Medicare Part D in Its Ninth Year: The 2014 Marketplace and Key Trends, 2006-2014

Section 4: The Low-Income Subsidy Program

Low-Income Subsidy Plan Availability

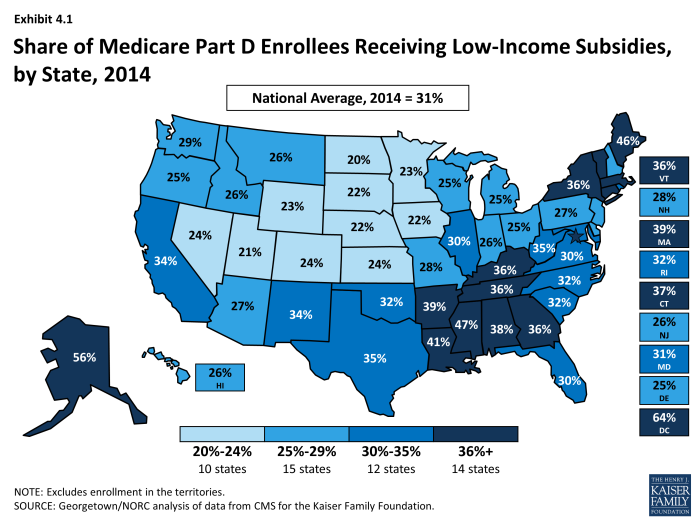

In 2014, 11.4 million Part D enrollees (30 percent of all Part D enrollees) were receiving the Low-Income Subsidy (LIS); of this total 8.3 million are enrolled in PDPs and 3.2 million in MA-PD plans. Most are deemed automatically eligible for the LIS based on being enrolled in both Medicare and Medicaid (or receiving benefits from Supplemental Security Income as well as Medicare). Based on data from 2009 (the most recent available data), only 16 percent obtain the LIS by applying under the program’s income and asset standards.1 The share of LIS enrollees varies considerably by state (Exhibit 4.1). In several of the more rural western states, between 20 percent and 25 percent of Part D enrollees receive LIS subsidies. By contrast, over 40 percent of Part D enrollees are receiving the LIS in Alaska, the District of Columbia, Louisiana, Maine, and Mississippi.

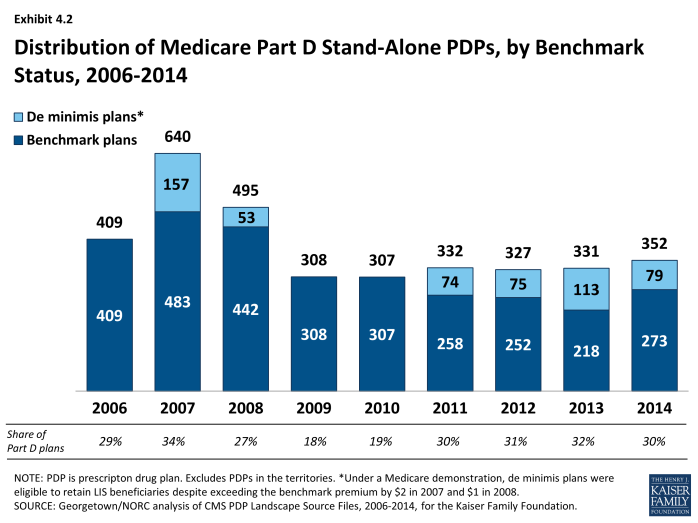

More “benchmark” plans—those available to beneficiaries receiving Part D Low-Income Subsidies for no monthly premium—are available in 2014 than in 2013, but they represent a marginally lower percentage of all PDPs in 2014. The total number of benchmark plans for LIS enrollees nationwide is 352 in 2014, an increase of 21 PDPs (6 percent) above the number in 2013 (Exhibit 4.2). Several policies in place since 2011, including the “de minimis” policy that allows plans to waive a premium amount of up to $2 in order to retain their LIS enrollees, has kept the number of benchmark plans from dropping. The number of LIS benchmark plans varies by region, ranging from 4 in Nevada to 15 in the Indiana/Kentucky region.

The benchmark plan market remains volatile, however. The benchmark plan market has changed considerably over the program’s eight years, which has generated significant instability for low-income enrollees. Of the 409 benchmark plans offered in 2006, only 13 plans have qualified as benchmark plans in every year since then. For a number of other plans, mergers interrupted continuous benchmark status, but the acquiring plan sponsor had a benchmark plan into which enrollees were transferred.2 Of the 331 benchmark plans available to LIS recipients for zero premium at the start of 2013, 46 lost benchmark status for 2014, a few more than between 2012 and 2013.3

As of the open enrollment period for the 2014 plan year (October 15 to December 7, 2013), one of every five LIS beneficiaries (1.9 million) were enrolled in benchmark PDPs in 2013 that failed to qualify as benchmark plans in 2014. To address this issue in part, CMS randomly reassigned about 392,000 PDP beneficiaries to PDPs operated by different sponsors for the 2014 benefit year (another 210,000 shifted to other PDPs operated by the same sponsors).4 Most of the others were not eligible for automatic reassignment by CMS because at some point they had switched plans on their own.

Premiums for Low-Income Subsidy Enrollees

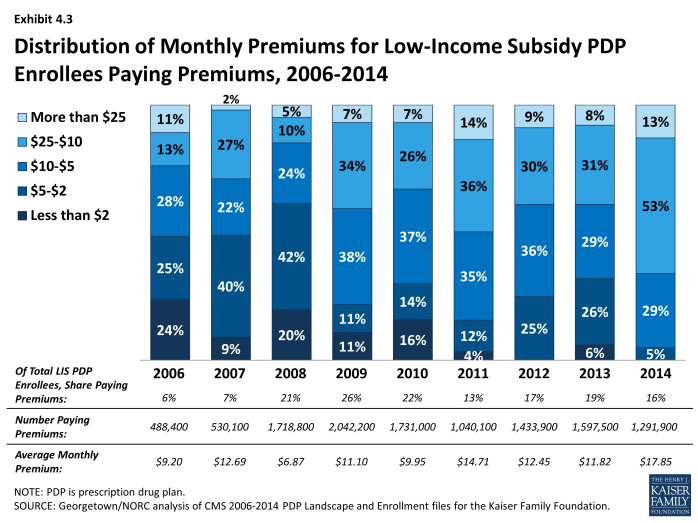

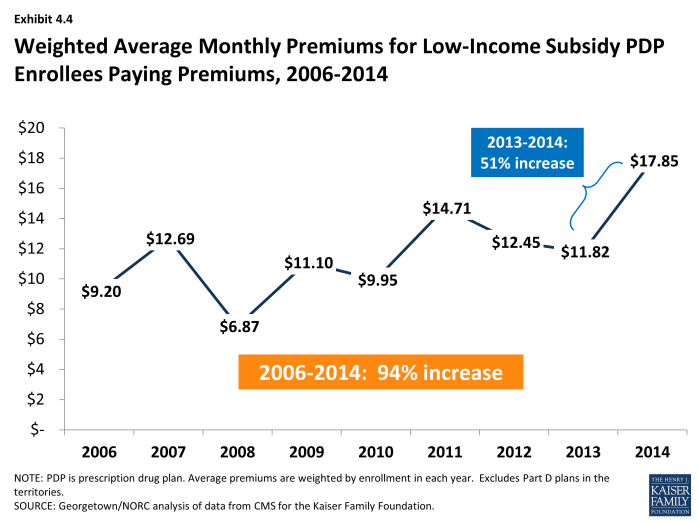

About 1.3 million LIS beneficiaries (16 percent of all LIS enrollees in PDPs) remain in non-benchmark PDPs in 2014 and are paying premiums for Part D coverage this year, a modest decrease from 2013 (Exhibit 4.3). The average monthly premium paid by these enrollees is $17.85—a 51 percent increase from 2013 (Exhibit 4.4). This amounts to over $200 annually in premium payments for beneficiaries whose incomes generally cannot exceed 135 percent of the federal poverty level. For beneficiaries not in benchmark plans, the federal government still pays the maximum subsidy amount for the beneficiary’s region of residence. But the government does not pay any amount above the benchmark, nor does it pay any portion of the premium that corresponds to enhanced benefits—even if the total Part D premium is below the benchmark.

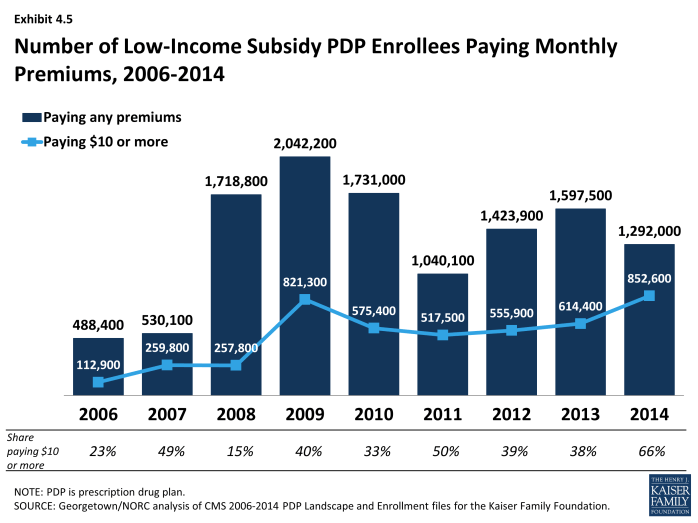

The proportion of LIS beneficiaries in PDPs paying premiums rose from 6 percent in 2006 to 26 percent in 2009, declined to 13 percent in 2011, but was back up to 16 percent in 2014 (Exhibit 4.5). About half of the LIS beneficiaries paying premiums in 2014 are enrolled in PDPs offered by UnitedHealth, mostly in the MedicareRx Preferred PDP, which lost benchmark status in all regions over the past two years. Depending on the region, these 634,000 UnitedHealth enrollees are paying from $4.70 to $26.90 per month.

In addition to the LIS enrollees who pay premiums for their PDPs, another 304,000 LIS beneficiaries enrolled in MA-PD plans pay a Part D premium. They represent 19 percent of all LIS beneficiaries enrolled in MA-PD plans (excluding those in Medicare Advantage plans designated as special needs plans, which are restricted to specific types of beneficiaries, such as those dually eligible for Medicare and Medicaid).

The de minimis premium waiver policy that allows 79 additional plans to qualify as benchmark PDPs helps many LIS enrollees avoid disruption. Without the de minimis premium waiver, about 1.2 million LIS beneficiaries in these PDPs (about one of every seven LIS enrollees) would either pay a small premium or would have been reassigned to different PDPs to avoid a premium.

About 853,000 LIS beneficiaries in PDPs are paying monthly premiums of $10 or more in 2014, representing about two-thirds of the 1.3 million LIS beneficiaries enrolled in PDPs who pay any premium (Exhibit 4.5). Another 135,000 LIS beneficiaries in MA-PD plans also pay premiums of $10 or more in 2014. It is possible that the LIS enrollees who pay a premium to enroll in these plans do so because of formulary or other individual considerations; another possibility, however, is that these enrollees are not reevaluating their plan options each year, even when it could save them money. It may be that they do not know that there are zero-premium plans available to them or have been unable to navigate the process of switching plans to avoid paying a premium.