Kaiser Health Tracking Poll - March 2018: Non-Group Enrollees

Key Findings:

- As part of the Republican tax reform plan signed into law at the end of 2017, lawmakers eliminated the ACA’s individual mandate penalty starting in 2019. About one-fifth of non-group enrollees (19 percent) are aware the mandate penalty has been repealed but is still in effect for this year. Regardless of the lack of awareness, nine in ten non-group enrollees say they intend to continue to buy their own insurance even with the repeal of the individual mandate. About one-third (34 percent) say the mandate was a “major reason” why they chose to buy insurance.

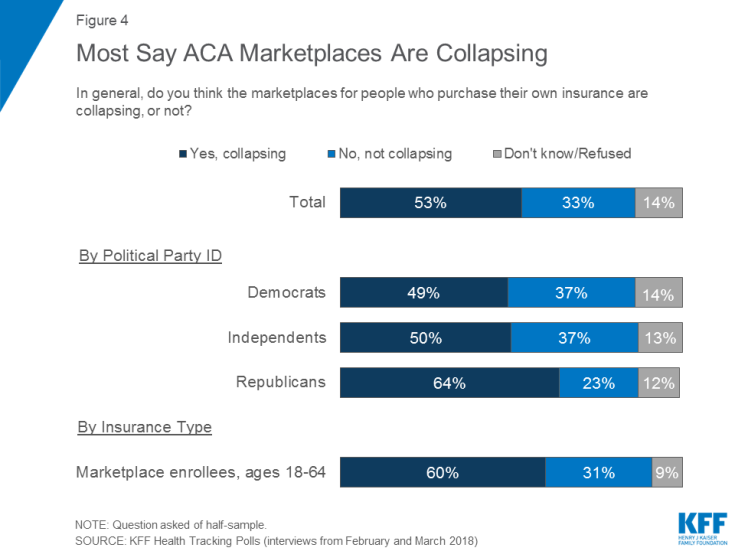

- About half the public overall believes the ACA marketplaces are “collapsing,” including six in ten of those with coverage purchased through these marketplaces. In fact, across party identification and insurance type, more say the marketplaces are “collapsing” than say the marketplaces are not collapsing.

- Overall, the population who buy their insurance through the ACA marketplace report being satisfied with the insurance options available to them during the most recent open enrollment period and more than half give the value of their insurance a positive rating. Yet, some (32 percent) experienced problems while trying to renew or buy their coverage and six in ten marketplace enrollees say they are worried about the possible lack of health insurance coverage in their areas.

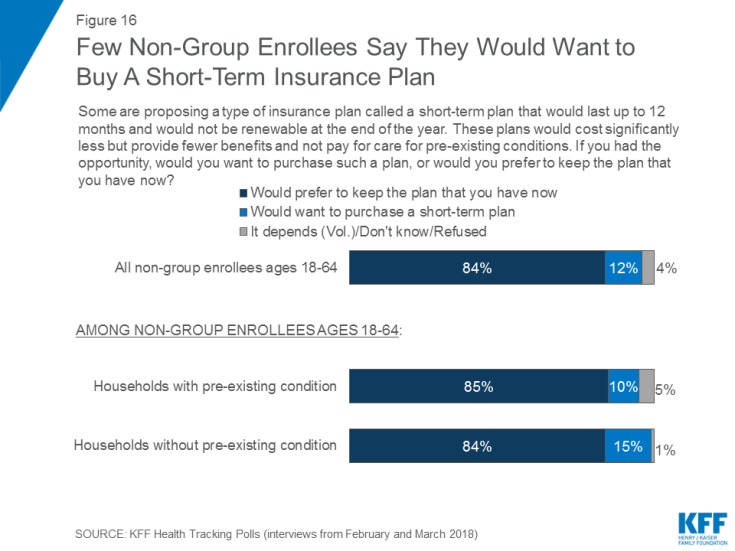

- In 2017, President Trump issued an executive order directing his administration to expand the availability of non-renewable short-term insurance plans, and regulations have been proposed to implement the order. When asked whether non-group enrollees would prefer to purchase such a plan or prefer to keep the plan they have now, the vast majority (84 percent) say they would keep the plan they have now while 12 percent say they would want to purchase a short-term plan.

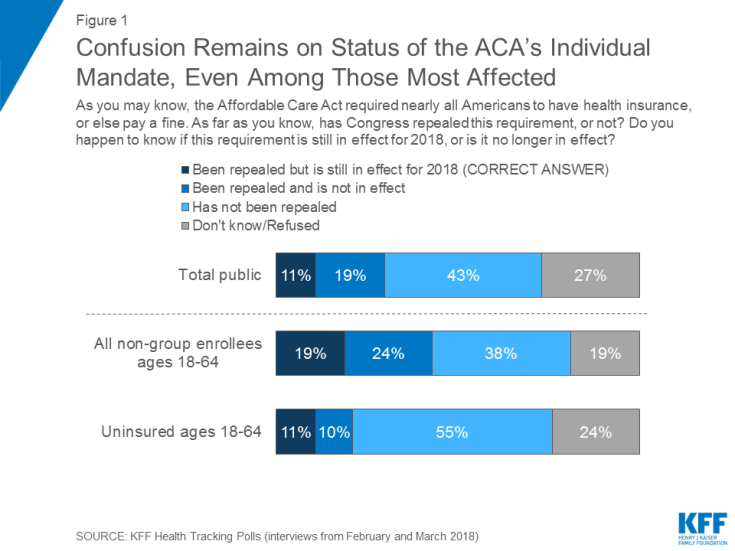

- The most common response offered by people who are uninsured when asked the reason why they don’t have health insurance is that it is too expensive and they can’t afford it (36 percent), followed by job-related issues such as unemployment or their employer doesn’t offer health insurance (20 percent).

Who Are Non-Group Enrollees?

This report examines people’s experiences with the current health insurance market focusing on individuals who currently have health insurance they purchased themselves (referred to as “non-group enrollees” throughout the report). This is comprised of individuals who purchase their own insurance through an Affordable Care Act (ACA) marketplace (“marketplace enrollees”) as well as those who purchase their insurance outside of the ACA markets.1

In the first half of 2017, 10.1 million people had health insurance that they purchased through the ACA exchanges or marketplaces.2 For comparison, the report also examines individuals ages 18-64 without health insurance (“uninsured”) as well as those who get their insurance through their employer (“employer-sponsored insurance”). These extended interviews were conducted as part of the February and March Kaiser Health Tracking Polls and were completed after the close of the law’s fifth open enrollment period, which ended earlier this year.

The Individual Mandate

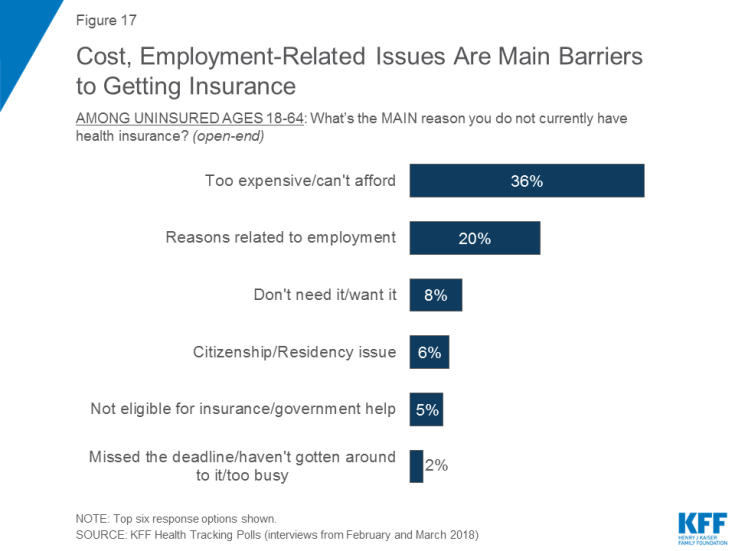

As part of the Republican tax reform plan signed into law at the end of 2017, lawmakers eliminated the ACA’s individual mandate penalty. The tax plan reduced the individual penalty for not having health insurance to zero beginning in 2019, effectively repealing the least favorable provision of the ACA (according to polling conducted by Kaiser Family Foundation). There is still uncertainty among the public as well as among the groups most directly affected by the individual mandate (non-group enrollees and the uninsured) on the status of the mandate. About one-fifth of non-group enrollees (19 percent) and one in ten uninsured (11 percent) are aware that the individual penalty has been repealed but it is still in effect for the current year. This is similar to the share of the overall public (11 percent) who are aware.

Figure 1: Confusion Remains on Status of the ACA’s Individual Mandate, Even Among Those Most Affected

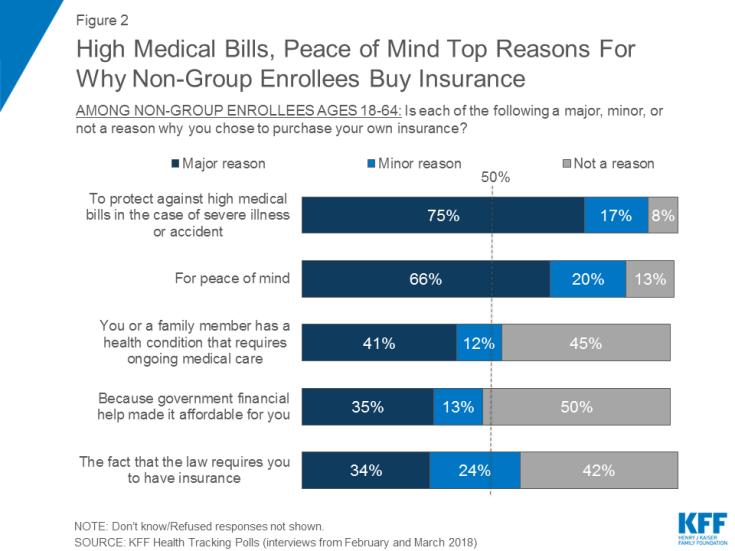

In KFF polling last fall before the mandate was repealed, few non-group enrollees (22 percent) reported that the individual mandate was a “major reason” why they chose to purchase their coverage.3 This continues to be true after the repeal of the mandate penalty, with the mandate ranking lowest on a list of “major reasons” people give for buying their own insurance. A majority of non-group enrollees say protecting against high medical bills (75 percent) and peace of mind (66 percent) are “major reasons” why they chose to purchase their own insurance. About four in ten say they buy insurance because they or a family member has an ongoing health condition (41 percent), while one-third say the major reason is because there is government financial help to make it affordable (35 percent) or because the law requires them to have it (34 percent).

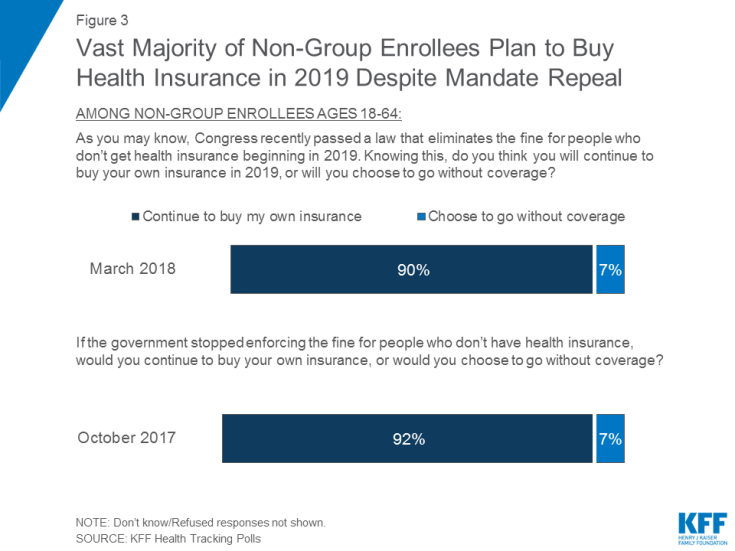

In addition, nine in ten non-group enrollees say they intend to continue to buy their own insurance in 2019 when the mandate penalty is no longer in effect. This is nearly identical to the share who said they would continue to buy their own insurance even if the government stopped enforcing the fine for people who don’t have health insurance in October 2017.

Figure 3: Vast Majority of Non-Group Enrollees Plan to Buy Health Insurance in 2019 Despite Mandate Repeal

Views of ACA Marketplace

With the Affordable Care Act’s (ACA) fifth open enrollment period recently ending, this report – focusing on the experiences and attitudes of individuals who buy their own health insurance – finds major concerns among this population about the future of the ACA marketplaces. About half of the public say they think the marketplaces are collapsing. This holds true across party identification and insurance type – including six in ten of those who purchase their insurance through the marketplaces. Slightly larger shares of the overall public now say the marketplaces for people who purchase their own insurance are collapsing than said the same earlier this year (53 percent compared to 42 percent in January).4

Non-Group Enrollees Are Worried About Lack of Coverage in Their Areas

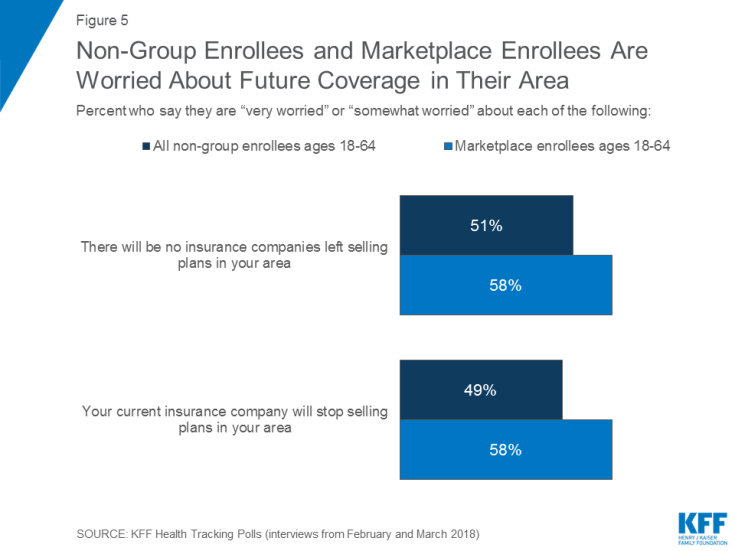

Half of non-group enrollees and six in ten marketplace enrollees say they are worried about the potential for lack of health insurance coverage in their areas. Half of non-group enrollees (51 percent) and six in ten marketplace enrollees (58 percent) say they are “very worried” or “somewhat worried” there will be no insurance companies left selling plan in their area in the future, similar to the share who say they worry that their own current insurance company will stop selling plans in their area (49 percent and 58 percent, respectively).

Figure 5: Non-Group Enrollees and Marketplace Enrollees Are Worried About Future Coverage in Their Area

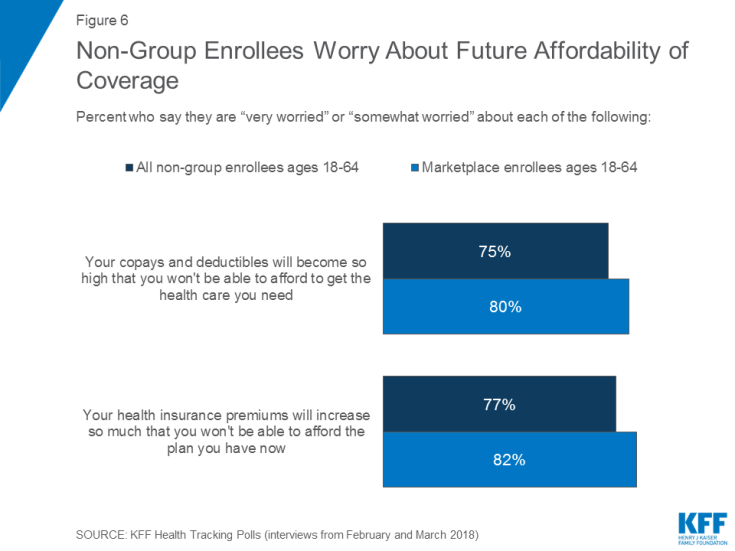

Non-Group Enrollees Are Worried About Future Affordability of Coverage

Even larger shares of marketplace enrollees and non-group enrollees worry about the future affordability of their copays, deductibles, and premiums. Eight in ten marketplace enrollees and three-fourths of non-group enrollees report being either “very worried” or “somewhat worried” about their out-of-pocket costs increasing so high that either will not be able to get the health care they need or afford the health insurance plan they have now.

Experiences of Marketplace Enrollees During Most Recent Open Enrollment Period

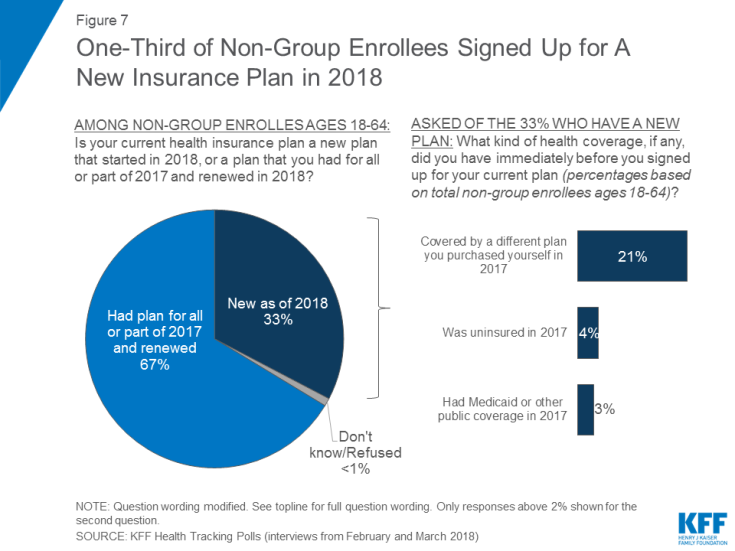

The most recent open enrollment period for non-group insurance ended for people in most states on December 15, 2017. Most current enrollees (67 percent) say they renewed a plan that they had in 2017 while one-third purchased a new plan this year.

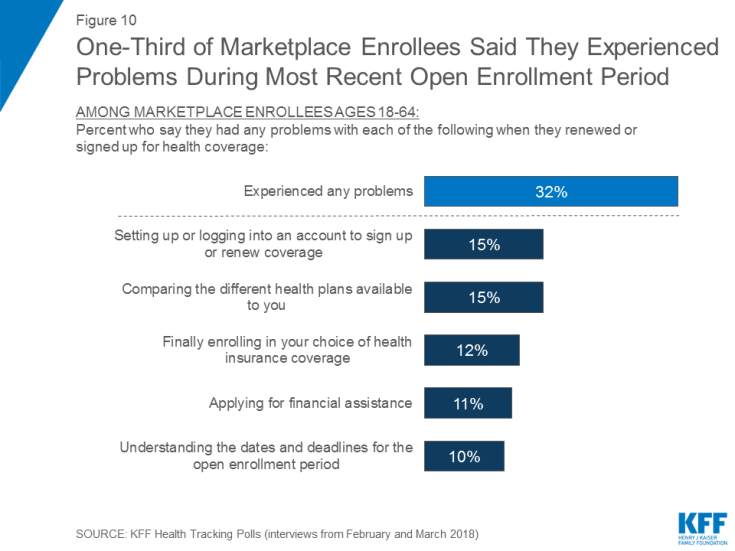

Overall, the marketplace population report being satisfied with the insurance options available to them; yet, about one-third (32 percent) experienced problems while trying to renew or buy their coverage.

Choice of Plans or Insurers

About seven in ten marketplace enrollees (71 percent) say they had a choice of health plans from different insurance companies when they bought their current plan, while about one-fourth (23 percent) say there was only one insurer selling plans in their area. A majority of marketplace enrollees (61 percent) report being satisfied with their insurance choices with about one-third (32 percent) reporting being “very satisfied.”

Figure 8: Most Marketplace Enrollees Report Being Satisfied with Insurance Choices Available to Them

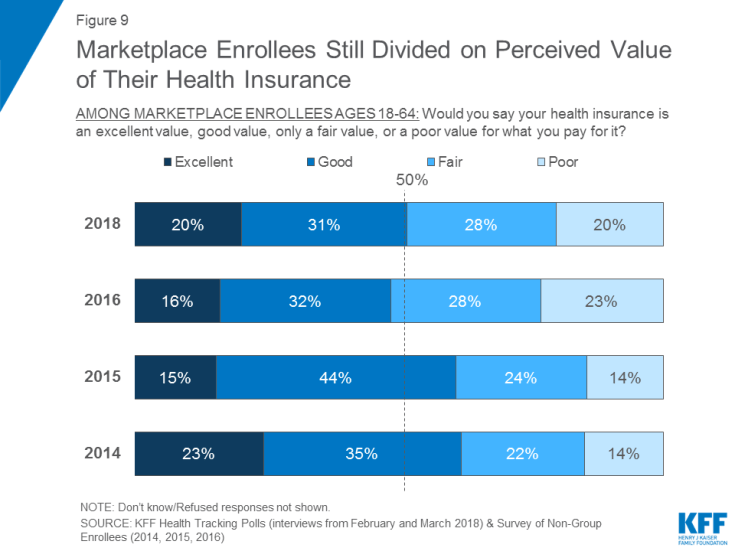

Marketplace Enrollees Divided on the Value of Health Insurance

Nearly equal shares of marketplace enrollees say their coverage is an “excellent” or “good” value as say it is a “fair” or “poor” value. About half of marketplace enrollees (51 percent) say their coverage is an “excellent” (20 percent) or “good” value (31 percent) for what they pay for it, while 48 percent say it is a “fair” (28 percent) or “poor” value (20 percent). This is similar to the results in 2016 and appears to halt the increase in the share who said their health insurance was a “fair” or “poor” value as reported two years ago.

Most Common Problems During Open Enrollment Period

One-third (32 percent) of marketplace enrollees said they experienced problems when they tried to renew or sign up for health coverage for 2018. About one in eight said they experienced problems when setting up or logging into their account (15 percent) or when comparing the different plans available (15 percent). About one in ten said they had problems enrolling in their insurance choice (12 percent), and applying for financial assistance (11 percent), or understanding the dates and deadlines (10 percent).

Figure 10: One-Third of Marketplace Enrollees Said They Experienced Problems During Most Recent Open Enrollment Period

Half of those who experienced problems (19 percent of all marketplace enrollees), said that they received help from an outside source when they had a problem.

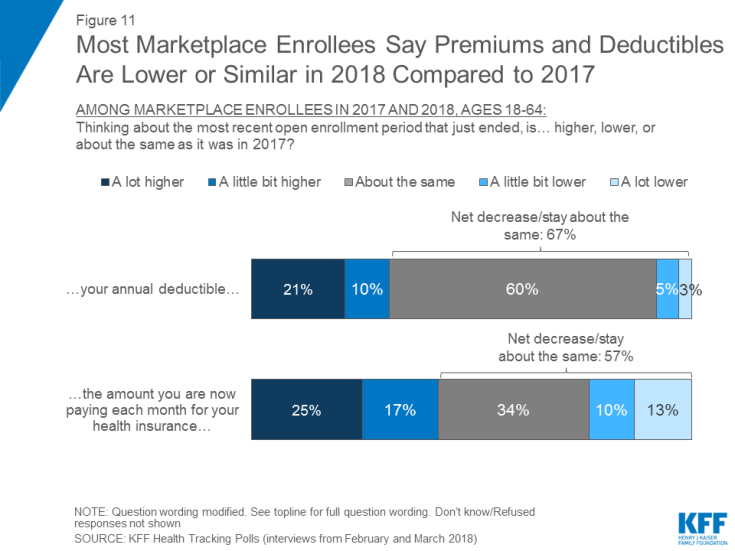

Most Say Their Monthly Premiums Are Lower or Will Stay the Same in 2018

Most marketplace enrollees, who also were in the non-group market in 2017, say their health insurance premiums are either “lower” this year or “about the same” as they were in 2017. One-third (34 percent) say their premiums are “about the same” this year compared to last year while one-fourth (23 percent) say they experienced a decrease in their premiums this year. This may be because many marketplace enrollees receive financial assistance through premium tax credits to help cover the cost of their premiums, which protects them from being directly impacted by premium increases. About four in ten (42 percent) marketplace enrollees say their health insurance premiums are higher this year compared to last year, including one-fourth who say their premiums are “a lot higher” and 17 percent who say they are “a little bit higher.”

Figure 11: Most Marketplace Enrollees Say Premiums and Deductibles Are Lower or Similar in 2018 Compared to 2017

The majority of marketplace enrollees (60 percent) say their deductibles are about the same this year as they were last year. Three in ten saw an increase in their deductibles and few (8 percent) say they experienced a decrease.

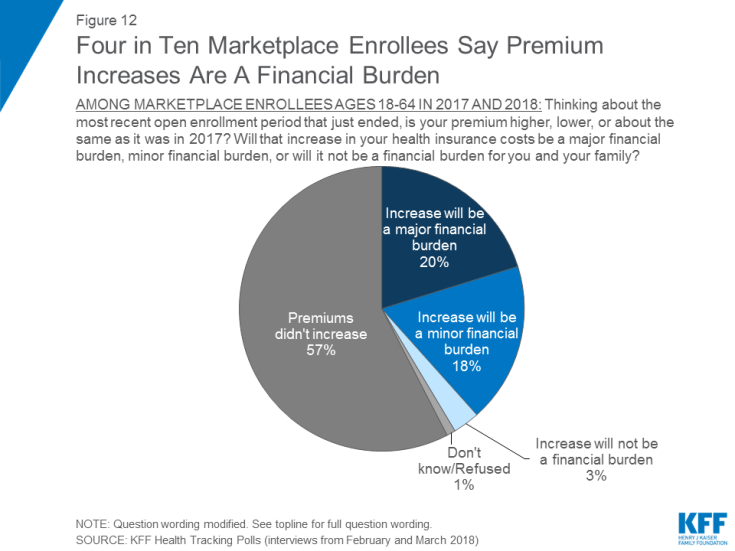

Four in Ten Marketplace Enrollees Say Increases in Monthly Premiums Are A Financial Burden

Four in ten marketplace enrollees say the increase in their premium will be a financial burden for them this year. One-fifth say the increase will be a “major financial burden,” while 18 percent say the increase will be a “minor financial burden.”

Most See Health Insurance as Something They Need

This report compares the attitudes of individuals who purchase their own insurance through an ACA marketplace or more generally the non-group health insurance market to those who get their insurance through their employer as well as to those who do not have health insurance coverage. Overall, the views of these groups are more similar than different, especially when it comes to their overall views of health insurance with majorities valuing health insurance and prioritizing comprehensive coverage.

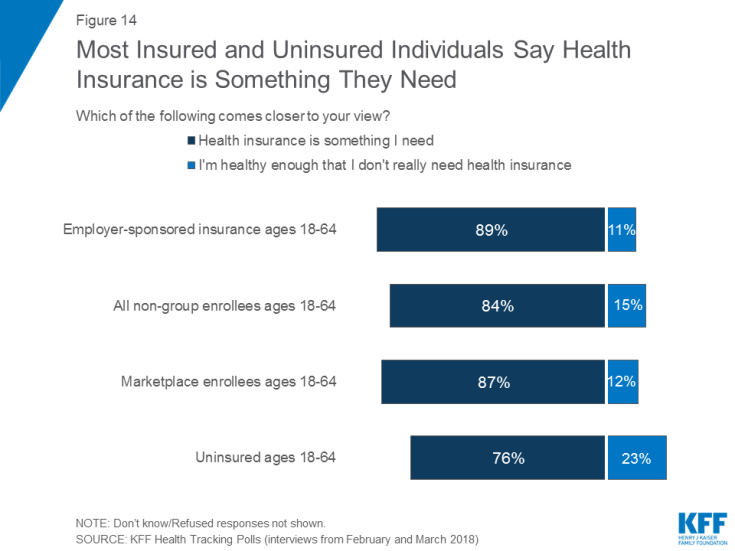

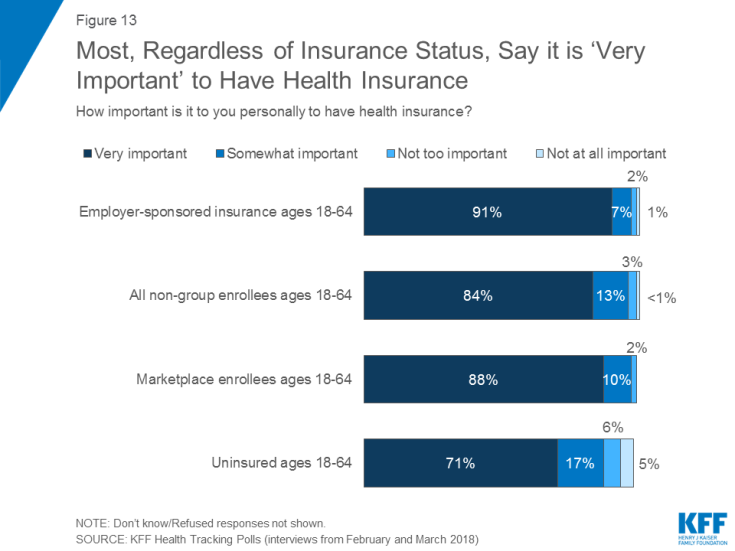

Vast majorities of those with employer-sponsored insurance (91 percent), non-group enrollees (84 percent) and marketplace enrollees (88 percent), as well as seven in ten uninsured adults (71 percent), say it is “very important” to them personally to have health insurance.

Figure 13: Most, Regardless of Insurance Status, Say it is ‘Very Important’ to Have Health Insurance

In addition, when asked whether health insurance is something they need, at least three-fourths of those with employer-sponsored insurance (89 percent), non-group enrollees (84 percent), marketplace enrollees (87 percent), and uninsured (76 percent) say health insurance is something they need. Among the uninsured, 23 percent say they are healthy enough that they don’t need insurance.

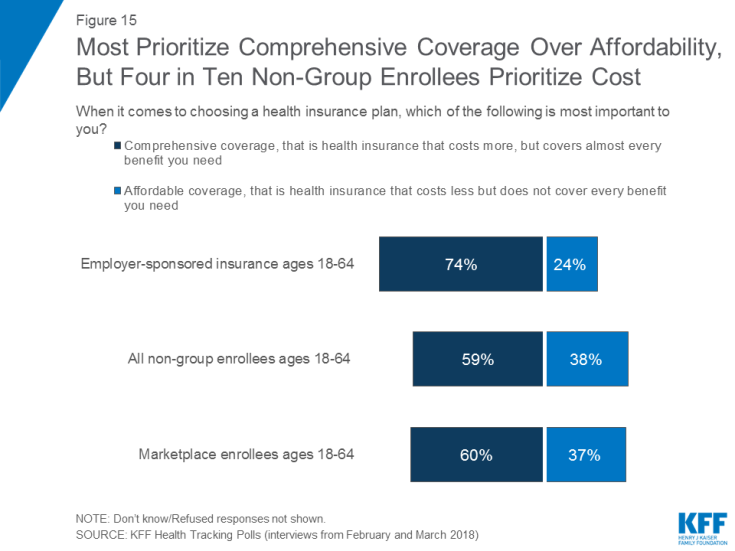

Majorities Prioritize Comprehensive Coverage over Affordability

Larger shares say comprehensive coverage is more important to them when choosing a health plan than affordability. Three-fourths (74 percent) of those with employer-sponsored coverage say that when choosing a health plan, comprehensive coverage – that is, health insurance that costs more but covers almost every benefit – is more important to them than choosing a plan that costs less but does not cover every needed benefit (24 percent). While larger shares of non-group enrollees and marketplace enrollees say affordable coverage is more important (38 percent and 37 percent), most still say comprehensive coverage is more important (59 percent and 60 percent).

Figure 15: Most Prioritize Comprehensive Coverage Over Affordability, But Four in Ten Non-Group Enrollees Prioritize Cost

Few Non-Group Enrollees Say They Would Purchase A Short-term Insurance Plan

In 2017, President Trump issued an executive order directing his administration to expand the availability of non-renewable short-term insurance plans, and regulations have been proposed implementing that order. These plans are designed for people who have a temporary gap in their coverage and the plans are exempt from many of the requirements of the ACA, including the requirements that insurance companies must accept all applicants and cover pre-existing conditions.5 These plans tend to cost less but provide fewer benefits overall. When non-group enrollees were asked whether they would want to purchase such a plan or prefer to keep the plan they have now, the vast majority (84 percent) say they would keep the plan they have now while 12 percent would want to purchase a short-term plan. Responses to this question were similar among individuals living in households both with and without pre-existing conditions.

Experiences of the Uninsured

A potential target group for marketplace enrollment are those who remain without health coverage. When people who are uninsured are asked about the main reason they don’t have coverage, the most common response offered is that it is too expensive and they can’t afford it (36 percent), followed by job-related issues such as unemployment or their employer doesn’t offer health insurance (20 percent). Fewer say they don’t need or want health insurance (8 percent), citizenship or residency issues have prevented them from getting it (6 percent), they aren’t eligible for insurance or government help (5 percent), or that they missed the deadline or have been too busy to sign-up (2 percent).

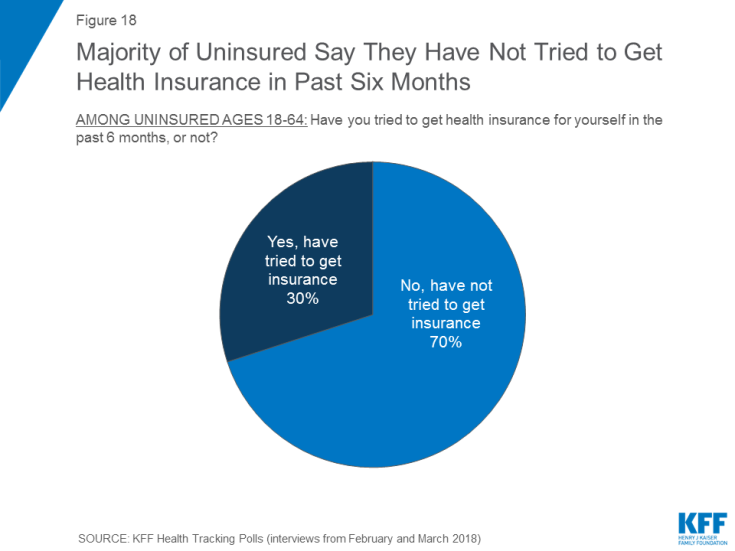

Most uninsured people (70 percent) say they have not tried to get health insurance in the past six months while three in ten say they have tried to get coverage.

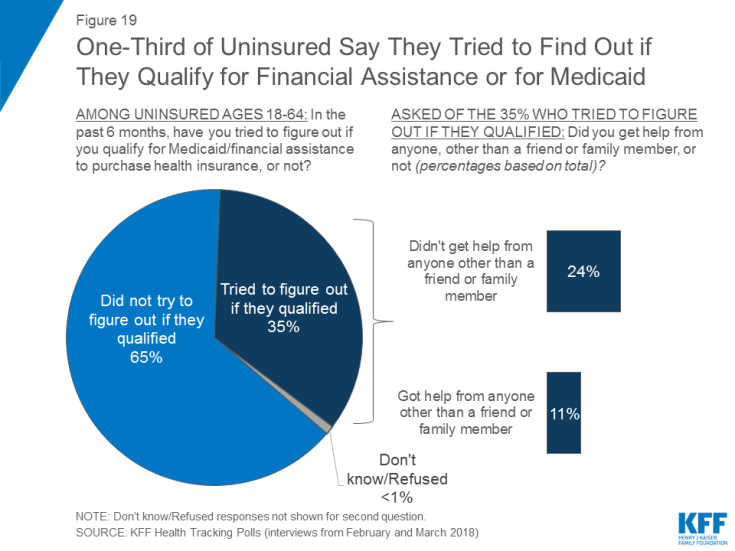

Similarly, one-third (35 percent) say they have tried to figure out if they qualify for Medicaid or financial assistance to pay for health coverage in the past six months, but few (11 percent of all uninsured) sought outside help in order to figure out if they qualified.

Figure 19: One-Third of Uninsured Say They Tried to Find Out if They Qualify for Financial Assistance or for Medicaid

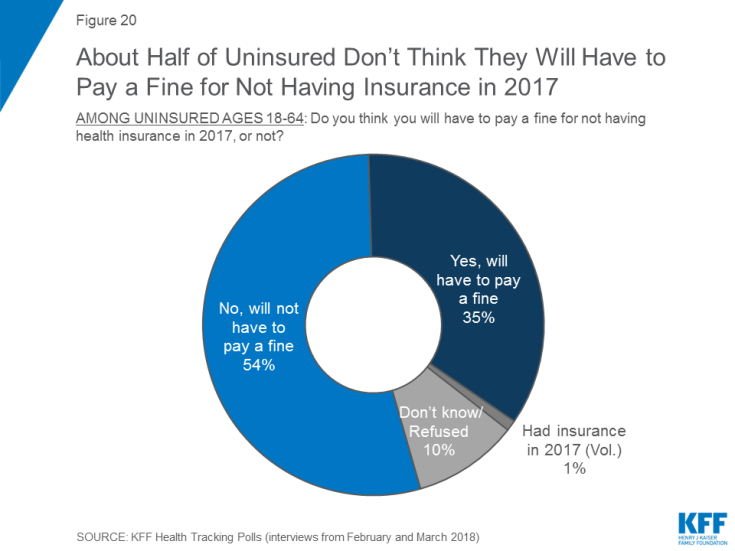

Slightly more than half (54 percent) of people who are uninsured say they won’t have to pay a fine for not having health insurance in 2017, while one-third (35 percent) anticipate that they will have to pay a fine for not being covered. The remaining 11 percent say either they don’t know or they had insurance in 2017. Some uninsured people may in fact be exempt from the fine because of hardship exemptions available under the law.