Medicaid Moving Ahead in Uncertain Times: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2017 and 2018

Emerging Delivery System and Payment Reforms

| Key Section Findings |

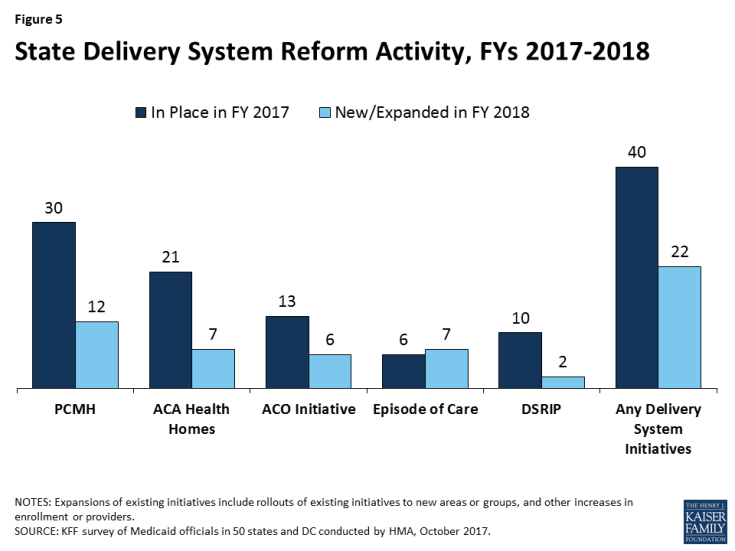

| In addition to managed care, Medicaid programs have been expanding their use of other service delivery and payment reform models to achieve better outcomes and lower costs. Forty states have one or more delivery system or payment reform initiatives in place in FY 2017 (e.g., patient-centered medical home (PCMH), ACA Health Home, accountable care organization (ACO), episode of care payment, or delivery system reform incentive program (DSRIP)).

What to watch: Six states reported episode of care initiatives in place in FY 2017 (up from only two states in FY 2015). For FY 2018, four of these states reported expanding these initiatives and three states reported new episode of care initiatives. Although states continue to show interest in DSRIP initiatives (that emerged under the Obama administration), the future of DSRIP remains unclear under the new administration. In response to two new survey questions, 19 states reported new or expanded initiatives to expand dental access or improve oral health outcomes (for children and/or adults) in FY 2017 or FY 2018 and 19 states also reported initiatives to expand the use of telehealth in FY 2018 or FY 2019. Table 9 contains more detailed information on emerging delivery system and payment reform initiatives in place in FY 2017 and new or expanded initiatives in FY 2018. |

This year’s survey asked states whether certain delivery system and payment reform models designed to improve health outcomes and constrain cost growth were in place in FY 2017, and whether they planned to adopt or enhance these models in FY 2018. Over three-quarters of all state Medicaid programs (40) had at least one of the specified delivery system or payment reform models in place in FY 2017 (Figure 5 and Table 9). If all actions reported by states for FY 2018 are implemented as planned, that number will grow to 44 states by the end of FY 2018, demonstrating the continued widespread and growing interest in Medicaid transformation. For FY 2018, a total of 22 states reported plans to adopt or expand one or more of the models to reward quality and encourage integrated care. Key initiatives include patient-centered medical homes (PCMHs), Health Homes, and Accountable Care Organizations (ACOs).

Patient-Centered Medical Homes (PCMHs)

PCMH initiatives operated in over half (30) of Medicaid programs in FY 2017 (Table 9). Under a PCMH model, a physician-led, multi-disciplinary care team holistically manages the patient’s ongoing care, including recommended preventive services, care for chronic conditions, and access to social services and supports. Generally, providers or provider organizations that operate as a PCMH seek recognition from organizations like the National Committee for Quality Assurance (NCQA).1 PCMHs are often paid (by state Medicaid agencies directly or through MCO contracts) a per member per month (PMPM) fee in addition to regular FFS payments for their Medicaid patients.2

In this year’s survey, 12 states reported plans to adopt or expand PCMHs in FY 2018 (Table 9). A few of these states reported notable expansions. Through its Centennial Care managed care program, New Mexico indicated that it now serves approximately 300,000 members through a PCMH and further expansion is planned for FY 2018. Tennessee reported launching its statewide multi-payer PCMH program (through its TennCare MCOs) with 29 organizations in January 2017 with plans to add practices each year. Wyoming, a state without MCO or PCCM programs, implemented PCMHs prior to FY 2017, but reported that it will continue to recruit and enroll physician practices into the program in FY 2018. Alaska, Delaware, and Illinois are planning to implement new PCMH initiatives in FY 2018 and Georgia’s MCO contracts will support expansion of the number of PCMHs in FY 2018.

In contrast, three states reported the restriction or elimination of a PCMH program: Massachusetts ended a PCMH program in December 2016 as part of its transition towards primary care-led reform through ACO models; Maine reported that the multi-payer PCMH program that it participated in was eliminated at the federal level, and South Carolina reported that it would be restricting its PCMH program by eliminating “level 1” funding after finding that many PCMHs remained in the application phase for more than 18 months.

ACA Health Homes

The ACA Health Homes option, created under Section 2703 of the ACA, builds on the PCMH concept. By design, Health Homes must target beneficiaries who have at least two chronic conditions (or one and risk of a second, or a serious and persistent mental health condition), and provide a person-centered system of care that facilitates access to and coordination of the full array of primary and acute physical health services, behavioral health care, and social and long-term services and supports. This includes services such as comprehensive care management, referrals to community and social support services, and the use of health information technology (HIT) to link services, among others. States receive a 90 percent federal match rate for qualified Health Home service expenditures for the first eight quarters under each Health Home State Plan Amendment; states can (and have) created more than one Health Home program to target different populations.

Over one-third of states (21) had at least one Health Home initiative in place in FY 2017 (Table 9). One of these states (Alabama) specifically noted that it is continuing to operate its Health Home initiative even though the eight quarters of enhanced federal funding has expired. In this survey, seven states also reported plans to adopt or expand Health Homes in FY 2018 (Table 9). Of these seven states, three (Alaska, California, and Illinois) reported new Health Home State Plan Amendments (SPAs) and four states (New Mexico, New York, Vermont, and West Virginia) reported expansions of existing Health Home programs. Ohio, however, reported plans to end its Health Home program in January 2018 as part of a behavioral health redesign initiative.

Accountable Care Organizations (ACOs)

Thirteen states reported having ACOs in place for at least some of their Medicaid beneficiaries in FY 2017 (Table 9).3 While there is no uniform, commonly accepted federal definition of an ACO, an ACO generally refers to a group of health care providers or, in some cases, a regional entity that contracts with providers and/or health plans, that agrees to share responsibility for the health care delivery and outcomes for a defined population.4 An ACO that meets quality performance standards that have been set by the payer and achieves savings relative to a benchmark can share in the savings. States use different terminology in referring to their Medicaid ACO initiatives, such as Regional Care Collaborative Organizations (RCCOs) in Colorado5 and Accountable Entities in Rhode Island.

In this survey, no state reported a new ACO initiative, but six states reported plans to expand an existing initiative in FY 2018 (Table 9). Four states with more mature ACO programs (Colorado, Maine, Minnesota, and Vermont) reported continued expansions of those programs in FY 2018, including Vermont, which also reported that it had aligned its existing ACO model with the design of the Medicare/CMS Next Generation ACO model beginning in January 2017. Two states (Massachusetts and Rhode Island) reported more significant expansions. Massachusetts reported that its ACO pilot program would be expanded statewide in January 2018 employing three different ACO models: an ACO/MCO partnership model; an ACO contracting directly with the state (without an MCO partner), and an exclusively MCO administered model. Massachusetts expects approximately 900,000 Medicaid beneficiaries to be enrolled in an ACO (out of 1.4 million total Medicaid enrollees). Rhode Island also reported plans to expand its current pilot “Accountable Entity” (AE) program in partnership with its existing MCOs with a long-term goal of having at least one-third of its Medicaid eligibles attributed to a certified AE.6

Episode-of-Care Payment Initiatives

Unlike FFS reimbursement, where providers are paid separately for each service, or capitation, where a health plan receives a PMPM payment for each enrollee intended to cover the costs for all covered services, episode-of-care payment provides a set dollar amount for the care a patient receives in connection with a defined condition or health event (e.g., heart attack or knee replacement). Episode-based payments usually involve payment for multiple services and providers, creating a financial incentive for physicians, hospitals, and other providers to work together to improve patient care and manage costs. Six states (Arkansas, New Mexico, New York, Ohio, Pennsylvania, and Tennessee) reported that they had episode-of-care payment initiatives in place in FY 2017, up from only two states in FY 2015 (Table 9). Four of these states (Arkansas, New Mexico, Ohio, and Tennessee) also reported planned expansions of these initiatives in FY 2018. Another three states (Alaska, Connecticut, and South Carolina) reported plans to implement a new episode-of-care initiative in FY 2018 (Table 9).

Delivery System Reform Incentive Payment (DSRIP) Program

DSRIP initiatives,7 which emerged under the Obama administration, provide states with significant federal funding to support hospitals and other providers in changing how they provide care to Medicaid beneficiaries.8 DSRIP initiatives link funding for eligible providers to process and performance metrics. Ten states reported DSRIP initiatives in place in FY 2017 (Table 9). Two of these states (Massachusetts and Texas) reported expansions planned for FY 2018: Massachusetts’ expanded DSRIP will support the development of ACOs and Texas reported new protocols for DSRIP activities, subject to CMS approval. Although states continue to show interest in pursuing delivery system reform through Section 1115 waiver authority, the future of DSRIP initiatives remains unclear under the new administration.

Other Initiatives

In addition to the initiatives discussed above, states mentioned a variety of other delivery system and payment reform initiatives (not counted in the totals for Figure 5 and Table 9). For example, DC reported on its pay for performance (P4P) initiatives including a new rate methodology for nursing facilities that includes P4P and an federally qualified health center (FQHC) P4P program focused on reducing inappropriate use of the emergency room, decreasing the rate of potentially avoidable hospital admissions, and addressing the problem of hospital readmissions. Montana reported on the implementation and expansion of a tribal health improvement program. Nevada reported implementing Certified Community Behavioral Health Clinics (CCBHCs) using an integrated behavioral health model, a prospective payment system, and pay for performance measures. Rhode Island reported using Section 1115 waiver authority to receive federal matching funds for services currently provided by various state agencies to support a new Designated State Health Program aimed at supporting quality-based payment programs, and Wisconsin reported plans to implement incentives to reduce potentially preventable hospital readmissions among both managed care and FFS members.

All-payer claims database (APCD) systems are large-scale databases that systematically collect medical claims, pharmacy claims, dental claims (typically, but not always), and eligibility and provider files from both private and public payers. APCDs can be used to help identify areas to focus reform efforts and for other purposes. Sixteen states (up from 11 in FY 2015) reported that an APCD was in place in their states (although Minnesota reported that the Medicaid program did not have access to the APCD in its state); one state (Connecticut) reported an APCD expansion planned for FY 2018; and three states (Delaware, Hawaii, and Washington) reported plans for new APCDs in FY 2018. Tennessee, however, reported that its APCD would be eliminated stating that following the United States Supreme Court’s 2016 decision in Gobeille v. Liberty Mutual Insurance Company,9 the Tennessee Attorney General opined that the statute authorizing the Tennessee APCD could no longer be enforced.

Access Improvement Focus Areas

This year’s survey included additional questions for states focusing on initiatives to increase access to dental care or improve oral health outcomes and initiatives to increase access to telehealth. States were asked to briefly describe initiatives implemented in FY 2017 or planned for FY 2018.

Improving Dental Access or Oral Health Outcomes

Oral health is a critical component of overall health and well-being, but the prevalence of dental disease and tooth loss is disproportionately high among people with low income, reflecting lack of access to dental coverage and care.10 While all state Medicaid programs are required to provide a comprehensive dental benefit for children, dental services remain an optional benefit for adults and securing an adequate number of dental providers is a challenge in many areas. In this year’s survey, 19 states described a variety of new or expanded initiatives to expand dental access or improve oral health outcomes (for children and/or adults) implemented in FY 2017 or FY 2018 (Exhibit 6).

| Exhibit 6: Strategies to Improve Dental Access or Oral Health Outcomes | ||

| # of States | States | |

| Payment incentives or value-based purchasing arrangements | 8 | CA, DC, MN, OH, OR, TX, WA, WI |

| Reimbursement rate increases (sometimes targeted) | 5 | CA, MN, OR, PA, WI |

| New or planned contracts with Dental Benefit Managers (DBMs) | 4 | AR, FL, NE, NV |

| Dental performance measures or Performance Improvement Projects (PIPs) within managed care | 4 | FL, MI, MO, OR |

| Consumer outreach/education campaigns | 2 | FL, MN |

In addition to the strategies noted in Exhibit 6 above, Pennsylvania reported expanded use of mid-level oral healthcare providers; Maryland reported expanded dental coverage to former foster care adults; and South Dakota reported working with its DBM vendor on care coordination initiatives (between primary care and dental care). Also see the “Benefit Changes” section of this report for details on states with dental benefit expansions. A number of other states mentioned ongoing initiatives implemented prior to FY 2017.

Improving Access to Care Through Telehealth

Interest in telehealth has grown across both public and commercial payers as a way to expand access to care, create greater convenience for patients, improve the quality of care, and reduce the costs of care. There are various types of telehealth services including: medical care/consultation between a patient at home and a distant clinician or between a patient in the presence of a clinician and a distant clinician; consultations between two clinicians without the patient present; remote monitoring of a patient at home or in a hospital or other facility; and secure electronic transfer of patient information (e.g., an image or lab results) to a clinician.11

In this year’s survey, 19 states reported initiatives to expand the use of telehealth in FY 2017 or FY 2018. Nine states reported expanding telehealth by covering additional services, diagnoses, or provider types (Arizona, Minnesota, Mississippi, Montana, and Washington), removing a 20 mile distance restriction (Indiana), adding or encouraging remote patient monitoring (Florida and Maryland) and distant site providers (Maryland), and allowing a patient’s home to be an acceptable patient site and clarifying that an initial in-person visit is not required if the telehealth service is being used to treat a behavioral health condition (Texas). California and Colorado reported telehealth pilot programs; Nevada indicated that its MCOs had implemented “NowClinics” to promote telehealth utilization, and South Dakota reported that it was working with tribal facilities to expand telehealth availability. Other states that reported new or expanded telehealth initiatives include Arkansas, Hawaii, Illinois, New Jersey, New Mexico, and New York.

TABLE 9: SELECT DELIVERY SYSTEM AND PAYMENT REFORM INITIATIVES IN ALL 50 STATES AND DC, IN PLACE IN FY 2017 AND ACTIONS TAKEN IN FY 2018

| States | Patient-Centered Medical Homes (PCMH) |

ACA Health Homes | Accountable Care Organizations (ACO) | Episode of Care Payments | Delivery System Reform Incentive Payment Program (DSRIP) |

Any Delivery System or Payment Reform Initiatives | ||||||

| In Place FY 2017 | New/ Expand FY 2018 | In Place FY 2017 | New/ Expand FY 2018 | In Place FY 2017 | New/ Expand FY 2018 | In Place FY 2017 | New/ Expand FY 2018 | In Place FY 2017 | New/ Expand FY 2018 | In place FY 2017 | New/ Exp in FY 2018 |

|

| Alabama | X | X | X | |||||||||

| Alaska | X* | X* | X* | X* | ||||||||

| Arizona | X | X | ||||||||||

| Arkansas | X | X | X | X | X | X | ||||||

| California | X* | X | X | X | ||||||||

| Colorado | X | X | X | X | X | X | ||||||

| Connecticut | X | X | X | X* | X | X | ||||||

| Delaware | X* | X* | ||||||||||

| DC | X | X | ||||||||||

| Florida | X | X | ||||||||||

| Georgia | X* | X* | ||||||||||

| Hawaii | ||||||||||||

| Idaho | X | X | ||||||||||

| Illinois | X* | X* | X* | |||||||||

| Indiana | ||||||||||||

| Iowa | X | X | X | X | ||||||||

| Kansas | X | X | ||||||||||

| Kentucky | ||||||||||||

| Louisiana | ||||||||||||

| Maine | X | X | X | X | ||||||||

| Maryland | X | X | ||||||||||

| Massachusetts | X | X | X | X | X | X | X | |||||

| Michigan | X | X | X | X | X | |||||||

| Minnesota | X | X | X | X | X | X | ||||||

| Mississippi | ||||||||||||

| Missouri | X | X | X | X | ||||||||

| Montana | X | X | ||||||||||

| Nebraska | X | X | ||||||||||

| Nevada | X | X | ||||||||||

| New Hampshire | X | X | ||||||||||

| New Jersey | X | X | X | X | ||||||||

| New Mexico | X | X | X | X | X | X | X | X | X | |||

| New York | X | X | X | X | X | X | X | X | ||||

| North Carolina | X | X | X | |||||||||

| North Dakota | ||||||||||||

| Ohio | X | X | X | X | X | X | X | |||||

| Oklahoma | X | X | X | |||||||||

| Oregon | X | X | ||||||||||

| Pennsylvania | X | X | X | X | X | X | X | |||||

| Rhode Island | X | X | X | X | X | X | ||||||

| South Carolina | X | X* | X | X | ||||||||

| South Dakota | X | X | ||||||||||

| Tennessee | X | X | X | X | X | X | X | |||||

| Texas | X | X | X | X | X | |||||||

| Utah | ||||||||||||

| Vermont | X | X | X | X | X | X | X | |||||

| Virginia | X | X | ||||||||||

| Washington | X | X | X | |||||||||

| West Virginia | X | X | X | X | ||||||||

| Wisconsin | X | X | X | |||||||||

| Wyoming | X | X | X | X | ||||||||

| Totals | 30 | 12 | 21 | 7 | 13 | 6 | 6 | 7 | 10 | 2 | 40 | 22 |

| NOTES: Expansions of existing initiatives include rollouts of existing initiatives to new areas or groups and significant increases in enrollment or providers. “*” indicates that a policy was newly adopted in FY 2018, meaning that the state did not have any policy in that category/column in place in FY 2017. SOURCE: Kaiser Family Foundation Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2017. |

||||||||||||