Coverage for Abortion Services in Medicaid, Marketplace Plans and Private Plans

Issue Brief

State and federal efforts to address insurance and Medicaid coverage of abortion services began soon after the 1973 Supreme Court’s Roe v. Wade decision legalizing abortion and have continued to the present day. Starting in 1977, the Hyde Amendment banned the use of any federal funds for abortion, allowing only exceptions for pregnancies that endanger the life of the woman, or that result from rape or incest. The issue of abortion coverage was at the heart of many debates in the run up to the passage of the ACA, and subsequently led to renewed legislative efforts at the state level to limit coverage of abortions, this time in private insurance plans. As insurance and Medicaid coverage for abortion is increasingly limited by state and federal regulations as well as insurer coverage policies, in many states hundreds of thousands of women seeking abortion services annually are left without coverage options – even when they are victims of rape or incest or if the pregnancy is determined to be a threat to their health. This brief reviews current federal and state policies on Medicaid and insurance coverage of abortion services, and presents national and state estimates on the availability of abortion coverage for women enrolled in private plans, Marketplace plans and Medicaid.

FEDERAL AND STATE LAWS REGARDING COVERAGE OR PAYMENT FOR ABORTION

Almost one million women in the U.S. have an abortion every year.1 Federal and state laws, as well as insurers’ coverage policies, shape the extent to which women can have coverage for abortion services under both publicly funded programs and private plans. Women who seek an abortion, but do not have coverage for the service, shoulder the out-of-pocket costs of the services. The cost of an abortion varies depending on factors such as location, facility, timing and type of procedure. The median cost of an abortion at 10 weeks gestation is $500, whereas the median cost of an abortion at 20 weeks gestation is $1195.2 Though the vast majority (~90%) of abortions are performed in the first trimester of pregnancy, the costs are challenging for many low-income women.3 ,4 Approximately 5% of abortions are performed at 16 weeks or later in the pregnancy.5 For women with medically complicated health situations or who need a second-trimester abortion, the costs could be prohibitive. In some cases, women find they have to delay their abortion while they take time to raise funds,6 or women may first learn of a fetal anomaly in the second trimester when the costs are considerably higher.7 According to the Federal Reserve Board, forty percent of U.S. adults do not have enough savings to pay for a $400 emergency expense.

Since 1977, federal law has banned the use of any federal funds for abortion unless the pregnancy is a result of rape, incest, or if it is determined to endanger the woman’s life. This rule, also known as the Hyde Amendment, is not a permanent law; rather it has been attached annually to Congressional appropriations bills and has been approved every year by Congress.

The Hyde Amendment initially affected only funding for abortions under Medicaid, but over the years, its reach broadened to limit federal funds for abortion for federal employees and women in the Indian Health Service. From 1981 to 2013, the military health insurance program limited coverage for abortion to circumstances when the woman’s life was endangered. In early 2013, an amendment to the National Defense Authorization Act expanded insurance coverage for servicewomen and military dependents to include abortions of pregnancies resulting from rape or incest, as permitted in other federal programs.8 Federal funds cannot be used to pay for abortions in other circumstances, and abortions can only be performed at military medical facilities in cases of life endangerment, rape, or incest. State level policies also have a large impact on how insurance and Medicaid cover abortions, particularly since states are responsible for the operation of Medicaid programs and insurance regulation.

Medicaid

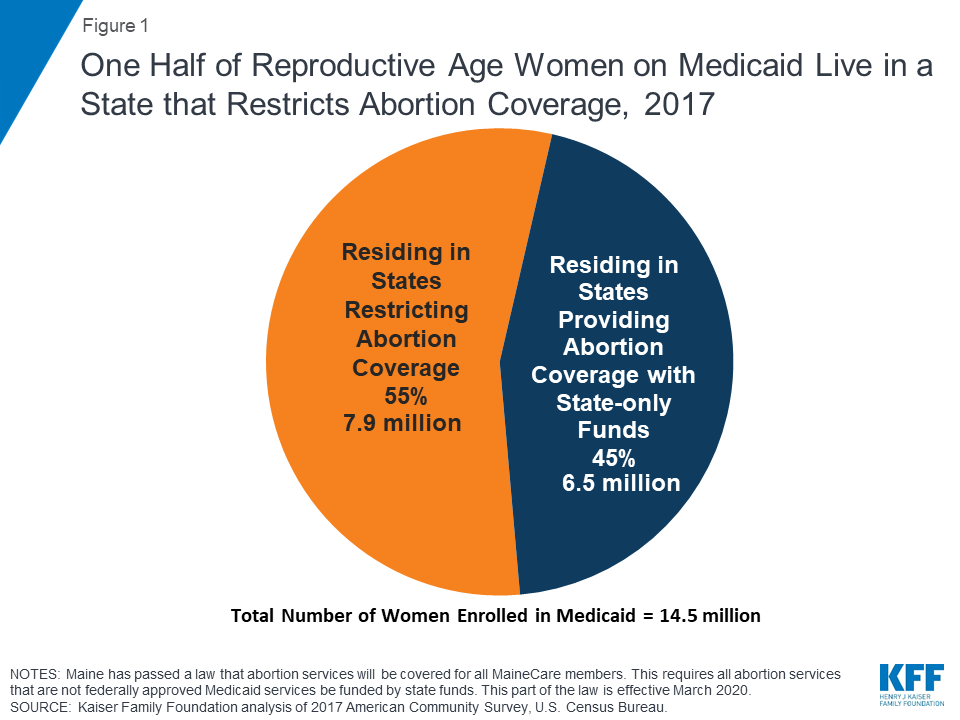

The Medicaid program serves millions of low-income women and is a major funder of reproductive health services nationally. Approximately two-thirds of adult women enrolled in Medicaid are in their reproductive years.9 As discussed earlier, the federal Hyde Amendment restricts state Medicaid programs from using federal funds to cover abortions beyond the cases of life endangerment, rape, or incest. However, if a state chooses to, it can use its own funds to cover abortions in other circumstances. Currently, 16 states use state-only funds to pay for abortions for women on Medicaid in circumstances different from those federal limitations set in the Hyde Amendment.10 In 35 states and the District of Columbia, Medicaid programs do not pay for any abortions beyond the Hyde exceptions (Appendix Table 1) 11 12 Currently, half of women with Medicaid coverage live in states that use their own funds to pay for abortion services, beyond the federal Hyde limitations (Figure 1 and Appendix Table 2).

A 2019 GAO study of state policies regarding Medicaid coverage of abortion found that South Dakota’s Medicaid program only covers abortions in the case of life endangerment and not in the cases of rape or incest, in violation of federal law. The same study also found that 14 state Medicaid programs do not cover Mifeprex, the prescription drug most commonly used for medication abortions.13 All 14 of these states only pay for abortions in the circumstances permitted by the Hyde Amendment. So the only option for women enrolled in Medicaid in these states would be to obtain a surgical abortion in the cases of rape, incest, and life endangerment and they or their doctors would not be able to opt for a medication abortion. CMS has not taken any action against these 14 states for failing to comply with the outpatient drug requirements, or against South Dakota for not covering abortion in all of the circumstances required by Hyde. Furthermore, while 37 states reported that their Medicaid programs cover Mifeprex, only 13 of these states have actually requested a Medicaid rebate for this drug. In the other states, the program had not paid for this drug for a patient in the last three years, indicating that medication abortions may be very limited in these states.

The ACA includes a provision that applies the Hyde restrictions to Marketplace plans, ensuring that federal funds are only used to subsidize coverage for pregnancy terminations that endanger the life of the woman or that are a result of rape or incest. State Medicaid expansion programs can only fund abortions in other circumstances using only state funds and no federal funds. President Obama issued an executive order as part of health reform that restated the federal limits specifically for Medicaid coverage of abortion.14 The law also explicitly does not preempt other current state policies regarding abortion, such as parental consent or notification, waiting period laws or any of the abortion limits or coverage requirements that states have enacted.

Private Insurance

States have the responsibility to regulate fully insured individual, small, and large group plans issued in their state, whereas the federal government regulates self-insured plans under the Employee Retirement Income Security Act (ERISA). States can choose to regulate whether abortion coverage is included or excluded in private plans that are not self-insured. In the private insurance sector, 11 states impose restrictions on the circumstances under which insurance will cover abortions (Appendix Table 1). Some states follow the same restrictions as the federal Hyde Amendment for their private plans, while some are more restrictive. Idaho has exceptions for cases of rape, incest, or to save the woman’s life for plans sold on the Marketplace, but limits abortion coverage to cases of life endangerment to the woman for all other private plans issued in the state. Utah has exceptions to save the life of the mother or avert serious risk of loss of a major bodily function, if the fetus has a defect as documented by a physician that is uniformly diagnosable and lethal, and in cases of rape or incest. However, six states (Kansas, Kentucky, Missouri, Nebraska, North Dakota, and Oklahoma) have an exception only to save the woman’s life for all fully insured private plans regulated by the state. Michigan allows abortion coverage in cases of life endangerment, in cases involving a pregnancy reduction for a multi-fetal pregnancy when the abortion increases the probability of a live birth, or preserves the life or health of the child after live birth.15 Texas allows abortion coverage only in the cases of severe health endangerment or life endangerment. Five states had these laws on the books prior to the ACA, and six more states have passed new laws restricting private plan coverage post-ACA. While ten of these states allow insurers to sell riders for abortion coverage on the private market, a Kaiser Family Foundation study found that in 2018, no insurers offered abortion riders to women insured through individually purchased plans, and only one insurance company in one state offered an abortion rider in the group market. The lack of abortion riders leaves women insured by private plans in these states with no option to secure coverage for abortion services. Utah does not allow riders to be sold for abortion coverage.

There is no recent data on the number of private plans that include abortion coverage. Only four states (California, New York, Oregon, and Washington) require all state-regulated private health plans, including Marketplace plans, to include coverage for abortion.16 Maine enacted a law that requires all private health insurance plans renewed on or after January 1, 2020 that cover maternity care to cover abortion services.17 California and Washington require all plans including individual and employer plans to treat abortion coverage and maternity coverage neutrally. As all plans are required to include maternity coverage, all plans must also include abortion coverage.18 ,19

ACA Marketplace Plans

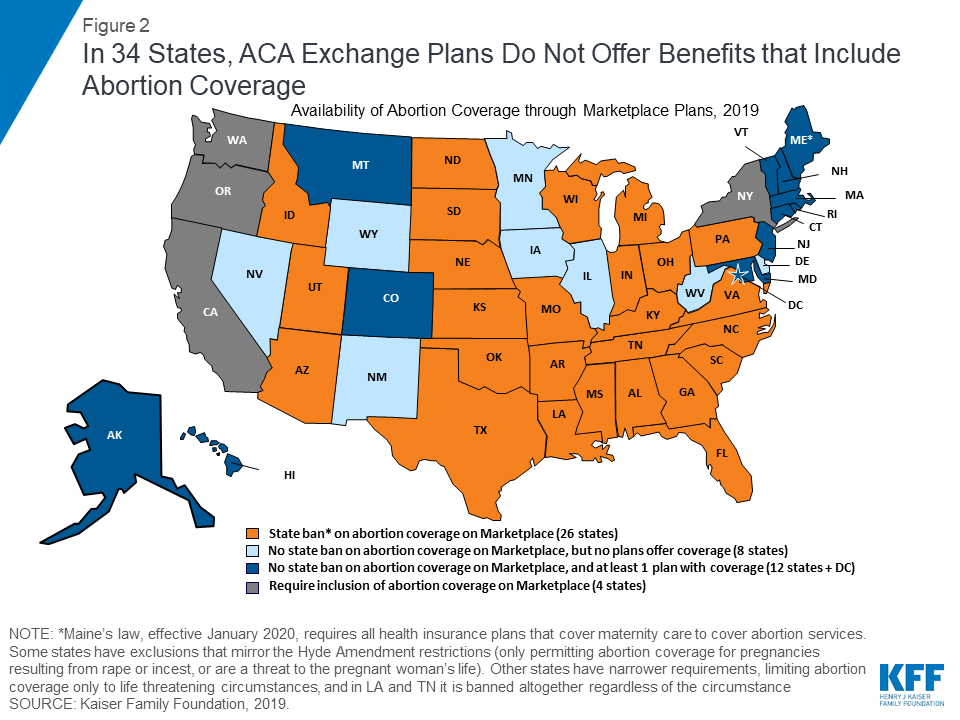

All plans offered on the ACA Marketplaces must provide coverage for 10 Essential Health Benefits (EHB), including maternity care and prescription drugs. Abortion services, however, are explicitly excluded from the list of EHBs that all plans are required to offer. Under federal law, no plan is required to cover abortion. States can enact laws that bar all plans participating in the state Marketplace from covering abortions, which 26 states have done since the ACA was signed into law in 2010 (Figure 2). Most state laws include narrow exceptions for women whose pregnancies endanger their life or are the result of rape or incest, but two states (Louisiana and Tennessee) do not provide for any exceptions.20 The ACA prohibits plans in the state Marketplaces from discriminating against any provider because of “unwillingness” to provide abortions.

In a review of 2019 Marketplace plans, eight states that do not have laws restricting abortion coverage (Delaware, Iowa, Illinois, Minnesota, New Mexico, Nevada, West Virginia, and Wyoming), had no Marketplace plans that offered abortion coverage (Figure 2). In the five states (Connecticut, Hawaii, Maryland, New Hampshire, and Vermont) and the District of Columbia that have no laws banning on requiring abortion coverage, all of the 2019 Marketplace plans include abortion coverage. Four states (California, New York, Oregon, and Washington) require abortion coverage from plans on the marketplace. As of January 1, 2020, abortion coverage will be required on the Marketplace in Maine. There are seven states (Alaska, Colorado, Maine,21 Massachusetts, Montana, New Jersey, and Rhode Island) that do not require abortion coverage and offer at least one plan on the Marketplace that includes abortion coverage. For women in these seven states, the actual availability of coverage depends on whether there is a plan offered in their area that includes abortion services. As a combined result of the state laws and insurance company choices, women in 34 states currently do not have access to insurance coverage for abortions through a Marketplace plan – the only place where consumers can qualify for tax subsidies to help pay for the cost of health insurance premiums if they are income eligible.

Special Rules for Billing and Payment for Marketplace Plans that Include Abortion Coverage

In states that do not restrict coverage of abortions on plans available through the Marketplace, insurers may offer a plan that covers abortions beyond the federal limitations but this coverage must be paid for using private, not federal, dollars. Plans must notify consumers of the abortion coverage as part of the Summary of Benefits and Coverage explanation at the time of enrollment. The ACA outlines a methodology for states to follow to ensure that no federal funds are used towards coverage for abortions beyond the Hyde limitations. Any plan that covers abortions beyond Hyde limitations must estimate the actuarial value of such coverage by taking into account the cost of the abortion benefit (valued at least $1 per enrollee per month). This estimate cannot take into account any savings that might be achieved as a result of the abortions (such as prenatal care or delivery).22

Furthermore, the federal rules stipulate that plans that offer abortion coverage and receive federal subsidies (it is believed that all plans in the state Marketplace receive at least some federal subsidies) need to collect two premium payments so that the funds go into separate accounts. One payment is for the value of the abortion benefit, and the other payment is for the value of all other services covered by the plan. The plan issuer must deposit the funds in separate allocation accounts overseen for compliance by state health insurance commissioners.23

Both sides of the abortion debate have been unsatisfied with these rules. While it is clear that there is no abortion coverage available to women eligible for subsidies in the states that have barred it in the Marketplace, there has been a lot of attention about how difficult it is for consumers in the remaining states to determine whether plans include abortion coverage and any limitations placed on the coverage. While Marketplace plans are required to include whether abortion is covered in their Summary of Benefits and Coverage (SBC), the limitations on abortion coverage may not be specified in the SBC or individual policies. Members may need to call their insurance claims department to determine under which conditions abortion is covered. The phrase “limitations may apply” can mean a variety of things. Some plans include a range of limitations, including time limits (only covering abortion up until 18 weeks of pregnancy), lifetime limits (only two abortions covered per lifetime), or limitations on what kind of abortion is covered (medication vs. surgical). Several plans that list that abortion is covered with limitations outline in their individual plan documents that abortion is only covered under Hyde conditions – rape, incest, or life endagerment.

While the reasons why issuers in states that permit abortion coverage have opted to exclude abortion coverage are not known, it is possible that the complexity of the requirements specific only to abortion coverage could be a deterrent to the plans. This was raised as a possible outcome during the pre-ACA abortion coverage debate. The Nelson Amendment included in the final law requires plans to segregate funds used for abortion coverage, effectively collecting an additional fee for this coverage, and adding a layer of administrative complexity.24 Plans that choose to include abortion coverage are also subject to additional reporting standards and audit requirements. For example, this might be the case in West Virginia, where the same insurance carrier that does not offer abortion coverage for individual policies is, however, including abortion coverage in the group policies sold to small firms through the small group marketplace plans, where the abortion-related accounting rules and reporting requirements do not apply.

The Trump Administration has recently proposed two rules that would further complicate the requirements for both consumers and issuers that offer Marketplace plans that include abortion coverage. HHS takes the position that the current abortion coverage regulations finalized by the Obama Administration do “not adequately reflect…Congressional intent that the QHP issuer bill separately for two distinct (that is “separate”) payments as required by Section 1303 of the PPACA.” To address this, on November 7, 2018, the Trump Administration issued a proposed regulation, which would require significant changes to how issuers must bill, and consumers must pay, for non-Hyde abortion coverage in Marketplace plans that include abortion coverage. Under this proposed rule:

- Issuers would be required to send two separate monthly bills either by mail or electronically to each policyholder: one bill would be for the non-Hyde abortion coverage (at least $1 per member per month) and one bill would be the premium for everything else excluding the non-Hyde abortion coverage.

- Consumers would be instructed by the issuer to pay in two separate transactions. If the consumer is paying by mail, the consumer must be told to send two checks in separate envelopes or make two electronic payments in the cases where the policyholder pays through electronic funds transfer.

CMS received over 70,000 comments on this provision, and has not finalized this rule.

On January 24, 2019, the Trump Administration issued the proposed Notice of Benefit and Payment Parameters (NBPP) regulation, mostly aimed at technical changes to the ACA Marketplaces. However, this proposed rule also included a provision requiring Marketplace plans offering abortion coverage beyond the Hyde circumstances to offer “mirror plans” that would only provide coverage of abortion in the circumstances permitted by the Hyde Amendment (rape, incest, or life endangerment). The proposal would effectively require a Marketplace issuer that provides abortion coverage to offer two plans, one with abortion coverage and a second “mirror plan” with very limited or no abortion coverage.

CMS is continuing to review the over 25,000 comments on this provision and did not finalize this proposed requirement when it issued the final 2020 Notice of Benefit and Payment Parameters rule. If CMS finalizes either this provision or the special billing and payment regulations, the availability of coverage for abortion will likely be further eroded.

CONCLUSION

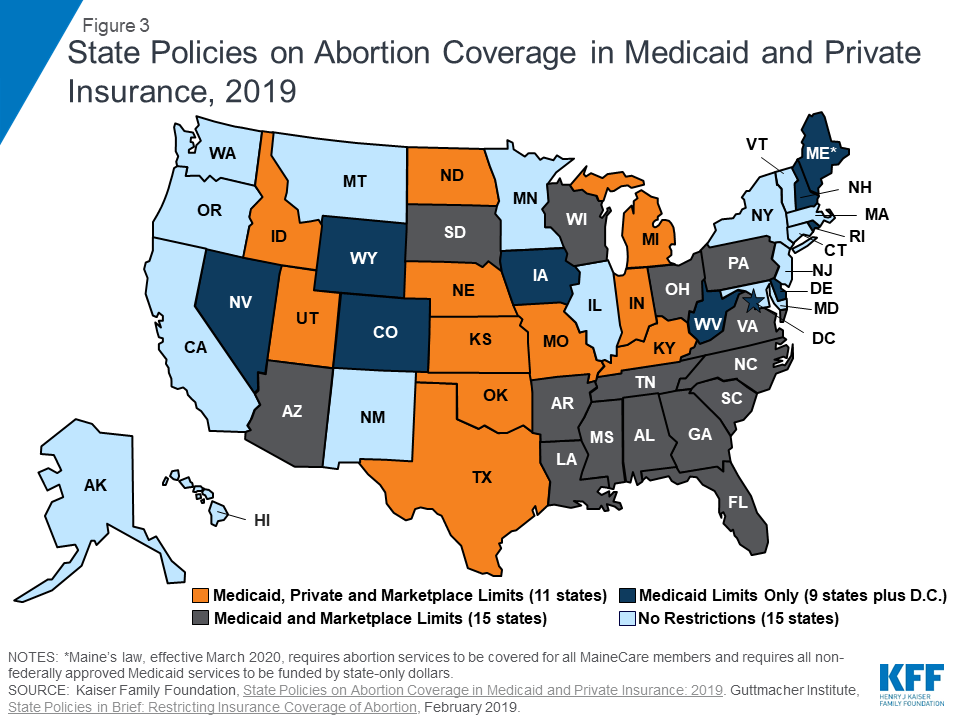

The combination of longstanding federal and state policies along with the new wave of state laws that restrict abortion coverage has made coverage options constrained in many states. In 11 states, women enrolled in Medicaid, Private, and Marketplace Plans, have essentially no abortion coverage options. (Figure 3). In 15 additional states, women who qualify for Medicaid or who seek to get coverage through their state Marketplace also lack abortion coverage; in 9 other states and DC women enrolled in Medicaid have abortion coverage limited to the circumstances permitted in the Hyde Amendment. Furthermore, while there are 24 states and DC that do not have policies that limit abortion coverage in the ACA Marketplace, 8 of these states do not offer any 2019 Marketplace plans that include abortion coverage.

The impact of the abortion coverage restrictions disproportionately affects poor and low-income women, who have limited ability to pay for abortion services with out-of-pocket funds. Today, half of women on Medicaid have abortion coverage that is limited to pregnancies resulting from rape, incest, or life endangerment. While millions of women have gained health insurance coverage as a result of the ACA insurance expansions, many are enrolled in plans that restrict the circumstances in which abortion services will be covered. In the coming years, laws enacted at the federal and state levels, as well as the choices made by insurers, employers, and policyholders will ultimately determine the extent of abortion coverage that will be available to women across the nation.

The authors would like to thank Anthony Damico an independent consultant to the Kaiser Family Foundation for assistance with data analysis.

Appendix

| Appendix Table 1: Scope of Abortion Coverage in Medicaid and Private Plans, by State as of May 2019 | ||||

| State | States with No MedicaidExpansion and Not Using State Funds to Pay for Abortions | States with MedicaidExpansion and Not Using State Funds to Pay for Abortions | State Law RestrictingAbortion Coverage to Limited Circumstances in Marketplace Plans | State Law LimitingAbortion in Private InsuranceIssued in the State |

| United States | 14 | 22 | 26 | 11 |

| Alabama | X | X | ||

| Alaska | ||||

| Arizona* | X | X | ||

| Arkansas | X | X | ||

| California | ||||

| Colorado | X | |||

| Connecticut | ||||

| Delaware | X | |||

| DC | X | |||

| Florida | X | X | ||

| Georgia | X | X | ||

| Hawaii | ||||

| Idaho | X | X | X | |

| Illinois | ||||

| Indiana | X | X | X | |

| Iowa | X | |||

| Kansas | X | X | X | |

| Kentucky | X | X | X | |

| Louisiana | X | X | ||

| Maine** | X | |||

| Maryland | ||||

| Massachusetts | ||||

| Michigan | X | X | X | |

| Minnesota | ||||

| Mississippi | X | X | ||

| Missouri | X | X | X | |

| Montana | ||||

| Nebraska | X | X | X | |

| Nevada | X | |||

| New Hampshire | X | |||

| New Jersey | ||||

| New Mexico | ||||

| New York | ||||

| North Carolina | X | X | ||

| North Dakota | X | X | X | |

| Ohio | X | X | ||

| Oklahoma | X | X | X | |

| Oregon | ||||

| Pennsylvania | X | X | ||

| Rhode Island | X | |||

| South Carolina | X | X | ||

| South Dakota*** | X | X | ||

| Tennessee | X | X | ||

| Texas | X | X | X | |

| Utah | X | X | X | |

| Vermont | ||||

| Virginia | X | X | ||

| Washington | ||||

| West Virginia | X | |||

| Wisconsin | X | X | ||

| Wyoming | X | |||

| NOTES: *Arizona’s state Medicaid program does not pay for medically necessary abortions, despite court order. **Maine has passed a law that abortion services will be covered for all MaineCare members. This requires all abortion services that are not federally approved Medicaid services be funded by state funds. This part of the law is effective March 2020. This law also requires all private health insurance plans that cover maternity care in Maine to cover abortion services. This provision will be in effect January 2020. ***South Dakota pays for abortion only in cases of life endangerment.SOURCE: Kaiser Family Foundation State Health Facts; Guttmacher Institute, State Policies in Brief, Overview of Abortion Laws, June 2019. | ||||

| Appendix Table 2: Health Insurance Coverage of Women Ages 15-49 | ||||||

| State | Total | Employer | Medicaid | Other | Direct Purchase | Uninsured |

| U.S. Total | 72,811,478 | 42,778,519 | 14,490,605 | 1,569,461 | 5,528,416 | 8,443,630 |

| Alabama | 1,083,980 | 624,045 | 187,236 | 34,753 | 87,069 | 150,877 |

| Alaska | 165,031 | 83,193 | 36,749 | 12,489 | 7,096 | 25,504 |

| Arizona* | 1,533,095 | 841,013 | 361,079 | 30,014 | 102,432 | 198,557 |

| Arkansas | 648,833 | 343,901 | 172,400 | 15,726 | 47,823 | 68,983 |

| California | 9,255,238 | 5,063,680 | 2,434,123 | 152,049 | 790,389 | 814,997 |

| Colorado | 1,297,912 | 772,508 | 255,827 | 39,981 | 107,609 | 121,987 |

| Connecticut | 770,052 | 482,155 | 171,271 | 11,622 | 52,204 | 52,800 |

| Delaware | 205,504 | 132,396 | 36,688 | 6,245 | 15,052 | 15,123 |

| DC | 190,247 | 124,471 | 43,468 | 3,040 | 13,493 | 5,775 |

| Florida | 4,433,626 | 2,285,358 | 712,826 | 112,536 | 537,114 | 785,792 |

| Georgia | 2,453,499 | 1,417,987 | 301,206 | 79,980 | 198,659 | 455,667 |

| Hawaii | 298,401 | 191,654 | 54,199 | 22,172 | 14,173 | 16,203 |

| Idaho | 372,380 | 208,777 | 51,797 | 7,436 | 43,756 | 60,614 |

| Illinois | 2,898,140 | 1,803,691 | 605,796 | 34,618 | 195,971 | 258,064 |

| Indiana | 1,469,052 | 920,513 | 267,537 | 20,645 | 97,576 | 162,781 |

| Iowa | 660,809 | 444,699 | 124,506 | 7,849 | 46,111 | 37,644 |

| Kansas | 624,810 | 406,069 | 72,121 | 23,539 | 50,638 | 72,443 |

| Kentucky | 963,443 | 547,500 | 279,907 | 22,490 | 47,594 | 65,952 |

| Louisiana | 1,060,358 | 546,659 | 312,524 | 23,598 | 72,917 | 104,660 |

| Maine* | 267,211 | 165,978 | 47,628 | 4,175 | 20,445 | 28,985 |

| Maryland | 1,371,743 | 899,380 | 249,573 | 37,317 | 86,307 | 99,166 |

| Massachusetts | 1,533,232 | 984,287 | 390,819 | 13,448 | 97,273 | 47,405 |

| Michigan | 2,155,734 | 1,329,323 | 543,535 | 22,404 | 130,712 | 129,760 |

| Minnesota | 1,215,704 | 820,978 | 231,886 | 15,657 | 78,586 | 68,597 |

| Mississippi | 663,521 | 349,244 | 130,634 | 20,541 | 49,050 | 114,052 |

| Missouri | 1,320,510 | 834,358 | 178,798 | 30,005 | 107,416 | 169,933 |

| Montana | 217,557 | 118,588 | 46,141 | 4,414 | 23,024 | 25,390 |

| Nebraska | 406,614 | 262,143 | 43,241 | 11,295 | 40,009 | 49,926 |

| Nevada | 686,486 | 403,515 | 124,289 | 17,166 | 40,442 | 101,074 |

| New Hampshire | 275,094 | 194,338 | 37,952 | 5,750 | 17,765 | 19,289 |

| New Jersey | 2,004,561 | 1,295,179 | 335,819 | 26,752 | 133,129 | 213,682 |

| New Mexico | 448,293 | 193,055 | 163,787 | 14,322 | 22,129 | 55,000 |

| New York | 4,524,937 | 2,645,195 | 1,215,128 | 43,212 | 307,394 | 314,008 |

| North Carolina | 2,321,229 | 1,321,710 | 370,953 | 85,714 | 195,033 | 347,819 |

| North Dakota | 157,832 | 105,946 | 14,697 | 5,266 | 15,922 | 16,001 |

| Ohio | 2,515,633 | 1,538,192 | 615,117 | 41,803 | 141,078 | 179,443 |

| Oklahoma | 861,106 | 482,518 | 119,278 | 27,079 | 61,800 | 170,431 |

| Oregon | 922,510 | 527,426 | 224,041 | 11,504 | 78,010 | 81,529 |

| Pennsylvania | 2,681,877 | 1,700,565 | 570,345 | 45,478 | 181,075 | 184,414 |

| Rhode Island | 230,392 | 139,320 | 59,883 | 3,353 | 14,837 | 12,999 |

| South Carolina | 1,094,681 | 614,719 | 191,702 | 33,444 | 85,397 | 169,419 |

| South Dakota*** | 174,117 | 110,457 | 20,542 | 3,202 | 19,415 | 20,501 |

| Tennessee | 1,499,939 | 860,104 | 319,042 | 44,155 | 105,578 | 171,060 |

| Texas | 6,707,147 | 3,717,353 | 766,624 | 140,650 | 477,420 | 1,605,100 |

| Utah | 749,681 | 515,905 | 65,698 | 10,241 | 74,128 | 83,709 |

| Vermont | 125,190 | 69,659 | 39,560 | 8,709 | 6,415 | |

| Virginia | 1,905,914 | 1,208,329 | 194,750 | 117,232 | 159,384 | 226,219 |

| Washington | 1,668,709 | 1,027,071 | 344,964 | 49,656 | 117,740 | 129,278 |

| West Virginia | 372,596 | 197,957 | 123,024 | 7,965 | 15,134 | 28,516 |

| Wisconsin | 1,228,349 | 833,447 | 215,205 | 11,723 | 88,155 | 79,819 |

| Wyoming | 118,969 | 72,011 | 14,690 | 3,756 | 8,244 | 20,268 |

| NOTES: *Arizona’s state Medicaid program does not pay for medically necessary abortions, despite court order.**South Dakota pays for abortion only in cases of life endangerment. | ||||||

| Blue shading indicates states with limitations on abortion coverage in private plans. | ||||||

| Gray shading indicates states restricting Medicaid abortion coverage to Hyde Amendment rules. | ||||||

| *Arizona’s state Medicaid program does not pay for medically necessary abortions, despite court order. **Maine has passed a law that abortion services will be covered for all MaineCare members. This requires all abortion services that are not federally approved Medicaid services be funded by state funds. This part of the law is effective March 2020. This law also requires all private health insurance plans that cover maternity care in Maine to cover abortion services. This provision will be in effect January 2020. ***South Dakota pays for abortion only in cases of life endangerment.SOURCES: Kaiser Family Foundation estimates based on 2017 Census Bureau’s American Community Survey; Guttmacher Institute State Policies in Brief Overview of Abortion Laws, June 2019 | ||||||

Endnotes

- Guttmacher Institute Facts on Induced Abortion in the United States January 2018. ↩︎

- Guttmacher Institute, Medicaid Funding of Abortion February 2018. ↩︎

- Guttmacher Institute. State Policies in Brief Overview of Abortion Laws April 1, 2019. ↩︎

- Guttmacher Institute Facts on Induced Abortion in the United States January 2018. ↩︎

- Ibid. ↩︎

- Heather D. Boonstra Guttmacher Institute Abortion in the Lives of Women Struggling Financially: Why Insurance Coverage Matters July 2016. ↩︎

- National Journal “Should Mothers Be Forced to Bear Disabled Children Against Their Will?” October 2013. ↩︎

- Senator Shaheen “Shaheen Amendment Signed into Law” January 3 2013. ↩︎

- Kaiser Family Foundation Medicaid’s Role for Women March 2019. ↩︎

- Guttmacher Institute. State Policies in Brief Overview of Abortion Laws April 2019. ↩︎

- H.P. 594, 129th Maine Legislature, Reg. Sess. 2019. Maine has passed a law that abortion services will be covered for all MaineCare members. This requires all abortion services that are not federally approved Medicaid services be funded by state funds. This part of the law is effective March 2020. ↩︎

- South Dakota does not have a rape or incest exception limiting coverage to cases of life endangerment for the woman. ↩︎

- The 14 states that reported not covering Mifeprex were Alabama, Arkansas, Colorado, District of Columbia, Florida, Idaho, Kentucky, Missouri, North Carolina, Oklahoma, Rhode Island, South Carolina, Texas, and Utah. ↩︎

- The White House Office of the Press Secretary Executive Order 13535– Patient Protection and Affordable Care Act’s Consistency with Longstanding Restrictions of the Use of Federal Funds for Abortion March 24 2010. ↩︎

- Michigan Act 182: Abortion Insurance Opt Out Act. ↩︎

- Kaiser Family Foundation Abortion Coverage in the Premium Relief Act of 2017 (HR 4666) March 2018. ↩︎

- H.P. 594, 129th Maine Legislature, Reg. Sess. 2019. ↩︎

- Michelle Rouillard Director of Department of Managed Health Care letter to Mark Morgan California President of Anthem Blue Cross RE: Limitations or Exclusions of Abortion Services. August 22 2014. Available: https://www.dmhc.ca.gov/Portals/0/082214letters/abc082214.pdf. ↩︎

- Washington State Legislature. SB 6219 2017 -18. Concerning health plan coverage of reproductive care. ↩︎

- Guttmacher Institute. Restricting Insurance Coverage of Abortion, April 2019. ↩︎

- H.P. 594, 129th Maine Legislature, Reg. Sess. 2019. Maine has passed a law, effective January 1, 2020, that requires all private health insurance plans, including those on the Marketplace, that cover maternity care in Maine to cover abortion services. ↩︎

- The Patient Protection and Affordable Care Act Section 1303 Special Rules. ↩︎

- Kaiser Family Foundation, Abortion Coverage in the ACA Marketplace Plans: The Impact of Proposed Rules for Consumers, Insurers, and Regulators, December 2018. ↩︎

- The Patient Protection and Affordable Care Act Section 1303 Special Rules. ↩︎