2023 Employer Health Benefits Survey

Abstract

This 25th annual survey of employers provides a detailed look at trends in employer-sponsored health coverage, including premiums, employee contributions, cost-sharing provisions, offer rates, wellness programs, and employer practices. The 2023 survey included 2,133 interviews with non-federal public and private firms.

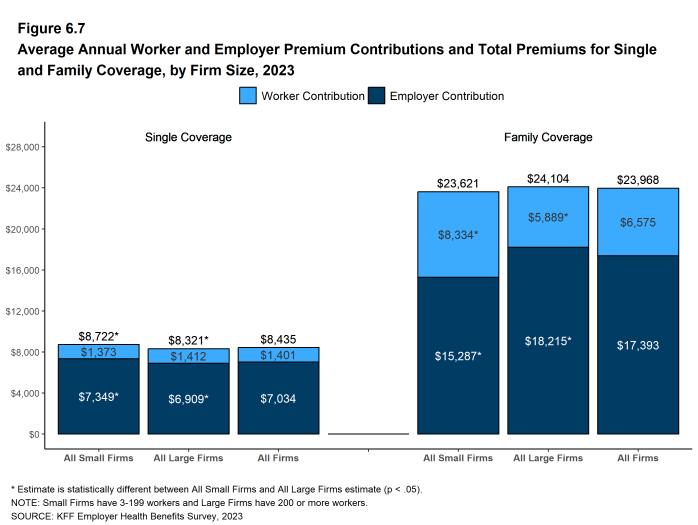

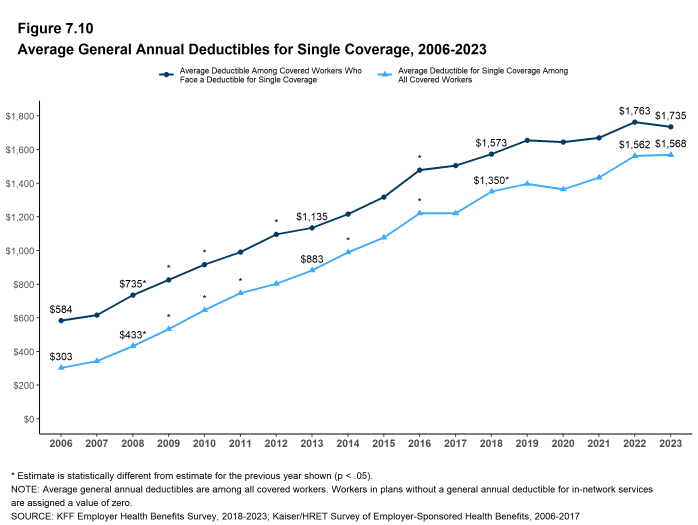

Annual premiums for employer-sponsored family health coverage reached $23,968 this year, with workers on average paying $6,575 toward the cost of their coverage. The average deductible among covered workers in a plan with a general annual deductible is $1,735 for single coverage. Workers at smaller firms on average contribute $2,445 more toward the cost of family coverage than workers at smaller firms. This year’s report also looks at employers’ experiences and views about abortion coverage, mental health and substance use services, and wellness programs.

Survey results are released in several formats, including a full report with downloadable tables on a variety of topics, a summary of findings, and an article published in the journal Health Affairs.

NEWS RELEASE

- A news release announcing the publication of the Employer Health Benefits Survey is available.

SUMMARY OF FINDINGS

- The Summary of Findings provides an overview of the survey results and is available under the Summary of Findings.

FULL REPORT

- The complete Employer Health Benefits Survey report includes over 200 exhibits and is available under the Report. The “Report” contains 13 separate sections. Users can view each section separately or download the section exhibits from the right side of the respective section page.

HEALTH AFFAIRS

- The peer-reviewed journal Health Affairs has published an article with key findings from the survey (subscription required): Health Benefits In 2023: Premiums Increase With Inflation And Employer Coverage In The Wake Of Dobb

INTERACTIVE GRAPHIC

- This graphing tool allows users to look at changes in premiums and worker contributions for covered workers at different types of firms over time: Premiums and Worker Contributions Among Workers Covered by Employer-Sponsored Coverage, 1999-2023.

CHARTPACK

- Key slides from the 2023 Employer Health Benefits Survey are here.

2023 TABLES BY SECTION (.xls)

ADDITIONAL RESOURCES

- Standard errors for selected estimates are available in the Technical Supplement here.

- Employer Health Benefits Surveys from 1998–2022 are available here. Please note that historic survey reports have not been revised with methodological changes.

- Researchers may request a public use dataset by completing a data use agreement (available here).

- For questions about the Employer Health Benefits Survey, please visit Contact Us and choose “TOPIC: Health Costs.”

Summary of Findings

Employer-sponsored insurance covers almost 153 million nonelderly people1. To provide a current snapshot of employer-sponsored health benefits, KFF conducts an annual survey of private and non-federal public employers with three or more workers. This is the 25th Employer Health Benefits Survey (EHBS) and reflects employer-sponsored health benefits in 2023. The survey was fielded from January to July of 2023.

HEALTH INSURANCE PREMIUMS AND WORKER CONTRIBUTIONS

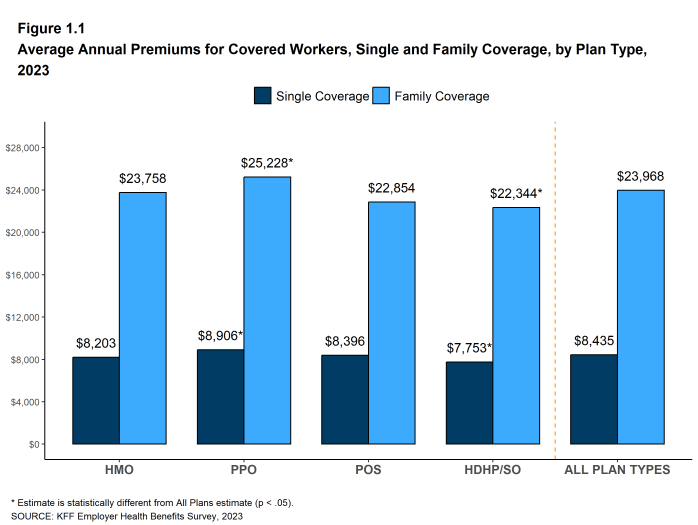

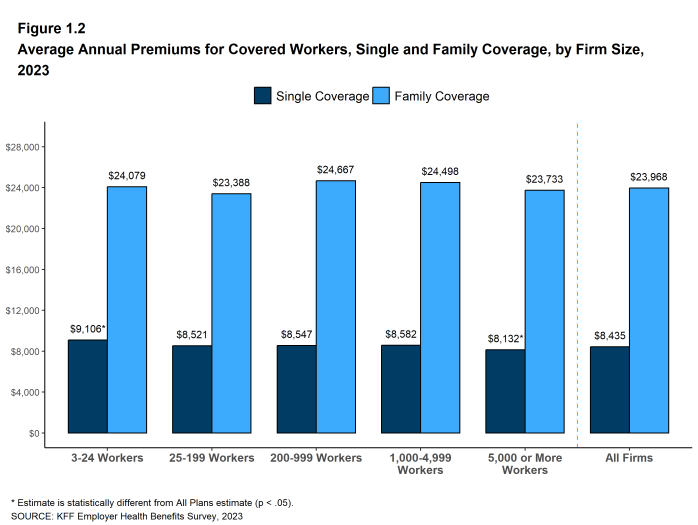

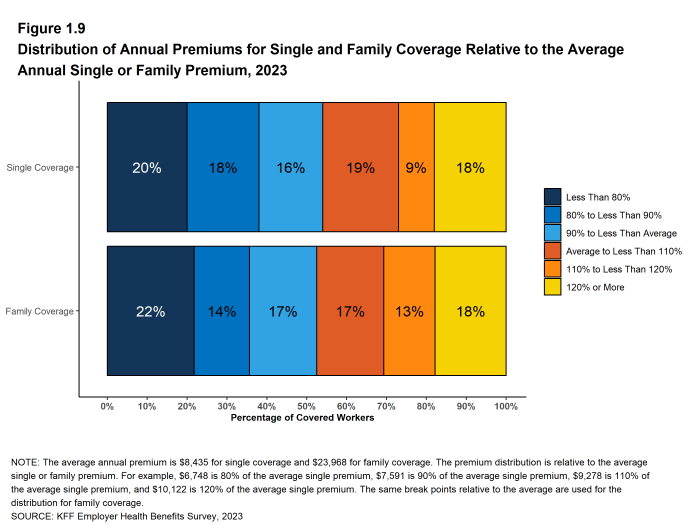

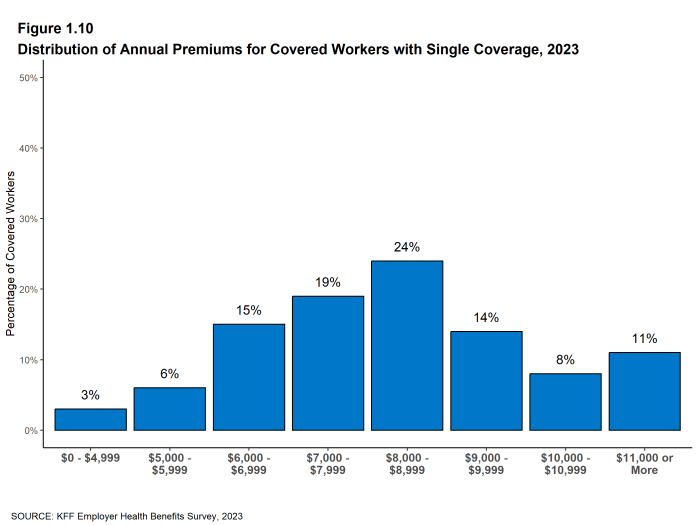

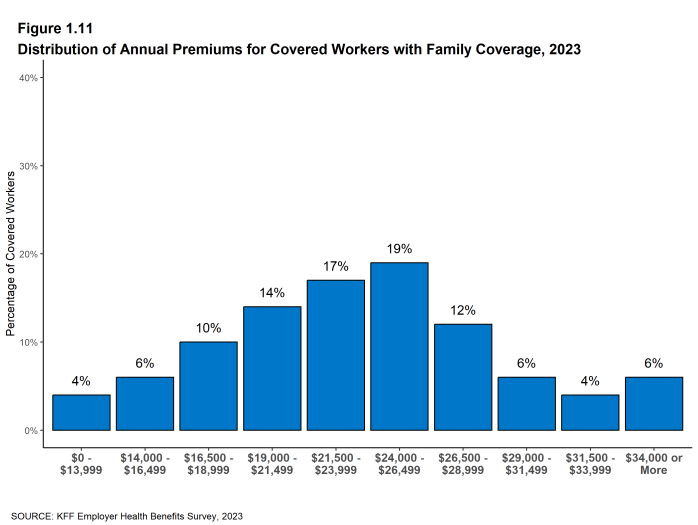

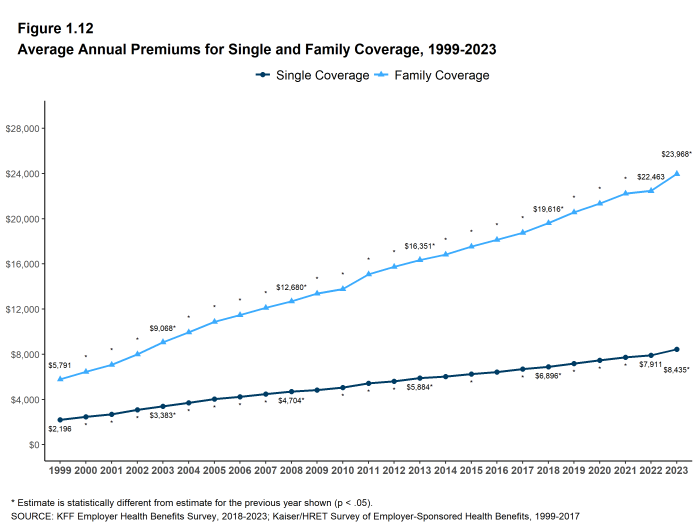

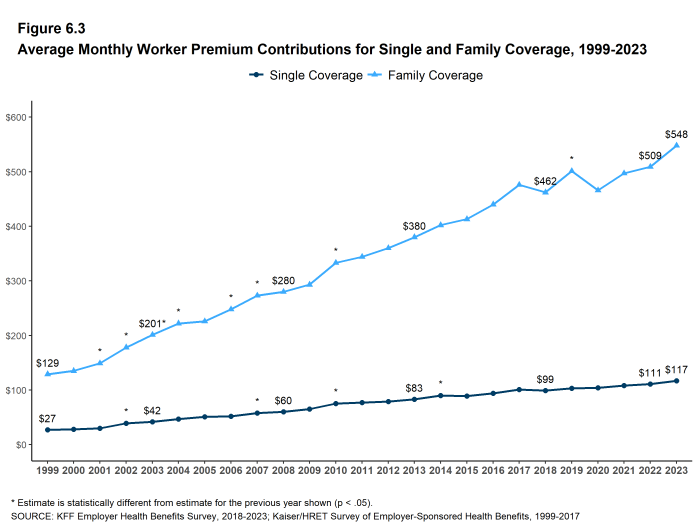

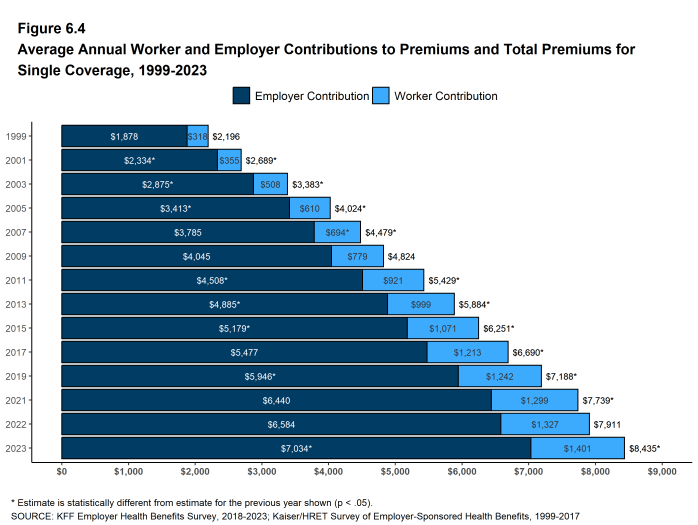

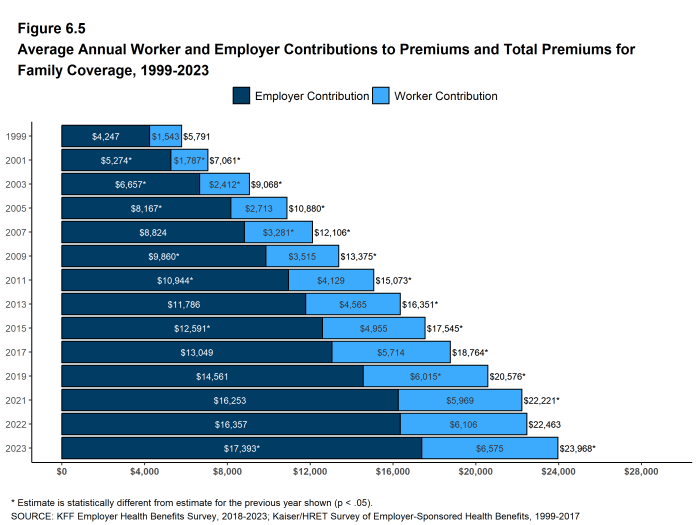

The average annual premium for employer-sponsored health insurance in 2023 is $8,435 for single coverage and $23,968 for family coverage. The average annual single premium and the average annual family premium each increased by 7% over the last year. Comparatively, there was an increase of 5.2% in workers’ wages and inflation of 5.8%2. The average single and family premiums increased faster this year than last year (2% vs. 7% and 1% vs. 7% respectively).

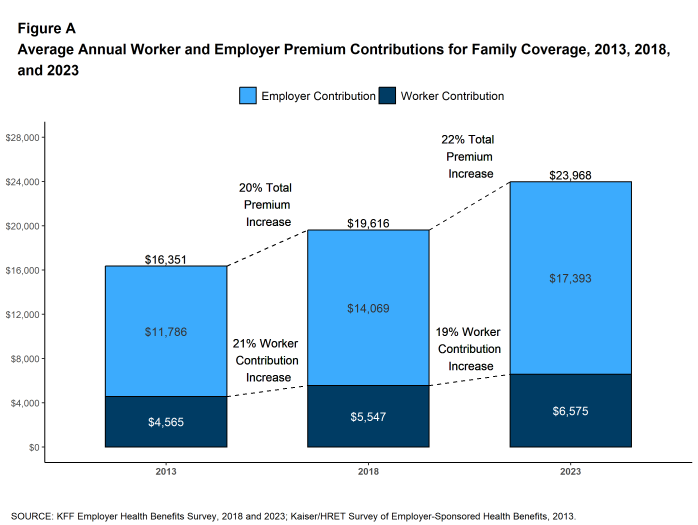

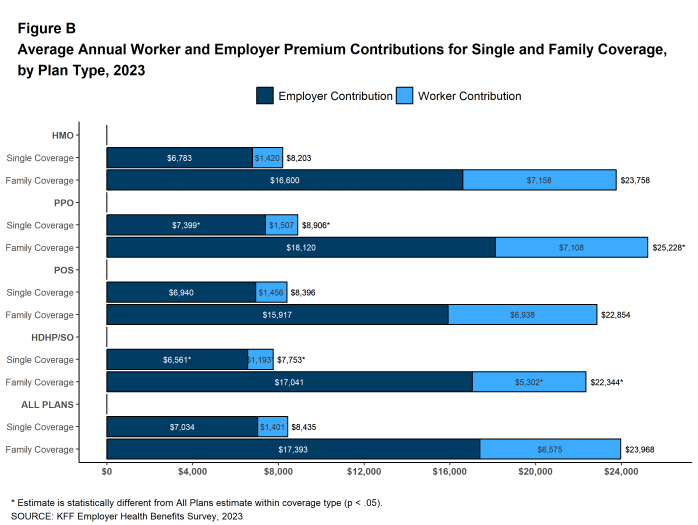

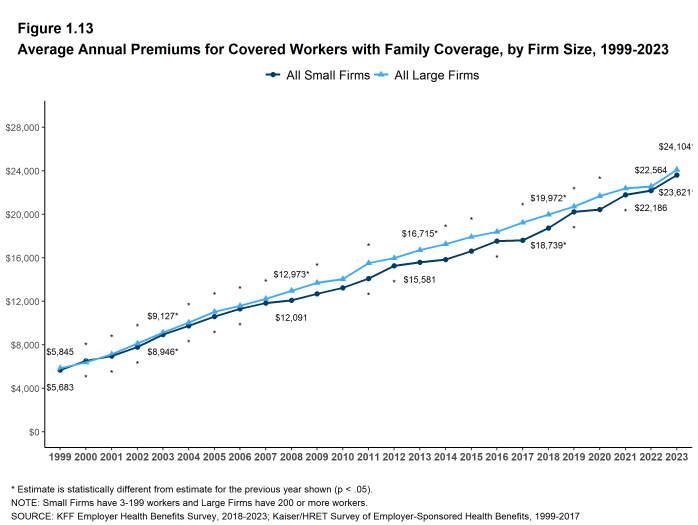

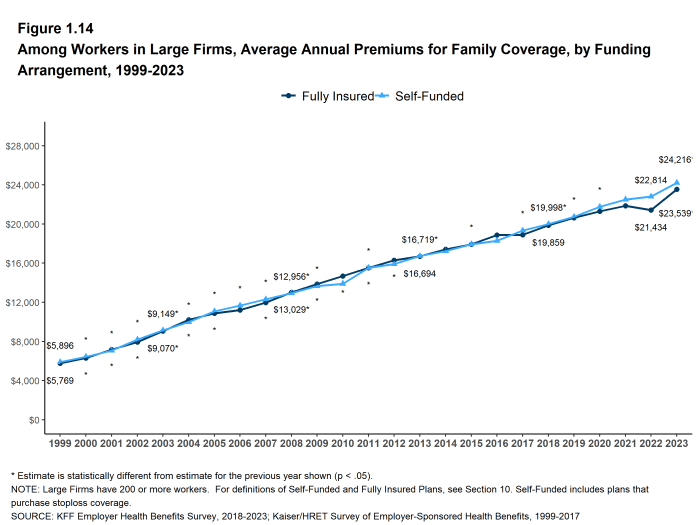

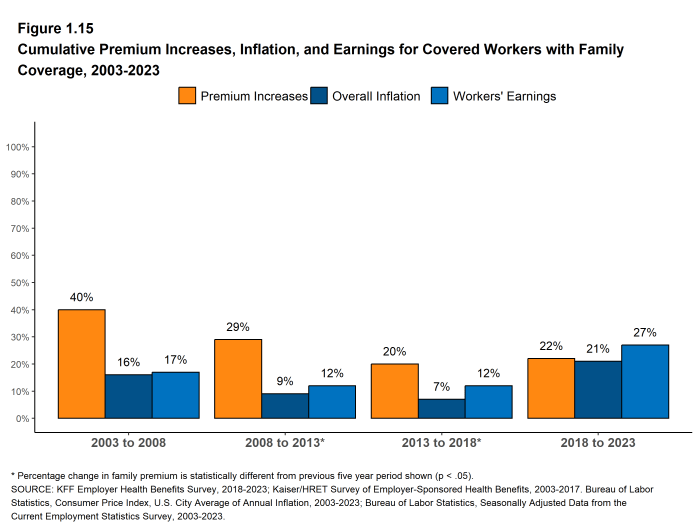

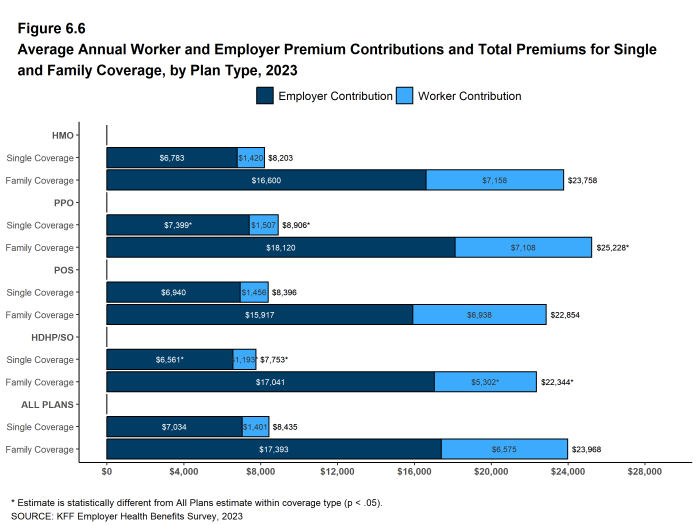

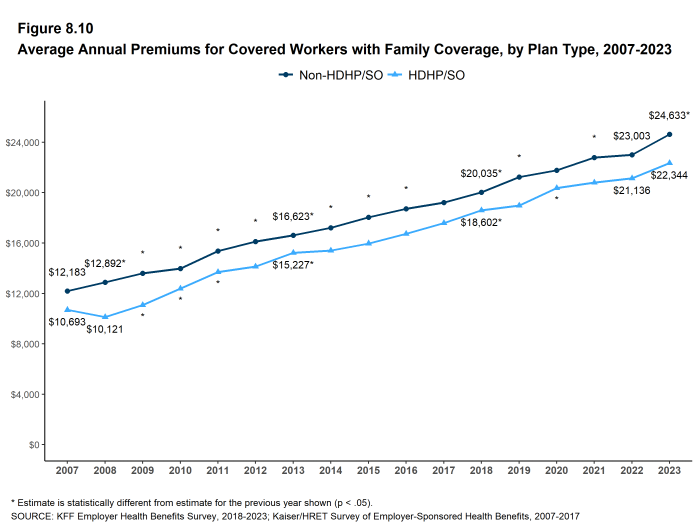

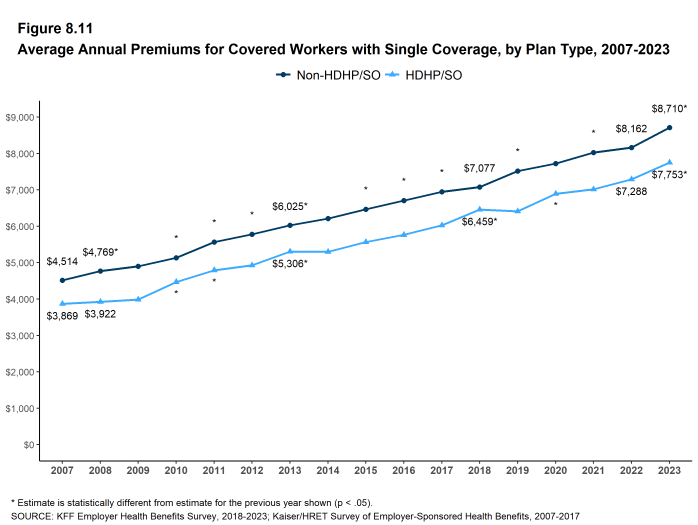

Over the last five years, the average premium for family coverage has increased by 22% compared to an 27% increase in workers’ wages and 21% inflation [Figure A].

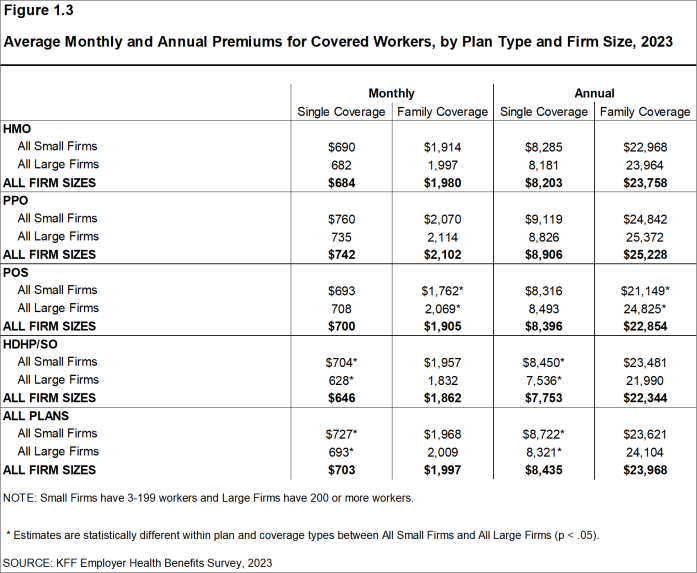

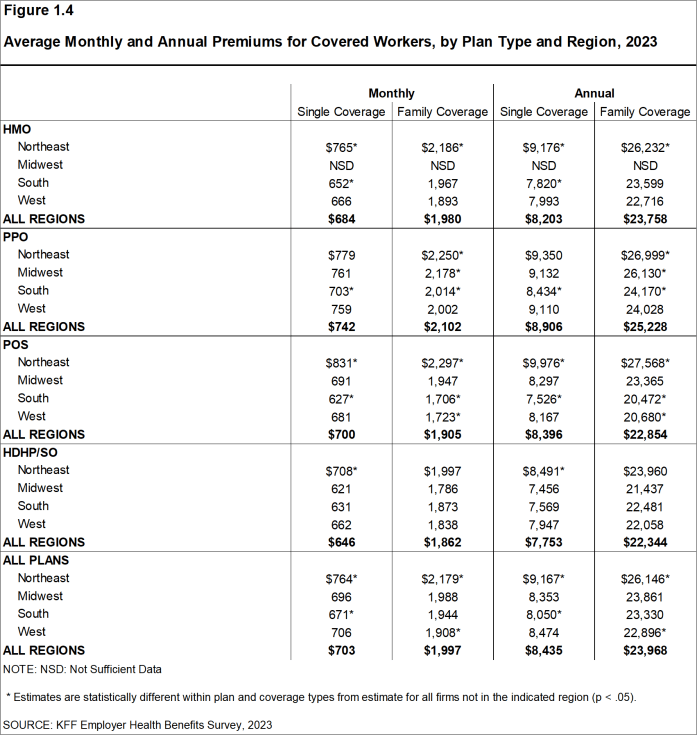

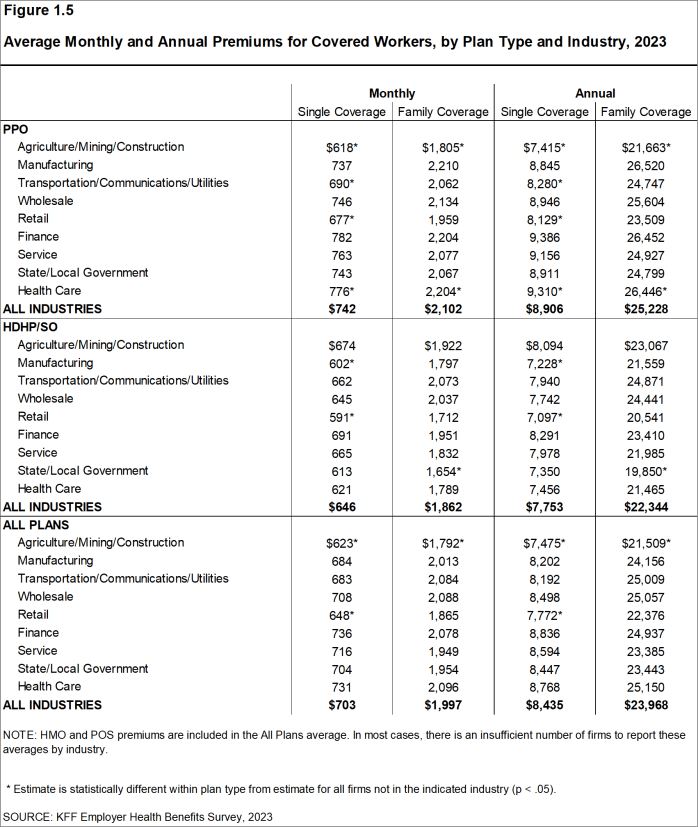

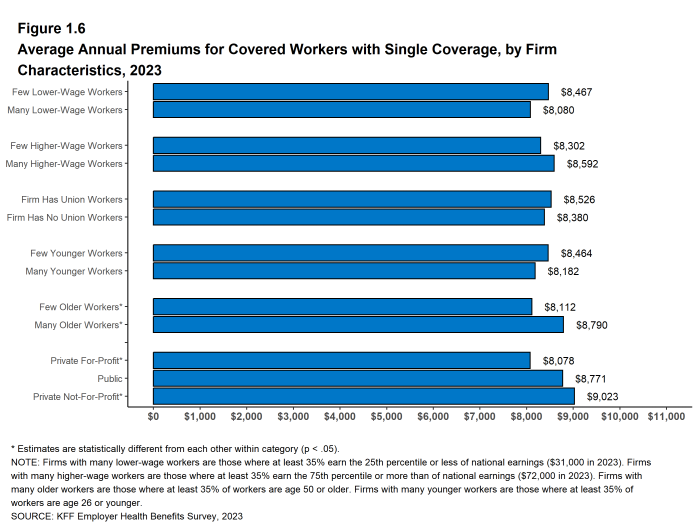

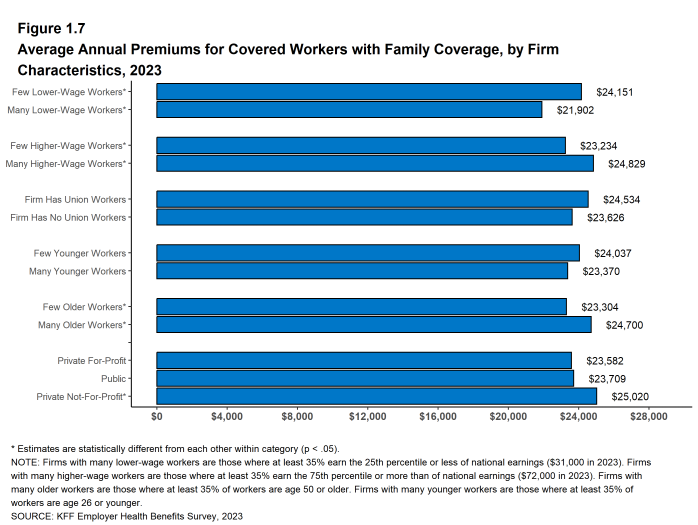

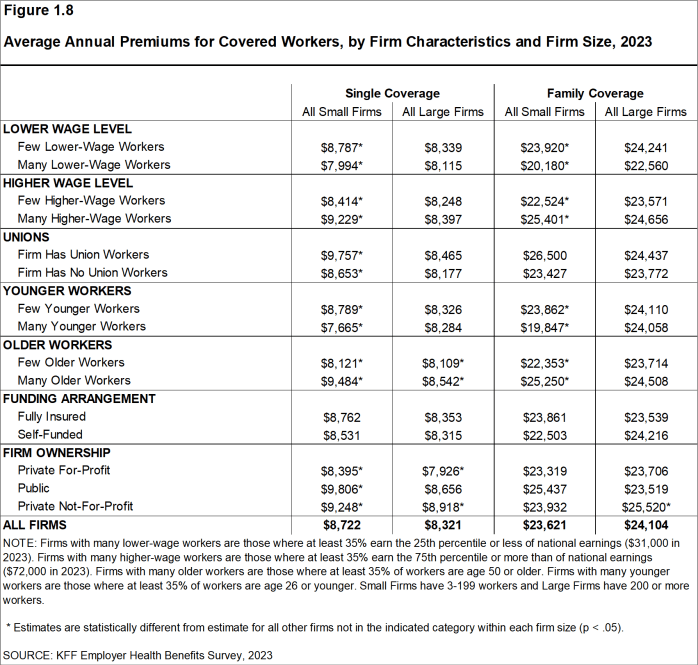

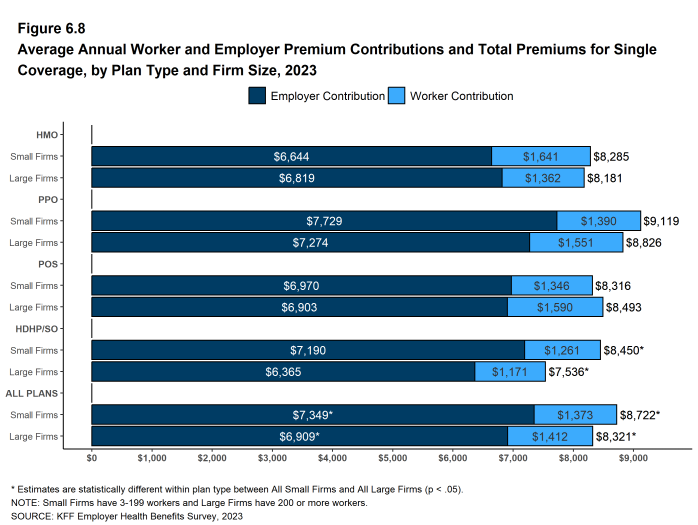

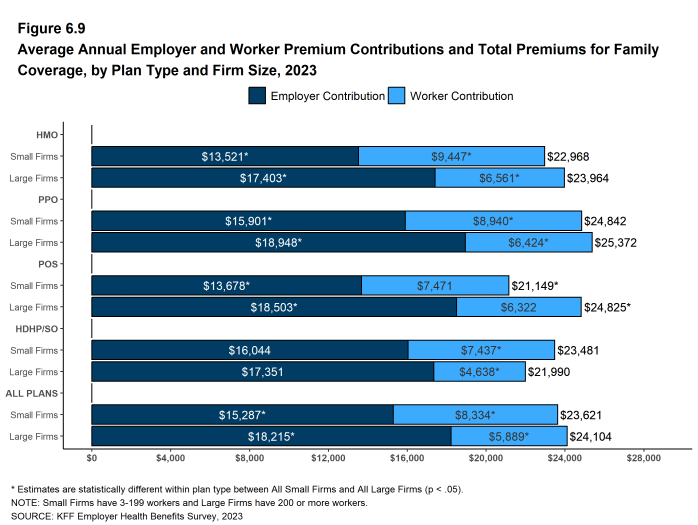

For single coverage, the average premium for covered workers is higher at small firms than at large firms ($8,722 vs. $8,321). The average premiums for family coverage are comparable for covered workers in small and large firms ($23,621 vs. $24,104). The average premiums for covered workers in high-deductible health plans with a savings option (HDHP/SO) are lower than the overall average premiums for both single coverage ($7,753) and family coverage ($22,344) [Figure B]. By contrast, average premiums for covered workers enrolled in PPOs are higher than the overall average premiums for both single ($8,906) and family coverage ($25,228). The average premium for single coverage is lower for covered workers at private for-profit firms ($8,078) than for those at public ($8,771) or private not-for-profit firms ($9,023). The average premiums for covered workers at firms with a relatively large share of older workers (where at least 35% of the workers are age 50 or older) are higher than the average premium for covered workers at firms with smaller shares of older workers, for both single coverage ($8,790 vs. $8,112) and family coverage ($24,700 vs. $23,304).

Figure A: Average Annual Worker and Employer Premium Contributions for Family Coverage, 2013, 2018, and 2023

Figure B: Average Annual Worker and Employer Premium Contributions for Single and Family Coverage, by Plan Type, 2023

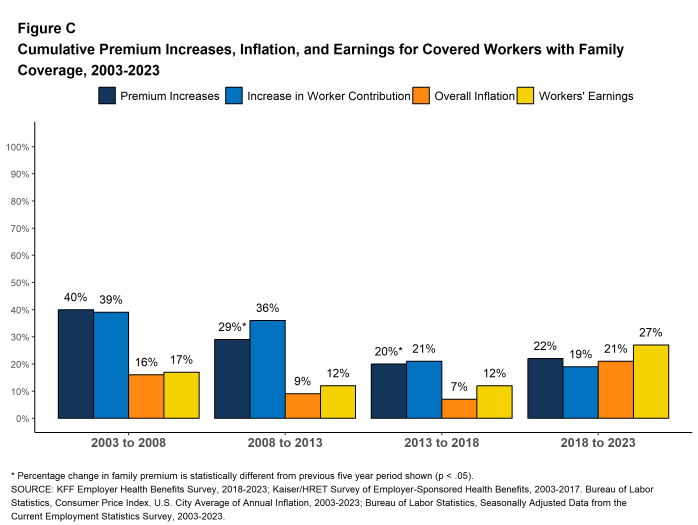

Figure C: Cumulative Premium Increases, Inflation, and Earnings for Covered Workers With Family Coverage, 2003-2023

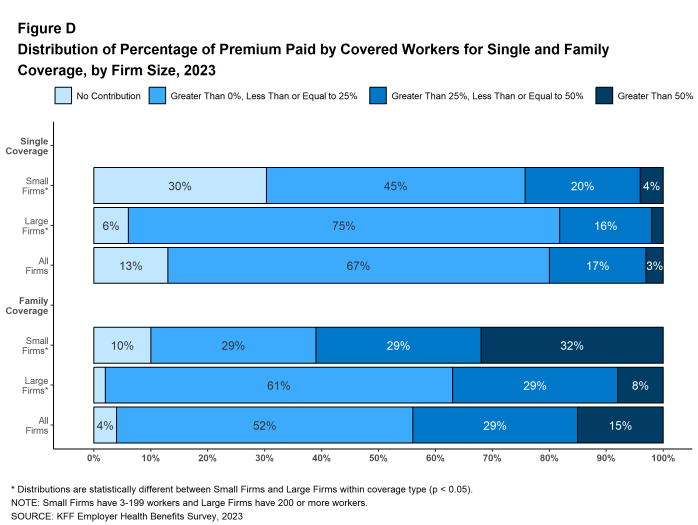

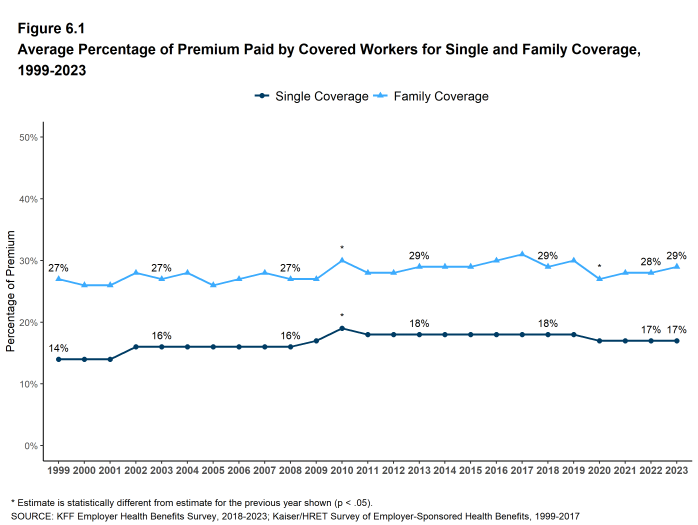

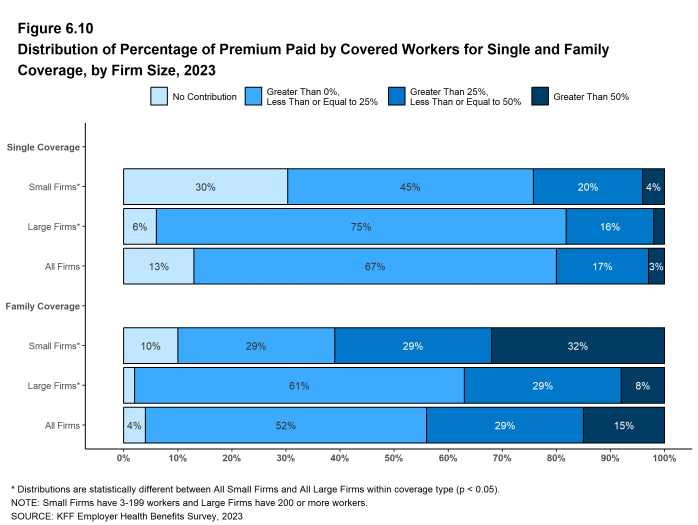

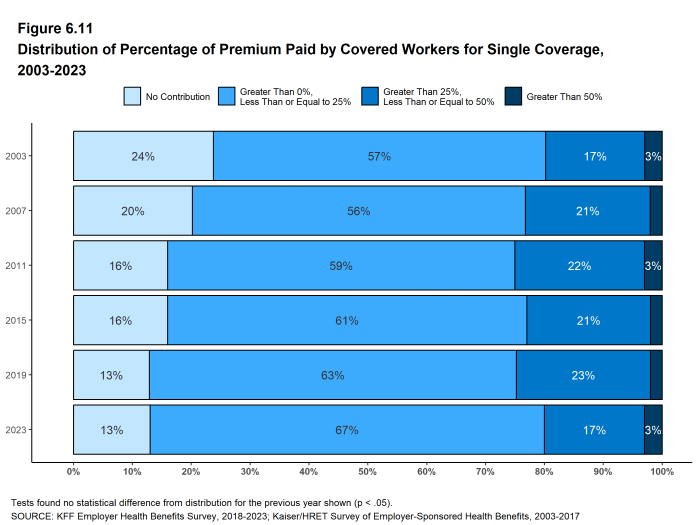

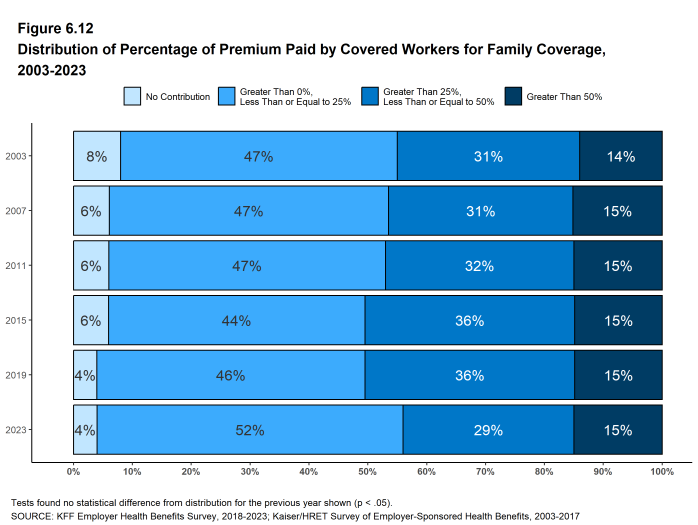

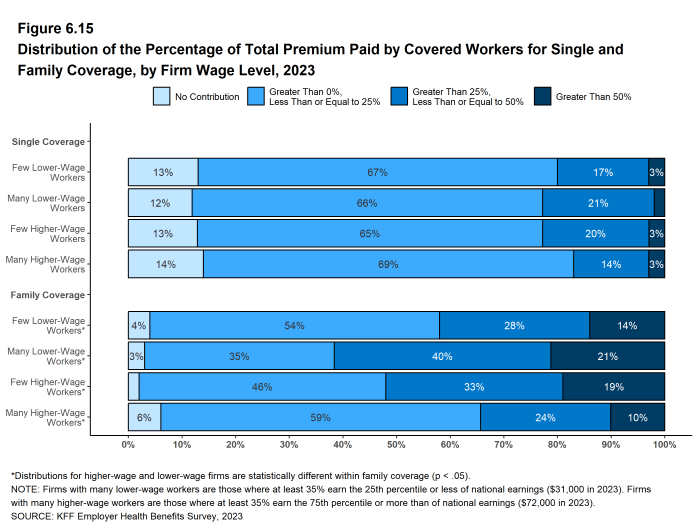

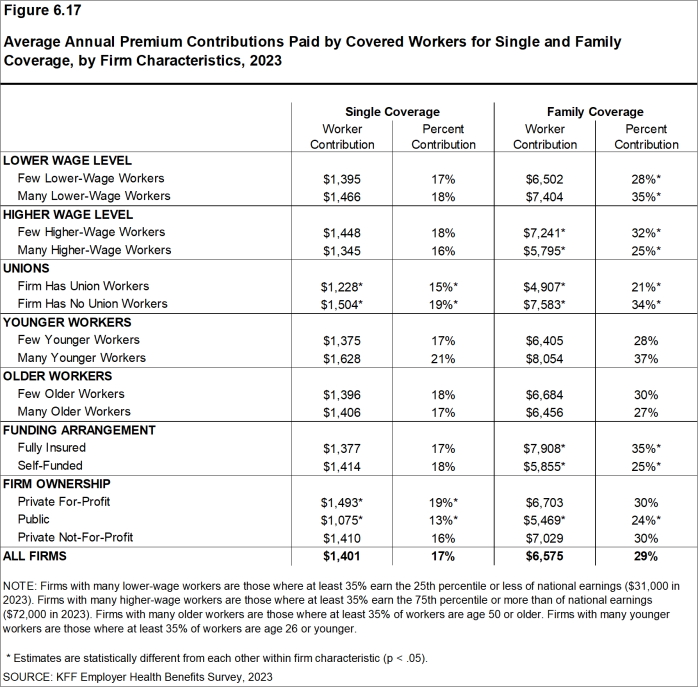

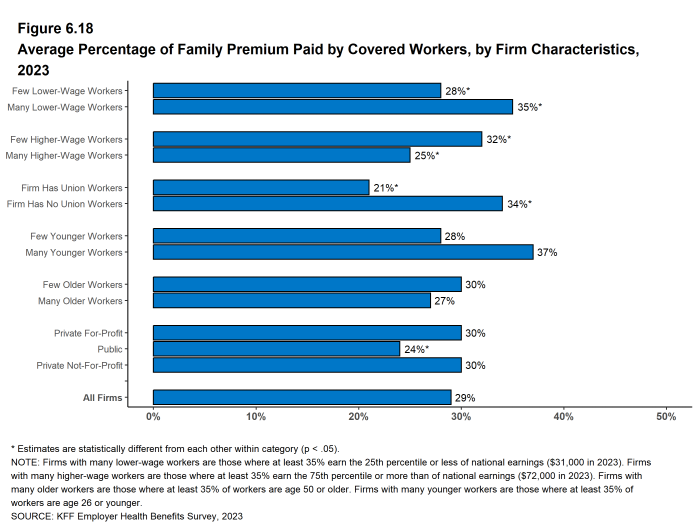

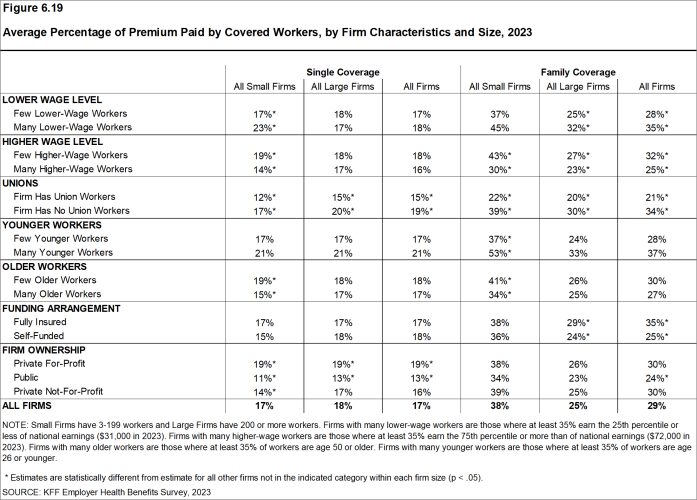

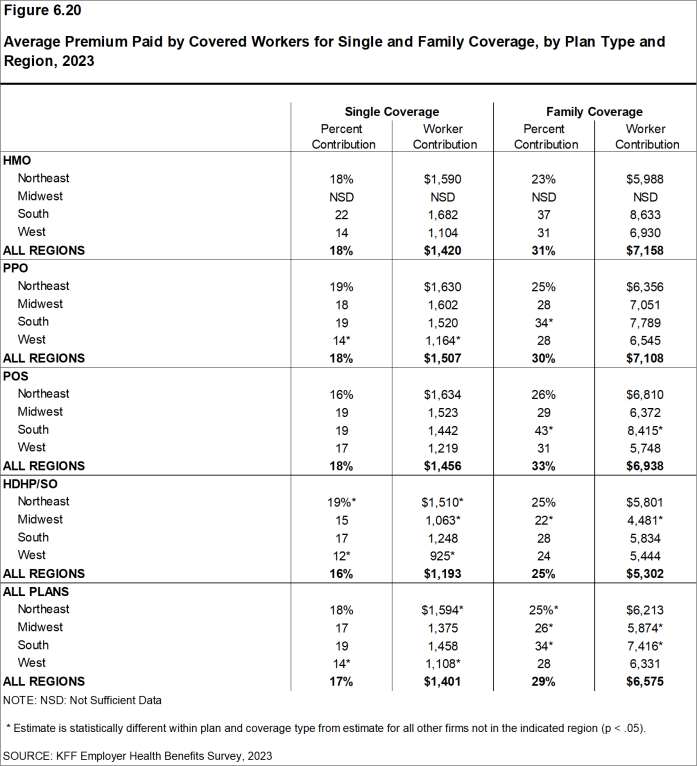

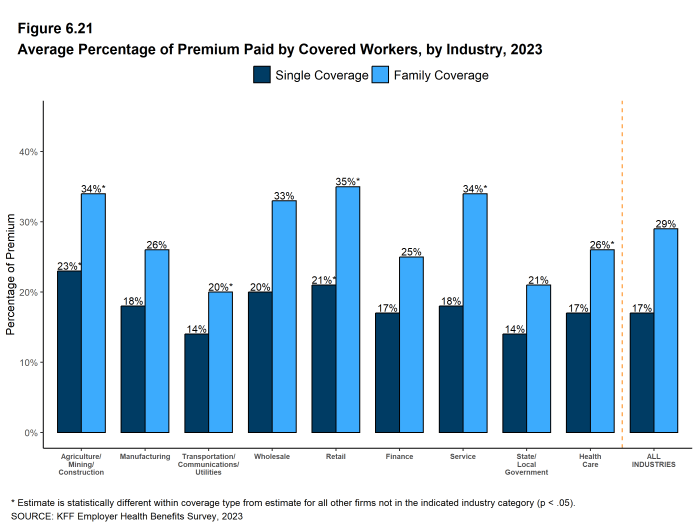

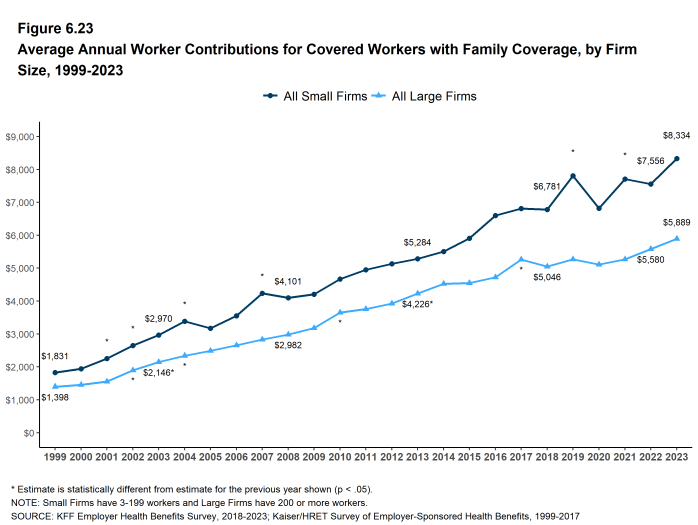

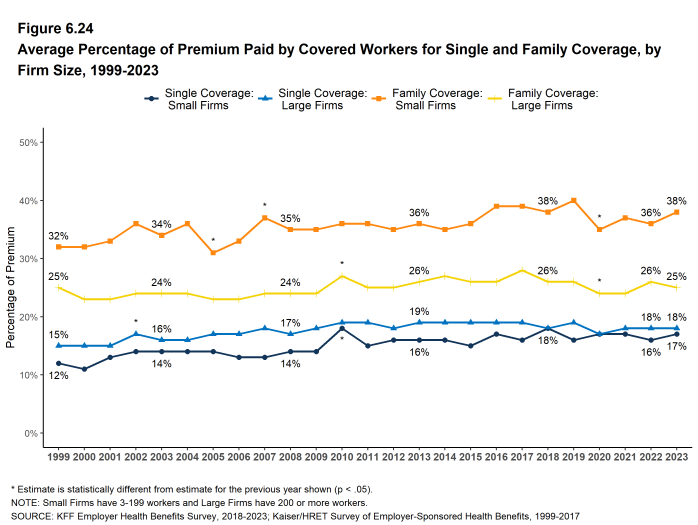

Most covered workers contribute to the cost of the premium for their coverage. On average, covered workers contribute 17% of the premium for single coverage and 29% of the premium for family coverage, similar to the percentages contributed in 2022. Covered workers at small firms contribute, on average, a higher percentage of the premium for family coverage than those at large firms (38% vs. 25%). As a result, the average contribution amount for covered workers at small firms ($8,334) is considerably higher than the average contribution amount for covered workers at large firms ($5,889).

Covered workers at private, for-profit firms have relatively high premium contribution rates for single coverage (19%). Covered workers at public organizations have relatively low premium contributions for single coverage (13%) and family (24%) coverage.

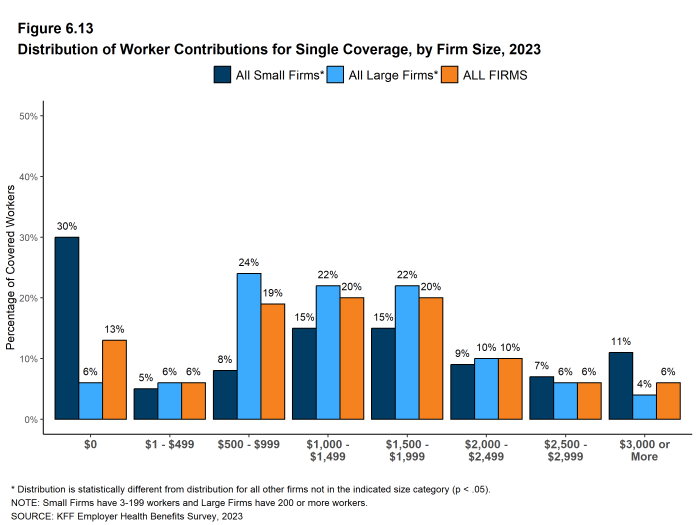

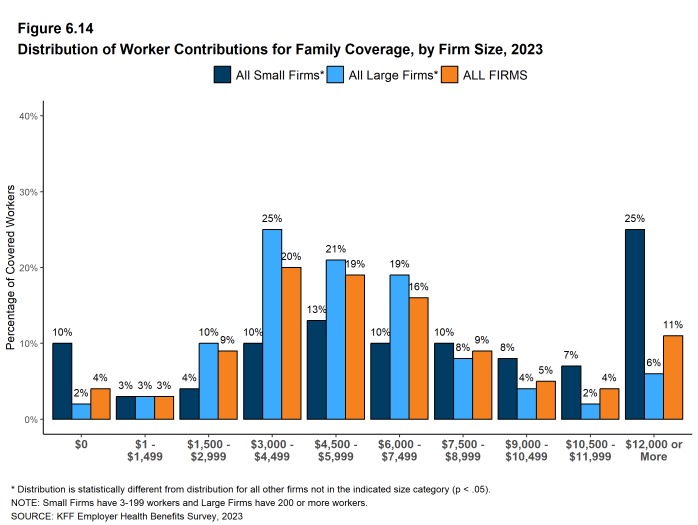

Thirty percent of covered workers at small firms are enrolled in a plan where the employer pays the entire premium for single coverage. This is the case for only 6% of covered workers at large firms. However, 32% of covered workers at small firms are in a plan where they must contribute more than half of the premium for family coverage, compared to 8% of covered workers at large firms [Figure D].

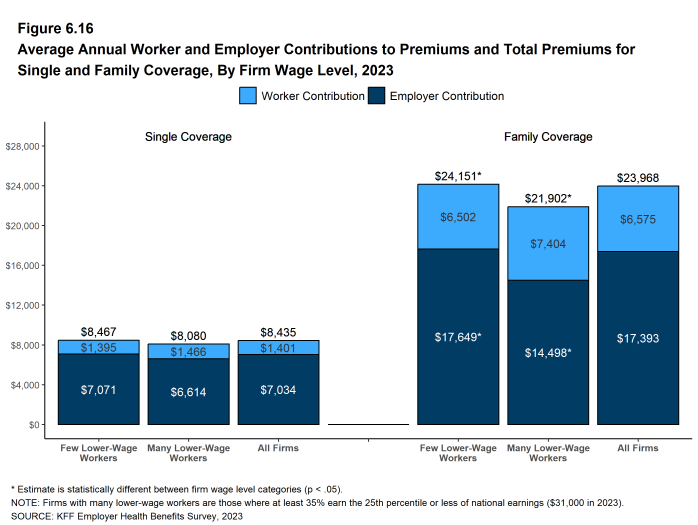

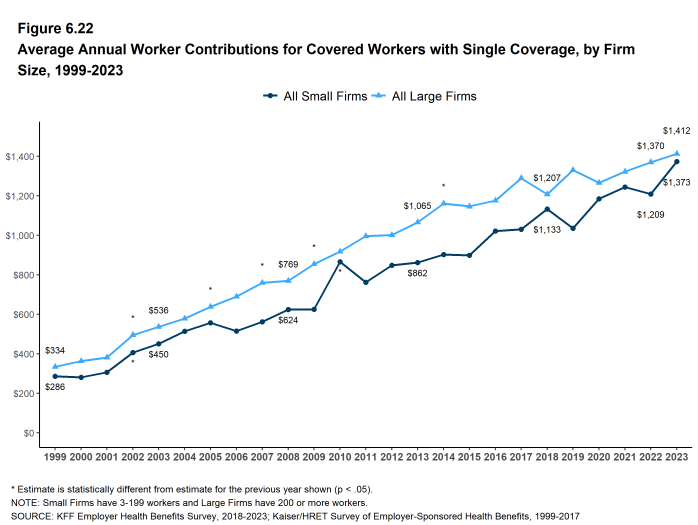

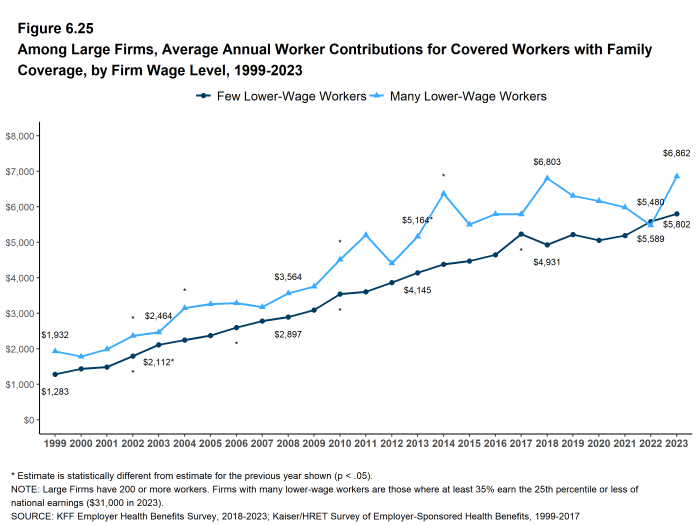

The average annual dollar amounts contributed by covered workers in 2023 are $1,401 for single coverage and $6,575 for family coverage, similar to the amounts last year but greater than five years ago. Eleven percent of covered workers, including 25% of covered workers at small firms, are in a plan with a worker contribution of $12,000 or more for family coverage. Single and family premium contributions for covered workers in HDHP/SO plans are, on average, lower than contributions for workers in other plan types.

Figure D: Distribution of Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 2023

PLAN ENROLLMENT

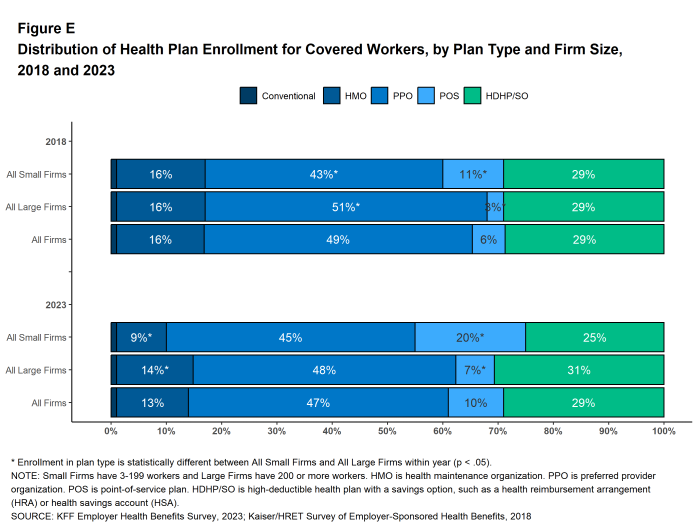

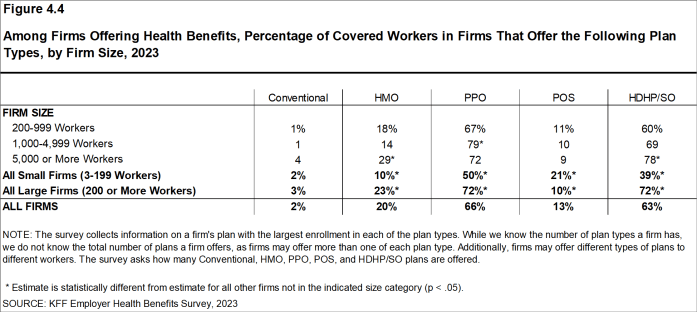

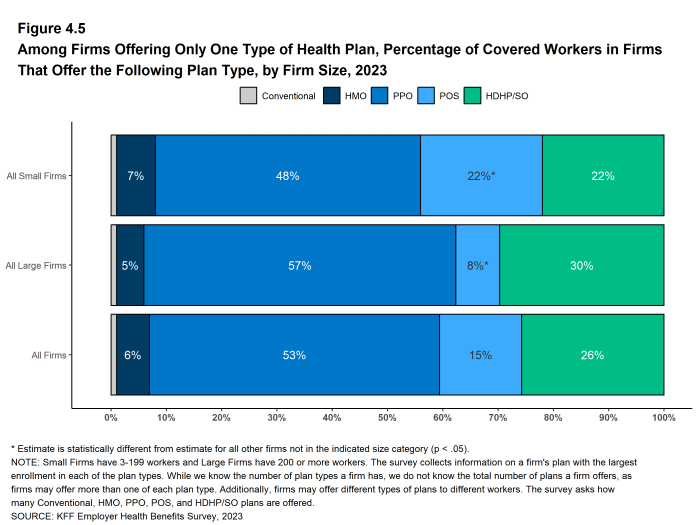

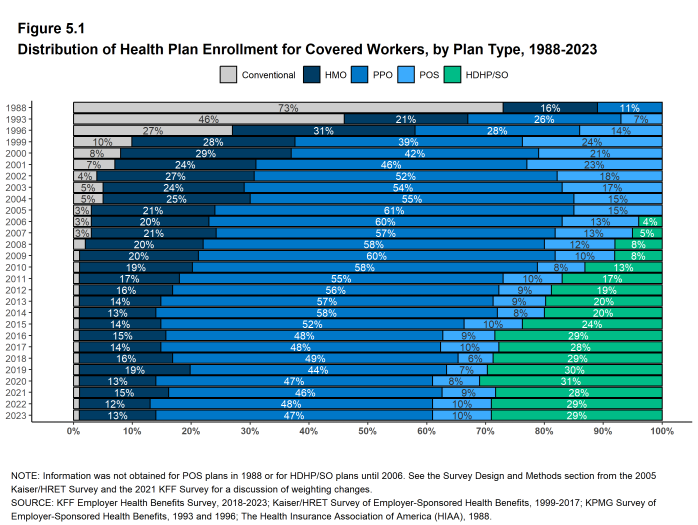

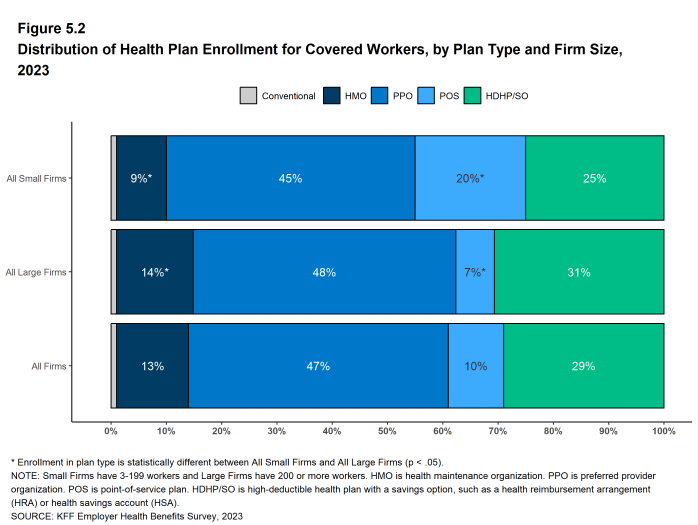

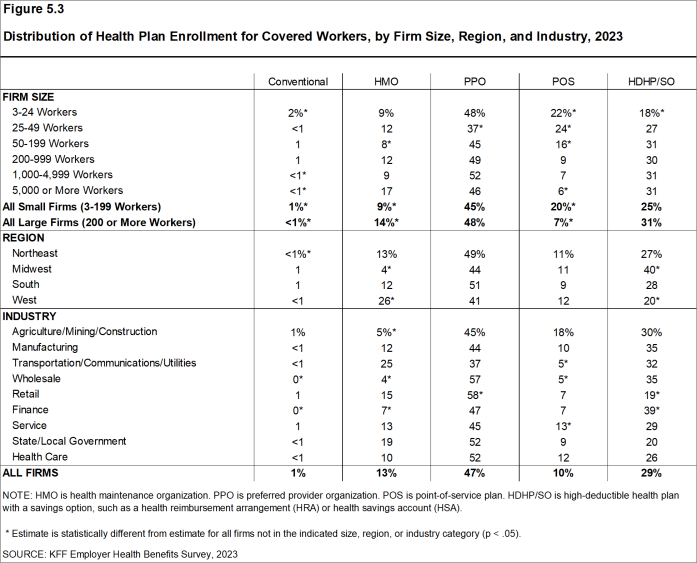

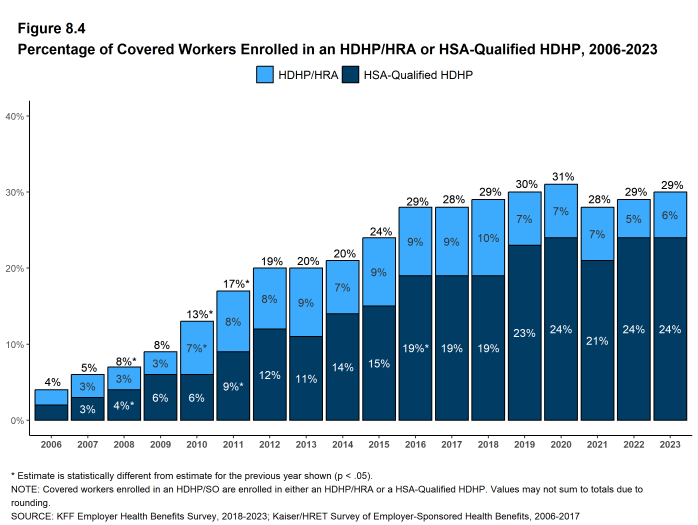

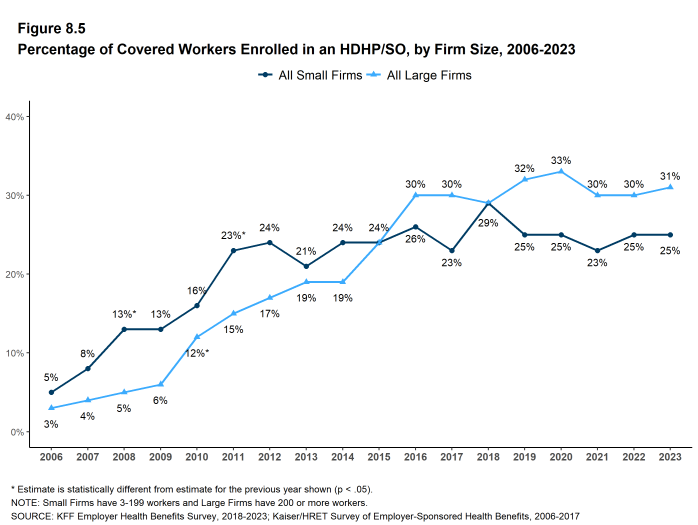

PPOs remain the most common plan type. In 2023, 47% of covered workers are enrolled in a PPO, 29% in a high-deductible plan with a savings option (HDHP/SO), 13% in an HMO, 10% in a POS plan, and 1% in a conventional (also known as an indemnity) plan [Figure E]. This distribution of covered workers across plan types is similar to the distributions of covered workers by plan type in recent years.

Figure E: Distribution of Health Plan Enrollment for Covered Workers, by Plan Type and Firm Size, 2018 and 2023

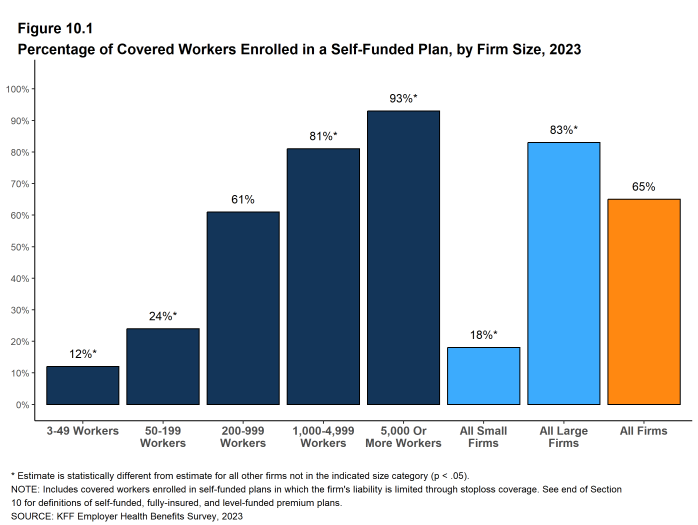

SELF FUNDING

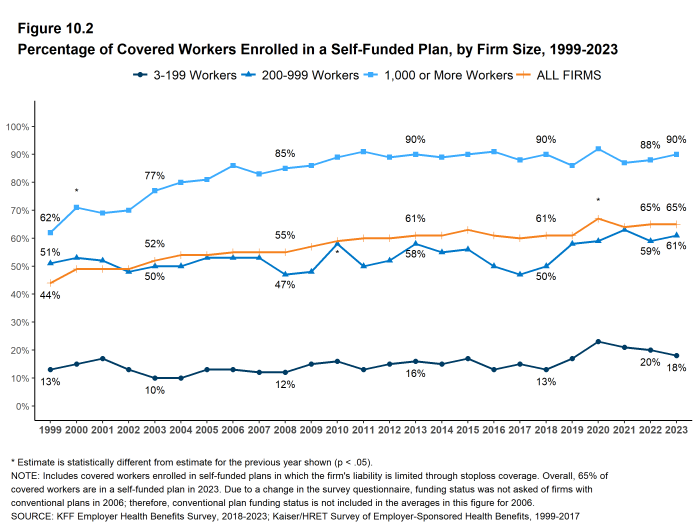

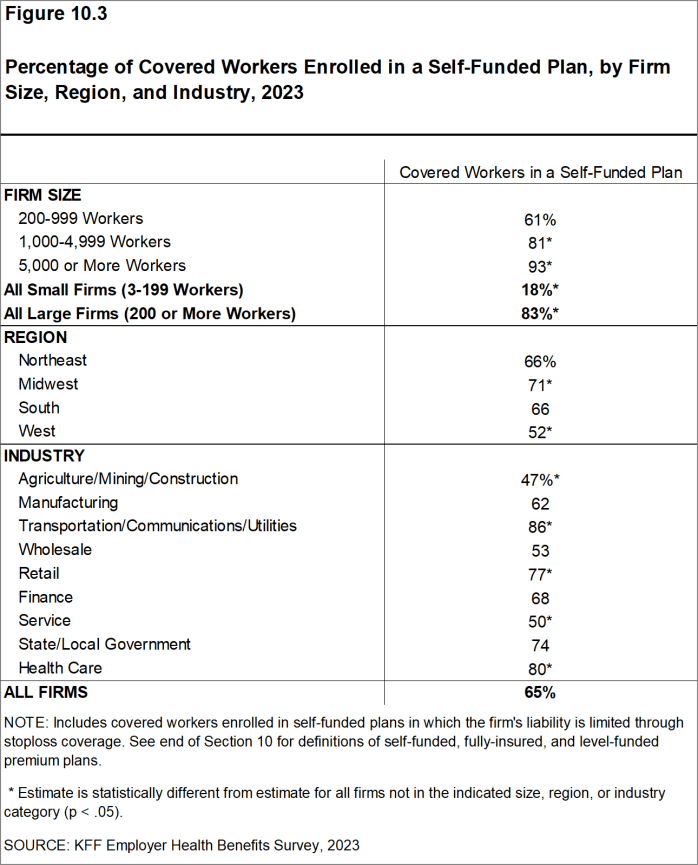

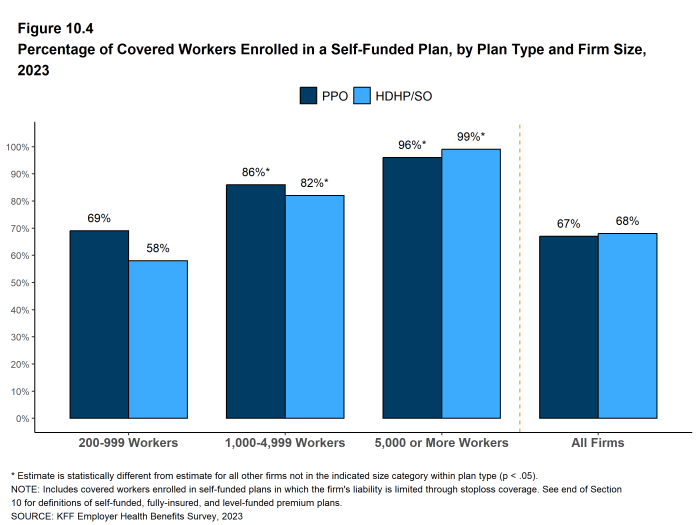

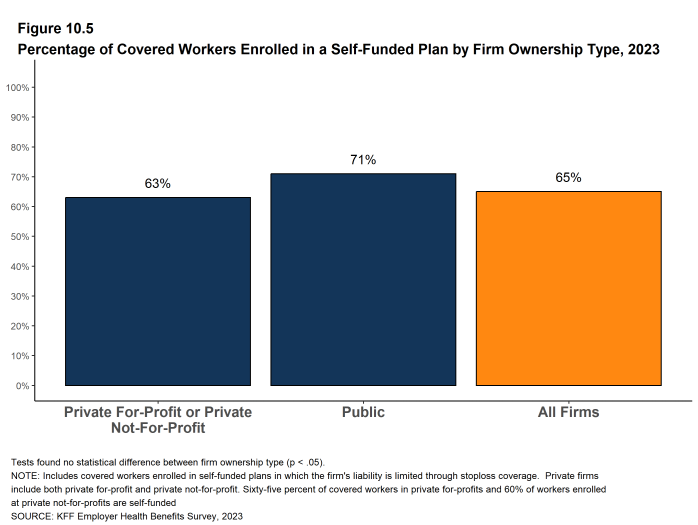

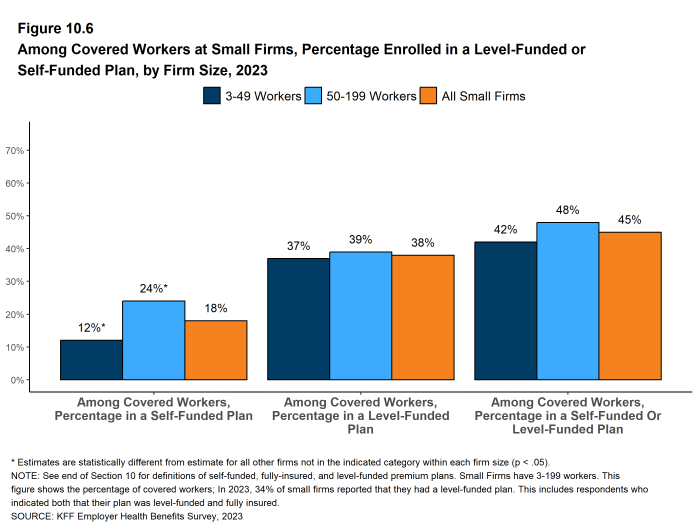

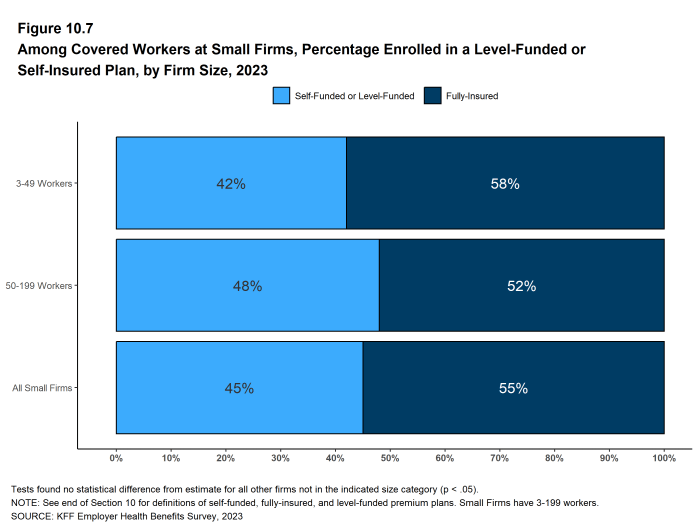

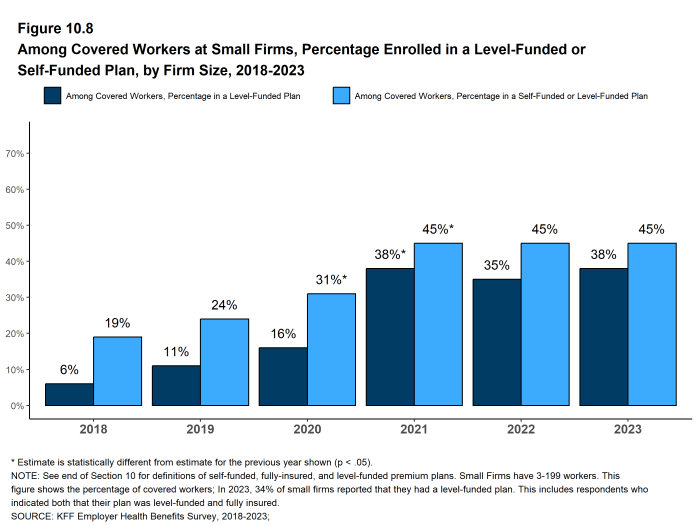

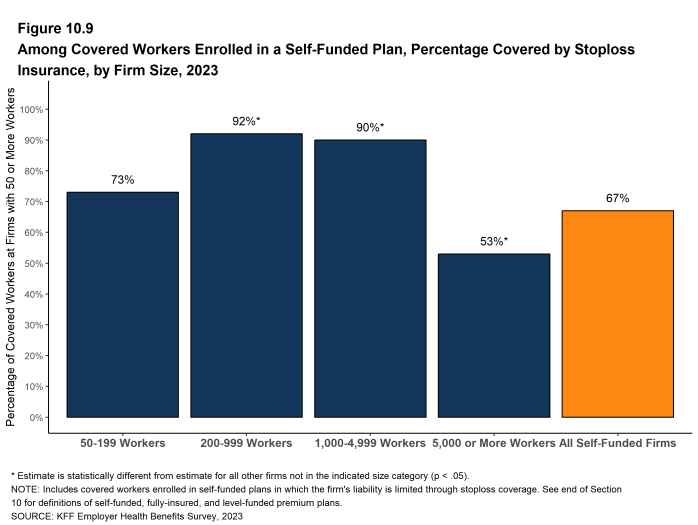

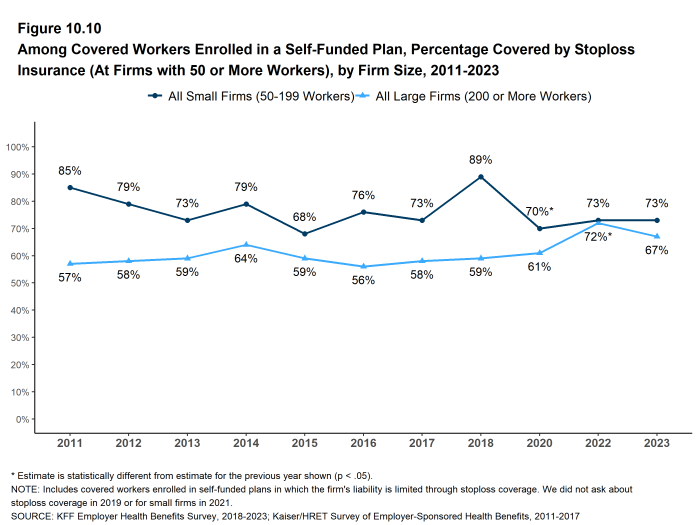

Many firms – particularly larger firms – self-fund, which means that they pay for the health services for their workers directly from their own funds rather than through the purchase of health insurance. Sixty-five percent of covered workers, including 18% of covered workers at small firms and 83% at large firms are enrolled in plans that are self-funded. The percentage of covered workers in self-funded plans in 2023 is similar to last year.

Thirty-four percent of small firms offering health benefits report that they have a level-funded plan, similar to the percentage in 2022. Level-funded arrangements combine a relatively small self-funded component with stop-loss insurance, which limits the employer’s liability and transfers a substantial share of the risk to insurers. These plans have the potential to meaningfully affect competition in the small group market because, unlike insured plans, they use health status as a factor in rating and underwriting and are not required to provide all of the essential health benefits that are mandatory for other plans..

EMPLOYEE COST SHARING

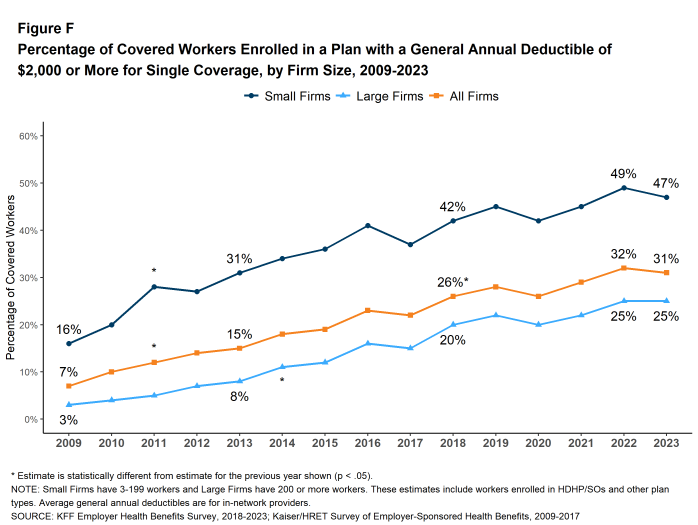

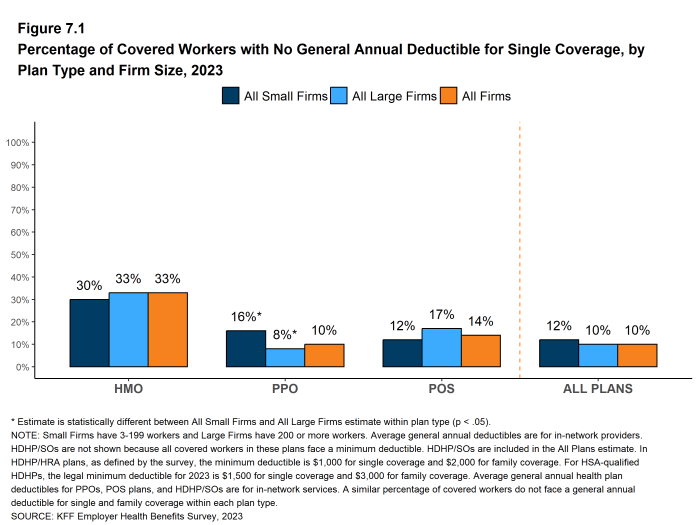

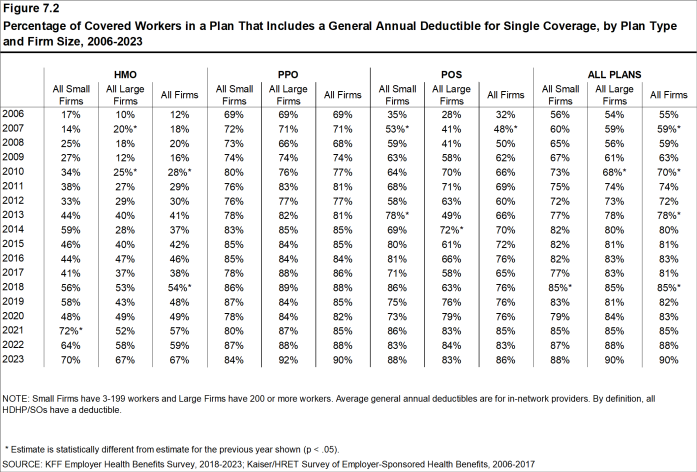

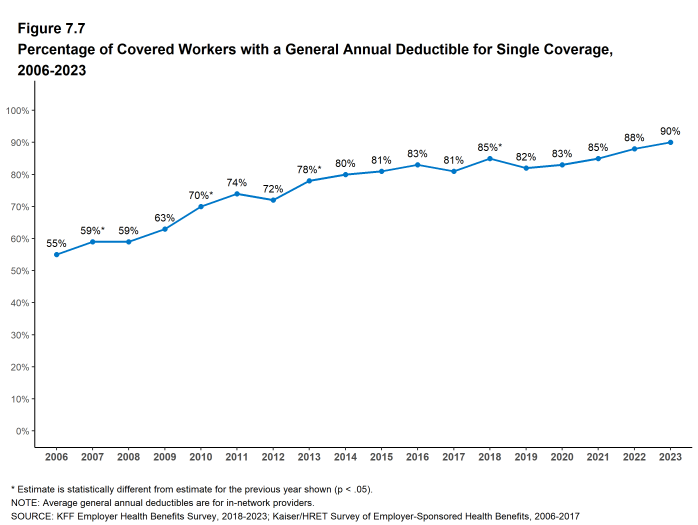

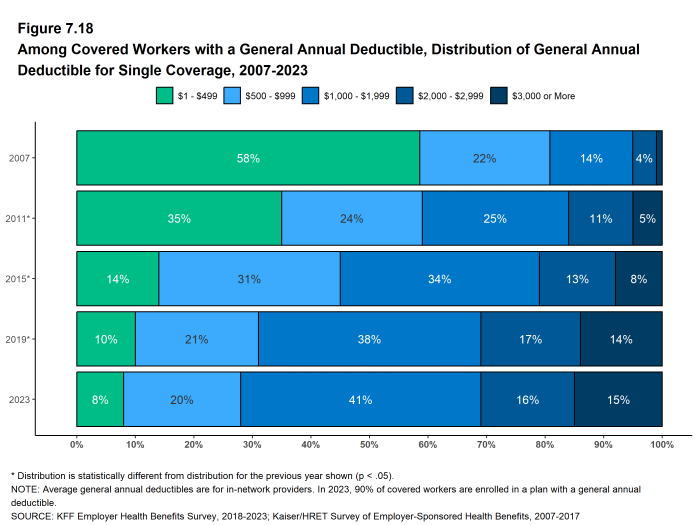

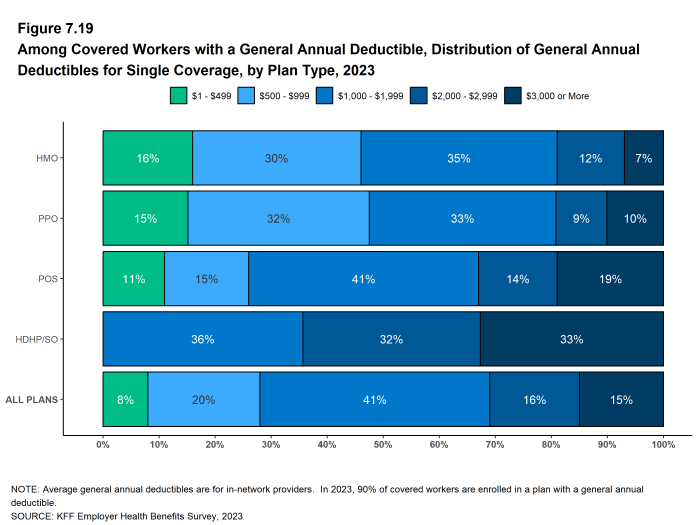

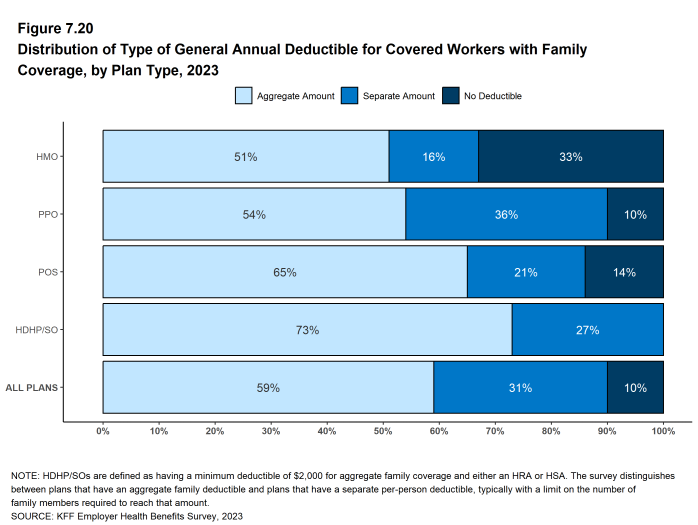

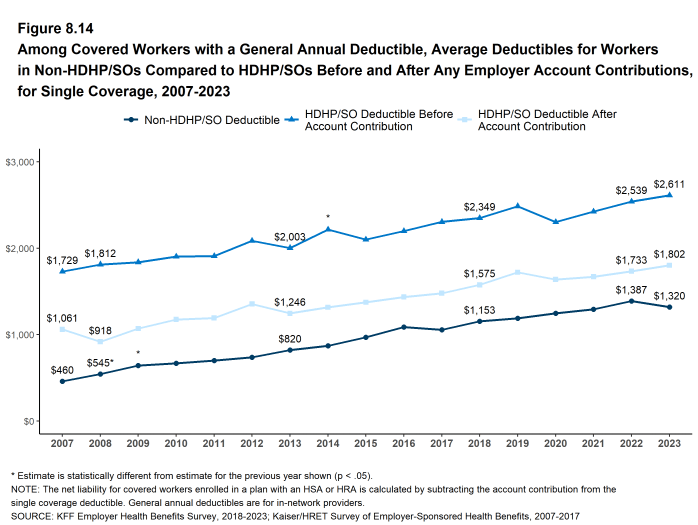

Ninety percent of workers with single coverage have a general annual deductible that must be met before most services are paid for by the plan, similar to the percentage last year (88%).

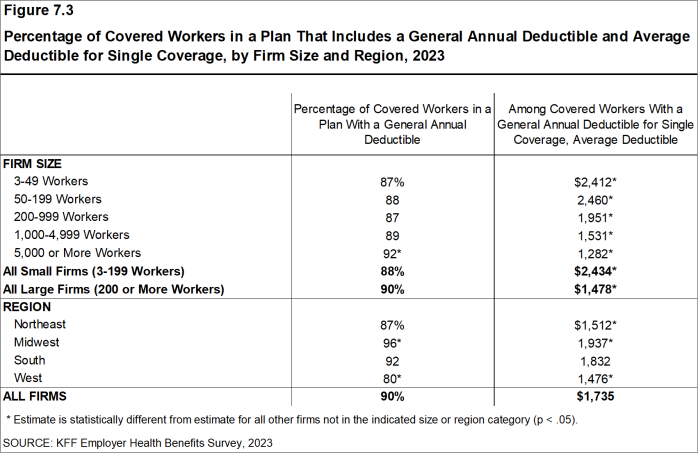

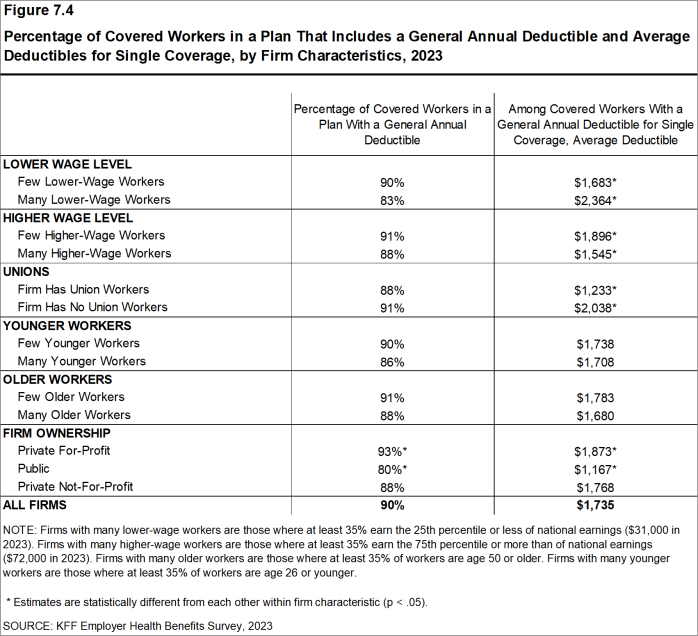

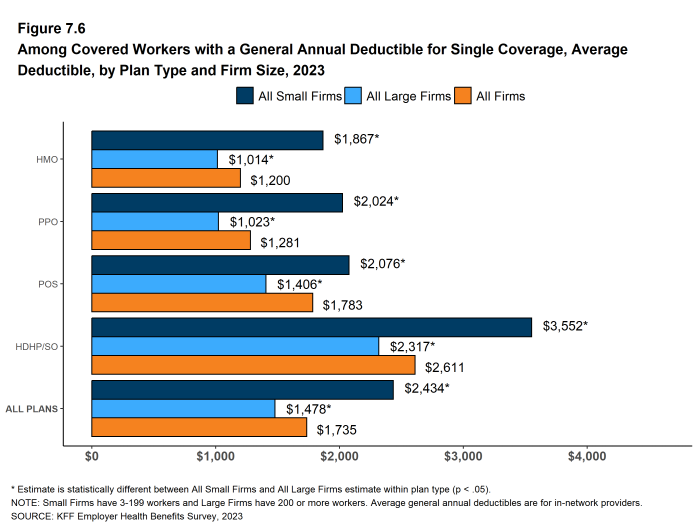

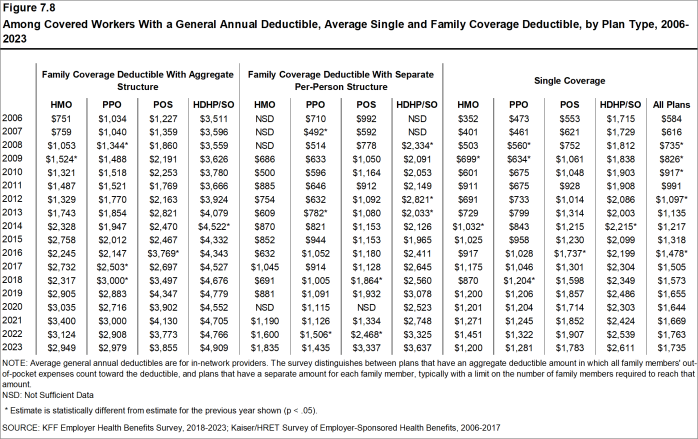

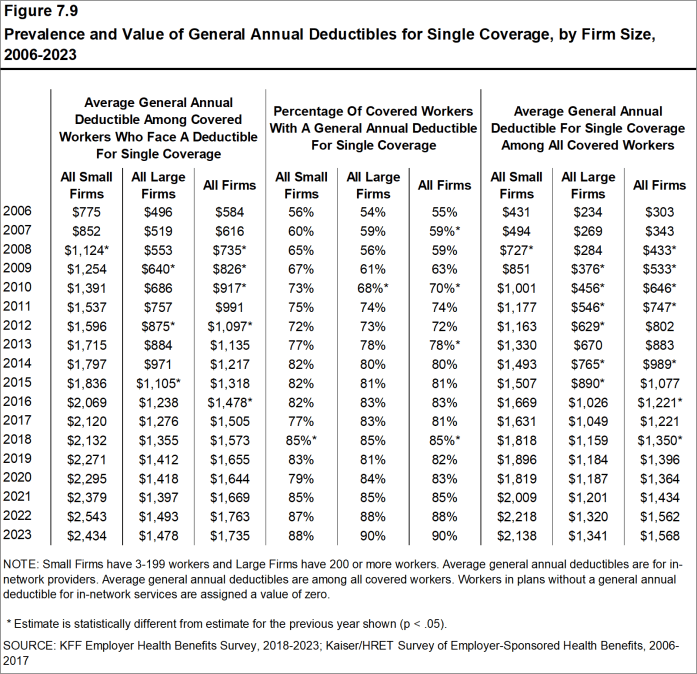

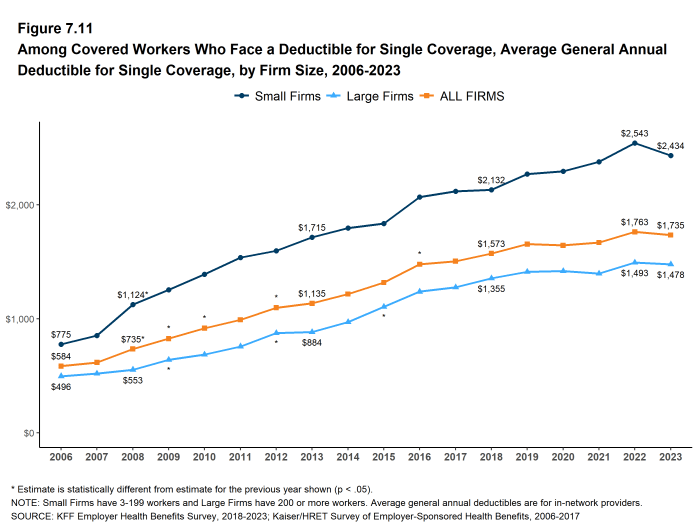

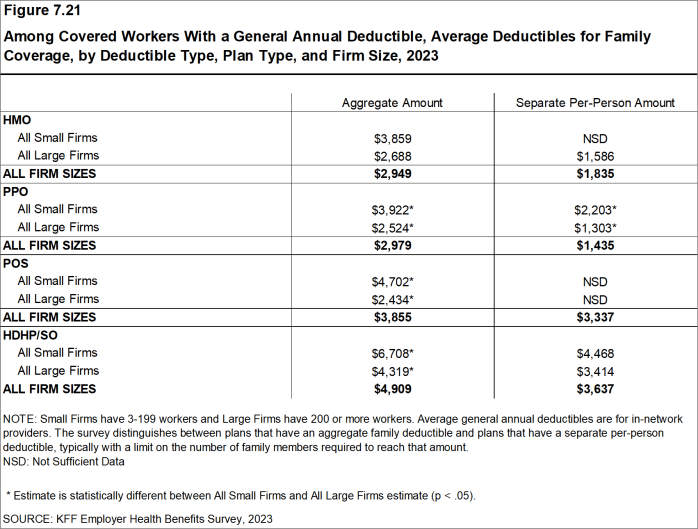

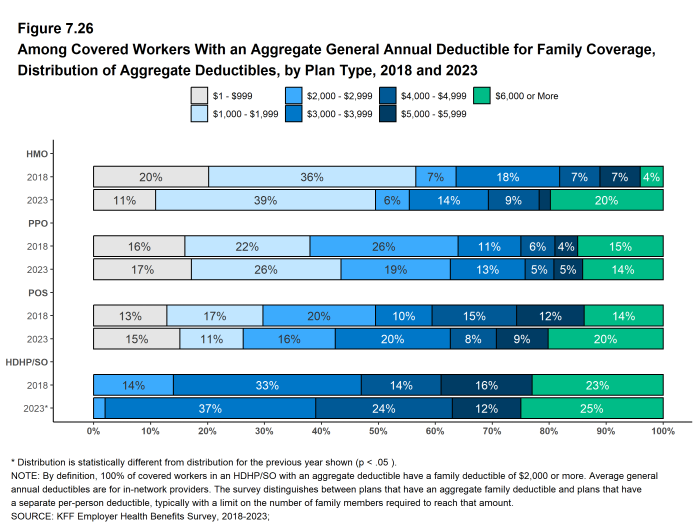

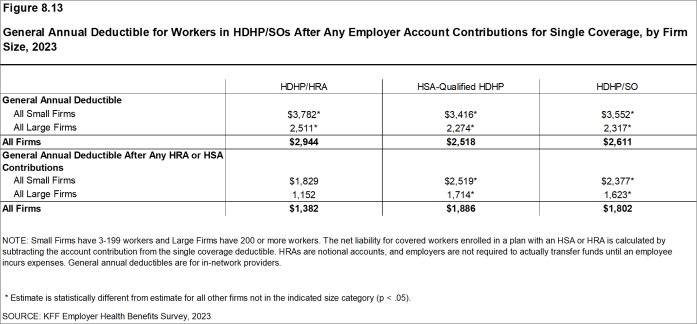

The average deductible amount in 2023 for workers with single coverage and a general annual deductible is $1,735, similar to last year. The average deductible for covered workers is much higher at small firms than large firms ($2,434 vs. $1,478). Among workers with single coverage and any deductible, the average deductible amount has increased 10% over the last five years and 53% over the last ten years.

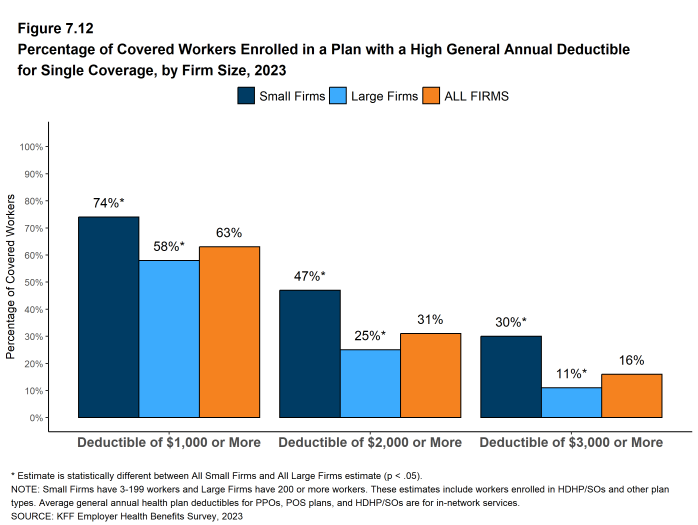

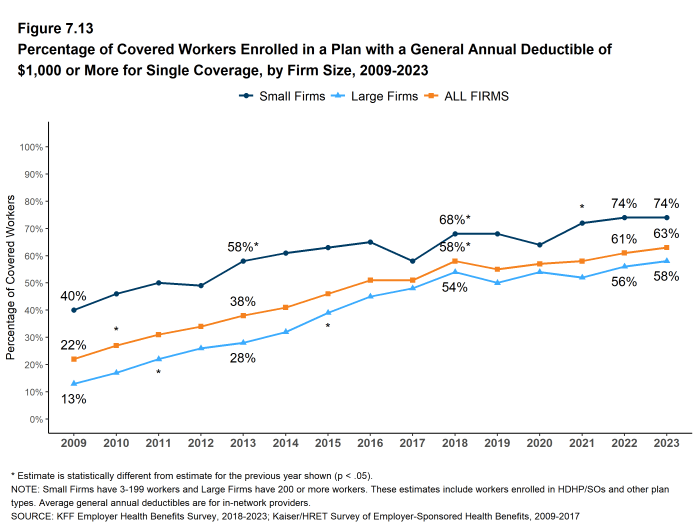

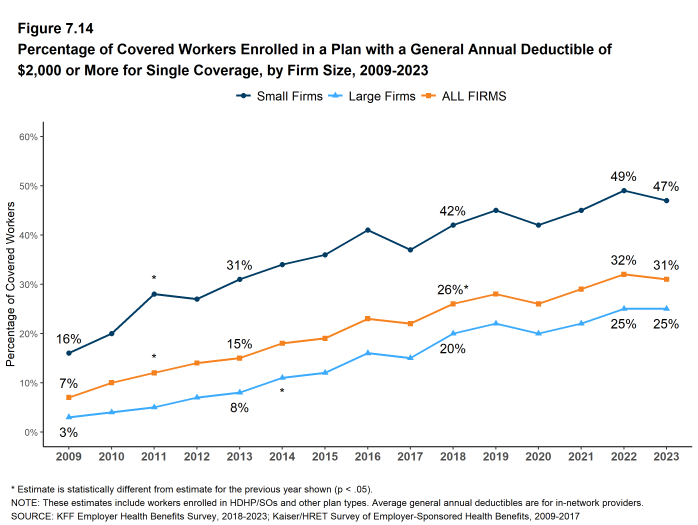

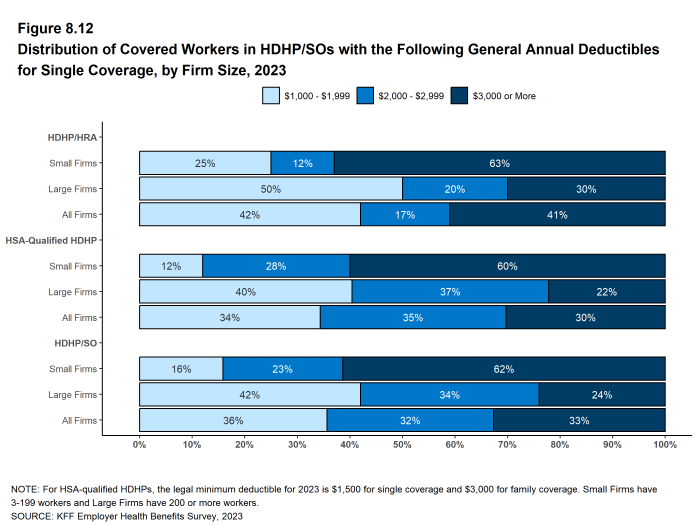

In 2023, among workers with single coverage, 47% of workers at small firms and 25% of workers at large firms have a general annual deductible of $2,000 or more. Over the last five years, the percentage of covered workers with a general annual deductible of $2,000 or more for single coverage has grown from 26% to 31% [Figure F].

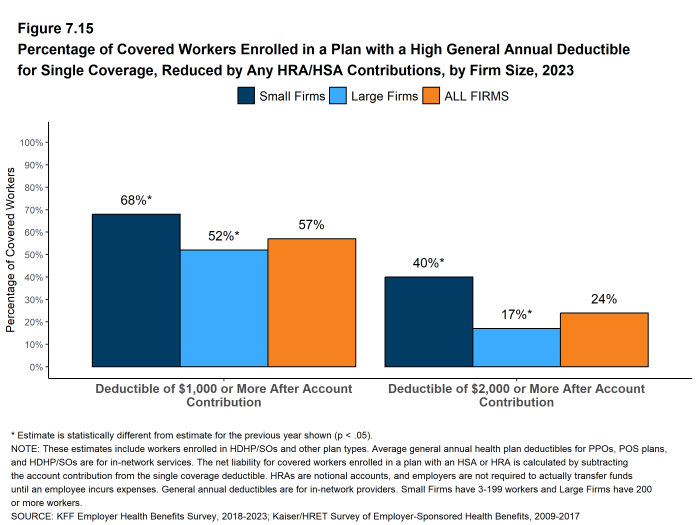

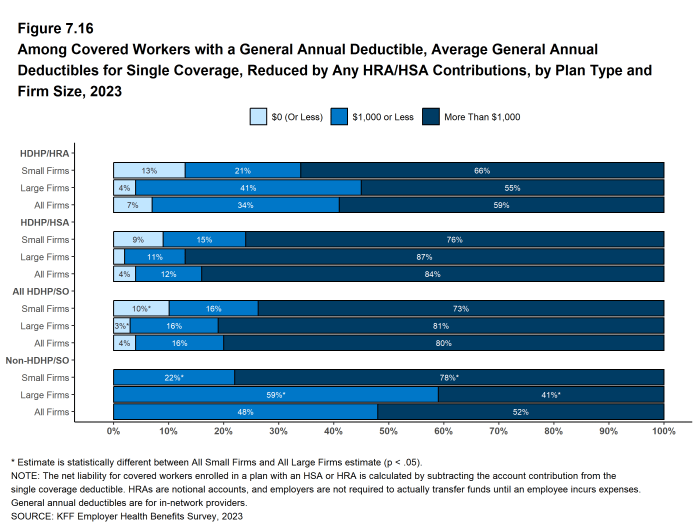

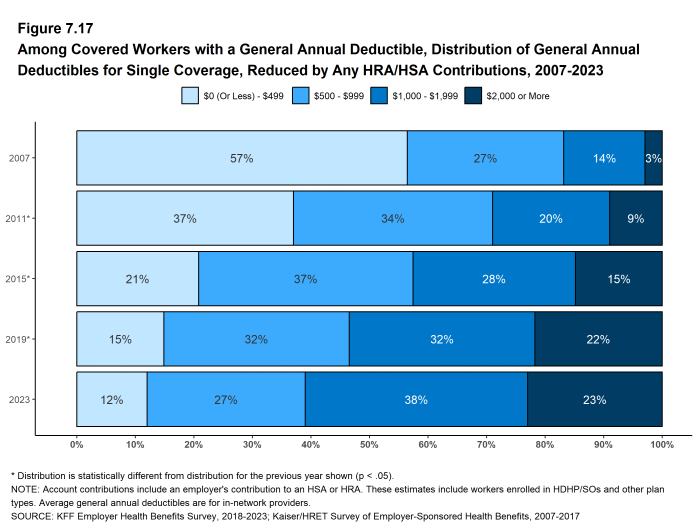

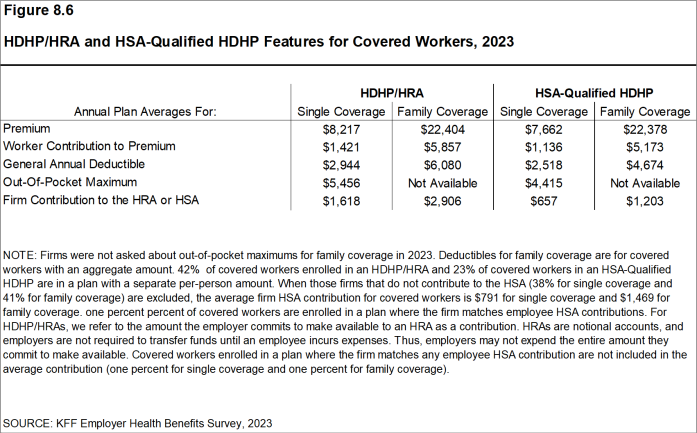

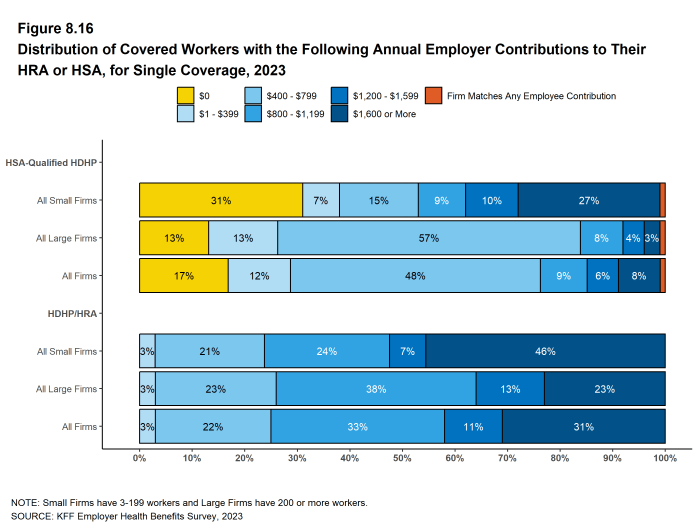

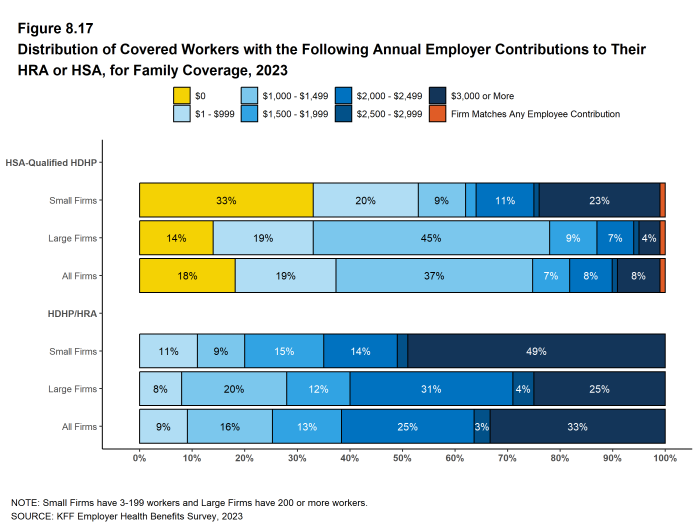

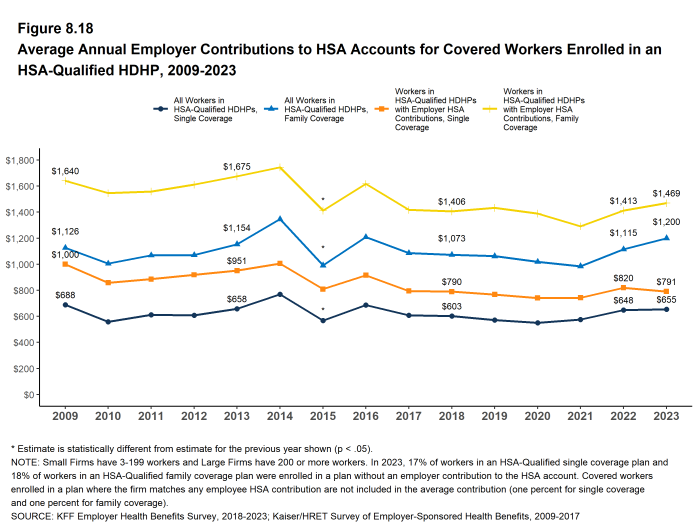

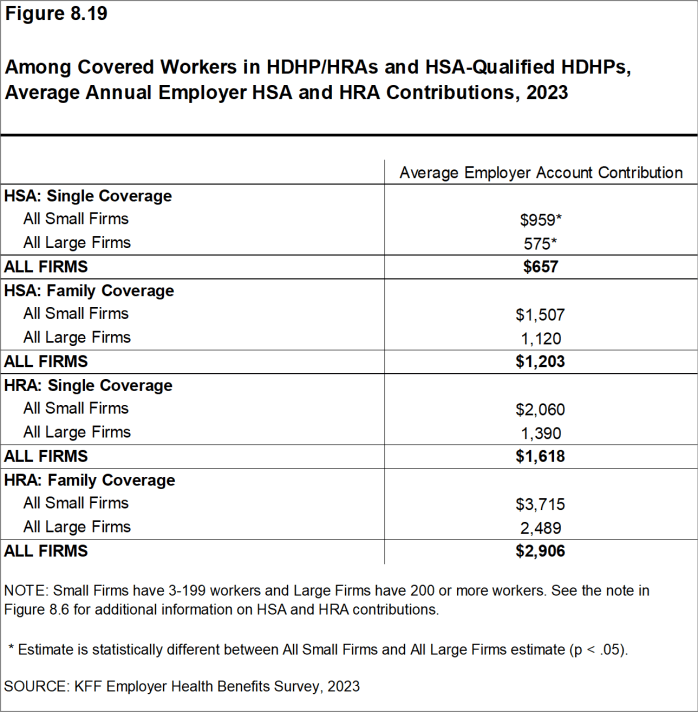

Some workers in health plans with high deductibles also receive contributions to savings accounts from their employers. These contributions can be used to reduce cost sharing amounts. Seven percent of covered workers in an HDHP with a Health Reimbursement Arrangement (HRA), and 4% of covered workers in a Health Savings Account (HSA)-qualified HDHP receive an account contribution for single coverage that is greater than or equal to their deductible amount. Additionally, 34% of covered workers in an HDHP with an HRA and 12% of covered workers in an HSA-qualified HDHP receive account contributions that, if applied to their deductible, would reduce their personal annual liability to less than $1,000.

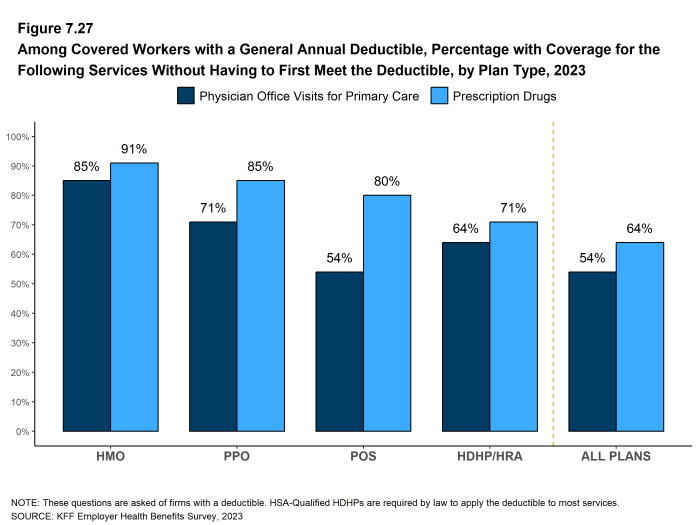

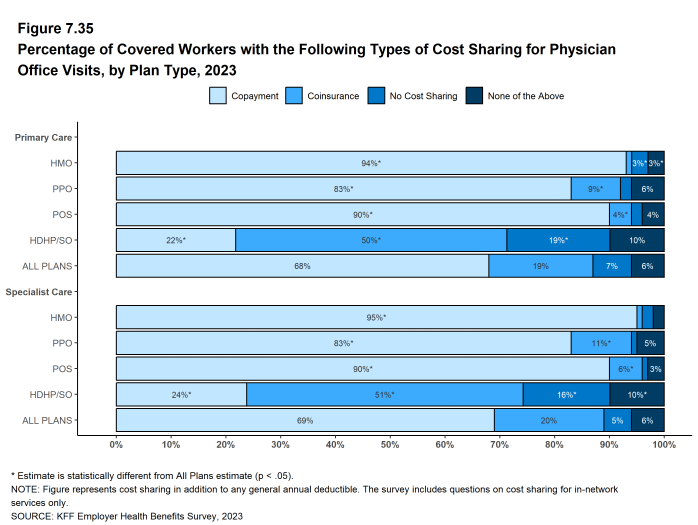

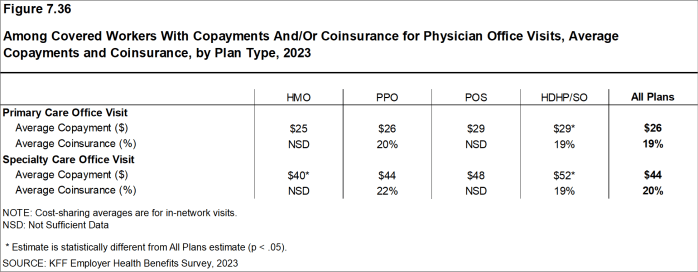

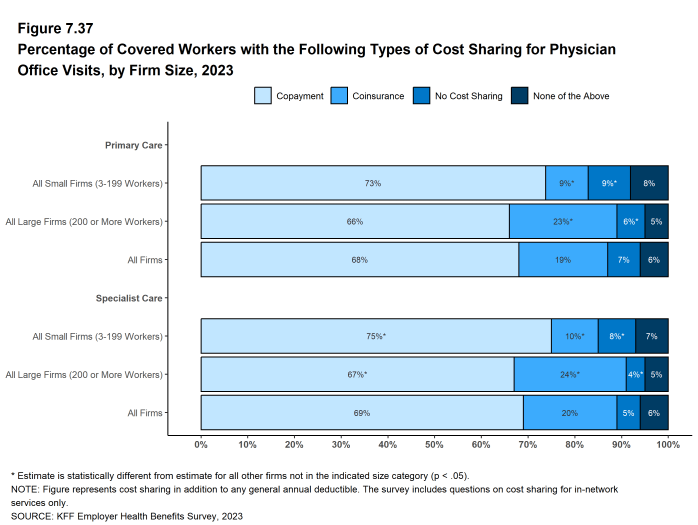

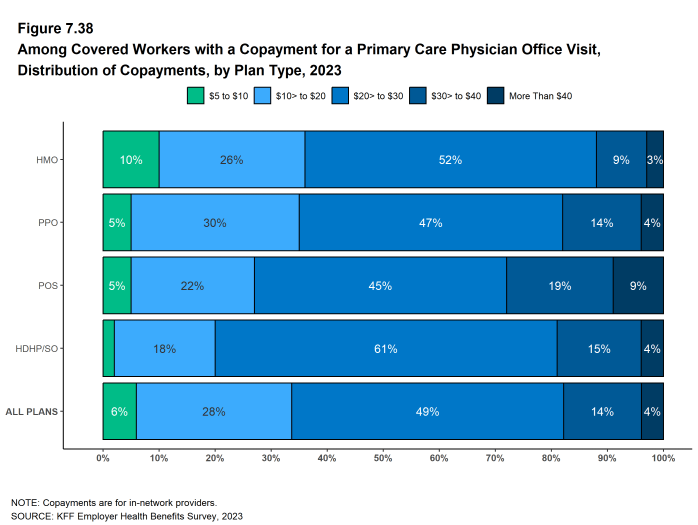

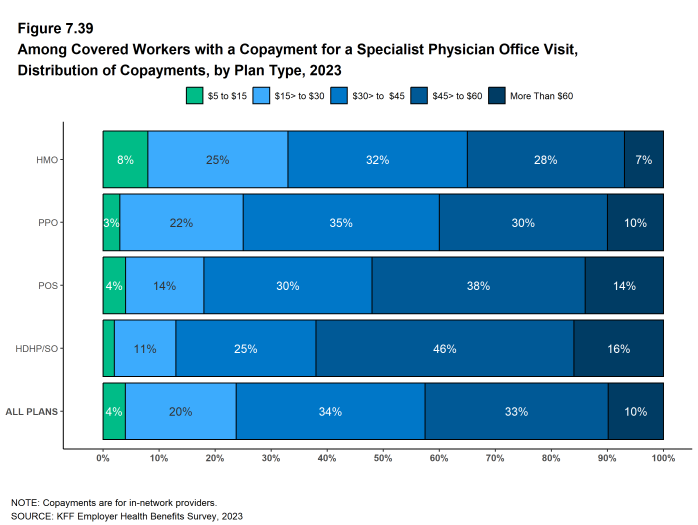

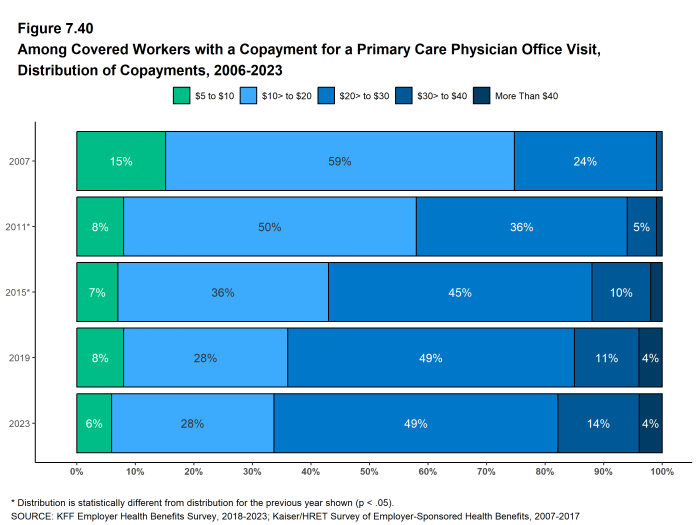

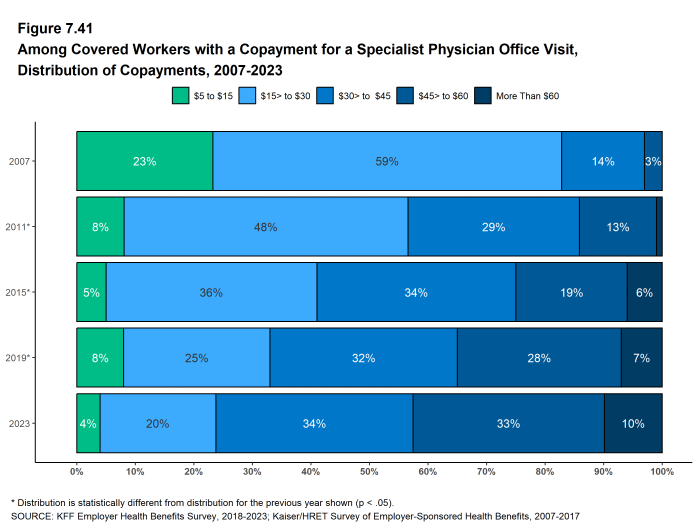

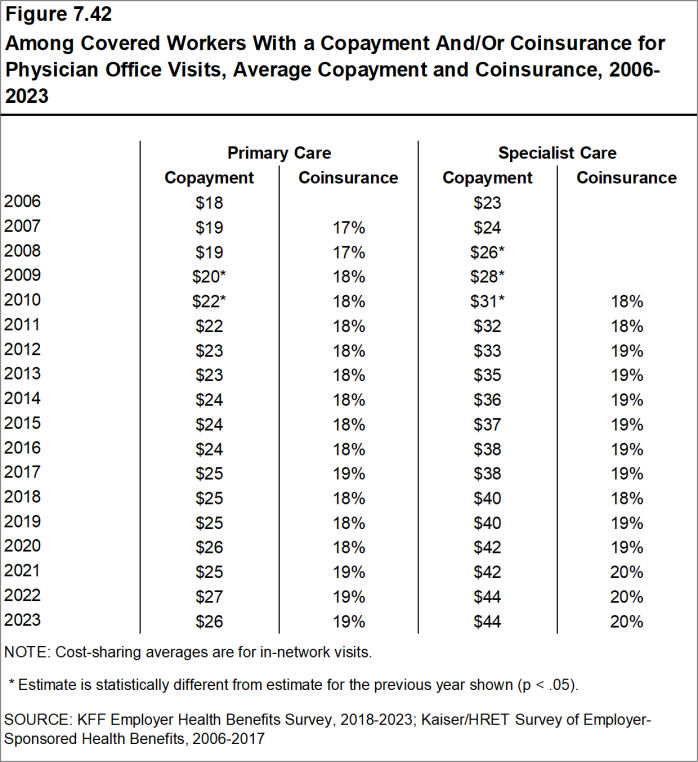

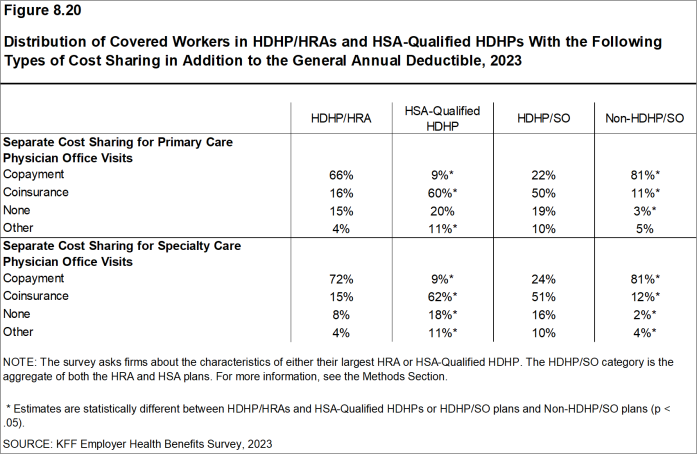

Regardless of their plan deductible, most covered workers also pay a portion of the cost for a physician office visit. Many covered workers face a copayment (a fixed dollar amount) when they visit a doctor, but some workers have coinsurance requirements (a percentage of the covered amount) instead. The average copayments are $26 for primary care and $44 for specialty care physician appointments, and average coinsurance rates are 19% for primary care and 20% for specialty care. These amounts are similar to 2022.

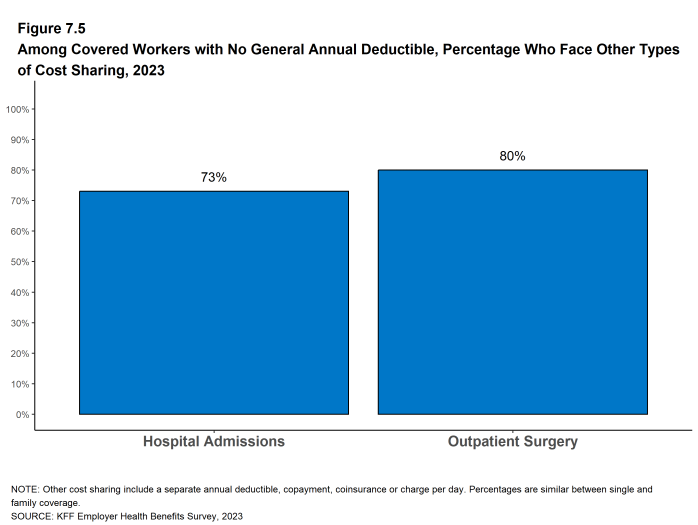

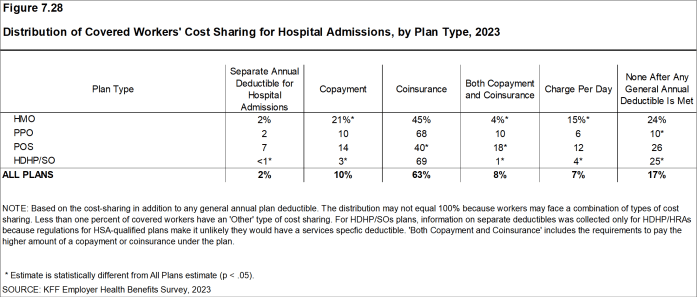

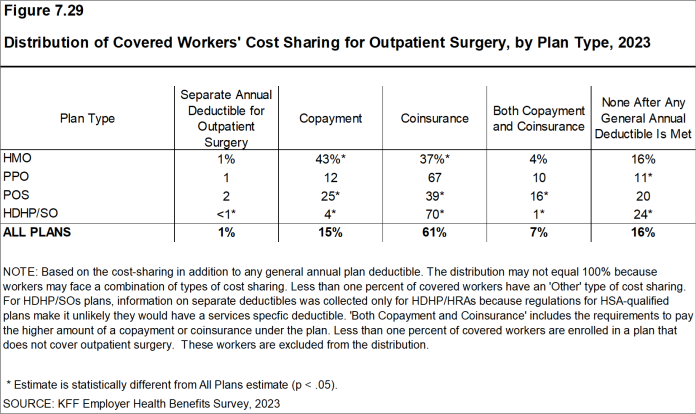

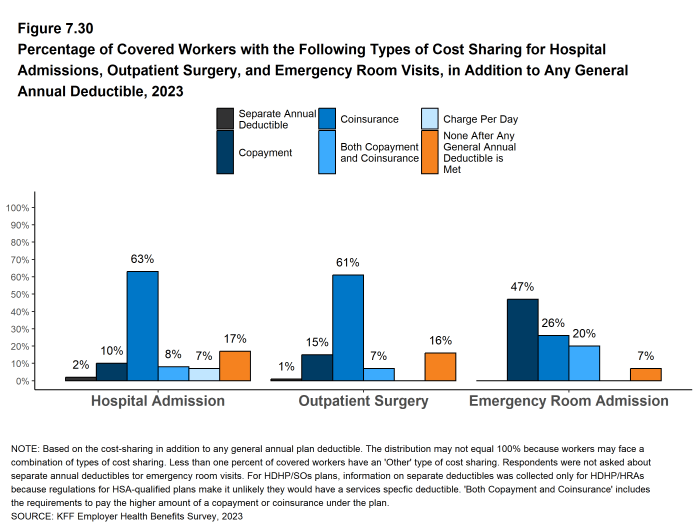

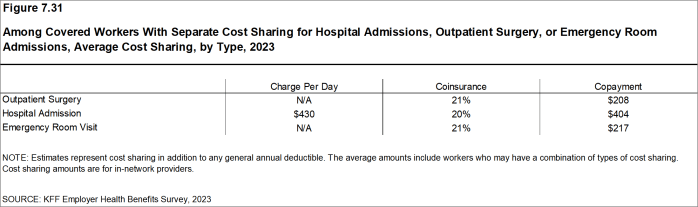

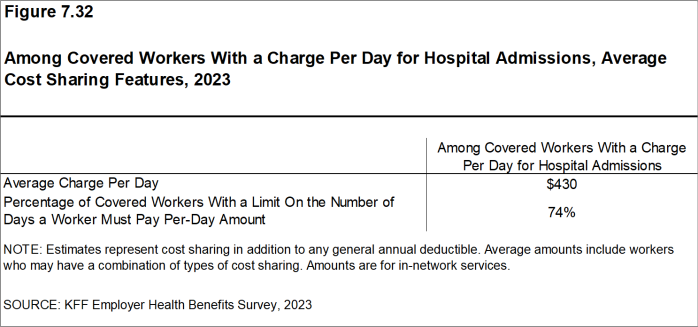

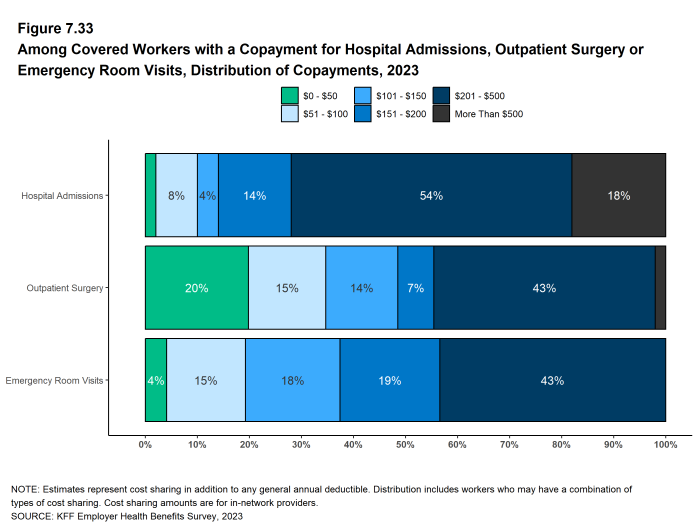

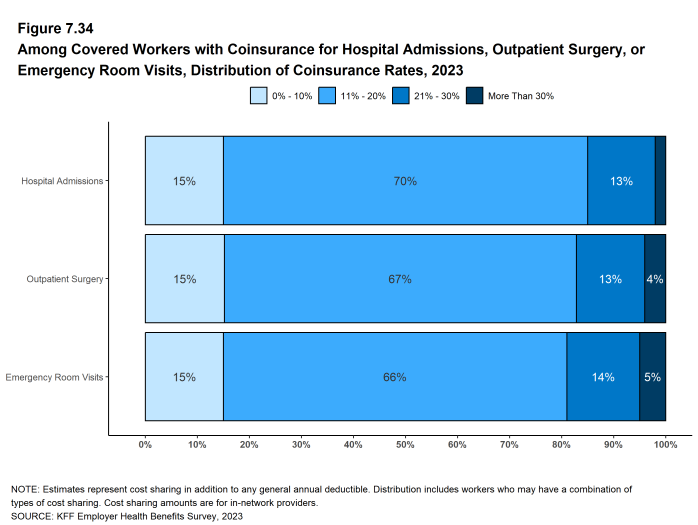

Most workers also face additional cost sharing for a hospital admission or outpatient surgery. Sixty-three percent of covered workers have coinsurance requirements, 10% have a copayment and 8% have both a copayment and coinsurance for hospital admissions. The average coinsurance rate for a hospital admission is 20% and the average copayment amount is $404. The cost sharing requirements for outpatient surgery follow a similar pattern to those for hospital admissions. However, the average copayment amount for outpatient surgery is lower, at $208.

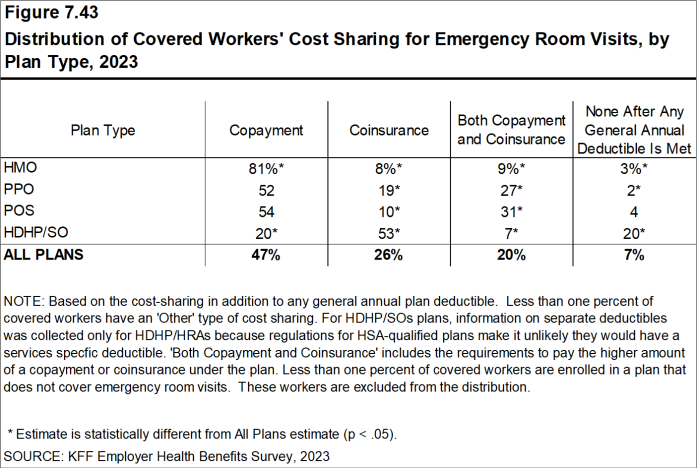

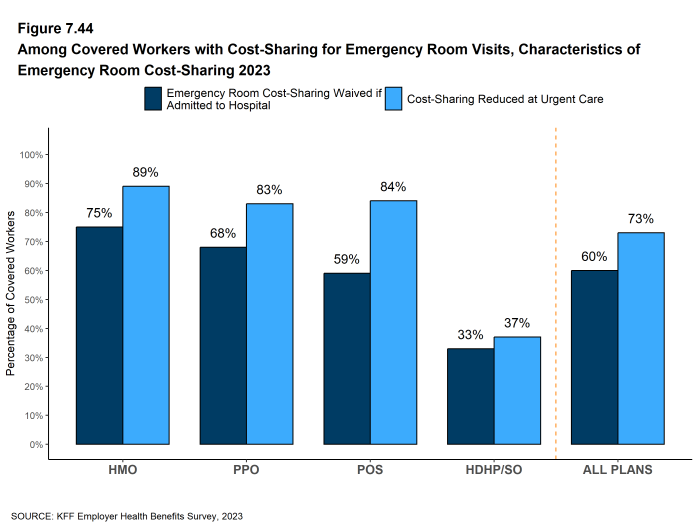

Over nine in ten (93%) covered workers face cost sharing for emergency room visits in addition to any general annual deductible in 2023. Among these covered workers, 47% have a copay for an ER visit, 26% have a coinsurance requirement and 20% have both a copay and coinsurance requirement or whichever is greater. The average copayment amount for an emergency room visit is $217 and the average coinsurance amount is 21%. The average copayment and coinsurance amounts are both higher for small firms than for large firms.

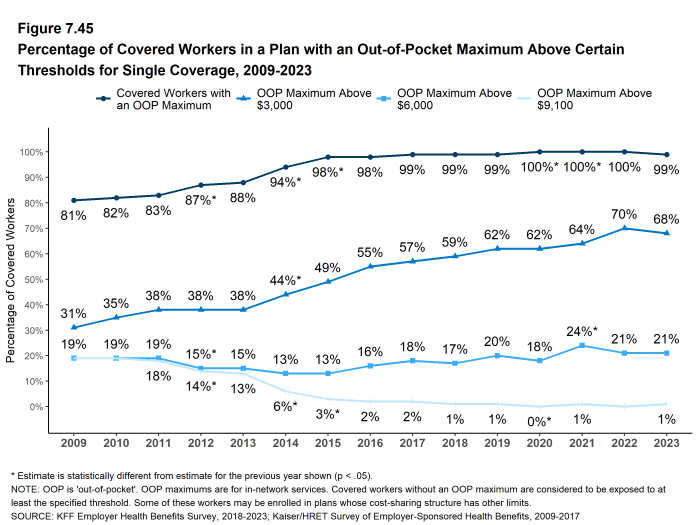

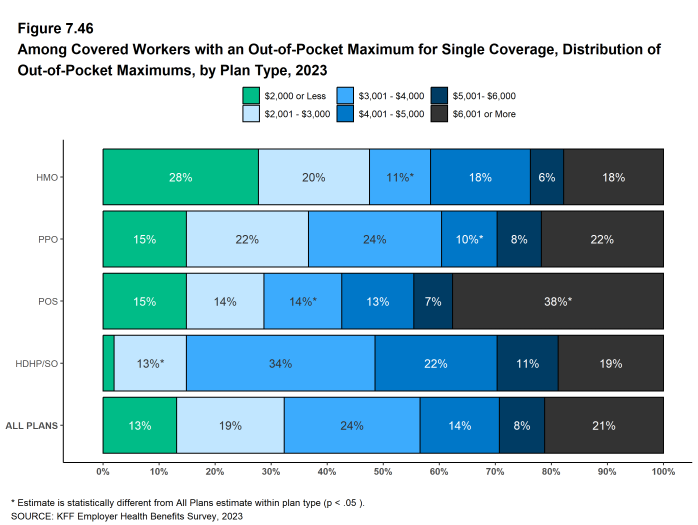

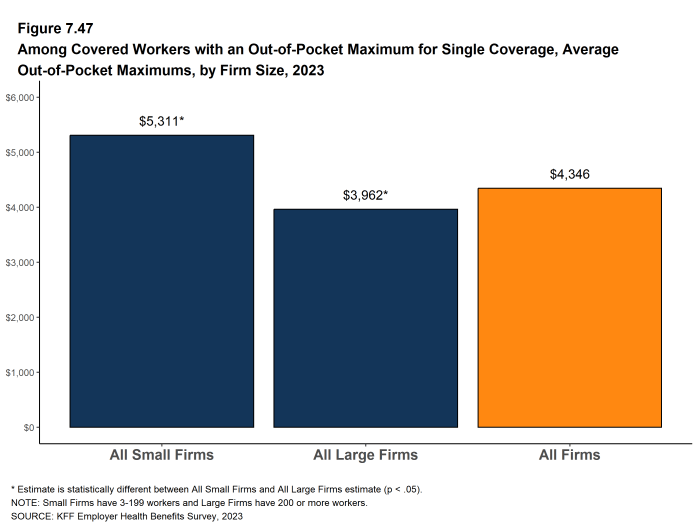

Virtually all covered workers are in plans with an annual limit on in-network cost sharing (called an out-of-pocket maximum) for single coverage, though these limits vary significantly. Among covered workers in plans with an out-of-pocket maximum for single coverage, 13% are in a plan with an out-of-pocket limit of $2,000 or less, while 21% are in a plan with a limit of $6,001 or more.

Figure F: Percentage of Covered Workers Enrolled in a Plan With a General Annual Deductible of $2,000 or More for Single Coverage, by Firm Size, 2009-2023

AVAILABILITY OF EMPLOYER-SPONSORED COVERAGE

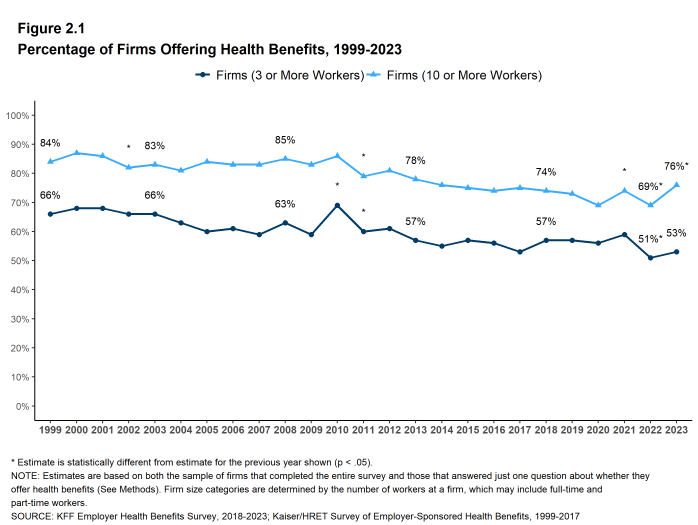

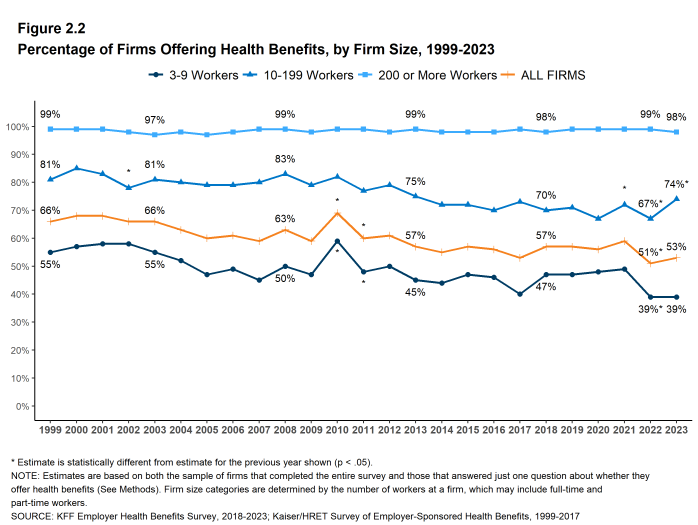

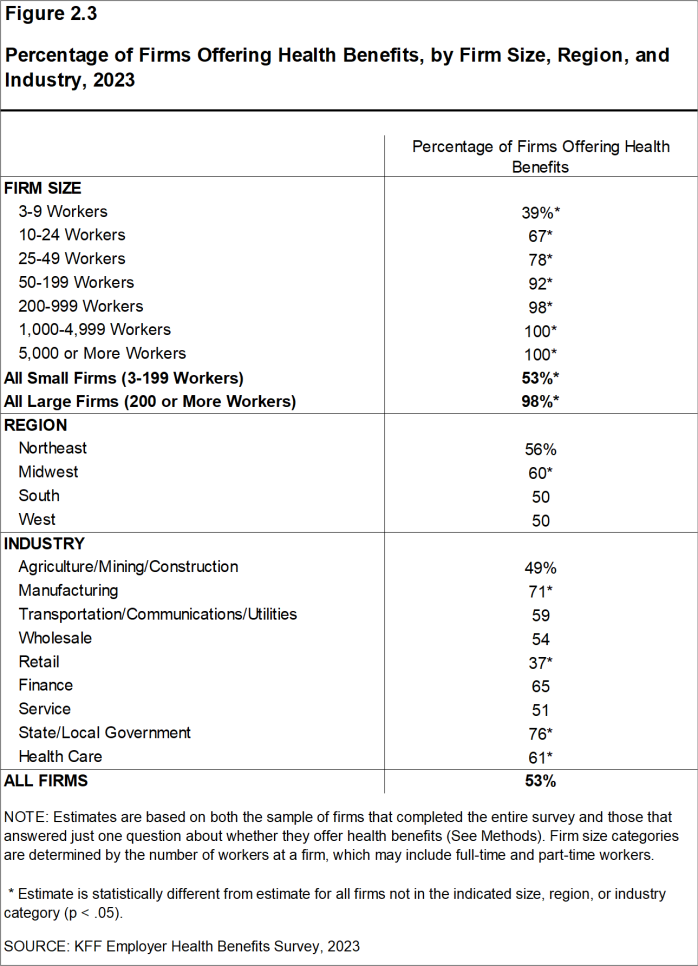

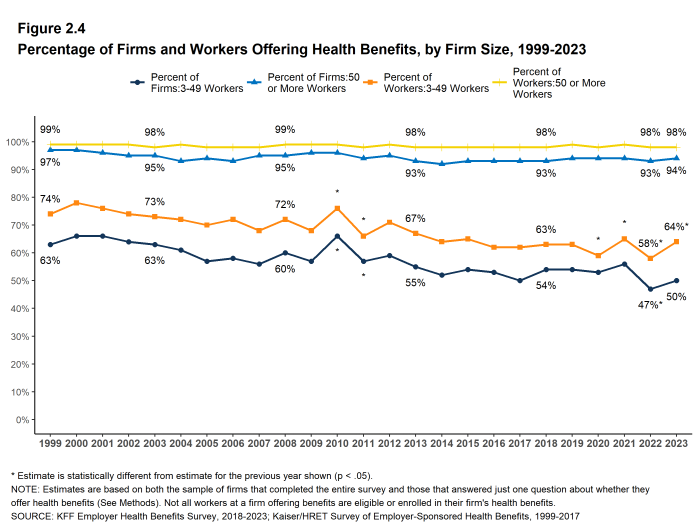

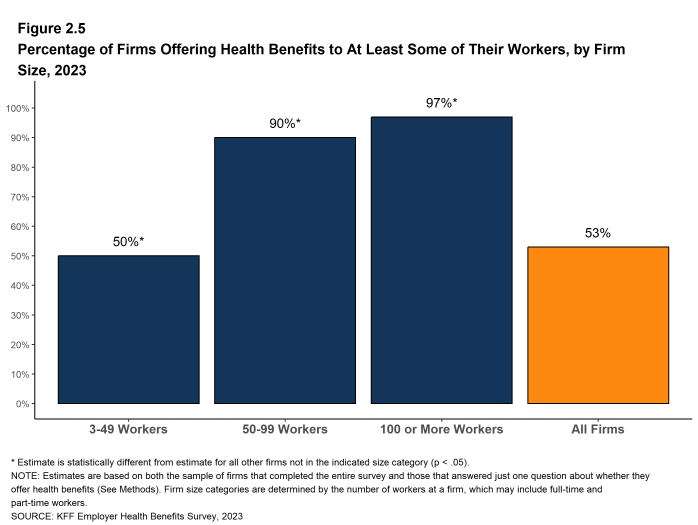

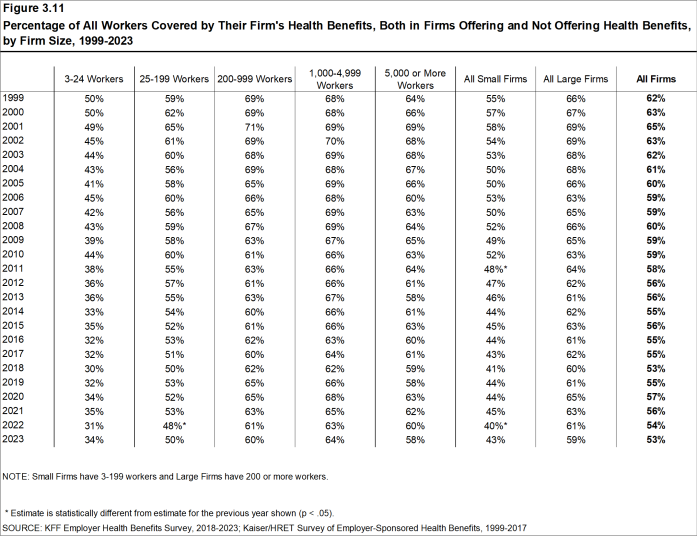

While nearly all large firms (firms with 200 or more workers) offer health benefits to at least some workers, small firms (3-199 workers) are significantly less likely to do so. In 2023, 53% of all firms offered some health benefits, similar to the percentage last year (51%).

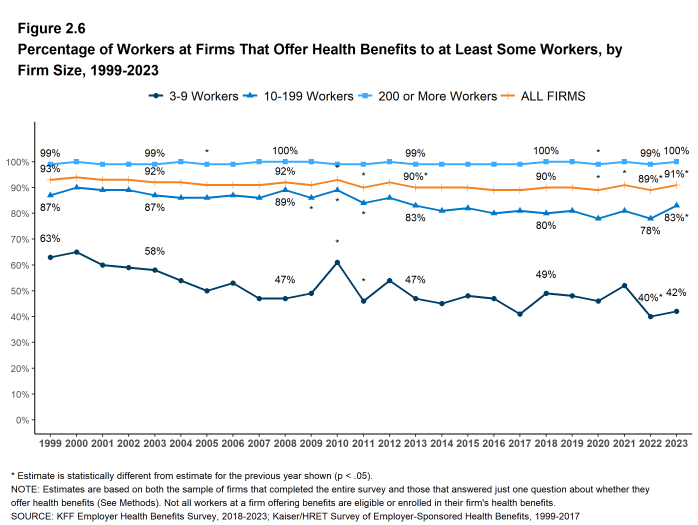

Most firms are very small, leading to fluctuations in the overall offer rate, as the offer rates of small firms can vary widely from year to year. Most workers, however, work for larger firms, where the offer rates are high and much more stable. Over ninety percent (94%) of firms with 50 or more workers offer health benefits in 2023. This percentage has remained consistent over the last 10 years. Overall, 91% of workers employed at firms with 3 or more workers are employed at a firm that offers health benefits to at least some of its workers.

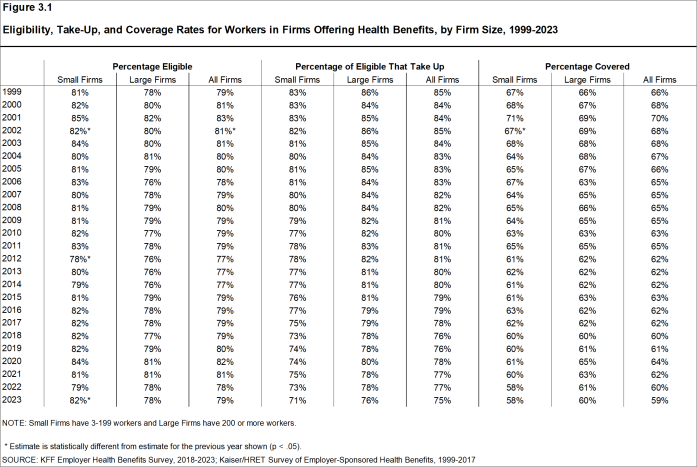

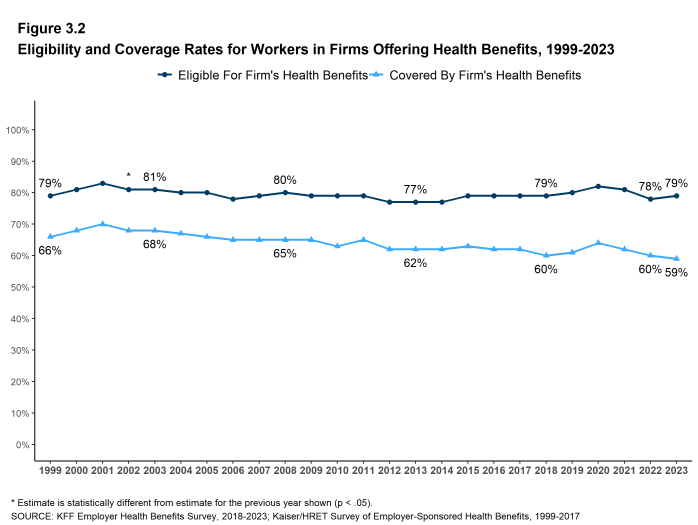

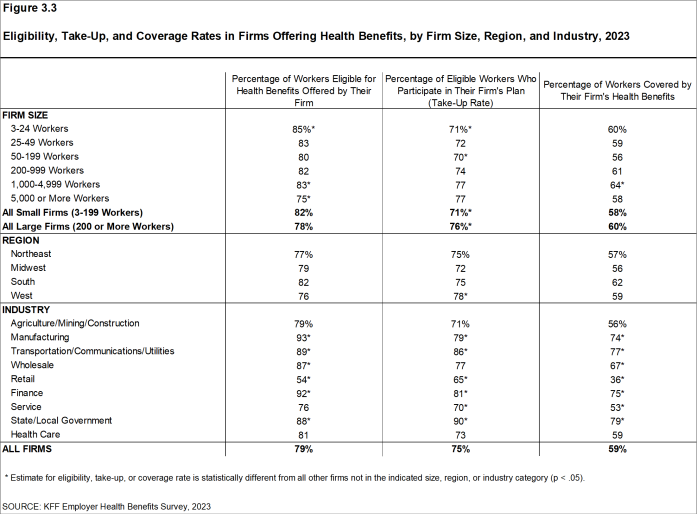

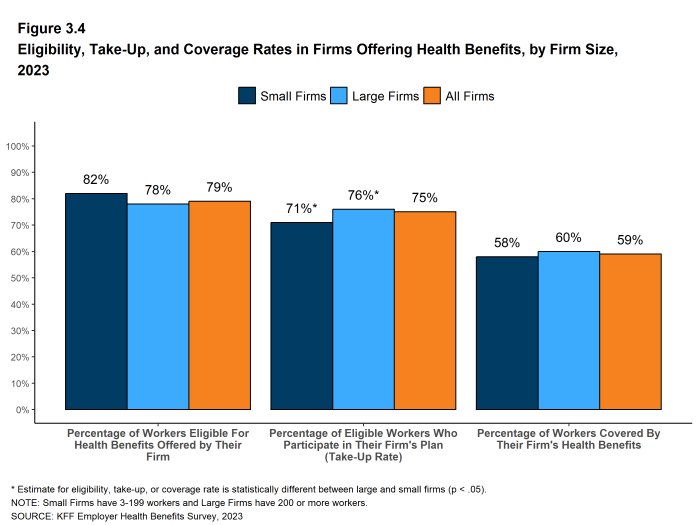

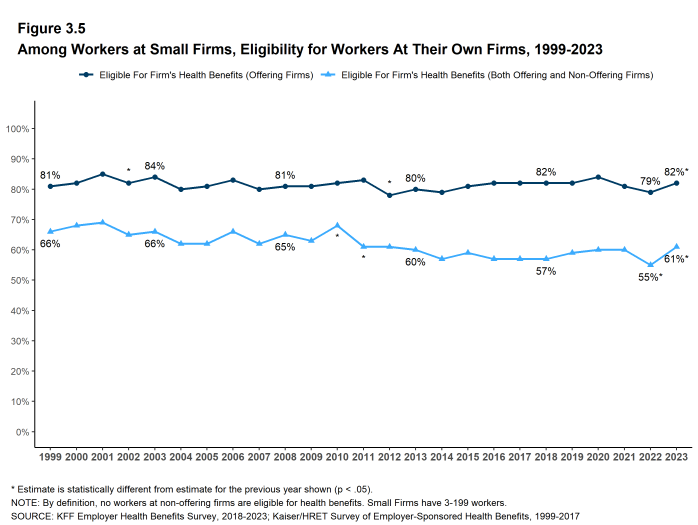

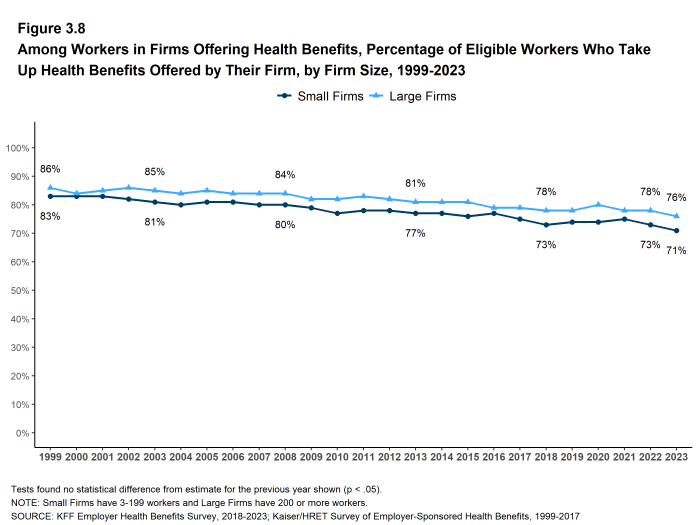

Although the vast majority of workers are employed by firms that offer health benefits, many workers are not covered by their employers. Some are not eligible to enroll (due to factors such as waiting periods or part-time or temporary work status), while others who are eligible choose not to enroll (they may feel the coverage is too expensive, or they may be covered through another source). Overall, at firms that offer coverage, an average of 79% of workers are eligible. Among eligible workers, 75% take up the firm’s offer. Ultimately, 59% of workers at firms that offer health benefits are enrolled in coverage. All of these percentages are similar to those in 2022.

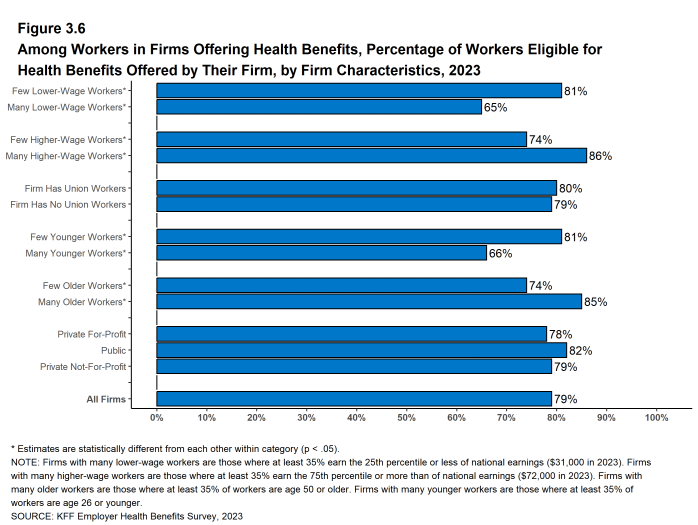

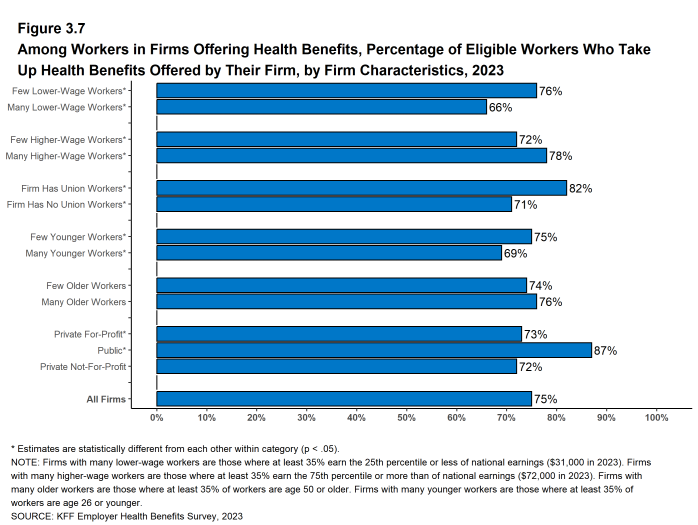

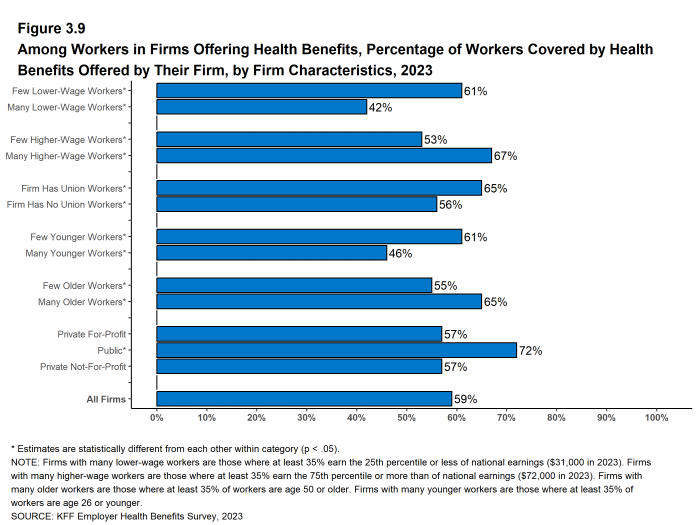

Among workers at firms offering health benefits, those at firms with a relatively large share of lower-wage workers are less likely to be covered by their own firm than workers at firms with a smaller share of lower-wage workers (42% vs. 61%)3. Similarly, workers at firms with a relatively large share of higher-wage workers are more likely to be covered by their employer’s health benefits than those at firms with a smaller share of higher-wage workers (67% vs. 53%). The share of workers employed at public organizations covered by their own employer (72%) is higher than the shares of workers employed at private for-profit firms (57%) or private non-for-profit firms (57%) covered at their work.

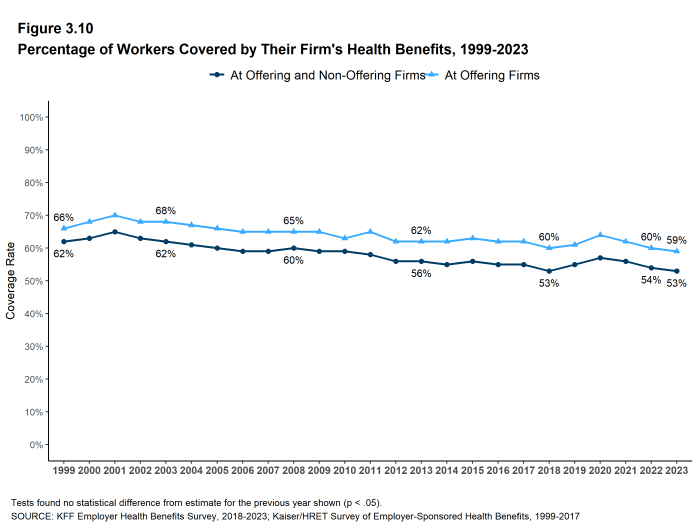

Across firms that offer health benefits and firms that do not, 53% of all workers are covered by health plans offered by their employer. This is similar to the percentage last year..

HEALTH PROMOTION AND WELLNESS PROGRAMS

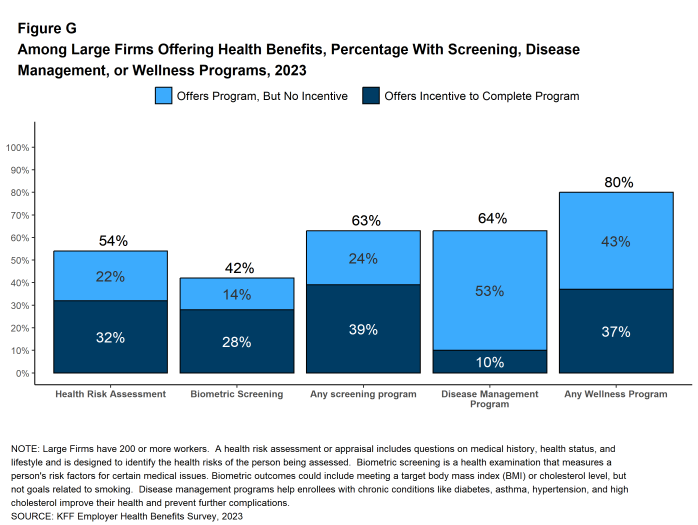

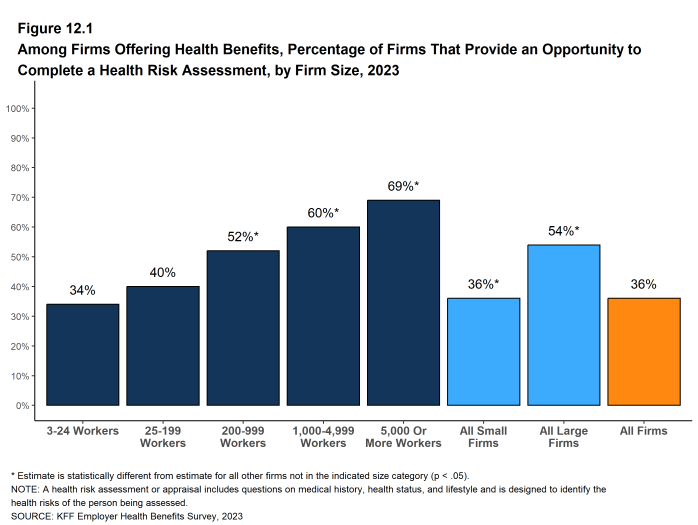

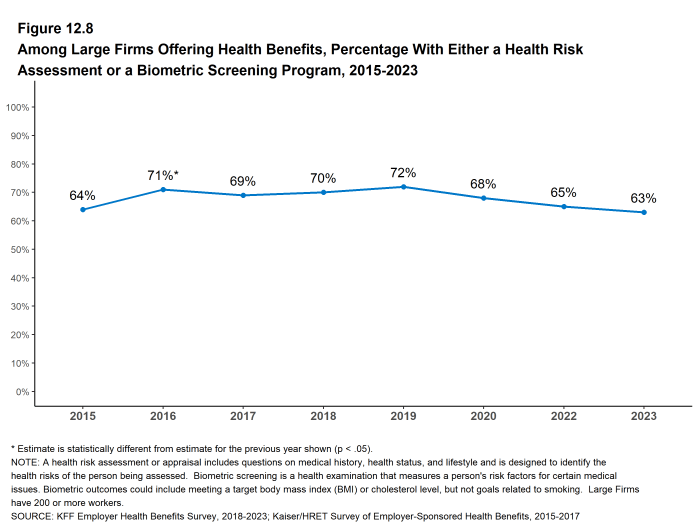

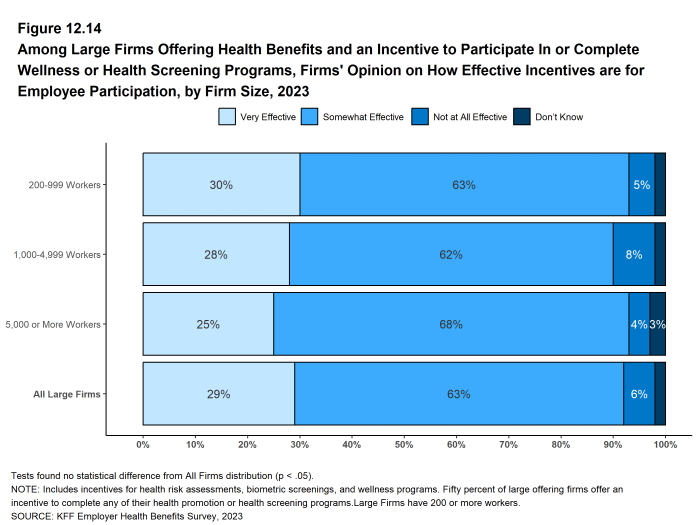

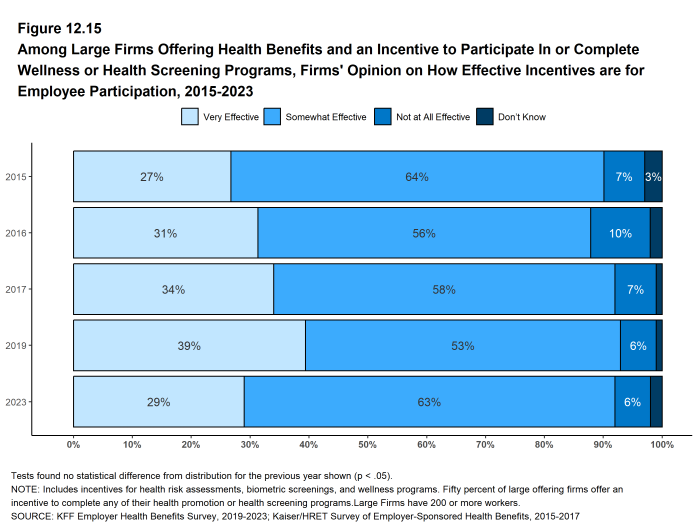

Many firms have programs that help workers identify health issues and manage chronic conditions. These programs include health risk assessments, biometric screenings, and health promotion programs [Figure G].

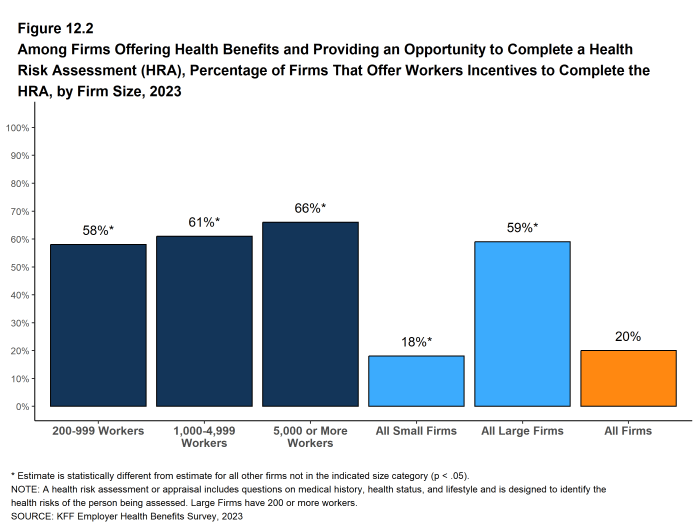

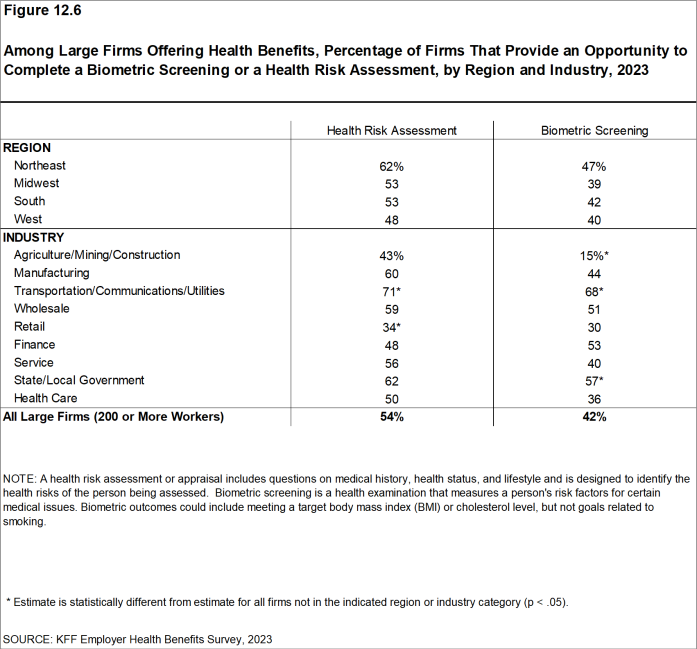

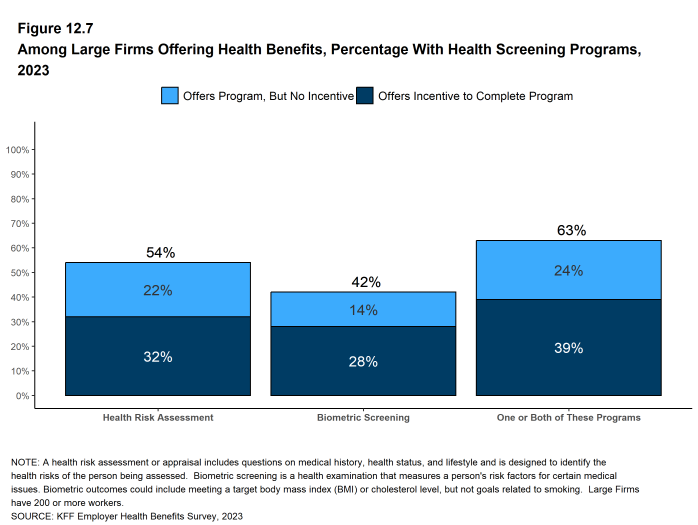

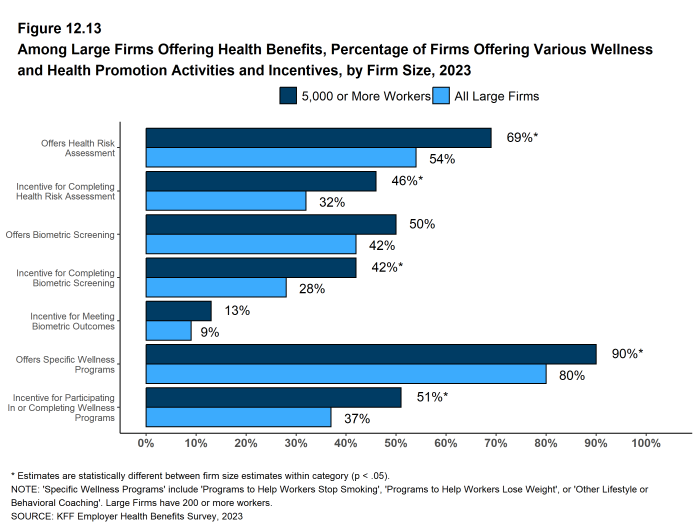

Health Risk Assessments. Among firms offering health benefits, 36% of small firms and 54% of large firms provide workers the opportunity to complete a health risk assessment, similar to the percentages last year. Among large firms that offer a health risk assessment, 59% use incentives or penalties to encourage workers to complete the assessment, higher than the percentage (50%) in 2022.

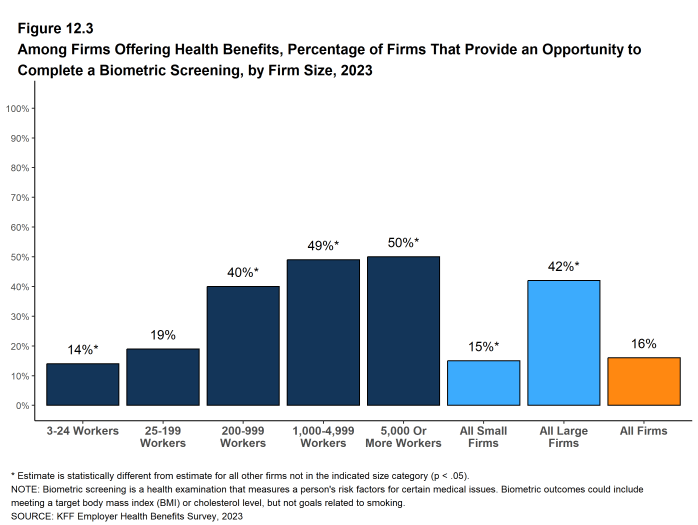

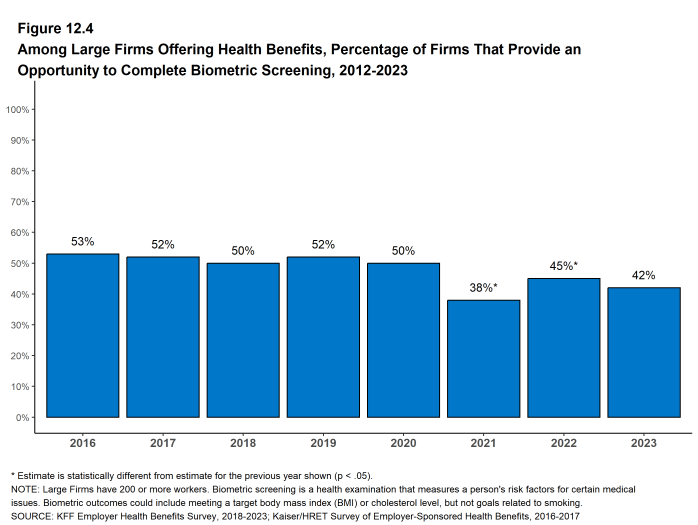

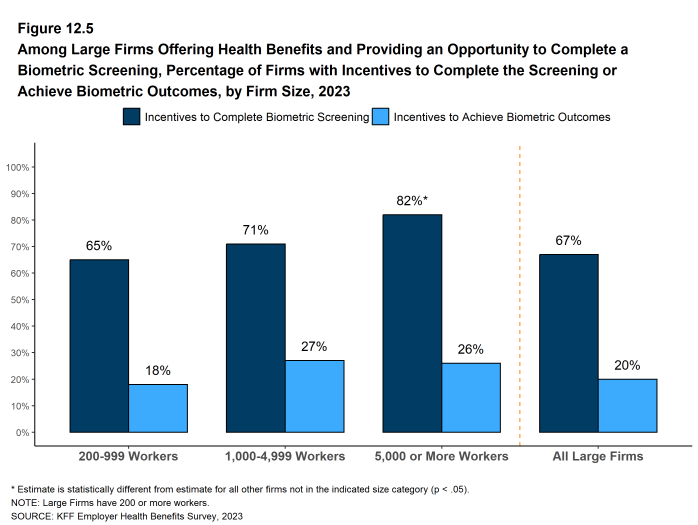

Biometric Screenings. Among firms offering health benefits, 15% of small firms and 42% of large firms provide workers the opportunity to complete a biometric screening, similar to the percentages last year. Among large firms with a biometric screening program, 67% use incentives or penalties to encourage workers to complete the assessment. Although this is a larger share than last year (57%), it is not significantly different.

Figure G: Among Large Firms Offering Health Benefits, Percentage With Screening, Disease Management, or Wellness Programs, 2023

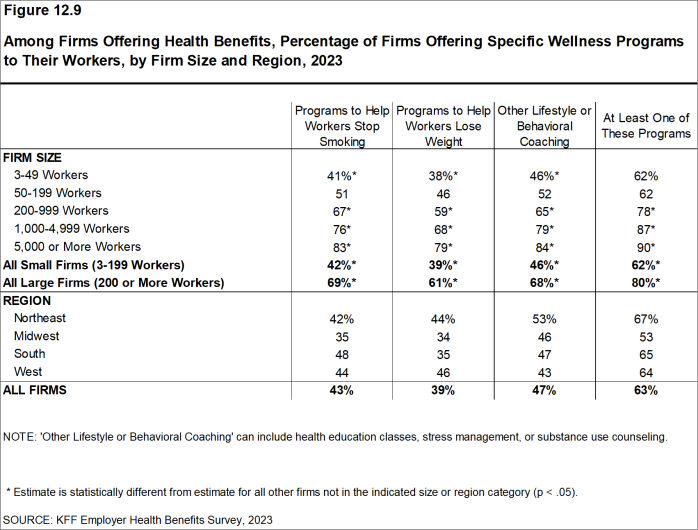

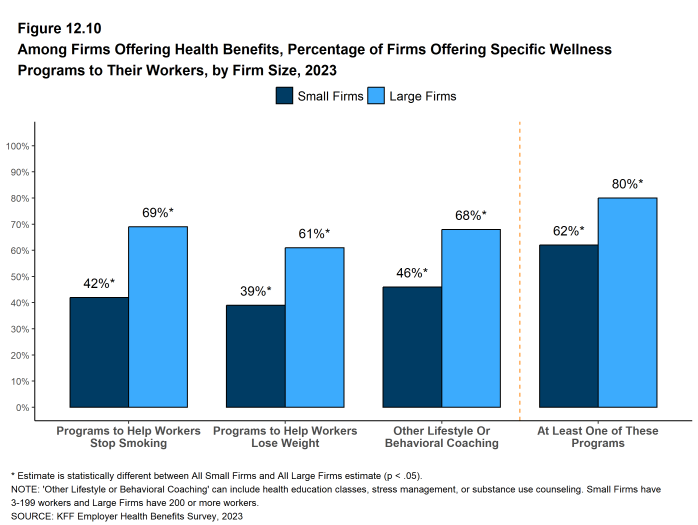

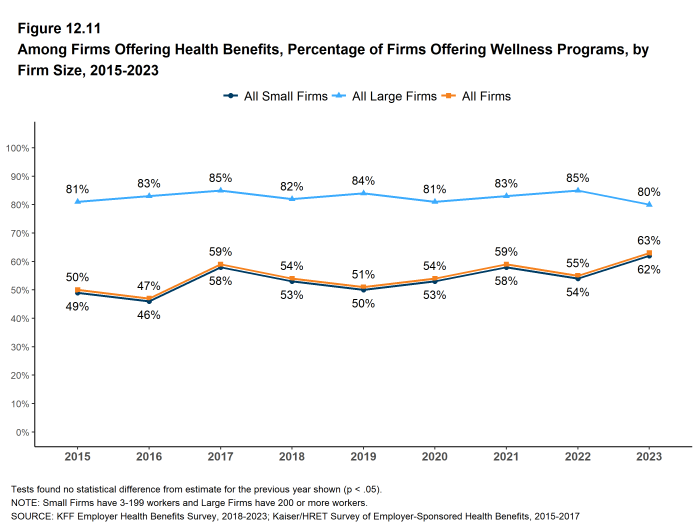

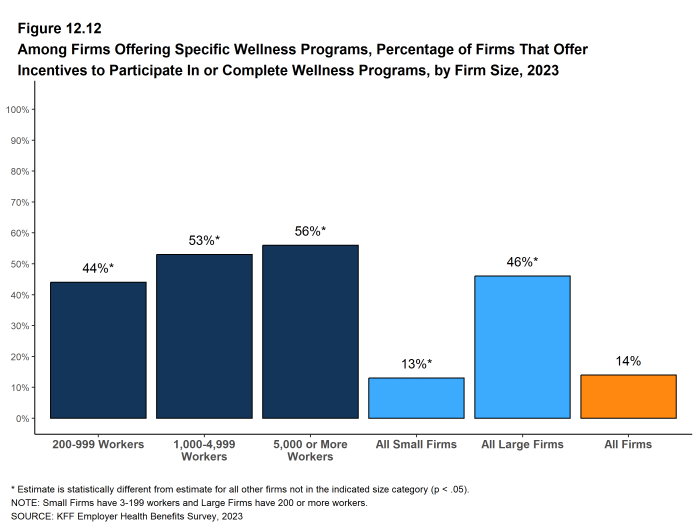

Health and Wellness Promotion Programs. Most firms offering health benefits offer programs to help workers identify and address health risks and unhealthy behaviors. Sixty-two percent of small firms and 80% of large firms offer a program in at least one of these areas: smoking cessation, weight management, and behavioral or lifestyle coaching. The percentage of both small firms and large firms offering one of these programs are similar to the percentages last year (54% and 85% respectively).

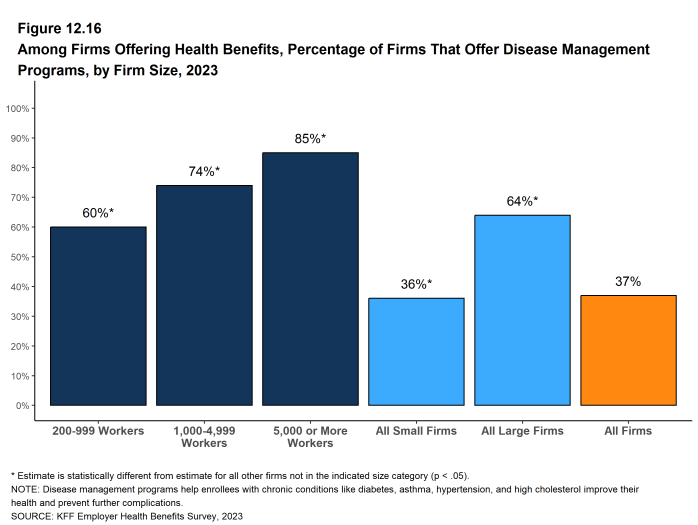

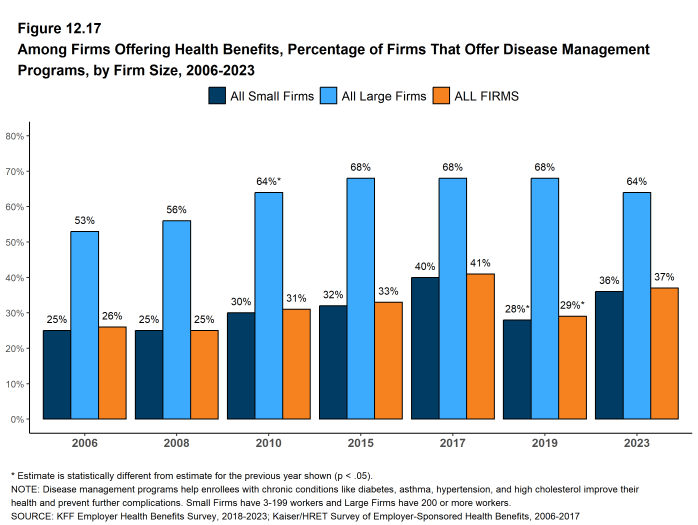

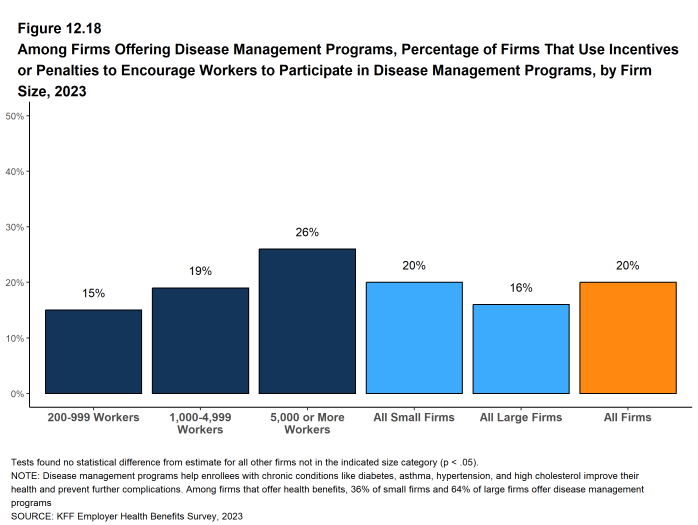

Disease Management Programs. Among firms that offer health benefits, 36% of small firms and 64% of large firms offer disease management programs. These programs aim to improve health and reduce costs for enrollees with certain chronic illnesses by educating them about their disease and suggesting treatment options..

EMPLOYER PERCEPTIONS OF ENROLLEE SATISFACTION

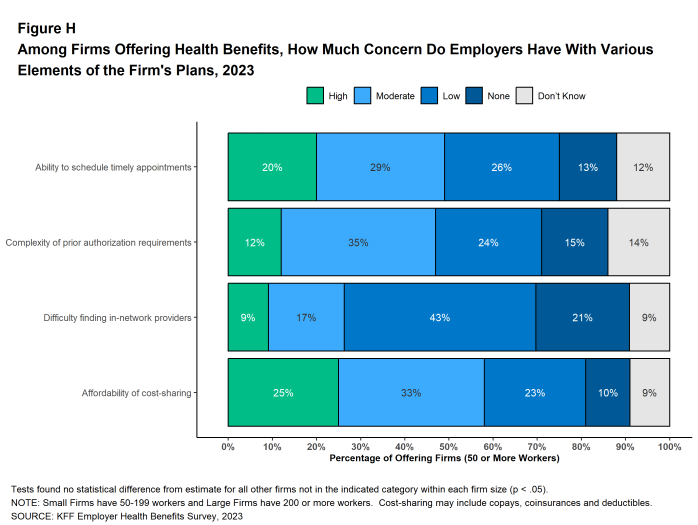

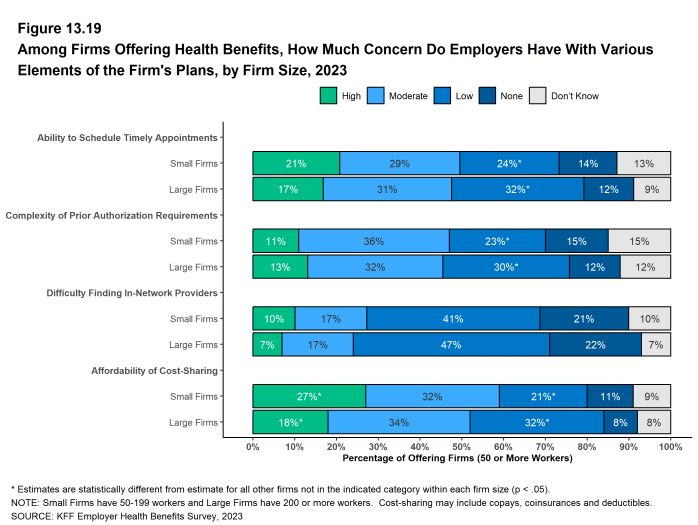

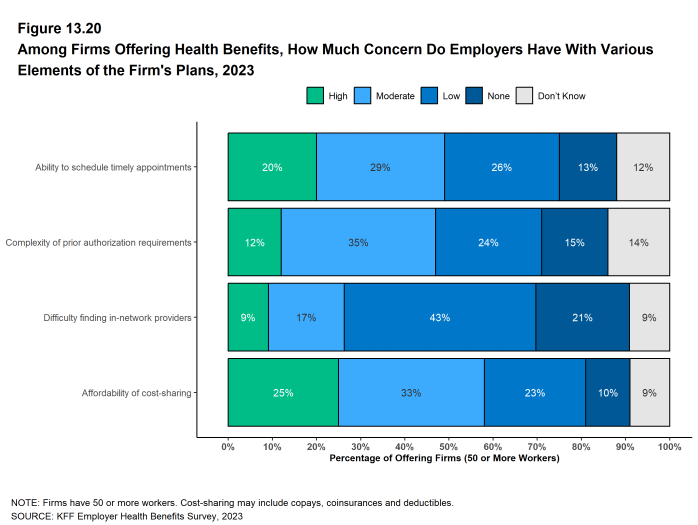

Employers use health benefits to attract and keep workers, making them an important part of the overall compensation that employers provide. Employers therefore have strong interest in assuring that their health benefit plans perform well and are viewed favorably by their workers. At the same time, health benefits are expensive. Therefore, employers manage plan costs within the broader context of the overall compensation they offer to their employees. Employers with 50 or more employees offering health benefits were asked about their views regarding the level of concern their employees had over certain aspects of their health benefit plans:

- Appointments – Twenty percent of these employers believe that their employees have a “high” level of concern about their ability to schedule timely appointments for care, and another 29% believe that their employees have a “moderate” level of concern.

- Prior Authorization – Twelve percent of these employers believe that their employees have a “high” level of concern about the complexity of prior authorization requirements in their health plan, and another 35% believe that their employees have a “moderate” level of concern.

- Finding In-Network Providers – Nine percent of these employers believe that their employees have a “high” level of concern about the difficulty of finding in-network providers, and another 17% believe that their employees have a “moderate” level of concern.

- Affordability of Cost Sharing – Twenty-five percent of these employers believe that their employees have a “high” level of concern about the affordability of cost sharing, and another 33% believe that their employees have a “moderate” level of concern.

Figure H: Among Firms Offering Health Benefits, How Much Concern Do Employers Have With Various Elements of the Firm’s Plans, 2023

HEALTH PLAN PROVIDER NETWORKS

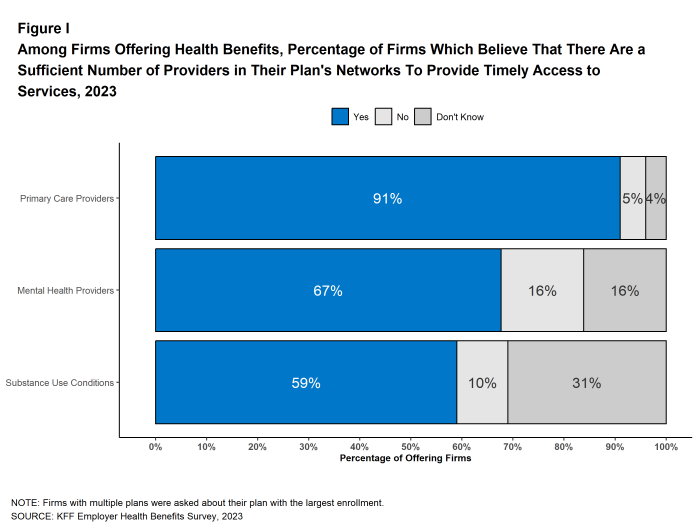

Firms and health plans structure their networks of providers to ensure access to care, as well as to encourage enrollees to use providers who are lower cost or who provide better care. The breadth and composition of plan networks are key components in assuring timely access to necessary medical care for plan enrollees.

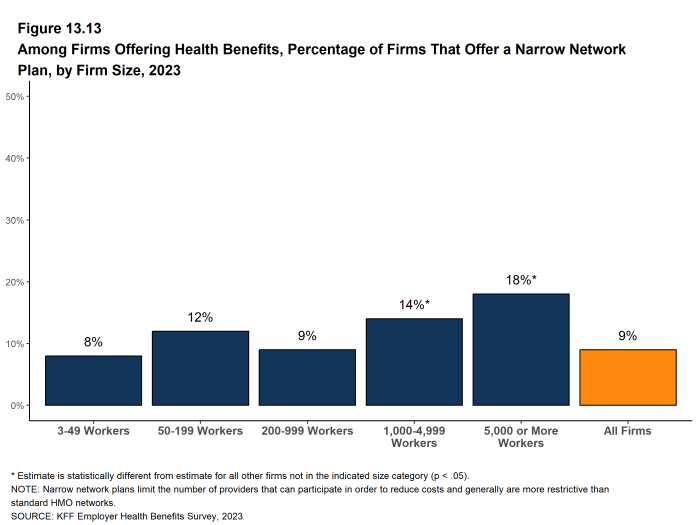

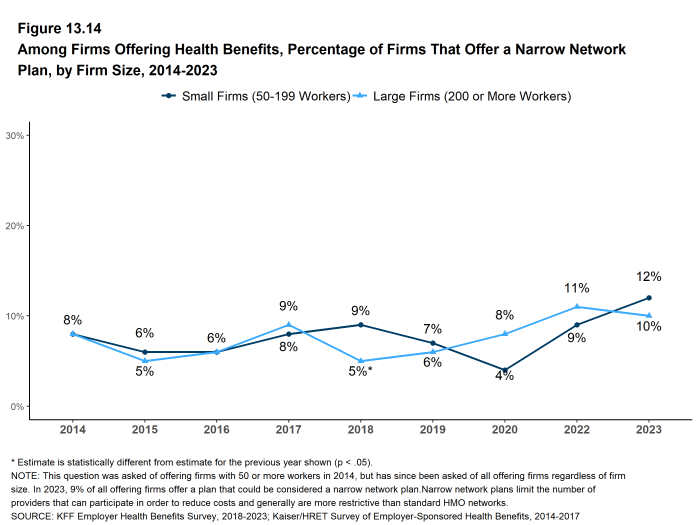

Narrow Networks Some employers offer a health plan with a relatively small, or narrow, network of providers. Narrow network plans reduce costs by limiting the number of providers that can participate, and generally are more restrictive than standard HMO networks. Nine percent of firms offering health benefits in 2023 report that they offer at least one plan that they considered to be a narrow network plan, the same as the percentage reported last year (9%). Firms with 1,000 to 4,999 workers and firms with 5,000 or more workers are more likely than smaller firms to offer at least one plan with a narrow network (14% and 18% respectively).

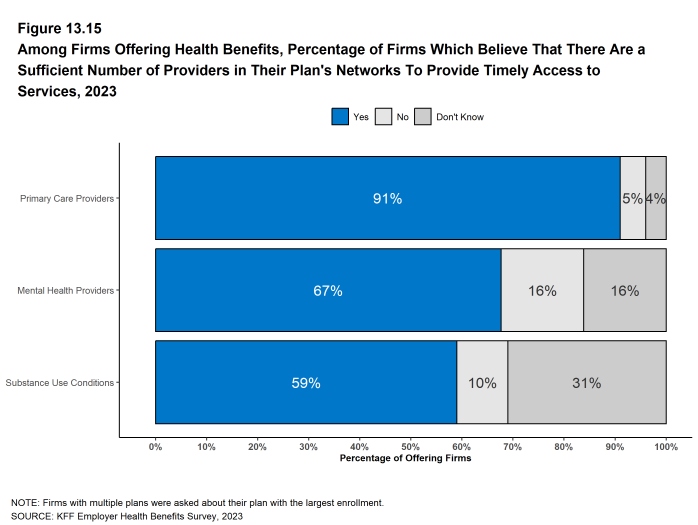

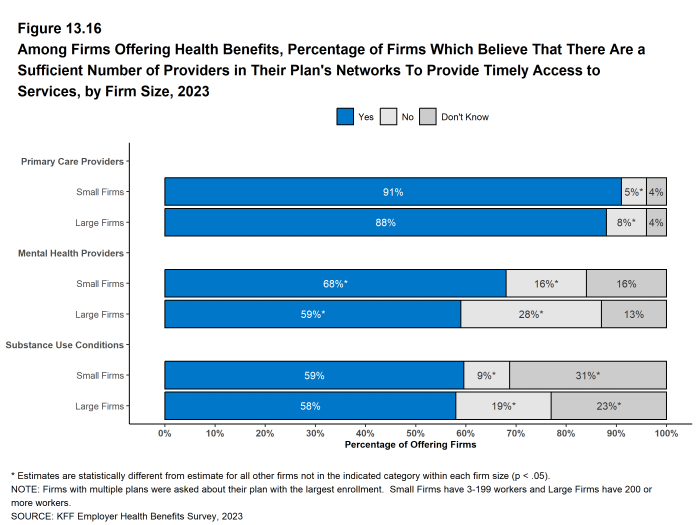

Timely Access to Care Over nine in ten (91%) firms offering health benefits say that there are a sufficient number primary care providers in the plan’s networks to provide timely access to services for workers and their family members. However, only 67% of firms that say there are a sufficient number of behavioral health providers and in the plan’s network to do this. Large firms are less likely than small firms to say that there are a sufficient number of providers to provide timely access to behavioral health services. Similarly, only 59% of firms offering health benefits say there are a sufficient number of providers who treat substance use conditions in the plan network to provide enrollees with timely access to substance use services.

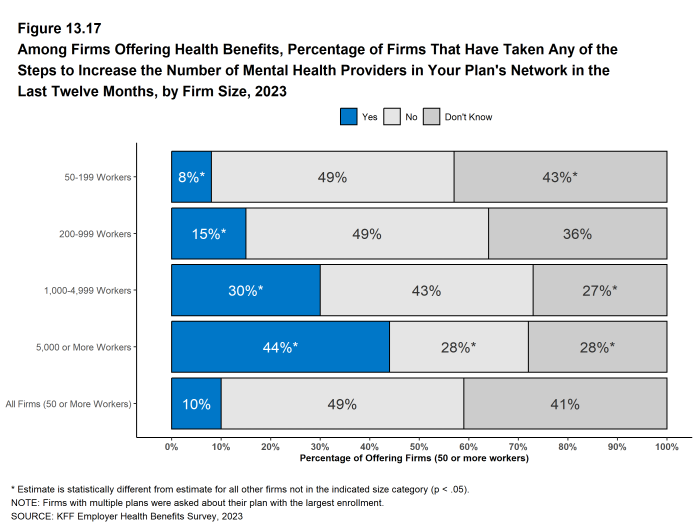

In the past 12 months, 30% of firms with 1,000 to 4,999 workers and 44% of firms with 5,000 or more workers took steps to increase the number of mental health providers in their plan networks.

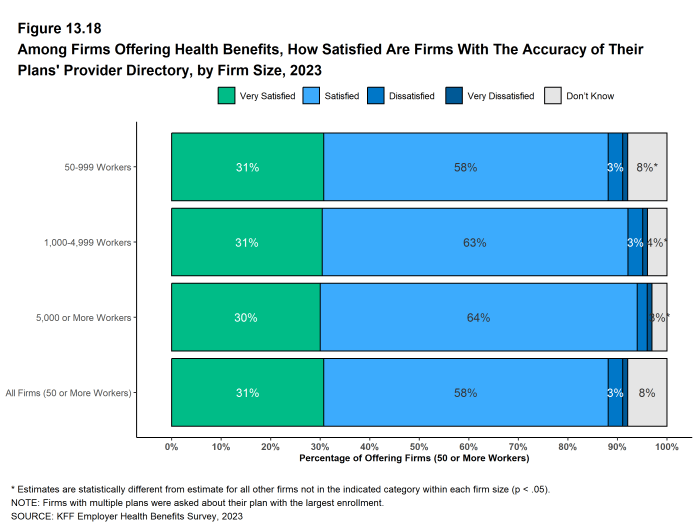

Provider Directories Firms with 50 or more workers offering health benefits generally are satisfied with the accuracy of plan provider directories, with 31% stating they are “very satisfied” and an additional 58% reporting being “satisfied” with their accuracy.

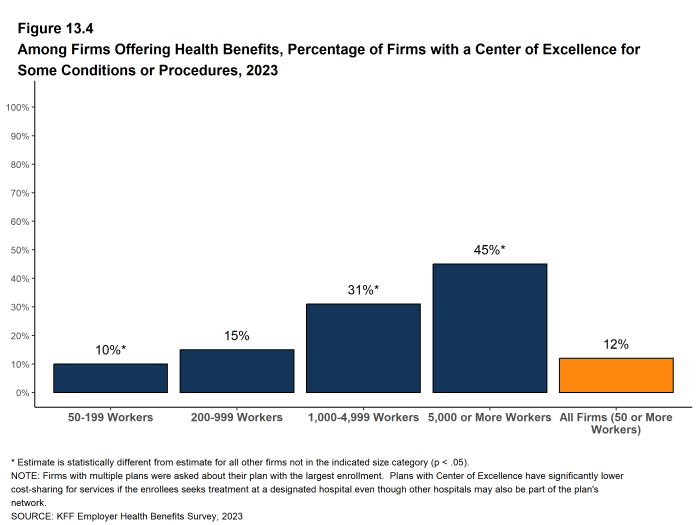

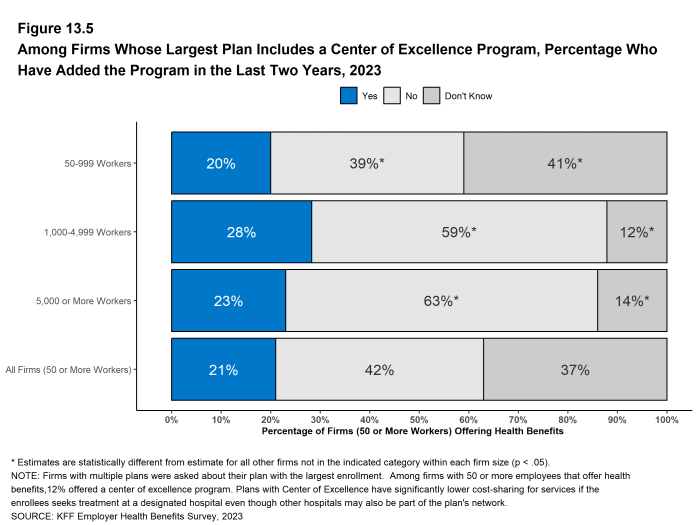

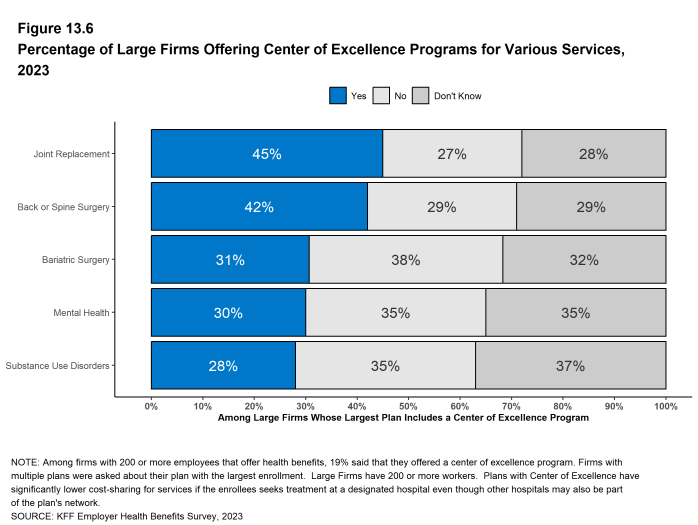

Centers of Excellence Some plans limit their coverage of designated services to care received from a group of providers participating in a “Center of Excellence” program, or provide preferential cost sharing for enrollees who do so. These programs select providers based on the cost and quality of the services they provide, and may limit in-network coverage for theses services to a smaller group of providers than participate in the provider network overall. Among large firms offering health benefits, 19% said that they offered a center of excellence program, including 45% of firms with 5,000 or more workers. Among these firms, 22% have introduced a new center of excellence program within the last two years.

Forty-five percent of large employers with a center of excellence program indicated they had program for joint replacement, followed by 42% for back or spine surgery, 31% for bariatric surgery, 30% for mental health conditions and 28% for substance use disorders.

Figure I: Among Firms Offering Health Benefits, Percentage of Firms Which Believe That There Are a Sufficient Number of Providers in Their Plan’s Networks to Provide Timely Access to Services, 2023

TELEMEDICINE

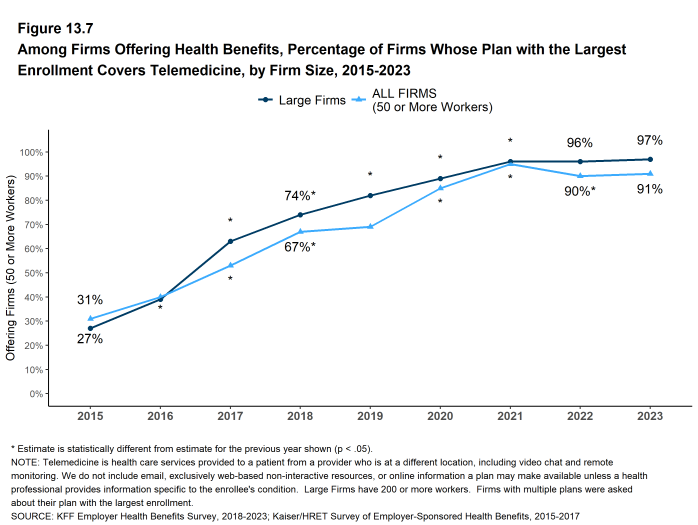

Among firms with 50 or more workers offering health benefits, 91% cover the provision of some health care services through telemedicine in their largest health plan, similar to the previous year (90%). Large firms are more likely than small firms (50-199 workers) to cover telemedicine services (97% vs. 89%).

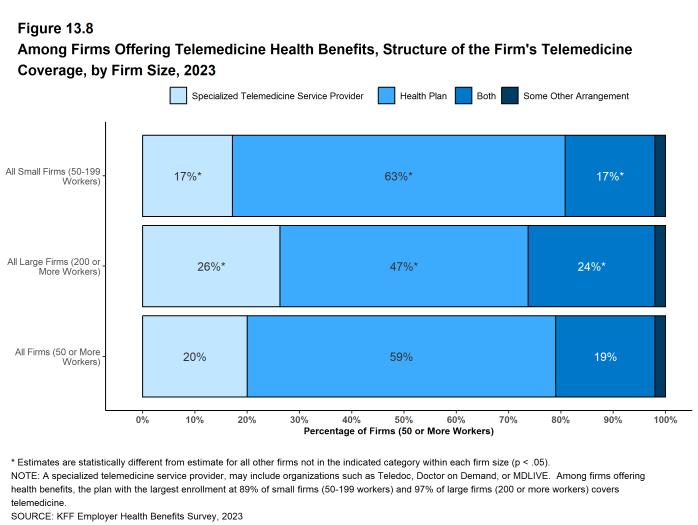

Among these firms, 20% use a specialized telemedicine service provider, such as Teledoc, Doctor on Demand, or MDLIVE, while 59% offer services through their health plan, 19% offer services through both a specialized telemedicine provider and their health plan, and 2% provide services through some other arrangement. Small firms are more likely than large firms to provide telemedicine services only through their health plan while large firms are more likely than small firms to provide telemedicine services through a specialized telemedicine provider, or through both their health plan and a specialized telemedicine provider.

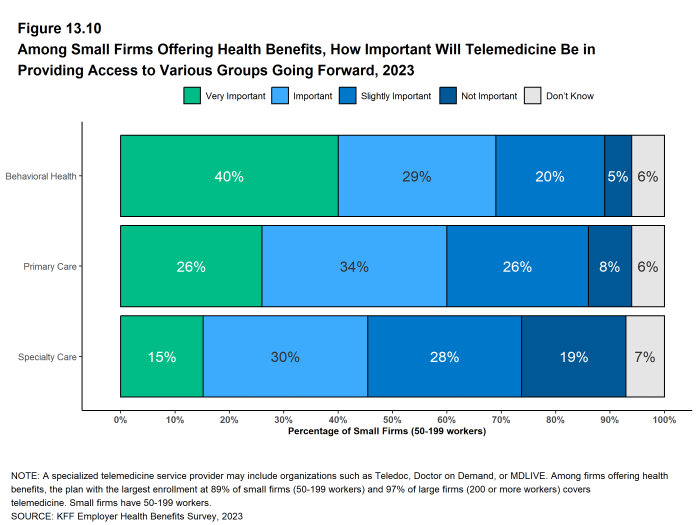

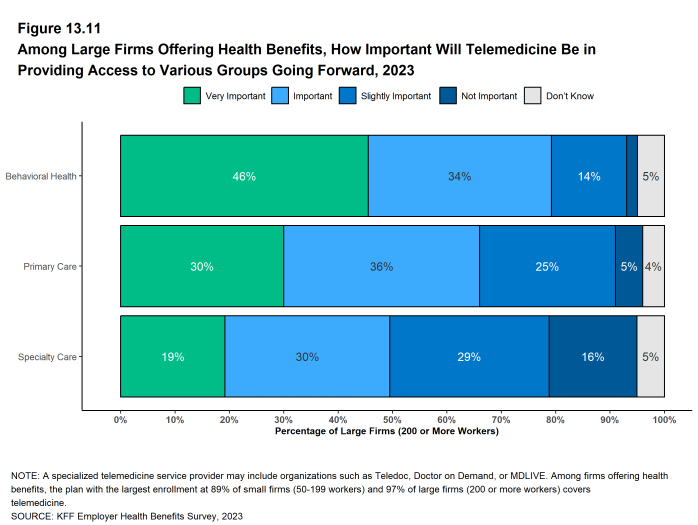

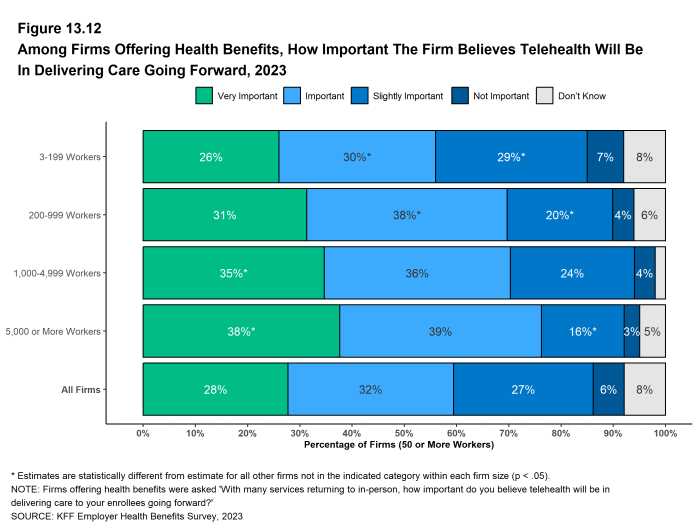

With the effects of the pandemic waning, medical services are generally available on an in-person basis and many employees have partially or fully returned to their workplaces. With this context, we asked employers how important they felt telemedicine would be in providing care to employees going forward, both overall and for several specific types of services. Among firms with 50 or more enrollees offering health benefits:

- Overall – Twenty-eight percent of firms say that telemedicine will be “very important” in providing access to enrollees in the future, and another 32% of firms say that it will be “important.”

- Behavioral Health Services – Forty-one percent say that telemedicine will be “very important” in providing access to behavioral health services in the future, and another 30% say that it will be “important”. Larger firms (1,000 or more workers) are more likely than smaller firms to say that telemedicine will be “very important” to providing access to behavioral health services. (57% vs. 40%).

- Primary Care – Twenty-seven percent say that telemedicine will be “very important” in providing access to primary care in the future, and another 34% say that it will be “important” to providing access primary care.

- Specialty Care – Sixteen percent say that telemedicine will be “very important” in providing access to specialty care in the future, and another 30% say that it will be “important” to providing access to specialty care.

ABORTION SERVICES

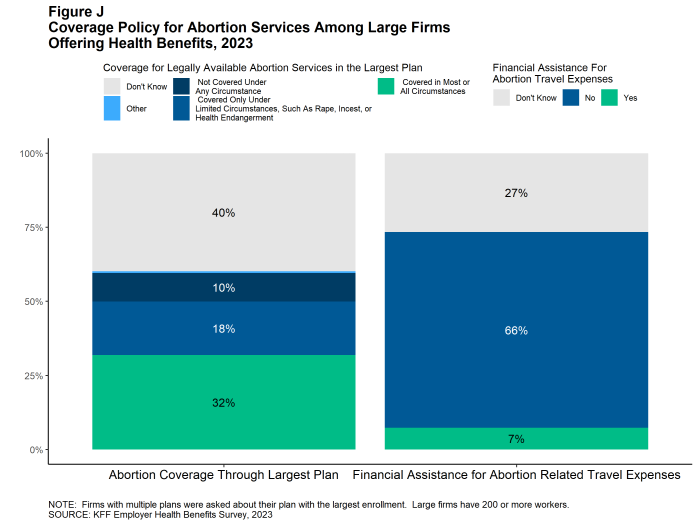

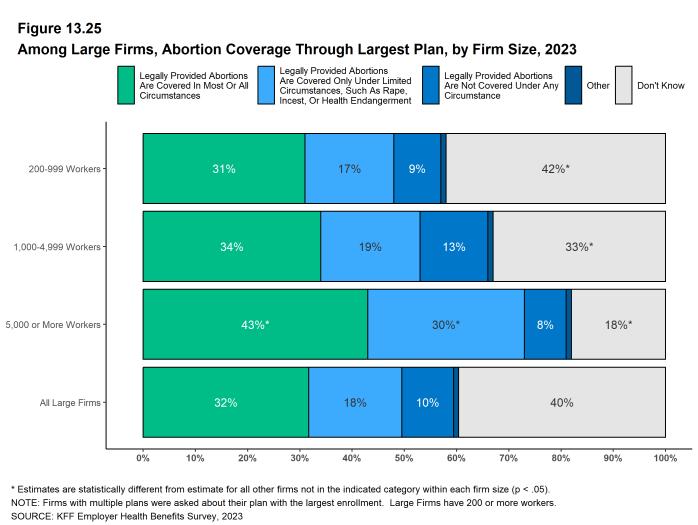

The United States Supreme Court decision in Dobbs vs. Jackson, overturning Roe v Wade, and subsequent state activity to regulate abortion has increased interest in coverage for abortion services in employer plans. We asked large employers (those with 200 or more workers) offering health benefits which of several statements best described the coverage of abortion services in their largest health plan.

- Thirty-two percent of these firms said that legally provided abortions are covered in most or all circumstances (sometimes referred to as elective or voluntary abortion). Firms with 5,000 or more workers were more likely than smaller firms to give this response (43%).

- Eighteen percent of these firms said that legally provided abortions are covered only under limited circumstances, such as rape, incest, or health or life endangerment of the pregnant enrollee. Firms with 5,000 or more workers were more likely than smaller firms to give this reply (30%).

- Ten percent of these firms said that legally provided abortions are not covered under any circumstance.

- Forty percent of responding firms answered “Don’t know” to this question. Respondents with 200 to 999 workers were more likely than other respondents to answer “Don’t know,” while respondents with 1,000 to 4,999 workers and 5,000 or more workers were less likely to do so.

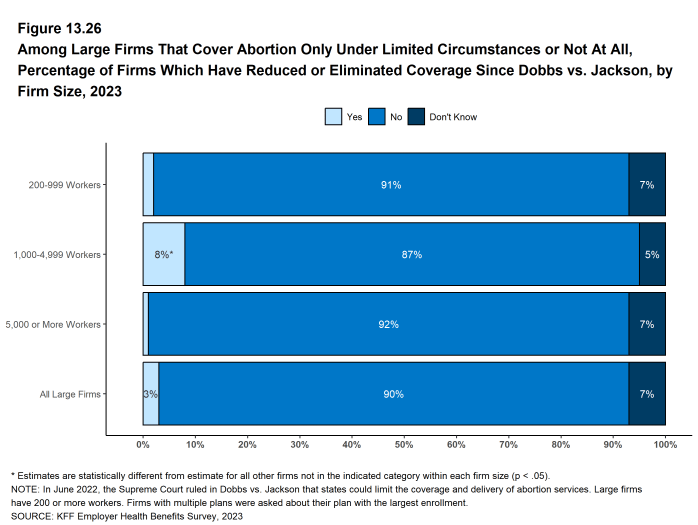

Large firms also were asked if they or their health plan had taken certain actions related to coverage of abortion following the Supreme Court decision.

- Among firms that said they did not cover legally provided abortion services, or covered them only in limited circumstances, 3% reduced or eliminated coverage for abortion services in circumstances where they could be legally provided. Firms with 1,000 to 4,999 workers were more likely than larger or smaller firms to make this change (8%).

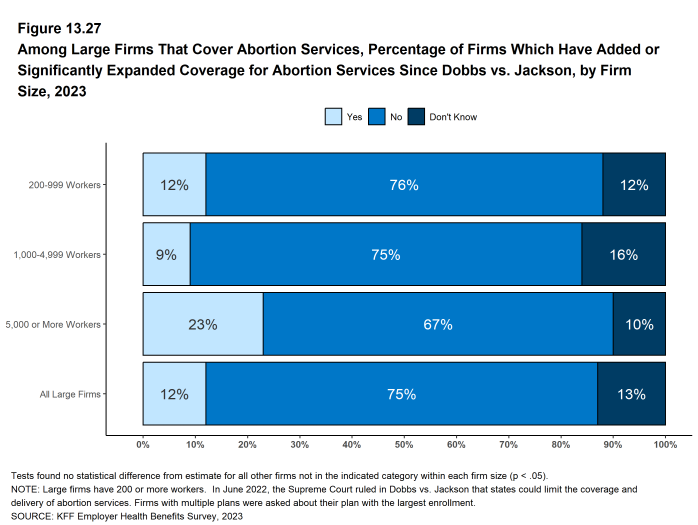

- Among firms that said legally provided abortion services were generally covered, 12% of these firms had added or significantly expanded coverage for abortion services in circumstances where they could be legally provided.

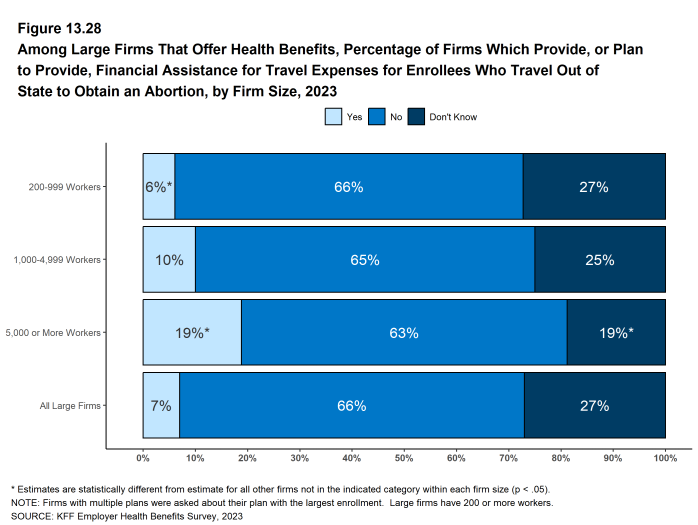

Seven percent of large firms offering health benefits currently provide or plan to provide financial assistance for travel expenses for enrollees who travel out of state to obtain an abortion if they do not have access near their home. Firms with 5,000 or more workers are more likely than other firms to say they provide or plan to provide travel benefits (19% vs. 7%).

Figure J: Among Large Firms, Abortion Coverage Through Largest Plan, by Firm Size, 2023

DISCUSSION

The average annual premiums for both single and family coverage increased 7% in 2023. This is a big change compared to last year, when there was not a statistically significant increase from the prior year, and suggests that the higher overall prices we have seen since 2022 in the rest of the economy have begun to affect premiums. Looking forward, both inflation and employer costs for labor are projected to moderate over the next two years4, although premiums may not reflect these underlying changes right away. Over the last five years, family premiums have grown 22%, roughly comparable to the rate of inflation (21%) and the change in wages (27%) over the period.

Compared to premiums, deductible amounts have been growing relatively slowly. The average deductible in 2023 for single coverage among those with a deductible ($1,735) is similar to the amount last year ($1,763) and only 10% higher than the amount five years ago. This relatively low growth may reflect employer concerns about the ability of workers to afford higher out-of-pocket costs, particularly for workers with lower wages. As noted above, 25% of employers with 50 or more employees believe that their employees have a high level of concern about the affordability of cost sharing, with another 33% believing that their employees have a moderate level of concern. Employers also may be reluctant to reduce the value and attractiveness of their coverage offerings during this long period of low unemployment and intense competition for labor.

Whether and how to cover abortion services have become pressing issues for employers. The U.S. Supreme Court’s decision in Dobbs v. Jackson, and subsequent state initiatives to restrict access to abortion services as well as coverage for those services, have created a complicated legal environment for employers, with potential civil or even criminal liability for providing coverage in some states or situations. Amid this backdrop, 32% of large firms (200 or more workers) said that they cover legally provided abortions in most or all circumstances, 18% said that legally provided abortions are covered only under limited circumstances, such as rape, incest, or health or life endangerment, and 10% said that legally provided abortions are not covered under any circumstance. A large share of respondents did not know the answer to this question or did not respond, perhaps reflecting the complexity of the issue and changing landscape of state laws.

The sufficiency of mental health providers in plan networks remains a concern for employers in 2023, with only 59% of large employers offering health benefits believing that there are a sufficient number of behavioral health providers in their plan’s network to provide timely access to services for workers and their family members. Among larger firms offering health benefits, 30% of firms with 1,000 to 4,999 workers and 44% of firms with 5,000 or more workers took steps within the past 12 months to increase the number of mental health providers in their plan networks..

METHODOLOGY

The KFF 2023 Employer Health Benefits Survey reports findings from a survey of 2,133 randomly selected non-federal public and private employers with three or more workers. Davis Research, LLC conducted the field work between January and July 2023. The overall response rate is 15%, which includes firms that offer and do not offer health benefits. Unless otherwise noted, differences referred to in the text and figures use the 0.05 confidence level as the threshold for significance. Small firms have 3-199 workers unless otherwise noted. Values below 3% are not shown on graphs to improve readability. Some distributions may not sum due to rounding. For more information survey methodology, see the Survey Design and Methods section at ehbs.kff.org.

KFF is the independent source for health policy research, polling, and journalism. Our mission is to serve as a nonpartisan source of information for policymakers, the media, the health policy community, and the public.

- Estimate from the KFF’s analysis of the 2021 American Community Survey. KFF. Health insurance coverage of the nonelderly 0–64 [Internet]. San Francisco (CA): KFF; 2021 [cited 2023 Aug 29]. Available from: https://www.kff.org/other/state-indicator/nonelderly-0-64↩︎

- Bureau of Labor Statistics. Consumer Price Index, U.S. City Average of Annual Inflation, 2013-2023 [Internet]. Washington (DC): BLS; [cited 2023 May 26]. Available from: https://data.bls.gov/timeseries/CUUR0000SA0Seasonally adjusted data from the Current Employment Statistics Survey. Bureau of Labor Statistics. Employment, Hours, and Earnings from the Current Employment Statistics survey (National), 2013-2023 [Internet]. Washington (DC): BLS; [cited 2023 June 13]. Available from: https://data.bls.gov/timeseries/CES0500000008↩︎

- This threshold is based on the twenty-fifth percentile of workers’ earnings ($31,000 in 2023). Seasonally adjusted data from the Current Employment Statistics Survey. Bureau of Labor Statistics. Current Employment Statistics—CES (national) [Internet]. Washington (DC): BLS; [cited 2023 Oct 4]. Available from: https://www.bls.gov/ces/publications/highlights/highlights-archive.htm↩︎

- An Update to the Economic Outlook: 2023-2025. [Internet] Washington (DC): Congressional Budget Office; [cited 2023 July]. Available from: https://www.cbo.gov/publication/59431#_idTextAnchor010.↩︎

Survey Design and Methods

KFF has conducted this annual survey of employer-sponsored health benefits since 1999. Since 2020, KFF has employed Davis Research LLC (Davis) to field the survey. From January to July 2023, Davis interviewed business owners as well as human resource and benefits managers at 2,133 firms.

SURVEY TOPICS

The survey includes questions on the cost of health insurance, health benefit offer rates, coverage, eligibility, plan type enrollment, premium contributions, employee cost sharing, prescription drug benefits, retiree health benefits, and wellness benefits.

Firms that offer health benefits are asked about the plan attributes of their largest health maintenance organization (HMO), preferred provider organization (PPO), point-of-service (POS) plan, and high-deductible health plan with a savings option (HDHP/SO).5 We treat exclusive provider organizations (EPOs) and HMOs as one plan type and conventional (or indemnity) plans as PPOs. The survey defines an HMO as a plan that does not cover nonemergency out-of-network services. POS plans use a primary care gatekeeper to screen for specialist and hospital visits. HDHP/SOs are plans with a deductible of at least $1,000 for single coverage and $2,000 for family coverage and that either offer a health reimbursement arrangement (HRA) or are eligible for a health savings account (HSA). Definitions of the health plan types are available in Types of Plans Offered, and a detailed explanation of the HDHP/SO plan type is in High-deductible Health Plans with Savings. Throughout this report, we use the term “in-network” to refer to services received from a preferred provider.

To reduce survey burden, questions on cost sharing for office visits, hospitalization, outpatient surgery and prescription drugs were only asked about the firm’s largest plan type. Firms sponsoring multiple plan types were asked about premiums, worker contributions and deductibles for their two largest plan types. Within each plan type, respondents are asked about the plan with the most enrollment.

Firms are asked about the attributes of their current plans during the interview. While the survey’s fielding period begins in January, many respondents may have a plan whose 2023 plan year lags behind the calendar year. In some cases, plans may report the attributes of their 2022 plans and some plan attributes (such as HSA deductible limits) may not meet the calendar year regulatory requirements. Decisions concerning plan features and costs may have taken place months before the interview..

SAMPLE DESIGN

The sample for the annual KFF Employer Health Benefits Survey includes private firms and nonfederal government employers with three or more employees. The universe is defined by the U.S. Census’ 2019 Statistics of U.S. Businesses (SUSB) for private firms and the 2017 Census of Governments (COG) for non-federal public employers. At the time of the sample design (December 2022), this data represented the most current information on the number of public and private firms nationwide with three or more workers. As in the past, the post-stratification is based on the most up-to-date Census data available (the 2020 SUSB). We determine the sample size based on the number of firms needed to ensure a target number of completes in six size categories.

We attempted to repeat interviews with prior years’ survey respondents (with at least ten employees) who participated in either the 2021 or the 2022 survey, or both. Firms with 3-9 employees are not included in the panel to minimize the potential of panel effects. In total, 205 firms participated in 2021, 452 firms participated in 2022, and 452 firms participated in both 2021 and 2022. Non-panel firms are randomly selected within size and industry groups.

Since 2010, the sample has been drawn from a Dynata list (based on a census assembled by Dun and Bradstreet) of the nation’s private employers and the COG for public employers. To increase precision, we stratified the sample by ten industry categories and six size categories. The federal government and businesses with fewer than three employees are not included. Education is a separate category for the purposes of sampling, and included in ‘Service’category for weighting. For information on changes to the sampling methods over time, please consult the extended methods at ehbs.kff.org.

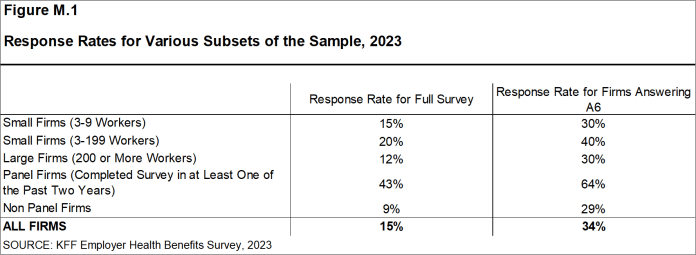

RESPONSE RATE

Response rates are calculated using a CASRO method, which accounts for firms that are determined to be ineligible in its calculation. The overall response rate is 15% [Figure M.1].6 The response rate for panel firms is higher than the response rate for non-panel firms. Similar to other employer and household surveys, the Employer Health Benefits Survey has seen a general decrease in response rates over time. Since 2017, we have attempted to increase the number of completes by increasing the number of non-panel firms in the sample. While this generally increases the precision of estimates by ensuring a sufficient number of respondents in various sub-groups, it has the effect of reducing the overall response rate.

The vast majority of questions are asked only of firms that offer health benefits. A total of 1,714 of the 2,133 responding firms indicated they offered health benefits. We asked one question of all firms in the study with which we made phone contact even if the firm declined to participate: “Does your company offer a health insurance program as a benefit to any of your employees?”. A total of 4,892 firms responded to this question (including 2,133 who responded to the full survey and 2,759 who responded to this one question). These responses are included in our estimates of the percentage of firms offering health benefits.7 The response rate for this question is 34% [Figure M.1].

Figure M.1: Response Rates for Various Subsets of the Sample, 2023

While response rates have decreased, elements of the survey design limit the potential impact of a response bias. Most major statistics are weighted by the percentage of covered workers at a firm. Collectively, 3,100,000 of the 73,600,000 workers covered by their own firm’s health benefits in the United States were employed by firms which completed in the survey. The most important statistic that is weighted by the number of employers is the offer rate; firms that do not complete the full survey are asked whether their firm offers health benefits to any employees. As noted, this question relies on a wider set of respondents than just those completing the full survey. As in years past the majority of firms are very small, so the considerable fluctuation we see across years in the offer rate for these small firms drives the overall offer rate..

FIRM SIZES AND KEY DEFINITIONS

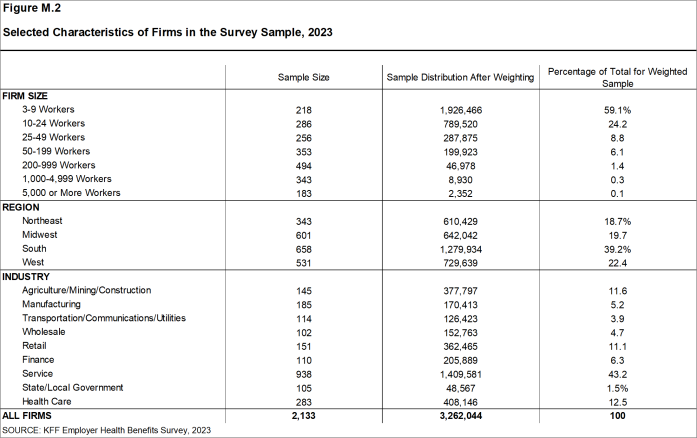

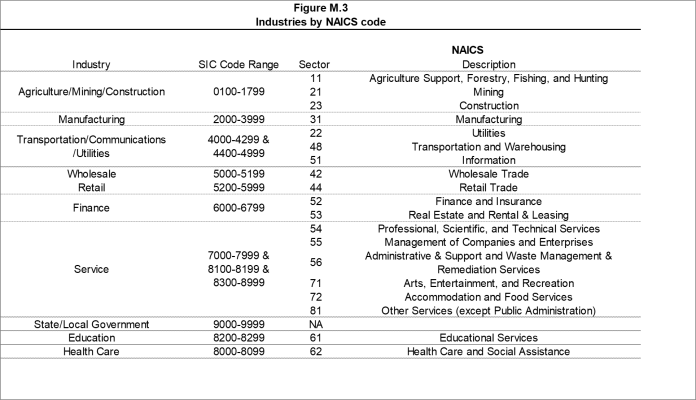

Throughout the report, we report data by size of firm, region, and industry. Unless otherwise specified, firm size definitions are as follows: small firms: 3-199 workers; and large firms: 200 or more workers. [Figure M.2] shows selected characteristics of the survey sample. A firm’s primary industry classification is determined from Dynata’s designation on the sampling frame and is based on the U.S. Census Bureau’s North American Industry Classification System (NAICS), [Figure M.3]. A firm’s ownership category and other firm characteristics such as the firm’s wage level and the age of the work force are based on respondents’ answers. While there is considerable overlap in firms in the “State/Local Government” industry category and those in the “public” ownership category, they are not identical. For example, public school districts are included in the ‘Service’ industry even though they are publicly owned. Family coverage is defined as health coverage for a family of four.

Figure M.2: Selected Characteristics of Firms in the Survey Sample, 2023

Figure M.3: Industries by NAICS code

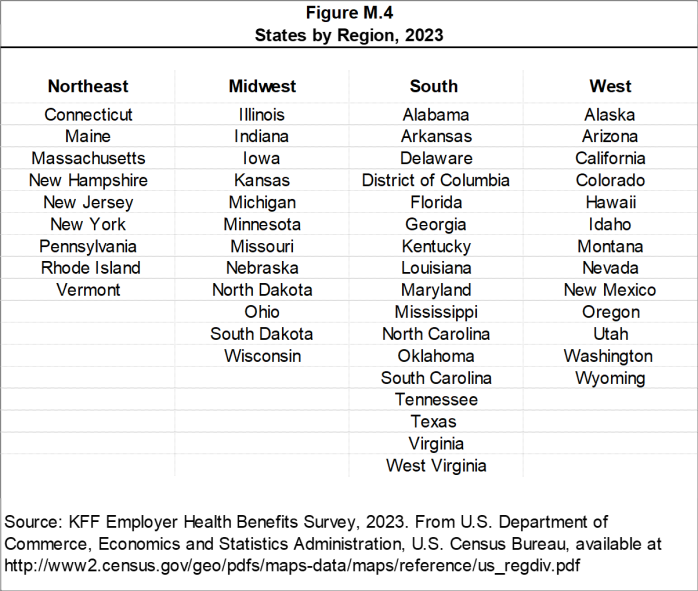

[Figure M.4] presents the breakdown of states into regions and is based on the U.S Census Bureau’s categorizations. State-level data are not reported both because the sample size is insufficient in many states and we only collect information on a firm’s primary location rather than where all workers may actually be employed. Some mid- and large-size employers have employees in more than one state, so the location of the headquarters may not match the location of the plan for which we collected premium information.

Figure M.4: States by Region, 2023

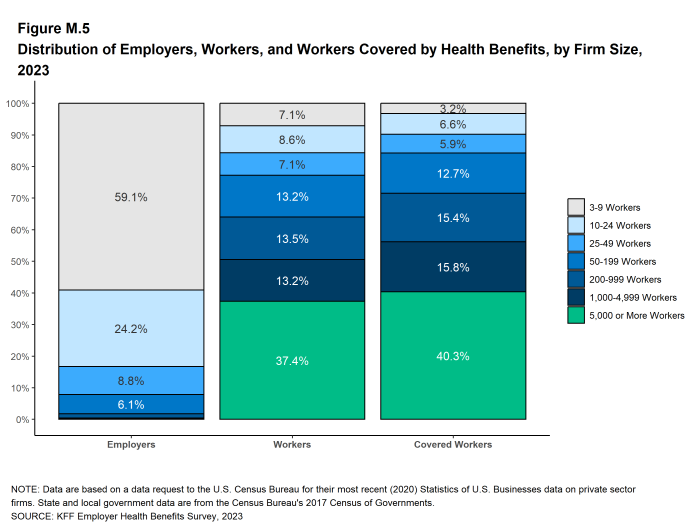

[Figure M.5] displays the distribution of the nation’s firms, workers, and covered workers (employees receiving coverage from their employer). Among the three million firms nationally, approximately 59.1% employ 3 to 9 workers; such firms employ 7.1% of workers, and 3.2% of workers covered by health insurance. In contrast, less than one percent of firms employ 5,000 or more workers; these firms employ 37.4% of workers and 40.3% of covered workers. Therefore, the smallest firms dominate any statistics weighted by the number of employers. For this reason, most statistics about firms are broken out by size categories. In contrast, firms with 1,000 or more workers are the most influential employer group in calculating statistics regarding covered workers, since they employ the largest percentage of the nation’s workforce. Statistics among small firms and those weighted by the number of firms tend to have more variability.

Figure M.5: Distribution of Employers, Workers, and Workers Covered by Health Benefits, by Firm Size, 2023

Although most firms in the United States are small, most workers covered by health benefits are employed at large firms: 72% of the covered worker weight is controlled by firms with 200 or more employees. Conversely, firms with 3–199 employees represent 98% percent of the employer weight.

The survey asks firms what percentage of their employees earn more or less than a specified amount in order to identify the portion of a firm’s workforce that has relatively lower or higher wages. This year, the income threshold is $31,000 or less per year for lower-wage workers and $72,000 or more for higher-wage workers. These thresholds are based on the 25th and 75th percentile of workers’ earnings as reported by the Bureau of Labor Statistics using data from the Occupational Employment Statistics (OES) (2021).8 The cutoffs were inflation-adjusted and rounded to the nearest thousand.

Annual inflation estimates are calculated as an average of the first three months of the year. The 12 month percentage change for this period was 5.8%.9 Data presented is nominal unless indicated specifically otherwise..

ROUNDING AND IMPUTATION

Some figures in the report do not sum to totals due to rounding. Although overall totals and totals for size and industry are statistically valid, some breakdowns may not be available due to limited sample sizes or high relative standard errors. Where the unweighted sample size is fewer than 30 observations, figures include the notation “NSD” (Not Sufficient Data). Estimates with high relative standard errors are reviewed and in some cases not published. Many breakouts by subsets may have a large standard error, meaning that even large differences between estimates are not statistically different. Values below 3% are not shown on graphical figures to improve the readability of those graphs. The underlying data for all estimates presented in graphs are available in the Excel documents accompanying each section on ehbs.kff.org/.

To control for item nonresponse bias, we impute values that are missing for most variables in the survey. On average, 13% of observations are imputed. All variables are imputed following a hotdeck approach. The hotdeck approach replaces missing information with observed values from a firm similar in size and industry to the firm for which data are missing. In 2023, there were eighty-six variables where the imputation rate exceeded 20%; most of these cases were for individual plan level statistics. When aggregate variables were constructed for all of the plans, the imputation rate is usually much lower. There are a few variables that we have decided not to impute; these are typically variables where “don’t know” is considered a valid response option. Some variables are imputed based on their relationship to each other. For example, if a firm provided a worker contribution for family coverage but no premium information, a ratio between the family premium and family contribution was imputed and then the family premium was calculated. We estimate separate single and family coverage premiums for firms that provide premium amounts as the average cost for all covered workers.

To ensure data accuracy we have several processes to review outliers and illogical responses. Every year several hundred firms are called back to confirm or correct responses. In some cases, answers are edited based on responses to open-ended questions or based on established logic rules.

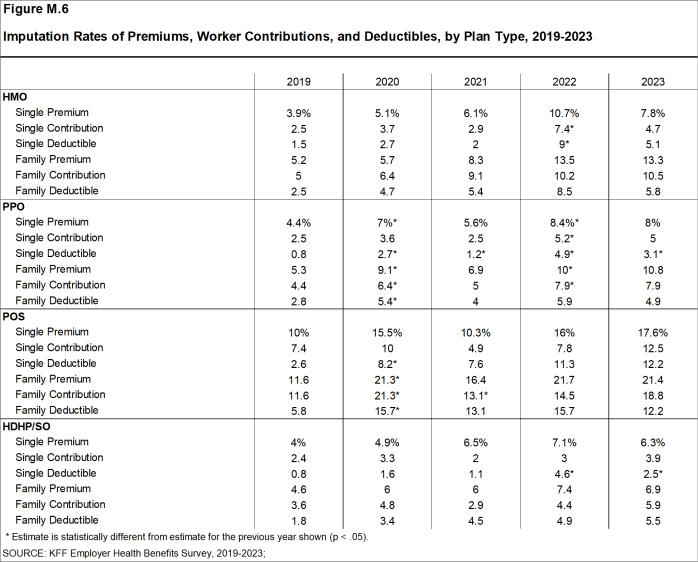

Figure M.6: Imputation Rates of Premiums, Worker Contributions, and Deductibles, by Plan Type, 2019-2023

WEIGHTING

Because we select firms randomly, it is possible through the use of weights to extrapolate the results to national (as well as firm size, regional, and industry) averages. These weights allow us to present findings based on the number of workers covered by health plans, the number of total workers, and the number of firms. In general, findings in dollar amounts (such as premiums, worker contributions, and cost sharing) are weighted by covered workers. Other estimates, such as the offer rate, are weighted by firms.

The employer weight was determined by calculating the firm’s probability of selection. This weight was trimmed of overly influential weights and calibrated to U.S. Census Bureau’s 2020 Statistics of U.S. Businesses for firms in the private sector, and the 2017 Census of Governments totals. The worker weight was calculated by multiplying the employer weight by the number of workers at the firm and then following the same weight adjustment process described above. The covered-worker weight and the plan-specific weights were calculated by multiplying the percentage of workers enrolled in each of the plan types by the firm’s worker weight. These weights allow analyses of all workers covered by health benefits and of workers in a particular type of health plan.

The trimming procedure follows the following steps: First, we grouped firms into size and offer categories of observations. Within each strata, we calculated the trimming cut point as the median plus six times the interquartile range (M + [6 * IQR]). Weight values larger than this cut point are trimmed. In all instances, very few weight values were trimmed.

To account for design effects, the statistical computing package R version 4.3.1 (2023-06-16 ucrt) and the library “survey” version 4.2.1 were used to calculate standard errors..

STATISTICAL SIGNIFICANCE AND LIMITATIONS

All statistical tests are performed at the .05 confidence level. For figures with multiple years, statistical tests are conducted for each year against the previous year shown, unless otherwise noted. No statistical tests are conducted for years prior to 1999.

Statistical tests for a given subgroup are tested against all other firm sizes not included in that subgroup: For example, Northeast is compared to all firms NOT in the Northeast (an aggregate of firms in the Midwest, South, and West). However, statistical tests for estimates compared across plan types (for example, average premiums in PPOs) are tested against the “All Plans” estimate. In some cases, we also test plan-specific estimates against similar estimates for other plan types (for example, single and family premiums for HDHP/SOs against single and family premiums for HMO, PPO, and POS plans); these are noted specifically in the text. The two types of statistical tests performed are the t-test and the Wald test. The small number of observations for some variables resulted in large variability around the point estimates. These observations sometimes carry large weights, primarily for small firms. The reader should be cautioned that these influential weights may result in large movements in point estimates from year to year; however, these movements are often not statistically significant. Standard Errors for some key statistics are available in a technical supplement available at ehbs.kff.org.

Due to the complexity of many employer health benefits programs, this survey is not able to capture all the components of any particular plan. For example, many employers have complex and varied prescription drug benefits, premium contributions, and incentives for wellness programs. We attempted to complete interviews with the person who is most knowledgeable about the firm’s health benefits. In some cases, the firm may not know details of some elements of their plan and not others. While we collect information on the number of workers enrolled in health benefits, the survey is not able to capture the characteristics of the workers offered or enrolled in any particular plan..

DATA COLLECTION AND SURVEY MODE

Starting in 2022, we expanded the use of computer assisted web interview (CAWI), offering most respondents the opportunity to complete the survey using an online questionnaire rather a telephone interview. In total fifty-five percent of survey responses were completed via telephone interview, and the remainder were completed online.

Survey mode did not impact the survey results in a systematic or obvious manner. The effects of mode and firm size on major firm characteristics such as annual premiums, contributions, and deductibles was tested using standard linear regression. For certain plan types, survey implementation through telephone interview had a negative effect on the reported value. However, the plan types affected were random, so this effect is more likely due to confounding variables. When examining demographic characteristics between the two modes, there were small differences in the distribution of categorical variables such as region and age..

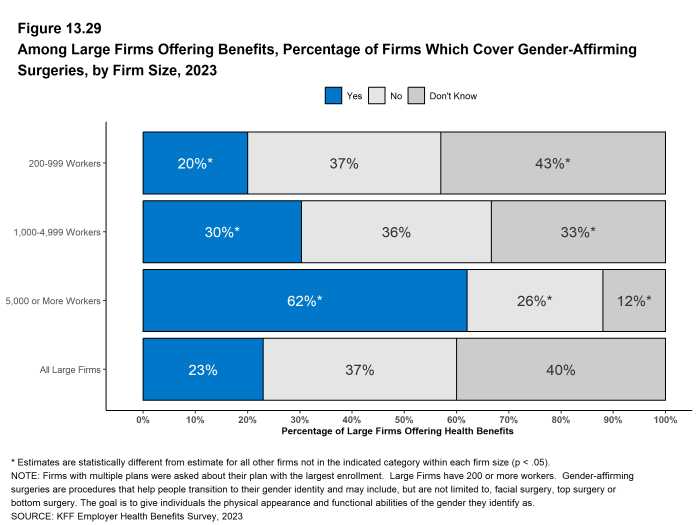

2023 SURVEY

The 2023 survey features questions which have not been asked for several years including questions on spousal benefits, voluntary benefits, such as dental and vision coverage, waiting periods and emergency room cost-sharing. In addition, the survey includes new questions, on abortion coverage, prior authorization, coverage limits and coverage for gender-affirming care.

In 2022, the Employer Health Benefit Survey over-sampled California based firms in order to provide estimates for the California Health Care Foundation’s Health Benefit Survey. For more information please see: https://www.chcf.org/publication/2023-edition-california-employer-health-benefits/. As a result, both our weighting and sampling in 2022 took into account whether a firm was located in California. In 2023, we sampled non-panel firms based on whether they were located in California. Our 2023 sampling method is similar to the methods used prior to 2022, and is based on a firms size and industry.

As in previous years, modification were made to existing survey questions, both to improve clarity or respond to changes in the marketplace.

- Starting in 2023, respondents are able to provider either monthly or annual HSA contribution amounts.

- The interview notes for the question on level-funding was editing to clarify that employing a third-party administrator does not necessarily mean a plan is level-funded.

- The question on whether a firm or plan gives workers the opportunity to complete biometeric screening was edited to include take-home kits, which collect biometetric data, not just in-person exams.

- The distribution of cost-sharing for hospital admission and outpatient surgery was edited, to make the categories “copay”, “coninsurance”, and “both copay and coinsurance”, mutually exclusive. The both category may include covered workers who face either both cost-sharing requirements or which ever is greater.

Based on interview debriefs, we elected not to report the share of employers who believe that telehealth will be important for enrollees in remote settings. We continue to revise our data cleaning and editing procedures..

OTHER RESOURCES

Additional information on the 2023 Employer Health Benefit Survey is available at ehbs.kff.org, including an article in the Journal Health Affairs, an interactive graphic and historic reports. Standard errors for some statistics are available in the online technical supplement. Researchers may also request a public use dataset here: https://www.kff.org/contact-us/

The survey design and methods section found on our website (ehbs.kff.org) contains an extended methods document that was not included in the portable document format (PDF) or the printed versions of this book. Readers interested in the extended methodology should consult the online edition of this publication.

Published: October 18, 2023. Last Updated: October 09, 2023.

HISTORICAL DATA

Data in this report focus primarily on findings from surveys conducted and authored by KFF since 1999. Between 1999 and 2017, the Health Research & Educational Trust (HRET) co-authored this survey. HRET’s divestiture had no impact on our survey methods, which remain the same as years past. Prior to 1999, the survey was conducted by the Health Insurance Association of America (HIAA) and KPMG using a similar survey instrument, but data are not available for all the intervening years. Following the survey’s introduction in 1987, the HIAA conducted the survey through 1990, but some data are not available for analysis. KPMG conducted the survey from 1991-1998. However, in 1991, 1992, 1994, and 1997, only larger firms were sampled. In 1993, 1995, 1996, and 1998, KPMG interviewed both large and small firms. In 1998, KPMG divested itself of its Compensation and Benefits Practice, and part of that divestiture included donating the annual survey of health benefits to HRET.

This report uses historical data from the 1993, 1996, and 1998 KPMG Surveys of Employer-Sponsored Health Benefits and the 1999-2017 Kaiser/HRET Survey of Employer-Sponsored Health Benefits. For a longer-term perspective, we also use the 1988 survey of the nation’s employers conducted by the HIAA, on which the KPMG and KFF surveys are based. The survey designs for the three surveys are similar.

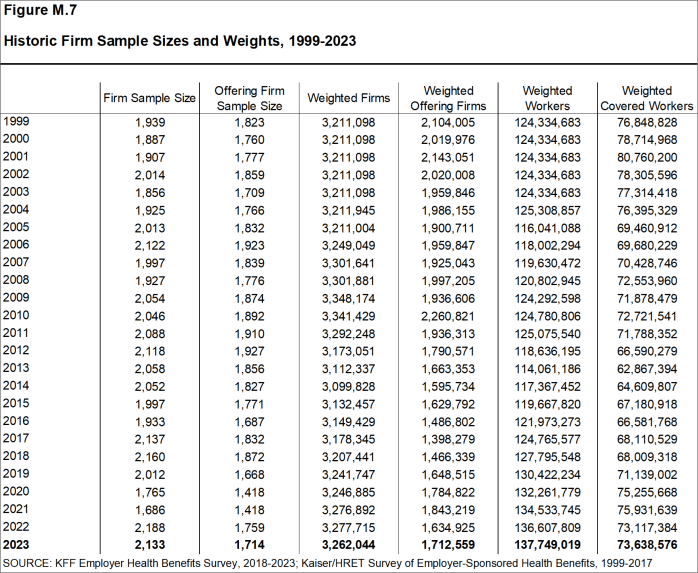

[Figure M.7] displays the historic sample sizes and weights of firms, workers, and covered workers (employees receiving coverage from their employer).

Figure M.7: Historic Firm Sample Sizes and Weights, 1999-2023

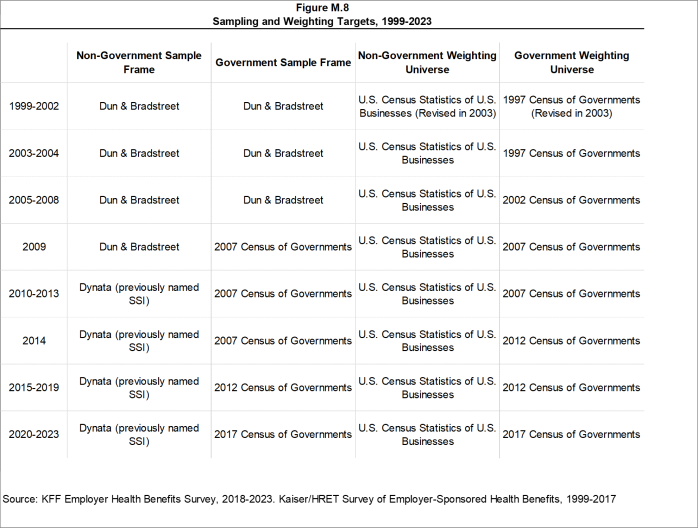

[Figure M.8] displays the historic sample frames and weighting universes.

Figure M.8: Sampling and Weighting Targets, 1999-2023

1999

The Kaiser Family Foundation and The Health Research and Educational Trust (Kaiser/HRET) began sponsoring the survey of employer-sponsored health benefits supported for many years by KPMG Peat Marwick LLP, an international consulting and accounting firm. In 1998, KPMG divested itself of its Compensation and Benefits Practice, and donated the annual survey of health benefits to HRET, a non-profit research organization affiliated with the American Hospital Association. From 1999 until 2017, the survey was conducted under a partnership between HRET and The Kaiser Family Foundation, a health care philanthropy and policy research organization that is not affiliated with Kaiser Permanente or Kaiser Industries. Starting in 1999, survey continued a core set of questions from prior KPMG surveys, but was expanded to include small employers and a variety of policy-oriented questions. Some reports include data from the 1993, 1996 and 1998 KPMG Surveys of Employer-Sponsored Health Benefits. For a longer-term perspective, we also use the 1988 survey of the nation’s employers conducted by the Health Insurance Association of America (HIAA), on which the KPMG, Kaiser/HRET, and Kaiser Family Foundation surveys were based. Many of the questions in the HIAA, KPMG, Kaiser/HRET, and Kaiser Family Foundation surveys are identical, as is the sample design. Since Point-of-Service (POS) plans did not exist in 1988, reports do not include statistics for this plan type in that year. Starting in 1999, Kaiser/HRET drew its sample from a Dun & Bradstreet list of the nation’s private and public employers with three or more workers. To increase precision, Kaiser/HRET stratified the sample by industry and the number of workers in the firm. Kaiser/HRET attempted to repeat interviews with many of the 2,759 firms interviewed in 1998 and replaced non-responding firms with another firm from the same industry and firm size. As a result, 1,377 firms in the 1999 total sample of 1,939 firms participated in both the 1998 and 1999 surveys.

For more detail about the 1999 survey, see the Survey Methodology section of that year’s report.

2000

Kaiser/HRET attempted to repeat interviews with many of the 1,939 firms interviewed in 1999 and replaced non-responding firms with other firms of the same industry and firm size. As a result, 982 firms in the 2000 survey’s total sample of 1,887 firms participated in both the 1999 and 2000 surveys. The overall response rate was 45% down from 60% in 1999. Contributing to the declining response rate was the decision not to re-interview any firms with 3-9 workers who participated in the 1999 survey. In 1999, the survey weights had instead been adjusted to control for the fact that firms with 3-9 workers that are in the panel (responded in either 1998 or 1999) are biased in favor of offering a health plan. The response rate in 2000 for firms with 3-9 workers was 30%.

For more detail about the 2000 survey, see the Survey Methodology section of that year’s report.

2001

For more detail about the 2001 survey, see the Survey Methodology section of that year’s report.

2002

The list of imputed variables was greatly expanded in 2002 to also include self-insurance status, level of benefits, prescription drug cost-sharing, copay and coinsurance amounts for prescription drugs, and firm workforce characteristics such as average income, age and part-time status. On average, 2% of these observations are imputed for any given variable. The imputed values are determined based on the distribution of the reported values within stratum defined by firm size and region.

For more detail about the 2002 survey, see the Survey Methodology section of that year’s report.

2003

The calculation of the weights followed a similar approach to previous years, but with several notable changes in 2003. First, as in years past, the basic weight was determined, followed by a nonresponse adjustment added this year to reflect the fact that small firms that do not participate in the full survey are less likely to offer health benefits and, consequently, are unlikely to answer the single offer rate question. To make this adjustment, Kaiser/HRET conducted a follow-up survey of all firms with 3-49 workers that did not participate in the full survey. Each of these 1,744 firms was asked the single question, “Does your company offer or contribute to a health insurance program as a benefit to its employees?” The main difference between this follow-up survey and the original survey is that in the follow-up survey the first person who answered the telephone was asked whether the firm offered health benefits, whereas in the original survey the question was asked of the person who was identified as most knowledgeable about the firm’s health benefits. Conducting the follow-up survey accomplished two objectives. First, statistical techniques (a McNemar analysis which was confirmed by a chi-squared test) demonstrated that the change in method-speaking with the person answering the phone rather than a benefits manager-did not bias the results of the follow-up survey. Analyzing firms who responded to the offer question twice, in both the original and follow-up survey, proved that there was no difference in the likelihood that a firm offers coverage based on which employee answered the question about whether a firm offers health benefits. Second, the follow-up survey demonstrated that very small firms not offering health benefits to their workers are less likely to answer the one survey question about coverage. Kaiser/HRET analyzed the group of firms that only responded to the follow-up survey and performed a t-test between the firms who had responded to the initial survey as well as the follow-up, and those who only responded to the follow-up. Tests confirmed the hypothesis that the firms that did not answer the single offer rate question in the original survey were less likely to offer health benefits. To adjust the offer rate data for this finding an additional non-response adjustment was applied to increase the weight of firms in the sample that do not offer coverage. The second change to the weighting method in 2003 was to trim the weights in order to reduce the influence of weight outliers. On occasion one or two firms will, through the weighting process, represent a highly disproportionate number of firms or covered workers. Rather than excluding these observations from the sample, a set cut point that would minimize the variances of several key variables (such as premium change and offer rate) was determined. The additional weight represented by outliers is then spread among the other firms in the same sampling cell. Finally, a post-stratification adjustment was applied. In the past, Kaiser/HRET was poststratified back to the Dun & Bradstreet frequency counts. Concern over volatility of counts in recent years led to the use of an alternate source for information on firm and industry data. This year the survey uses the recently released Statistics of U.S. Businesses conducted by the U.S. Census as the basis for the post-stratification adjustment. These Census data indicate the percentage of the nation’s firms with 3-9 workers is 59% rather than the higher percentages (e.g., 76% in 2002) derived from Dun & Bradstreet’s national database. This change has little impact on worker-based estimates, since firms with 3-9 workers accounted for less than 10% of the nation’s workforce. The impact on estimates expressed as a percentage of employers (e.g., the percent of firms offering coverage), however, may be significant. Due to these changes, Kaiser/HRET recalculated the weights for survey years 1999-2002 and modified estimates published in the survey where appropriate. The vast majority of these estimates are not statistically different. However, please note that the survey data published starting in 2003 varies slightly from previously published reports.

For more detail about the 2003 survey, see the Survey Methodology section of that year’s report.

2004

For more detail about the 2004 survey, see the Survey Methodology section of that year’s report.

2005

In 2005, the Kaiser/HRET survey added two additional sections to the questionnaire to collect information about high-deductible health plans (HDHP) that are offered along with a health reimbursement account (HRA) or are health savings account (HSA) qualified. Questions in these sections were asked of all firms offering these plan types, regardless of enrollment. Specific weights were also created to analyze the HDHP plans that are offered along with HRAs or are HSA qualified. These weights represent the proportion of employees enrolled in each of these arrangements.

We updated our data to reflect the 2002 Census of Governments. We also removed federal government employee counts from our post-stratification.

For more detail about the 2005 survey, see the Survey Methodology section of that year’s report.

2006

For the first time in 2006, Kaiser/HRET asked questions about the highest enrollment HDHP/SO as a separate plan type, equal to the other plan types. In prior years, data on HDHP/SO plans were collected as part of one of the other types of plans. Therefore, the removal of HDHP/SOs from the other plan types may affect the year to year comparisons for the other plan types. Given the decline in conventional health plan enrollment and the addition of HDHP/SO as a plan type option, Kaiser/HRET eliminated nearly all questions pertaining to conventional coverage from the survey instrument. We continue to ask firms whether or not they offer a conventional health plan and, if so, how much their premium for conventional coverage increased in the last year, but respondents are not asked additional questions about the attributes of the conventional plans they offer. Because we have limited information about conventional health plans, we must make adjustments in calculating all plan averages or distributions. In cases where a firm offers only conventional health plans, no information from that respondent is included in all plan averages. The exception is for the rate of premium growth, for which we have information. If a firm offers a conventional health plan and at least one other plan type, for categorical variables we assign the values from the health plan with the largest enrollment (other than the conventional plan) to the workers in the conventional plan. In the case of continuous variables, covered workers in conventional plans are assigned the weighted average value of the other plan types in the firm.

The survey newly distinguished between plans that have an aggregate deductible amount in which all family members’ out-of-pocket expenses count toward the deductible and plans that have a separate amount for each family member, typically with a limit on the number of family members required to reach that amount.

In 2006, Kaiser/HRET began asking employers if they had a health plan that was an exclusive provider organization (EPO). We treat EPOs and HMOs together as one plan type and report the information under the banner of “HMO”; if an employer sponsors both an HMO and an EPO, they are asked about the attributes of the plan with the larger enrollment.

Kaiser/HRET made a slight change to one of the industry groups: we removed Wholesale from the group that also included Agriculture, Mining and Construction. The nine industry categories now reported are: Agriculture/Mining/Construction, Manufacturing, Transportation/Communications/Utilities, Wholesale, Retail, Finance, Service, State/Local Government, and Health Care.

Starting in 2006, we made an important change to the way we test the subgroups of data within a year. Statistical tests for a given subgroup (firms with 25-49 workers, for instance) are tested against all other firm sizes not included in that subgroup (all firm sizes NOT including firms with 25-49 workers in this example). Tests are done similarly for region and industry: Northeast is compared to all firms NOT in the Northeast (an aggregate of firms in the Midwest, South, and West). Statistical tests for estimates compared across plan types (for example, average premiums in PPOs) are tested against the “All Plans” estimate. In some cases, we also test plan specific estimates against similar estimates for other plan types (for example, single and family premiums for HDHP/SOs against single and family premiums in HMO, PPO, and POS plans). Those are noted specifically in the text. This year, we also changed the type of Chi-square test from the Chi-square test for goodness-of-fit to the Pearson Chi-square test. Therefore, in 2006, the two types of statistical tests performed are the t-test and the Pearson Chi-square test.

For more detail about the 2006 survey, see the Survey Methodology section of that year’s report.

2007

Kaiser/HRET drew its sample from a Survey Sampling Incorporated list (based on an original Dun and Bradstreet list) of the nation’s private and public employers with three or more workers.

In prior years, many variables were imputed following a hotdeck approach, while others followed a distributional approach (where values were randomly determined from the variable’s distribution, assuming a normal distribution). This year, all variables are imputed following a hotdeck approach. This imputation method does not rely on a normal distribution assumption and replaces missing values with observed values from a firm with similar characteristics, in this case, size and industry. Due to the low imputation rate for most variables, the change in methodology is not expected to have a major impact on the results. In some cases, due to small sample size, imputed outliers are excluded. There are a few variables that Kaiser/HRET has decided should not be imputed; these are typically variables where “don’t know” is considered a valid response option (for example, firms’ opinions about effectiveness of various strategies to control health insurance costs).

The survey now contains a few questions on employee cost sharing that are asked only of firms that indicate in a previous question that they have a certain cost-sharing provision. For example, the copayment amount for prescription drugs is asked only of those that report they have copayments for prescription drugs. Because the composite variables are reflective of only those plans with the provision, separate weights for the relevant variables were created in order to account for the fact that not all covered workers have such provisions.

For more detail about the 2007 survey, see the Survey Methodology section of that year’s report.

2008

National Research, LLC (NR), our Washington, D.C.-based survey research firm, introduced a new CATI (Computer Assisted Telephone Interview) system at the end of 2007, and, due to several delays in the field, obtained fewer responses than expected. As a result, an incentive of $50 was offered during the final two and a half weeks the survey was in the field. Kaiser/HRET compared the distribution of key variables between firms receiving the incentive and firms not receiving the incentive to determine any potential bias. Chi-square test results were not significant, suggesting minimal to no bias.

In 2008, we changed the method used to report the annual percentage premium increase. In prior years, the reported percentage was based on a series of questions that asked responding firms the percentage increase or decrease in premiums from the previous year to the current year for a family of four in the largest plan of each plan type (e.g., HMO, PPO). The reported premium increase was the average of the reported percentage changes (i.e., 6.1% for 2007) weighted by covered workers. This year, we calculate the overall percentage increase in premiums from year to year for family coverage using the average of the premium dollar amounts for a family of four in the largest plan of each plan type reported by respondents and weighted by covered workers (i.e., $12,106 for 2007 and $12,680 for 2008, an increase of 5%). A principal advantage of using the premium dollar amounts to calculate the annual change in premiums is that we are better able to capture changes in the cost of health insurance for those firms that are newly in the market or that change plan types, especially those that move to plans with very different premium levels. For example, in the first year that a firm offers a plan of a new plan type, such as a consumer-directed plan, the firm can report the level of the premium they paid, but using the previous method would be unable to report the rate of change from the previous year since the plan was not previously offered. If the premium for the new plan is relatively low compared to other premiums in the market, the relatively low premium amount that the firm reports will tend to lower the weighted average premium dollar amount reported in the survey, but the firm responses would not provide any information to the percentage premium increase question. Another advantage of using premium dollar amounts to examine trends is that these data directly relate to the other findings in the survey and better address a principal public policy issue (i.e., what was the change in the cost of insurance over some past period). Many users noted, for example, that the percentage change calculated from the reported premium dollar amounts between two years did not directly match the reported average premium increase for the same period. There are several reasons why we would not expect these questions to produce identical results: 1) they are separate questions subject to varying degrees of reporting error, 2) firms could report a premium dollar amount for a plan type they might not have offered in the previous year, therefore, contributing information to one measure but not the other, or 3) firms could report a premium dollar amount for a plan that was not the largest plan of that type in the previous year. Although the two approaches have generated similar results in terms of the long-term growth rate of overall family premiums, there are greater discrepancies in trends for subgroups like small employers and self-funded firms. Focusing on the dollar amount changes over time will provide a more reliable and consistent measure of premium change that also is more sensitive to firms offering new plan options.

As we have in past years, this year we collected information on the cost-sharing provisions for hospital admissions and outpatient surgery that is in addition to any general annual plan deductible. However, for the 2008 survey, we changed the structure of the question and now include “separate annual deductible or hospital admissions” as a response option rather than collecting the information through a separate question. We continue to examine and sometimes modify the questions on hospital and outpatient surgery cost sharing because this can be a complex component of health benefit plans. For example, for some plans it is difficult to distinguish a separate hospital deductible from one categorized as a general annual deductible, where office visits and preventive care are covered and the deductible only applies to hospital use. Because this continues to be a point of confusion, we continue to refine the series of questions in order to clearly convey the information we are attempting to collect from respondents.

As in 2007, we asked firms if they offer health benefits to opposite-sex or same-sex domestic partners. However, this year, we changed the response options because during early tests of the 2008 survey, several firms noted that they had not encountered the issue yet, indicating that the responses of “yes,” “no,” and “don’t know” were insufficient. Therefore, this year we added the response option “not applicable/not encountered” to better capture the number of firms that report not having a policy on the issue.

For more detail about the 2008 survey, see the Survey Methodology section of that year’s report.

2009

In the fall of 2008, with guidance from experts in survey methods and design from NORC, we reviewed the methods used for the survey. As a result of this review, several important modifications were made to the 2009 survey, including the sample design and questionnaire. For the first time, this year we determined the sample requirements based on the universe of firms obtained from the U.S. Census rather than Dun and Bradstreet. Prior to the 2009 survey, the sample requirements were based on the total counts provided by Survey Sampling Incorporated (SSI) (which obtains data from Dun and Bradstreet). Over the years, we have found the Dun and Bradstreet frequency counts to be volatile because of duplicate listings of firms, or firms that are no longer in business. These inaccuracies vary by firm size and industry. In 2003, we began using the more consistent and accurate counts provided by the Census Bureau’s Statistics of U.S. Businesses and the Census of Governments as the basis for post-stratification, although the sample was still drawn from a Dun and Bradstreet list. In order to further address this concern at the time of sampling, we now also use Census data as the basis for the sample. This change resulted in shifts in the sample of firms required in some size and industry categories.

This year, we also defined Education as a separate sampling category, rather than as a subgroup of the Service category. In the past, Education firms were a disproportionately large share of Service firms. Education is controlled for during post-stratification, and adjusting the sampling frame to also control for Education allows for a more accurate representation of both Education and Service industries.