Sources of Supplemental Coverage Among Medicare Beneficiaries in 2016

Today, 60 million people, including 51 million older adults and 9 million younger adults with disabilities, rely on Medicare for their health insurance coverage. Medicare beneficiaries can choose to get their Medicare benefits (Part A and Part B) through the traditional Medicare program, or they can enroll in a Medicare Advantage plan, such as a Medicare HMO or PPO. In 2018, two-thirds of Medicare beneficiaries are in traditional Medicare, and one-third are enrolled in Medicare Advantage plans.

Many traditional Medicare beneficiaries also rely on other sources of coverage to supplement their Medicare benefits. Supplemental insurance coverage typically covers some or all of Medicare Part A and Part B cost-sharing requirements and, in some instances, covers benefits Medicare does not. This data note explores sources of supplemental coverage among beneficiaries in traditional Medicare, based on data from the 2016 Medicare Current Beneficiary Survey (the most recent year available).

Sources of Supplemental Coverage in 2016

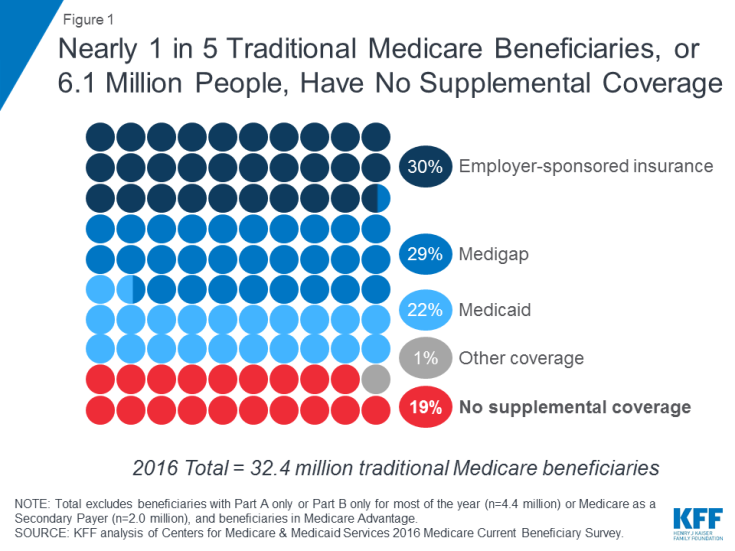

In 2016, eight in 10 beneficiaries in traditional Medicare (81%) had some type of supplemental insurance, including employer-sponsored insurance (30%), Medigap (29%), and Medicaid (22%) (Figure 1). But nearly 1 in 5 beneficiaries in traditional Medicare (19%)—6.1 million beneficiaries overall—had no source of supplemental coverage in 2016, which places them at greater risk of incurring high medical expenses or foregoing medical care due to costs.

Nearly 1 in 5 Traditional Medicare Beneficiaries, or 6.1 Million People, Have No Supplemental Coverage

- Employer-sponsored insurance provides retiree health coverage to 3 in 10 (30%) traditional Medicare beneficiaries in 2016, or nearly 10 million beneficiaries (not including 3.4 million beneficiaries who were enrolled in Medicare Advantage plans offered exclusively to employers’ or unions’ retirees and 2.0 million who had Medicare as a secondary payer). Compared to all traditional Medicare beneficiaries in 2016, those with employer-sponsored retiree coverage had relatively high incomes and higher education levels, and were disproportionately white (Table 1). Over time, the share of beneficiaries with employer-sponsored retiree coverage is expected to decline, because the share of large firms offering it to their employees has dropped over time.

- Medigap, also called Medicare Supplement Insurance, provided supplemental coverage to nearly 3 in 10 (29%) beneficiaries in traditional Medicare in 2016, or roughly 9 million beneficiaries, although the share with Medigap varies by state. Medigap policies, sold by private insurance companies, fully or partially cover Part A and Part B cost-sharing requirements, including deductibles, copayments, and coinsurance. Compared to all traditional Medicare beneficiaries in 2016, those with Medigap had higher incomes and education levels, and were more likely to be white—similar to the characteristics of beneficiaries with retiree health benefits. Only a small share of Medigap policyholders (3%) were under age 65 and qualified for Medicare due to a disability; most states do not provide underwriting protections or require insurers to issue Medigap policies to beneficiaries under age 65

- Medicaid, the federal-state program that provides health and long-term care coverage to low-income people, was a source of supplemental coverage for more than 1 in 5 (22%, or 7.0 million) traditional Medicare beneficiaries with low incomes and modest assets in 2016 (not including 3.5 million beneficiaries who were enrolled in both Medicare Advantage and Medicaid). For these beneficiaries, sometimes called dual eligible beneficiaries because they are eligible for both Medicare and Medicaid, Medicaid typically covers the Medicare Part B premium and may also pay a portion of Medicare deductibles and other cost-sharing requirements. The majority of dually eligible beneficiaries are eligible for full Medicaid benefits, including long-term services and supports. Compared to all traditional Medicare beneficiaries in 2016, a significantly larger share of traditional Medicare beneficiaries with Medicaid had low incomes, reported their health status as fair or poor, were under age 65 and qualified for Medicare due to a disability, and were black (18%) or Hispanic (15%).

- No supplemental coverage. In 2016, 6.1 million Medicare beneficiaries—nearly 1 in 5 (19%) Medicare beneficiaries in traditional Medicare—had no other source of coverage. Compared to all traditional Medicare beneficiaries in 2016, a larger share of beneficiaries with no supplemental coverage had modest incomes (between $20,000 and $40,000), were age 85 or older, and male. Beneficiaries in traditional Medicare with no supplemental coverage are fully exposed to Medicare’s cost-sharing requirements, unlike people with ESI and Medigap, and lack the protection of an annual limit on out-of-pocket spending, unlike beneficiaries enrolled in Medicare Advantage.

Methods

This analysis based on data from the Centers for Medicare & Medicaid Services 2016 Medicare Current Beneficiary Survey (MCBS). Sources of supplemental coverage are determined based on the source of coverage held for the most months of Medicare enrollment in 2016. The analysis excludes beneficiaries who were enrolled in Part A only or Part B only for most of their Medicare enrollment in 2016 (n=4.4 million), beneficiaries who had Medicare as a secondary payer (n=2.0 million), and beneficiaries enrolled in Medicare Advantage. The exclusion of Medicare Advantage enrollees is due to data discrepancies between the MCBS and Medicare enrollment files, whereby the weighted total number of Medicare Advantage enrollees as reported in the MCBS is higher than the total number of Medicare Advantage enrollees as reported in the Medicare enrollment files.

| Table 1: Characteristics of Traditional Medicare Beneficiaries by Type of Supplemental Coverage, 2016 | |||||||

| All Traditional Medicare Beneficiaries (32.4 million) |

Medicaid (7.0 million) |

Employer-sponsored Insurance (9.6 million) |

Medigap (9.5 million) |

Other Coverage (0.3 million) |

No Supplemental Coverage (n=6.1 million) |

||

| Gender | |||||||

| Male | 45% | 40%* | 46% | 42%* | 48% | 51%* | |

| Female | 55% | 60%* | 54% | 58%* | 52% | 49%* | |

| Age | |||||||

| Under 65 | 16% | 46%* | 5%* | 3%* | 27% | 18% | |

| 65-74 | 45% | 27%* | 49%* | 55%* | 49% | 45% | |

| 75-84 | 26% | 16%* | 33%* | 29%* | 14%* | 22%* | |

| 85+ | 13% | 11%* | 13% | 13% | 10% | 16%* | |

| Race/ethnicity | |||||||

| White | 79% | 56%* | 84%* | 91%* | 58%* | 77% | |

| Black | 9% | 18%* | 8% | 3%* | 17% | 11% | |

| Hispanic | 6% | 15%* | 4%* | 2%* | 17% | 5% | |

| Other | 6% | 10%* | 4%* | 4%* | 9% | 7% | |

| Education | |||||||

| Less than high school | 17% | 37%* | 8%* | 9%* | 18% | 19% | |

| High school/GED | 27% | 33%* | 23%* | 27% | 30% | 28% | |

| Some college or vocational school |

31% | 24%* | 33% | 32% | 38% | 32% | |

| Bachelor’s or higher | 26% | 5%* | 36%* | 32%* | 15%* | 21%* | |

| Geographic area | |||||||

| Metropolitan | 74% | 73% | 78% | 72% | 77% | 73% | |

| Rural micropolitan | 17% | 16% | 15% | 18% | 16% | 17% | |

| Rural adjacent or nonadjacent | 9% | 10% | 7% | 10% | 8% | 10% | |

| Income | |||||||

| Under $10,000 | 13% | 38%* | 4%* | 6%* | 14% | 11%* | |

| $10,000 to <$20,000 | 25% | 50%* | 14%* | 18%* | 34% | 26% | |

| $20,000 to <$40,000 | 30% | 11%* | 34%* | 37%* | 31% | 36%* | |

| $40,000 or more | 31% | 1%* | 48%* | 39%* | 20% | 28%* | |

| Health status | |||||||

| Excellent | 16% | 6%* | 21%* | 20%* | 17% | 14% | |

| Very good | 28% | 14%* | 34%* | 34%* | 25% | 26% | |

| Good | 30% | 30% | 30% | 29% | 16%* | 30% | |

| Fair | 18% | 32%* | 12%* | 13%* | 31% | 22%* | |

| Poor | 7% | 17%* | 3%* | 4%* | 11% | 8% | |

| NOTE: *Indicates statistically significant difference from all traditional Medicare beneficiaries at the 95th percentile. Estimates exclude beneficiaries enrolled in Medicare Advantage, beneficiaries in Part A only or Part B only for most of their enrollment in 2016, and beneficiaries with Medicare as a secondary payer. Sources of supplemental coverage are assigned based on the source of coverage held for the most months of enrollment in 2016. SOURCE: KFF analysis of Centers for Medicare & Medicaid Services 2016 Medicare Current Beneficiary Survey. |

|||||||