2024 Employer Health Benefits Survey

Published:

Section 6: Worker and Employer Contributions for Premiums

The vast majority of covered workers make contributions towards the cost of their coverage.

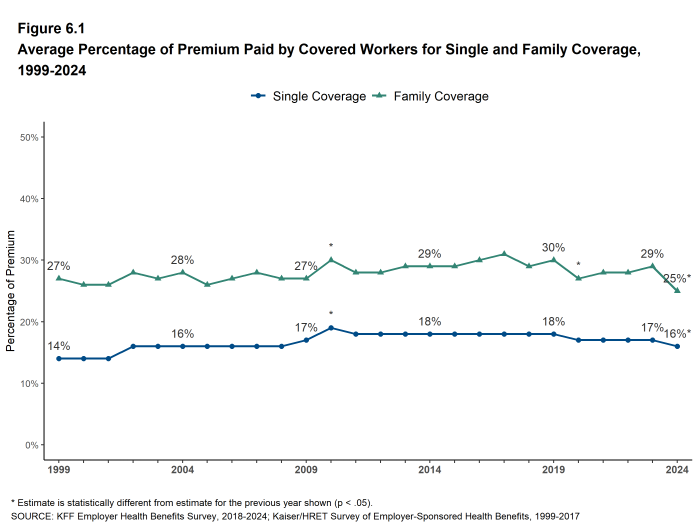

- In 2024, covered workers contribute, on average, 16% of the premium for single coverage and 25% of the premium for family coverage.

- The average percentages contributed for single and family coverage are each lower than the average contribution levels last year [Figure 6.1].13

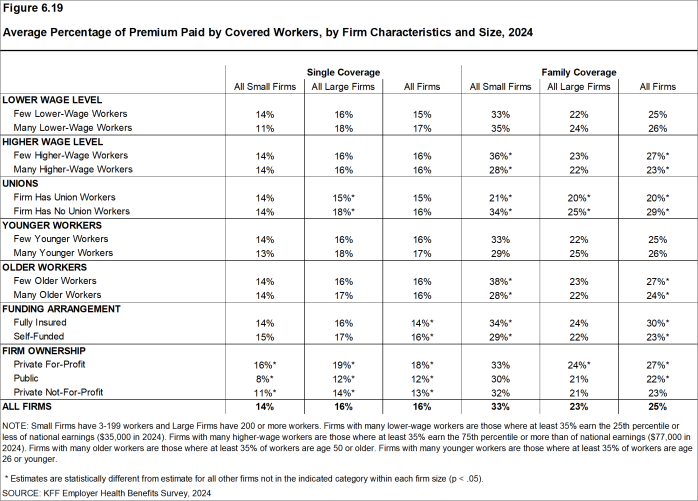

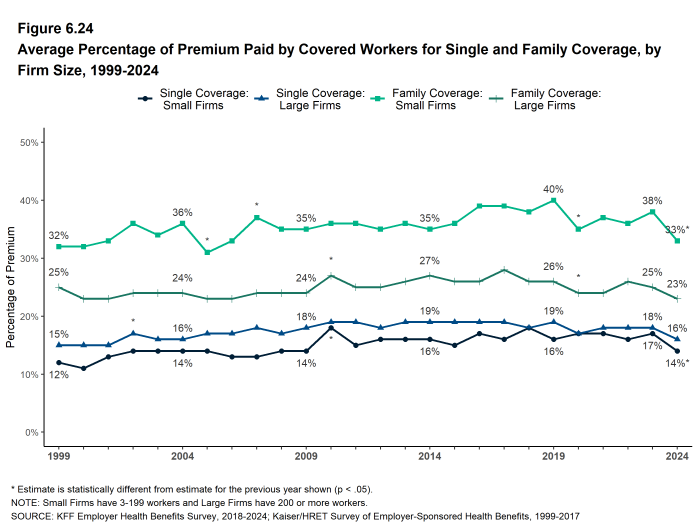

- Covered workers in small firms, on average, contribute a lower percentage of the premium for single coverage than covered workers in large firms (14% vs. 16%) [Figure 6.2].

- Covered workers in small firms contribute, on average, a much higher percentage of the premium for family coverage than covered workers in large firms (33% vs. 23%) [Figure 6.2].

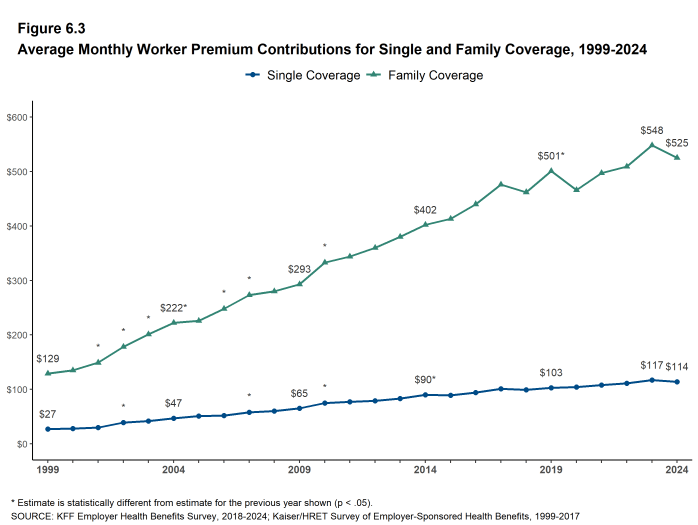

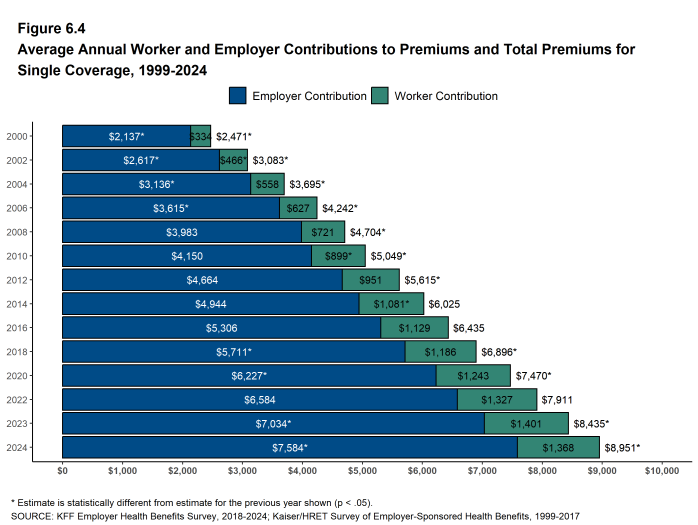

- The average contribution amount for covered workers for single coverage is $114 per month ($1,368 annually), similar to the amount last year [Figure 6.4].

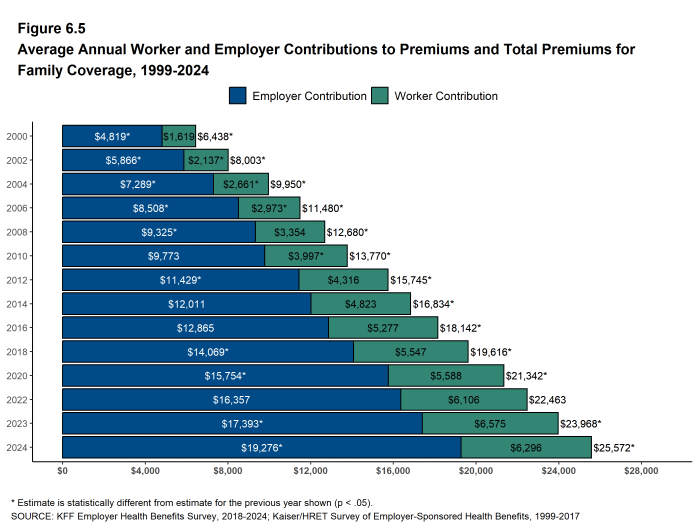

- The average contribution amount for covered workers for family coverage is $525 per month ($6,296 annually), similar to the amount last year [Figure 6.5].

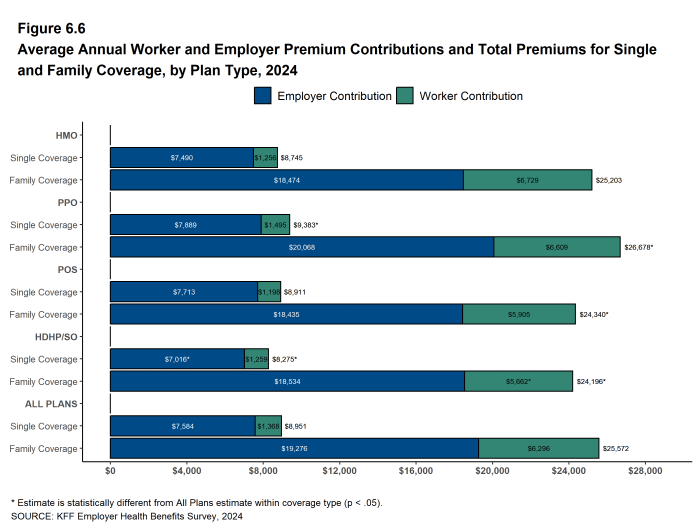

- The average contributions for workers enrolled in HDHP/SOs is lower than the overall average worker contributions for family coverage ($5,662 vs. $6,296) [Figure 6.6].

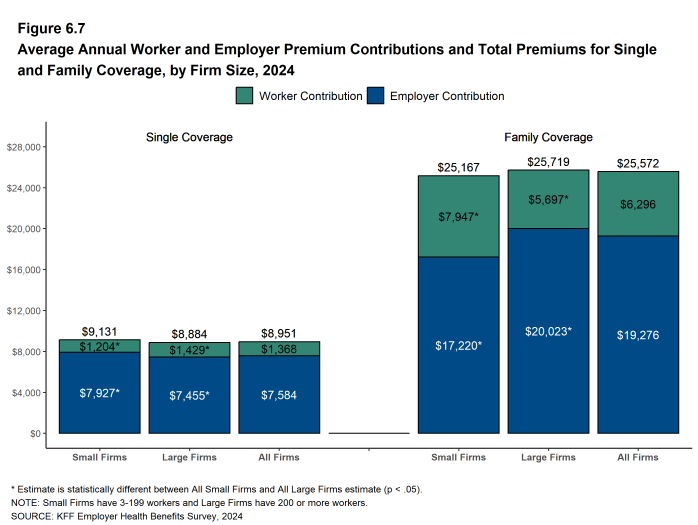

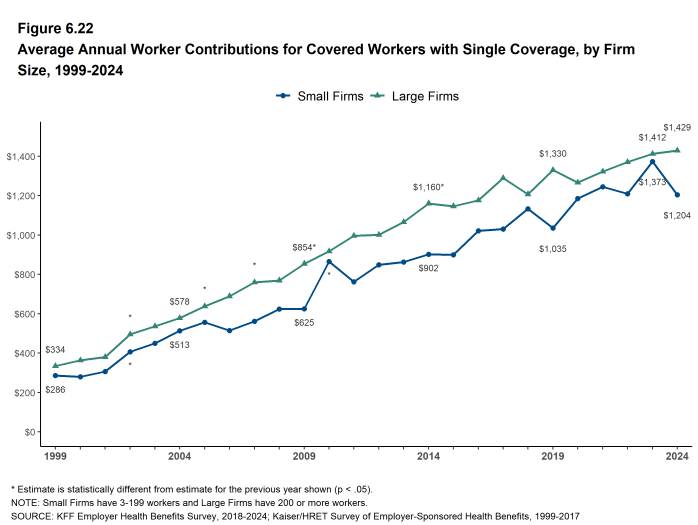

- Covered workers in small firms, on average, contribute a lower amount annually for single coverage than covered workers in large firms ($1,204 vs. $1,429) [Figure 6.7].

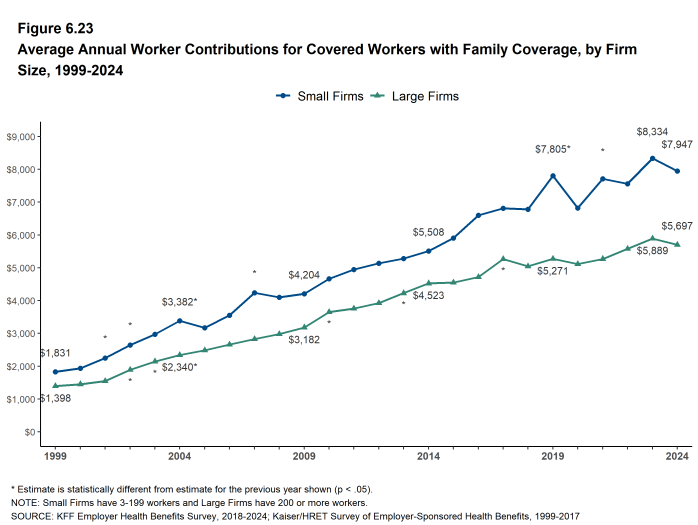

- Covered workers in small firms, on average, contribute a significantly higher amount annually for family coverage than covered workers in large firms ($7,947 vs. $5,697) [Figure 6.7].

Figure 6.1: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, 1999-2024

Figure 6.2: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 2024

Figure 6.4: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Single Coverage, 1999-2024

Figure 6.5: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Family Coverage, 1999-2024

Figure 6.6: Average Annual Worker and Employer Premium Contributions and Total Premiums for Single and Family Coverage, by Plan Type, 2024

Figure 6.7: Average Annual Worker and Employer Premium Contributions and Total Premiums for Single and Family Coverage, by Firm Size, 2024

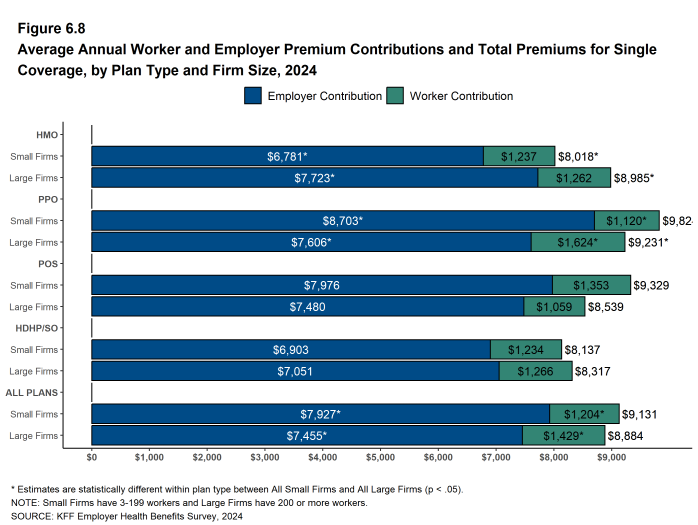

Figure 6.8: Average Annual Worker and Employer Premium Contributions and Total Premiums for Single Coverage, by Plan Type and Firm Size, 2024

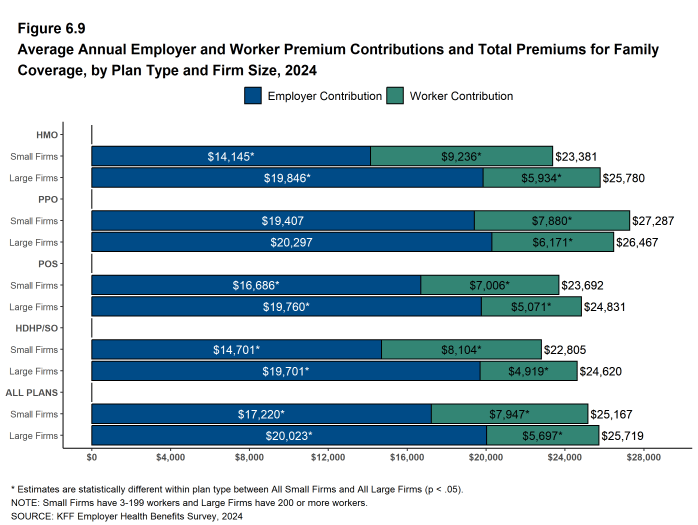

Figure 6.9: Average Annual Employer and Worker Premium Contributions and Total Premiums for Family Coverage, by Plan Type and Firm Size, 2024

DISTRIBUTIONS OF WORKER CONTRIBUTIONS TO THE PREMIUM

- Almost nine in ten (89%) of covered workers are in a plan where the employer contributes at least half of the premium for both single and family coverage.

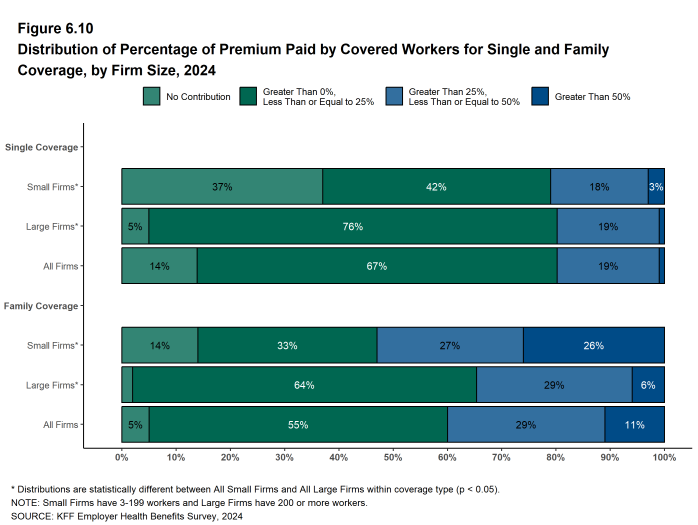

- Fourteen percent of covered workers are in a plan where the employer pays the entire premium for single coverage, while only 5% of covered workers are in a plan where the employer pays the entire premium for family coverage [Figure 6.10].

- Covered workers in small firms are much more likely than covered workers in large firms to be in a plan where the employer pays the entire premium for single coverage.

- Thirty-seven percent of covered workers in small firms have an employer that pays the full premium for single coverage, compared to 5% of covered workers in large firms [Figure 6.10].

- For family coverage, 14% of covered workers in small firms have an employer that pays the full premium, compared to 2% of covered workers in large firms [Figure 6.10].

- Eleven percent of covered workers are in a plan where the worker contributes more than half of the premium for family coverage [Figure 6.10].

- This percentage differs significantly with firm size. Twenty-six percent of covered workers in small firms work in a firm where the worker contribution for family coverage is more than half of the premium, a much higher percentage than the 6% of covered workers in large firms [Figure 6.10].

- Small shares of covered workers in small firms (3%) and large firms (less than one percent) must pay more than 50% of the premium for single coverage [Figure 6.10].

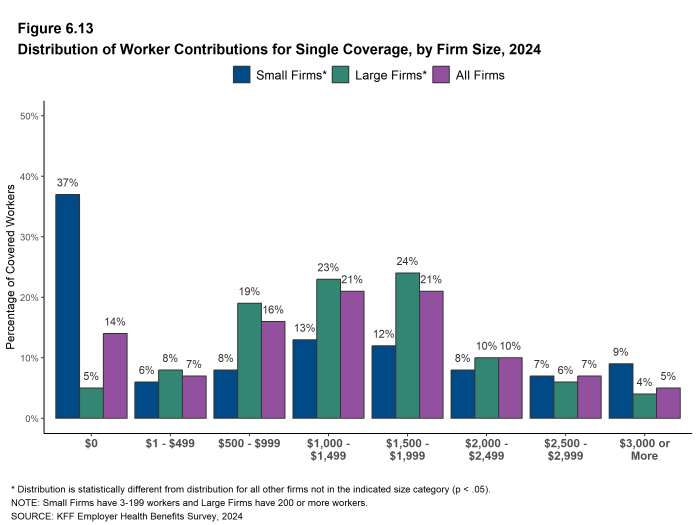

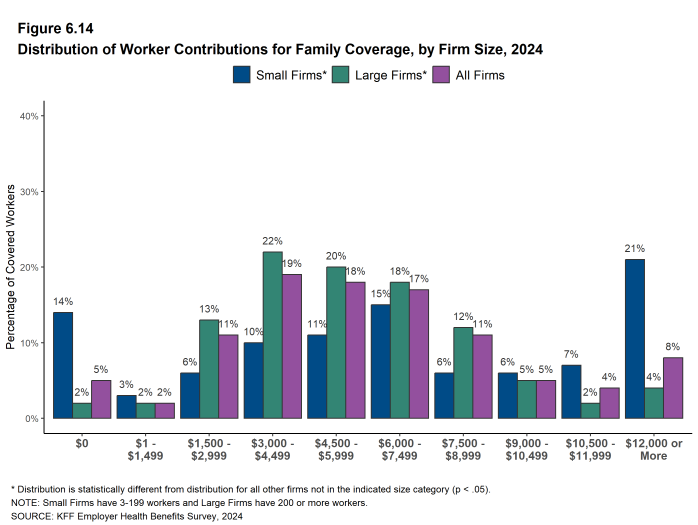

- There is substantial variation between small and large firms in the dollar amounts that covered workers must contribute towards health coverage.

- Among covered workers in small firms, 43% have a contribution for single coverage of less than $500 a year, while 24% have a contribution of $2,000 or more [Figure 6.13]. For family coverage, 17% have a contribution of less than $1,500, while 28% have a contribution of $10,500 or more [Figure 6.14].

- Among covered workers in large firms, 13% contribute less than $500 a year for single coverage, while 21% have a contribution of $2,000 or more [Figure 6.13]. For family coverage, only 4% contribute less than $1,500 a year, while 6% have a contribution of $10,500 or more [Figure 6.14].

Figure 6.10: Distribution of Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 2024

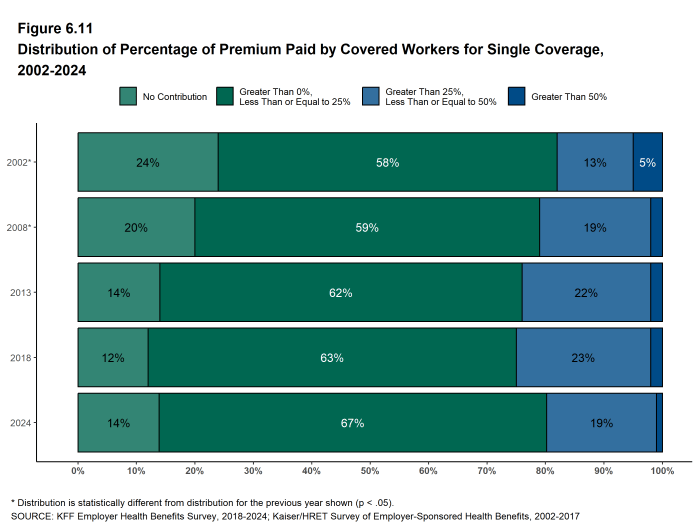

Figure 6.11: Distribution of Percentage of Premium Paid by Covered Workers for Single Coverage, 2002-2024

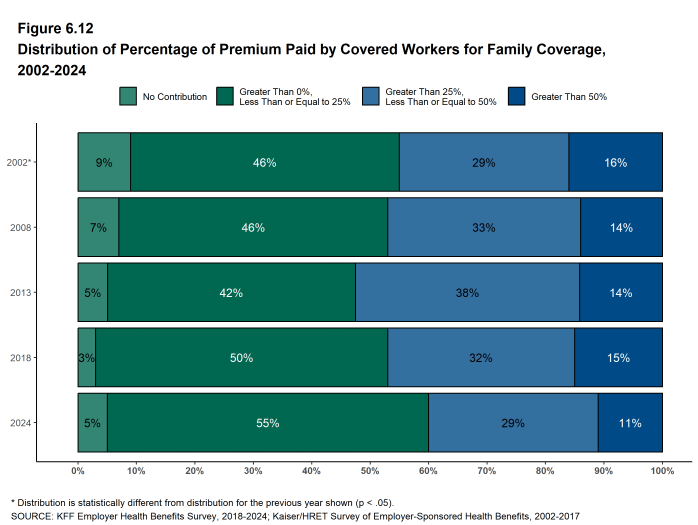

Figure 6.12: Distribution of Percentage of Premium Paid by Covered Workers for Family Coverage, 2002-2024

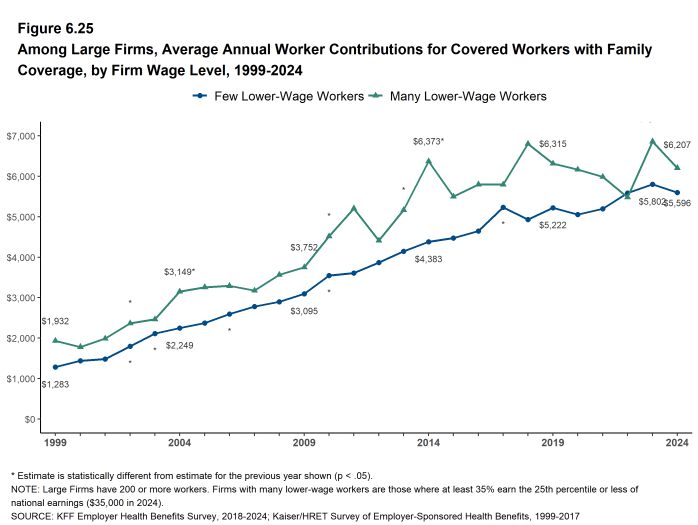

DIFFERENCES BY FIRM CHARACTERISTICS

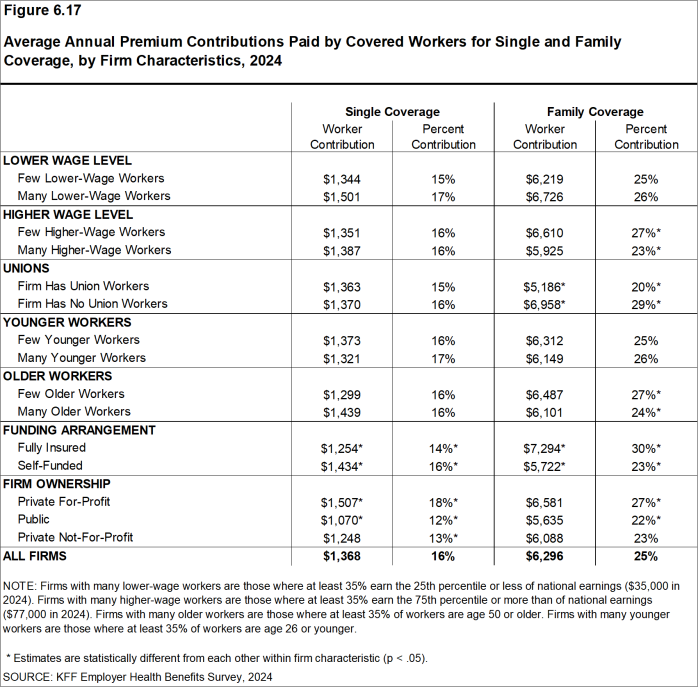

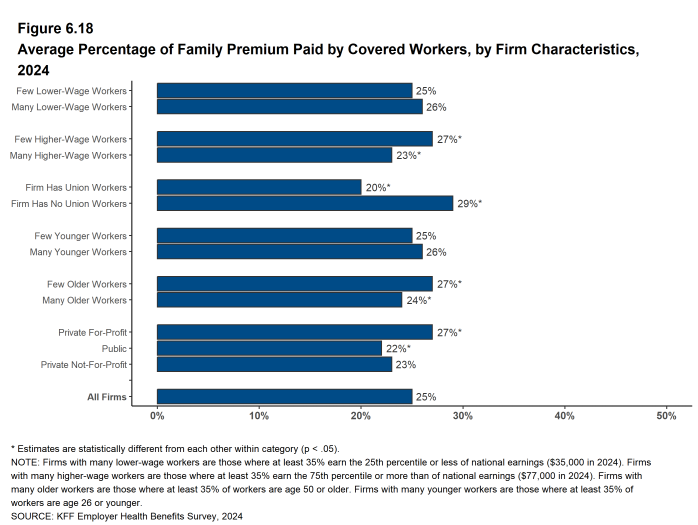

- The percentage of the premium paid by covered workers varies with firm characteristics.

- Covered workers in private, for-profit firms have a relatively high premium contribution rates for single coverage (18%) and family (27%) coverage. [Figure 6.17].

- Covered workers in firms with a relatively large share of older workers (where at least 35% are age 50 or higher) have a lower average percent contribution for family coverage than those in firms with a smaller share of older workers (24% vs. 27%) [Figure 6.17].

- Covered workers in firms with a relatively large share of higher-wage workers (where at least 35% earn $77,000 or more annually) have a lower average contribution for family coverage than those in firms with a smaller share of higher-wage workers (23% vs. 27%) [Figure 6.17].

- Covered workers in firms that have at least some union workers have a lower average contribution rate for family coverage than those in firms without any union workers (20% vs. 29%) [Figure 6.17].

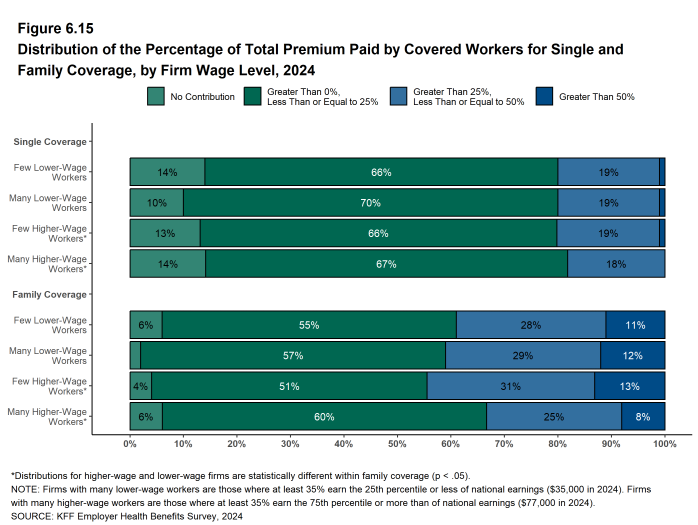

Figure 6.15: Distribution of the Percentage of Total Premium Paid by Covered Workers for Single and Family Coverage, by Firm Wage Level, 2024

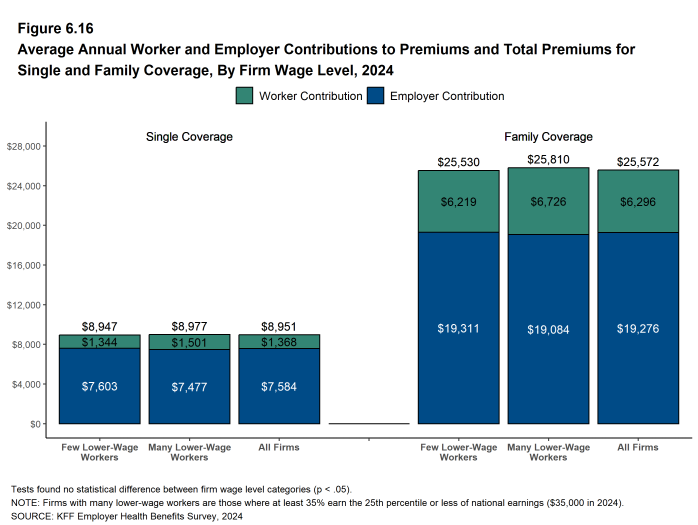

Figure 6.16: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Single and Family Coverage, by Firm Wage Level, 2024

Figure 6.17: Average Annual Premium Contributions Paid by Covered Workers for Single and Family Coverage, by Firm Characteristics, 2024

Figure 6.18: Average Percentage of Family Premium Paid by Covered Workers, by Firm Characteristics, 2024

DIFFERENCES BY REGION AND INDUSTRY

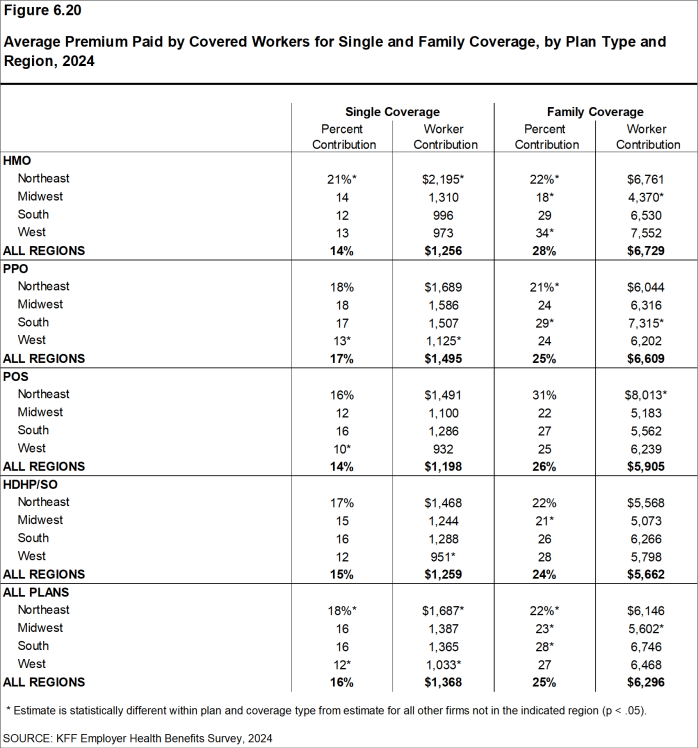

- The average worker contribution for single coverage is relatively high in the Northeast and relatively low in the West (12%) [Figure 6.20].

- The average worker contribution for family coverage is relatively low in the Northeast (22%) and the Midwest (23%) and relatively high in the South (28%) [Figure 6.20].

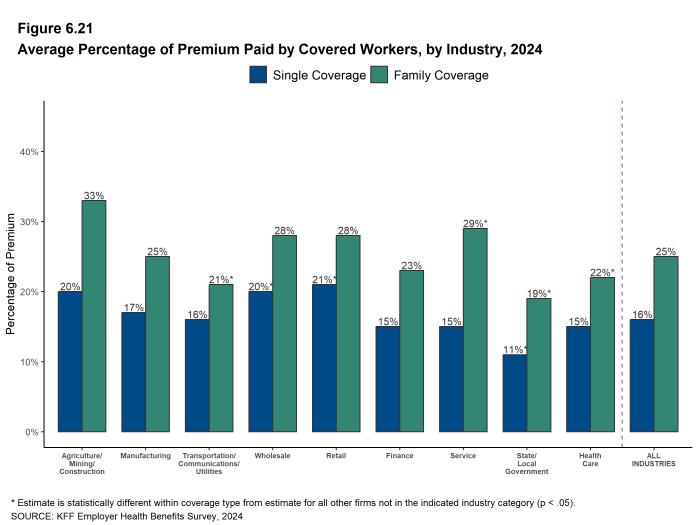

- Average worker contributions vary across industries for single and family coverage [Figure 6.21].

Figure 6.20: Average Premium Paid by Covered Workers for Single and Family Coverage, by Plan Type and Region, 2024

CHANGES OVER TIME

- The average worker contributions in 2024 for single coverage ($1,368) and for family coverage ($6,296) are similar to the average contribution levels last year [Figure 6.4] and [Figure 6.5].

- Over the last five years, the average worker contributions for single coverage has increased 10% and the average worker contribution for family coverage increased 5%.

- Over the last 10 years, the average worker contributions for single coverage has increased 27% and the average worker contribution for family coverage increased 31% [Figure 6.4] and [Figure 6.5].

Figure 6.22: Average Annual Worker Contributions for Covered Workers With Single Coverage, by Firm Size, 1999-2024

Figure 6.23: Average Annual Worker Contributions for Covered Workers With Family Coverage, by Firm Size, 1999-2024

Figure 6.24: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 1999-2024

- The average percentage contribution is calculated as a weighted average of all a firm’s plan types and may not necessarily equal the average worker contribution divided by the average premium.↩︎

Sections

- Section 1: Cost of Health Insurance

- Section 2: Health Benefits Offer Rates

- Section 3: Employee Coverage, Eligibility, and Participation

- Section 4: Types of Plans Offered

- Section 5: Market Shares of Health Plans

- Section 6: Worker and Employer Contributions for Premiums

- Section 7: Employee Cost Sharing

- Section 8: High-Deductible Health Plans with Savings Option

- Section 9: Prescription Drug Benefits

- Section 10: Plan Funding

- Section 11: Retiree Health Benefits

- Section 12: Health Screening and Health Promotion and Wellness Programs

- Section 13: Employer Practices, Provider Networks, Coverage for GLP-1s, Abortion and Family Building Benefits