Medicaid and CHIP Eligibility, Enrollment, and Cost Sharing Policies as of January 2020: Findings from a 50-State Survey

Premiums and Cost Sharing

Federal rules limit premiums and cost sharing in Medicaid and CHIP given enrollees’ limited ability to pay out of pocket costs. Under these rules, states may not charge premiums in Medicaid for enrollees with incomes less than 150% FPL. However, some states have obtained waivers to impose charges in Medicaid that federal rules do not otherwise allow. Maximum allowable cost sharing varies by type of service and income in Medicaid (Table 1). CHIP programs have more flexibility to charge premiums and cost sharing, but both Medicaid and CHIP limit total family out-of-pocket costs to no more than 5% of family income, and states are required to maintain tracking systems to cease cost-sharing once a family meets the cap. Under the Families First Coronavirus Response Act, states must provide COVID-19 testing with no cost sharing under Medicaid and CHIP. Moreover, to access the increased federal match rate for Medicaid provided under the law, states may not charge any cost sharing for any testing or treatments for COVID-19, including vaccines, specialized equipment, or therapies.

| Table 1: Allowable Cost Sharing Amounts for Adults in Medicaid by Income | |||

| <100% FPL | 100% – 150% FPL | >150% FPL | |

| Outpatient Services | up to $4 | up to 10% of state cost | up to 20% of state cost |

| Non-Emergency use of ER | up to $8 | up to $8 | No limit |

| Prescription Drugs | Preferred: up to $4 Non-Preferred: up to $8 |

Preferred: up to $4 Non-Preferred: up to $8 |

Preferred: up to $4 Non-Preferred: up to 20% of state cost |

| Inpatient Services | up to $75 per stay | up to 10% of state cost | up to 20% of state cost |

Premiums and Cost Sharing for Children

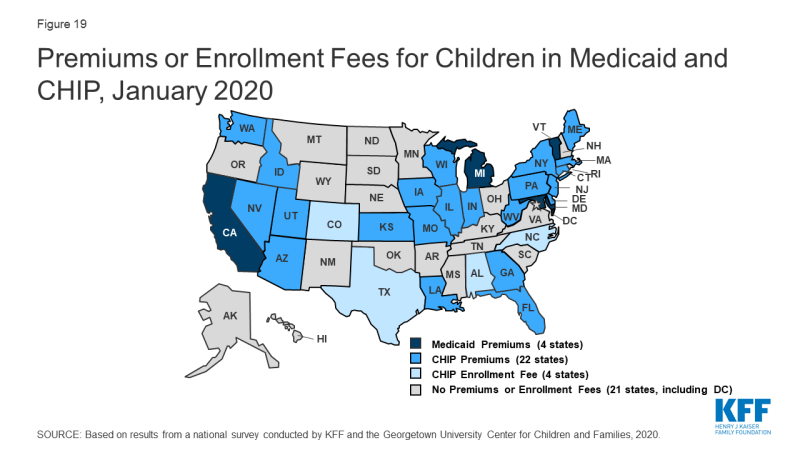

The number of states (30) charging premiums or enrollment fees for children remained steady in 2019 (Figure 19). The total number of states charging premiums or enrollment fees for children has decreased from 34 in 2009, just prior to the ACA. This decrease, in part, reflects some states transitioning their separate CHIP programs to Medicaid expansions. The stability of premiums since then reflects that extensions in CHIP funding have included a maintenance of effort provision, under which states may not implement new premiums or increase premiums outside of routine increases that were approved in the state’s plan as of 2010. As of January 2020, four states without separate CHIP programs charge premiums to children in Medicaid starting at 160% FPL, and 26 of the 35 separate CHIP programs charge either annual enrollment fees (4 states) or impose monthly or quarterly premiums for children starting at 133% FPL. In 11 states, premiums are family-based, while 15 states have a family cap that limits premiums to no more than three times the individual child rate. Premiums range from $10 for families with income at 151% FPL to a high of $154 per child at 301% FPL.

States vary in disenrollment policies related to non-payment of premiums. Under federal rules, the minimum grace period before canceling coverage for non-payment of premiums is 60 days in Medicaid and 30 days in CHIP. However, 15 of the 22 states charging monthly or quarterly premiums in CHIP provide at least a 60-day grace period. In Medicaid, children who are disenrolled for non-payment of premiums cannot be locked-out of coverage as a penalty for non-payment, while separate CHIP programs may establish a lockout period of up to 90 days. Among the 22 states charging monthly or quarterly premiums in CHIP, eight states do not impose lockout periods. As of January 2020, 14 states have lockout periods in CHIP, with 12 of those states imposing the maximum 90 days.

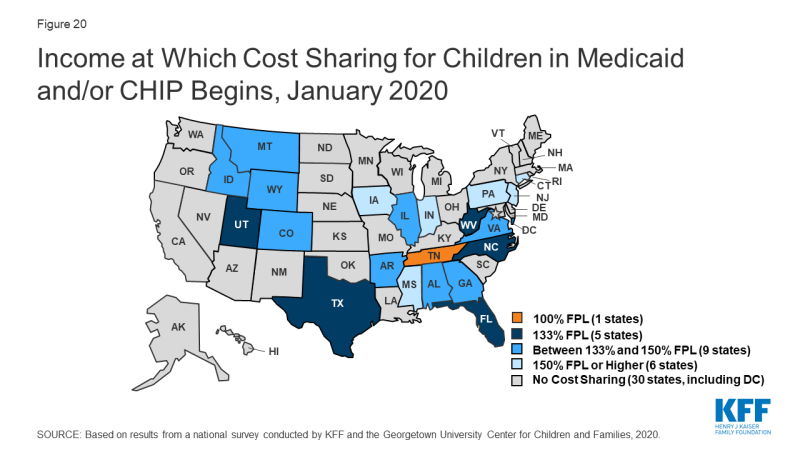

As of January 2020, the majority of states (29) do not charge copayments to children in Medicaid or CHIP. In 2019, North Dakota eliminated copayments for children in Medicaid and Wisconsin stopped charging copayments in both Medicaid and CHIP. With these changes, as of January 2020, 21 of the 35 states with separate CHIP programs charge copayments (Figure 20). Tennessee is the only state that charges copayments for children in Medicaid, and, under a longstanding waiver, it charges copayments for families with incomes below the federal minimum of 133% FPL. Cost sharing varies by state and service. At 151% FPL, 16 states charge cost sharing for non-preventive physician visits, 11 states charge for an inpatient hospital visit, and 12 charge for generic drugs.

Premiums and Cost Sharing for Parents and Other Adults

As of January 2020, seven states have approved waivers to charge premiums or monthly contributions for adults in Medicaid that federal rules do not otherwise allow, but only five states have implemented these charges.1 Arkansas, Indiana, Iowa, Michigan, and Montana charge premiums or monthly contributions for parents and other adults covered through the ACA Medicaid expansion. In Indiana, these charges also apply to parents covered through the traditional eligibility pathway that existed before the ACA. Some of these waivers also allow individuals to be locked out of coverage for a specified period if they are disenrolled due to non-payment and to delay coverage until after the first premium is paid.

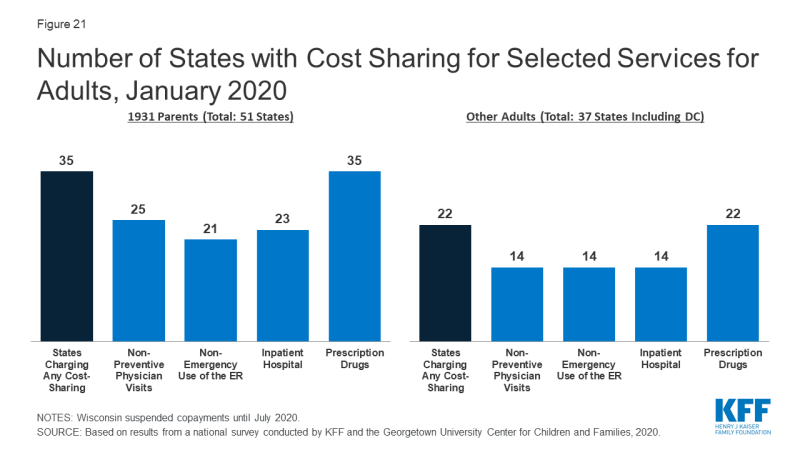

As of January 2020, the majority of states charge cost sharing for parents and other adults, regardless of income. However, the total number of states charging cost sharing fell during 2019, with Illinois, Montana, and North Dakota eliminating copayments for parents and adults. Wisconsin also suspended copayments but plans to reinstate them in July 2020. As of January 2020, 35 states charge copayments for parents eligible for Medicaid under the traditional pathway that existed before the ACA (Figure 21). In addition, of the 37 states that cover other adults (counting the 36 states Medicaid expansion states and Wisconsin, which covers other adults but has not adopted the expansion), 22 charge copayments, including Utah, which expanded Medicaid as of January 2020.