2022 Employer Health Benefits Survey

Section 13: Employer Practices, Telehealth, Provider Networks and Coverage for Mental Health Services

Employers frequently review and modify their health plans to incorporate new options or adapt to new circumstances. We continue to monitor the use of telemedicine, and ask about changes in the health or policy environments.

In 2021, with employers focused on COVID-19, we modified the survey to focus on how employers were adjusting their benefits and policies in response to the pandemic. Changes in telemedicine and access to mental health services received particular attention. For 2022 we continued our focus on telemedicine and mental health, although not necessarily through a COVID-19 lens. We also asked employers about their satisfaction with different aspects of their health benefits and health plan options, as well as about health benefit options targeted to lower-wage employees.

EMPLOYER SATISFACTION WITH HEALTH BENEFIT OFFERINGS

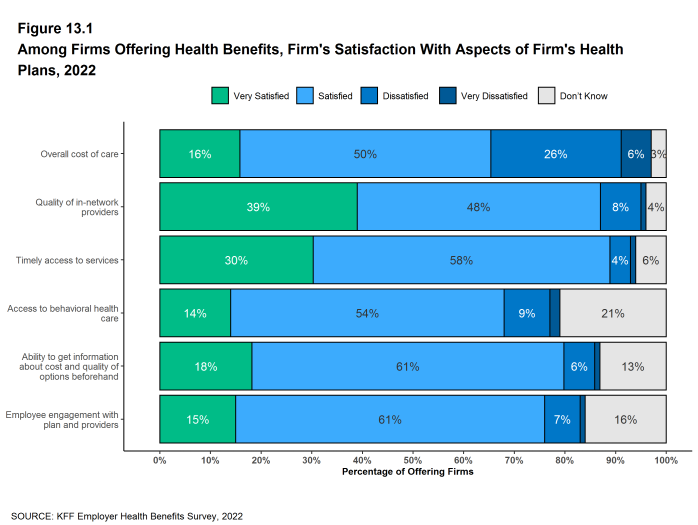

We asked employers about their level of satisfaction with their several aspects of their health plan offerings, including the overall costs for employees, access to care, including access to mental health services, quality of care, and adequacy of plan networks.

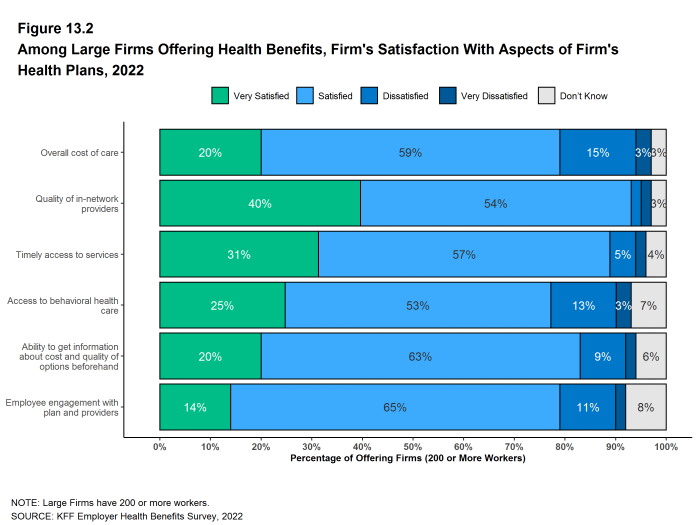

- A large share (66%) of firms offering health benefits said they were “very satisfied” or “satisfied” with the overall cost of care for their employees. Large firms are more likely to be at least “satisfied” with the overall cost of care than small firms (79% vs. 65%)[Figure 13.1] and [Figure 13.2].

- Among firms offering health benefits, 39% are “very satisfied” and another 48% are “satisfied” with the quality of the health care providers participating in their health plan networks. These percentages are similar for large and small firms [Figure 13.1].

- Among firms offering health benefits, 30% are “very satisfied” and another 58% are “satisfied” with the timely access to services for plan enrollees. These percentages are similar for large and small firms.

- Among firms offering health benefits, 14% are “very satisfied” and another 54% are “satisfied” with access to behavioral health care in their health plans for enrollees who need it. Large firms are more likely than small firms to be “very satisfied” with access to behavioral health care in their health plans (25% vs. 13%), while small firms are more likely to say that they do not know (22% vs. 7%) [Figure 13.1].

- Among firms offering health benefits, 15% are “very satisfied” and another 61% are “satisfied” with the level of employee engagement with the plan and providers. These percentages are similar for large and small firms.

Figure 13.1: Among Firms Offering Health Benefits, Firm’s Satisfaction With Aspects of Firm’s Health Plans, 2022

TELEMEDICINE

Access to telemedicine benefits, which had been growing steadily before the COVID-19 pandemic, skyrocketed during the lockdown period as people sheltered at home and refrained from seeking non-emergency health care. Both state and federal policymakers took steps to reduce regulatory barriers to the provision of telemedicine services, while employers and insurers also took steps to make it easier for patients to use them. We asked employers about their telemedicine benefit offerings as well as whether they view these benefits as an important source of access to health care in the future.

We define telemedicine as the delivery of health care services through telecommunications to a patient from a provider who is at a remote location, including video chat and remote monitoring. This generally does not include the mere exchange of information via email, exclusively web-based resources, or online information that a plan may make available, unless a health professional provides information specific to the enrollee`s condition. We note that during the coronavirus pandemic, some plans have eased their definitions to allow more types of digital communication to be reimbursed.

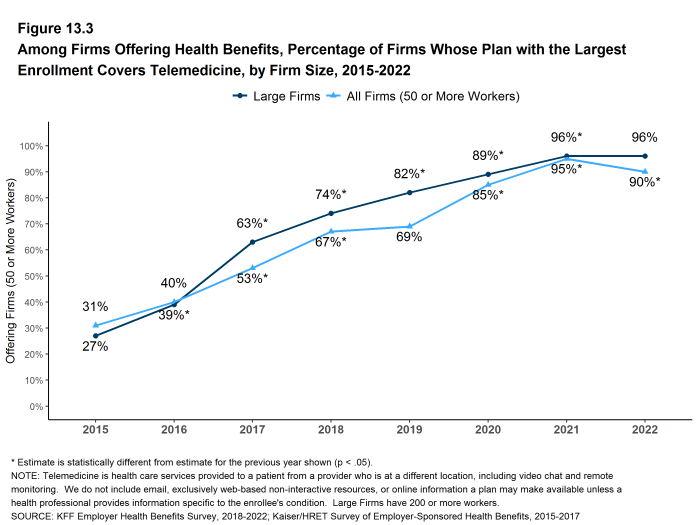

- Among firms with 50 or more workers offering health benefits, 87% of small firms and 96% of large firms cover the provision of some health care services through telemedicine in their largest health plan [Figure 13.3].

- The percentage of small firms (50-199 workers) offering telemedicine benefits in 2022 is lower than the percentage last year (87% vs. 94%). As a result of this change for small firms, the percentage of all firms offering telemedicine benefits also is lower this year [Figure 13.3].

- The percentages of small firms (50-199 workers) and large firms reporting that they cover services through telemedicine are much higher than they were three years ago (87% vs. 65% for small firms and 96% vs. 82% for large firms) [Figure 13.3].

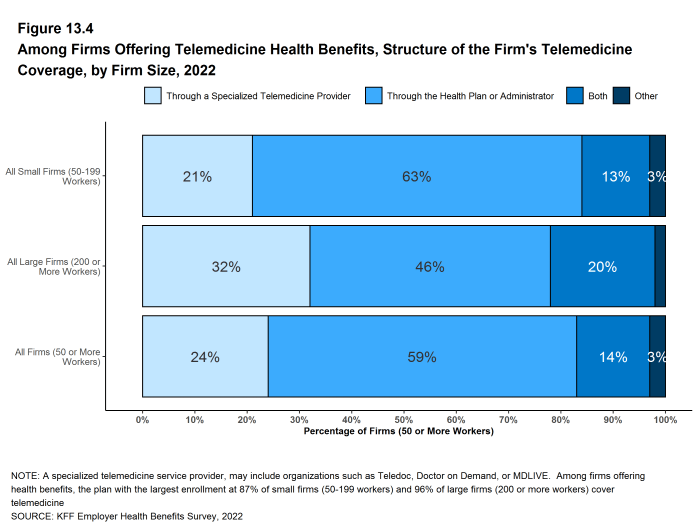

- Among firms with 50 or more employees offering telemedicine services, 24% use a specialized telemedicine service provider, such as Teledoc, Doctor on Demand, OR MDLIVE, 59% offer services through their health plan, 14% offer services through both a specialized telemedicine provider and their health plan, and 3% provide services through some other arrangement [Figure 13.4].

- Small firms are more likely than larger firms to provide telemedicine services only through their health plan (63% vs. 46%) [Figure 13.4].

- Large firms are more likely than smaller firms to provide telemedicine services through a specialized telemedicine provider (32% vs. 21%) or through both a specialized telemedicine provider and their health plan (20% vs. 13%) [Figure 13.4].

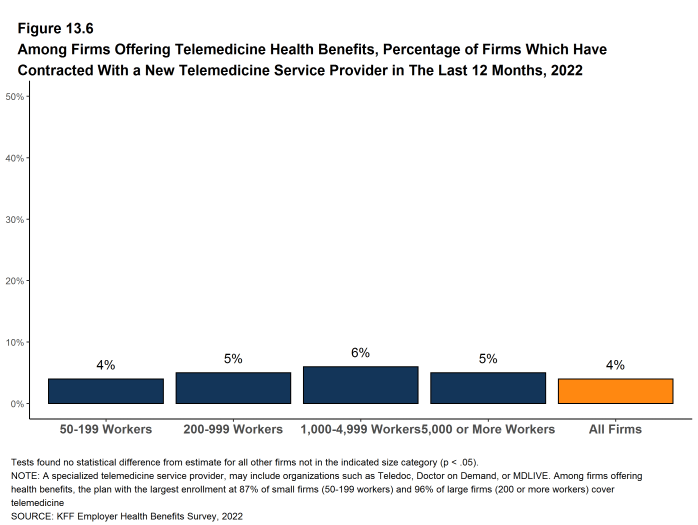

- Among firms with 50 or more employees offering health benefits, only 4% have contracted with a new telemedicine service provider within the last 12 months [Figure 13.6].

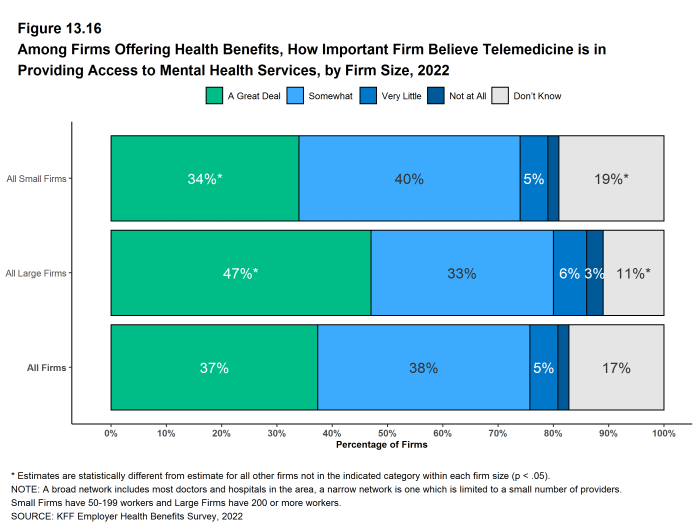

- Among firms with 50 or more employees offering telemedicine benefits, 37% say that telemedicine is “very important” in providing access to mental health services for enrollees, and another 38% say that it is “important” to providing access to these services. Large firms are more likely than small firms to say that telemedicine is “very important” to providing access to mental health services. (47% vs. 34%) while small firms are more likely than large firms to say that they do not know [Figure 13.16].

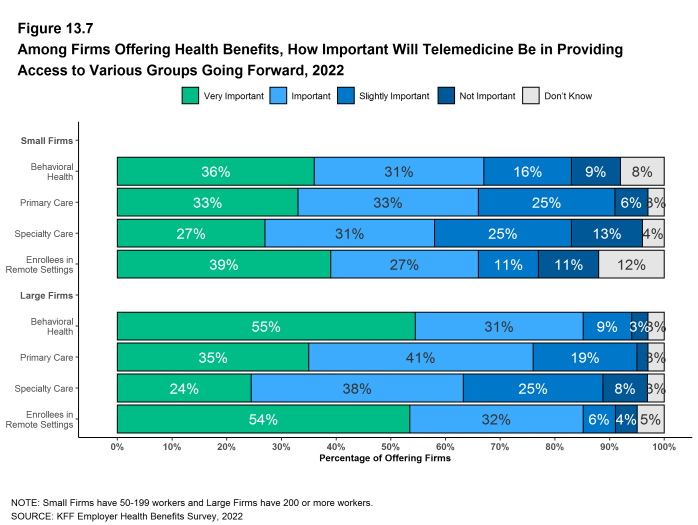

- We asked firms offering health benefits how important they felt telemedicine would be in providing access for their employees to certain types of services in the coming years. Among these firms:

- Behavioral Health Services – Thirty-six percent say that telemedicine will be “very important” in providing access to behavioral health services in the future, and another 31% say that it will be “important” to providing access to these services. Large firms are more likely than small firms to say that telemedicine will be “very important” to providing access to these services. (55% vs. 36%) [Figure 13.7].

- Primary Care – Thirty-three percent say that telemedicine will be “very important” in providing access to primary care in the future, and another 33% say that it will be “important” to providing access primary care].

- Specialty Care – Twenty-seven percent say that telemedicine will be “very important” in providing access to specialty care in the future, and another 31% say that it will be “important” to providing access to specialty care.

- Enrollees in Remote Areas – Forty percent say that telemedicine will be “very important” in providing future access to care for enrollees in remote areas, and another 27% say that it will be “important” to providing future access for remote enrollees. Large firms are more likely than small firms to say that telemedicine will be “very important” to providing access for enrollees in remote areas (54% vs. 39%) while small firms are more likely than large firms to say that telemedicine will be “not important” in providing access for remote enrollees (12% vs. 5%) or to say that they do not know [Figure 13.7].

- We asked firms with 50 or more employees offering telemedicine benefits about their expectations and experience with telemedicine use and cost. Among these employers:

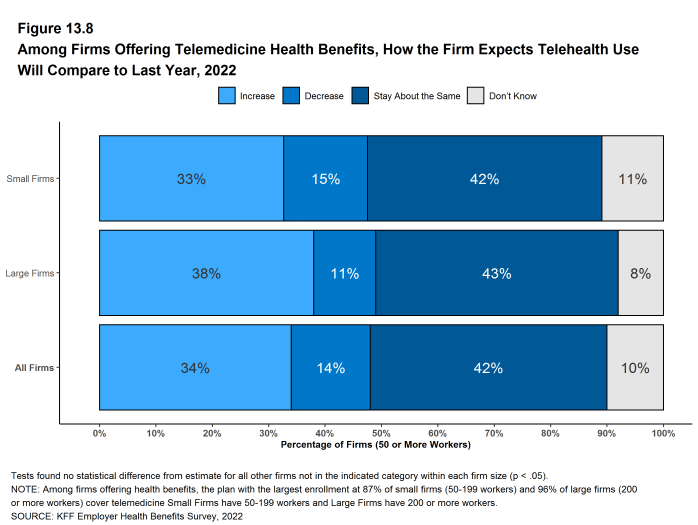

- Thirty-four percent expect the use of telemedicine to increase in 2022 as compared to last year, 14% expect it to decrease, and 42% expect it to stay about the same [Figure 13.8].

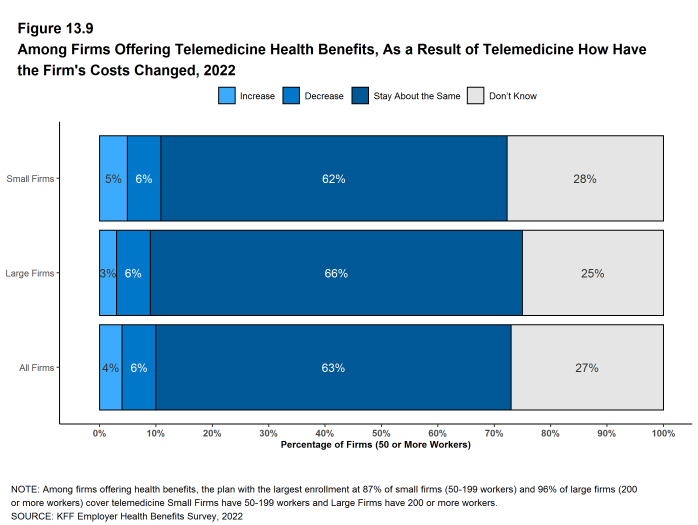

- Four percent say that their costs have increased as a result of telemedicine, 6% say that costs have decreased, 63% say that costs have stayed about the same, and 27% say that they do not know [Figure 13.9].

- Virtually no firms reported introducing any restrictions on telemedicine benefits due to concerns about use or cost in 2022. Eighty-five percent say that they have not introduced restrictions and 15% say that they do not know.

Figure 13.3: Among Firms Offering Health Benefits, Percentage of Firms Whose Plan With the Largest Enrollment Covers Telemedicine, by Firm Size, 2015-2022

Figure 13.4: Among Firms Offering Telemedicine Health Benefits, Structure of the Firm’s Telemedicine Coverage, by Firm Size, 2022

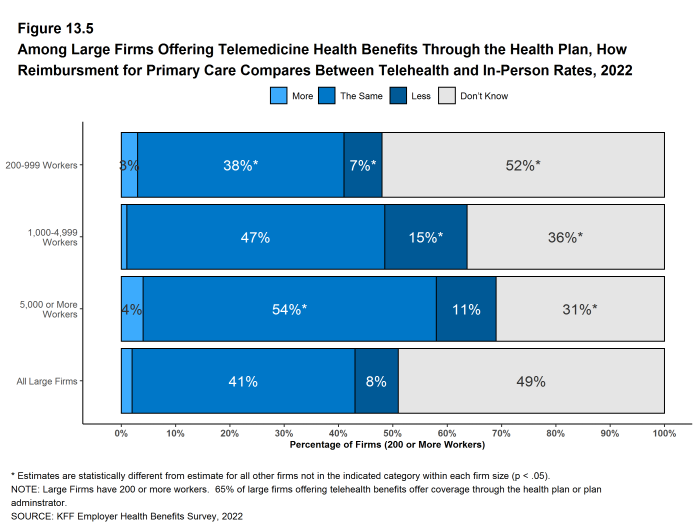

Figure 13.5: Among Large Firms Offering Telemedicine Health Benefits Through the Health Plan, How Reimbursment for Primary Care Compares Between Telehealth and In-Person Rates, 2022

Figure 13.6: Among Firms Offering Telemedicine Health Benefits, Percentage of Firms Which Have Contracted With a New Telemedicine Service Provider in the Last 12 Months, 2022

Figure 13.7: Among Firms Offering Health Benefits, How Important Will Telemedicine Be in Providing Access to Various Groups Going Forward, 2022

Figure 13.8: Among Firms Offering Telemedicine Health Benefits, How the Firm Expects Telehealth Use Will Compare to Last Year, 2022

FIRM APPROACHES TO PLAN NETWORKS

Firms and health plans structure their networks of providers to ensure access to care, as well as to encourage enrollees to use providers who are lower cost, or who provide better care. Periodically we ask employers about network strategies, such as using tiered or narrow networks.

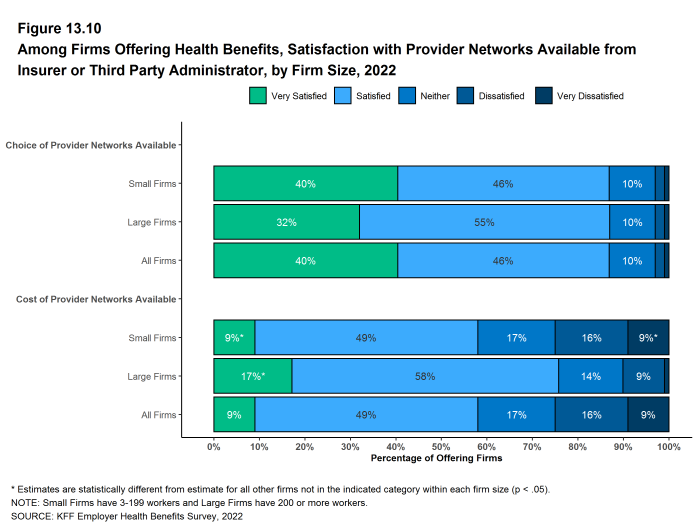

- Overall, employers report being satisfied with the choice of provider networks made available to them by their insurer or plan administrator.

- Among firms offering health benefits, 40% report being “very satisfied” and 46% report being “satisfied” by the choice of provider networks available to them [Figure 13.10].

- Employers are somewhat less satisfied with the cost of the provider networks available to them from their insurer or administrator. Among employers offering health benefits, only 9% of firms report being “very satisfied” while 49% report being “satisfied” with the cost of provider networks available to them. Large firms are more likely than small firms to be “very satisfied” with the cost of the provider networks available to them. Small firms are more likely than large firms to be “very dissatisfied” [Figure 13.10].

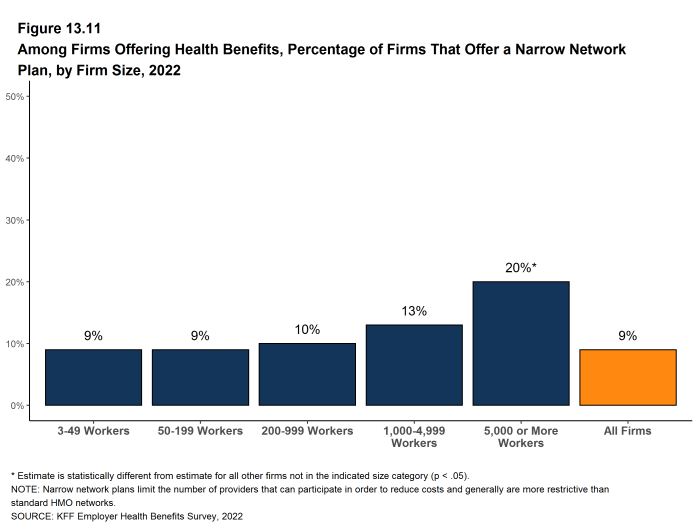

- Some employers offer a health plan with a relatively small, or narrow, network of providers to their employees. Narrow network plans limit the number of providers that can participate in order to reduce costs, and generally are more restrictive than standard HMO networks.

- Nine percent of firms offering health benefits report that they offer at least one plan that they considered to be a narrow network plan, similar to the percentage reported in 2020 [Figure 13.12].

- Firms with 5,000 or more workers offering health benefits are more likely than firms of other sizes to offer at least one plan with a narrow network (20%) [Figure 13.11].

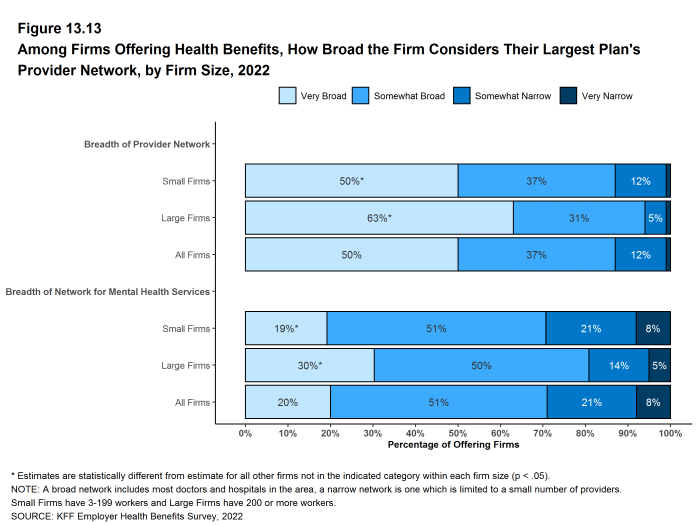

- We asked employers offering health benefits to characterize the breadth of the provider network in their plan with the largest enrollment. Fifty percent of firms say that the network in the plan with the largest enrollment is “very broad,” 37% say it is “somewhat broad,” and 12% say it is ‘somewhat narrow’ [Figure 13.13].

- Large firms are more likely than small firms to characterize the network in their largest health plan to be “very broad” (63% vs. 50%) [Figure 13.13].

- We also asked employers offering health benefits to characterize the breadth of the network for mental health and substance use services in their plan with the largest enrollment. Twenty percent of firms say that the network for mental health and substance use in the plan with the largest enrollment is “very broad,” 51% say it is “somewhat broad,” 21% say it is “somewhat narrow,” and 8% say it is “very narrow” [Figure 13.13].

- Large firms are more likely than small firms to characterize the network for mental health and substance use services in their largest health plan as “very broad” (30% vs. 19%) [Figure 13.13].

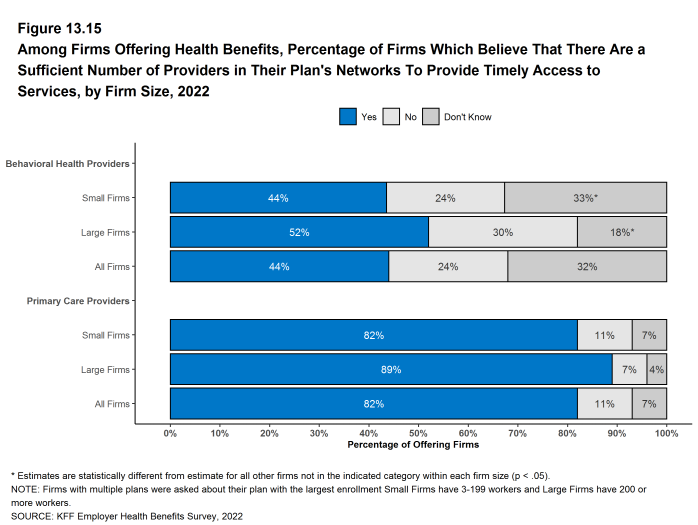

- We asked firms offering health benefits about whether they believed that the provider network for their health plan with the largest enrollment provided timely access to certain services.

- Over four in five (82%) firms offering health benefits believe that there are a sufficient number primary care providers in the plan’s networks to provide timely access to services for workers and their family members [Figure 13.15].

- In contrast, only 44% of firms offering health benefits believe that there is a sufficient number of behavioral health providers in the plan’s network to provide timely access to services for workers and their family members. Thirty-three percent of small firms and 18% of large firms do not know the answer to this question [Figure 13.15].

Figure 13.10: Among Firms Offering Health Benefits, Satisfaction With Provider Networks Available From Insurer or Third Party Administrator, by Firm Size, 2022

Figure 13.11: Among Firms Offering Health Benefits, Percentage of Firms That Offer a Narrow Network Plan, by Firm Size, 2022

Figure 13.12: Among Firms With 50 or More Workers Offering Health Benefits, Percentage of Firms That Offer a Narrow Network Plan, by Firm Size, 2014-2022

Figure 13.13: Among Firms Offering Health Benefits, How Broad the Firm Considers Their Largest Plan’s Provider Network, by Firm Size, 2022

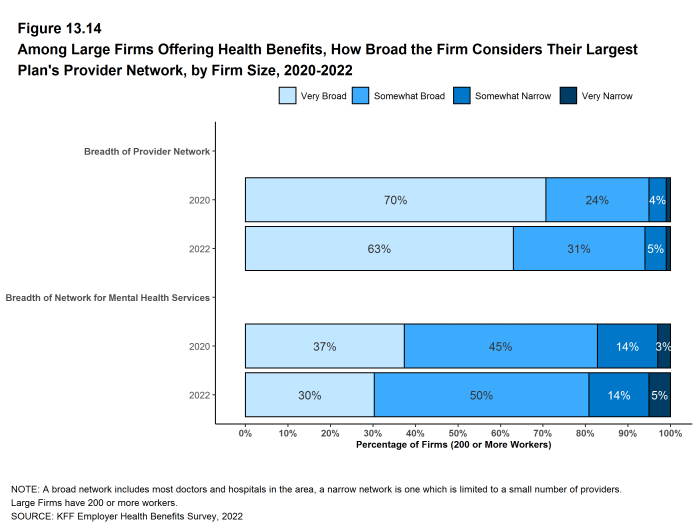

Figure 13.14: Among Large Firms Offering Health Benefits, How Broad the Firm Considers Their Largest Plan’s Provider Network, by Firm Size, 2020-2022

MENTAL AND BEHAVIORAL HEALTH

Access to mental and behavioral health services has been an issue for employers and policymakers for a number of years. The COVID-19 pandemic, with the accompanying social and economic disruptions, focused even more attention this topic. In the 2021 survey, we documented steps that employers and health plans were taking to improve access and meet the increased demand for these services. This year we asked employers about the demand for and use of these services, and whether they took further steps to expand access in 2022. The issue of network adequacy for mental and behavioral health services is addressed in the next section.

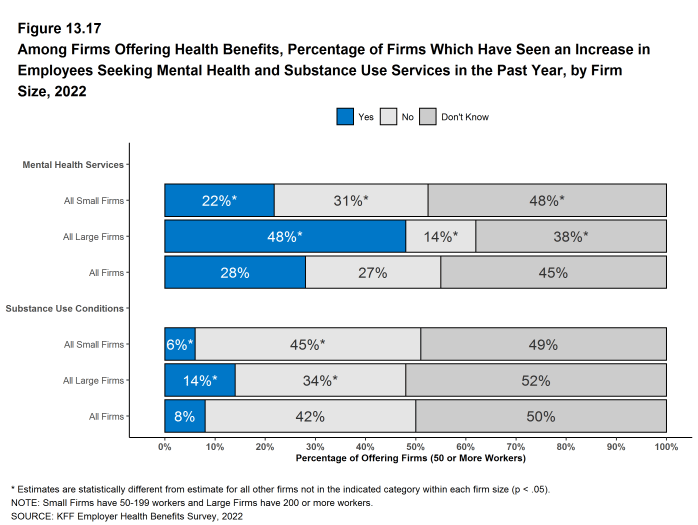

- Among firms with 50 or more workers offering health benefits, 22% of small firms and 48% of large firms say that the percentage of employees receiving mental health services increased in the last year. Large shares of small firms (48%) and large firms (38%) responded “Don’t Know” to this question [Figure 13.17].

- Among firms with 50 or more workers offering health benefits, 6% of small firms and 14% of large firms say that the percentage of employees receiving services for substance use conditions increased in the last year. As with the question about mental health services, large shares of small firms (49%) and large firms (52%) responded “Don’t Know” to this question [Figure 13.17].

- Among firms with 50 or more workers offering health benefits, 13% of small firms and 29% of large firms say that the percentage of employees requesting FMLA leave for mental health conditions increased in the last year [Figure 13.18].

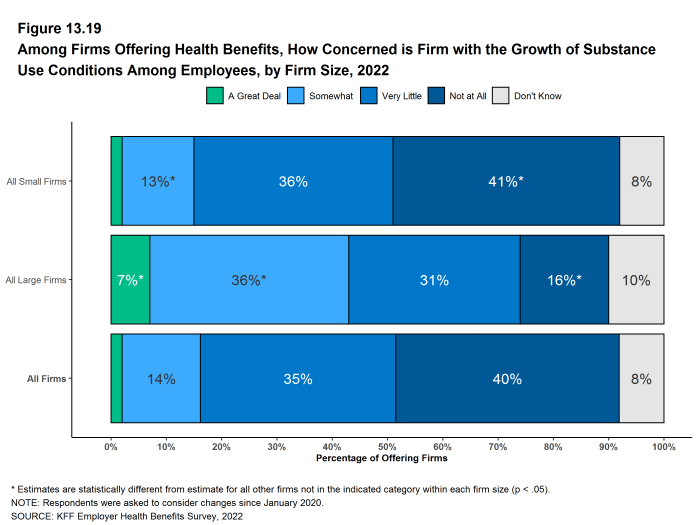

- We asked all firms offering health benefits whether they were concerned with the growth of substance use conditions among their employees since the beginning of the COVID-19 pandemic. A relatively small share of firms say that they are concerned “a great deal” about the growth of substance conditions (2%), 14% say that they are “somewhat” concerned, 35% say that they are concerned “a very little,” and 40% say that they are “not at all” concerned [Figure 13.19].

- Large firms are more likely than small firms to say that they are concerned “a great deal” (7% vs. 2%) or “somewhat” concerned (36% vs. 13%) [Figure 13.19].

- Small firms are more likely than large firms to say that they are “not at all” concerned (41% vs. 16%) [Figure 13.19].

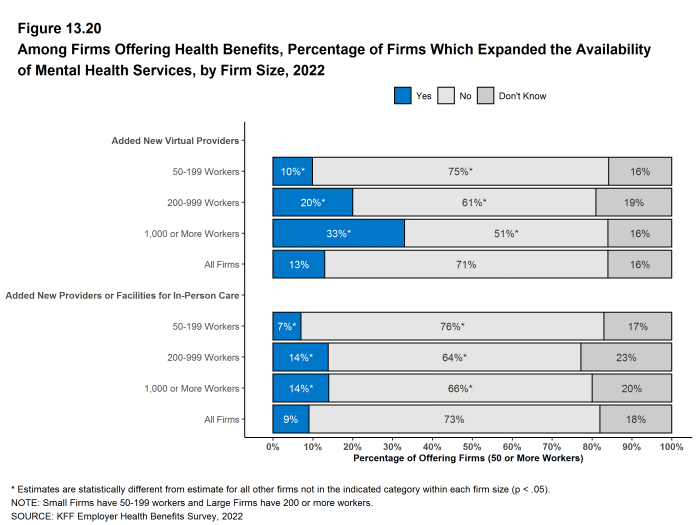

- We asked firms with 50 or more workers offering health benefits if they had taken steps to expand the availability of mental health services.

- Ten percent of small firms and 22% of large firms, including 33% of firms with 1,000 or more workers, say they expanded the availability of mental health services by adding new virtual providers [Figure 13.20].

- Seven percent of small firms and 14% of large firms say they expanded the availability of mental health services by adding new providers or facilities for in-person care [Figure 13.20].

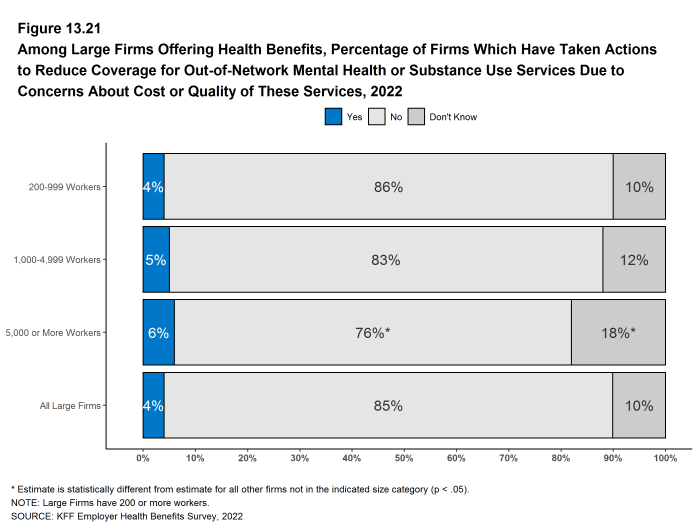

- Among large firms (200 or more workers) offering health benefits, 4% say that they have taken actions to reduce coverage for out-of-network mental health or substance use services, due to concerns about cost or quality of these services [Figure 13.21].

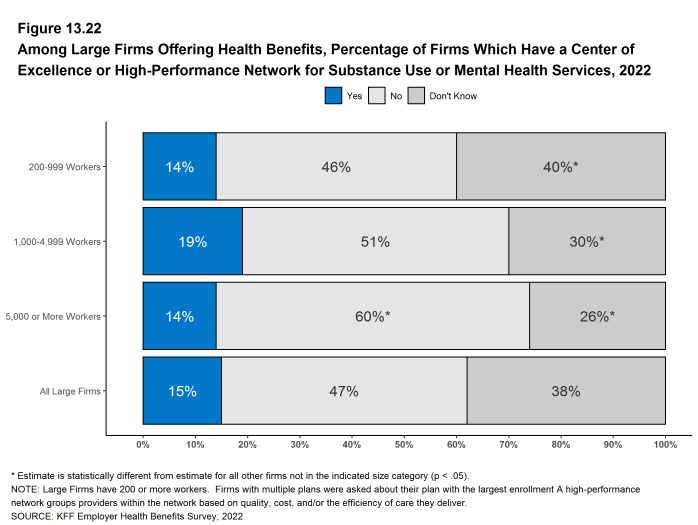

- Among large firms (200 or more workers) offering health benefits, 15% say that their health plan with the highest enrollment has a center of excellence or high-performance network for substance use or mental health services. Thirty-eight percent of these firms did not know the answer to this question [Figure 13.22].

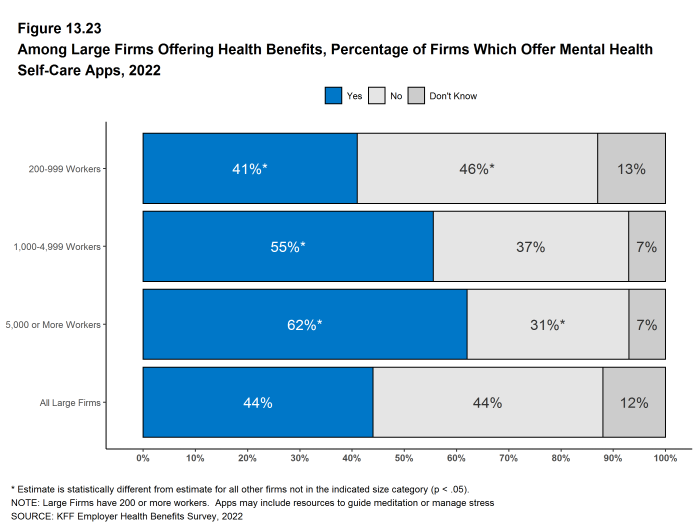

- Among large firms (200 or more workers) offering health benefits, 44% offer employees mental health self-care applications, such as resources to guide meditation or manage stress, separate from those available through the health plan [Figure 13.23].

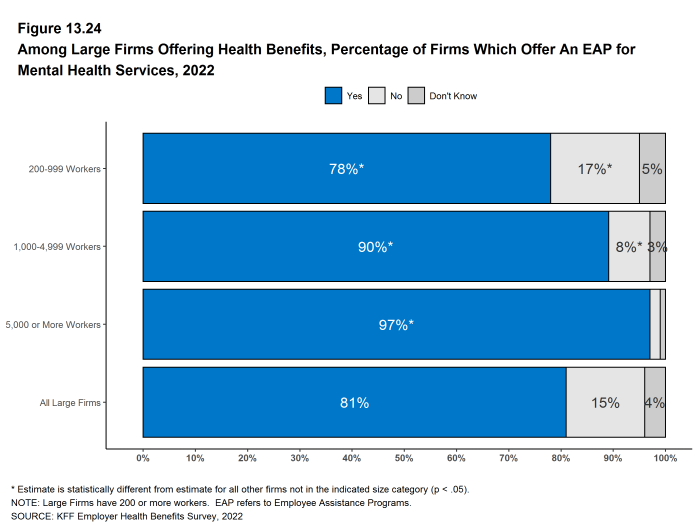

- Among large firms (200 or more workers) offering health benefits, a large share (81%) offer employee assistance programs, separate from those available through the health plan, for mental health [Figure 13.24].

Figure 13.16: Among Firms Offering Health Benefits, How Important Firm Believe Telemedicine Is in Providing Access to Mental Health Services, by Firm Size, 2022

Figure 13.17: Among Firms Offering Health Benefits, Percentage of Firms Which Have Seen an Increase in Employees Seeking Mental Health and Substance Use Services in the Past Year, by Firm Size, 2022

Figure 13.18: Among Firms Offering Health Benefits, Percentage of Firms Which Have Seen an Increase in the Percentage of Employees Requesting Fmla Leave for Mental Health Conditions, by Firm Size, 2022

Figure 13.19: Among Firms Offering Health Benefits, How Concerned Is Firm With the Growth of Substance Use Conditions Among Employees, by Firm Size, 2022

Figure 13.20: Among Firms Offering Health Benefits, Percentage of Firms Which Expanded the Availability of Mental Health Services, by Firm Size, 2022

Figure 13.21: Among Large Firms Offering Health Benefits, Percentage of Firms Which Have Taken Actions to Reduce Coverage for Out-Of-Network Mental Health or Substance Use Services Due to Concerns About Cost or Quality of These Services, 2022

Figure 13.22: Among Large Firms Offering Health Benefits, Percentage of Firms Which Have a Center of Excellence or High-Performance Network for Substance Use or Mental Health Services, 2022

Figure 13.23: Among Large Firms Offering Health Benefits, Percentage of Firms Which Offer Mental Health Self-Care Apps, 2022

STATE ALL-PAYER CLAIMS DATABASES

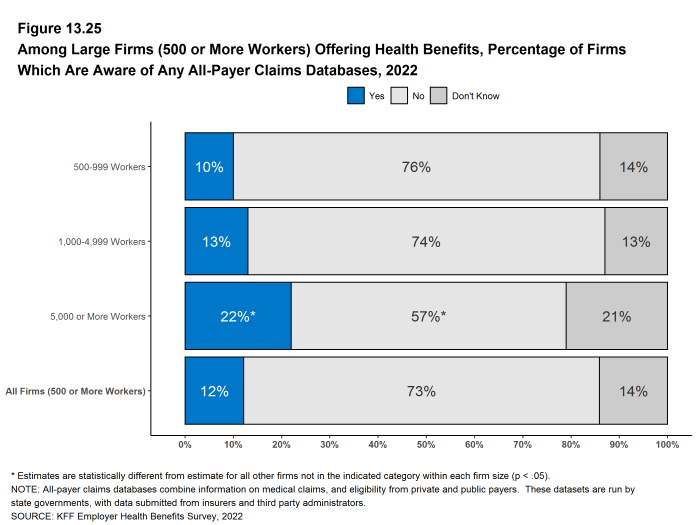

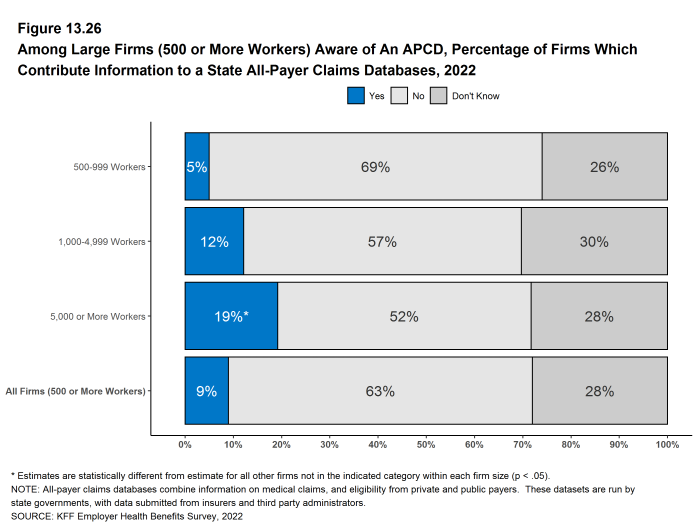

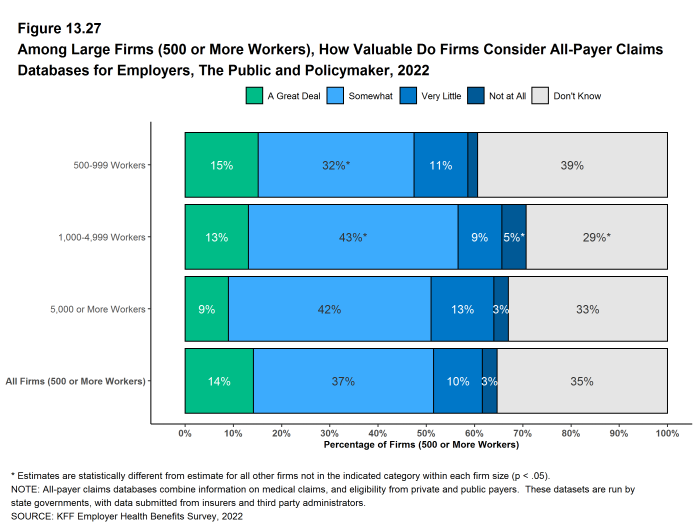

Some states have databases that collect medical claims and eligibility information from public and private health plans. The information in these databases can be used to study state and local health care markets and to compare the cost and performance of providers and payers. We asked firms with 500 or more workers about their awareness of these efforts and their participation.

- Among firms with 500 or more workers that currently offer health benefits, 12% say that they are aware of state all-payer claims databases. Firms with 5,000 or more workers are more likely to be aware of them [Figure 13.25].

- Among firms with 500 or more workers that currently offer health benefits, 9% contribute information to at least one state all-payer claims databases. Firms with 5,000 or more workers are more likely than other large firms to contribute information to a state all-payer claims database and firms with 500 to 999 workers are less likely to do so [Figure 13.26].

- We asked firms with 500 or more workers that currently offer health benefits how valuable they consider these databases for employers, the public, and policymakers. Among these employers, 14% say they have “a great deal” of value, 37% say that they are “somewhat” valuable, 10% say they have “very little” value, 3% say that they are “not at all” valuable, and 35% responded “don’t know” [Figure 13.27].

Figure 13.25: Among Large Firms (500 or More Workers) Offering Health Benefits, Percentage of Firms Which Are Aware of Any All-Payer Claims Databases, 2022

Figure 13.26: Among Large Firms (500 or More Workers) Aware of an Apcd, Percentage of Firms Which Contribute Information to a State All-Payer Claims Databases, 2022

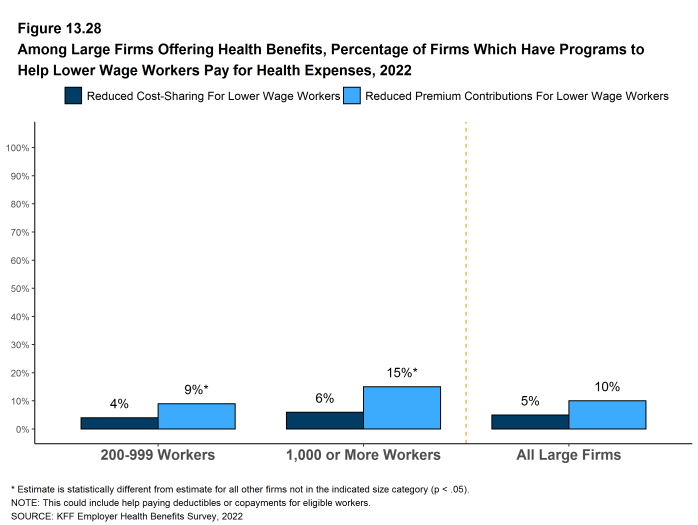

ASSISTANCE FOR LOWER-WAGE WORKERS

Some employers provide assistance to their lower-wage employees to help them with the costs of participating in their health plans. We asked large firms whether they provided assistance to help lower-wage workers with contributions or cost sharing.

- Ten percent of large firms offering health benefits have a program to lower the premium contributions of lower-wage workers, similar to the percentage (11%) in 2018 [Figure 13.28].

- Firms with 1,000 or more workers are more likely to have a program to lower premium contributions for lower-wage workers than other large firms, while firms with 200 to 999 workers are less likely to do so [Figure 13.28].

- Five percent of large firms offering health benefits have a program to lower the cost sharing of lower-wage workers, similar to the percentage (6%) in 2020 [Figure 13.28].