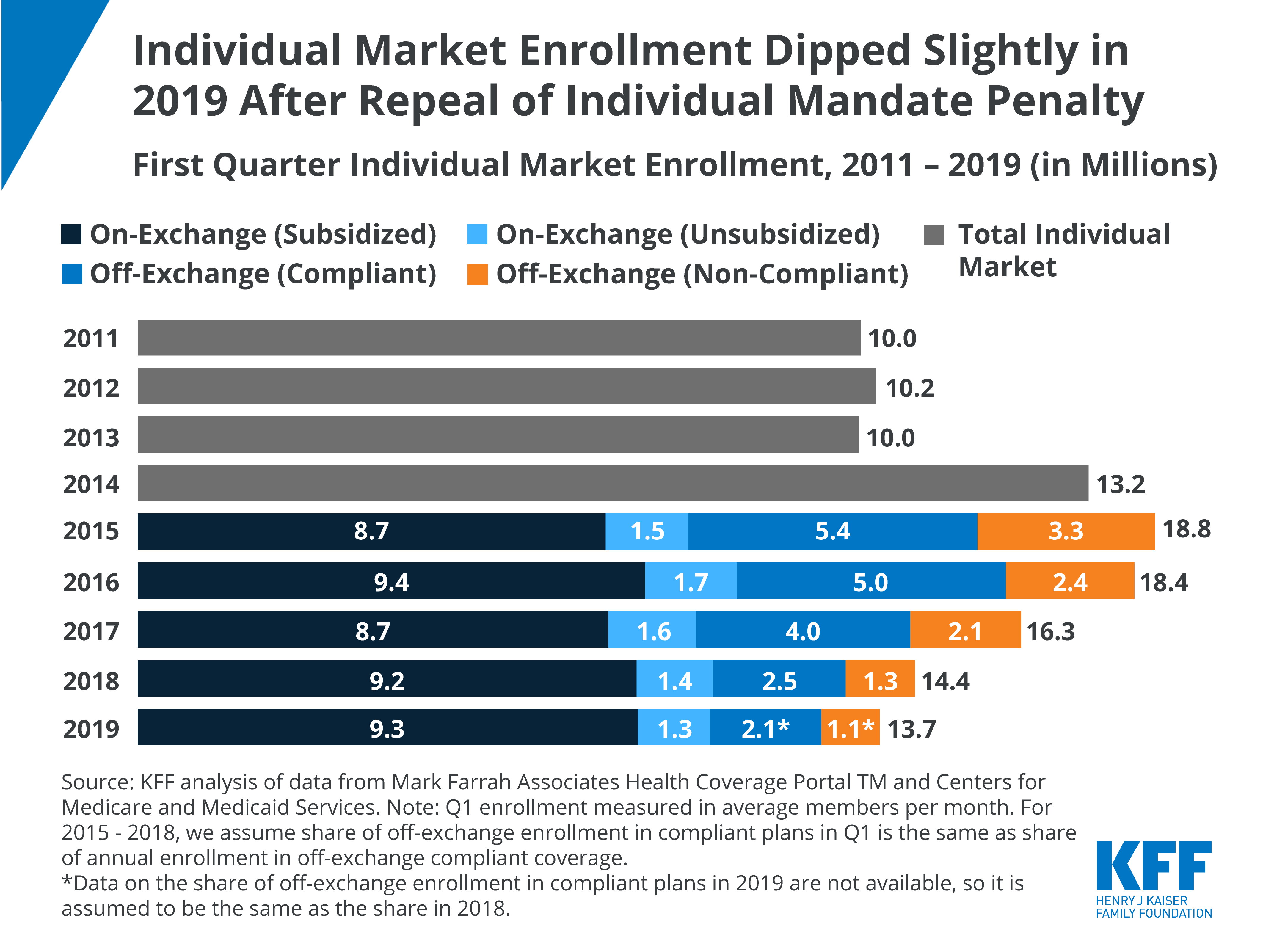

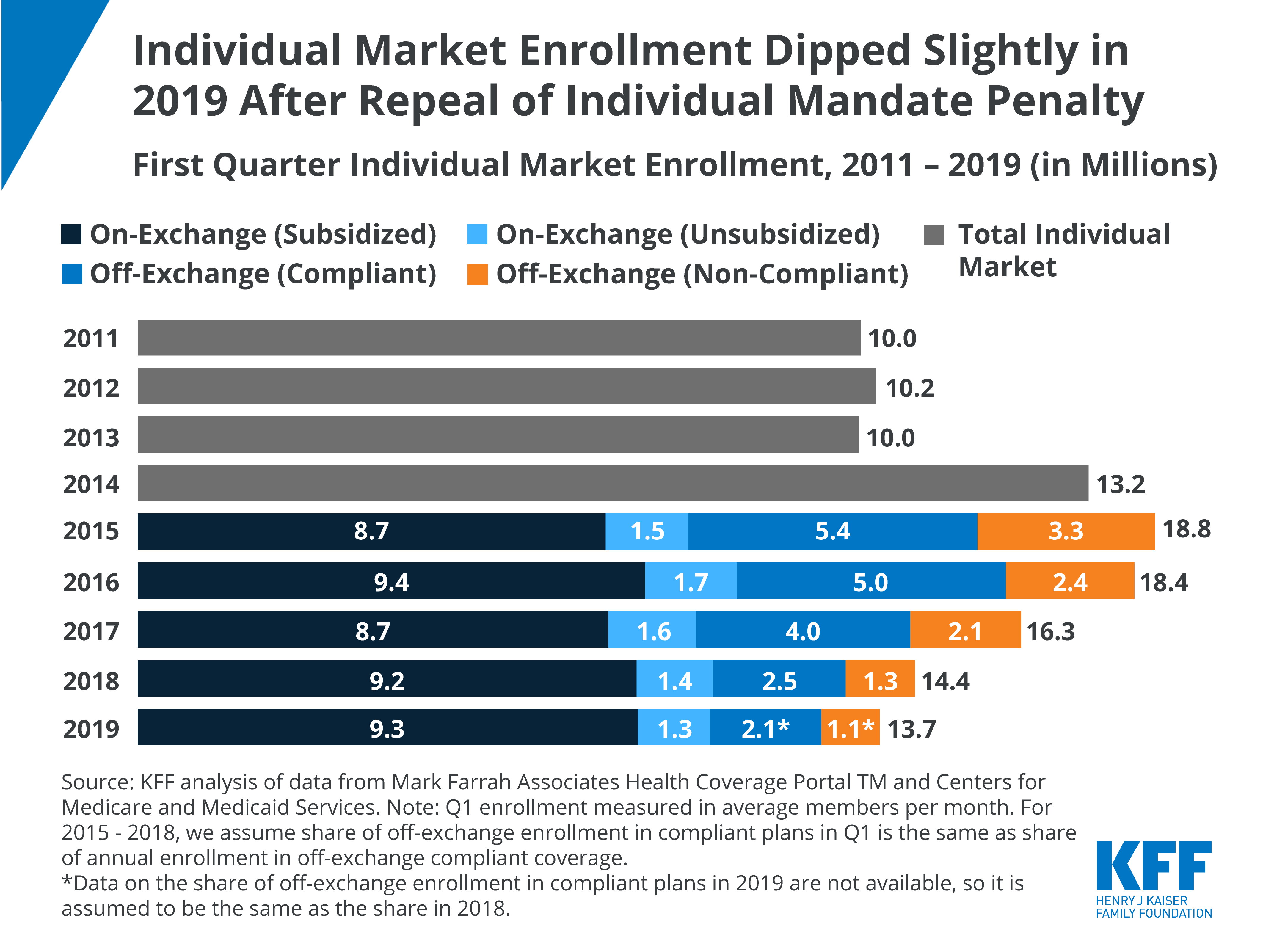

Individual Market Enrollment Dipped Slightly in 2019 After Repeal of Individual Mandate Penalty

Source

Data Note: Changes in Enrollment in the Individual Health Insurance Market through Early 2019

The independent source for health policy research, polling, and news.

KFF’s policy research provides facts and analysis on a wide range of policy issues and public programs.

KFF designs, conducts and analyzes original public opinion and survey research on Americans’ attitudes, knowledge, and experiences with the health care system to help amplify the public’s voice in major national debates.

KFF Health News is a national newsroom that produces in-depth journalism about health issues and is one of the organization’s core operating programs.

Data Note: Changes in Enrollment in the Individual Health Insurance Market through Early 2019

© 2025 KFF