Section 1: Cost of Health Insurance

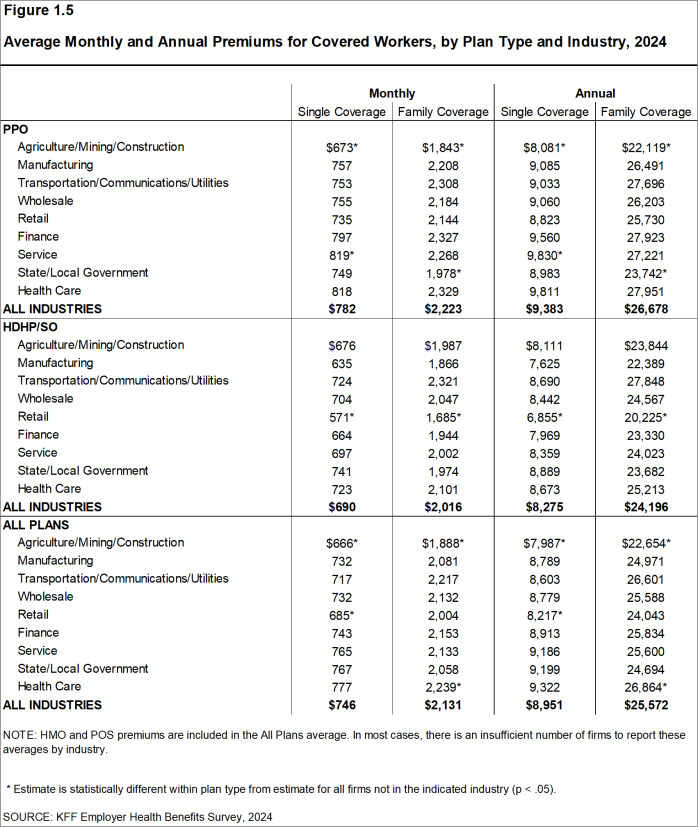

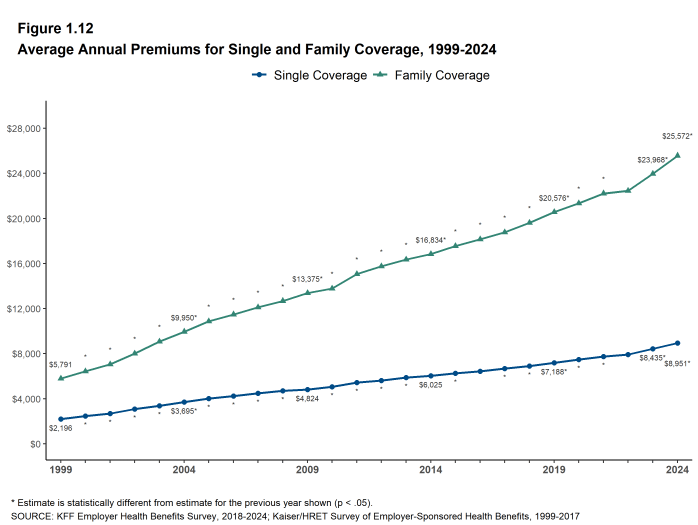

The average annual health insurance premiums in 2024 are $8,951 for single coverage and $25,572 for family coverage. The average single coverage premium increased 6% in 2024 while the average family premium increased 7%. The average family premium has increased 24% since 2019 and 52% since 2014.

As part of this report, KFF publishes an online tool which allows users to look at changes in premiums and worker contributions for covered workers at different types of firms over time: https://www.kff.org/interactive/premiums-and-worker-contributions/

PREMIUMS FOR SINGLE AND FAMILY COVERAGE

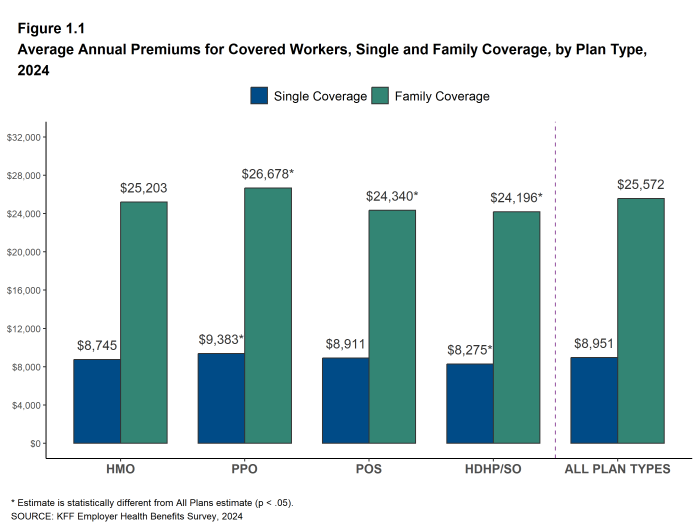

- The average premium for single coverage in 2024 is $8,951 per year. The average premium for family coverage is $25,572 per year [Figure 1.1].

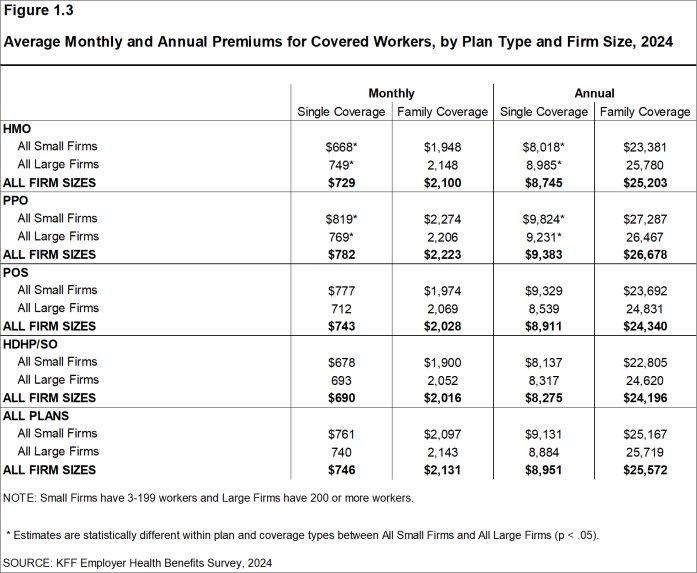

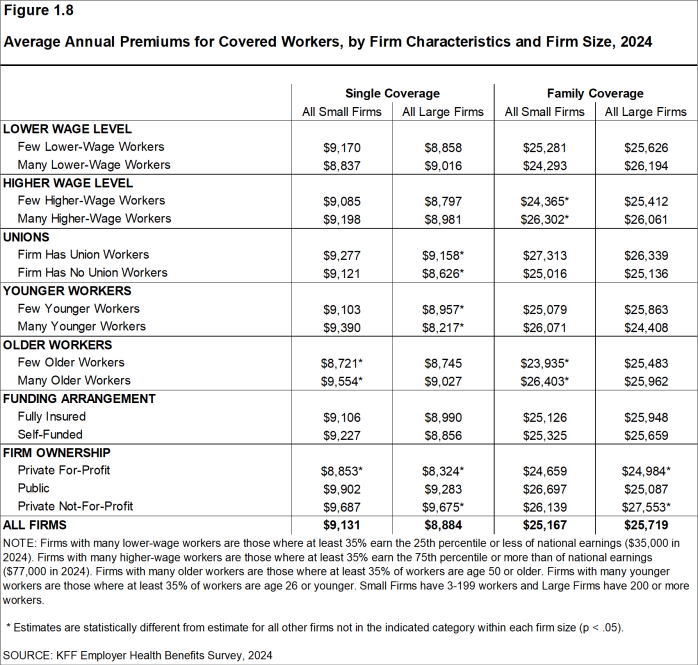

- The average annual premiums for single coverage are similar for covered workers at small firms ($9,131) and at large firms ($8,884) [Figure 1.3].

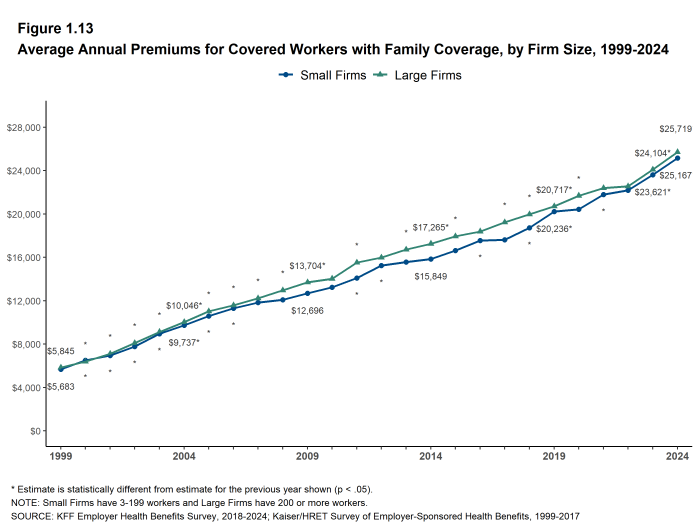

- The average annual premiums for family coverage are similar for covered workers at small firms ($25,167) and at large firms ($25,719) [Figure 1.3].

- The average annual premiums for covered workers in HDHP/SOs are lower than the average premiums for coverage overall for both single coverage ($8,275 vs. $8,951) and family coverage ($24,196 vs. $25,572). The average premiums for covered workers in PPOs are higher than the overall average premiums for both single coverage ($9,383 vs. $8,951) and family coverage ($26,678 vs. $25,572) [Figure 1.1].

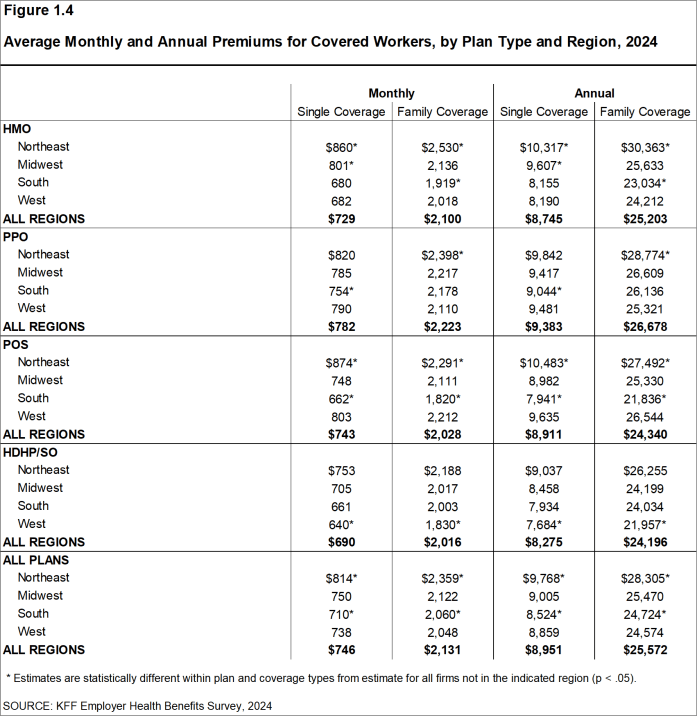

- The average premium for covered workers with both single and family coverage is relatively higher in the Northeast and relatively lower in the South [Figure 1.4].

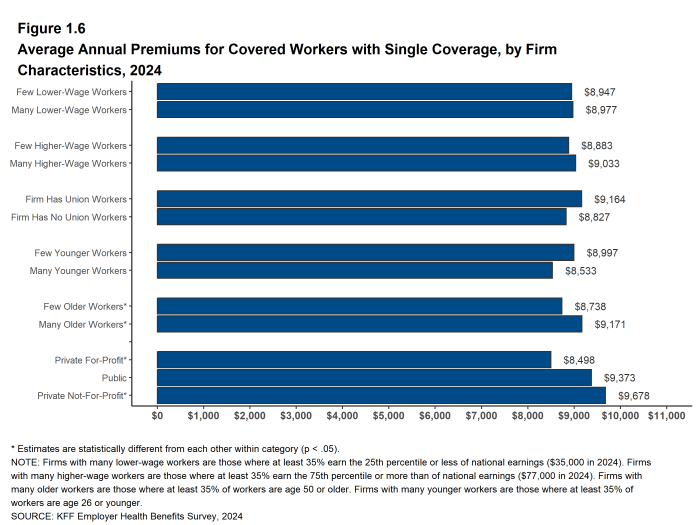

- The average premiums for covered workers at firms with a relatively large share of older workers (firms where at least 35% of the workers are age 50 or older) are higher than the average premium for covered workers at firms with smaller shares of older workers for single coverage ($9,171 vs. $8,738) [Figure 1.6].

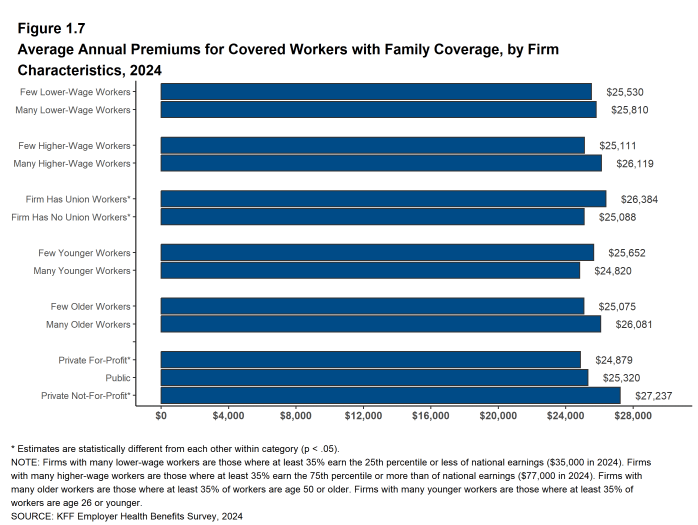

- The average premiums for single coverage and family coverage are lower for covered workers at private for-profit firms and higher for covered workers at private not-for profit firms [Figure 1.6] and [Figure 1.7].

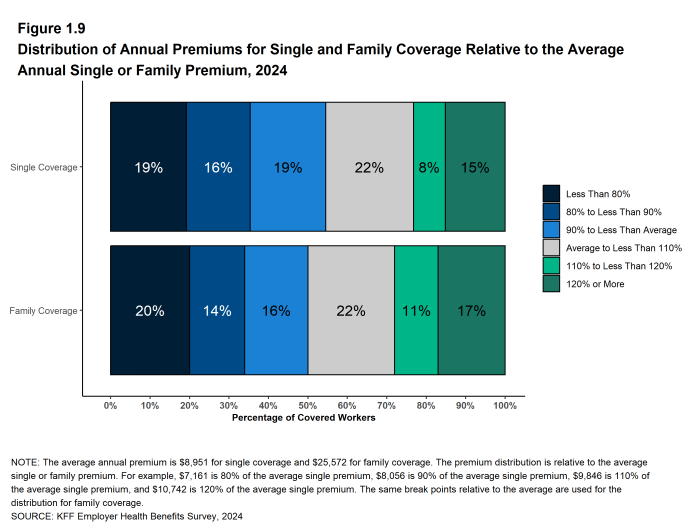

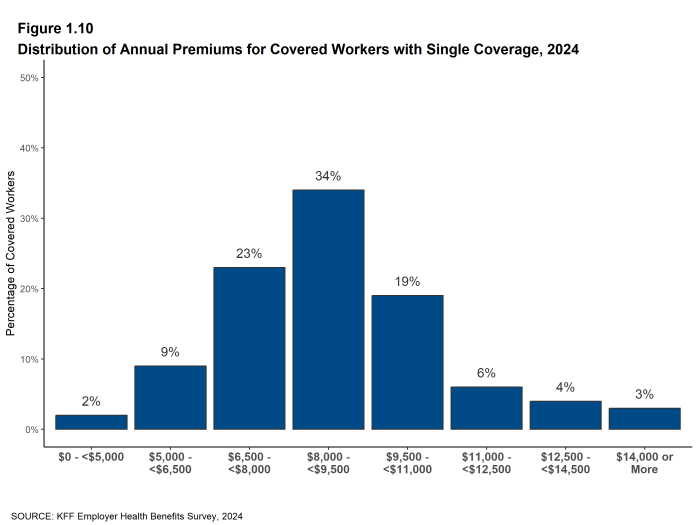

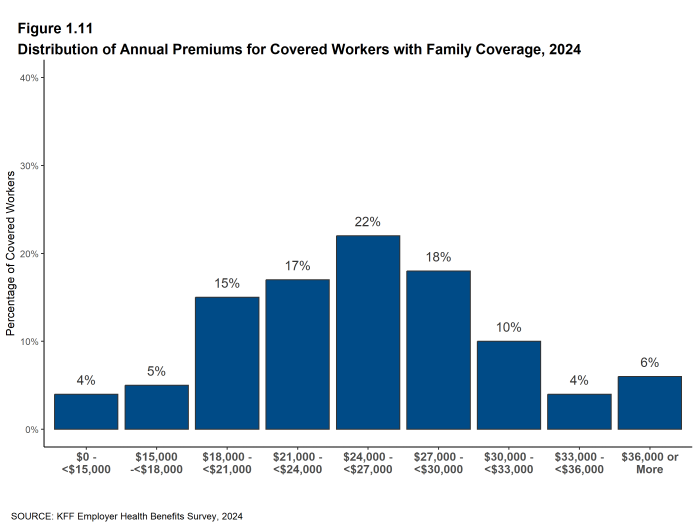

PREMIUM DISTRIBUTION

- There is considerable variation in premiums for both single and family coverage.

- Fifteen percent of covered workers are employed at a firm where the single coverage premium is at least 20% higher than the average single premium, while 19% of covered workers are at firms with a single premium less than 80% of the average single premium [Figure 1.9].

- For family coverage, 17% of covered workers are employed at a firm with a family premium at least 20% higher than the average family premium, while 20% of covered workers are at firms with a family premium less than 80% of the average family premium [Figure 1.9].

- Seven percent of covered workers are at a firm with an average annual premium of at least $12,500 for single coverage [Figure 1.10]. Ten percent of covered workers are at a firm with an average annual premium of at least $33,000 for family coverage [Figure 1.11].

PREMIUM CHANGES OVER TIME

- The average premiums for covered workers for single and family coverage increased 6% and 7% respectively from last year [Figure 1.12].

- The average premium for single coverage has grown 25% in the past five years [Figure 1.12].

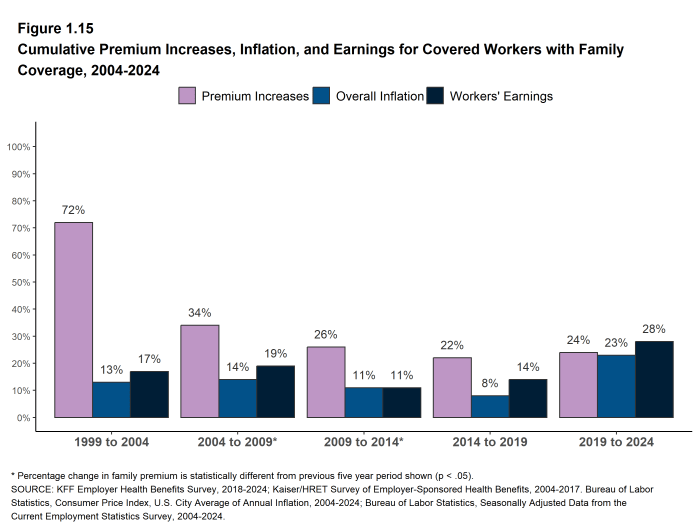

- The $25,572 average family premium in 2024 is 24% higher than the average family premium in 2019 and 52% higher than the average family premium in 2014. The 24% family premium growth in the past five years is similar to the 22% growth between 2014 and 2019 [Figure 1.15].

- The average family premiums for covered workers at small firms and at large firms have grown at similar rates since 2019 (24% at small firms and 24% at large firms). For small firms, the average family premium rose from $20,236 in 2019 to $25,167 in 2024. For large firms, the average family premium rose from $20,717 in 2019 to $25,719 in 2024 [Figure 1.13].

- The average family premiums have grown at similar rates since 2014 for covered workers at small firms and at large firms (59% at small firms and 49% at large firms). At small firms, the average family premium rose from $15,849 in 2014 to $25,167 in 2024. In large firms, the average family premium rose from $17,265 in 2014 to $25,719 in 2024 [Figure 1.13].

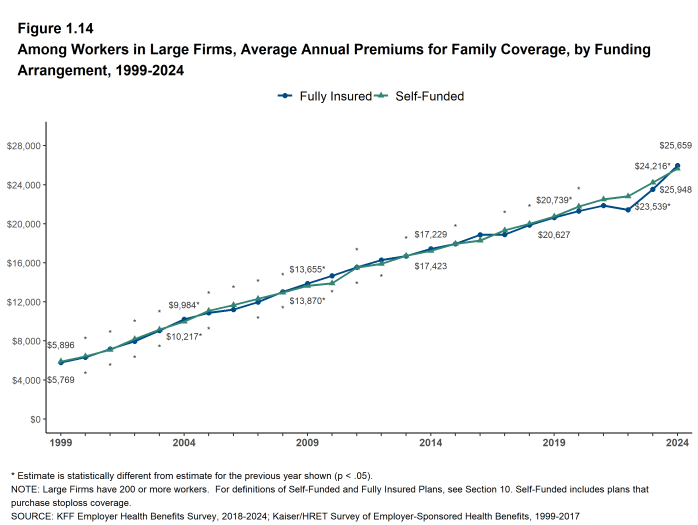

- Over the past five years, the average family premium for covered workers at large firms that are fully insured has grown at a similar rate to the average family premium for covered workers in fully or partially self-funded plan (26% for fully insured plans and 24% for self-funded firms) [Figure 1.14].

- The average family premium grew 7% in 2024 while the rate of inflation was (3.2%). Over the last 5 years, family premiums grew 24%, similar to the rate of inflation during this period (23%). Over the last ten years, the growth in the average premium for family coverage far outpaced inflation (52% vs. 32%) [Figure 1.15].

- The average family premium grew 7% in 2024 while wages grew 4.5%. Over the last 5 years, family premiums grew 24%, similar to the 28% growth in wages. Over the last ten years, the average family premium and average wages grew at roughly comparable rates (52% vs. 45%) [Figure 1.15].