2019 Employer Health Benefits Survey

Employer-sponsored insurance covers over half of the non-elderly population; approximately 153 million nonelderly people in total.1 To provide current information about employer-sponsored health benefits, the Kaiser Family Foundation (KFF) conducts an annual survey of private and non-federal public employers with three or more workers. This is the twenty-first survey and reflects employer-sponsored health benefits in 2019.

PLAN ENROLLMENT

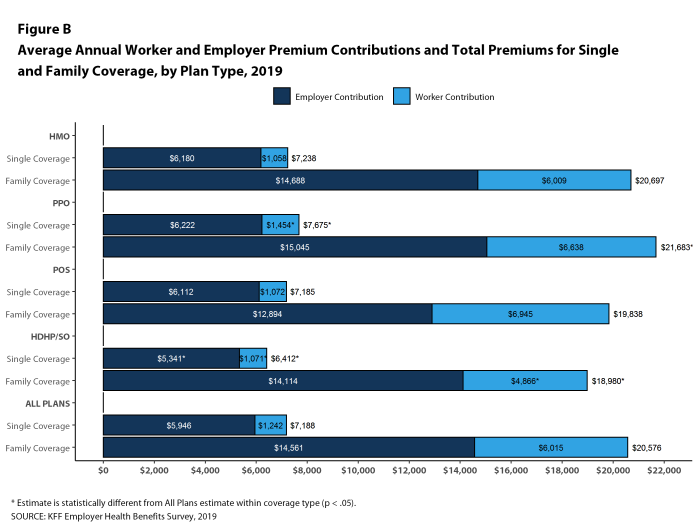

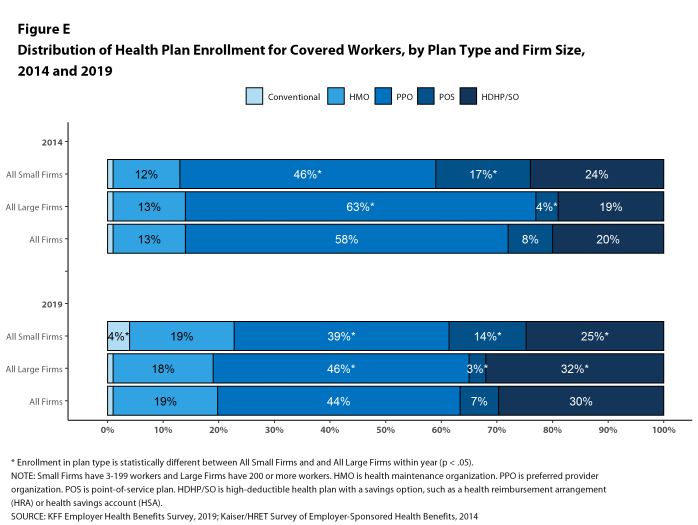

PPOs continue to be the most common plan type, enrolling 44% of covered workers in 2019. Thirty percent of covered workers are enrolled in a high-deductible plan with a savings option (HDHP/SO), 19% in an HMO, 7% in a POS plan, and 1% in a conventional (also known as an indemnity) plan [Figure E].

Figure E: Distribution of Health Plan Enrollment for Covered Workers, by Plan Type and Firm Size, 2014 and 2019

Self-Funding. Sixty-one percent of covered workers, including 17% of covered workers in small firms and 80% in large firms, are enrolled in plans that are either partially or completely self-funded.

Seven percent of small firms report that they have a level-funded plan. These arrangements combine a relatively small self-funded component with stoploss insurance with low attachment points that may transfer a substantial share of the risk to insurers. These arrangements are complex and some small employers may not be entirely certain about the funding status of their plans.

EMPLOYEE COST SHARING

Most covered workers must pay a share of the cost when they use health care services. Eighty-two percent of covered workers have a general annual deductible for single coverage that must be met before most services are paid for by the plan.

Among covered workers with a general annual deductible, the average deductible amount for single coverage is $1,655, similar to the average deductible last year. The average deductible for covered workers is higher in small firms than large firms ($2,271 vs. $1,412). The average annual deductible among covered workers with a deductible has increased 36% over the last five years and 100% over the last ten years.

Deductibles have increased in recent years due to higher deductibles within plan types and higher enrollment in HDHP/SOs. While growing deductibles in PPOs and other plan types generally increase enrollee out-of-pocket liability, the shift to enrollment in HDHP/SOs does not necessarily do so because many HDHP/SO enrollees receive an account contribution from their employers. Twenty-one percent of covered workers in an HDHP with a Health Reimbursement Arrangement (HRA), and 2% of covered workers in a Health Savings Account (HSA)-qualified HDHP receive an account contribution for single coverage at least equal to their deductible, while another 22% of covered workers in an HDHP with an HRA and 23% of covered workers in an HSA-qualified HDHP receive account contributions that, if applied to their deductible, would reduce their actual liability to less than $1,000.

The 2019 value is 41% higher than the average general annual deductible of $989 in 2014 and 162% higher than the average general annual deductible of $533 in 2009.

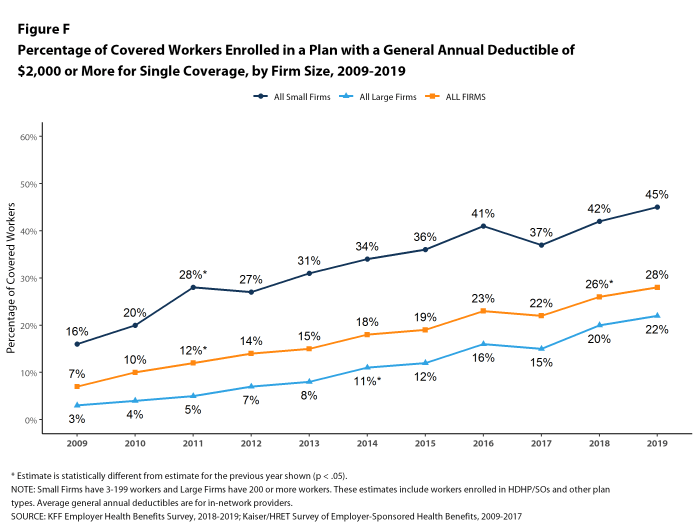

Another way to look at deductibles is the percentage of all covered workers who are in a plan with a deductible that exceeds certain thresholds. Over the past five years, the percentage of covered workers with a general annual deductible of $2,000 or more for single coverage has grown from 18% to 28% [Figure F].

A large share of covered workers also pay a portion of the cost when they visit an in-network physician. Most covered workers face a copayment (a fixed dollar amount) when they visit a doctor, although some workers face coinsurance requirements (a percentage of the covered amount). The average copayments are $25 for primary care and $40 for specialty care. The average coinsurance rates are 18% for primary care and 19% for specialty care. These amounts are similar to those in 2018.

Most workers also face additional cost sharing for a hospital admission or outpatient surgery. Sixty-six percent of covered workers have coinsurance and 14% have a copayment for hospital admissions. The average coinsurance rate for a hospital admission is 20% and the average copayment is $326 per hospital admission. The cost-sharing provisions for outpatient surgery follow a similar pattern to those for hospital admissions.

Almost all (99%) covered workers are in plans with a limit on in-network cost sharing (called an out-of-pocket maximum) for single coverage, though the limits vary significantly. Among covered workers in plans with an out-of-pocket maximum for single coverage, 12% are in a plan with an out-of-pocket maximum of less than $2,000, while 20% are in a plan with an out-of-pocket maximum of $6,000 or more.

AVAILABILITY OF EMPLOYER-SPONSORED COVERAGE

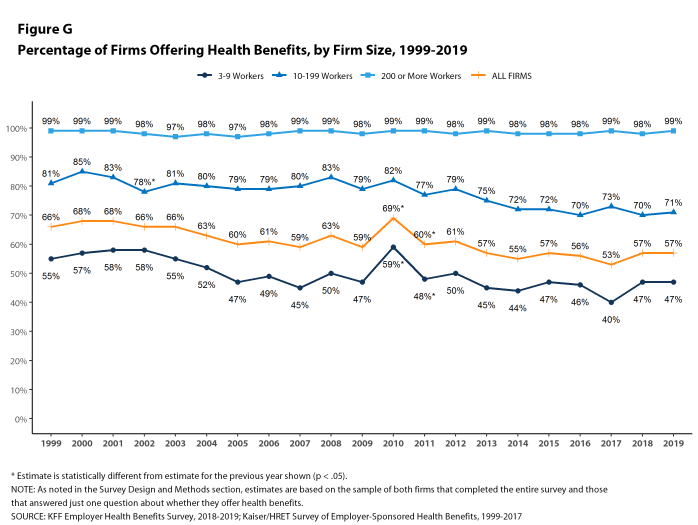

Fifty-seven percent of firms offer health benefits to at least some of their workers, similar to the percentage last year [Figure G]. The likelihood of offering health benefits differs significantly by firm size; only 47% of firms with 3 to 9 workers offer coverage, while virtually all firms with 1,000 or more workers offer coverage.

While the vast majority of firms are small, most workers work for large firms that offer coverage. In 2019, 90% of workers are employed by a firm that offers health benefits to at least some of its workers.

Although the vast majority of workers are employed by firms that offer health benefits, many workers are not covered at their job. Some are not eligible to enroll (e.g., waiting periods or part-time or temporary work status) and others who are eligible choose not to enroll (e.g., they feel the coverage is too expensive or they are covered through another source). In firms that offer coverage, 80% of workers are eligible for the health benefits offered, and of those eligible, 76% take up the firm’s offer, resulting in 61% of workers in offering firms enrolling in coverage through their employer. All of these percentages are similar to 2018.

Looking at workers in both firms that offer and firms that do not offer health benefits, 55% of workers are covered by health plans offered by their employer, similar to the percentage last year.

Repeal of the Individual Mandate Beginning in 2019, there is no penalty for individuals who do not maintain health insurance, sometimes called the Individual Mandate. Among firms offering health benefits with at least 50 employees, 9% say that they believed the repeal of the penalty reduced the percentage of employees and dependents that elected the firm’s coverage in 2019. We did not, however, observe a change in the takeup rate for workers offered coverage at their job since last year.

HEALTH AND WELLNESS PROGRAMS

Most large firms and many small firms have programs that help workers identify health issues and manage chronic conditions, including health risk assessments, biometric screenings, and health promotion programs.

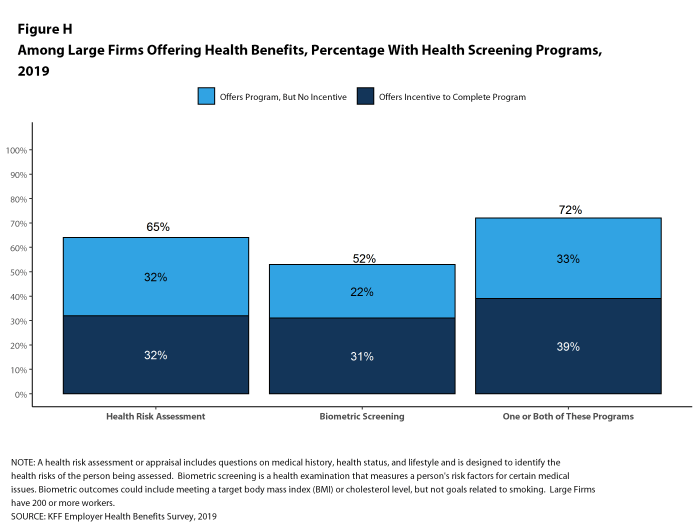

Health Risk Assessments. Among firms offering health benefits, 41% of small firms and 65% of large firms provide workers the opportunity to complete a health risk assessment. A health risk assessment includes questions about a person’s medical history, health status, and lifestyle. Fifty percent of large firms with a health risk assessment program offer an incentive to encourage workers to complete the assessment. Incentives may include: gift cards, merchandise or similar rewards; lower premium contributions or cost sharing; and financial rewards, such as cash, contributions to health-related savings accounts, or avoiding a payroll fee.

Biometric Screenings. Among firms offering health benefits, 26% of small firms and 52% of large firms provide workers the opportunity to complete a biometric screening. A biometric screening is an in-person health examination that measures a person’s risk factors, such as body mass index (BMI), cholesterol, blood pressure, stress, and nutrition. Fifty-eight percent of large firms with biometric screening programs offer workers an incentive to complete the screening, similar to the incentives for completing health risk assessments.

Additionally, among large firms with biometric screening programs, 14% reward or penalize workers based on achieving specified biometric outcomes (such as meeting a target BMI). The size of these incentives varies considerably: among large firms offering a reward or penalty for meeting biometric outcomes, the maximum reward is valued at $150 or less in 17% of firms and more than $1,000 in 11% of firms.

Health and Wellness Promotion Programs. Most firms offering health benefits offer programs to help workers identify and address health risks and unhealthy behaviors. Fifty percent of small firms and 84% of large firms offer a program in at least one of these areas: smoking cessation, weight management, and behavioral or lifestyle coaching. Among large firms offering at least one of these programs, 41% offer workers an incentive to participate in or complete the program.

As health screenings and wellness programs have become more complex, incentives have become more sophisticated and may involve participating in or meeting goals in different programs. We asked firms that had incentives for any of these programs to estimate the maximum incentive for a worker across all of their screening and promotion programs combined. Among large firms with any type of incentive, 16% have a maximum incentive of $150 or less, while 20% have a maximum incentive of more than $1,000.

SITES OF CARE

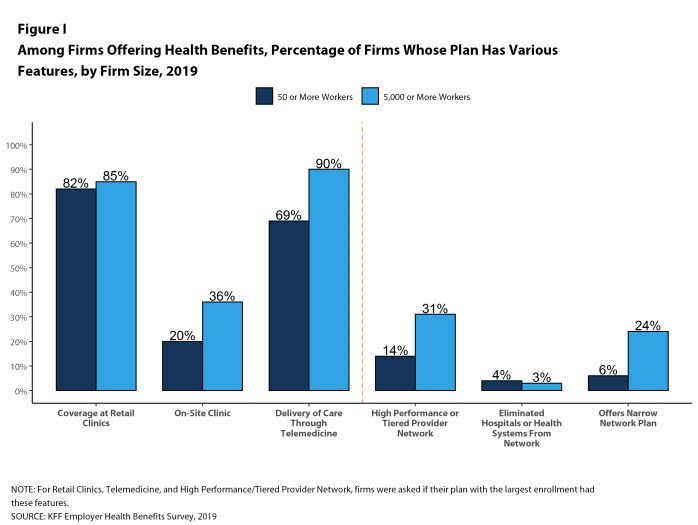

Telemedicine. Sixty-nine percent of firms with 50 or more workers offering health benefits cover the provision of health care services through telemedicine in their largest health plan [Figure I]. Telemedicine is the delivery of health care services through telecommunications to a patient from a provider who is at a remote location, including video chat and remote monitoring. Firms with 5,000 or more workers are more likely to cover services provided through telemedicine than smaller firms.

Retail Health Clinics. Seventy-seven percent of large firms offering health benefits cover health care services received in retail clinics, such as those located in pharmacies, supermarkets and retail stores, in their largest health plan [Figure I]. These clinics are often staffed by nurse practitioners or physician assistants and treat minor illnesses and provide preventive services.

On-Site and Near-Site Health Clinics 19% of large firms offering health benefits, including 36% of firms with 5,000 or more employees, have a health clinic for their employees at or near one or more of their major locations. A large share of these firms report that employees can receive treatment for non-work-related illnesses at their on-site clinics.

PROVIDER NETWORKS

Firms and health plans can structure their networks of providers and their cost sharing to encourage enrollees to use providers who are lower cost or who provide better care. Periodically we ask employers about network strategies, such as using tiered or narrow networks. For 2019, as part of our partnership with the Peterson Center on Healthcare, we added questions about additional network strategies and about employer satisfaction with the options available to them.

Satisfaction with Network Choices Among employers offering health benefits, 42% of firms report being ‘very satisfied’ and 42% report being ‘satisfied’ by the choice of provider networks available to them. They are somewhat less satisfied with the cost of the provider networks available to them, however. Only 11% of these firms report being ‘very satisfied’ while 46% report being ‘satisfied’ with the cost of provider networks available to them. Large firms are more likely than small firms to be very satisfied with the cost of available provider networks, while small firms are more likely to be ‘dissatisfied’ or ‘very dissatisfied’ with the cost of the provider networks available to them.

When asked to identify the most important factor they use to assess provider networks, employers are fairly evenly divided, with 30% of employers identifying the number and convenience of providers as most important, 33% identifying the cost of providers as most important, and 36% identifying the quality of providers as most important.

Narrow Networks Among employers offering health benefits, 55% say that the network for their plan with the largest enrollment is ‘very broad’, 37% say it is ‘somewhat broad’, and 7% say it is ‘somewhat narrow’. When asked how much cost savings the firm would need to realize to shift any of their health plans to narrower networks, a significant share of employers (39%) say that they would not reduce network size for cost savings, 25% say that they would need to realize savings of more than 30%, and 11% say that they would need to realize savings of between 20% and 30%. When employers were asked to identify the biggest obstacle adopting a narrower network plan or plans, 28% cite employee considerations, such as disruption of provider relationships or employee backlash, 14% cite concerns about access or convenience for employees, 9% say that they are in a rural area and/or there was a lack of providers, 11% say that their employees are spread out over a large area, and 12% cite concerns about the cost or quality of care.

Tiered or High-Performance Networks Fourteen percent of firms with 50 or more workers that offer health benefits include a high-performance or tiered provider network in their health plan with the largest enrollment, similar to the percentage last year. A tiered or high-performance network typically groups providers in the network based on the cost, quality and/or efficiency of the care they deliver and uses financial incentives to encourage enrollees to use providers on the preferred tier.

Direct Contracting Some employers also contract directly with certain health plans or health systems, outside of their established provider networks, to treat patients with specified conditions. Among large employers with at least one self-funded health plan, 8% have such an arrangement.

EXCISE TAX ON HIGH COST HEALTH PLANS

The high-cost plan tax, sometimes called the “Cadillac Tax”, is an excise tax on health benefit plans with premiums and other costs that exceed specified thresholds. The tax was scheduled to take effect in 2018, but its effective date has been delayed several times, and recently a bill passed the House that would repeal the provision entirely.4 Only 16% of firms offering health benefits with 50 or more employees say they expect the high-cost plan tax to take effect as scheduled, 52% say it will not take effect as scheduled, and 31% say they do not know. Thirty-three percent of offering firms say that the upcoming high-cost plan tax was ‘very important’ or ‘somewhat important’ when making health benefit decisions for 2019, while 62% say that was ‘not too important’ or ‘not important at all.’ A recent Kaiser Family Foundation analysis finds that at least one in five employers would be affected by the tax if it takes effect in 2022 unless they make changes to lower plan costs.5

PRESCRIPTION DRUG PRACTICE

The cost of prescription drugs is one of the largest challenges facing employers and families. Recent policy options have focused on the complexity involving the delivery and pricing of prescription drugs and the lack of transparency about the true price for individual prescriptions. In particular, policy makers have focused on rebate payments from pharmaceutical manufacturers to payers and intermediaries as obscuring true costs. Payers have also raised questions about discount coupons and other patient assistance that manufacturers provide to patients which reduce patient cost sharing and mute financial incentives in payer formularies to encourage patients to use lower-priced alternatives.

Among employers offering health benefits with 1,000 or more employees, 27% say that they receive ‘most’ of the prescription drug rebate negotiated by their PBM or health plan, 32% say that they receive ‘some’ of the negotiated rebate, 18% say that they receive ‘very little’ of the negotiated rebate, and 23% do not know. When asked about discount coupons and patient assistance programs, only 7% say they believe that they have a ‘substantial impact’ on the cost of their health plans, 33% say that have ‘some impact’ on plan costs, 34% say that they have ‘little impact’ on plan costs, 9% say that they have ‘no impact’ on plans costs, while 17% do not know.

DISCUSSION

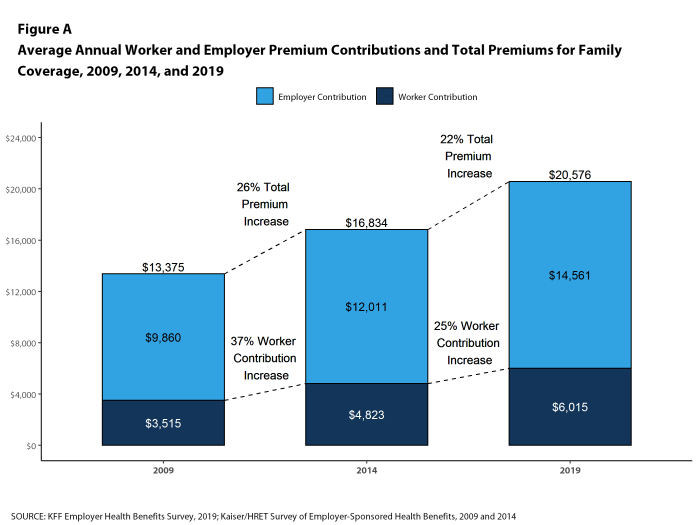

Trends in the market for employer-based coverage have been moderate for several years now. Premiums go up each year, but in the low to mid-single digits, which seems tame for those who remember the much higher increases in the early 2000’s and periods before. Cost sharing, particularly deductibles, has increased meaningfully over time, but the largest percentage increases were now a few years ago. New ideas and new approaches – things like narrow networks, value-based pricing, telemedicine, direct contracting – are tried and sometimes gradually implemented, but with modest impact on the basic structure of the market or the overall cost of coverage. Even though actual cost levels are quite high (the average family premium exceeds $20,000 for a family of four), an expanding economy and historically low underlying health care cost growth appear to have dampened any impatience for big changes, although predicted economic slowing over the next couple of years could push employers to consider more significant actions.

One thing that is new this year is the context: the public debate over expanding Medicare or creating public program options is raising questions about the performance of employer-based coverage that are rarely triggered when looking only at annual performance. In particular, those suggesting a bigger role for public programs raise issues about the cost and affordability of health care for the society overall and for individuals and families. Although premium growth has been low, it still exceeds inflation, and the prices employer plans pay for care are rising faster than either Medicare or Medicaid. One side of the coin calls this a cost shift from public plans to private payers; the other side suggests a lack of any real cost-control efforts in private plans. Negotiating lower prices means that plans have to be willing to tell higher-priced providers they cannot be in the network, but as the survey findings show, narrowing networks is both unpopular with employers and, due to dispersed workforces and rural challenges, impractical for many. Other than increasing cost-sharing, this is the most (and maybe only) powerful cost-reducing tool that private plans have, but it is rarely employed.

How to best assure affordable access to care for individuals and families is really the main theme in the debate about public plan options, and our polling suggests this issue raises important questions about the adequacy of employer-based plans. In a recent survey conducted by KFF and the LA Times, 40 percent of non-elderly adults with employer-based coverage said that they or a family member had difficulty affording health insurance or health care or had problems paying medical bills.6 Roughly one-in-two said that they or a family member had skipped or postponed getting health care or prescriptions in the past 12 months due to costs. Among those with employer-based coverage who say that someone under the plan has a chronic health condition, roughly three in five say they are confident that they have enough money or health insurance to afford the cost of a major illness; this percentage falls to just one-in-three for those in plans with the highest deductibles ($3,000 for single coverage; $5,000 or more for family coverage).

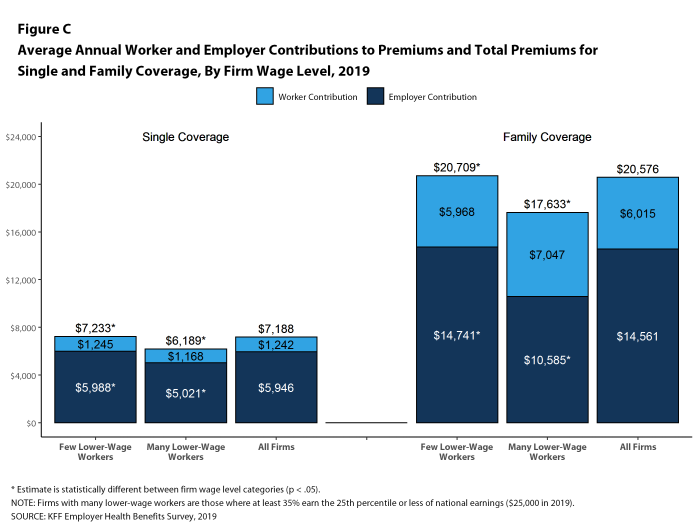

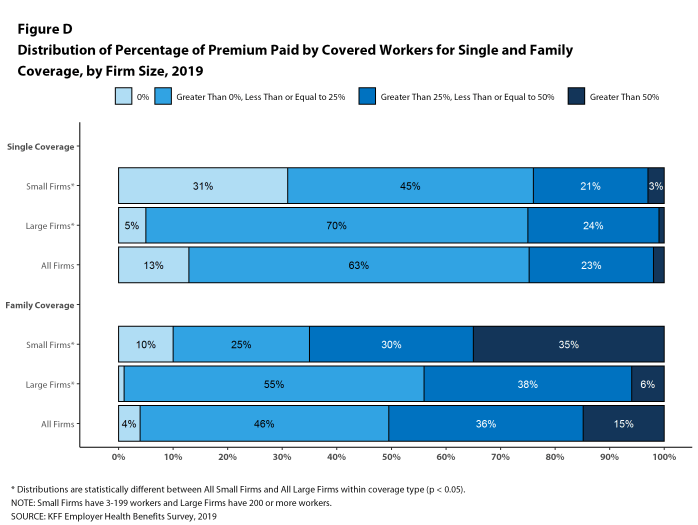

This survey shows other affordability issues as well, particularly for some identifiable groups. Covered workers in small firms face relatively high deductibles for single coverage and a meaningful share face substantial premium contributions if they choose family coverage. Covered workers in firms with large shares of lower-wage workers on average face higher deductibles for single coverage and must contribute a greater share of the premium for family coverage than workers in firms with a smaller share of lower-wage workers. When people talk about the 153 million people with employer-based coverage they often gloss over the very real cost differences for different groups of workers across the marketplace.

Regardless of its outcome, the national debate about expanding Medicare or creating public program options provides an opportunity to step back and evaluate how well employer-based coverage is doing in achieving national goals relating to costs and affordability. In doing so, it will be important to look past averages and examine how well the market serves the many different types of employers and working families in the many different circumstances that they face.

METHODOLOGY

The Kaiser Family Foundation 2019 Employer Health Benefits Survey reports findings from a telephone survey of 2,012 randomly selected non-federal public and private employers with three or more workers. Researchers at NORC at the University of Chicago and the Kaiser Family Foundation designed and analyzed the survey. National Research, LLC conducted the fieldwork between January and July 2019. In 2019, the overall response rate is 27%, which includes firms that offer and do not offer health benefits. Among firms that offer health benefits, the survey’s response rate is 26%. To improve estimates for small firms, the 2018 survey had a significantly larger sample than in previous years; the increased sample size led to both more firms completing the survey and a lower response rate than in years past. Unless otherwise noted, differences referred to in the text and figures use the 0.05 confidence level as the threshold for significance. Values below 3% are not shown on graphical figures to improve the readability of those graphs. Some distributions may not sum due to rounding. In 2019, we modified our weighting methodology by no longer using a non-response adjustment; this change had the largest impact on the offer rate but had a negligible effect on most statistics.

For more information on the survey methodology, please visit the Survey Design and Methods section at http://ehbs.kff.org/.

Filling the need for trusted information on national health issues, the Kaiser Family Foundation is a nonprofit organization based in San Francisco, California.

- Kaiser Family Foundation. The Uninsured and the ACA: A Primer: Supplemental Tables. 2019 Jan (cited 2019 Aug 16). https://www.kff.org/uninsured/report/the-uninsured-and-the-aca-a-primer-key-facts-about-health-insurance-and-the-uninsured-amidst-changes-to-the-affordable-care-act/. See Table 1: 267.5 million nonelderly people, 57.1% of whom are covered by employer-sponsored insurance.↩

- Bureau of Labor Statistics. Consumer Price Index – All Urban Consumers (April to April – not seasonally adjusted): Department of Labor; 2019. https://beta.bls.gov/dataViewer/view/timeseries/CUUR0000SA0. Wage data are from the Bureau of Labor Statistics and based on the change in total average hourly earnings of production and nonsupervisory employees. Employment, hours, and earnings from the Current Employment Statistics survey: Department of Labor; 2019. https://beta.bls.gov/dataViewer/view/timeseries/CES0500000008↩

- This threshold is based on the twenty-fifth percentile of workers’ earnings. Bureau of Labor Statistics. May 2018 National Occupational Employment and Wage Estimates: United States. Washington (DC): BLS. Available from: http://www.bls.gov/oes/current/oes_nat.htm↩

- Middle Class Health Benefits Tax Repeal Act, H.R. 748, 116th Cong. (2019)↩

- Rae, Matthew; Claxton, Gary; Levitt, Larry. “How Many Employers Could Be Affected by the High-Cost Plan Tax” Kaiser Family Foundation. July 12, 2019. https://www.kff.org/private-insurance/issue-brief/how-many-employers-could-be-affected-by-the-high-cost-plan-tax/↩

- Hamel, Liz; Munana, Cailey and Brodie, Mollyann. “Kaiser Family Foundation/LA Times Survey Of Adults With Employer-Sponsored Insurance.” Kaiser Family Foundation. May 2, 2019. https://www.kff.org/report-section/kaiser-family-foundation-la-times-survey-of-adults-with-employer-sponsored-insurance-section-2-affordability-of-health-care-and-insurance/↩