2024 Employer Health Benefits Survey

Section 11: Retiree Health Benefits

Retiree health benefits are an important consideration for older workers making decisions about retirement, and can be a crucial source of coverage for people retiring before Medicare eligibility. For retirees with Medicare coverage, retiree health benefits can provide an important supplement to Medicare, helping them pay for cost sharing and benefits not otherwise covered by Medicare.

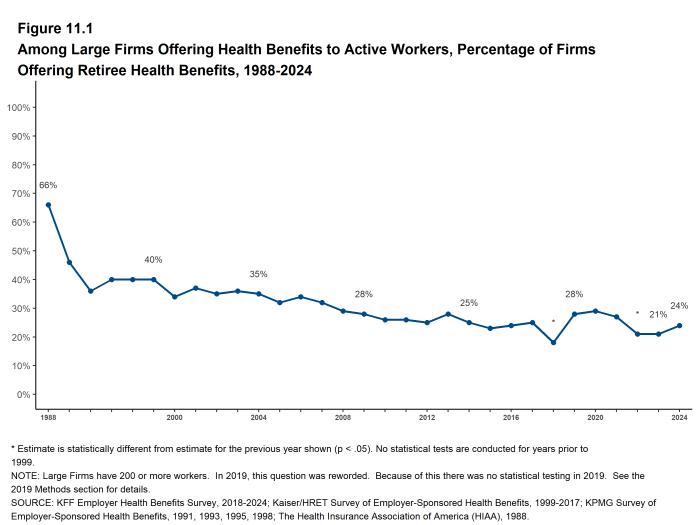

Twenty-four percent of large firms offering health benefits offer retiree health benefits in 2024, similar to the percentage in 2023 (21%).

This survey asks retiree health benefits questions only of large firms (200 or more workers).

EMPLOYER RETIREE BENEFITS

- In 2024, 24% of large firms that offer health benefits offer retiree health benefits for at least some current workers or retirees [Figure 11.1]. In 2019, we modified the question about retiree health benefits to instruct firms to respond “yes” if they were providing coverage for retirees but weren’t offering current employees these benefits, or if they were planning to give current employees retiree health coverage in the future. For this reason, estimates of retiree health benefits from 2019 and after are not comparable to prior survey estimates.

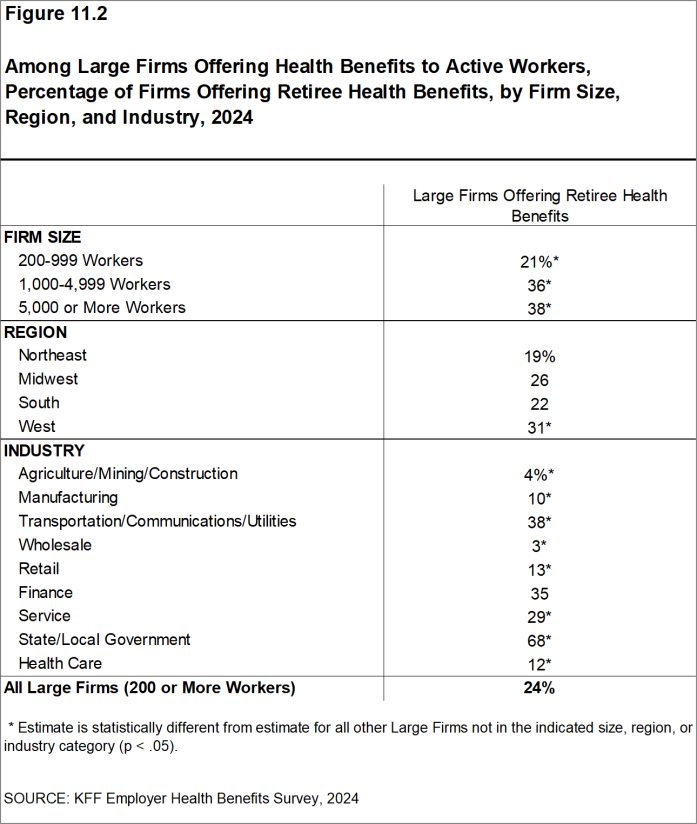

- Retiree health benefits offer rates vary considerably by firm characteristics.

- Among large firms offering health benefits, firms with 1,000 or more workers are more likely to offer retiree health benefits than those with 200 to 999 workers (36% v. 21%) [Figure 11.2].

- The share of large firms offering retiree health benefits varies considerably by industry [Figure 11.2].

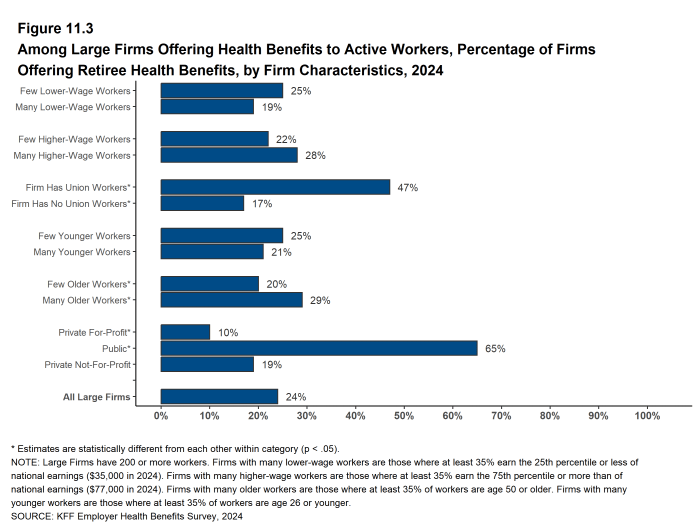

- Among large firms offering health benefits, public employers are more likely (65%) and private for-profit employers are less likely (10%) to offer retiree health benefits than other firm types [Figure 11.3].

- Large firms offering health benefits with at least some union workers are more likely to offer retiree health benefits than large firms without any union workers (47% vs. 17%) [Figure 11.3].

- Large firms offering health benefits with a relatively large share of older workers (where at least 35% of the workers are age 50 or older) are more likely to offer retiree health benefits than large firms with a smaller share of older workers (29% vs. 20%) [Figure 11.3].

Figure 11.1: Among Large Firms Offering Health Benefits to Active Workers, Percentage of Firms Offering Retiree Health Benefits, 1988-2024

Figure 11.2: Among Large Firms Offering Health Benefits to Active Workers, Percentage of Firms Offering Retiree Health Benefits, by Firm Size, Region, and Industry, 2024

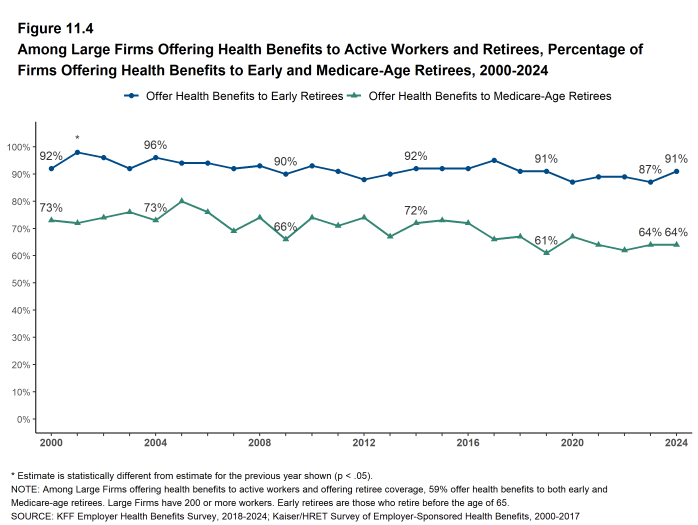

COVERAGE FOR EARLY RETIREES AND MEDICARE-AGE RETIREES

- Among large firms offering retiree health benefits to active workers and retirees, 91% offer benefits to early retirees under the age of 65 and 64% offer them to Medicare-age retirees [Figure 11.4].

- Among large firms offering retiree health benefits, 59% offer benefits to both early and Medicare-age retirees.

- Among all large firms offering health benefits, 15% offer retiree health benefits to Medicare-age retirees.

BENEFIT ELIGIBILITY

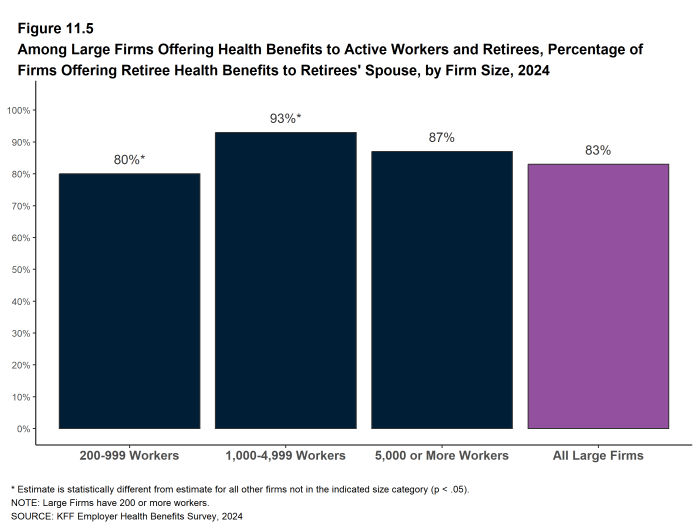

- Among large firms offering retiree benefits, a large share (83%) report offering health benefits to the spouses of retirees [Figure 11.5].

MEDICARE ADVANTAGE

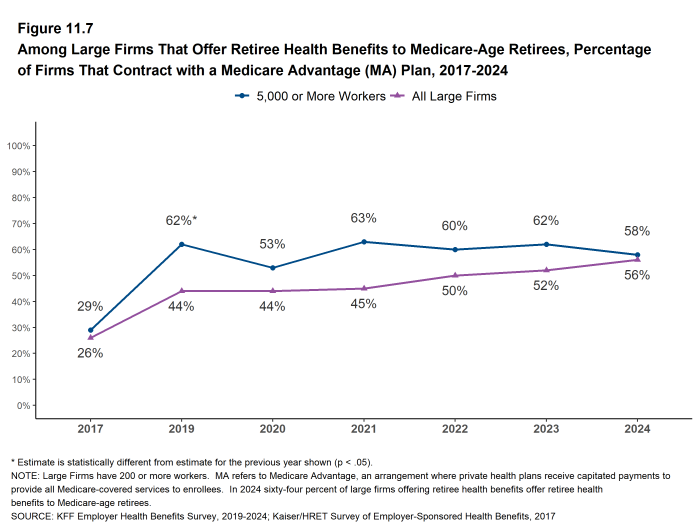

- Fifty-six percent of large employers offering retiree health benefits to Medicare-age retirees offer coverage to at least some Medicare-age retirees through a contract with a Medicare Advantage plan, similar to last year (52%) [Figure 11.7]. This share has more than doubled since 2017 (26%).

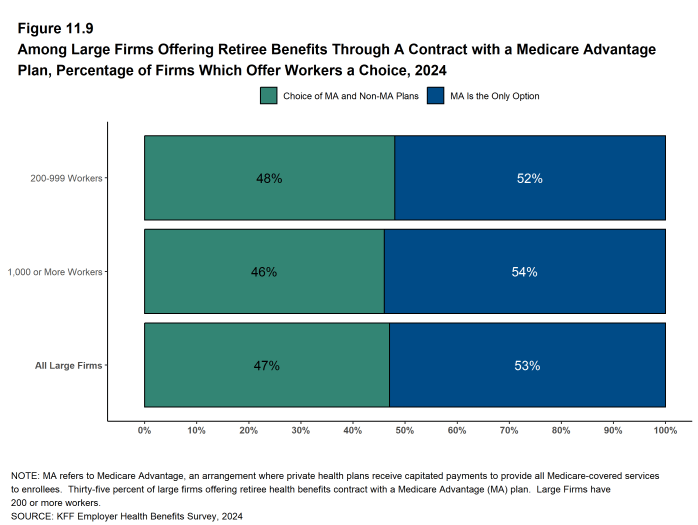

- Among large firms offering retiree health benefits through a Medicare Advantage plan, 53% offer retiree health benefits only through Medicare Advantage plans while 47% offer a choice of other types of plans for retiree for retiree health benefits [Figure 11.9]. Both of these shares are similar to last year.

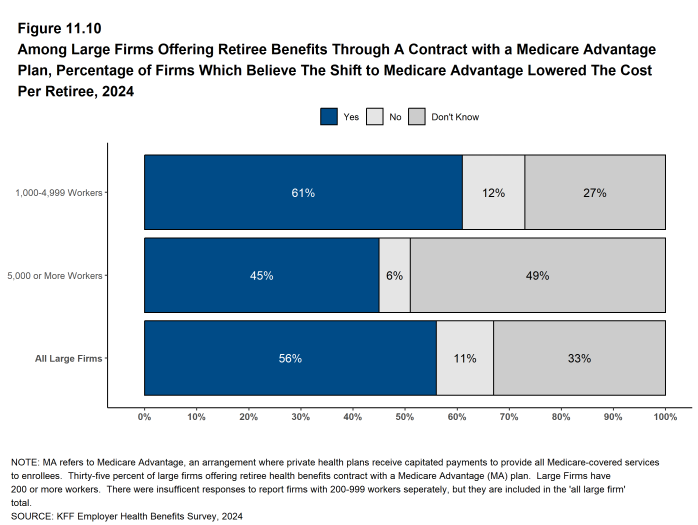

- Among large firms offering retiree health benefits through a Medicare Advantage plan, 56% said to the best of their knowledge that the shift to offering Medicare Advantage plans lowered their per retiree costs, 11% said the shift to Medicare Advantage plans did not lower their per retiree costs, while 33% did not know the answer [Figure 11.10].

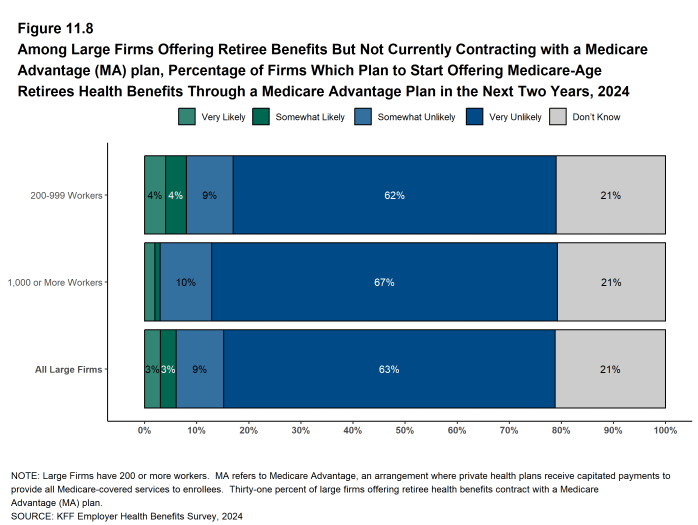

- Among large firms offering retiree health benefits that do not offer benefits through a Medicare Advantage plan in 2024, 6% are “Very Likely” or “Somewhat Likely” to do so in the next two years [Figure 11.8].

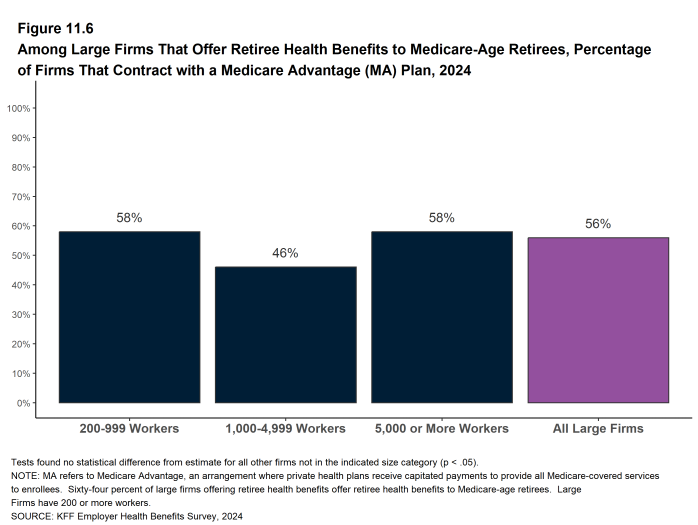

Figure 11.6: Among Large Firms That Offer Retiree Health Benefits to Medicare-Age Retirees, Percentage of Firms That Contract With a Medicare Advantage (MA) Plan, 2024

Figure 11.7: Among Large Firms That Offer Retiree Health Benefits to Medicare-Age Retirees, Percentage of Firms That Contract With a Medicare Advantage (MA) Plan, 2017-2024

Figure 11.8: Among Large Firms Offering Retiree Benefits But Not Currently Contracting With a Medicare Advantage (MA) Plan, Percentage of Firms Which Plan to Start Offering Medicare-Age Retirees Health Benefits Through a Medicare Advantage Plan in the Next Two Years, 2024

Figure 11.9: Among Large Firms Offering Retiree Benefits Through a Contract With a Medicare Advantage Plan, Percentage of Firms Which Offer Workers a Choice, 2024