Medigap Enrollment and Consumer Protections Vary Across States

Note: KFF has published more recent briefs about the basics of Medigap and about state and federal guaranteed issue rules for Medigap.

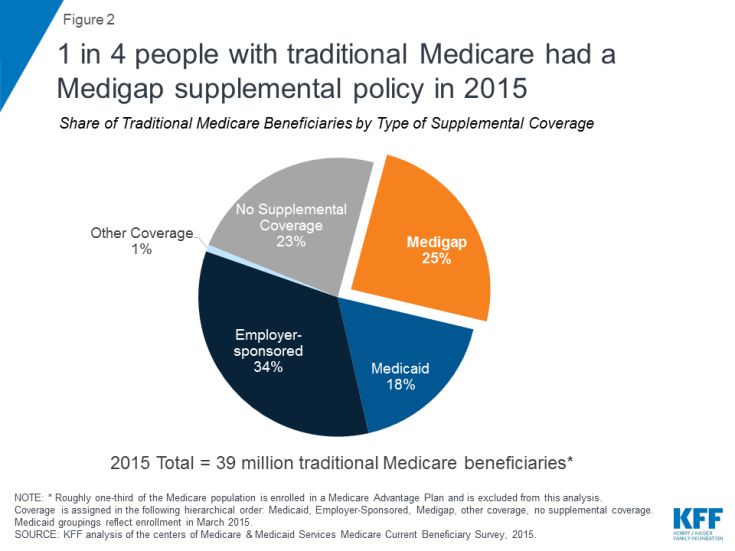

One in four people in traditional Medicare (25 percent) had private, supplemental health insurance in 2015—also known as Medigap—to help cover their Medicare deductibles and cost-sharing requirements, as well as protect themselves against catastrophic expenses for Medicare-covered services. This issue brief provides an overview of Medigap enrollment and analyzes consumer protections under federal law and state regulations that can affect beneficiaries’ access to Medigap. In particular, this brief examines implications for older adults with pre-existing medical conditions who may be unable to purchase a Medigap policy or change their supplemental coverage after their initial open enrollment period.

Key Findings

- The share of beneficiaries with Medigap varies widely by state—from 3 percent in Hawaii to 51 percent in Kansas.

- Federal law provides limited consumer protections for adults ages 65 and older who want to purchase a supplemental Medigap policy—including, a one-time, 6-month open enrollment period that begins when they first enroll in Medicare Part B.

- States have the flexibility to institute consumer protections for Medigap that go beyond the minimum federal standards. For example, 28 states require Medigap insurers to issue policies to eligible Medicare beneficiaries whose employer has changed their retiree health coverage benefits.

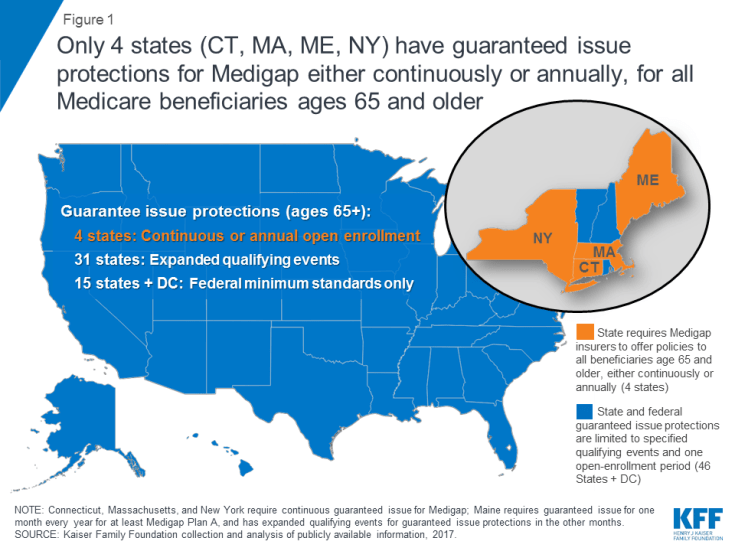

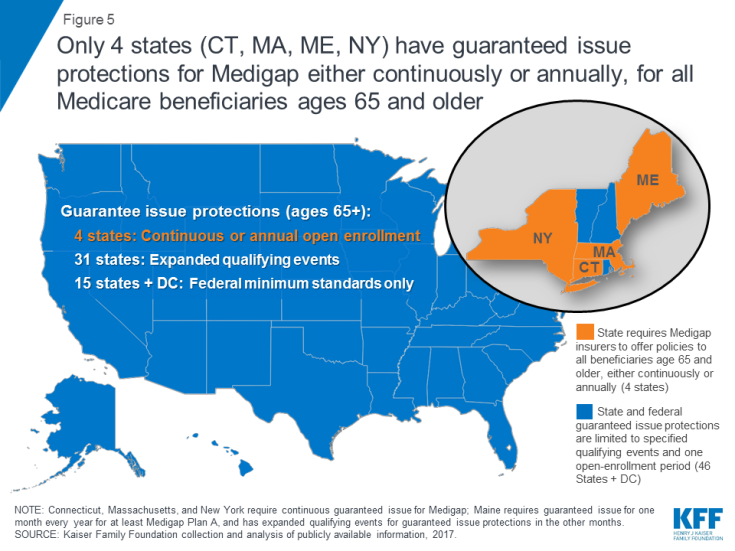

- Only four states (CT, MA, ME, NY) require either continuous or annual guaranteed issue protections for Medigap for all beneficiaries in traditional Medicare ages 65 and older, regardless of medical history (Figure 1). Guaranteed issue protections prohibit insurers from denying a Medigap policy to eligible applicants, including people with pre-existing conditions, such as diabetes and heart disease.

- In all other states and D.C., people who switch from a Medicare Advantage plan to traditional Medicare may be denied a Medigap policy due to a pre-existing condition, with few exceptions, such as if they move to a new area or are in a Medicare Advantage trial period.

Medigap is a key source of supplemental coverage for people in traditional Medicare

Medicare beneficiaries can choose to get their Medicare benefits (Parts A and B) through the traditional Medicare program or a Medicare Advantage plan, such as a Medicare HMO or PPO. Roughly two-thirds of Medicare beneficiaries are in traditional Medicare, and most have some form of supplemental health insurance coverage because Medicare’s benefit design includes substantial cost-sharing requirements, with no limit on out-of-pocket spending. Medicare requires a Part A deductible for hospitalizations ($1,340 in 2018), a separate deductible for most Part B services ($183), 20 percent coinsurance for many Part B (physician and outpatient) services, daily copayments for hospital stays that are longer than 60 days, and daily copays for extended stays in skilled nursing facilities.

To help with these expenses and limit their exposure to catastrophic out-of-pocket costs for Medicare-covered services, a quarter of beneficiaries in traditional Medicare (25 percent) had a private, supplemental insurance policy, known as Medigap in 2015 (Figure 2). Medigap serves as a key source of supplemental coverage for people in traditional Medicare who do not have supplemental employer- or union-sponsored retiree coverage or Medicaid, because their incomes and assets are too high to qualify. Medicare beneficiaries also purchase Medigap policies to make health care costs more predictable by spreading costs over the course of the year through monthly premium payments, and to reduce the paperwork burden associated with medical bills.1

| What is Medigap? Medigap is Medicare supplemental insurance, which is a type of private health insurance designed to supplement traditional Medicare. Medigap policies help cover out-of-pocket costs for services covered under Medicare Parts A and B. There are 10 different types of Medigap Plans (labeled A through N), each having a different, standardized set of benefits. Most cover some or all of the Part A deductible. Some are high deductible plans with an out-of-pocket maximum, and a few cover some overseas travel (Table 1). Three states, Massachusetts, Minnesota, and Wisconsin, have a different set of standardized plans, through a federal waiver. |

| Table 1: Standard Medigap Plan Benefits, 2018 | ||||||||||

| BENEFITS | MEDIGAP POLICY | |||||||||

| A | B | C | D | F | G | K | L | M | N | |

| Medicare Part A Coinsurance and All Costs After Hospital Benefits are Exhausted | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Medicare Part B Coinsurance or Copayment for Other than Preventive Service | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes* |

| Blood (First 3 Pints) | Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Hospice Care Coinsurance or Copayment (Added to Plans A, B, C, D, F, and G in June 2010) |

Yes | Yes | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Skilled Nursing Facility Care Coinsurance | No | No | Yes | Yes | Yes | Yes | 50% | 75% | Yes | Yes |

| Medicare Part A Deductible | No | Yes | Yes | Yes | Yes | Yes | 50% | 75% | 50% | Yes |

| Medicare Part B Deductible | No | No | Yes | No | Yes | No | No | No | No | No |

| Medicare Part B Excess Charge | No | No | No | No | Yes | Yes | No | No | No | No |

| Foreign Travel Emergency (Up to Plan Limits)* | No | No | 80% | 80% | 80% | 80% | No | No | 80% | 80% |

| Out-of-Pocket Limit | N/A | N/A | N/A | N/A | N/A | N/A | $5,240 | $2,620 | N/A | N/A |

| NOTE: These plans are effective on or after June 1, 2010. Plans E, H, I, and J are no longer offered to new applicants, as of 2010. Starting in 2020, Plans C and F will no longer be offered to new applicants. “Yes” indicates 100 percent of benefit coverage. * Plan N pays 100% of the Part B coinsurance except up to $20 copayment for office visits and up to $50 for emergency department visits. SOURCE: Centers for Medicare & Medicaid Services, How to compare Medigap policies, 2018. |

||||||||||

Medigap policy benefits were standardized through the Omnibus Budget Reconciliation Act of 1990, which also included additional consumer protections discussed later in this issue brief.2 Of the 10 standard Medigap policies available to beneficiaries, Plan F is the most popular, accounting for over half of all policyholders in 2016, because it covers the Part A and B deductibles (as does Plan C), and all cost-sharing for Part A and B covered services.3

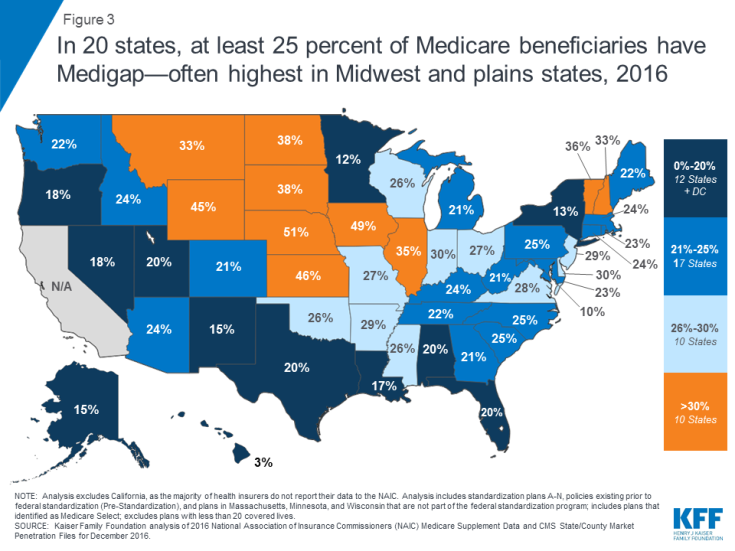

The share of all Medicare beneficiaries with Medigap coverage varies widely by state—from 3 percent in Hawaii to 51 percent in Kansas in 2016 (Figure 3, Appendix Table). In 20 states, at least one-quarter of all Medicare beneficiaries have a Medigap policy. States with higher Medigap enrollment tend to be in the Midwest and plains states, where relatively fewer beneficiaries are enrolled in Medicare Advantage plans.4

Figure 3: In 20 states, at least 25 percent of Medicare beneficiaries have Medigap—often highest in Midwest and plains states, 2016

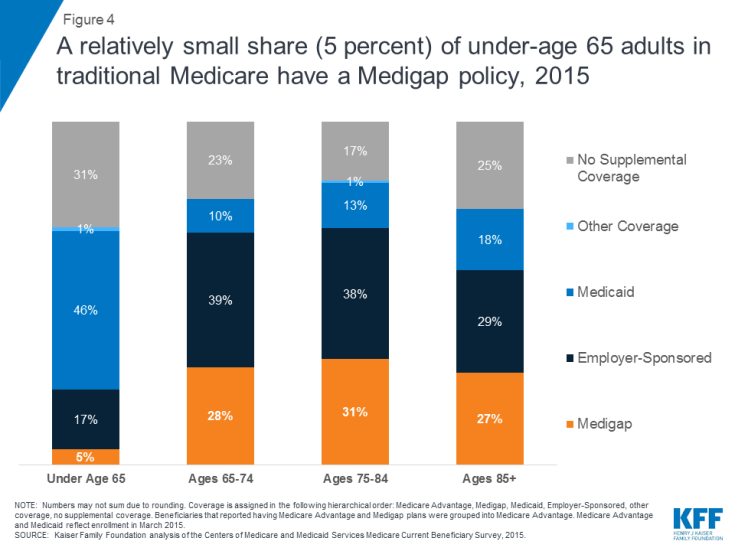

Medigap coverage is substantially more common for Medicare beneficiaries ages 65 and older than it is for younger Medicare beneficiaries, many of whom qualify for Medicare because of a long-term disability. Only 5 percent of traditional Medicare beneficiaries under age 65 had Medigap in 2015—considerably lower than the shares in older age brackets (Figure 4). The low enrollment in Medigap by beneficiaries under age 65 is likely due to the absence of federal guarantee issue requirements for younger Medicare beneficiaries with disabilities (discussed later in this brief) and higher rates of Medicaid coverage for people on Medicare with disabilities who tend to have relatively low incomes.

Figure 4: A relatively small share (5 percent) of under-age 65 adults in traditional Medicare have a Medigap policy, 2015

Federal law provides limited consumer protections for Medigap policies

In general, Medigap insurance is state regulated, but also subject to certain federal minimum requirements and consumer protections. For example, federal law requires Medigap plans to be standardized to make it easier for consumers to compare benefits and premiums across plans. Federal law also requires Medigap insurers to offer “guaranteed issue” policies to Medicare beneficiaries age 65 and older during the first six months of their enrollment in Medicare Part B and during other qualifying events (listed later in this brief). During these defined periods, Medigap insurers cannot deny a Medigap policy to any applicant based on factors such as age, gender, or health status. Further, during these periods, Medigap insurers cannot vary premiums based on an applicant’s pre-existing medical conditions (i.e., medical underwriting). However, under federal law, Medigap insurers may impose a waiting period of up to six months to cover services related to pre-existing conditions, only if the applicant did not have at least six months of prior continuous creditable coverage.5 As described later in this brief, states have the flexibility to institute Medigap consumer protections that go further than the minimum federal standards.

Federal law also imposes other consumer protections for Medigap policies. These include “guaranteed renewability” (with few exceptions), minimum medical loss ratios, limits on agent commissions to discourage “churning” of policies, and rules prohibiting Medigap policies to be sold to applicants with duplicate health coverage.6 (For further details on these requirements and a history of federal involvement in the Medigap market, see Medigap: Spotlight on Enrollment, Premiums, and Recent Trends, April 2013.)

When does federal law require guaranteed issue protections for Medigap?

Federal law provides guaranteed issue protections for Medigap policies during a one-time, six-month Medigap open enrollment period for beneficiaries ages 65 and older when enrolling in Medicare Part B, and for certain qualifying events. These limited circumstances include instances when Medicare beneficiaries involuntarily lose supplemental coverage, such as when their Medicare Advantage plan discontinues coverage in their area, or when their employers cancel their retiree coverage. Beneficiaries who are in a Medicare Advantage plan also have federal guaranteed issue rights when they move to a new area and can no longer access coverage from their Medicare Advantage plan. In these qualifying events, people ages 65 and older in Medicare generally have 63 days to apply for a supplemental Medigap policy under these federal guaranteed issue protections.

Federal law also requires that Medigap polices be sold with guaranteed issue rights during specified “trial” periods for Medicare Advantage plans. One of these trial periods is during the first year older adults enroll in Medicare. During that time, older adults can try a Medicare Advantage plan, but if they disenroll within the first year, they have guaranteed issue rights to purchase a Medigap policy under federal law. Another trial period applies to Medicare beneficiaries who cancel their Medigap policy to enroll in a Medicare Advantage plan. These beneficiaries have time-limited guaranteed issue rights to purchase their same Medigap policy if, within a year of signing up for a Medicare Advantage plan, they decide to disenroll to obtain coverage under traditional Medicare.

States have the flexibility to institute Medigap consumer protections that go further than the minimum federal standards, such as extending guaranteed issue requirements beyond the open enrollment period or adding other qualifying events that would require insurers to issue policies, as discussed later in this brief.

When does federal law not provide guaranteed issue protections for Medigap?

Broadly speaking, after 6 months of enrolling in Medicare Part B, older adults do not have federal guaranteed issue protections when applying for Medigap, except for specified qualifying events described earlier (Table 2). Therefore, older adults in traditional Medicare who miss the open enrollment period may, in most states, be subject to medical underwriting, and potentially denied a Medigap policy due to pre-existing conditions, or charged higher premiums due to their health status.

| Table 2: When do people seeking a Medigap policy have guaranteed issue protections under federal law? | ||

| Beneficiaries’ coverage status | Guaranteed issue rights | |

| Federally-required | NOT federally-required | |

| In traditional Medicare |

|

|

| In a Medicare Advantage Plan or PACE |

|

|

| Has employer-sponsored supplemental (retiree) coverage |

|

|

| Medigap |

|

|

| Has Medicaid |

|

|

| Under age 65 in Medicare |

|

|

| NOTE: Beneficiaries typically have a 63-day period of guaranteed-issue rights for Medigap when a Medicare Advantage plan withdraws from their area or when an employer group plan (including COBRA) or union cancels coverage. Beneficiaries have guaranteed issue rights if their Medicare Advantage or Medigap insurer commits fraud. aTrial rights apply to beneficiaries who canceled their Medigap policy to join a Medicare Advantage plan and to beneficiaries who enrolled in Medicare Advantage during their first year on Medicare and disenrolled within a year. bBeneficiaries may suspend Medigap for up to two years if they become eligible for Medicaid, in which case they have no new medical underwriting or waiting periods for pre-existing conditions when they restart their Medigap. cWhen beneficiaries under age 65 turn 65, they have the same federally-guaranteed issue protections for Medigap as people age 65 and older, regardless of whether or not they had Medigap when they were under age 65. SOURCE: KFF analysis of federal requirements for Medigap insurers. |

||

Medical Underwriting. Insurance companies that sell Medigap policies may refuse to sell a policy to an applicant with medical conditions, except under circumstances described above. The Text Box on this page provides examples of health conditions that may lead to the denial of Medigap policies, derived from underwriting manuals/guides from multiple insurance companies selling Medigap policies. Examples of conditions listed by insurers as reasons for policy denials include diabetes, heart disease, cancer, and being advised by a physician to have surgery, medical tests, treatments, or therapies.

Barriers for Beneficiaries Under Age 65 with Disabilities. Under federal law, Medigap insurers are not required to sell Medigap policies to the over 9 million Medicare beneficiaries who are under age of 65, many of whom qualify for Medicare based on a long-term disability. (However, when these beneficiaries turn age 65, federal law requires that they be eligible for the same six-month open enrollment period for Medigap that is available to new beneficiaries age 65 and older.)

Beneficiaries Choosing to Switch from Medicare Advantage to Traditional Medicare. There are no federal guarantee issue protections for individuals who choose to switch from a Medicare Advantage plan to traditional Medicare and apply for a Medigap policy, except under limited circumstances described in Table 2. In most states, therefore, beneficiaries who want to switch from their Medicare Advantage plan to traditional Medicare may be subject to medical underwriting and denied coverage when they apply for a Medigap policy because they do not have guaranteed issue rights, with some exceptions (e.g., if they have moved or if they are in a limited trial period). In states that allow medical underwriting for Medigap, Medicare Advantage enrollees with pre-existing conditions may find it too financially risky to switch to traditional Medicare if they are unable to purchase a Medigap policy. Without Medigap, they could be exposed to high cost-sharing requirements, mainly because traditional Medicare does not have a limit on out-of-pocket spending (in contrast to Medicare Advantage plans).7

| Potential medical conditions for which a Medigap Insurer may deny coverage without guaranteed issue protections |

NOTE: Uninsurable health conditions vary by plan. This list is not an extensive list of all possible conditions/reasons for denial.

SOURCE: Kaiser Family Foundation collection and analysis of numerous insurance companies’ 2016-2017 Medicare supplemental underwriting manuals/guides. |

Some states require guaranteed issue and other consumer protections for Medigap beyond the federal minimum requirements

States have the flexibility to institute Medigap consumer protections that go further than the minimum federal standards. While many states have used this flexibility to expand guarantee issue rights for Medigap under certain circumstances, 15 states and the District of Columbia have not, relying only the minimum guarantee issue requirements under federal law (Table 3).

Only four states require Medigap insurers to offer policies to Medicare beneficiaries age 65 and older (Figure 5). Three of these states (Connecticut, Massachusetts, and New York) have continuous open enrollment, with guaranteed issue rights throughout the year, and one state (Maine) requires insurers to issue Medigap Plan A (the least generous Medigap plan shown earlier in Table 1) during an annual one-month open enrollment period. Consistent with federal law, Medigap insurers in New York, Connecticut, and Maine may impose up to a six-month “waiting period” to cover services related to pre-existing conditions if the applicant did not have six months of continuous creditable coverage prior to purchasing a policy during the initial Medigap open enrollment period.8 Massachusetts prohibits pre-existing condition waiting periods for its Medicare supplement policies.

Figure 5: Only 4 states (CT, MA, ME, NY) have guaranteed issue protections for Medigap either continuously or annually, for all Medicare beneficiaries ages 65 and older

Some states provide additional guaranteed issue rights for current Medigap policyholders. Two states (CA and OR) allow beneficiaries to switch each year to a different Medigap plan with equal or lesser benefits within 30 days of their birthday, and another state (MO) allows policyholders to switch to an equivalent plan within 30 days before or after the annual anniversary date of their policy. Medigap policyholders in Maine can switch to a policy with equal or less generous benefits at any time during the year (not only during the annual open enrollment period) if there is less than a 90 day gap in coverage. Some Medigap insurers may also provide guaranteed issue rights to their policies that go beyond the state requirements. In Illinois, Blue Cross Blue Shield of Illinois and Health Alliance provide ongoing guaranteed issue rights for all beneficiaries ages 65 or older.

Many other states have expanded on the federal minimum standards in more narrow ways by requiring Medigap insurers to offer policies to eligible applicants during additional qualifying events (Table 3). For example, 28 states require Medigap insurers to issue policies when an applicant has an involuntary change in their employer (retiree) coverage. (This qualifying event is more expansive than federal law, which applies only when retiree coverage is completely eliminated.) Nine states provide guaranteed issue rights for applicants who lose their Medicaid eligibility.9

As noted above, federal law does not require Medigap insurers to issue policies to Medicare beneficiaries under the age of 65, most of whom qualify for Medicare because of a long-term disability. However, 31 states require insurers to provide at least one kind of Medigap policy to beneficiaries younger than age 65 (typically through an initial open enrollment period).10

| Table 3: Medigap Guaranteed Issue Requirements for Medicare Beneficiaries Ages 65+, by State, 2017 | |||||

| Federal Minimum Standards Only | Guaranteed Issue Rights (continuous or annual) | Qualifying Events For Guaranteed Issue Rights Beyond Minimum Federal Standards | |||

| Upon Retiree Benefit Changes | Upon Loss of Medicaid Eligibility | Other* | |||

| Total State Counts | 16 | 4 | 28 | 9 | 14 |

| Alabama | Yes | – | – | – | – |

| Alaska | No | No | Yes | No | Yes |

| Arizona | Yes | – | – | – | – |

| Arkansas | No | No | Yes | No | No |

| California | No | No | Yes | Yes | Yes |

| Colorado | No | No | Yes | No | Yes |

| Connecticut | No | Continuous | n/a | n/a | n/a |

| Delaware | Yes | – | – | – | – |

| District of Columbia | Yes | – | – | – | – |

| Florida | No | No | Yes | No | Yes |

| Georgia | Yes | – | – | – | – |

| Hawaii | Yes | – | – | – | – |

| Idaho | No | No | Yes | No | No |

| Illinois | No | No | Yes | No | No |

| Indiana | No | No | Yes | No | No |

| Iowa | No | No | Yes | No | No |

| Kansas | No | No | Yes | Yes | Yes |

| Kentucky | Yes | – | – | – | – |

| Louisiana | No | No | Yes | No | Yes |

| Maine1 | No | One month/year | Yes | Yes | Yes |

| Maryland | Yes | – | – | – | – |

| Massachusetts | No | Continuous | n/a | n/a | n/a |

| Michigan | Yes | – | – | – | – |

| Minnesota | No | No | Yes | No | No |

| Mississippi | Yes | – | – | – | – |

| Missouri | No | No | Yes | No | No |

| Montana | No | No | Yes | Yes | Yes |

| Nebraska | No | No | Yes | No | No |

| Nevada | No | No | Yes | No | No |

| New Hampshire | Yes | – | – | – | – |

| New Jersey | No | No | Yes | No | No |

| New Mexico | No | No | Yes | No | No |

| New York | No | Continuous | n/a | n/a | n/a |

| North Carolina | Yes | – | – | – | – |

| North Dakota | Yes | – | – | – | – |

| Ohio | No | No | Yes | No | No |

| Oklahoma | No | No | Yes | No | Yes |

| Oregon | No | No | Yes | Yes | Yes |

| Pennsylvania | No | No | Yes | No | No |

| Rhode Island | Yes | – | – | – | – |

| South Carolina | Yes | – | – | – | – |

| South Dakota | Yes | – | – | – | – |

| Tennessee | No | No | No | Yes | No |

| Texas | No | No | Yes | Yes | Yes |

| Utah | No | No | No | Yes | No |

| Vermont | No | No | Yes | No | No |

| Virginia | No | No | Yes | No | No |

| Washington | No | No | No | No | Yes |

| West Virginia | No | No | Yes | No | No |

| Wisconsin | No | No | Yes | Yes | Yes |

| Wyoming | No | No | No | No | Yes |

| NOTE: 1In Maine, Medigap insurers must offer guaranteed-issue policies, at least for Plan A during one month of their choosing each year. *Examples of “Other” qualifying events include: beneficiary’s health plan changes its benefits, a participating hospital leaves the network of a beneficiary’s health plan. SOURCE: Kaiser Family Foundation analysis of state insurance regulations, 2017. |

|||||

Some states provide stronger consumer protections for Medigap premiums than others

States also have the flexibility to establish rules on whether or not Medigap premiums may be affected by factors such as a policyholder’s age, smoking status, gender, and residential area. Federal law allows states to alter premiums based on these factors, even during guaranteed issue open enrollment periods.

There are three different rating systems that can affect how Medigap insurers determine premiums: community rating, issue-age rating, or attained-age rating (defined in the Text box below). States can impose regulations on which of these rating systems are permitted or required for Medigap policies sold in their state. Of the three, community rating provides the strongest consumer protection for Medigap policies because it does not allow premiums to be based on the applicant or policyholder’s age or health status. However, insurers in states that require community rating may charge different premiums based on other factors, such as smoking status and residential area. In states that allow attained age rating, older applicants and policyholders have considerably less protection from higher premiums because premiums may increase at unpredictable rates as policyholders age.

Premium rating systemsCommunity rating: Insurers must charge all policyholders within a given plan type the same premium without regard to age (among people age 65 and older) or health status. Insurers can raise premiums only if they do so for all policyholders of the given plan type. Insurers may still adjust premiums based on other factors, including smoking status, gender, and residential area. Issue-age rating: Insurers may vary premiums based on the age of the policyholder at the time of purchase, but cannot increase the policyholder’s premium automatically in later years based on his/her age. Additionally, insurers may charge different premiums based on other factors, including health status, smoking status, and residential area. Attained-age rating: Insurers may vary premiums based on the age of the policyholder at the time of purchase and increase premiums for policyholders as they age. Additionally, insurers may charge different premiums based on other factors, including health status, smoking status, and residential area. |

Currently, eight states (AR, CT, MA, ME, MN, NY, VT, and WA) require premiums to be community rated among policyholders ages 65 and older. This means that Medigap insurers cannot charge higher premiums to people because they are older or sicker, and therefore, must charge an 80-year old policyholder the same as a 70-year old policyholder regardless of health status (Table 4). Insurers may still adjust premiums based on other factors, including smoking status, gender, and residential area. A state’s community rating requirement does not, in itself, guarantee that applicants will be issued a policy in the state. However, as described earlier, four of the states that have community rating (CT, MA, ME, NY), have guarantee issue protections and require insurers to issue Medigap policies to eligible applicants either continuously during the year, or during an annual enrollment period.

| Table 4: Medigap Premium Rating Rules | |||

| Community Rating Required | Issue Age Rating or Attained Age Rating | ||

| Arkansas | Alabama | Kentucky | Oklahoma |

| Connecticut | Alaska | Louisiana | Oregon |

| Maine | Arizona | Maryland | Pennsylvania |

| Massachusetts | California | Michigan | Rhode Island |

| Minnesota | Colorado | Mississippi | South Carolina |

| New York | Delaware | Missouri | South Dakota |

| Vermont | District of Columbia | Montana | Tennessee |

| Washington | Florida | Nebraska | Texas |

| Georgia | Nevada | Utah | |

| Hawaii | New Hampshire | Virginia | |

| Idaho | New Jersey | West Virginia | |

| Illinois | New Mexico | Wisconsin | |

| Indiana | North Carolina | Wyoming | |

| Iowa | North Dakota | ||

| Kansas | Ohio | ||

| NOTE: The 8 states listed in the left-hand column prohibit issue age and attained age rating. States that require issue age rating do not allow attained age rating; but states that allow attained age rating, typically allow issue age ratings. All states permit insurers to use community rating. SOURCE: Kaiser Family Foundation collection and analysis of publicly available information, 2017. |

|||

The remaining 38 states and the District of Columbia do not require premiums to be community rated; therefore, Medigap premiums in these states may be subject to issue-age and attained-age rating systems, depending on state regulation. Medigap insurers are permitted to offer community rated policies in these states, but most do not.11 Additionally, Medigap insurers may increase premiums due to inflation, regardless of the premium rating system.12

Discussion

Medigap plays a major role in providing supplemental coverage for people in traditional Medicare, particularly among those who do not have an employer-sponsored retiree plan or do not qualify for cost-sharing assistance under Medicaid. Medigap helps beneficiaries budget for out-of-pocket expenses under traditional Medicare. Medigap also limits the financial exposure that beneficiaries would otherwise face due to the absence of an out-of-pocket limit under traditional Medicare.

Nonetheless, Medigap is not subject to the same federal guaranteed issue protections that apply to Medicare Advantage and Part D plans, with an annual open enrollment period. As a result, in most states, medical underwriting is permitted which means that beneficiaries with pre-existing conditions may be denied a Medigap policy due to their health status, except under limited circumstances.

Federal law requires Medigap guaranteed issue protections for people age 65 and older during the first six months of their Medicare Part B enrollment and during a “trial” Medicare Advantage enrollment period. Medicare beneficiaries who miss these windows of opportunity may unwittingly forgo the chance to purchase a Medigap policy later in life if their needs or priorities change.13 This constraint potentially affects the nearly 9 million beneficiaries in traditional Medicare with no supplemental coverage; it may also affect millions of Medicare Advantage plan enrollees who may incorrectly assume they will be able to purchase supplemental coverage if they choose to switch to traditional Medicare at some point during their many years on Medicare.

Only four states (CT, MA, NY, ME) require Medigap policies to be issued, either continuously or for one month per year for all Medicare beneficiaries age 65 and older. Policymakers could consider a number of other policy options to broaden access to Medigap. One approach could be to require annual Medigap open enrollment periods, as is the case with Medicare Advantage and Part D plans, making Medigap available to all applicants without regard to medical history during this period. Another option would be to make voluntary disenrollment from a Medicare Advantage plan a qualifying event with guaranteed issue rights for Medigap, recognizing the presence of beneficiaries’ previous “creditable” coverage. For Medicare beneficiaries younger than age 65, policymakers could consider adopting federal guaranteed issue protections, building on rules already established by the majority of states.

On the one hand, these expanded guaranteed issue protections would increase beneficiaries’ access to Medigap, especially for people with pre-existing medical conditions. They would also treat Medigap similarly to Medicare Advantage in this regard, and make it easier for older adults to switch between Medicare Advantage and traditional Medicare if their Medicare Advantage plan is not serving their needs in later life. On the other hand, broader guaranteed issue policies could result in some beneficiaries waiting until they have a serious health problem before purchasing Medigap coverage, which would likely increase premiums for all Medigap policyholders. A different approach altogether would be to minimize the need for supplemental coverage in Medicare by adding an out-of-pocket limit to traditional Medicare.14

Ongoing policy discussions affecting Medicare and its benefit design could provide an opportunity to consider various ways to enhance federal consumer protections for supplemental coverage or manage beneficiary exposure to high out-of-pocket costs. As older adults age on to Medicare, they would be well-advised to understand the Medigap rules where they live, and the trade-offs involved when making coverage decisions.

Data Sources and MethodsWe analyzed data from the Centers for Medicare and Medicaid Services (CMS) 2015 Medicare Current Beneficiary Survey (MCBS) to examine the characteristics of Medicare beneficiaries, by source of supplemental coverage. The MCBS is a nationally representative longitudinal survey of Medicare beneficiaries, which provides information on beneficiary characteristics, coverage, service utilization, and spending. We used data from the National Association of Insurance Commissioners (NAIC) Medicare Supplement Insurance files for our analysis of Medigap enrollment by plan type and by state. These data include the number of policyholders as of December 31, 2016 for each state, insurance company, and type of plan sold. The number of covered lives represent a snapshot of enrollment at that time, rather than average enrollment over the course of the year. This analysis used data from 49 states and the District of Columbia excluding California because only a small share of companies reported California data to the NAIC. We also excluded data from all US territories and plans reporting fewer than 20 enrollees. In this analysis, Medigap policies issued prior to Medigap standardization in 1992 are treated as a single additional type of plan, “Pre-Standardized.” In addition, policies sold in the three states exempted from Medigap standardization (MA, MN, and WI) are also grouped together as “Waivered.” |

This issue brief was funded in part by The Retirement Research Foundation.

Laura Kanji interned with the Kaiser Family Foundation and contributed significantly to the data collection and analysis of state insurance regulations.