Potential Supreme Court Decision: Who Will Bear the Coverage “Burdens?”

One of the elements of the Affordable Care Act that has received considerable national attention is the requirement that employers that provide health insurance to their workers must include coverage for all FDA approved contraceptive services and supplies.1 This requirement has been at the center of a case that has now reached the Supreme Court. The plaintiffs, Hobby Lobby and Conestoga Wood Specialties, are two for-profit corporations contending that the requirement that they include coverage for certain contraceptive services (emergency contraceptive pills and intrauterine devices) in their insurance plans “substantially burdens” both the corporation’s and the owners’ religious rights. In the March 2014 oral arguments, several of the justices discussed the extent to which the corporations did or not did not have a choice in offering coverage to their workers. In this brief, we explore some of the factors influencing coverage decisions and possible consequences2 for women and employers given two possible Supreme Court decision options: either upholding the contraceptive coverage requirement as it applies to Hobby Lobby or in favor of Hobby Lobby. For ease of using one example, we will use Hobby Lobby in this brief. Any decision will apply to both companies.

Background

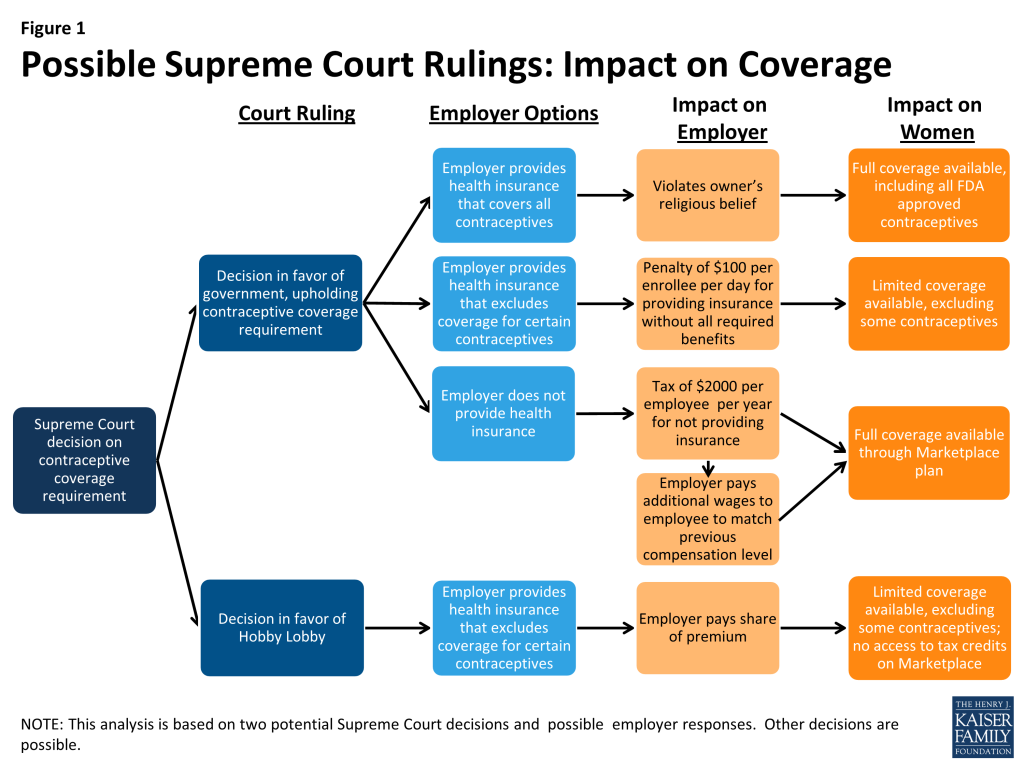

Hobby Lobby is seeking relief from the contraceptive requirement on religious grounds. Depending on the court’s decision and Hobby Lobby’s response, there are multiple possible outcomes. Figure 1 illustrates two possible decisions and the potential impact on coverage, but the Court also could craft a decision that finds a middle ground. If Hobby Lobby provides employer sponsored insurance that does not include the full range of FDA approved methods then they will be forced to pay a steep penalty of $100 per day per enrollee, estimated to be almost $564 million a year for Hobby Lobby,3 a fine they say would lead them to bankruptcy. Alternatively, they state that the other option of not insuring their workers would be inconsistent with their religious beliefs to care for their workers, and it would also require them to pay an “Employer Shared Responsibility Payment” which is a $2,000 tax per full-time employee (excluding the first 30 employees) per year. With 16,000 full-time employees, Hobby Lobby would have to pay almost $32 million per year.4

Oral Arguments

During the oral argument, the Supreme Court Justices discussed what would be the impact if Hobby Lobby did not provide health coverage to its employees and instead paid the tax.5 Justice Sotomayor noted: “The briefs on both sides are written as if the penalty for not having a health insurance policy that covers contraceptives is at issue. But isn’t there another choice nobody talks about, which is paying the tax, which is a lot less than the penalty and a lot less than the cost of health insurance at all?” Justice Kagan echoed Justice Sotomayor and said “There’s a choice. And so the question is: why is there substantial burden at all?”

Chief Justice Roberts highlighted one of Hobby Lobby’s arguments: “I thought that part of the religious commitment of the owners was to provide health care for it employees.” Justice Kagan questioned whether Hobby Lobby’s religion mandates them to provide health insurance: “… I’m sure they want to be good employers. But again that’s a different thing than saying that their religious beliefs mandate them to provide health insurance, because here Congress has said that the health insurance that they’re providing is not adequate, it’s not the full package.” While Hobby Lobby offers health insurance to its 16,000 full-time employees it does not offer health insurance to its 12,000 part-time employees.6

In their brief, Hobby Lobby asserts that it will suffer “significant competitive disadvantages in hiring and retaining employees” if it were to discontinue its plan.7 This point was raised by Justice Scalia: “Well of course it wouldn’t be the same price at the end of the day. If they deny health insurance, they’re going to have to raise wages if they are going to get employees.” Justice Kennedy questioned: “Let’s assume that the cost of providing insurance is roughly equivalent to the $2000 penalty. How – how is the employer hurt? He can just raise the wages.”

The Justices were attempting to estimate whether a financial burden would be placed on Hobby Lobby by dropping their health insurance and paying the $2,000 per employee tax. This is a very complicated equation with many variables including how much Hobby Lobby contributes toward health insurance for their workers, how comprehensive the plan is, household income, family size, and the workers’ wages.

Why Employers Offer Insurance

There are many reasons that insurance coverage is a good way to compensate workers from a business and tax perspective.8 Employees are not taxed on the employer’s contribution toward health insurance premiums, which reduces their overall tax liability. In addition, in the pre-ACA marketplace, it was difficult for individuals to buy affordable health insurance comparable to employer sponsored insurance. Many plans sold on the individual market either excluded or charged substantially more for coverage to many individuals with pre-existing conditions. The ACA introduced new variables into the equation by making premium subsidies available to low and modest income individuals, and ending higher pricing and coverage restrictions for pre-existing conditions.

Today, the value of employer sponsored insurance is shaped by worker income, with the value greater to higher income workers who benefit from the tax exclusions because they pay a higher tax rate and are not eligible for premium tax credits available on the Marketplace.9 Lower income workers, on the other hand do not benefit as much from this tax exclusion, since their tax rate is lower, and may now qualify for premium tax credits on the Marketplace.10 However, if their employer offers coverage, workers are not eligible for premium tax credits, regardless of how low their household income is.

Employee costs to obtain coverage on the Marketplace and the level of assistance for which they would qualify depend on their age, family size, household income, and where they live. Instead of offering employer sponsored insurance, firms could adjust workers’ compensation to offset the loss of that coverage, and enable workers to purchase insurance on the Marketplace. Firms, however, are not permitted to pay workers with the same job different amounts based on whether the worker qualifies for premium tax credits, but could make an adjustment based on the aggregate characteristics of their workforce.

Potential Coverage Consequences of Decision

The Supreme Court is expected to issue its decision by the end of June 2014. While the Court could write a nuanced opinion that finds a middle ground, it is instructive to consider the coverage and cost implications on the workers and the employers of the two decisions on each extreme: The Court either finds that Hobby Lobby must comply with the contraceptive requirement, or that Hobby Lobby does not need to comply with the contraceptive requirement because it violates their religious rights.

If the Court decides that Hobby Lobby must comply with the contraceptive coverage requirement, Hobby Lobby will likely choose to stop providing health insurance, given the litigation around the violation of religious rights and the very high costs of the $100 per employee penalty for not providing the required benefits. In this outcome, the option of paying a $2000 tax per employee seems to be the most likely outcome. This $2,000 tax per employee is not deductible as a business expense like health insurance or wages. Without information about Hobby Lobby’s sponsored insurance and characteristics of their workforce, it is not possible to estimate Hobby Lobby’s specific costs or savings of not offering health insurance to their workers or make a direct comparison to a plan on a Marketplace.11

If Hobby Lobby were to adjust their worker’s compensation to offset the loss of employer sponsored insurance and maintain a competitive advantage, the amount and form of compensation will depend on a number of factors including: Hobby Lobby’s prior contribution toward worker coverage, the type of coverage, the age and income distribution of their workforce, and labor market conditions. As we discussed earlier, there would be different tax consequences for employees of varying incomes if they were to receive additional compensation in the form of wages rather than health insurance. Hobby Lobby could adjust compensation in various ways other than increased wages by offering additional vacation time, retirement, or other wellness benefits, that may be attractive to higher wage workers.12

If, however, the Supreme Court exempts Hobby Lobby from the requirement that they include all prescribed FDA approved contraceptives as the ACA requires, some female employees and dependents who are covered by Hobby Lobby’s health insurance may either have to go without their preferred contraceptive method, pay out of pocket, or seek subsidized services at a government funded clinic. Intrauterine devices (IUDs), one of the contraceptives that Hobby Lobby has objected to, are the most effective form of contraceptives, but they also have more upfront charges, as the average cost of an IUD including insertion is over $1,000. In this case, the objection is to IUDs and emergency contraceptive pills, but it would be easy to envision that other corporations with religious objections to the full range of contraceptives would eliminate coverage of all contraceptive methods from their plans if this avenue were available to them. The “burden” of the costs of contraceptive care would be placed on the women and in some cases on the taxpayers who will pay for care at subsidized clinics, if they are available to the women.

Clearly, the impact of the Supreme Court’s decision will likely be far-reaching, affecting not only the corporations that are objecting to the requirement but also the scope of coverage and out of pocket costs, and contraceptive choices that the women workers and their dependents will have to make.

- Some employers are eligible for an exemption or accommodation. For an explanation of the legal background please see Kaiser Family Foundation, A Guide to the Supreme Court’s Review of the Contraceptive Coverage Requirement, Dec. 2013. ↩︎

- This brief will not delve into the possible broader ramifications of allowing for-profit corporations to have religious rights. ↩︎

- Hobby Lobby has estimated the penalty and tax based on 13,000 full-time employees. We calculate the penalty and the tax based on 16,000 full-time employees. This figure was provided in Hobby Lobby Press Release, February 5, 2014 and email correspondence on April 1, 2014 with Ashley Wilemon, Saxum, public relations firm representing Hobby Lobby. ↩︎

- To avoid a payment for failing to offer health coverage, employers need to offer coverage to 70 percent of their full-time employees in 2015 and 95 percent in 2016 and beyond. U.S. Treasury Department, Fact Sheet: Final Regulations Implementing Employer Shared Responsibility Under the Affordable Care Act (ACA) for 2015 ↩︎

- Professor Martin Lederman first wrote about this option. Some of the amicus briefs raised this issue. See Brief of Religious Organizations as Amici Curiae Supporting the Government, January 28, 2014, and Brief of The Guttmacher Institute and Professor Sara Rosenbaum as Amici Curiae in Support of the Government, January 2014 ↩︎

- Hobby Lobby Press Release, February 5, 2014 and email correspondence on April 1, 2014 with Ashley Wilemon, Saxum, public relations firm representing Hobby Lobby. ↩︎

- Sebelius v. Hobby Lobby, Brief for Respondents, February, 2014 page 10 ↩︎

- See, Kaiser Family Foundation, Tax Subsidies for Health Insurance, July 2008; Burtless G and Milusheva S, Effects of Employer Sponsored Health Insurance Costs on Social Security Taxable Wages, Security Bulletin, Vol. 73, No. 1, 2013 and Gruber J, The Tax Exclusion for Employer-Sponsored Health Insurance, Working Paper 15766, National Bureau of Economic Research, February 2010 ↩︎

- The 12.4% employee-employer assessment to support Social Security is capped; the assessment is only collected on wages up to an annual per employee earnings limit. The limit in 2014 is $117,000 per worker.The tax benefits of employer sponsored insurance are higher up to the Social Security earnings limit, after which the tax benefit falls. ↩︎

- Some experts have identified 250 percent of the Federal poverty level as the threshold at which the value of the premium tax credit will (on average) exceed the value of the tax exclusion for employer –sponsored insurance, although the calculation will depend on household circumstances, employee contributions, and plan parameters. Buchmueller Thomas, Carey, Colleen and Levy, Helen G. Will Employers Drop Health Insurance Coverage Because Of The Affordable Care, Health Affairs, 32, no.9 (2013):1522-1530 at page 1526 citing Blumberg L, Buettgens M, Feder J, Holahan J. Why Employers Will Continue to Provide Health Insurance: The Impact of the Affordable Care ActWashington (DC): Urban Institute; October 2011 ↩︎

- For example, silver plans have an actuarial value of 70% which means that means that for a standard population, the plan will pay 70% of their health care expenses, while the enrollees themselves will pay 30% through some combination of deductibles, copays, and coinsurance. The ACA requires employer sponsored plans to have a minimum value which requires an actuarial value of at least 60%. But in 2010, a majority of employer sponsored plans had actuarial values of over 80% using the Federal Employees Health Benefits program Blue Cross/ Blue Shield PPO as an external benchmark. See CMS, Department of Health and Human Services, Minimum Value Calculator Methodology and ASPE, Actuarial Value and Employer Sponsored Insurance Research Brief ↩︎

- Singhal S, Stueland J, Ungerman D, How US health Care Reform Will Affect Employee Benefits. McKinsey Quarterly, June 2011 ↩︎