Medicare Advantage 2016 Data Spotlight: Overview of Plan Changes

Market Structure: Plan Availability and Characteristics of Plans Offered by Major Firms

While many organizations offer Medicare Advantage plans, a handful of firms and affiliates have historically accounted for the majority of all Medicare Advantage enrollment nationally. This spotlight examines trends among and across these firms and affiliates that account for large shares of Medicare Advantage enrollment nationally: UnitedHealthcare, Humana, Blue Cross and Blue Shield (BCBS) affiliated companies (including Anthem BCBS plans), Kaiser Permanente, Aetna, Cigna, and Wellcare. Together, these seven firms and affiliates accounted for almost three-quarters of all Medicare Advantage enrollment in 2015.1 The potential impact of proposed mergers between some of these large firms (Aetna’s proposed acquisition of Humana and Anthem’s proposed acquisition of Cigna) is not yet clear.

Change in Number and Availability of Plans Offered by Firm

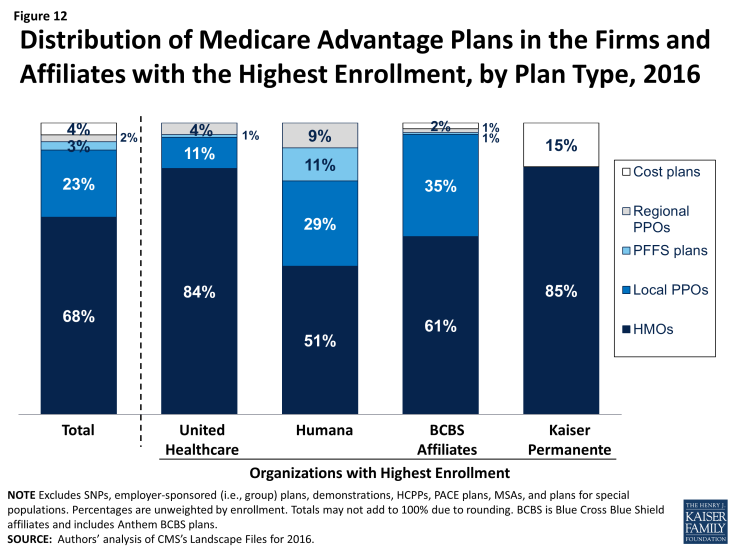

The firms and affiliates profiled in Table A4 account for 61 percent of available plans being offered in 2016 (Table A4). The types of plans offered vary across these firms and affiliates. Firm strategies are reflected both in the types of plans they offer and the share of beneficiaries to whom they are available (Figure 12; Table A5). This analysis focuses only on plans offered for broad based individual enrollment, and excludes special needs plans, employer-sponsored group plans for retirees and other types of plans only available to certain beneficiaries.

Figure 12: Distribution of Medicare Advantage Plans in the Firms and Affiliates with the Highest Enrollment, by Plan Type, 2016

UnitedHealthcare. UnitedHealthcare has historically had a large Medicare Advantage footprint and it will continue to do so in 2016. Seven in ten Medicare beneficiaries (70%) will have access to a UnitedHealthcare plan in 2016. UnitedHealthcare has historically offered a mix of plan types, but HMOs comprise the vast majority (84%) of its plan offerings, with a smaller share local PPOs (11%), regional PPOs (5%) and PFFS plans (1%). More than half of beneficiaries (55%) will have access to a UnitedHealthcare HMO in 2016, up from 50 percent of beneficiaries in 2015. Average premiums (not weighted by enrollment) in HMOs offered by UnitedHealthcare will decline between 2015 and 2016, while premiums for the firm’s local PPOs, PFFS plans, and regional PPOs will increase (Table A6). This is a slight reversal of the firm’s strategy in 2015 when it introduced premiums across most of its plans that previously had zero-premiums. In early 2015, 20 percent of Medicare Advantage enrollees were in a UnitedHealthcare plan.2

Humana. Humana also has had a large footprint in Medicare Advantage for over a decade, and Medicare Advantage likewise comprises a large share of Humana’s business. Humana will continue to offer a broader mix of plan types than any other large firm or affiliate in 2016, but the total number of plans the firm offers will decline from 395 plans to 362 plans, continuing the firm’s trend of offering fewer plans each year since 2013. Similar to prior years, about half (51%) of Humana’s plans will be HMOs, about three in ten will be local PPOs (29%), and about one in ten will be PFFS plans (11%) or regional PPOs (9%). The vast majority of Medicare beneficiaries (85%) will have access to a plan offered by Humana in 2016, similar to 2015. HMOs, local PPOs, and regional PPOs offered by Humana will be available to more than half of beneficiaries (58%, 53%, and 61%, respectively) and Humana PFFS plans will be available to more than four in ten beneficiaries (43%). Average premiums (not weighted by enrollment) for local PPOs offered by Humana will decline between 2015 and 2016, while average premiums for other plan types offered by Humana will increase, with the largest average increases in premiums among PFFS plans. In early 2015, 19 percent of Medicare Advantage enrollees were in a Humana plan.

Blue Cross and Blue Shield Affiliates (BCBS). BCBS affiliates are separate companies that do not directly compete with each other and are affiliated nationally.3 Some have converted from non-profit to for-profit status in recent years, most notably Anthem BCBS. We analyze the BCBS affiliates together because the affiliation results in some similarities in approach. In 2016, more than six in ten of BCBS affiliates’ Medicare Advantage offerings will be HMOs (61%) while 35 percent will be local PPOs. Nearly three out of four beneficiaries nationwide (72%) will have access to a BCBS affiliated plan, including almost one-quarter (24%) who will have with access to an Anthem BCBS plan and 55 percent who will have access to plans offered by other companies under the BCBS trademark. In early 2015, 3 percent of Medicare Advantage enrollees were in an Anthem plan, including Anthem BCBS plans, and another 13 percent were in plans offered by other BCBS affiliates.

Kaiser Permanente. Similar to prior years, fewer beneficiaries (17%) will have access to a Kaiser Permanente plan than other firms included in this analysis. Kaiser Permanente has historically been geographically concentrated in California, Colorado, Georgia, Hawaii, Oregon, Washington, and the metropolitan area surrounding the District of Columbia, but its plans tend to have many enrollees in the places in which it operates. In contrast to other firms, Kaiser Permanente only offers HMOs (83%) and cost plans, which are somewhat similarly structured. Only 13 percent of beneficiaries will have access to a Kaiser Permanente HMO and only 2 percent of beneficiaries will have access to a Kaiser Permanente cost plan in 2016. In early 2015, 8 percent of Medicare Advantage enrollees were in a plan offered by Kaiser Permanente.

Aetna. Aetna’s footprint in the Medicare Advantage market has expanded since its acquisition of Coventry, and will become even larger if its proposed acquisition of Humana is approved by the Department of Justice. In 2016, Aetna plans will be available to almost half (49%) of all beneficiaries, up slightly from 45 percent in 2015 and 33 percent in 2014 prior to the acquisition of Coventry. Between 2015 and 2016, Aetna will increase the number of local PPOs it offers, rising from 74 plans in 2015 to 82 plans in 2016. Accordingly, a larger share of beneficiaries will have access to an Aetna local PPO (40%) in 2016, up from one-third (33%) of beneficiaries in 2015. Beginning in 2016, Aetna will begin offering regional PPOs in New Jersey and Ohio, and 7 percent of beneficiaries nationwide will have access to these new regional PPOs in 2016. In prior years, the only firms and affiliates that offered regional PPOs were UnitedHealthcare, Humana, and BCBS affiliates. In early 2015, 7 percent of Medicare Advantage enrollees were in a plan offered by Aetna.

Other Firms. About one-third (32%) and one-fifth (20%) of beneficiaries will have access to a plan offered by Wellcare and Cigna, respectively. Both firms heavily emphasize HMOs, with Wellcare exclusively offering HMOs and Cigna offering predominantly HMOs. Wellcare will increase the number of HMOs it offers from 40 plans in 2015 to 49 plans in 2016; Cigna will slightly increase the number of HMOs it offers by 3 plans, increasing from 40 plans in 2015 to 43 plans in 2016.

Beyond these firms, many other firms and organizations sponsor Medicare Advantage plans, usually in limited geographical markets. Taken together, these firms provide plan options to 79 percent of beneficiaries.