Medicare Part D in 2016 and Trends over Time

Section 2: Part D Premiums

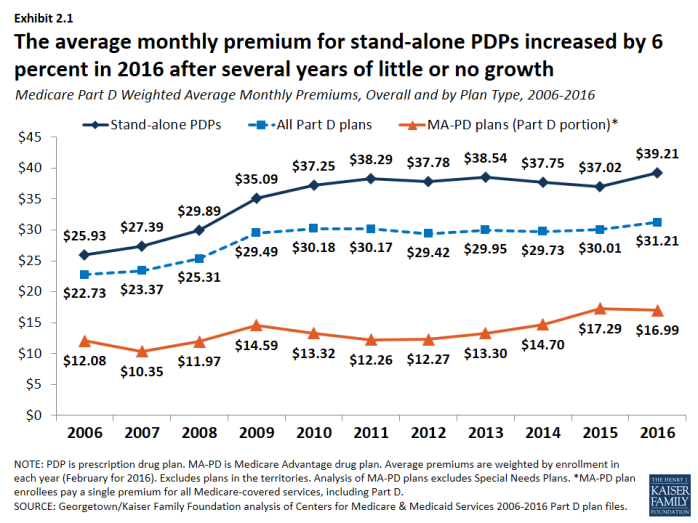

Average monthly PDP premiums rose in 2016 after being essentially flat since 2010; MA-PD plan premiums for Part D coverage only have risen modestly in the past few years.

- PDP enrollees are in plans with an average monthly premium of $39.21 in 2016, up by 6 percent from 2015 (Exhibit 2.1). MA-PD plan enrollees are in plans with an average monthly premium of $16.99 for Part D benefits, a lower amount due in part to the ability of firms offering MA-PD plans to use rebate dollars from Medicare payments for benefits covered under Parts A and B to lower their Part D premiums. The combined average Part D premium for PDP and MA-PD plan enrollees is $31.21 in 2016.

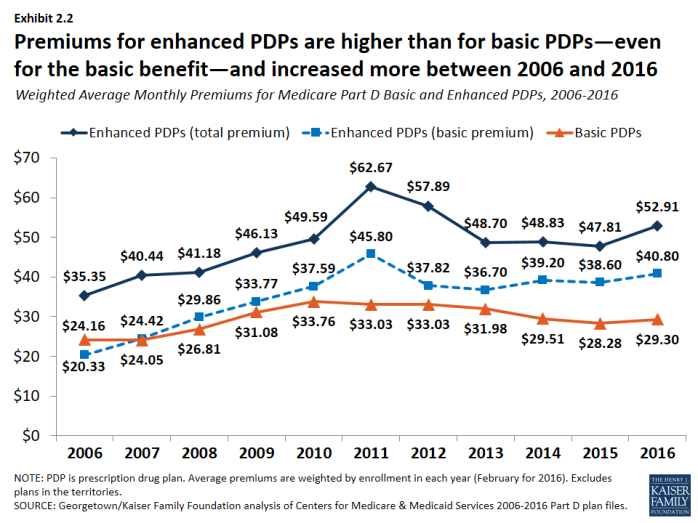

- Premiums for enhanced PDPs grew more rapidly than premiums for basic plans from 2015 to 2016 (11 percent versus 4 percent) (Exhibit 2.2).

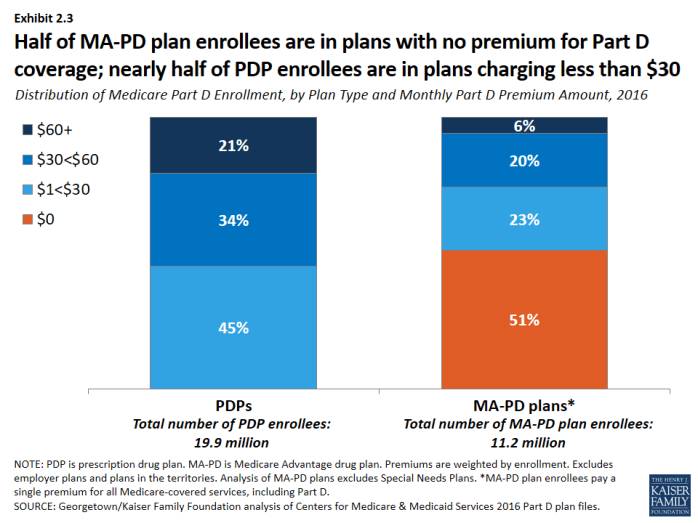

- In 2016, just over half of MA-PD plan enrollees are in plans that charge no monthly premium for Part D coverage. Nearly half of PDP enrollees are in plans that charge less than $30 per month, but one in five are in plans charging at least $60 (Exhibit 2.3).

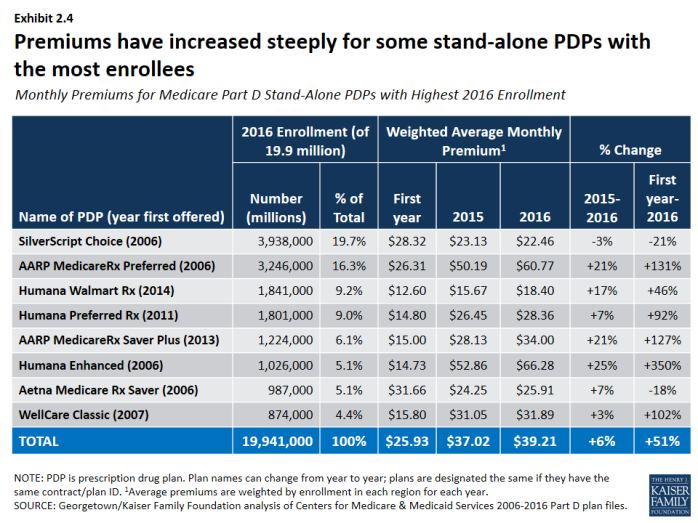

Premiums for some of the most popular plans increased in 2016, while for others, premiums fell.

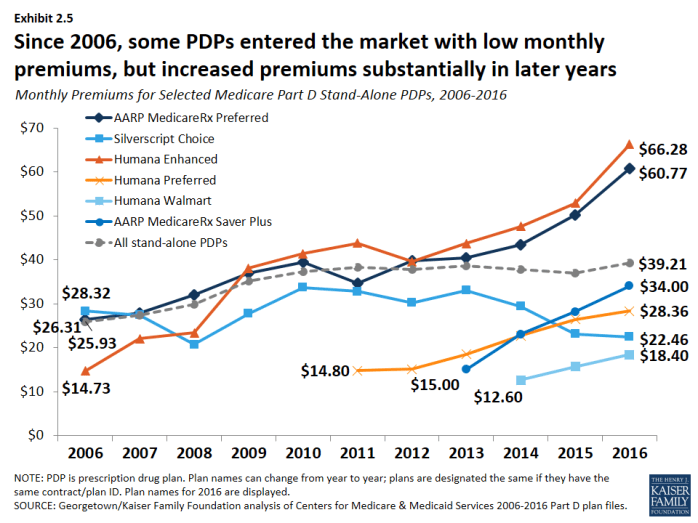

- Monthly premiums for three of the six largest PDPs (AARP MedicareRx Preferred, AARP MedicareRx Saver Plus, and Humana Enhanced) increased premiums by at least 20 percent in 2016 over 2015 levels (Exhibit 2.4); (Exhibit 2.5). By contrast, SilverScript Choice lowered its premium by 3 percent. Some PDPs have entered the market and gained enrollment by charging low premiums, but increased premiums substantially in later years.

Premiums vary widely across plans, even among those offering an equivalent benefit type.

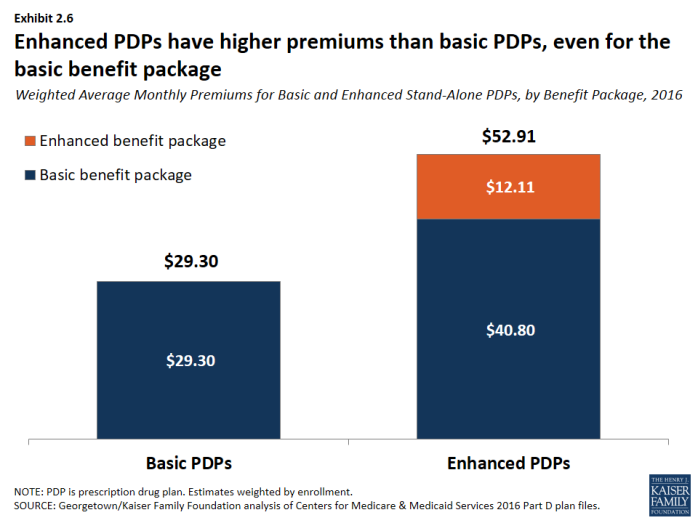

- PDPs offering the basic Part D benefit have an average monthly premium of $29.30 in 2016, while PDPs offering enhanced benefits have a higher average monthly premium of $52.91. The portion of the premium for enhanced plans that is attributable to the basic benefit is about 40 percent higher than the average premium for basic plans, suggesting that some of the difference may be attributable to health differences of enrollees in enhanced plans not captured by risk adjusters (Exhibit 2.6).

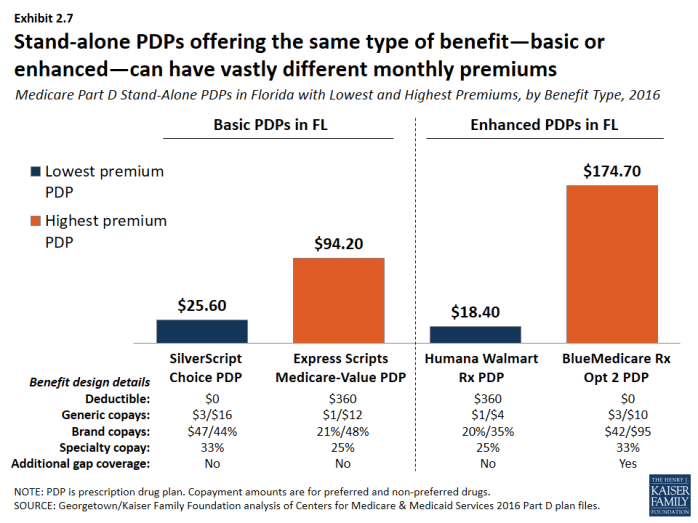

- Premiums vary widely for basic-benefit PDPs, ranging from $11.40 (SilverScript Choice in Arkansas) to $139.70 (Transamerica MedicareRx Classic in Illinois). Premiums for enhanced PDPs also vary widely, from $18.40 for the Humana Walmart Rx PDP, available in all 34 regions, to $174.40 for the BlueMedicare Rx-Option 2 PDP, only available in Florida. Even within any given region, stand-alone PDPs offering the same type of benefit—basic or enhanced—can have vastly different monthly premiums (Exhibit 2.7).

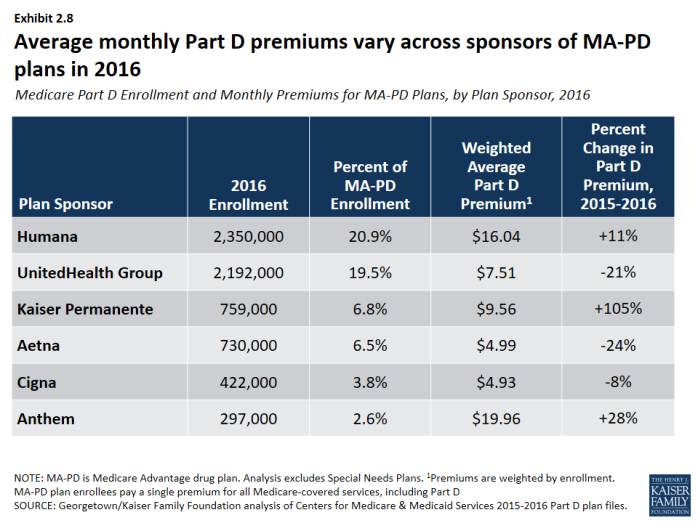

- MA-PD plan monthly premiums for Part D benefits also vary considerably, although MA-PD plan enrollees typically see a total premium that combines the cost of their medical and drug benefits. About half of MA-PD plan enrollees are in plans with a $0 drug premium, but premiums range as high as $78.80 for a plan offering the basic benefit and $139.10 for a plan with an enhanced benefit. Weighted average Part D premiums for the firms with the most MA-PD plan enrollees range from about $5 per month (Aetna and Cigna) to about $20 per month (Anthem) (Exhibit 2.8).

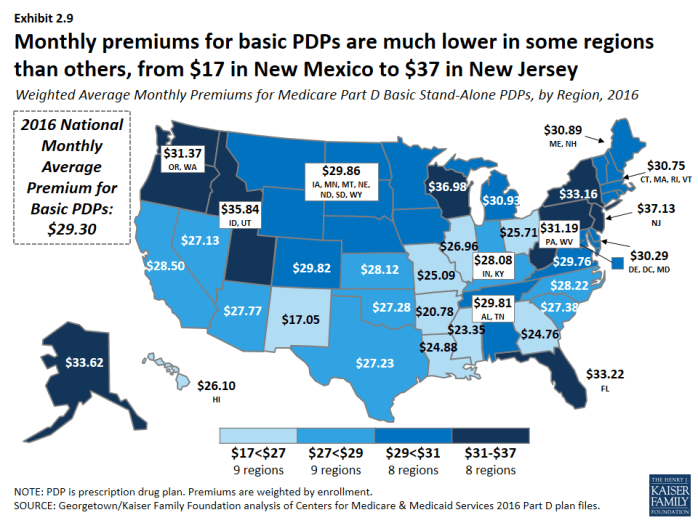

Premiums vary widely across geographic regions.

- The average monthly premium for PDPs offering the basic benefit is $17.05 in New Mexico, but it is more than twice that amount ($37.13) in New Jersey (Exhibit 2.9).

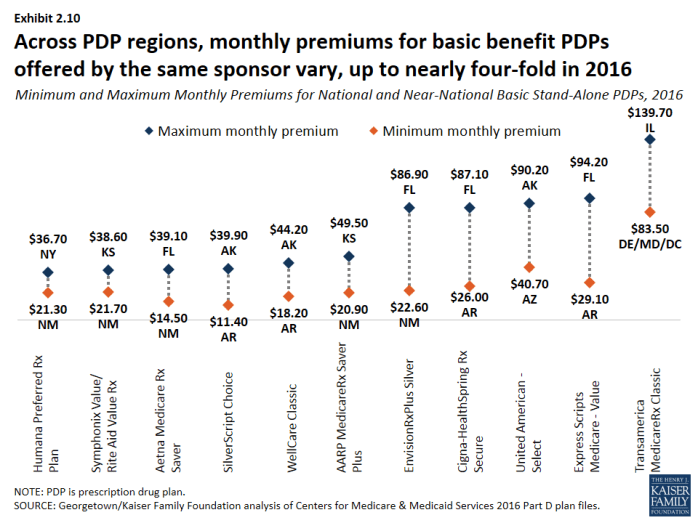

- For the identical plan offered by the same sponsor, monthly premiums vary across regions by as much as nearly four-fold (Exhibit 2.10). For example, premiums for SilverScript Choice, the PDP with the most enrollees nationally, range from $11.40 in Arkansas to more than three times that amount ($39.90) in Alaska.

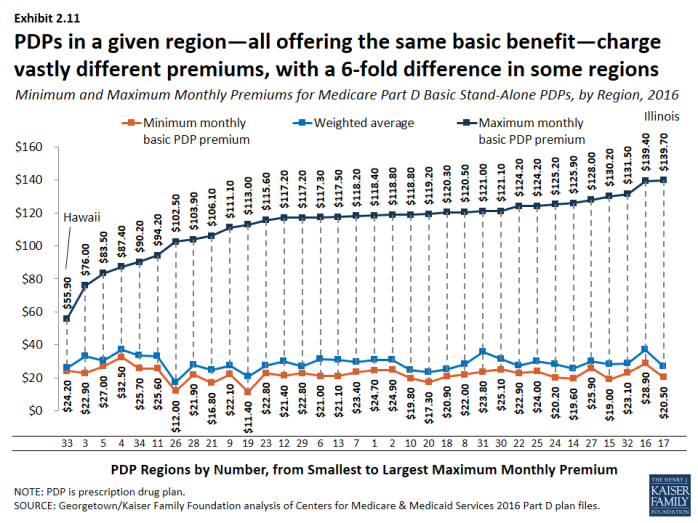

- In most regions, the range of premiums for PDPs offering the basic benefit is substantial (Exhibit 2.11). In Illinois, for example, the highest basic PDP premium is $139.70, almost seven times higher than the lowest basic PDP premium of $20.50. These differences are exaggerated by high premiums for the Transamerica MedicareRx Classic PDPs, which has no more than 0.2 percent of enrollment in any of the 30 regions where it is offered.

Section 1: Part D Enrollment and Plan Availability

Section 3: Part D Benefit Design and Cost Sharing

x

Exhibit 2.1

x

Exhibit 2.2

x

Exhibit 2.3

x

Exhibit 2.4

x

Exhibit 2.5

x

Exhibit 2.6

x

Exhibit 2.7

x

Exhibit 2.8

x

Exhibit 2.9

x

Exhibit 2.10

x