.1 The program was implemented in phases with opportunities for beneficiaries to opt in or out. Enrollees choose or are assigned to one of three managed care plans, referred to as Medicaid-Medicare Plans (MMPs), which are charged with overseeing the delivery and coordination of an enhanced set of services. Prior to the CCC program, few dually eligible Medicare beneficiaries in Virginia were enrolled in Medicare Advantage plans. The state did have experience with the delivery of Medicaid services through managed care plans, but dually eligible beneficiaries were excluded from these plans. Thus, many providers serving the dually eligible population had little experience with managed care. The demonstration also represents a significant change for the state in terms of how long-term services and supports (LTSS) are provided. Prior to the demonstration, there was no broadly-available option for managed LTSS in Virginia.2

This case study provides an early look at the experiences of dually eligible beneficiaries and other stakeholders in Virginia’s CCC program. It describes key program features, highlights early successes, and discusses efforts to overcome initial difficulties. The case study is based on interviews with state officials, service providers, plan staff, advocates, and other stakeholders. Interviews were conducted during a site visit to Richmond, Virginia, in late October 2014 and were supplemented by telephone interviews between July and November. The findings reported here reflect the observations of almost 50 people (including state officials, representatives of provider organization, participating health plans, and consumer organizations) who agreed to discuss the program. A review of materials published on the program website as well as data provided by program officials provided additional information.

As an early snapshot of activities in Virginia, the information in this case study about start-up problems and solutions should be valuable for other states as they implement new programs. It is important to note, however, that the emphasis on early problems should not eclipse consideration of other program design and policy issues that may affect the program’s longer-term prospects. These were also discussed and the results are reported here.

Program Features

Program Administration

The Department of Medical Assistance Services (DMAS), the state Medicaid agency, administers the Commonwealth Coordinated Care program in Virginia. Staff associated with the Department of Aging and Rehabilitative Services (DARS) also play important roles. The program staff has a reputation among stakeholders for being hard working and highly invested in the new program. Many have been involved for years in efforts to promote service delivery improvement for Medicaid medical and long-term services and supports. Still, one official characterized the rollout of the CCC program as “harder than anything DMAS has ever done” and noted that having broad political support was a positive factor as the program was developed and launched. Significantly, the demonstration proposal was developed during the administration of Republican Governor Bob McDonnell and was implemented during the administration of Democratic Governor Terry McAuliffe.

Virginia did not receive an early federal design contract for program development as some other demonstration states did, but the state has devoted significant resources to create new positions, hire staff, apply for related federal grants, make major data system changes, educate and communicate with stakeholders, and fund an early state-specific evaluation. CMS is an important partner in the demonstration.

Outreach and Enrollment

At the start of the program, approximately 78,600 dually eligible beneficiaries in five regions of Virginia were estimated eligible to participate in the CCC program.3 Almost one-third of them were receiving long-term services and supports – 17 percent in nursing facilities and 13 percent through the Elderly or Disabled with Consumer Direction (EDCD) waiver program.4 The remaining 70 percent live in the community and do not participate in a waiver program.5

Enrollment information and assistance: The state pays an enrollment broker a flat fee to assist beneficiaries with enrollment or with questions about MMP characteristics such as provider networks, drug formularies, or enhanced benefits. The CCC program also relies on the Virginia Insurance Counseling and Assistance Program (VICAP) to play an important role in counseling beneficiaries who request assistance. VICAP is a well-established federally funded state health insurance assistance program that offers one-on-one counseling and assistance primarily from volunteers in person or by telephone to people with Medicare and their families.6 At the start of the CCC program, the state VICAP office received a federal grant to hire an Options Counseling Coordinator who handles inquiries from beneficiaries about the program and conducts outreach events across the state for beneficiaries and providers, including sessions at nursing facilities and senior housing units. The new position also increased the state office’s capacity to handle inquiries about the CCC program from beneficiaries and from local VICAP counselors who were generally aware of the new program, but not overly familiar with program details. Although DMAS expected that VICAP counselors would play an important role in explaining the CCC program, some counselors felt that they did not have enough information about Commonwealth Coordinated Care program details. Consequently they often referred clients to the enrollment broker for assistance. Also, VICAP agencies have limited capacity to provide counseling in languages other than English.

DMAS also hired a dedicated outreach specialist for the program and sponsors regular calls for beneficiaries and their advocates. Despite Virginia’s education and outreach efforts, respondents raised questions about how thoroughly beneficiaries understand the new program. One counselor was impressed by informed questions from beneficiaries who called about the program. Another thought that beneficiaries had a “broad awareness of change, but not so much on the specifics.” Another saw a “tremendous amount of confusion from beneficiaries.” Still another pointed out that obtaining information is not always a “one-stop” experience. For example, beneficiaries who consult VICAP counselors may also have to call plans directly to get the latest information about provider networks.

Some of the challenges that respondents said contributed to lack of awareness on the part of beneficiaries include:

- Program and plan staff report difficulties reaching eligible beneficiaries, especially when current contact information is missing. Thus it is not possible to know if beneficiaries who do not respond to letters about the program ever received them.

- Several respondents noted that some beneficiaries have low levels of health insurance literacy. They do not necessarily understand, for example, that the network of providers associated with a managed care plan may offer many fewer choices of providers than they are accustomed to having in a fee-for-service arrangement. They may not realize that their current providers are not necessarily participating in the new program.

- Respondents raised a particular concern about certain beneficiaries’ ability to make choices about their coverage, particularly beneficiaries with cognitive impairments who do not have a designated legal representative empowered to make decisions for them.

- Respondents generally did not see a substantial focus on “hard to reach” populations. Resources, counseling, and awareness of needs appeared to be scarce for populations whose first language is not English or whose culture differs from the mainstream. Introductory letters are available in languages other than English and the enrollment broker has translation services, but little targeted outreach has occurred to date.

The enrollment process: The process provides several opportunities for beneficiaries to opt in or out of the CCC program and to choose among the three plans: Anthem HealthKeepers, Humana Gold Plus Integrated, and Virginia Premier Complete Care. All eligible individuals received a maximum of four letters. The first introduced the program and offered them the opportunity to select an MMP. Eligible beneficiaries were also advised in that letter of their right to opt out of the program. About three months after the introductory letter, beneficiaries who neither selected a plan nor opted out of the program received a letter advising them that they would be automatically enrolled in an MMP in 60 days if they did not select one on their own or opt out of the program. A letter sent 30 days later repeated the same information.7 The health plans then sent a welcome package to all enrolled beneficiaries, whether they signed up voluntarily or were automatically enrolled. Beneficiaries were also advised that they may opt in or out of the program or may switch plans at any time.

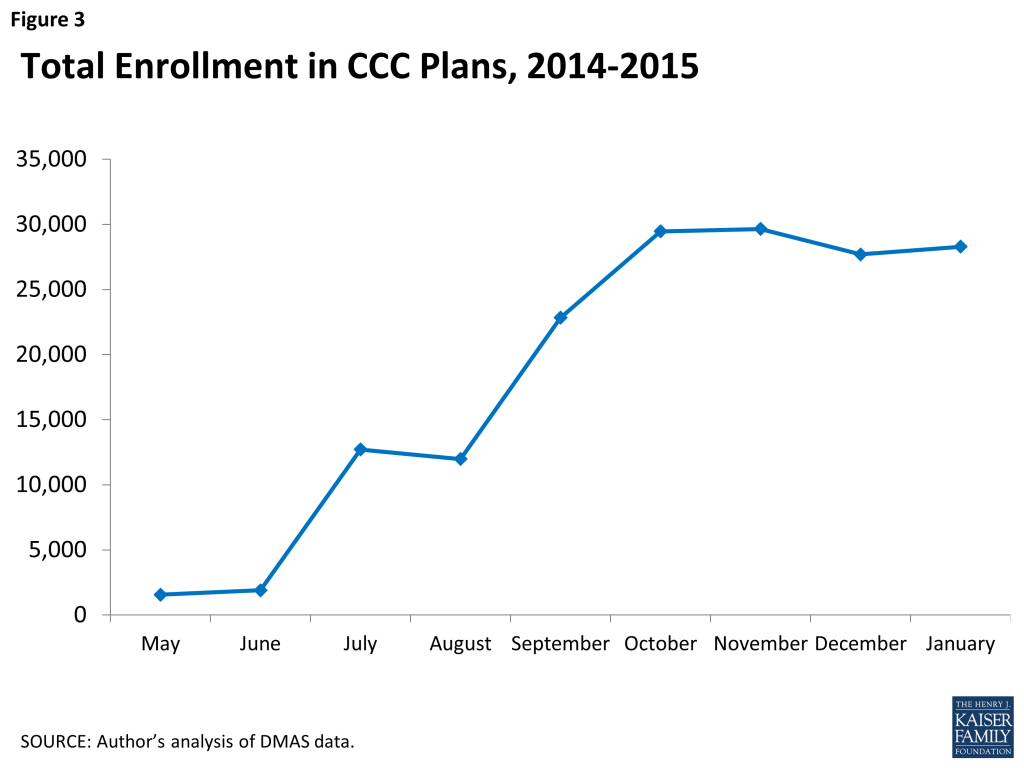

The enrollment process occurred in phases in 2014 in the five regions. The phase-in approach was helpful in that program administrators could improve operations in the later regions based on early lessons. Coverage for the first set of voluntary enrollees was effective April 1, 2014 in the Tidewater and Central Virginia regions; the first round of automatic enrollment in these regions was effective July 1, 2014 and September 1, respectively.8 A short time after the start of the outreach and enrollment process in the first two regions, the same process was repeated for the other three regions (see Table 1).

| Table 1: 2014 Enrollment Schedule for Virginia’s CCC Program | |||

| Region | Voluntary enrollmentfirst effective date | Automatic enrollmentfirst notification date | Automatic enrollmentfirst effective date |

| Tidewater | April 1 | May 1 | July 1 |

| Central Virginia | April 1 | July 1 | September 1 |

| Charlottesville | June 1 | August 1 | October 1 |

| Roanoke | June 1 | August 1 | October 1 |

| Northern Virginia | June 1 | September 1 | November 1 |

| SOURCE: Commonwealth Coordinated Care Enrollment Timeline and Update, July 2014. Available at: http://www.dmas.virginia.gov/content_pgs/altc-stkhld.aspx. | |||

Plan assignment: Notably, the CCC program was designed to use an “intelligent assignment” process for automatic enrollment that takes each beneficiary’s prior health service providers into account.9 The goal of intelligent assignment is to promote continuity of care by assigning beneficiaries to MMPs with networks that include their current providers if possible. Ideally, plan assignments can be based on Medicare and Medicaid claims data that indicate which primary care providers, specialists, and hospitals beneficiaries have used. As one of the earliest demonstrations, Virginia was at somewhat of a disadvantage in that expected data from Medicare were not available at the start of the program. Thus, assignments were based on other available data: previous health plan enrollment for the small number of enrollees who had been in Medicare Advantage plans and plan network participation by the beneficiary’s nursing facility or adult day health provider.10

Respondents reported that the intelligent assignment process, as implemented, assigned some beneficiaries to plans with networks that do not include their providers. Even when beneficiaries were matched based on residence in a nursing facility, sometimes the physicians who care for patients in the facilities were not in MMP networks. The state expects to have Medicare data from CMS for use in future automatic enrollments. In discussing the efficacy of the intelligent assignment process, stakeholders noted that even when data are available to identify beneficiaries’ primary care providers, those might not be the most appropriate matches because beneficiaries may have closer relationships with specialists such as cardiologists, endocrinologists, or with their personal care providers. Respondents recommended consideration of those relationships as well.

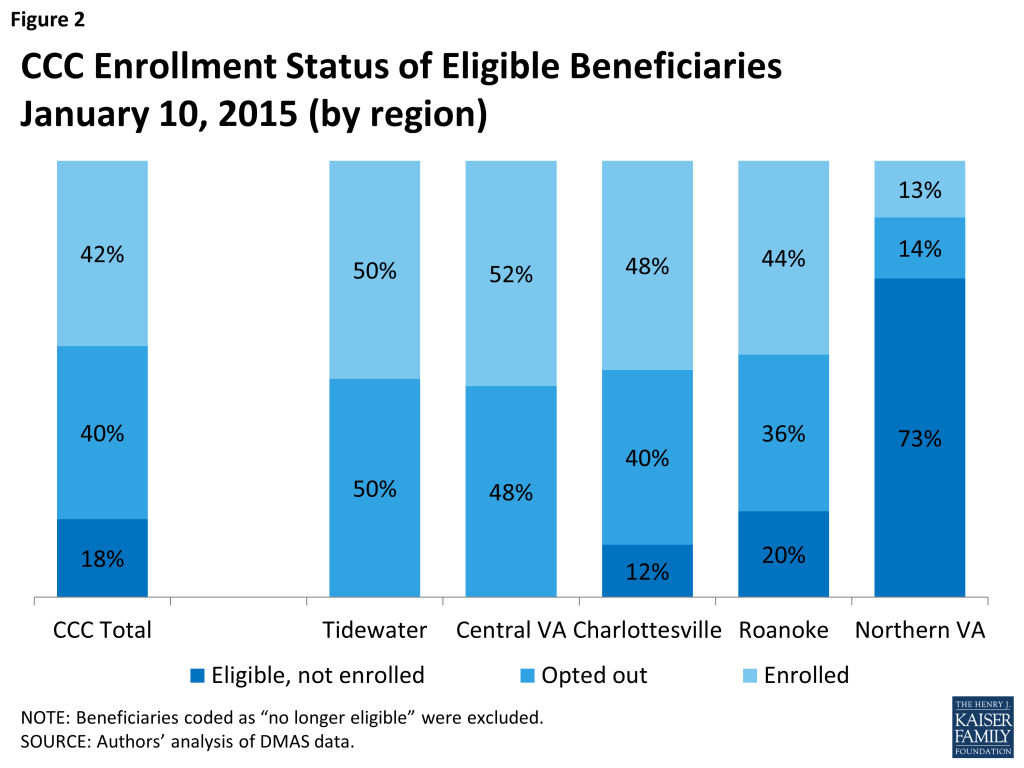

Program enrollment: As of January 10, 2015, 27,333 beneficiaries were enrolled in the CCC program across the five regions, representing about 42 percent of the eligible population. Another 40 percent of eligible beneficiaries opted out of the program. The remaining 18 percent were not enrolled, but had not yet opted out nor been subject to passive enrollment.11 Overall enrollment rose in increments as each round of passive enrollment occurred during 2014. Since the last round of passive enrollment effective in November 2014, enrollment has declined modestly as new opt-outs have outnumbered new opt-ins (Figures 1, 2, and 3).

Automatic enrollment and therefore program enrollment has lagged, particularly in some parts of the state, due to several unanticipated complications:

- Program rules specify that automatic enrollment cannot occur unless beneficiaries have a choice of plans, but early in the program, there were several locations with only one MMP available – particularly in some of the larger cities and counties in Northern Virginia.12 Therefore, beneficiaries in those locations could opt into the CCC program, but were not automatically enrolled. In the two regions where automatic enrollment has occurred in all localities, all eligible enrollees have either enrolled or opted out.

- In an effort to avoid confusion for beneficiaries, CMS directed the state to delay automatic enrollment until January 2015 for approximately 7,500 beneficiaries who had been randomly assigned or reassigned to a Medicare Part D plan effective for calendar year 2014.13

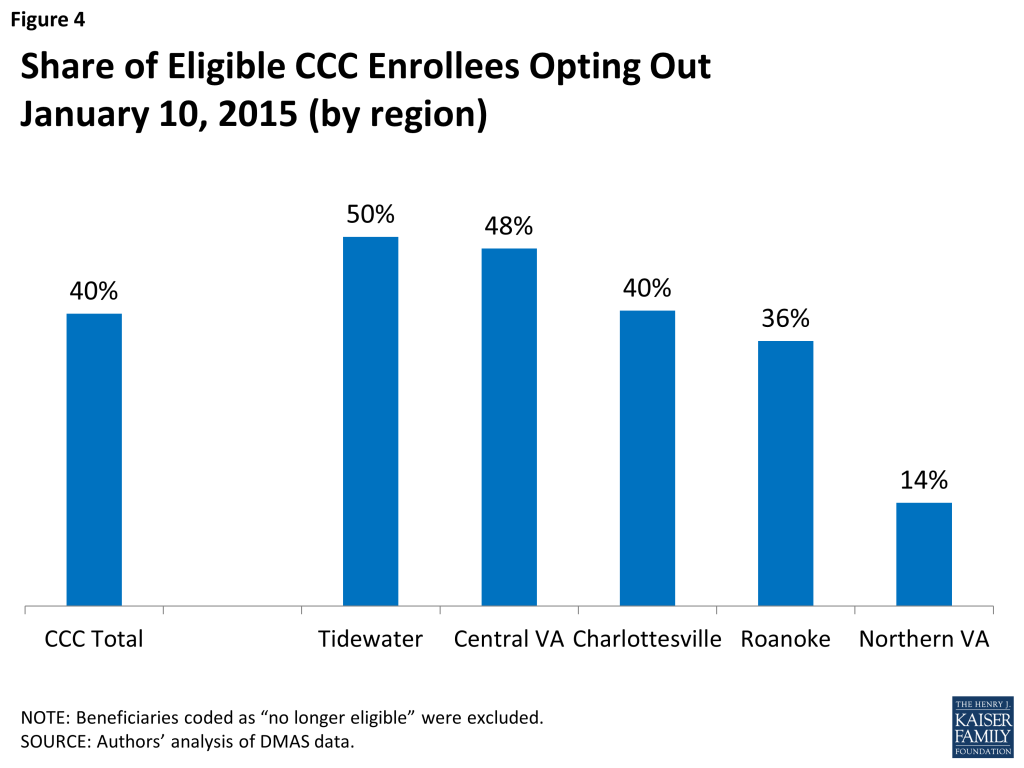

Program opt-out: The opt-out rate in Virginia is also a factor in low program enrollment. As of January 10, 2015, about 40 percent of all eligible beneficiaries have opted out across the state (Figure 4). In developing budget savings estimates, Virginia officials assumed that 80 percent of eligible beneficiaries would enroll in CCC plans.14 Opt-out rates to date leave enrollment considerably short of that level.

The share is modestly higher in the regions where early implementation of automatic enrollments occurred (50 percent in Tidewater and 48 percent in Central Virginia) and much lower (14 percent) in Northern Virginia, where automatic enrollments have not been possible in all localities.15 The higher rates for more established regions likely reflect the program design feature that allows beneficiaries to opt in or out of the program at any time. In the Tidewater region, for example, between the first letter that beneficiaries received and the scheduled enrollment date, about one-fourth of the 11,900 beneficiaries who received the letter opted out. A similar number opted out during their first three months as plan enrollees. Thus only 50 percent of the beneficiaries notified about automatic enrollment were actually enrolled three months after the scheduled enrollment date. The pattern appears similar for cohorts with later enrollment dates, although available data were incomplete at the time of this study. The overall opt-out rate could rise as those who were enrolled automatically have longer to consider their options.

The opt-out rates are considerably higher for those participating in the EDCD waiver (receiving LTSS at home), compared to the other two groups. Nearly two-thirds of EDCD beneficiaries have opted out. By contrast, opt-out rates for nursing facility residents and those living in the community and not receiving LTSS are similar to the program-wide opt-out rate.

Data collected by the enrollment broker indicate that the vast majority of beneficiaries who opted out of the CCC program said they are happy with their current Medicaid and Medicare coverage. A smaller but still significant group opted out because their current provider was not participating in the program.16 Given that the provider recruitment process was slower than anticipated and the implementation timeline was so short, beneficiaries had to consider whether their current providers participated in the CCC program even as plans were continuing to contract with providers. This caused confusion or worries for beneficiaries and posed an enrollment challenge.

Respondents reported that providers who were wary of the new program influenced beneficiaries’ enrollment choices and that initially some nursing facilities attempted to opt out all of their eligible residents. State officials responded with a Medicaid memo that explained the role of beneficiary choice in the CCC program and with a variety of activities to educate and engage providers.

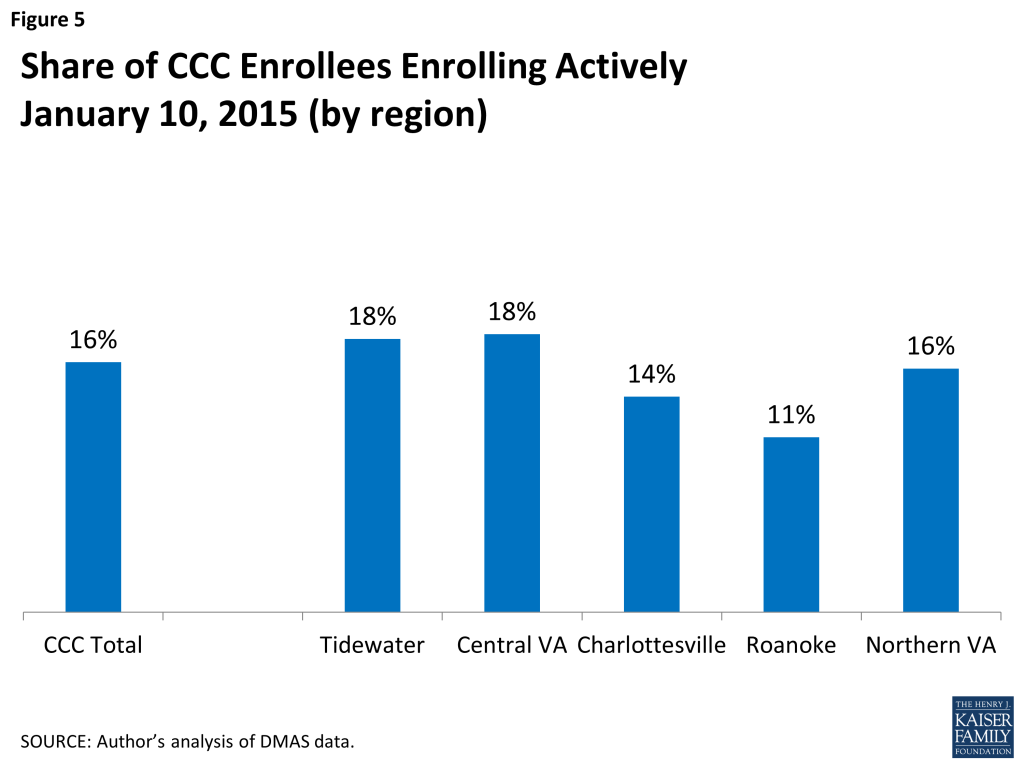

Program opt-in: The share of beneficiaries who actively chose a CCC plan, as of January 10, 2015 – only 16 percent of CCC enrollees – is similar in all regions across the state (Figure 5). The remaining enrollees were automatically enrolled into their plans.

Although the demonstration does not require that plans offer extra benefits beyond those required under Medicaid and Medicare, stakeholders report that some beneficiaries who opt into the program and select their own plans are attracted by plan benefits such as additional dental and vision services, podiatry, gym memberships, hearing exams and hearing aids. Others value the promise of additional care coordination.

Enrollment volatility: All beneficiaries retain the right to exit or join the program in any month and the right to switch among the three plans. Data supplied to DMAS by the enrollment broker indicate that approximately two-thirds of the beneficiaries who disenroll say it is because they want to go back to their original coverage or because their current provider does not participate in the program. Most of the others who disenroll say they are not satisfied with the program or the MMP or that they do not like the change in their coverage.17 Notably, understanding the reasons that beneficiaries disenroll has been a priority for CCC program staff as they think about how to engage beneficiaries who disenroll. The state is collecting information about reasons for disenrollment from plans and the enrollment broker and from focus groups and surveys that are part of the state-sponsored evaluation.

Stakeholders said that confusion is a primary reason for changes in program or plan enrollment, noting that many beneficiaries were not aware initially of a change in their coverage. Beneficiaries and providers who were aware of the new program struggled early on to understand more about how they would be affected.

Data obtained from DMAS provide some indication of how commonly beneficiaries move in and out of the program or switch among plans. As of January 2015 (about nine months after the first enrollments), about 2.6 percent of enrollees had switched from one plan to another. In addition, about 1.5 percent of enrollees have opted back into the program after opting out. Most of the latter group rejoined the program after they were auto-assigned to a plan by the state.

Stakeholders spoke about enrollment volatility and identified problems that arose early on related to enrollment changes:

- The state was not able to fully test systems for information exchange with Medicare before the start of the program. As a result of delays in information exchanges among various systems (Medicare, Medicaid, MMPs and the enrollment broker), providers lacked real-time information on beneficiaries’ enrollment status and therefore were not certain if or how they would be paid for services. For example, nursing facilities had difficulty determining which plans their residents were enrolled in. An eligibility system enhancement that became available in September 2014 allows providers to learn whether beneficiaries are in the CCC program and which plan they are enrolled in.

- Initially, some of the beneficiaries who left the CCC program were not aware that they had to re-enroll in a Medicare Part D plan in order to restore the prescription drug coverage they had before being enrolled in the CCC program. Medicare provided interim safety net coverage, but beneficiaries still had to re-enroll.

- Switches from plan to plan hampered the ability to conduct meaningful health assessments, develop care plans and coordinate services.

Stakeholders raised concerns about the longer-term stability and viability of the CCC program if too many beneficiaries opt out or if too much plan switching occurs. Some suggested that there be a “lock-in period,” even as short as several months, or a limit on the number of enrollment changes or plan switches in a given year. But they also recognized the need to balance those types of policies with the protection for beneficiaries provided by the ability to make changes.

Respondents noted that problems related to coverage instability could also occur if beneficiaries who do not complete the periodic Medicaid eligibility redetermination process become ineligible for Medicaid coverage and therefore for the CCC program, even for a short time. They suggested that efforts to ensure continuous coverage could be important in furthering program goals.

Health Plans

Plan participation: In April 2013, Virginia solicited applications from health plans with the goal of selecting at least two plans in each of the five regions. Ultimately, state officials selected three plans that proposed to serve beneficiaries in all five regions of the state, pending plan readiness.

Program administrators intentionally chose a relatively small number of plans to make program contract negotiations and monitoring manageable, to limit the number of plans providers would have to work with and to foster collaboration and cooperation among the plans. Stakeholders said that the decision to have no more than three plans was also helpful in that beneficiaries had meaningful choices, but the process of sorting through their options for enrolling in plans was easier than it would have been had they had a large number of plans to consider.

As Table 2 indicates, only one of the plans previously had both Medicare and Medicaid managed care experience in Virginia. But for the most part, the Virginia managed-care experience for these plans did not involve dually eligible beneficiaries.18 Anthem HealthKeepers and Humana are drawing upon experience of their parent organizations in other states, including their Medicare Advantage Special Needs Plans for dually eligible beneficiaries (dual SNPs). Both operated dual SNPs in Virginia, but Humana’s plans had only about 1,000 enrollees statewide, and Anthem’s plan had minimal enrollment.

| Table 2: Characteristics of the Three MMPs Participating in Virginia’s CCC Program | ||||

| Plan | Type of Organization | Organization Also Sponsors Medicare Advantage (MA) Plan in Virginia | Organization Also Sponsors Medicaid Plan in Virginia | CCC Enrollment Share, January 2015 |

| Anthem HealthKeepers | National for-profit company | 5th largest MA plan | Largest Medicaid managed care plan | 40% |

| Humana Gold Plus Integrated | National for-profit company | Largest MA plan | No Medicaid managed care plan contract | 37% |

| Virginia Premier Complete Care | Non-profit, affiliated with local provider | No MA contract | Second largest Medicaid managed care plan | 23% |

| SOURCES: Medicare Advantage and CCC enrollment from CMS administrative files. Medicaid enrollment from http://www.dmas.virginia.gov/Content_atchs/mc/mc-mcc2.pdf. | ||||

In practice, the three plans are participating in all five regions, though not in all cities or counties. Significant gaps in networks have been a particular problem in certain locations, where prominent providers have been reluctant to affiliate with plans. In some of the larger cities and counties in Northern Virginia, for example, only one of three plans has been approved with an adequate provider network. Negotiations with health systems have been an issue for the other two plans in that region. With only one plan approved, beneficiaries can opt into the CCC program, but auto-enrollment cannot occur.19

Provider networks in plans: All plans faced a significant challenge in developing provider networks for the CCC program. Networks for CCC plans require a broader scope of service providers than most Medicare, Medicaid, or private health insurance plans. The range of services includes traditional medical services, behavioral health services, and LTSS. State requirements for network adequacy are based on existing Medicaid and Medicare rules, generally following the more stringent of the two sets of rules.

Respondents indicated various issues with recruiting provider networks. Anthem HealthKeepers and Humana could build on existing networks for services covered by Medicare under Medicare Advantage. Similarly, Anthem already had contracts with some Medicaid service providers. Virginia Premier had a relationship with providers because of its affiliation with the VCU Medical Center, but that health system does not operate in all regions. It also had provider networks for its Medicaid managed care plan.

Developing LTSS provider networks posed a particular challenge early in the program. Medicaid has always paid LTSS providers on a FFS basis in Virginia so experience with managed LTSS was very limited. LTSS providers were encountering new policies and procedures. The learning curve was also steep for MMPs as they negotiated with new entities, including small business owners, and developed an understanding of the roles that community-based providers, such as Area Agencies on Aging or Centers for Independent Living, have played traditionally. Some stakeholders suggested that plans may have had little incentive to negotiate with a large number of small providers.

Certain program features helped in the development of provider networks. All plan contracts include an “any willing provider” policy for nursing facilities, whereby nursing facilities are included in plan networks as long as they accept standard contract terms. In addition, plans must pay nursing facilities at the same Medicaid rates used by the state. Plans are also required to contract with Community Service Boards, the public entities that provide behavioral health services. Also, the three plans must use the same fiscal agent for consumer-directed services. The state specified time frames for provider payments, and plans must report regularly to the state on their claims turnaround times.20 Several stakeholders mentioned that generally, providers have been paid on time.

Cooperation: Respondents spoke of frequent communication and a “culture of cooperation” both between CCC staff and MMPs and among the three plans; most stakeholders interviewed, including those who raised specific concerns about program requirements, complimented state officials on their openness and outreach efforts. Plans have sponsored joint training meetings with providers and provider organizations and have developed some common forms and procedures, such as for prior authorization. The state sponsors quarterly stakeholder meetings. Stakeholders said that state staff have been available to troubleshoot when individual problems arise. One challenge that a few respondents mentioned is turnover in leadership at MMPs during the CCC program’s short history.

Providers

All types of providers expressed support for the CCC program goals, particularly the emphasis on enhanced services and better service coordination, but some continue to have concerns about program details. Providers, particularly those who had not worked with managed care plans before, were somewhat wary of the CCC program and the “extra layer” of administration that they thought the MMPs represented so the tasks of recruiting providers for the plans and helping them understand new policies and procedures posed early challenges. Providers were particularly concerned about how they would get paid, whether payment would be prompt, and how to get service authorizations. Traditional Medicaid medical service providers, such as physicians and hospitals, tend to be more familiar with managed care. Behavioral health and LTSS providers had less experience at the start of the program. A few providers were very positive about the new arrangement noting that the close alignment of financial and clinical incentives in the CCC program allows them to provide the type of enhanced services that they believe are beneficial for their patients.

Early impact on providers: Larger provider organizations tend to have more capacity to respond to new requirements, though some report that their administrative offices have had to expand to accommodate new program procedures. For others, new administrative requirements related to credentialing, service authorization, and claims submission posed bigger challenges. Because some of their clients are in the demonstration and some are not, smaller “mom and pop” providers, especially LTSS providers that previously had dealt only with Medicaid and sometimes with Medicare, now must work with up to five entities – Medicaid, Medicare, and three plans – all with different requirements and procedures.

Some are not equipped for electronic billing and payment and have not yet developed the capacity to bill plans. Providers report that they are encountering differences in billing and authorization procedures for FFS Medicaid and Medicare and plans. For example, they may have to use both electronic portals and paper forms. Authorizations may be done online or by telephone. These differences can be confusing, especially when patients make transitions in or out of the CCC program. One goal of the demonstration is to streamline and align administrative processes for beneficiaries, but processes have become more complicated for some providers as they attempt to work with each of the three plans.

Stakeholders spoke about the need for clarification about Medicaid, Medicare, and CCC policies that do not always align, particularly when beneficiaries opt in or out of the CCC program. For example, Medicare has a 100-day limit on skilled nursing facility benefits, but CCC plans have the option of setting different limits. There is uncertainty about which rules apply if a patient receiving skilled care opts in or out of the CCC program but continues to be treated at the same nursing facility. Similarly, providers are confused about the Medicare three-day qualifying hospital stay requirement for skilled care, which was waived for the CCC program, but applies again if the beneficiary opts out. Also, rules related to hospital readmissions apply differently in the two settings. Nursing facilities are concerned about the implications of new approaches to service delivery employed by CCC plans for Medicaid and Medicare survey and certification reviews.

When unanticipated questions arose early in the program regarding the intersection of Medicaid, Medicare, and CCC policies, respondents said the clarification process was sometimes lengthy. One stakeholder noted that Medicaid and Medicare operations are not always in sync and observed, “In reality, they are still two separate programs.” Respondents spoke about the steep learning curve for state officials and stakeholders not accustomed to dealing with Medicare and mentioned that often program staff cannot resolve policy questions without input from CMS. Noting that resolving policy questions that require communication within the various CMS offices can take time, one respondent suggested that having a direct contact at the CMS Medicare office could be helpful.

Several providers recognized that many of the glitches they experienced are related to program start-up and expect that the program will work well once outstanding questions are resolved and stakeholders become more familiar with new program operations. Even at this early stage, one provider noted that the plans are “good to work with” and have resolved issues quickly. Another reported that the “we-they” attitude between providers and insurers is changing and that in the new program, “things (such as obtaining equipment) happen quicker for patients.”

Provider engagement: The number and variety of education and training efforts conducted for providers initially and on an ongoing basis is noteworthy. Early in the program, private foundations supported provider training for nursing facilities, personal care providers, and service facilitators. As the program roll-out continued, program and plan staff recognized the need for more “hand-holding” regarding the new way of doing business, particularly for smaller providers. The CCC program sponsors ongoing outreach and training for providers including regional town halls and on-site training by request. They also hold separate calls each week for five types of providers: adult day service providers, personal care and home health service facilitators, nursing facilities, hospitals and medical practices, and behavioral health providers. Six months after the first effective enrollment date, program staff noted that providers are at different stages of learning about the CCC program and that the program still had a strong focus on provider education.

Service Delivery

Initial assessments: MMPs must provide Health Risk Assessments (HRAs) for all members within 90 days of enrollment. If an enrollee is considered to be part of a “vulnerable subpopulation,” the assessment must occur within 60 days.21

Assessments are used as the basis for developing individual care plans, which specify the types and amounts of services beneficiaries receive. Plans are required to provide face-to-face assessments for nursing facility residents and EDCD waiver enrollees. Assessments for other categories of enrollees may be conducted by telephone. Providers emphasized the importance of conducting assessments for patients with complicated conditions and high needs in the home rather than from a cubicle or over the phone. The problem of assessment backlogs appears to be related to the program’s ambitious start-up schedule. A phased-in enrollment schedule was helpful in limiting the number of HRAs that had to be completed at any one time. Still, with automatic enrollment, large numbers of beneficiaries in any one region were assigned to plans effective on the same date.

Another factor that affected plans’ ability to conduct HRAs in a timely manner was that current contact information was missing for some of the beneficiaries who were automatically enrolled. This not only caused difficulties related to conducting HRAs, but also indicated that some of the auto-enrolled beneficiaries might not have received the information about the CCC program and would need explanations about the program as well as assessments. A promising practice is plans’ use of pharmacy records, when available, to help locate beneficiaries. Because prescriptions are often filled on a monthly basis, these events may be the first encounters between enrollees and their new plans.

At this point in the program’s history, it is difficult to know the extent to which assessments have led to changes in care plans or whether the HRAs are considered helpful by plan enrollees or their providers. Plan staff noted that the assessments provide the opportunity to identify under-reported behavioral health needs, to make disease management referrals, and to plan care for their high-cost, high-touch members. Observers were not aware of service reductions related to the first round of assessments and subsequent care plans. Each MMP has documented success stories about the role of assessments in improving care for enrollees. It is not possible to generalize from these anecdotes, however.

The assessment and care planning processes also provide an opportunity to discuss whether beneficiaries want to direct certain services, such as personal care attendant services, on their own. Stakeholders report that the plans are just in the early stages of working with beneficiaries on self-direction.

Continuity of services and providers: Continuity for beneficiaries during their transition period from traditional Medicaid and Medicare into an MMP is a fundamental priority for the CCC program. The transition period is also seen as a time for providers and MMPs to work through the credentialing and contracting processes for providers not initially included in plan networks. Plans must allow new CCC enrollees to maintain their current providers (including out-of-network providers) and preauthorized services for 180 days from the date of initial enrollment. Enrollees who transfer from another MMP may maintain current providers and preauthorized services for 30 days. Current residents of a nursing facility are permitted to stay in the facility for the duration of the demonstration as long as they continue to meet the criteria for nursing facility care, even if the facility is not part of their plan’s network.22 These policies are intended to promote continuity of care for beneficiaries.23

Few problems related to continuity of care were apparent early in the program, though respondents noted that the transition period was still in effect. They raised certain implementation issues:

- The transition protections may mask provider network inadequacies that could become apparent later.

- Beneficiaries who are not aware that their coverage has changed may be surprised at the end of the transition period by the need to find a new provider.

- Lack of familiarity with transition policies was cited as a reason that some providers discouraged the beneficiaries they serve from participating in the CCC program. Providers were not aware that they would continue to be paid for services they provided during the transition period, were not certain about how and when they would be paid, or did not know that the program includes an option for plans and providers to enter into “single case agreements,” which allow enrollees to continue to receive services from current providers who may not be part of plan networks.

Service access: Given that the transition period is still in effect for most enrollees, it is too early to understand the extent to which service access issues will arise. The new extra services and benefits that plans can offer through the CCC program are a particularly attractive feature. Stakeholders reported that early in the program some beneficiaries reported access problems related to these services. The potential for enrollees to receive enhanced behavioral health services is another popular program feature. For example, nursing facilities are looking forward to the availability of more behavioral health options and services for their residents. Health plans are working in partnership with Virginia’s Community Services Boards in the development of behavioral health homes to better coordinate care for CCC enrollees with serious mental illness. Plans to provide these types of services are progressing, but early reports indicate that for the most part the innovations have not been implemented yet.

The promise of improved access to community-based LTSS is another program feature of great interest. Plans have more flexibility in the types of services they provide. There is an expectation that program costs can be reduced as quality is improved if a larger share of beneficiaries who use LTSS want the opportunity to live independently and receive services in the community rather than in institutions. Respondents questioned whether the utilization of community-based services will be as great in Virginia given that the criteria to qualify for Medicaid LTSS are stricter than in other states. Other important issues flagged were whether communities have sufficient housing stock and adequate workforces to support community-based LTSS and whether MMPs can help build that capacity.

Program policies require that providers accommodate enrollees with disabilities by ensuring that facilities are physically accessible and scheduling for appointments is flexible. In addition, plans and providers must be able to communicate effectively with those who are deaf or hard of hearing, have limited English proficiency, or have cognitive impairments. At the time of the study it was too early to determine how effective those policies are in practice.

Service coordination and care management: A particularly desirable feature of the CCC program, according to many stakeholders, is the emphasis on service coordination. One provider said that the new program will give his organization the ability to place more emphasis on providing comprehensive health care. Notable improvements that respondents mentioned include the availability of more convenient round-trip transportation services from one plan and the development of a system that provides electronic record access to enhance care coordination for patients with behavioral health and medical conditions. Other potential coordination activities involve facilitating transitions from hospitals to the most appropriate setting or helping manage medications. Anecdotal reports from the MMPs refer to efforts on the part of care managers to recognize signs of severe depression and arrange for appropriate care, to help an enrollee and family members made decisions about end of life care, and to arrange for a personal emergency response system and home renovations so that an enrollee could live independently at home.

Care or service coordination generally refers to non-clinical functions such as providing information and logistical help to referred individuals, assuring timely and effective transfer of patient information, and tracking referrals and transitions to identify and remedy glitches. Case management often involves more intensive services provided by nurses or other health workers to high-risk patients.24 Stakeholders are confused about how different types of care coordinators and managers will communicate and work together and about how beneficiaries and providers will be affected. Prior to their enrollment in the CCC program beneficiaries may have been working with social workers at primary care practices or in institutions; they may have been receiving targeted case management services through Medicaid. After enrollment, care coordinators or managers from plans are also involved.

There are notable early instances of collaboration among organizations. Community-based Area Agency on Aging staff, which provides care management services under the FFS system, are now providing those services for at least one plan. And at least one large group primary care practice has made space at their facility so that MMP case managers can work on-site to facilitate better communication with provider care teams.

MMPs are required to have Interdisciplinary Care Teams (ICTs) and the program is designed to promote the creation of behavioral health homes in partnership with Community Services Boards for enrollees with serious mental illness. Respondents reported that plan staff are beginning to play a role, but noted that it is too early to assess the impact of their activities on providers or enrollees. The perception of one provider was that “at this point, ICTs really only exist in theory.”

Performance Assessment

All respondents agreed that it is too early to determine whether the program will meet its ambitious goals. When asked at the program’s six-month point, they suggested that at least a full year or two from the start of the program would be a reasonable timeframe to get past start-up issues and then begin to answer questions related to program success. Currently, however, DMAS is engaged in a number of efforts to monitor program operations, respond to problems as they are identified, and make adjustments to help ensure that the program functions well.

Demonstration oversight: Strong oversight is a notable feature of the CCC program. Each week, plans must complete and submit “dashboards” – operational data reports – to DMAS and CMS. Required data include: the number of opt-in enrollments and disenrollments, outreach calls and home visits to new members, completed HRAs and care plans, and new, open, and closed appeals. Plans also report on the most frequent call topics from enrollees and provider complaint topics as well as provider training activities, provider networks, and claims processing times. Program staff hold weekly contract monitoring team meetings with each plan.

CCC staff made program changes early on in response to the feedback they received. For example, in response to reports from providers about the confusion that occurs when beneficiaries disenroll from CCC and return to traditional Medicaid or Medicare, DMAS implemented a longer timeframe for continuity of care authorizations upon return to FFS. They also made enhancements to the system used to inquire about the eligibility status of Medicaid beneficiaries so that information about who is enrolled in the CCC program and the name of enrollees’ MMP is more readily available.

Quality measures: Virginia has developed a list of 113 core quality measures for the demonstration. They include 71 measures specified by CMS, another 32 measures related mostly to LTSS that the state already had developed for the EDCD waiver, and 10 measures developed specifically for the CCC program. The new measures pertain, for example, to tracking demographic data, documenting care goals, tracking increases in decreases in the authorization of certain LTSS services, and transitions of enrollees receiving LTSS between community-based and institutional settings. Subsets of the core quality measures are designated as “quality withhold measures.” In each year of the demonstration, the state and CMS with withhold a percentage of the capitation rate to be paid based on plan performance. Respondents, particularly in the plan and provider communities, indicated that while they appreciate the need for quality measurement, it is difficult to be responsive to and particularly to report on so many measures.

Stakeholder involvement: DMAS is making an effort to analyze and present program data publicly in a timely manner at quarterly meetings of a stakeholder advisory committee, other meetings, and on the program website. Plans must establish an independent beneficiary advisory committee that provides input to the governing board and includes beneficiaries with disabilities in the plan governance structure. Each of the plans held an advisory committee kick-off meeting in June 2014. Stakeholders think it is too early to know what impact these meetings will have.

Ombudsman office: The state received a federal grant at the start of the CCC program to help cover expenses for a new full-time staff member to expand the capacity of the state long-term care ombudsman to respond to issues related to community-based LTSS. A notable feature of the ombudsman office is that its operations are separate from the CCC program, though as a state government entity it is not entirely independent.25 This arrangement also requires extra effort, particularly to publicize the availability of assistance from the ombudsman. Early in the program, neither the role nor the existence of the new office was well known in the stakeholder community. Most of the 46 cases with which the CCC ombudsman was involved from June through late October 2014 concerned assistance with plan authorizations for enrollees or their providers; enrollment or disenrollment problems; Part D prescription drug coverage; or service access.26

Evaluation: In addition to participating in the national evaluation of the demonstration sponsored by CMS, DMAS and researchers at George Mason University are conducting a state-specific evaluation, comprising site visits and focus groups, to learn about beneficiaries’ early program experiences. A telephone survey of enrollees who are receiving personal care services is also planned. The evaluators are working with community-based groups such as Centers for Independent Living, Area Agencies on Aging, and Community Services Boards to recruit focus group participants. Preliminary focus group findings indicate that beneficiaries think enhanced benefits, care coordination, and customer service are positive features of the CCC program. Concerns identified by the beneficiaries include enrollment system errors, authorizations and payments for personal care attendants, narrow provider networks, and prescriptions that are not covered.27

Financing

State officials have projected that efficiencies gained through the CCC program should yield financial savings to Virginia. The agency’s budget forecast for state fiscal year 2014 included total savings of $44 million for 2014 through 2016 (half general funds and half federal matching funds) attributable to the demonstration.28 This projected savings amount assumes that 80 percent of eligible beneficiaries enroll in the CCC; the state projects $28 million in savings if enrollment reaches only 50 percent. The primary mechanism for savings is a series of reductions built into the capitation rates paid to the health plans. In January 2015, state officials reported a revised savings projection for fiscal years 2015 and 2016, reducing its savings estimate by $10 million in general funds ($20 million total), presumably to account for lower-than-expected enrollment.

Many stakeholders saw the potential for reducing costs through the CCC program, pointing to the potential for reducing unnecessary hospitalizations or emergency department visits and improving care coordination. Stakeholders also cautioned, however, that it will be important to understand the extent to which savings are associated with better service delivery or simply reductions in the types or amounts of services provided. Respondents said that it will likely take at least a year before savings can be achieved. Furthermore, some noted that upfront investments by plans and providers may be needed to develop better approaches to care delivery before those improvements yield savings.

CCC health plans receive capitation payments for each enrolled plan member to cover the cost of all services provided to CCC beneficiaries. Capitation payments include three separate payments: one from Virginia based on historical fee-for-service payments, one from CMS for all Medicare Parts A and B services, and another from CMS for Medicare Part D prescription drug services.29 Medicare payments are based on the standard methodologies for paying Medicare Advantage plans and Part D plans and are adjusted for a plan member’s health status using Medicare’s usual risk adjustment methodologies.

Virginia’s Medicaid payments are based on historical fee-for-service Medicaid payments. The state used payment claims for 2011 and 2012 to measure costs for the eligible population had the CCC program not existed. It adjusted those costs to include any changes in the state’s Medicaid benefits after those dates and to account for spending trends between the 2011-2012 period and the time of the demonstration. The base Medicaid rates are set separately for each of the five geographic regions used in the CCC program and then are risk-adjusted based on the appropriate rate cell for each plan member. The program uses four rate cells based on two factors: age (enrollees age 21 to 64 and age 65 and over) and whether or not enrollees meet nursing facility level of care criteria and are either enrolled in the EDCD waiver or residing in a nursing facility for 20 or more consecutive days; LTSS enrollees receive a “nursing home eligible” or “community well” designation.30 The rate cells do not take health conditions or service needs into account. The decision to construct rate cells in this manner means that plans receive the same payment, for example, for a “community well” enrollee who is in relatively good health and one with multiple chronic conditions, despite the likely differences in the cost of providing care to these different enrollees. It will be important to monitor the impact of these payment policies on whether all enrollees receive care appropriate to their needs.

Given that plans receive the same Medicaid payment for all enrollees who receive LTSS services, whether in the community or in a nursing facility, they have an incentive to provide community-based care, which generally is less costly on a per person basis.31 Plans receive a temporary enhanced rate for two months after an enrollee transitions from nursing home eligible to community well status. It will be important to understand how this policy plays out in terms of changes to level of care designations when redeterminations for nursing facility eligibility occur.

As established in the Memorandum of Understanding between Virginia and the federal government, both Medicaid payments and Medicare Parts A/B capitation payments (but not the Part D payment) build in a savings percentage by reducing the capitation payments otherwise calculated by 1 percent in year one, 2 percent in year two, and 4 percent in year three. The reductions are designed to capture the savings that should be achieved by the program’s promised coordination of services across Medicare and Medicaid. One additional provision builds in a limited form of risk sharing to protect the plans. In year three, the savings percentage will be lowered from 4 percent to 3 percent if any one of the three participating plans experience losses exceeding 3 percent of revenue in all regions in year one (based on 20 months of data from February 2014 to December 2015).

In addition to the savings reductions, the program will make quality withholds of 1 percent in year one, 2 percent in year one, and 3 percent in year three; these apply to state Medicaid payments and to the Medicare payment for Parts A and B, but not to Part D payments. Both federal and state agencies will evaluate plan performance according to a set of measures to determine if the plans earn back the quality withhold for a given year. Eight measures are specified for year 1 and a total of 12 measures for the next two years. For example, plans are evaluated on the share of enrollees with documented plans of care developed within specified time frames, the share of plans of care that include documented discussions of care goals, and whether plans have established a means to ensure smooth transitions to and from hospitals, nursing facilities, and the community.

The participating CCC plans are also subject to a minimum medical loss ratio requirement – the share of total payments that cover expenses directly related to medical claims or to the care and quality of plan enrollees. A plan that does not achieve a 90 percent loss ratio is subject to a corrective action plan or a fine if it falls between 85 and 90 percent. If a plan’s loss ratio is below 85 percent, the plan must return a portion of its payments. These provisions are designed to limit plan administrative costs and profits and ensure that most of the payments are spent on activities directly helping plan enrollees.

Looking Ahead

Respondents noted that the longer-term viability of the CCC program will depend on attracting and keeping beneficiaries enrolled. Some recommended restrictions regarding the timeframe or number for program opt-outs or plan switches. Others expressed concerns about limited beneficiary choice, however, and suggested that before policy changes are proposed, it will be important to determine the extent to which beneficiaries opt in or out of the program or switch plans after the transition. Unlike demonstrations in other states, beneficiaries are allowed to opt out of the CCC program and remain in fee-for-service Medicaid. If, as state officials have suggested, that option is not available in the future, it will be important to understand the impact on beneficiaries and the program.

Respondents also discussed the relationship between developing and maintaining robust provider networks and ensuring program viability. The decisions plans make about the breadth of their networks as well as providers’ decisions about whether to join networks and beneficiaries’ desires to continue using their current providers will all play a role. Stakeholders observed that beneficiaries are more likely to enroll or stay in the program if their providers support it and if they can continue with the same provider even after the transition period. They suggested that a continued commitment to providing information, education, and training as well as timely policy clarifications from CMS could increase providers’ confidence in the program.

As more information becomes available, understanding the extent to which health risk assessments lead to changes in care plans and whether the changes are for service enhancements or reductions will be important. Assessments of service accessibility will also be helpful. Examinations of the frequency with which the appeals process is used and the outcomes of appeals will be instructive.

It is too early to determine whether the program goal of improving care will be realized. Anecdotal reports from the plans highlight improvements in service delivery for individual beneficiaries, but the extent to which improvements are occurring is not yet clear. Respondents said that it will be important to understand how well coordinated services are on an ongoing basis and to review the results of health risk assessments and care plans as they are developed. Enrollment stability as well as stability of the plans’ care coordinator and case manager workforce are two factors that stakeholders say can affect service delivery over the longer term.

Stakeholders also want to understand the impact of the demonstration on the cost of providing services to dually eligible beneficiaries, but warn that it is too early to know whether savings will be achieved. They note that it will be important to understand the reasons for any savings that occur, for example the relative roles of better service coordination and service reductions. They suggest that the cost of investments to achieve better service delivery be taken into account as well.

Stakeholders generally were eager to move beyond CCC program start-up issues. As many noted, the post-transition period will be an important time to understand how the new program is affecting beneficiaries and what the longer-term impacts might be.

This issue brief was prepared by Laura Summer and Jack Hoadley of the Georgetown University Health Policy Institute.

Endnotes

- The five regions where the CCC program is operating are Central Virginia (including Richmond), Tidewater, Northern Virginia, Western/Charlottesville, and the area near Roanoke. Some counties and cities in southwestern and south central parts of the state are excluded from CCC. ↩︎

- Virginia does offer the PACE program (Program of All-inclusive Care for the Elderly) option for a limited number of beneficiaries. PACE is a Medicare and Medicaid program that helps people meet their health care needs in the community instead of going to a nursing home or other care facility. ↩︎

- Virginia Department of Medical Assistance Services, presentation by Karen E. Kimsey to the National Health Policy Forum, Improving Care for Medicare-Medicaid Enrollees, Virginia’s Financial Alignment Demonstration, December 6, 2013. Available at: http://www.nhpf.org/uploads/Handouts/Kimsey-slides_12-06-13.pdf. In its October 2014 enrollment report, DMAS reports a modestly lower count (75,300) of eligible beneficiaries. ↩︎

- The Medicaid EDCD Waiver program provides services that help individuals live in their own home or community instead of a nursing home. It is available to individuals 65 years of age and older, and to individuals of any age who have a disability. Individuals who depend on another person for their supports and have medical or nursing needs may be eligible for the EDCD Waiver. The EDCD Waiver offers services such as: adult day health care, agency and consumer-directed personal care, personal emergency response system, agency and consumer-directed respite care, and medication monitoring. ↩︎

- Excluded from the CCC program include those receiving hospice care, individuals with end-stage renal disease, those in home and community-based waiver programs other than EDCD, those in other programs (PACE, Money Follows the Person, Independence at Home), those in state mental hospitals or ICF/DDs, those under age 21, and those eligible for Medicaid for less than three months or based only on spend-down. ↩︎

- The Virginia Department of Aging and Rehabilitative Services (DARS) administers VICAP. ↩︎

- Letters are on the CCC website. The initial welcome and opt-in notice can be found at http://www.dmas.virginia.gov/Content_atchs/altc/mmfa-imme5.pdf. The 60-day passive enrollment notice is at http://www.dmas.virginia.gov/Content_atchs/altc/60DayLetterBeneficiaries.pdf. ↩︎

- Automatic enrollment was delayed one month in Central and Northern Virginia to give plans more time to get established and expand and diversify provider networks. ↩︎

- Automatic enrollment was delayed one month in Central and Northern Virginia to give plans more time to get established and expand and diversify provider networks. ↩︎

- An initial programming glitch caused confusion because the system matched first based on nursing facility residence rather than on current enrollment in a Medicare Advantage plan. ↩︎

- According to DMAS, about 12 percent of those originally estimated to be eligible had lost CCC eligibility because they lost Medicaid eligibility, moved out of the demonstration area, participate in some other exempt program, or are in an exempt facility. These beneficiaries are excluded from the numbers presented in this report. ↩︎

- By late October 2014, two localities in the Western/Charlottesville region and seven in the Northern Virginia region had only one approved MMP. Three localities in Northern Virginia had two plans available and started automatic enrollment in November 2014. ↩︎

- This group is known as “PDP Exclusion Members.” They are Medicare beneficiaries eligible for Part D’s Low-Income Subsidy (LIS) who are assigned to a plan by CMS if they do not select one on their own. In subsequent years, some LIS beneficiaries are reassigned by CMS to a new plan to ensure that they are in a premium-free plan. These reassignments are normally effective in January, so CMS opted to defer assignments to a CCC plan until January 2015 in order to avoid two changes in beneficiaries’ drug coverage within a single year. ↩︎

- Cindi B. Jones, “Estimates of Medicaid Reform Costs and Savings,” presentation to the Medicaid Innovation and Reform Commission, October 21, 2013. http://mirc.virginia.gov/documents/10-21-13/102113_No5_Jones_MIRC.pdf. ↩︎

- These rates are similar to those in Massachusetts, as of November 1, 2014 (27 percent overall and 37 percent in counties with automatic enrollment). Calculated from http://www.mass.gov/eohhs/docs/masshealth/onecare/enrollment-reports/enrollment-report-november2014.pdf. ↩︎

- Data for the period from June 14, 2014 to September 20, 2014 from: Virginia Department of Medical Assistance Services, presentation by Fuwei Guo to the Commonwealth Coordinated Care Advisory Committee, Examples of CCC Data Analytics, October 22, 2014. Available at: http://www.dmas.virginia.gov/Content_atchs/altc/October%2022%202014%20Duals%20Meeting%20Materials.pdf. ↩︎

- Data for the period from June 14, 2014 to September 20, 2014 from: Virginia Department of Medical Assistance Services, presentation by Fuwei Guo to the Commonwealth Coordinated Care Advisory Committee, Examples of CCC Data Analytics, October 22, 2014. Available at: http://www.dmas.virginia.gov/Content_atchs/altc/October%2022%202014%20Duals%20Meeting%20Materials.pdf. ↩︎

- According to 2010 data, 0.7 percent of Virginia duals were in Medicare Advantage Special Needs Plans for dually eligible beneficiaries (dual SNPs), and 0.3 percent were in PACE plans. No duals were in comprehensive Medicaid managed care plans. Marsha R. Gold, Gretchen A. Jacobson, and Rachel L. Garfield, “There is Little Experience and Limited Data to Support Policy Making on Integrated Care for Dual Eligibles,” Health Affairs 31(6):1176-1185, June 2012. ↩︎

- Networks were approved for a second plan in six additional cities and counties in early 2015. Beneficiaries not yet enrolled or opted out in those localities received their passive enrollment letters by May 1, 2015, with their coverage effective on July 1, 2015. As of April 2015, there were still nine cities or counties without two approved plans where passive enrollment is not authorized. ↩︎

- See Contract Between United States Department of Health and Human Services Centers for Medicare & Medicaid Services In Partnership with The Commonwealth of Virginia Department of Medical Assistance Services and (Health Plans) Issued: December 4, 2013. Section 2.7.5. Available at: http://www.cms.gov/Medicare-Medicaid-Coordination/Medicare-and-Medicaid-Coordination/Medicare-Medicaid-Coordination-Office/FinancialAlignmentInitiative/Downloads/VirginiaContract.pdf. ↩︎

- Vulnerable subpopulations include: Individuals enrolled in the EDCD Waiver; Individuals with intellectual/developmental disabilities; Individuals with cognitive or memory problems (e.g., dementia or traumatic brain injury); Individuals with physical or sensory disabilities; Individuals residing in nursing facilities; Individuals with serious and persistent mental illnesses; Individuals with end stage renal disease; and, Individuals with complex or multiple chronic conditions. See Contract Between United States Department of Health and Human Services Centers for Medicare & Medicaid Services In Partnership with The Commonwealth of Virginia Department of Medical Assistance Services and (Health Plans) Issued: December 4, 2013. Section 2.7.2.3. Available at: http://www.cms.gov/Medicare-Medicaid-Coordination/Medicare-and-Medicaid-Coordination/Medicare-Medicaid-Coordination-Office/FinancialAlignmentInitiative/Downloads/VirginiaContract.pdf. ↩︎

- See Contract Between United States Department of Health and Human Services Centers for Medicare & Medicaid Services In Partnership with The Commonwealth of Virginia Department of Medical Assistance Services and (Health Plans) Issued: December 4, 2013. Section 2.7.5. Available at: http://www.cms.gov/Medicare-Medicaid-Coordination/Medicare-and-Medicaid-Coordination/Medicare-Medicaid-Coordination-Office/FinancialAlignmentInitiative/Downloads/VirginiaContract.pdf. ↩︎

- These policies are similar to those in other states, though more comprehensive than some in terms of making provisions for enrollees if they change plans, and for allowing enrollees to remain in any nursing facility. The period for maintaining current providers generally ranges from 90 to 180 days in other demonstrations, though some allow certain groups of enrollees – such as those receiving home and community-based LTSS – to maintain current providers for up to one year. ↩︎

- Virginia Department of Medical Assistance Services, presentation by Tammy Whitlock to the Commonwealth Coordinated Care Advisory Committee, Virginia Update, July 17, 2012. Available at: http://www.dmas.virginia.gov/Content_atchs/altc/October%2022%202014%20Duals%20Meeting%20Materials.pdf. ↩︎

- The Ombudsman Office is located in the Department of Aging and Rehabilitative Services. ↩︎

- Virginia Department for Aging and Rehabilitative Services, presentation by Susan Johnson to the Commonwealth Coordinated Care Advisory Committee, Ombudsman Program Update, October 22, 2014. Available at: http://www.dmas.virginia.gov/Content_atchs/altc/October%2022%202014%20Duals%20Meeting%20Materials.pdf. ↩︎

- Virginia Department of Medical Assistance Services, presentation by Gerald A. Craver to the Commonwealth Coordinated Care Advisory Committee, Program Evaluation Update, October 22, 2014. Available at: http://www.dmas.virginia.gov/Content_atchs/altc/October%2022%202014%20Duals%20Meeting%20Materials.pdf. ↩︎

- Cindi B. Jones, “Estimates of Medicaid Reform Costs and Savings,” presentation to the Medicaid Innovation and Reform Commission, October 21, 2013. http://mirc.virginia.gov/documents/10-21-13/102113_No5_Jones_MIRC.pdf. Reductions in federal funds are based on Virginia’s 50 percent Federal Medical Assistance Percentage (FMAP). ↩︎

- “Commonwealth Coordinated Care CY 2014 Rate Report,” November 25, 2013. http://www.dmas.virginia.gov/Content_atchs/altc/cntct-mmfa_cr1.pdf. ↩︎

- A further adjustment is made to reflect the split of “nursing home eligible” beneficiaries between those in nursing facilities and those in the community at the time of enrollment into each plan. Because care in a facility is more costly, this adjustment ensures that a plan is not penalized if more of its passive enrollees or fewer of those opting out are in facilities at the time of enrollment. ↩︎

- There is a lagged adjustment in payment rate amounts reflecting each plan’s mix of nursing home eligible enrollees in nursing facilities versus the community. The intent is to maintain an incentive to keep nursing eligible enrollees in the community while capturing some savings for the state. ↩︎