2020 Employer Health Benefits Survey

Employer-sponsored insurance covers approximately 157 million people.1 To provide current information about employer-sponsored health benefits, the Kaiser Family Foundation (KFF) conducts an annual survey of private and non-federal public employers with three or more workers. This is the twenty-second Employer Health Benefits Survey (EHBS) and reflects employer-sponsored health benefits in 2020.

The social and economic upheavals resulting from the coronavirus pandemic have certainly impacted employers, workers and employee benefits. The EHBS was fielded between January and late July, which means that a portion of the interviews were conducted before the full impact of the pandemic became apparent, and other interviews were conducted as the implications unfolded; including during the period of significant job loss that occurred during and after March. Many of the metrics we look at, such as premiums, contributions, cost sharing and plan offerings, are determined before plan year begins, so it is likely that responses for those items were largely unaffected by the pandemic. Responses for other items, such as incentives for health screenings or inclusion of coverage for telehealth visits, may have changed during the course of the pandemic: employers for example, may have suspended certain incentives to accommodate employee reluctance to visit provider offices. As such we cannot determine how the pandemic has affected employer responses. Because of the timing of the survey, we were unable to include any direct questions about how employers reacted to the pandemic.

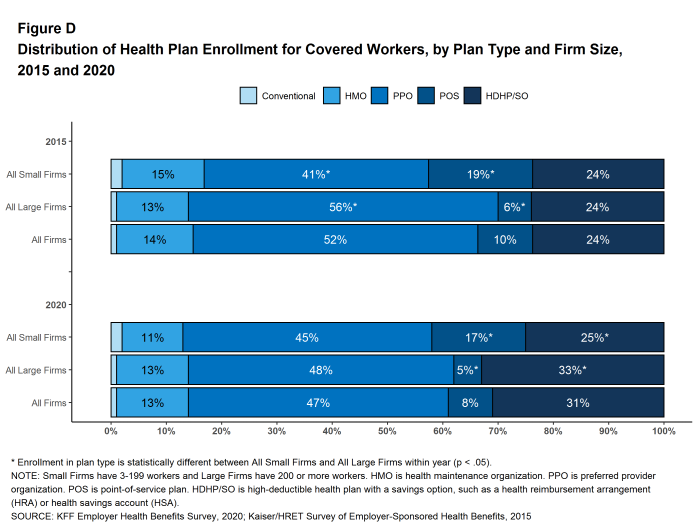

PLAN ENROLLMENT

PPOs are the most common plan type, enrolling 47% of covered workers in 2020. Thirty-one percent of covered workers are enrolled in a high-deductible plan with a savings option (HDHP/SO), 13% in an HMO, 8% in a POS plan, and 1% in a conventional (also known as an indemnity) plan [Figure D]. The percentage of covered workers enrolled in HMOs is significantly lower than the percentage last year (13% vs. 19%). This percentage has risen and fallen over the last four years so it is unclear if this trend will continue.

Figure D: Distribution of Health Plan Enrollment for Covered Workers, by Plan Type and Firm Size, 2015 and 2020

Self-Funding. Sixty-seven percent of covered workers, including 23% of covered workers in small firms and 84% in large firms, are enrolled in plans that are self-funded. The percentage of firms offering health benefits that are self funded in 2020 is higher than the percentage (61%) last year.

Thirteen percent of small firms report that they have a level-funded plan, similar to the percentage last year. These arrangements combine a relatively small self-funded component with stoploss insurance with low attachment points that may transfer a substantial share of the risk to insurers. These arrangements are complex and some small employers may not be entirely certain about the funding status of their plans. Among covered workers in small firms, 31% are in a plan that is either self-funded or told us that their plan was level-funded, higher than the percentage (24%) last year.

EMPLOYEE COST SHARING

Most covered workers must pay a share of the cost when they use health care services. Eighty-three percent of covered workers have a general annual deductible for single coverage that must be met before most services are paid for by the plan.

Among covered workers with a general annual deductible, the average deductible amount for single coverage is $1,644, similar to the average deductible last year. The average deductible for covered workers is higher in small firms than large firms ($2,295 vs. $1,418). The average single coverage annual deductible among covered workers with a deductible has increased 25% over the last five years and 79% over the last ten years.

Deductibles have increased in recent years due to higher deductibles within plan types and higher enrollment in HDHP/SOs. While growing deductibles in PPOs and other plan types generally increase enrollee out-of-pocket liability, the shift to enrollment in HDHP/SOs does not necessarily do so if HDHP/SO enrollees receive an offsetting account contribution from their employers. Ten percent of covered workers in an HDHP with a Health Reimbursement Arrangement (HRA), and 3% of covered workers in a Health Savings Account (HSA)-qualified HDHP receive an account contribution for single coverage at least equal to their deductible, while another 41% of covered workers in an HDHP with an HRA and 19% of covered workers in an HSA-qualified HDHP receive account contributions that, if applied to their deductible, would reduce their actual liability to less than $1,000.

We can look at the increase in the average deductible as well as the growing share of covered workers who have a deductible together by calculating an average deductible among all covered workers (assigning a zero to those without a deductible). The 2020 value of $1,364 is 27% higher than the average general annual deductible for single coverage of $1,077 in 2015 and 111% higher than the average general annual deductible of $646 in 2010.

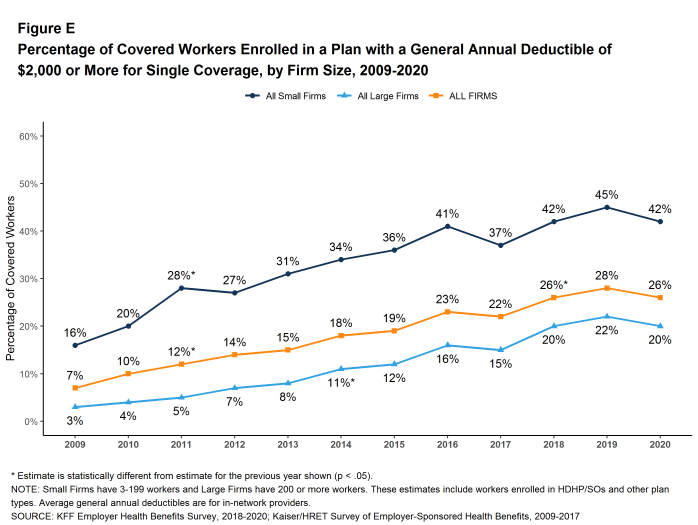

Another way to look at deductibles is the percentage of all covered workers who are in a plan with a deductible that exceeds certain thresholds. Over the past five years, the percentage of covered workers with a general annual deductible of $2,000 or more for single coverage has grown from 19% to 26% [Figure E].

Whether or not a deductible applies, a large share of covered workers also pay a portion of the cost when they visit an in-network physician. Most covered workers face a copayment (a fixed dollar amount) when they visit a doctor, although some workers face coinsurance requirements (a percentage of the covered amount). The average copayments are $26 for primary care and $42 for specialty care. The average coinsurance rates are 18% for primary care and 19% for specialty care. These amounts are similar to those in 2019.

Most workers also face additional cost sharing for a hospital admission or outpatient surgery. Sixty-five percent of covered workers have coinsurance and 13% have a copayment for hospital admissions. The average coinsurance rate for a hospital admission is 20% and the average copayment is $311 per hospital admission. The cost-sharing provisions for outpatient surgery follow a similar pattern to those for hospital admissions.

Virtually all covered workers are in plans with a limit on in-network cost sharing (called an out-of-pocket maximum) for single coverage, though the limits vary significantly. Among covered workers in plans with an out-of-pocket maximum for single coverage, 11% are in a plan with an out-of-pocket maximum of less than $2,000, while 18% are in a plan with an out-of-pocket maximum of $6,000 or more.

AVAILABILITY OF EMPLOYER-SPONSORED COVERAGE

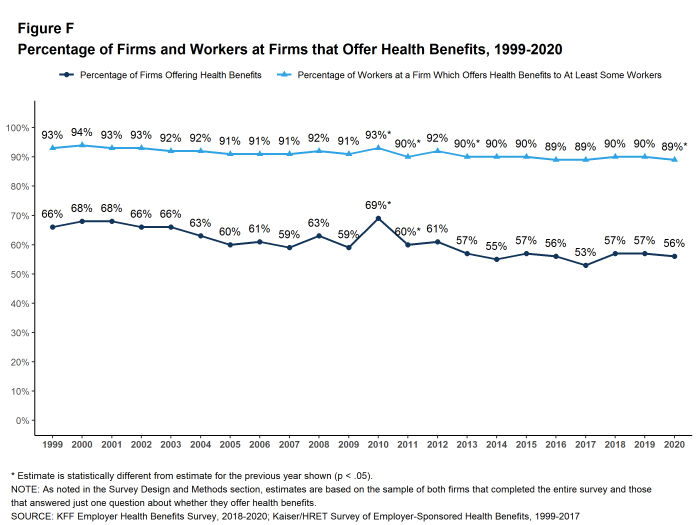

Fifty-six percent of firms offer health benefits to at least some of their workers, similar to the percentage last year [Figure F]. The likelihood of offering health benefits differs significantly by firm size; only 48% of firms with 3 to 9 workers offer coverage, while virtually all firms with 1,000 or more workers offer coverage.

While the vast majority of firms are small, most workers work for large firms that offer coverage. In 2020, 89% of workers are employed by a firm that offers health benefits to at least some of its workers [Figure F].

Although the vast majority of workers are employed by firms that offer health benefits, many workers are not covered at their job. Some are not eligible to enroll (e.g., waiting periods or part-time or temporary work status) and others who are eligible choose not to enroll (e.g., they feel the coverage is too expensive or they are covered through another source). In firms that offer coverage, 82% of workers are eligible for the health benefits offered, and of those eligible, 78% take up the firm’s offer, resulting in 64% of workers in offering firms enrolling in coverage through their employer. All of these percentages are similar to 2019.

Looking at workers in both firms that offer and firms that do not offer health benefits, 57% of workers are covered by health plans offered by their employer, similar to the percentage last year.

HEALTH AND WELLNESS PROGRAMS

Most large firms and many small firms have programs that help workers identify health issues and manage chronic conditions, including health risk assessments, biometric screenings, and health promotion programs.

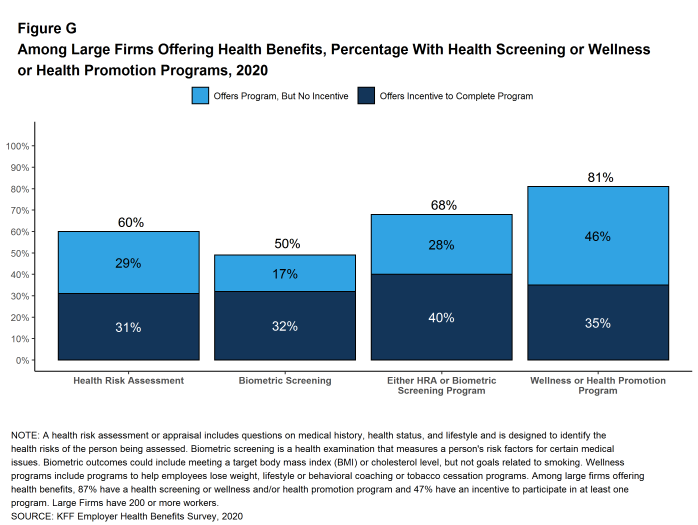

Health Risk Assessments. Among firms offering health benefits, 42% of small firms and 60% of large firms provide workers the opportunity to complete a health risk assessment [Figure G]. A health risk assessment includes questions about a person’s medical history, health status, and lifestyle. Fifty-two percent of large firms with a health risk assessment program offer an incentive to encourage workers to complete the assessment. Incentives may include: gift cards, merchandise or similar rewards; lower premium contributions or cost sharing; and financial rewards, such as cash, contributions to health-related savings accounts, or avoiding a payroll fee.

Biometric Screenings. Among firms offering health benefits, 33% of small firms and 50% of large firms provide workers the opportunity to complete a biometric screening. A biometric screening is an in-person health examination that measures a person’s risk factors, such as body mass index (BMI), cholesterol, blood pressure, stress, and nutrition. Sixty-five percent of large firms with biometric screening programs offer workers an incentive to complete the screening.

Additionally, among large firms with biometric screening programs, 18% reward or penalize workers based on achieving specified biometric outcomes (such as meeting a target BMI). The size of these incentives varies considerably: among large firms offering a reward or penalty for meeting biometric outcomes, the maximum reward is valued at $150 or less in 12% of firms and more than $1,000 in 32% of firms.

Effectiveness of Incentives. This year we asked large firms with an incentive to participate in a health promotion or health screening program, how effective they believed these incentives were at increasing employee participation. 30% believed incentives were ‘very effective’ and 47% believed they were ‘moderately effective’.

Health and Wellness Promotion Programs. Most firms offering health benefits offer programs to help workers identify and address health risks and unhealthy behaviors. Fifty-three percent of small firms and 81% of large firms offer a program in at least one of these areas: smoking cessation, weight management, and behavioral or lifestyle coaching. Among large firms offering at least one of these programs, 44% offer workers an incentive to participate in or complete the program [Figure G].

As health screenings and wellness programs have become more complex, incentives have become more sophisticated and may involve participating in or meeting goals in different programs. We asked firms that had incentives for any of these programs to estimate the maximum incentive for a worker across all of their screening and promotion programs combined. Among large firms with any type of incentive, 20% have a maximum incentive of $150 or less, while 20% have a maximum incentive of more than $1,000.

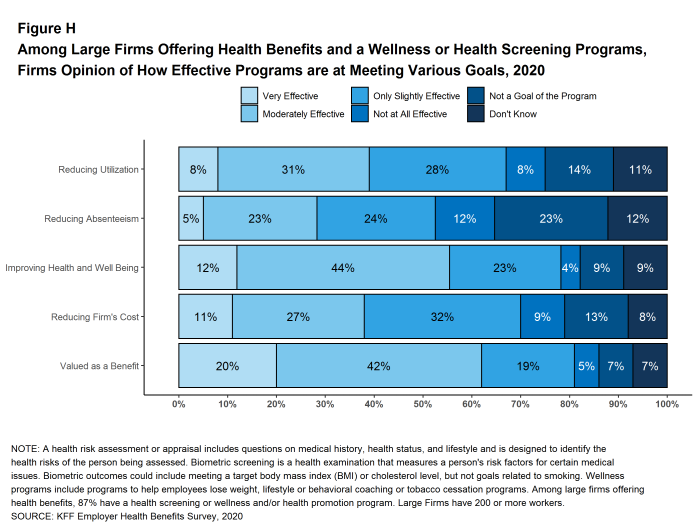

Effectiveness of Programs. Firms may have a variety of objectives for offering health screening and health promotion programs, including improving the health and wellbeing of enrollees, reducing absences from work, and reducing costs. Firms generally responded that their programs were effective to some degree in meeting certain specified objectives, although there were many who responded that they did not know [Figure H].

Figure G: Among Large Firms Offering Health Benefits, Percentage With Health Screening or Wellness or Health Promotion Programs, 2020

SITES OF CARE

Telemedicine. Telemedicine is the delivery of health care services through telecommunications to a patient from a provider who is at a remote location, including video chat and remote monitoring. In 2020, 85% of firms with 50 or more workers offering health benefits cover the provision of health care services through telemedicine in their largest health plan, higher than the percentage last year. Offering firms with 5,000 or more workers are more likely to cover services provided through telemedicine than smaller firms.

Over the past year, there was a significant increase in the percentage of firms, particularly smaller firms (50-199 workers), reporting that they cover some services through telemedicine. While telemedicine has grown in recent years, it is possible that some of the growth this year reflects changes in response to the coronavirus pandemic as well as to an increased awareness. It will be important to watch if this heightened focus on access to care through telemedicine continues or abates as concerns about the coronavirus recede.

Retail Health Clinics. Seventy-six percent of large firms offering health benefits cover health care services received in retail clinics, such as those located in pharmacies, supermarkets and retail stores, in their largest health plan. These clinics are often staffed by nurse practitioners or physician assistants and treat minor illnesses and provide preventive services.

PROVIDER NETWORKS

Firms and health plans can structure their networks of providers and their cost sharing to encourage enrollees to use providers who charge lower costs and/or who provide better care. This involves assuring that there are a sufficient number of providers to assure reasonable access while also limiting the network to those that deliver good quality and cost-effective care.

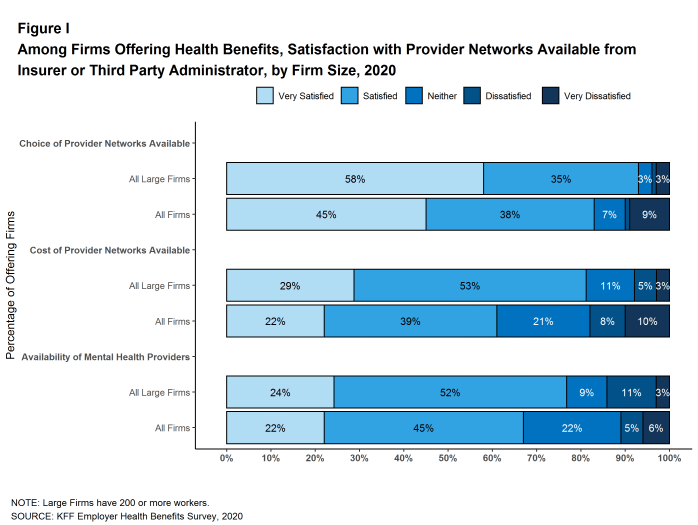

Satisfaction with Network Choices. Among employers offering health benefits, 45% of firms report being ‘very satisfied’ and 38% report being ‘satisfied’ by the choice of provider networks available to them [Figure I]. They are somewhat less satisfied with the cost of the provider networks available to them. Only 22% of these firms report being ‘very satisfied’ while 39% report being ‘satisfied’ with the cost of provider networks available. Small firms are more likely than large firms to be ‘very dissatisfied’ with the cost of the provider networks available.

Breadth of Provider Networks. Employers offering health benefits were asked to characterize the breadth of the provider network in their plan with the largest enrollment. Fifty-one percent of firms say that the network in the plan with the largest enrollment is ‘very broad’, 42% say it is ‘somewhat broad’, and 6% say it is ‘somewhat narrow’.

Seven percent of firms offering health benefits report that they offer at least one plan that they considered to be a narrow network plan, similar to the percentage last year. Firms with 5,000 or more workers were more likely to offer a narrow network plan than smaller firms.

Breadth of Provider Networks for Mental Health. Employers offering health benefits were also asked to characterize the breadth of the network for mental health and substance abuse providers in their plan with the largest enrollment. Thirty-five percent of firms say that the network for mental health and substance abuse in the plan with the largest enrollment is ‘very broad’, 46% say it is ‘somewhat broad’, 15% say it is ‘somewhat narrow’, and 4% say it is ‘very narrow’.

Only about one-in-five (22%) employers offering health benefits report being very satisfied with the availability of mental health providers in their provider networks. Among employers offering health benefits, 15% of employers with 1,000 to 4,999 employees and 23% of employers with 5,000 or more employees asked their insurer or third party administrator to increase access to in-network mental health and substance abuse providers.

COST SHARING FOR PEOPLE WITH CHRONIC CONDITIONS

Among employers with 200 or more employees offering health benefits, 21% say that their health plan with the largest enrollment waives cost-sharing for some medications or supplies to encourage employees with chronic illnesses to follow their treatment. This likelihood increases with firm size.

Recent changes in federal rules expanded the number and types of items and services that may be considered preventive by HSA-qualified health plans, allowing plan sponsors to pay for part or all of these services before enrollees meet the plan deductibles. Among employers with 200 or more employees offering an HSA-qualified health plan, 29% say that they changed the services or products that individuals with chronic conditions could receive without first meeting their deductibles. Firms with 5,000 or more employees (48%) are more likely to say they changed the services or products available before the deductible is met.

DISCUSSION

Looking at the metrics we usually consider, such as premiums, contributions, cost sharing, offer and coverage rates, we would conclude that the marketplace for employer-based health coverage had another stable year in 2020. Premium increases were modest and consistent with recent years, contributions and cost sharing largely did not change, nor did the shares of workers offered coverage or covered at their jobs. There is a meaningful increase in the share of workers in self-funded plans, which will be important to understand if the higher level persists. We will include additional questions in the 2021 survey to explore why employers are taking this option.

Of course the economic and social changes caused by the coronavirus pandemic have dramatically changed the employment landscape across the nation. Unprecedented job loss combined with shelter-at-home requirements and continuing delays in reopening of workplaces and schools are challenging employers and workers in many ways, including health benefits. There are questions, for example, about the continued availability of coverage for furloughed workers, the share of laid-off workers who are electing COBRA continuation coverage, and changes being made to employee assistance programs and health benefit plans to support workers with the emotional, social and financial stresses. As noted above, however, because the survey was fielded as the pandemic unfolded, we are not yet in a position to address how employers responded to the pandemic. Most of the metrics discussed above are fixed at the beginning of the plan year and may not reflect current circumstances. Some other responses may have been affected by the unfolding of the pandemic.

While we observed a relatively modest change in premiums in 2020, this does not capture the pandemic’s turbulent impacts on health care costs this year. During the spring, employers and plans saw lower health care utilization and correspondingly lower spending. With enrollees skipping some care, insurers reported lower than predicted cost through the first half of the year. As stay-at-home orders have lifted, health care utilization has again started picking up. Spending in 2021 remains uncertain as employers and insurers continue to adapt to an evolving situation. We do not know how the reduced use of care earlier this year will affect future costs and premiums: in some cases the need for care will have passed but in others the care will just have been deferred. Missed preventive and diagnostic care may also lead to worsening health and higher costs in the future. Beyond any potential pent-up demand, employer-based plans may face higher costs due to new COVID-19 tests, treatments and vaccines. Conversely, we have witnessed a dramatic economic slowdown which may lead to reduced utilization, offsetting some cost on plans.

For a year that started with historically low levels of unemployment, 2020 saw a stark increase in the unemployment rate. A less competitive job market and the economic slowdown may reduce pressure on employers to offer competitive benefit packages in the coming year. We largely reported similar average cost-sharing amounts to 2019 but some employers may be considering reducing plan generosity depending on how the economic crisis unfolds.

The challenge for the 2021 survey will be to understand how employers are responding to the pandemic and accompanying economic fallout while still maintaining the core questions and purpose of the survey. We do not know how long the pandemic will last nor what the longer term economic consequences will be, but we can ask employers about how this uncertainty affected their benefit plan decisions, what types of benefits they added and/or changed, whether they saw changes in how employees used their benefits, and whether they expect any changes to be more permanent. We also expect to ask how the disruption and uncertainty caused by the pandemic affected employer decisions about changing their plans or shopping for new vendors. The pandemic has already affected many employer benefits, and will continue to shape their decision-making as they anticipate new workplace accommodations, changes in premiums and the direct cost of the pandemic.

METHODOLOGY

The Kaiser Family Foundation 2020 Employer Health Benefits Survey reports findings from a telephone survey of 1,765 randomly selected non-federal public and private employers with three or more workers. Researchers at NORC at the University of Chicago and the Kaiser Family Foundation designed and analyzed the survey. Davis Research, LLC conducted the fieldwork between January and July 2020. In 2020, the overall response rate is 22%, which includes firms that offer and do not offer health benefits. Among firms participating in the past two years, the survey’s response rate is 51%. Unless otherwise noted, differences referred to in the text and figures use the 0.05 confidence level as the threshold for significance. Small firms have 3-199 workers. Values below 3% are not shown on graphical figures to improve the readability of those graphs. Some distributions may not sum due to rounding. For the first time since 1999, we contracted with a new data collection firm to conduct the survey. For more information on potential ‘house effects’ resulting from this change, as well as information on changes to our weighting methodology and measurements of workers’ wage and inflation see the Survey Design and Methods section.

For more information on the survey methodology, please visit the Survey Design and Methods section at http://ehbs.kff.org/.

Filling the need for trusted information on national health issues, the Kaiser Family Foundation is a nonprofit organization based in San Francisco, California.

- Kaiser Family Foundation. Health Insurance Coverage of the Total Population [Internet]. KFF (Kaiser Family Foundation). 2019 [cited 2020 Aug 10]. Available from: https://www.kff.org/other/state-indicator/total-population/ Coverage is based on calculations from the 2018 American Community Survey. During the winter and spring of 2020, there was a steep increase in the unemployment rate, potentially decreasing the number of people covered by employer coverage.↩︎

- Bureau of Labor Statistics. Consumer Price Index historical tables for, U.S. City Average of Annual Inflation [Internet]. Washington (DC): BLS; [cited 2020 Aug 10]. Available from: https://www.bls.gov/regions/mid-atlantic/data/consumerpriceindexhistorical1967base_us_table.htm AND Bureau of Labor Statistics. Current Employment Statistics—CES (National) [Internet]. Washington (DC): BLS; [cited 2020 Aug 10]. Available from: https://www.bls.gov/ces/publications/highlights/highlights-archive.htm↩︎

- This threshold is based on the twenty-fifth percentile of workers’ earnings ($26,000 in 2020). Bureau of Labor Statistics. May 2018 National Occupational Employment and Wage Estimates: United States. Washington (DC): BLS. Available from: http://www.bls.gov/oes/current/oes_nat.htm↩︎