States Focus on Quality and Outcomes Amid Waiver Changes: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2018 and 2019

Provider Rates and Taxes

| Key Section Findings |

| Provider rate changes are often tied to the economy. In FY 2018 and FY 2019, with stable economic conditions in most states, more states made or are planning provider rate increases compared to restrictions. This holds true across provider types, except for inpatient hospital rates (inpatient hospital rate restrictions are primarily rate freezes, which are counted as restrictions in this report). Further, the number of states that reported at least one rate restriction in FY 2019 is the smallest number since FY 2008. All states except Alaska rely on provider taxes and fees to fund a portion of the non-federal share of the costs of Medicaid. Two states indicate plans for new provider taxes in FY 2019, including Virginia that plans a new hospital provider tax to finance state costs of the newly adopted Medicaid expansion. Over half of MCO states (21 of 39) require MCO payments for some or all types of providers to follow percent or level changes made in comparable FFS rates. Twenty-seven states reported that their MCO contracts include rate floors for some provider types, and five states reported they had minimum MCO payment requirements for all types of Medicaid providers.

What to watch:

Tables 11 through 13 provide complete listings of Medicaid provider rate changes and provider taxes and fees in place in FY 2018 and FY 2019. |

Provider Rates

Provider rate changes are often tied to the economy. During economic downturns and budget shortfalls, states often turn to rate restrictions to contain costs, and during periods of recovery and revenue growth, states are more likely to increase rates. This report examines rate changes across major provider categories: inpatient hospitals, nursing facilities, MCOs, outpatient hospitals, primary care physicians, specialists, dentists, home and community-based services (HCBS), and pharmacy dispensing fees. States were asked to report aggregate rate changes for each provider category in their FFS programs.

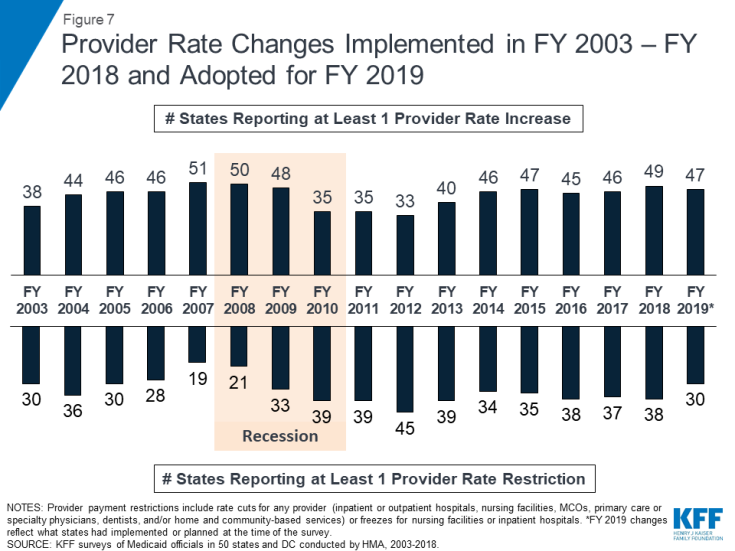

The number of states that made or are planning rate increases exceeds the number implementing or planning rate restrictions in both FY 2018 and FY 2019. In FY 2018, almost every state implemented rate increases for at least one category of providers (49 states), while fewer implemented rate restrictions (38 states) (Figure 7 and Table 11). For FY 2019, the number of states with at least one implemented or planned rate increase (47 states) is greater than the number of states with at least one implemented or planned rate restriction (31 states) (Figure 7 and Table 12). The number of states that reported at least one rate restriction in FY 2019 is the smallest number since FY 2008.

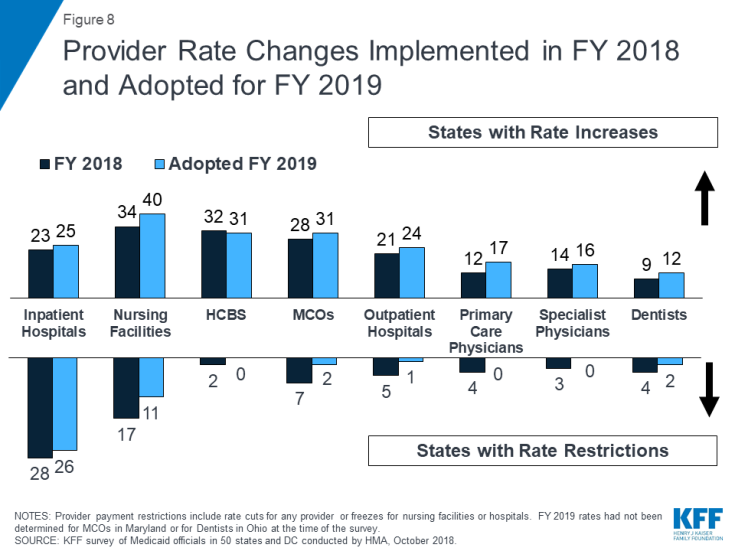

The number of states with rate increases exceeds the number of states with restrictions in FY 2018 and FY 2019 across all major categories of providers, with the exception of rates for inpatient hospital services (Figure 8 and Tables 11 and 12). For the purposes of this report, cuts or freezes in rates for inpatient hospitals and nursing facilities are counted as restrictions.1 Most of the restrictions of inpatient hospital rates are rate freezes. Three states in FY 2018 and three states in FY 2019 had implemented or planned cuts to inpatient hospital rates. While three states cut nursing facility rates in FY 2018, no states indicate plans to cut nursing facility rates in FY 2019.

The number of states planning to increase nursing facility rates in FY 2019 (40 states) is greater than the number of states increasing those rates in FY 2018 (34 states). HCBS providers were also among those most likely to receive rate increases (32 states in FY 2018 and 31 states in FY 2019) (Figure 8).

State authority to adjust capitation payments for MCOs is limited by the federal requirement that states pay actuarially sound rates. In FY 2018 and FY 2019, the majority of the 39 states with Medicaid MCOs either implemented or planned increases in MCO rates. While seven states reported MCO rate cuts in FY 2018, only two states plan to cut MCO rates in FY 2019.2

MCO Rate Requirements

Over half of MCO states require MCOs to change provider payment rates in accordance with FFS payment rate changes. In many states, MCOs make most of the Medicaid payments to providers. This year’s survey asked states to report whether they require their MCOs to make changes to their provider payments that follow percent or level changes in FFS rates. Of the 39 states with MCOs, 18 states indicated that they had no such requirement, 19 states have such a requirement for some provider types, and two states (Louisiana and Mississippi) required MCOs to make these changes for all types of Medicaid providers.

Most MCO states mandate minimum provider reimbursement rates in their MCO contracts. Of the 39 MCO states, seven indicated that they had no rate floors, 27 states indicated that they had rate floors for some provider types, and five states said they had minimum MCO payment requirements for all Medicaid provider types. Among states with rate floors for some provider types, the most commonly mentioned providers were long term care providers (nursing facilities and home and community-based service providers), community health centers (federally qualified health centers and rural health centers), and various providers of behavioral health services.

Provider Taxes and Fees

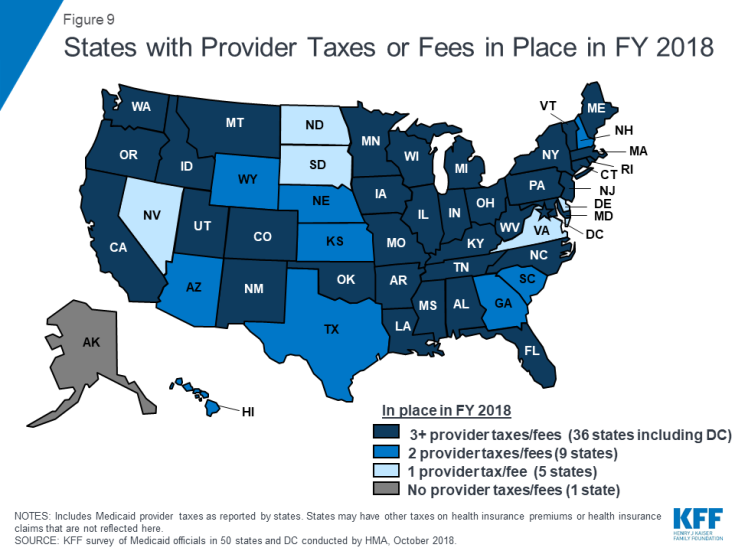

Provider taxes are an integral source of Medicaid financing. In this year’s survey, states reported continuing or increased reliance on provider taxes and fees to fund a portion of the non-federal share of Medicaid costs in FY 2018 and FY 2019. At the beginning of FY 2003, 21 states had at least one provider tax in place. Over the next decade, a majority of states imposed new taxes or fees and increased existing tax rates and fees to raise revenue to support Medicaid. By FY 2013, all but one state (Alaska) had at least one provider tax or fee in place.3 In FY 2018, 36 states, including DC, had three or more provider taxes in place (Figure 9).

Very few states made or are making any changes to their provider tax structure in FY 2018 or FY 2019. The most common Medicaid provider taxes in place in FY 2018 were taxes on nursing facilities (44 states), followed by taxes on hospitals (42 states) and taxes on intermediate care facilities for people with intellectual disabilities (36 states) (Table 13). Two states reported plans to add new taxes in FY 2019. Virginia is implementing a new hospital tax to fund the state’s share of Medicaid expansion costs, and California is implementing a new tax on Ground Emergency Medical Transportation (GEMT or ambulance).

Eleven states report planned increases to one or more provider taxes in FY 2019, while six states report provider tax decreases. In addition, 29 states reported at least one provider tax that is at or above 5.5% of net patient revenues, which is close to the maximum federal safe harbor threshold of 6%. Federal action to lower that threshold, as has been proposed in the past, would therefore have financial implications for many states.

Twelve states report that they have taxes on MCOs as of FY 2018. Federal Medicaid law was changed4 effective July 1, 2009 to restrict the use of Medicaid provider taxes on managed care organizations such as HMOs. Prior to that date, states could apply a provider tax to Medicaid HMOs that did not apply to MCOs more broadly and could use that revenue to match Medicaid federal funds. In recent years, several states have implemented new MCO taxes that tax member months rather than premiums and that meet the federal statistical requirements for broad-based and uniform taxes. As a result, the number of MCO taxes has increased in recent years. In addition to the 12 states reporting MCO taxes, some states have implemented taxes on health insurers more broadly that generate revenue for their Medicaid programs.

An increasingly common provider tax is a tax on Ground Emergency Medical Transportation, or an ambulance tax. As noted above, California is implementing such a tax in FY 2019, bringing the number of states with an ambulance tax to eight states.

Table 11: Provider Rate Changes in all 50 States and DC, FY 2018

| States | Inpatient Hospital | Outpatient Hospital | Primary Care Physicians | Specialists | Dentists | MCOs | Nursing Facilities | HCBS | Pharmacy Dispensing Fee | Total | ||||||||||

| Rate Change | + | – | + | – | + | – | + | – | + | – | + | – | + | – | + | – | + | – | + | – |

| Alabama | X | — | — | X | X | X | X | |||||||||||||

| Alaska | X | X | X | X | X | — | — | X | X | |||||||||||

| Arizona | X | X | X | X | X | X | X | X | X | |||||||||||

| Arkansas | X | — | — | X | X | X | ||||||||||||||

| California | X | X | X | X | X | X | X | X | X | X | ||||||||||

| Colorado | X | X | X | X | X | X | X | X | ||||||||||||

| Connecticut | X | X | — | X | X | X | ||||||||||||||

| Delaware | X | X | X | X | X | X | X | X | X | |||||||||||

| DC | X | X | X | X | X | X | X | |||||||||||||

| Florida | X | X | X | X | X | X | X | X | ||||||||||||

| Georgia | X | X | X | X | X | X | X | X | ||||||||||||

| Hawaii | X | X | X | X | X | X | X | |||||||||||||

| Idaho | X | X | X | X | — | — | X | X | X | X | ||||||||||

| Illinois | X | X | X | X | X | |||||||||||||||

| Indiana | X | — | X | X | X | X | X | |||||||||||||

| Iowa | X | X | X | X | X | X | ||||||||||||||

| Kansas | X | X | X | X | X | X | X | X | X | |||||||||||

| Kentucky | X | X | X | X | X | X | ||||||||||||||

| Louisiana | X | X | X | X | X | X | ||||||||||||||

| Maine | X | — | — | X | X | X | X | X | ||||||||||||

| Maryland | X | X | X | X | X | X | X | X | ||||||||||||

| Massachusetts | X | X | X | X | X | X | X | X | X | |||||||||||

| Michigan | X | X | X | X | X | X | X | |||||||||||||

| Minnesota | X | X | X | X | X | X | X | X | ||||||||||||

| Mississippi | X | X | X | X | X | X | X | X | ||||||||||||

| Missouri | X | X | X | X | X | X | X | X | X | X | X | |||||||||

| Montana | X | X | X | X | X | — | — | X | X | X | X | X | ||||||||

| Nebraska | X | X | X | X | X | X | ||||||||||||||

| Nevada | X | X | X | X | X | X | X | X | X | |||||||||||

| New Hampshire | X | X | X | X | NR | X | X | |||||||||||||

| New Jersey | X | X | X | X | X | X | X | |||||||||||||

| New Mexico | X | X | X | X | ||||||||||||||||

| New York | X | X | X | X | X | X | ||||||||||||||

| North Carolina | X | — | — | X | X | X | ||||||||||||||

| North Dakota | X | X | X | X | X | |||||||||||||||

| Ohio | X | X | X | X | X | X | ||||||||||||||

| Oklahoma | X | — | — | X | X | |||||||||||||||

| Oregon | X | X | X | X | X | X | X | X | ||||||||||||

| Pennsylvania | X | X | X | X | X | X | X | |||||||||||||

| Rhode Island | X | X | X | X | X | NR | X | X | ||||||||||||

| South Carolina | X | X | X | X | X | X | X | |||||||||||||

| South Dakota | X | — | — | X | X | X | X | |||||||||||||

| Tennessee | X | X | X | X | X | X | X | |||||||||||||

| Texas | X | X | X | X | X | |||||||||||||||

| Utah | X | X | X | X | X | X | ||||||||||||||

| Vermont | X | X | X | — | — | X | X | X | X | |||||||||||

| Virginia | X | X | X | X | X | |||||||||||||||

| Washington | X | X | X | X | ||||||||||||||||

| West Virginia | X | X | X | X | X | X | ||||||||||||||

| Wisconsin | X | X | X | X | X | X | X | X | ||||||||||||

| Wyoming | X | — | — | X | X | X | X | |||||||||||||

| Totals | 23 | 28 | 21 | 5 | 12 | 4 | 14 | 3 | 9 | 4 | 28 | 7 | 34 | 17 | 32 | 2 | 12 | 1 | 49 | 38 |

| NOTES: “+” refers to provider rate increases and “-” refers to provider rate restrictions. MCOs: Managed care organizations. HCBS: Home and community-based services. For the purposes of this report, provider rate restrictions include cuts to rates for physicians, dentists, outpatient hospitals, managed care organizations, HCBS, and pharmacy dispensing fees as well as both cuts or freezes in rates for inpatient hospitals and nursing facilities. There are 12 states that did not have Medicaid MCOs in operation in FY 2018; they are denoted as “—” in the MCO column. NR: State did not report.

SOURCE: Kaiser Family Foundation Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2018. |

||||||||||||||||||||

Table 12: Provider Rate Changes in all 50 States and DC, FY 2019

| States | Inpatient Hospital | Outpatient Hospital | Primary Care Physicians | Specialists | Dentists | MCOs | Nursing Facilities | HCBS | Pharmacy Dispensing Fee | Total | ||||||||||

| Rate Change | + | – | + | – | + | – | + | – | + | – | + | – | + | – | + | – | + | – | + | – |

| Alabama | X | — | — | X | X | X | X | |||||||||||||

| Alaska | X | X | X | X | X | — | — | X | X | X | ||||||||||

| Arizona | X | X | X | X | X | X | X | X | ||||||||||||

| Arkansas | X | — | — | X | X | X | ||||||||||||||

| California | X | X | X | X | X | X | X | X | X | X | ||||||||||

| Colorado | X | X | X | X | X | X | X | X | X | |||||||||||

| Connecticut | X | — | — | X | X | |||||||||||||||

| Delaware | X | X | X | X | X | X | X | X | X | X | ||||||||||

| DC | X | X | X | X | X | X | X | X | X | |||||||||||

| Florida | X | X | X | X | X | X | X | |||||||||||||

| Georgia | X | X | X | X | X | X | X | |||||||||||||

| Hawaii | X | X | X | X | X | X | ||||||||||||||

| Idaho | X | X | X | X | — | — | X | X | X | X | ||||||||||

| Illinois | X | X | X | X | ||||||||||||||||

| Indiana | X | X | X | |||||||||||||||||

| Iowa | X | X | X | X | X | X | ||||||||||||||

| Kansas | X | X | X | X | X | X | ||||||||||||||

| Kentucky | X | X | X | X | X | X | ||||||||||||||

| Louisiana | X | X | X | X | X | |||||||||||||||

| Maine | X | — | — | X | X | X | X | |||||||||||||

| Maryland | X | X | X | X | TBD | TBD | X | X | X | |||||||||||

| Massachusetts | X | X | X | X | X | X | ||||||||||||||

| Michigan | X | X | X | X | X | X | X | |||||||||||||

| Minnesota | X | X | X | X | X | X | X | X | ||||||||||||

| Mississippi | X | X | X | X | X | X | X | |||||||||||||

| Missouri | X | X | X | X | X | X | X | X | X | X | ||||||||||

| Montana | X | X | X | X | X | — | — | X | X | X | X | |||||||||

| Nebraska | X | X | X | |||||||||||||||||

| Nevada | X | X | X | X | X | X | ||||||||||||||

| New Hampshire | X | X | X | NR | X | X | ||||||||||||||

| New Jersey | X | X | X | X | X | X | X | X | X | |||||||||||

| New Mexico | X | X | X | X | X | X | X | |||||||||||||

| New York | X | X | X | X | X | X | ||||||||||||||

| North Carolina | X | — | — | X | X | X | ||||||||||||||

| North Dakota | X | X | X | X | X | |||||||||||||||

| Ohio | X | X | TBD | TBD | X | X | X | X | ||||||||||||

| Oklahoma | X | X | X | X | X | — | — | X | X | X | X | |||||||||

| Oregon | X | X | X | |||||||||||||||||

| Pennsylvania | X | X | X | X | X | X | ||||||||||||||

| Rhode Island | X | X | X | X | X | NR | X | X | ||||||||||||

| South Carolina | X | X | X | X | X | X | ||||||||||||||

| South Dakota | X | X | X | X | X | — | — | X | X | X | ||||||||||

| Tennessee | X | X | X | X | X | |||||||||||||||

| Texas | X | X | X | X | X | X | ||||||||||||||

| Utah | X | X | X | X | X | X | ||||||||||||||

| Vermont | X | X | X | — | — | X | X | X | ||||||||||||

| Virginia | X | X | X | X | X | |||||||||||||||

| Washington | X | X | X | X | X | X | ||||||||||||||

| West Virginia | X | X | X | X | X | |||||||||||||||

| Wisconsin | X | X | X | X | X | TBD | TBD | X | ||||||||||||

| Wyoming | X | — | — | X | X | X | X | |||||||||||||

| Totals | 25 | 26 | 24 | 1 | 17 | 0 | 16 | 0 | 12 | 2 | 31 | 2 | 40 | 11 | 31 | 0 | 7 | 0 | 47 | 31 |

| NOTES: “+” refers to provider rate increases and “-” refers to provider rate restrictions. MCOs: Managed care organizations. HCBS: Home and community-based services. For the purposes of this report, provider rate restrictions include cuts to rates for physicians, dentists, outpatient hospitals, managed care organizations, HCBS, and pharmacy dispensing fees as well as both cuts or freezes in rates for inpatient hospitals and nursing facilities. There are 12 states that did not have Medicaid MCOs in operation in FY 2019; they are denoted as “–” in the MCO column. TBD: At the time of the survey, calendar year 2019 MCO rates had not been set for Maryland, rates for dentists were in development in Ohio, and Wisconsin was considering changes to pharmacy dispensing fees. NR: State did not report.

SOURCE: Kaiser Family Foundation Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2018. |

||||||||||||||||||||

Table 13: Provider Taxes in Place in all 50 States and DC, FY 2018 and FY 2019

| States | Hospitals | Intermediate Care Facilities | Nursing Facilities | Other | ||||

| 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | 2018 | 2019 | |

| Alabama | X | X | X | X | X | X | ||

| Alaska | ||||||||

| Arizona | X | X | X | X | ||||

| Arkansas | X | X | X | X | X | X | ||

| California | X | X | X | X | X | X | X | X* |

| Colorado | X | X | X | X | X | X | ||

| Connecticut | X | X | X | X | X | X | X | X |

| Delaware | X | X | ||||||

| DC | X | X | X | X | X | X | X | X |

| Florida | X | X | X | X | X | X | ||

| Georgia | X | X | X | X | ||||

| Hawaii | X | X | X | X | ||||

| Idaho | X | X | X | X | X | X | ||

| Illinois | X | X | X | X | X | X | ||

| Indiana | X | X | X | X | X | X | ||

| Iowa | X | X | X | X | X | X | ||

| Kansas | X | X | X | X | ||||

| Kentucky | X | X | X | X | X | X | X* | X* |

| Louisiana | X | X | X | X | X | X | X* | X* |

| Maine | X | X | X | X | X | X | X | X |

| Maryland | X | X | X | X | X | X | X | X |

| Massachusetts | X | X | X | X | X | X | ||

| Michigan | X | X | X | X | X | X | ||

| Minnesota | X | X | X | X | X | X | X | X |

| Mississippi | X | X | X | X | X | X | X | X |

| Missouri | X | X | X | X | X | X | X* | X* |

| Montana | X | X | X | X | X | X | X | X |

| Nebraska | X | X | X | X | ||||

| Nevada | X | X | ||||||

| New Hampshire | X | X | X | X | ||||

| New Jersey | X | X | X | X | X | X | X* | X* |

| New Mexico | X* | X* | ||||||

| New York | X | X | X | X | X | X | X* | X* |

| North Carolina | X | X | X | X | X | X | ||

| North Dakota | X | X | ||||||

| Ohio | X | X | X | X | X | X | X | X |

| Oklahoma | X | X | X | X | X | X | ||

| Oregon | X | X | X | X | X | X | ||

| Pennsylvania | X | X | X | X | X | X | X* | X* |

| Rhode Island | X | X | X | X | X | X | ||

| South Carolina | X | X | X | X | ||||

| South Dakota | X | X | ||||||

| Tennessee | X | X | X | X | X | X | X* | X* |

| Texas | X | X | X | X | ||||

| Utah | X | X | X | X | X | X | X | X |

| Vermont | X | X | X | X | X | X | X* | X* |

| Virginia | X | X | X | |||||

| Washington | X | X | X | X | X | X | ||

| West Virginia | X | X | X | X | X | X | X* | X* |

| Wisconsin | X | X | X | X | X | X | ||

| Wyoming | X | X | X | X | ||||

| Totals | 42 | 43 | 36 | 36 | 44 | 44 | 26 | 26 |

| NOTES: This table includes Medicaid provider taxes as reported by states. Some states also have premium or claims taxes that apply to managed care organizations and other insurers. Since this type of tax is not considered a provider tax by CMS, these taxes are not counted as provider taxes in this report. (*) has been used to denote states with multiple “other” provider taxes.

SOURCE: Kaiser Family Foundation Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2018. |

||||||||