Medicare Advantage Hospital Networks: How Much Do They Vary?

Methods

We describe here the main elements of the study design. For a more detailed description of the study methods, see the Appendix.

Geographic Focus

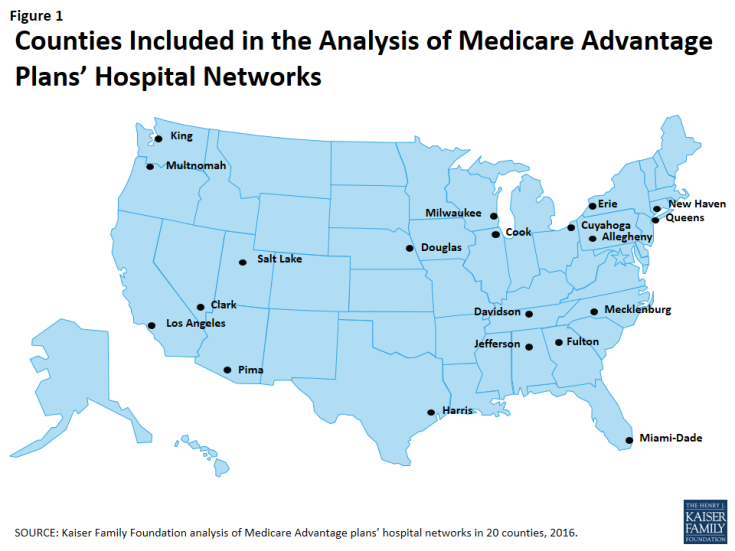

This study examined Medicare Advantage plans available in 2015 in 20 counties (Figure 1). The county is the smallest area, in general, that a Medicare Advantage plan must cover. Counties vary greatly in size and may not be the best metric to assess the health care market of particular locales. However, an analysis at the county level provided the most complete set of data available for this type of analysis, as well as a reasonable snapshot of the health care market accessible to beneficiaries in that region.

The counties included in this study were chosen to encompass a sizeable share of Medicare Advantage enrollees, to be geographically dispersed across the country, and to range in per capita Medicare spending, the number of plans offered to Medicare beneficiaries, and Medicare Advantage penetration rate. They include large, urban areas with Medicare Advantage markets led by national firms (e.g., UnitedHealthcare) and local firms (e.g., UAB Health System). Together, these counties represent 14 percent of all Medicare Advantage enrollees in 2015.

Inclusion Criteria for Medicare Advantage Plans

Only HMOs and local PPOs were included in the analysis because the other types of Medicare Advantage plans either do not have networks (e.g., some private fee-for-service plans), or networks that are structured to cover areas larger than a county (e.g., regional PPOs), or are paid in unique ways that influence providers available to beneficiaries (e.g. cost plans). The analysis also excluded Special Needs Plans (SNPs), employer-sponsored group plans, and other plans that are not available to all Medicare beneficiaries. In total, across the 20 counties, we included 409 plans, 307 HMOs and 102 local PPOs. Among the 307 HMOs, 10 were closed panel HMOs, with physicians or groups of physicians directly employed by the HMO, and the remainder were open panel HMOs. Together, these plans enrolled 1.6 million Medicare beneficiaries in 2015, 92 percent of whom were in HMOs and 8 percent of whom were in PPOs. Both HMOs and local PPOs were available in all 20 counties, with the exception of Los Angeles where only HMOs were available to Medicare beneficiaries.

Main Sources of Data

Provider directories were the primary source of data used for the study. The directories were gathered between November and December 2014, to coincide with the Medicare Annual Election Period for 2015, and were either downloaded from the company’s website in a PDF format, when possible, or using a searchable directory embedded in the company website. The information extracted from this data was complemented with other information available on these plans and counties in CMS’s Medicare Advantage Enrollment file for March 2015 and Landscape file for 2015, and the American Hospital Association’s (AHA) 2014 survey of hospitals.

Measures of Hospital Network Size and Composition

All short-term general hospitals in the 20 counties included in the study, and their characteristics, were identified using data from the AHA 2014 survey of hospitals. (To support sensitivity analyses, hospitals in the adjacent counties were also identified.) Veterans Health Administration hospitals and children’s hospitals were excluded because of their unique financing or population focus. Two basic measures of network size were constructed for each health plan by county: (1) the share of hospitals in the county included in the directory, and (2) the share of hospital beds in the county associated with the hospitals included in the directory.

Classification of Networks by Size

This study categorized networks into one of four sizes based on the share of hospitals in the county that were included in the directory: broad (70% or more of the hospitals), medium (30-69% of hospitals), narrow (10-29% of hospitals), and ultra-narrow (less than 10% of hospitals). Only one other study we know of, conducted by McKinsey & Company, categorized networks by the share of hospitals in the county included in the network (Table 1).1 Broad networks were defined consistently in both studies, but narrower networks were classified and labeled somewhat differently here.

| Table 1. Network Size Definitions | ||

| Share of Hospitals Included in Network | Kaiser Family Foundation Analysis of Medicare Advantage Networks | McKinsey & Company Analysis of Exchange Networks |

| 0-9% | Ultra-Narrow | Ultra-Narrow |

| 10-29% | Narrow | |

| 30-69% | Medium | Narrow |

| 70%+ | Broad | Broad |

| SOURCE: Kaiser Family Foundation analysis and Bauman N, Bello J, Coe E, and Lamb J. “Hospital networks: Evolution of the configurations on the 2015 exchanges,” McKinsey & Company, April 2015. | ||

The McKinsey & Company study examined the size of the networks of plans offered in the ACA exchanges, and categorized networks into one of three network sizes. The difference between the categories used in this study and the McKinsey study is that this study includes a category for medium-sized networks. That is, this study uses the term “medium” to describe the size of networks that McKinsey described as “narrow.”

Analytic Variables: Teaching Hospitals and Cancer Centers

This study examined the presence of two specific types of hospitals in plan networks: teaching hospitals and cancer centers. Academic Medical Centers and minor teaching hospitals were identified based upon data from the AHA 2014 survey of hospitals. Each of the 20 counties had at least one Academic Medical Center within its borders, 11 of which included more than one, including Cook County with 12 Academic Medical Centers and Los Angeles County with 8 Academic Medical Centers. All but one of the counties (Mecklenburg) included at least one minor teaching hospital.

Cancer centers designated by the National Cancer Institute (NCI) were identified through the list of centers on the NCI website, and cancer centers accredited by the American College of Surgeons (ACS) were identified based upon data from the AHA 2014 survey of hospitals. Fifteen of the 20 counties in the study had at least one NCI-Designated Cancer Center within the borders of the county, including Cook, Harris, and Los Angeles counties that had more than one NCI Cancer Center, and all but one of the counties (Pima) had at least one hospital with an ACS-accredited cancer program.

Limitations

This study has some limitations. Notably, counties vary in size and do not necessarily provide a good measure of the natural market for the health plan and all of its enrollees. The study also focuses on large, urban areas, and does not provide information about plans’ networks in rural areas that have both fewer beneficiaries and providers. In many cases, physicians, not the beneficiary, may be key drivers in the choice of health plan and this analysis provides no information on the effective match between the breadth of physician networks and hospital networks. Hospital care also is increasingly complex and varied, and a general analysis of hospital networks provides limited insight into the availability of particular services the enrollee may need and where these services are best performed in any given community. Ultimately, what may be important to beneficiaries is the availability and quality of providers in their plan’s network, and not necessarily the size of the network.