Retiree Health Benefits At the Crossroads

Implications of Recent Legislation for Retiree Health Coverage

Changes for Pre-65 Retirees

The Affordable Care Act of 2010

The ACA includes numerous provisions that directly or indirectly affect retiree health plans for pre-65 retirees, including, for example, the creation of the temporary Early Retiree Reinsurance Program and creation of a new marketplace where pre-Medicare retirees can for the first time obtain health coverage on a guaranteed issue basis with no pre-existing condition exclusions and on relatively favorable financial terms without having an employer directly sponsor a retiree health plan. A discussion of these ACA provisions follows.

Early Retiree Reinsurance Program

The ACA established the Early Retiree Reinsurance Program (ERRP) as a temporary program with $5 billion in total funding from its start on June 1, 2010, until the program was scheduled to end no later than January 1, 2014. Noting the decline in the availability of group health coverage for retirees age 55 to 64, the intent of ERRP was to try and stabilize coverage by providing financial assistance to plan sponsors offering retiree health benefits by reimbursing for 80 percent of claims between $15,000 and $90,000 for early retirees ages 55 to 64 and their spouses, surviving spouses, and dependents.

The demand for such assistance quickly outpaced the available funding. Due to the overwhelming response from public and private employers and union plans, the program ceased accepting applications on May 6, 2011. Six months later, on December 13, 2011, CMS announced in the Federal Register that based on the projected availability of ERRP funding, it exercised its authority to deny ERRP reimbursement requests, in their entirety, that include claims incurred after December 31, 2011.1 ERRP payments must be used to reduce the costs of plan participants or plan sponsors, and may not be used as general revenue. In a Federal Register notice of March 21, 2012, CMS formalized its expectation that a sponsor will use ERRP reimbursement funds as soon as possible, but not later than December 31, 2014.2 Even though the ERRP was intended to be temporary, the fact that claims for reimbursement so quickly exceeded funds available under this program illustrates the pent-up pressures among employers to seek financial relief from rising retiree health costs and underscores their continuing interest in pursuing alternative ways of loweringtheir retiree health costs as discussed further below under “Emerging Strategies for Employers Offering Retiree Health Coverage.”

Insurance Reforms, New Marketplaces and Premium and Cost-Sharing Subsidies

Effective January 1, 2014, new health care marketplaces (public exchanges) have become available in every state, either as federally-facilitated marketplaces or as marketplaces established by the states themselves. These new marketplaces have created another potential avenue through which pre-65 retirees can obtain coverage with or without financial support from the employer. Previously, there was no reliable individual insurance market for pre-65 retirees, and employer-provided health benefits enabled pre-65 retirees to retire with the confidence of having continued health coverage in retirement. Now, access to coverage for pre-65 retirees is guaranteed whether or not the employer provides a health plan, the benefits are comprehensive, the limits on age rating are favorable to retirees, and premium credits and cost sharing federal subsidies may be available to certain retirees who qualify based on income and do not receive an employer contribution..

Excise Tax on High-Cost Health Plans

The ACA established, effective in 2018, a non-deductible excise tax on high-cost employer-sponsored plans, which, for active employees and retirees ages 65 and older, is equal to 40 percent of the value of health coverage in excess of $10,200 for self-only coverage and $27,500 for family coverage. (This tax is sometimes referred to unofficially as the tax on so-called “Cadillac” health plans.) The law allows a higher threshold before the tax kicks in for qualified retirees, defined as any individual who is receiving coverage by reason of being a retiree, has attained age 55, and is not Medicare-eligible. For pre-65 retirees, the excise tax applies to coverage in excess of $11,850 for self-only coverage and $30,950 for family coverage. In determining the applicable cost of employer-sponsored coverage to retired employees, the plan may elect to treat pre-65 retirees and retirees ages 65 and older as being “similarly-situated beneficiaries,” meaning that the costs for both groups can be blended together. Since the cost of retiree coverage for Medicare-eligible retirees is considerably less than for pre-65 retirees, such blending would usually lower the average cost of the retiree plan for purposes of determining whether there is any taxable excess. Regulations setting forth how all this will work have yet to be issued. And although the tax is not effective for several years, many plan sponsors are generally projecting where their costs will be in 2018 and have already been making adjustments to scale back benefits so that they will not be subject to the tax.3 In addition, this tax has generally been reflected in the accounting of these benefits in financial statements since the passage of the ACA. With respect to retiree health plans, this pressure may be especially strong where the employer offers pre-65 coverage but does not also offer coverage for Medicare-eligible retirees that can be used to reduce the average cost.

Exemption for Retiree-Only Plans

Retiree-only plans are generally not subject to many of the ACA requirements for group health plans and market reforms. This is based on what had been a long-standing exemption for such plans under ERISA and the Internal Revenue Code. A group health plan is considered to be retiree-only plan if it has fewer than two participants who are active employees, and typically such plans are reviewed with legal counsel to ensure that the plan is governed by separate plan documents, summary plan description, administration and required reporting (e.g., Form 5500) with no commingling of assets. Because of this significant exemption, retiree-only plans are not required to comply with some of the more costly requirements of the ACA, e.g., extending medical plan eligibility to adult children up to age 26, no annual or lifetime dollar limits on essential health benefits, covering preventive health services with no patient cost sharing, the four-page uniform summary of benefits and coverage, as well as certain other provisions.4 The exemption also applies to nonfederal government retiree-only plans.5 As a result of the new ACA requirements and the exemption for retiree-only plans, many employers that had included retirees in the same plan with active employees had a financial incentive to create a separate legal plan for retirees and avoid the ACA cost increases with respect to the retirees. That change would allow the employer to continue providing the same coverage to retirees as was provided prior to the ACA. For example, under a retiree-only plan, employers who did not previously offer coverage to retirees with adult children under age 26 would not be required to comply with the ACA requirement to provide coverage for these children.

The exemption is also important because it allows stand-alone health reimbursement arrangements (HRAs) for retiree-only plans, which can be used to pay retiree premiums for group or individual health insurance coverage. Without the retiree-only exemption, stand-alone HRAs would violate the ACA’s ban on annual dollar limits and face other regulatory restrictions. (Under current rules, without the retiree-only exemption, HRAs must be integrated with a group health plan and cannot be used to pay premiums for individual health insurance coverage or coverage through a federal or state exchange.)

However, if an HRA is used to pay for federal/state health exchange coverage for a pre-65 retiree, that retiree is not eligible for federal premium credits or cost sharing subsidies because the HRA for this purpose is considered to be employer-sponsored coverage that bars the retiree from receiving federal subsidies. The same issue does not apply to Medicare-eligible retirees because they are not generally permitted to purchase coverage in a new exchange, and are ineligible for premium and cost-sharing subsidies.

Dedicated New Fees

The ACA also assesses two new sets of temporary, dedicated fees, one of which is relatively small and the second of which is considered substantial by large employers. The first is a temporary fee to fund the Patient Centered Outcomes Research Institute (PCORI), assessed at $1 per covered life in the first year it is in effect (plan years ending on or after October 1, 2012), $2 per covered life in the second year, and indexed thereafter until the fee sunsets in plan years ending before October 1, 2019. The fee applies to coverage provided to retirees, including retiree-only plans.6 The second is a temporary fee in the form of a transitional reinsurance fee payable by insured and self-insured group health plans offering “major medical coverage” in calendar years 2014 through 2016, funds intended to help stabilize premiums in the ACA reformed individual market. The fee is $63 per covered life in 2014. The fee applies to pre-65 coverage, even if the plan is a retiree-only plan,7 but does not apply to coverage for Medicare-eligible retirees because, based on the Medicare Secondary Payer rules, Medicare is the primary payer.

In addition, the ACA assesses a new, permanent fee beginning in 2014. The fee is called the Health Insurance Industry Tax and is intended to help fund premium tax subsidies for low-income individuals and families who purchase health insurance through the health insurance marketplaces. The fee is expected to collect $8 billion in 2014 and increasing annually up to $14.3 billion in 2018 with increases in the fee thereafter tied to the rate of premium growth. The fee applies to insured (but not self-insured) group health plans, Medicare Advantage plans and Part D plans; Medigap plans purchased by individuals (without subsidies from former employers or unions) are not subject to the fee. As with the PCORI fee and the reinsurance fee, there is nothing in the ACA or in the regulations that prevents plans from increasing premiums to recover the amount of the fee.

Changes for Medicare-Eligible Retirees

The Medicare Modernization Act of 2003

Historically, retiree health plans filled what had been until 2006 a major gap in traditional Medicare coverage, namely, the absence of prescription drug coverage. The Medicare Modernization Act of 2003 (MMA) established a voluntary outpatient prescription drug benefit, known as Part D, that went into effect in 2006. All 52 million elderly and disabled beneficiaries now have access to the Medicare drug benefit through private plans approved by the federal government, either stand-alone prescription drug plans (PDPs) or Medicare Advantage prescription drug (MA-PD) plans (mainly HMOs and PPOs) that cover all Medicare benefits including drugs. Part D sponsors offer plans with either a defined standard benefit8 or an alternative equal in value (“actuarially equivalent”), and can also offer plans with enhanced benefits.

The MMA included provisions to encourage employers to maintain prescription drug coverage for their retirees, in conjunction with other medical benefits. As noted earlier, the law provides federal subsidies to sponsors of certain qualified prescription drug plans (employer plans that offer drug benefits that are at least as good as the standard Medicare benefit). The federal subsidies equal 28 percent of allowable drug costs, which for most employers amounted to a retiree drug subsidy (RDS) payment of $500 to $600 per retiree.9 In addition, until recently, the law allowed plan sponsors to exclude the federal RDS payment from income and still deduct the full cost of retiree health benefits, in effect allowing employers to take a larger tax deduction than under the general tax rule, whereby taxpayers generally may not deduct costs that are reimbursed. The subsidy and favorable tax treatment were designed to discourage employers from dropping prescription drug coverage from their retiree health benefits and to minimize any disruption in drug coverage for retirees in employer-sponsored plans.

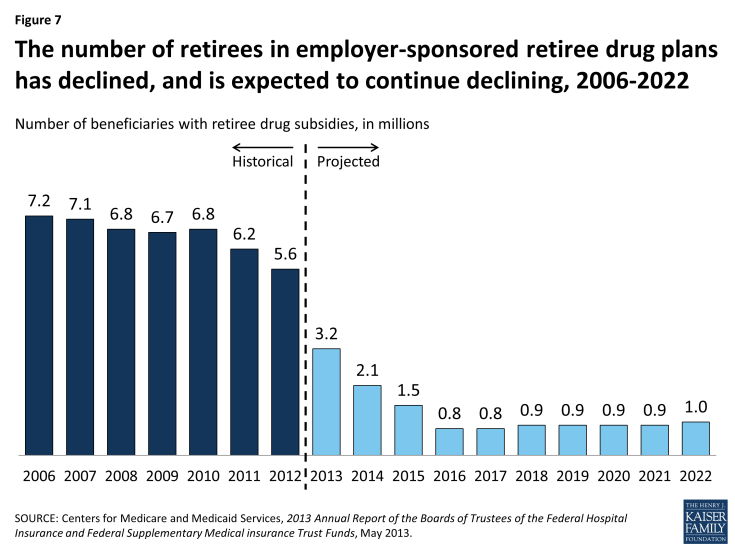

Initially, the vast majority of employers offering retiree health benefits to Medicare-eligible retirees chose to maintain drug coverage and accept the RDS. In 2006, 7.2 million Medicare beneficiaries with employer-sponsored retiree health benefits had claims reimbursed under the RDS – a figure that has dropped steadily since then, and is projected to drop sharply in the future, as described below.10

The Affordable Care Act of 2010

The ACA, though mainly designed to improve coverage for individuals younger than age 65 and not yet on Medicare, included changes to Medicare that are expected to affect employer-sponsored coverage for Medicare-eligible retirees. On the one hand, improvements in Medicare benefits, particularly provisions that close the “doughnut hole,” are expected to reduce out-of-pocket expenses for Medicare beneficiaries and consequently the costs of employer-provided retiree health plans that supplement Medicare.11 But on the other hand, certain other changes, notably the change in the tax treatment of the RDS, may accelerate changes in employer-sponsored coverage for Medicare-eligible retirees.

Closing the Medicare Part D “Doughnut Hole”

From a retiree health perspective, the most significant improvements in Medicare concern the Medicare Part D prescription drug benefits. Specifically, the ACA gradually phases in coverage in the Medicare Part D “doughnut hole,” eventually reducing what beneficiaries pay in the gap from 100 percent of total drug costs in 2010 to 25 percent in 2020 for both brand and generic drugs, at which point the enrollee would qualify for catastrophic drug coverage. Beginning in 2011, pharmaceutical manufacturers were required to provide a 50 percent discount off negotiated prices on brand-name drugs and biologics for Part D enrollees with spending in the coverage gap. In 2011, the coinsurance for generic drugs began to phase down, and in 2013, the coinsurance for brand-name drugs began phasing in. The ACA also reduces the catastrophic coverage threshold between 2014 and 2019, which provides relief to enrollees with high drug costs. Together, these improvements provide a substantial reduction in the cost of providing drug coverage to retirees for employers who contract with PDP or MA-PD plans. The financial attractiveness of employer plans using the RDS, however, was reduced in part by changes in the tax treatment of the RDS also included in the ACA.

Repealing the Retiree Drug Subsidy (RDS) Preferential Tax Treatment

The ACA repealed the provision that allowed plan sponsors to disregard the RDS payment for purposes of determining whether a deduction is allowable for subsidized costs, effective in 2013. Plan sponsors will be able to continue to exclude RDS payments from gross income, but will be subject to the normal rules disallowing a deduction for expenses for which the sponsors are reimbursed, in effect, making the RDS payment taxable. Even though the change was not effective until 2013, accounting rules required certain employers to record an accounting charge in their 2010 financial results to reflect the impact of the change in RDS tax status.

Employers who take the RDS do not benefit from the improvements in Medicare drug benefits in that RDS claims are ineligible for the 50 percent brand-name drug discount. Furthermore, RDS plans do not receive the financial benefits that flow to other Part D plans from the closing of the doughnut hole. Although RDS plans are at least actuarially equivalent to Medicare drug coverage, the RDS payment is in lieu of Part D plan coverage. Retirees in an RDS plan only receive the employer drug coverage and do not receive Part D plan benefits. The formula for calculating the RDS payment to the employer plan sponsor was not changed under the ACA. It remains based on the percentage of the retiree’s drug costs under the employer plan, not on what Part D pays. In 2014, for each RDS plan, subsidy payments to a plan sponsor for each qualifying covered retiree will generally equal 28 percent of allowable retiree costs under the employer plan between $310 and $6,350. The cost thresholds are indexed but the 28 percent remains fixed. So closing the doughnut hole does not result in a higher RDS subsidy even though the doughnut hole will be closing over time for other Part D drug plan participants.12

The number of Medicare beneficiaries with claims reimbursed under the RDS dropped from 7.2 million in 2006 to 6.8 million in 2010, even before the ACA was enacted, and has continued to decline since then to 5.6 million beneficiaries in 2012 (Figure 7). The Medicare Trustees project an even sharper decline starting in 2013, when just 3.2 million Medicare beneficiaries are expected to have RDS claims, falling to just 0.8 million by 2016.13

Figure 7: The number of retirees in employer-sponsored retiree drug plans has declined, and is expected to continue declining, 2006-2022

The expected drop in employers taking the RDS is due to several factors, in addition to the change in tax treatment that took effect in 2013. For some employers, the operational and administrative hassles associated with the subsidy program made alternative approaches more attractive, such as contracting with a Medicare PDP to administer additional prescription drug coverage to their retirees.14 Part D insurers have become more sophisticated in the administration of the employer group waiver programs, making it easier for employers to take advantage of new subsidies in the Part D program (e.g., pharmaceutical rebates and the closing of the doughnut hole). Employers, especially those with caps on their financial contribution toward retiree health benefits, have understood that over time, as the cap was hit and the retiree’s share of the total cost increased, the plan would eventually cease to satisfy the test of offering drug benefits that were actuarially equivalent to Medicare, which is required to qualify for the RDS. Public employers had their own set of reasons to shift away from the RDS. A new set of accounting rules (Statements 43 and 45) issued by the Government Accounting Standards Board (GASB) applied to state and local governments (including public universities and colleges) on a phased-in basis beginning in December 2006. These rules prohibit public entities from reflecting any accounting savings associated with the RDS 28% subsidy, although the rules do allow the accounting savings to be reflected for other Part D coordination approaches (e.g., supplemental/wraparound PDP coverage). These GASB accounting rules led public entities to more strongly consider alternative Medicare Part D coordination approaches as a way of managing costs well before the enactment of the ACA.15

Reducing Medicare Payments to Medicare Advantage Plans

In response to well-documented concerns about overpayments to plans, the ACA phases in reductions in future payments to Medicare Advantage plans. Although the provision does not specifically target group plans, group plans are nonetheless affected by the reduced payments to plans in the same manner as other Medicare Advantage plans.

A relatively small share of all Medicare beneficiaries with Medicare Advantage coverage — about 18 percent — are covered by group Medicare Advantage plans. Group enrollment rose by 9.4 percent in 2013, at about the same rate as the 9.8 percent growth in individual enrollment. The phase down in payments could discourage employers from maintaining or considering new arrangements with Medicare Advantage plans to provide benefits to retirees – although the number of retirees in Medicare Advantage group plans has continued to rise. Employers have for the past decade been somewhat hesitant to build their retiree health strategy around Medicare Advantage plans after building strategies around what were then called Medicare Risk HMOs in the past, only to experience subsequent dislocations when health insurers withdrew from many markets after legislated reductions in Medicare payment rates. Thus, employers currently sponsoring or considering sponsoring group Medicare Advantage plans will be assessing the potential effects on employer costs of future Medicare Advantage payments and the extent to which health insurers may withdraw plans from selected markets, as some already have said they are.16 In addition, employers will be watching the future of the Administration proposal to modify payments to employer group waiver plans as part of its FY 2015 Budget, although the provision was previously proposed in the FY 2014 Budget and not enacted into law.