Medicaid in an Era of Health & Delivery System Reform: Results from a 50-State Medicaid Budget Survey for State Fiscal Years 2014 and 2015

Provider Rates and Taxes or Fees

Provider Rates

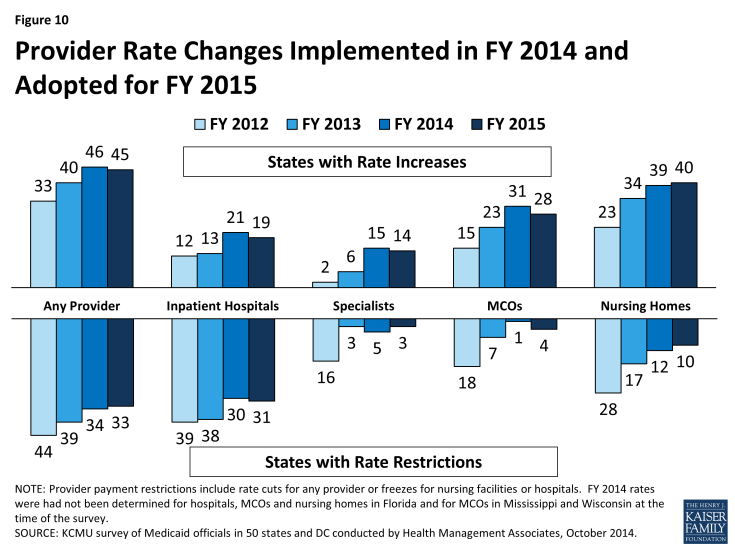

Medicaid provider rates are affected by state fiscal conditions. During economic downturns, states often turn to provider rate cuts to control costs. This was the case during the Great Recession and during the economic downturn from 2001 to 2004. Improving state finances in recent years have resulted in more states enhancing rates than restricting rates overall. In FY 2014, 34 states reported one or more rate restrictions across provider types and 46 states reported one or more rate increases. For FY 2015, 33 states have planned at least one provider rate restriction while 45 states are planning at least one rate increase. Reflecting improvements in the economy, there were more rate increases in FY 2014 and FY 2015 across all major categories of providers (physicians, MCOs and nursing homes) except for inpatient rates for hospitals than in previous years.1 (Figure 10) Twelve states (Colorado, Hawaii, Idaho, Kentucky, Massachusetts, Nebraska, New Jersey, North Dakota, South Carolina, Vermont, Wisconsin, and West Virginia) reported no rate restrictions either year. In addition to these 12, five states had no restrictions in FY 2014, and six states reported no restrictions in FY 2015.

Institutional providers like hospitals and nursing homes are more likely than other providers to have inflation adjustments built into their rates, so historically they have been more likely than other groups to have rate increases. States are also more likely to use provider tax arrangements to support Medicaid payment rates for these provider groups. However, even with improvements in the economy and the use of hospital provider taxes in most states, hospitals are not seeing increases in their Medicaid rates in the majority of states while more than half of states report restrictions in hospital rates; nearly all of these states held inpatient hospital rates flat with a small number of states cutting such rates. Managed Care Organizations (MCOs) are generally bolstered by the federal requirement that states pay actuarially sound rates. In FY 2014 and FY 2015, the majority of states reported increases or planned increases in MCO rates with few states reporting restrictions.

Overall, about half of states increased rates for one or more physician groups in both FY 2014 and FY 2015 while fewer states imposed rate cuts for such groups; a sharp change from recent years. The survey asked more specifically about rates for specialists, dentists and for outpatient services. For each of these categories, states reported more rate increases than rate restrictions. (See following table).

| States Changing Rates for Specialist, Dental, and Outpatient Hospital, FY 2012-FY 2015 | ||||||||

| Provider Type | FY 2012 Rates | FY 2013 Rates | FY 2014 Rates | FY 2015 Rates | ||||

| Increase | Decrease | Increase | Decrease | Increase | Decrease | Increase | Decrease | |

| Specialists | 2 | 16 | 6 | 3 | 15 | 5 | 14 | 3 |

| Dentists | 3 | 13 | 5 | 2 | 12 | 4 | 11 | 3 |

| Outpatient Hospital | 14 | 5 | 20 | 7 | 17 | 2 | ||

| NOTE: States were not asked about Outpatient hospital rates in FY 2012 or prior years. | ||||||||

| Primary Care Payments |

The ACA included a provision to increase Medicaid payment rates for primary care services to Medicare rates from January 1, 2013 through December 31, 2014. The federal government funded 100 percent of the difference between Medicaid rates that were in effect as of July 1, 2009 and the full Medicare rates for these two years. States were asked about their plans to extend this provision beyond December 31, 2014 (at regular FMAP rates). For states that have Medicaid rates for physician services that were already at or close to 100 percent of Medicare rates, this issue was not significant.

|

Provider Rates Methodology Note

For the purposes of this report, provider rate restrictions include cuts to rates for physicians, dentists, outpatient hospitals, and managed care organizations as well as both cuts or freezes in rates for inpatient hospitals and nursing homes.

Provider Taxes and Fees

States continue to rely on provider taxes and fees to provide a portion of the non-federal share of the costs of Medicaid. At the beginning of FY 2003, a total of 21 states had at least one provider tax in place; the most common provider tax was a tax on nursing facilities (44 states.) Over the past decade, a majority of states imposed new taxes and increased existing tax rates to raise revenue. By FY 2013, all but one state (Alaska) had one or more provider taxes in place.

Since FY 2013 there have been few changes in the number of provider taxes. In FY 2014, one provider tax (MCO tax in Oregon) was eliminated and two provider taxes (hospital tax in Arizona and a MCO tax in New Mexico2) were added. Arizona’s hospital fee will be used to fund costs related to their coverage restoration and eventually costs related to the Medicaid expansion in later years. In FY 2015, two states (Oregon and the District of Columbia) reported plans to eliminate hospital taxes and two states reported plans to add provider taxes. Illinois plans to implement a tax on providers in the Supportive Living Program; New Hampshire plans to implement a new MCO tax. A limited number of states reported changes to tax rates in FY 2014 and FY 2015, most notable were increases to rates for hospital taxes and fees (6 states in FY 2014 and 8 states in FY 2015) as well as increases to rates for nursing home taxes and fees in five states each year. A small number of states also reported reducing tax rates, again mostly for hospital and nursing home taxes and fees.

Tables 7 and 8 provide a complete listing of Medicaid provider rate changes for FY 2014 and FY 2015. Table 9 provides a complete listing of Medicaid provider taxes in place for FYs 2014 and 2015.

TABLE 7: PROVIDER RATE CHANGES TAKEN BY ALL 50 STATES AND DC, FY 2014 |

||||||||||||||

| States |

Inpatient

Hospital

|

Outpatient Hospital | Specialists | Dentists | Managed Care Organizations | Nursing Facilities | Total | |||||||

| Increase Rates | Restrict Rates | Increase Rates | Restrict Rates | Increase Rates | Restrict Rates | Increase Rates | Restrict Rates | Increase Rates | Restrict Rates | Increase Rates | Restrict Rates | Increase Rates | Restrict Rates | |

| Alabama | X | X | — | — | X | X | X | |||||||

| Alaska | X | X | X | X | — | — | X | X | X | |||||

| Arizona | X | X | X | X | X | X | X | X | ||||||

| Arkansas | X | — | — | X | X | X | ||||||||

| California | X | X | X | X | X | X | X | |||||||

| Colorado | X | X | X | X | X | X | X | |||||||

| Connecticut | X | — | — | X | X | |||||||||

| Delaware | X | X | X | X | X | X | X | X | ||||||

| DC | X | X | X | X | X | X | X | |||||||

| Florida | X | X | X | X | X | X | ||||||||

| Georgia | X | X | X | X | X | |||||||||

| Hawaii | X | X | X | X | ||||||||||

| Idaho | X | X | — | — | X | X | ||||||||

| Illinois | X | X | X | X | X | |||||||||

| Indiana | X | X | X | X | X | X | ||||||||

| Iowa | X | X | X | X | X | X | X | |||||||

| Kansas | X | X | X | X | X | |||||||||

| Kentucky | X | X | X | X | ||||||||||

| Louisiana | X | X | X | X | X | |||||||||

| Maine | X | X | — | — | X | X | X | |||||||

| Maryland | X | X | X | X | X | X | ||||||||

| Massachusetts | X | X | X | X | X | |||||||||

| Michigan | X | X | X | X | X | |||||||||

| Minnesota | X | X | X | X | X | X | X | |||||||

| Mississippi | X | X | X | X | X | |||||||||

| Missouri | X | X | X | X | X | X | ||||||||

| Montana | X | X | X | — | — | X | X | |||||||

| Nebraska | X | X | X | X | X | X | ||||||||

| Nevada | X | X | X | X | X | X | X | |||||||

| New Hampshire | X | X | X | |||||||||||

| New Jersey | X | X | X | X | X | |||||||||

| New Mexico | X | X | X | X | X | |||||||||

| New York | X | X | X | X | X | |||||||||

| North Carolina | X | X | X | X | X | X | ||||||||

| North Dakota | X | X | X | X | X | X | ||||||||

| Ohio | X | X | X | X | X | X | ||||||||

| Oklahoma | X | X | — | — | X | X | X | |||||||

| Oregon | X | X | X | X | X | |||||||||

| Pennsylvania | X | X | X | X | X | |||||||||

| Rhode Island | X | X | X | X | X | |||||||||

| South Carolina | X | X | X | X | X | |||||||||

| South Dakota | X | X | X | — | — | X | X | X | ||||||

| Tennessee | X | X | X | X | ||||||||||

| Texas | X | X | X | X | X | X | ||||||||

| Utah | X | X | X | X | X | X | ||||||||

| Vermont | X | X | X | X | — | — | X | X | ||||||

| Virginia | X | X | X | X | X | |||||||||

| Washington | X | X | X | X | X | |||||||||

| West Virginia | X | X | X | X | ||||||||||

| Wisconsin | X | X | X | X | X | X | ||||||||

| Wyoming | X | X | — | — | X | X | ||||||||

| Totals | 21 | 30 | 20 | 7 | 15 | 5 | 12 | 4 | 31 | 1 | 39 | 12 | 46 | 34 |

|

NOTES: For the purposes of this report, provider rate restrictions include cuts to rates for physicians, dentists, outpatient hospitals, and managed care organizations as well as both cuts or freezes in rates for inpatient hospitals and nursing homes.

Also, mandatory requirements, such as the increase in primary care rates under the ACA, were excluded from these counts. SOURCE: Kaiser Commission on Medicaid and the Uninsured Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2014.

|

||||||||||||||

TABLE 8: PROVIDER RATE CHANGES TAKEN BY ALL 50 STATES AND DC, FY 2015 |

||||||||||||||

| States | Inpatient Hospital | Outpatient Hospital | Specialists | Dentists | Managed Care Organizations | Nursing Facilities | Total | |||||||

| Increase Rates | Restrict Rates | Increase Rates | Restrict Rates | Increase Rates | Restrict Rates | Increase Rates | Restrict Rates | Increase Rates | Restrict Rates | Increase Rates | Restrict Rates | Increase Rates | Restrict Rates | |

| Alabama | X | X | X | — | — | X | X | X | ||||||

| Alaska | X | X | X | X | — | — | TBD | TBD | X | |||||

| Arizona | X | X | X | X | X | |||||||||

| Arkansas | X | — | — | X | X | X | ||||||||

| California | X | X | X | X | ||||||||||

| Colorado | X | X | X | X | X | X | X | |||||||

| Connecticut | X | — | — | X | X | |||||||||

| Delaware | X | X | X | X | X | X | X | X | ||||||

| DC | X | X | X | X | X | X | X | |||||||

| Florida | X | TBD | TBD | X | X | X | X | |||||||

| Georgia | X | X | X | X | X | |||||||||

| Hawaii | X | X | X | X | ||||||||||

| Idaho | X | X | X | X | X | |||||||||

| Illinois | X | X | X | X | X | X | ||||||||

| Indiana | X | X | X | X | X | |||||||||

| Iowa | X | X | X | X | ||||||||||

| Kansas | X | X | X | X | X | |||||||||

| Kentucky | X | X | X | X | ||||||||||

| Louisiana | X | X | X | X | X | X | ||||||||

| Maine | X | — | — | X | X | X | ||||||||

| Maryland | X | X | X | X | X | X | ||||||||

| Massachusetts | X | X | X | X | X | |||||||||

| Michigan | X | X | X | X | X | |||||||||

| Minnesota | X | X | X | |||||||||||

| Mississippi | X | X | X | X | X | |||||||||

| Missouri | X | X | X | X | X | X | ||||||||

| Montana | X | X | X | X | — | — | X | X | X | |||||

| Nebraska | X | X | X | X | X | X | X | |||||||

| Nevada | X | X | X | X | X | |||||||||

| New Hampshire | X | X | X | X | X | |||||||||

| New Jersey | X | X | X | X | X | |||||||||

| New Mexico | X | X | X | X | X | |||||||||

| New York | X | X | X | X | X | X | ||||||||

| North Carolina | X | X | X | X | X | |||||||||

| North Dakota | X | X | X | X | TBD | TBD | X | X | ||||||

| Ohio | X | X | X | |||||||||||

| Oklahoma | X | X | X | X | — | — | X | X | ||||||

| Oregon | X | X | X | X | X | |||||||||

| Pennsylvania | X | X | X | X | X | |||||||||

| Rhode Island | X | X | X | X | X | |||||||||

| South Carolina | X | X | X | X | X | |||||||||

| South Dakota | X | X | X | X | — | — | X | X | ||||||

| Tennessee | X | X | X | X | X | |||||||||

| Texas | X | X | X | X | X | |||||||||

| Utah | X | X | X | X | X | X | ||||||||

| Vermont | X | X | X | X | — | — | X | X | ||||||

| Virginia | X | X | X | X | X | X | ||||||||

| Washington | X | X | X | X | ||||||||||

| West Virginia | X | X | X | X | ||||||||||

| Wisconsin | TBD | TBD | TBD | TBD | X | TBD | TBD | X | X | |||||

| Wyoming | X | — | — | X | X | |||||||||

| Totals | 19 | 31 | 17 | 2 | 14 | 3 | 11 | 3 | 28 | 4 | 40 | 10 | 45 | 33 |

|

NOTES: For the purposes of this report, provider rate restrictions include cuts to rates for physicians, dentists, outpatient hospitals, and managed care organizations as well as both cuts or freezes in rates for inpatient hospitals and nursing homes. Changes to primary care rates were asked about separately and are not included in this table. TBD – At the time of the survey, some rates for a few states were still being determined; these are denoted as TBD.

SOURCE: Kaiser Commission on Medicaid and the Uninsured Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2014.

|

||||||||||||||

TABLE 9: PROVIDER TAXES IN PLACE IN THE 50 STATES AND DC, FY 2014 AND 2015 |

||||||||||

| States | Hospitals | Intermediate Care Facilities | Nursing Facilities | Other | Any Provider Tax | |||||

| 2014 | 2015 | 2014 | 2015 | 2014 | 2015 | 2014 | 2015 | 2014 | 2015 | |

| Alabama | X | X | X | X | X | X | X | X | ||

| Alaska | ||||||||||

| Arizona | X | X | X | X | X | X | X | X | ||

| Arkansas | X | X | X | X | X | X | X | X | ||

| California | X | X | X | X | X | X | X | X | X | X |

| Colorado | X | X | X | X | X | X | X | X | ||

| Connecticut | X | X | X | X | X | X | X | X | ||

| Delaware | X | X | X | X | ||||||

| DC | X | X | X | X | X | X | X | X | X | |

| Florida | X | X | X | X | X | X | X | X | ||

| Georgia | X | X | X | X | X | X | X | X | ||

| Hawaii | X | X | X | X | X | X | ||||

| Idaho | X | X | X | X | X | X | X | X | ||

| Illinois | X | X | X | X | X | X | X | X | X | |

| Indiana | X | X | X | X | X | X | X | X | ||

| Iowa | X | X | X | X | X | X | X | X | ||

| Kansas | X | X | X | X | X | X | ||||

| Kentucky | X | X | X | X | X | X | X | X | X | X |

| Louisiana | X | X | X | X | X | X | X | X | ||

| Maine | X | X | X | X | X | X | X | X | X | X |

| Maryland | X | X | X | X | X | X | X | X | X | X |

| Massachusetts | X | X | X | X | X | X | X | |||

| Michigan | X | X | X | X | X | X | ||||

| Minnesota | X | X | X | X | X | X | X | X | X | X |

| Mississippi | X | X | X | X | X | X | X | X | X | X |

| Missouri | X | X | X | X | X | X | X | X | X | X |

| Montana | X | X | X | X | X | X | X | X | ||

| Nebraska | X | X | X | X | X | X | ||||

| Nevada | X | X | X | X | ||||||

| New Hampshire | X | X | X | X | X | X | X | |||

| New Jersey | X | X | X | X | X | X | X | X | X | X |

| New Mexico | X | X | X | X | ||||||

| New York | X | X | X | X | X | X | X | X | X | X |

| North Carolina | X | X | X | X | X | X | X | X | ||

| North Dakota | X | X | X | X | ||||||

| Ohio | X | X | X | X | X | X | X | X | ||

| Oklahoma | X | X | X | X | X | X | X | X | ||

| Oregon | X | X | X | X | X | |||||

| Pennsylvania | X | X | X | X | X | X | X | X | X | X |

| Rhode Island | X | X | X | X | X | X | X | X | ||

| South Carolina | X | X | X | X | X | X | ||||

| South Dakota | X | X | X | X | ||||||

| Tennessee | X | X | X | X | X | X | X | X | X | X |

| Texas | X | X | X | X | X | X | ||||

| Utah | X | X | X | X | X | X | X | X | ||

| Vermont | X | X | X | X | X | X | X | X | X | X |

| Virginia | X | X | X | X | ||||||

| Washington | X | X | X | X | X | X | X | X | ||

| West Virginia | X | X | X | X | X | X | X | X | X | X |

| Wisconsin | X | X | X | X | X | X | X | X | X | X |

| Wyoming | X | X | X | X | ||||||

| Totals | 40 | 38 | 37 | 37 | 44 | 44 | 21 | 24 | 50 | 50 |

| NOTES: This table includes Medicaid provider taxes as reported by states. Other taxes include taxes on provider types not listed, including but not limited to MCOs. It is possible that there are other sources of revenue from taxes collected on health insurance premiums not reflected here. In FY 2014 and FY 2015, Louisiana, Missouri, New Jersey, New York, Vermont and West Virginia reported two provider taxes or fees that are categorized as “Other.” In FY 2015 only, New Mexico reported two provider taxes or fees that are categorized as “Other.” SOURCE: Kaiser Commission on Medicaid and the Uninsured Survey of Medicaid Officials in 50 states and DC conducted by Health Management Associates, October 2014. |

||||||||||