How Narrow or Broad Are ACA Marketplace Physician Networks?

Methods and Scope

Plan Enrollment: This analysis estimates the share of physicians included in individual Marketplace plans in 2021. In total, 11.4 million enrollees selected a plan on either HealthCare.gov (7.9 million) or a state-based Marketplace (3.6 million). There were 5,120 plans offered, 4,619 of which had at least ten enrollees. Plan enrollment at the county level was estimated by distributing HIOS level enrollment in each county to the associated plans offered in the county, proportional to their total enrollment. An insurer may use the same provider network for several plans, either in different markets or within the same service area. In some areas, insurers may use multiple provider networks across the plan choices they offer.

Provider Network Data: Information on plan provider directories was compiled by Ideon through an API with insurers as well as other data including the National Plan and Provider Enumeration System (NPPES). These files are widely cited as some of the most reliable snapshots of provider directory data currently available (Zhu et al., Oh et al., Politzer et al., Marr et al.). Data for carriers not participating in the Ideon API were supplemented with carriers’ public filings. The 2021 Ideon researcher file contained incomplete information for a limited number of plans. To account for networks with truncated data, we applied several trimming rules. First, networks with fewer than 223 physicians (the 2nd percentile) or without a hospital were excluded. Second, following Zhu et al., networks with fewer than 2.5% of the physicians within the market were excluded. In total, plans with about 2.5% of Marketplace enrollment were excluded from the analysis. The Ideon researcher file was made available with the support of the Robert Wood Johnson Foundation.

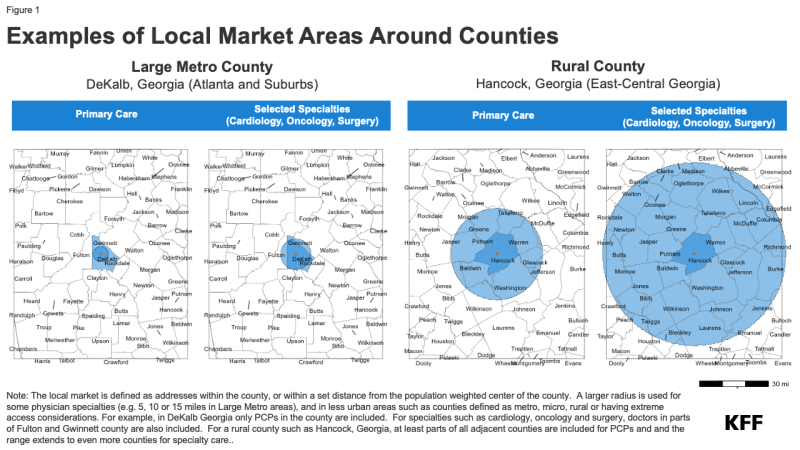

Local Markets: Local physicians are defined as those who practice within the same county as an enrollee or are within the distance thresholds specified as part of CMS’s network adequacy standards for HealthCare.gov plans. Thus, a wider area is used for enrollees living in more rural counties, or for specialist physicians. This approach accounts for differences in county geographical sizes and acknowledges that physician markets do not conform to county boundaries. For example, in a Large Metro county, primary care physicians are included in the denominator if they are within the county or 5 miles of its center, compared to 30 miles from the county center in a Rural county. A specialist such as a cardiologist is included in Large Metro counties if they are within the county or 10 miles of its center, or within 60 miles of a Rural county center. While the mileage standards in network adequacy regulations are based on the proximity to plan enrollees, this analysis measures the distance from the population-weighted center of the county.

In total, CMS designates 78 “Large Metro” counties based on their population and population density and 723 “Metro” counties. Most ACA enrollees live in one of these urban county designations, including 38% in Large Metro counties and 48% in Metro counties. For example, Large Metro areas are classified as counties with at least one million people and a population density of at least 1,000 people per square mile, or counties with 500,000-999,999 people and a population density of at least 1,500 people per square mile, or counties with a population density of at least 5,000 people. The county classifications follow the definitions used in the Medicare Advantage network adequacy rules (Table 3-1) and are available in the 2022 Health Service Delivery file published by CMS.

Active Physician Workforce: Private health plan network directories often include many physicians who may have retired or are otherwise no longer working in patient care. To estimate the total number of physicians who are in active practice, we relied on Medicare Data on Provider Practice and Specialty (MD-PPAS), a federal database of physicians who submitted at least one Medicare Part B claim in 2021 and therefore saw at least one Medicare patient in the year. Medicare Part B is the largest payer of physician services, covering some 58 million people ages 65 and older and younger adults with disabilities. Virtually all non-pediatric physicians participate in the program, with about 1% formally opting out altogether. In total, 680,000 physicians, including 181,000 primary care doctors, were included in MD-PPAS in 2021.

Estimates of the number of physicians vary. The Health Resources and Services Administration (HRSA) and the Association of American Medical Colleges (AAMC) use the American Medical Association (AMA) Physician Masterfile, which contains 947,000 physicians. The Bureau of Labor Statistics estimates there were 762,000 jobs for physicians and surgeons in 2021. Many of these physicians may be engaged in jobs that do not require them to regularly see patients, including research, administration, or management roles. As a proxy for the number of physicians working in patient care, this analysis is limited to physicians who submitted at least one Medicare Part B claim in the year. This may include at least some physicians who are in roles where they only occasionally see patients.

Physician Specialties and Addresses: Specialties are defined in MD-PPAS based on physician submissions to the Provider Enrollment, Chain, and Ownership System (PECOS) as well as which claims were submitted to Medicare. Throughout, MD-PPAS’s discrete classification of five specialties (psychiatry, primary care, medical specialist, surgical specialist, and hospitalist) is used. A provider is considered a hospitalist if they self-report being a hospitalist in PECOS, or if more than 90% of their claim lines were delivered on an inpatient basis. In total, 29% of physicians in the MD-PPAS file are defined as hospitalists. Sub-specialties, including those listed in the appendix, are defined using a provider’s primary National Uniform Claim Committee (NUCC) taxonomy code in NPPES. Specialty groupings are defined using the definitions specified in CMS’s network adequacy template.

Within and across network directories, physicians may have multiple address listings, in some cases because they have several practice locations, and in other cases, plan directories may have incorrect or obsolete address information. Physicians were assigned to a single address based on the location in which they were listed most frequently across directories for plans with at least 25 enrollees.

Plan Premiums: The percentage change in premiums associated with physician network breadth is calculated by modeling the logged-transformed premium for a Silver plan for a 40-year-old enrollee across all 38,000 Marketplace plan/county combinations. The model holds constant plan type and local market characteristics through fixed effects within the rating area. Plans with physician penetration rates between 25% and 50% and more than 50% have significantly higher premiums than plans narrower than these thresholds (p <.0001 and p <.0001, respectively). There is considerable variation in the premiums. Factors other than physician networks, including market characteristics and hospital networks, are also related to plan premiums.

Limitations: A central challenge in analyzing provider networks is determining the size of the physician workforce. While the vast majority of physicians engaged in active practice accept Medicare, some physicians may be inadvertently missed, including those in closed-network HMOs serving exclusively commercial populations or those specializing in services not typically used by Medicare enrollees. Telehealth providers whose addresses are not within the local market are also excluded. Further, this analysis only considers individual-level physicians enumerated in the plan directory. In some cases, plans may include group health practices in their networks and not individually list providers.

Conversely, this analysis may exaggerate the breadth of provider networks. “Phantom providers,” or physicians who are listed in the plan directory but no longer accept the plan, may artificially increase the breadth of some plans. One secret shopper study documented that 10% of physicians in California Marketplace plans’ provider directories had never accepted the plan. Additionally, this analysis includes all providers whose NPIs are in the directory; some providers may be included in the network for some services or at some locations but not others.

Inherently, this analysis only measures whether providers are included in a plan’s network, not their availability for enrollees wishing to schedule appointments. Some relatively small networks may have physicians with smaller panels and be able to better accommodate enrollees’ health needs than relatively broad networks in which providers are included in a large number of plans.