2017 Employer Health Benefits Survey

Section 14: Employer Practices and Health Plan Networks

Employers play a significant role in financing and arranging for health care and health insurance coverage, so their experiences are important factors in health policy discussions. In recent years, employers have included new providers and sites of care, such as retail clinics, and some have pursued changes to their networks to reduce costs or improve quality. There also has been considerable interest in private health exchanges, which could provide firms and workers with a wider array of health plan choices, although thus far enrollment has been low.

SHOPPING FOR HEALTH COVERAGE

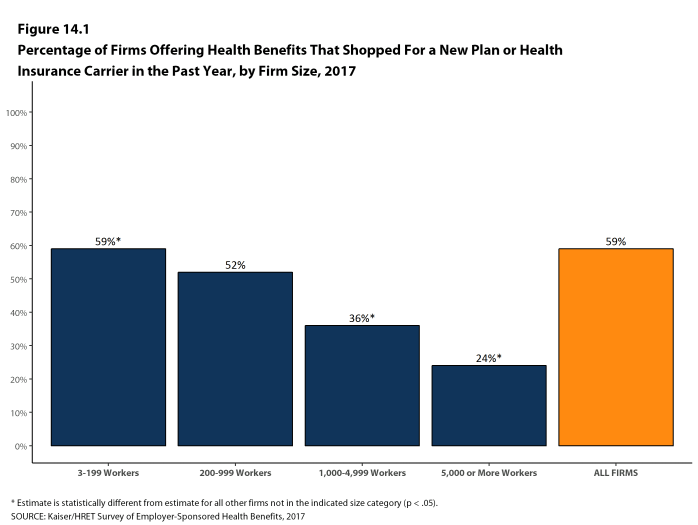

Fifty-nine percent of firms offering health benefits reported shopping for a new health plan or a new insurance carrier in the past year, similar to the percentage last year. Small firms (3-199 workers) were more likely to shop for coverage (59%), and firms with 1,000-4,999 workers and firms with 5,000 or more workers were less likely to shop for coverage (36% and 24%, respectively) than firms in other size categories [Figure 14.1].

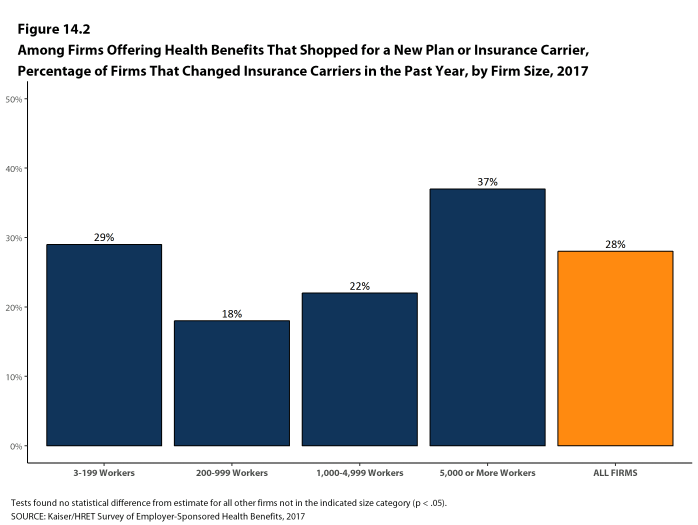

- Among firms that offer health benefits and who shopped for a new plan or carrier in the past year, 28% changed insurance carriers [Figure 14.2].

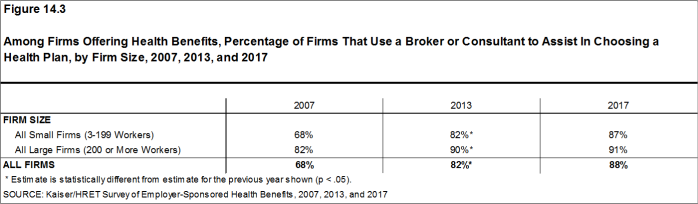

- Eighty-eight percent of firms offering health benefits used a broker or consultant to assist in choosing a health plan [Figure 14.3].

Figure 14.1: Percentage of Firms Offering Health Benefits That Shopped for a New Plan or Health Insurance Carrier In the Past Year, by Firm Size, 2017

Figure 14.2: Among Firms Offering Health Benefits That Shopped for a New Plan or Insurance Carrier, Percentage of Firms That Changed Insurance Carriers In the Past Year, by Firm Size, 2017

PROVIDER NETWORKS

Firms and health plans can structure their networks of providers and their cost sharing to encourage enrollees to use providers who are lower cost or who provide better care. A tiered or high-performance network groups providers in the network based on the cost, quality and/or efficiency of the care they deliver. These networks encourage enrollees to visit preferred doctors by either restricting networks to efficient providers, or by having different cost sharing requirements based on the provider’s tier.

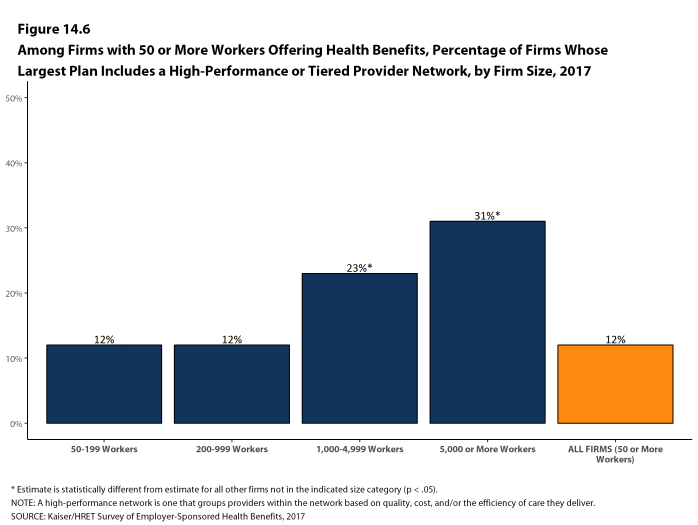

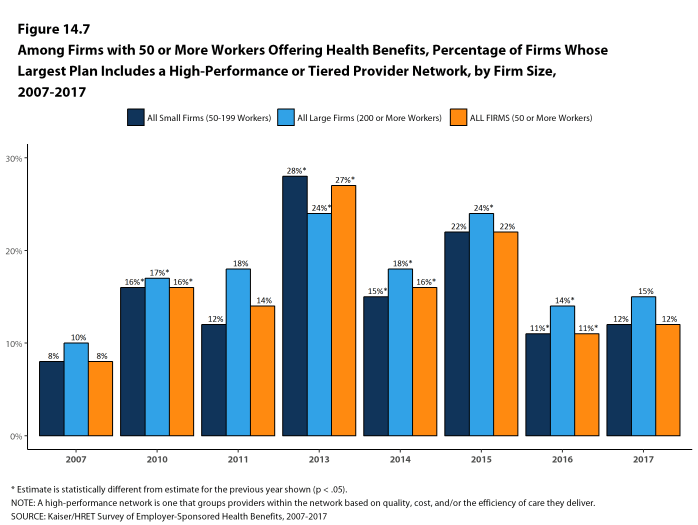

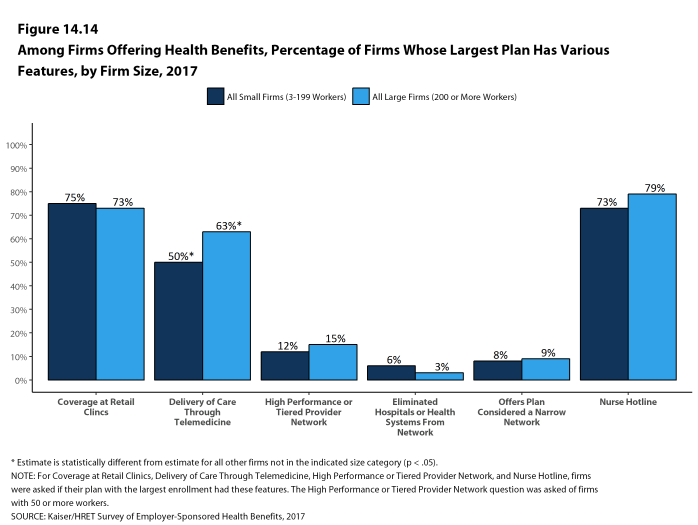

- Twelve percent of firms with 50 or more workers that offer health benefits include a high-performance or tiered provider network in their health plan with the largest enrollment, a similar percentage to last year [Figures 14.6 and 14.7].

- Firms with 1,000-4,999 workers (23%) and firms with 5,000 or more workers (31%) are more likely to incorporate a high-performance or tiered network into their largest plan [Figure 14.6].

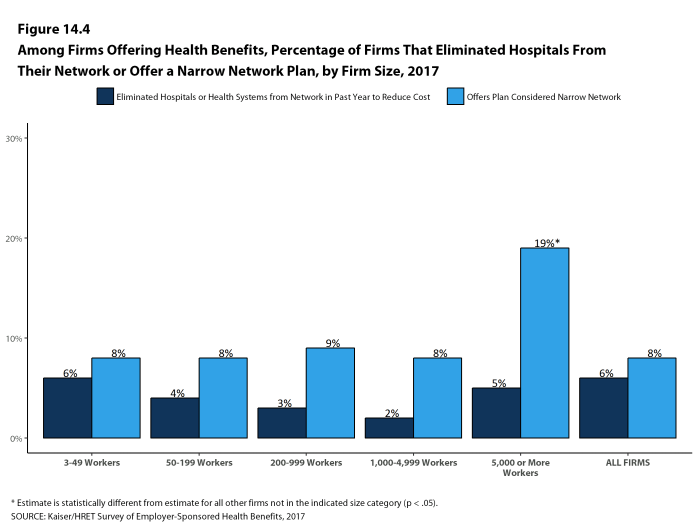

- Eight percent of firms offering health benefits report that they offer a plan that they considered to be a narrow network plan, similar to the percentage reported last year [Figures 14.4]. Narrow network plans limit the number of providers who can participate in order to reduce costs. Narrow network plans are generally more restrictive than standard HMO networks.

- Firms with 5,000 or more workers offering health benefits are more likely to offer at least one plan with a narrow network than firms of other sizes [Figure 14.4].

- Six percent of firms offering health benefits said that either they or their insurer eliminated a hospital or health system from a provider network in order to reduce the plan’s cost during the last year [Figure 14.4].

Figure 14.4: Among Firms Offering Health Benefits, Percentage of Firms That Eliminated Hospitals From Their Network or Offer a Narrow Network Plan, by Firm Size, 2017

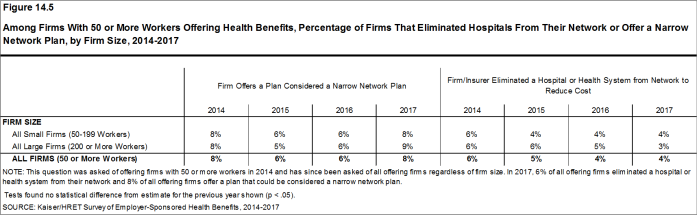

Figure 14.5: Among Firms With 50 or More Workers Offering Health Benefits, Percentage of Firms That Eliminated Hospitals From Their Network or Offer a Narrow Network Plan, by Firm Size, 2014-2017

Figure 14.6: Among Firms With 50 or More Workers Offering Health Benefits, Percentage of Firms Whose Largest Plan Includes a High-Performance or Tiered Provider Network, by Firm Size, 2017

ALTERNATIVE CARE SETTINGS: TELEMEDICINE AND RETAIL CLINICS

Firms and health plans are incorporating new sites and methods of care in order to improve convenience and potentially reduce costs.

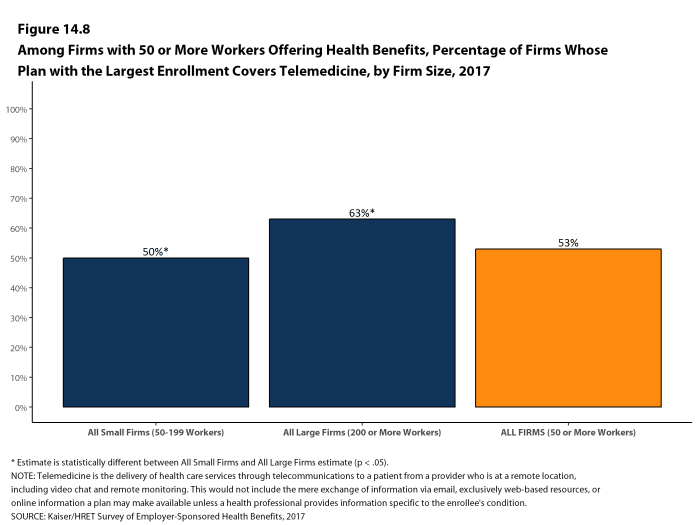

- Fifty-three percent of firms with 50 or more workers who offer health benefits cover the provision of some health care services through telemedicine in their largest health plan [Figure 14.8]. Telemedicine is the delivery of health care services through telecommunications to a patient from a provider who is at a remote location, including video chat and remote monitoring. This would not include the mere exchange of information via email, exclusively web-based resources, or online information a plan may make available unless a health professional provides information specific to the enrollee’s condition. Larger firms are more likely to cover services provided through telemedicine than smaller firms [Figure 14.8].

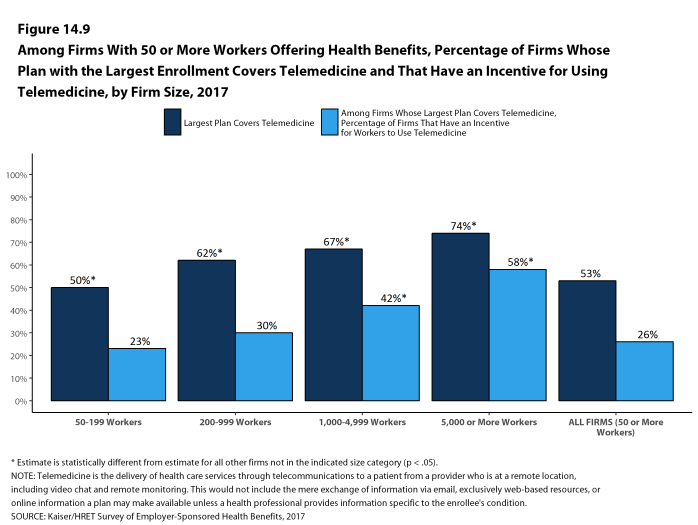

- Among firms with 50 or more workers whose plans cover health services through telemedicine, 26% provide a financial incentive for workers to use telemedicine instead of visiting a traditional physician’s office in-person [Figure 14.9].

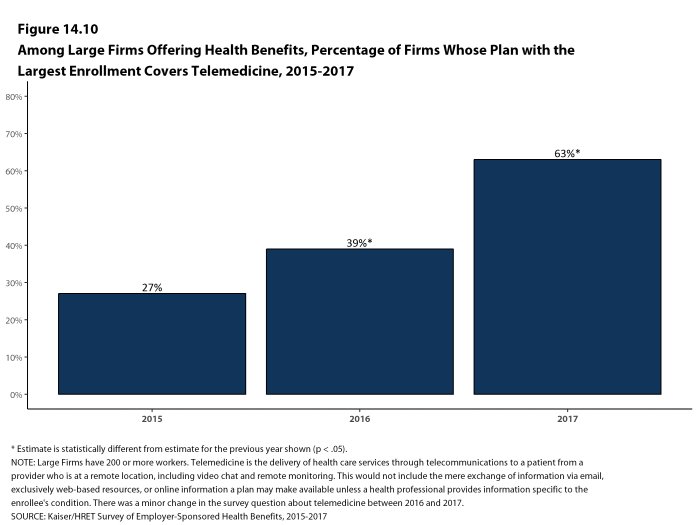

- The percentage of large firms reporting that they cover services through telemedicine rose significantly in the last year, from 39% last year to 63% this year [Figure 14.10]. We note that we made a small change to the survey question, which could account for some of that change. This is a significant increase in one year, and we will examine this next year to see if the higher prevalence persists.

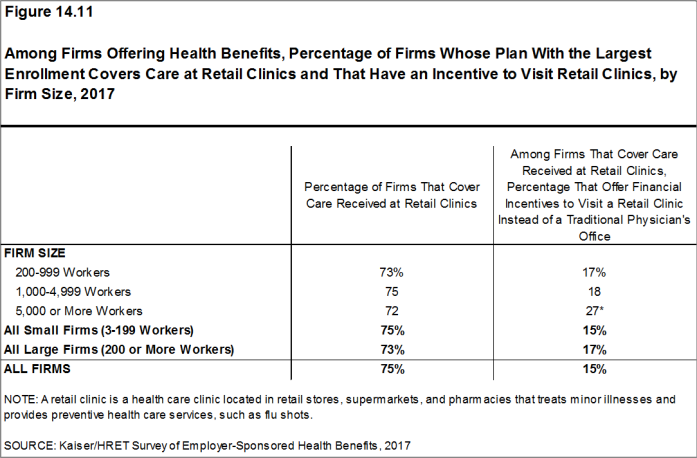

- Seventy-five percent of firms that offer health benefits cover care received in retail clinics, such as those located in pharmacies, supermarkets and retail stores, in their largest health plan [Figure 14.11]. These clinics are often staffed by nurse practitioners or physician assistants and treat minor illnesses and provide preventive services.

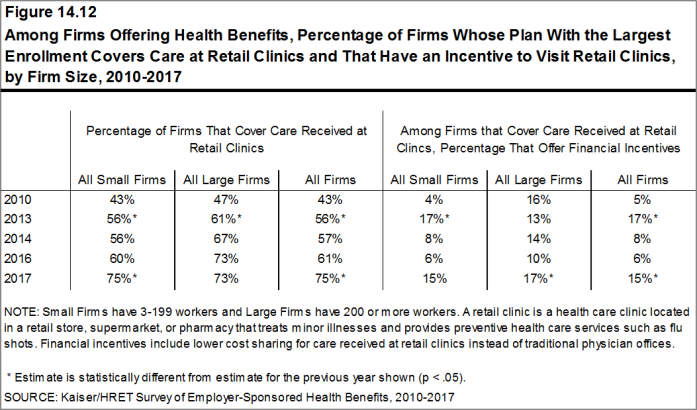

- The percentage of firms covering care received in retail clinics in their largest health plan increased in the last year [Figure 14.12].

- Fifteen percent of firms that cover care at retail clinics provide a financial incentive for workers to visit a retail clinic instead of a traditional physician’s office [Figure 14.11].

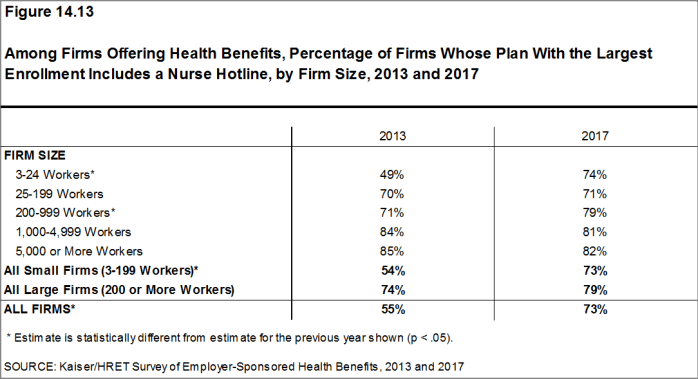

- Seventy-three percent of firms that offer health benefits include a nurse hotline in their largest health plan. This is a significant increase from 55% in 2013 [Figure 14.13].

Figure 14.8: Among Firms With 50 or More Workers Offering Health Benefits, Percentage of Firms Whose Plan With the Largest Enrollment Covers Telemedicine, by Firm Size, 2017

Figure 14.9: Among Firms With 50 or More Workers Offering Health Benefits, Percentage of Firms Whose Plan With the Largest Enrollment Covers Telemedicine and That Have an Incentive for Using Telemedicine, by Firm Size, 2017

Figure 14.10: Among Large Firms Offering Health Benefits, Percentage of Firms Whose Plan With the Largest Enrollment Covers Telemedicine, 2015-2017

Figure 14.11: Among Firms Offering Health Benefits, Percentage of Firms Whose Plan With the Largest Enrollment Covers Care at Retail Clinics and That Have an Incentive to Visit Retail Clinics, by Firm Size, 2017

Figure 14.12: Among Firms Offering Health Benefits, Percentage of Firms Whose Plan With the Largest Enrollment Covers Care at Retail Clinics and That Have an Incentive to Visit Retail Clinics, by Firm Size, 2010-2017

Figure 14.13: Among Firms Offering Health Benefits, Percentage of Firms Whose Plan With the Largest Enrollment Includes a Nurse Hotline, by Firm Size, 2013 and 2017

PRIVATE EXCHANGES AND DEFINED CONTRIBUTIONS

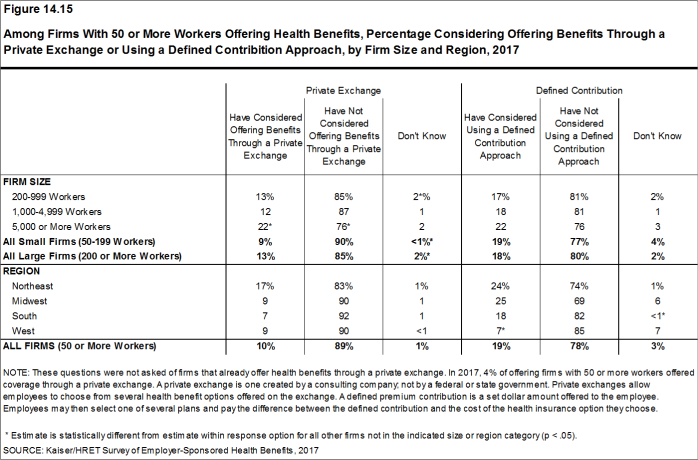

A private exchange is a virtual market that allows employers to provide their workers with a choice of several different health benefit options, often including supplemental or ancillary benefits options. Private exchanges generally are created by consulting firms, insurers, or brokers, and are different than the public exchanges run by the states or the federal government. There is considerable variation in the types of exchanges currently offered: some exchanges allow workers to choose between multiple plans offered by the same carrier while in other cases multiple carriers participate. The exchange operator may establish standards for the plans offered and may negotiate with insurers over the price and services provided. Although there has been considerable attention to the potential of private exchanges to change the market for employer-based coverage, participation thus far has been quite modest.

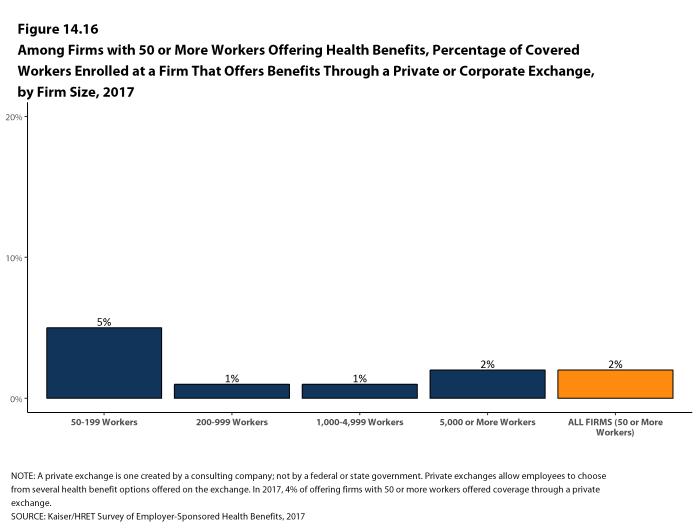

- Four percent of firms offering health benefits with 50 or more workers offer coverage through a private exchange. These firms provide coverage to 2% of covered workers in firms with 50 or more workers [Figure 14.16]. These percentages are the same as those in 2016.

- Firms offering health benefits with 50 or more workers that do not already offer health benefits through a private exchange were asked whether they had considered offering coverage through a private exchange. Ten percent of these firms are considering such an approach, lower than the percentage last year (18%) [Figure 14.15].

Some firms use a defined contribution approach to contribute toward the cost of health insurance. A defined contribution is a set dollar amount offered to the worker by the employer. Workers may then select one of several plans, paying the difference between the defined contribution and the cost of their chosen health insurance plan. This allows a firm to offer a larger variety of health plans to workers and to structure contributions or other rules to encourage workers to choose more efficient plans. Some private exchanges encourage employers to use a defined contribution approach to encourage competition among the participating insurers.

- Firms offering health benefits with 50 or more workers and that do not already offer benefits through a private exchange were asked whether they had considered using a defined contribution approach. Nineteen percent of these firms were considering such an approach [Figure 14.15].

Figure 14.15: Among Firms With 50 or More Workers Offering Health Benefits, Percentage Considering Offering Benefits Through a Private Exchange or Using a Defined Contribition Approach, by Firm Size and Region, 2017

ASSOCIATION HEALTH PLANS AND MEDICAID

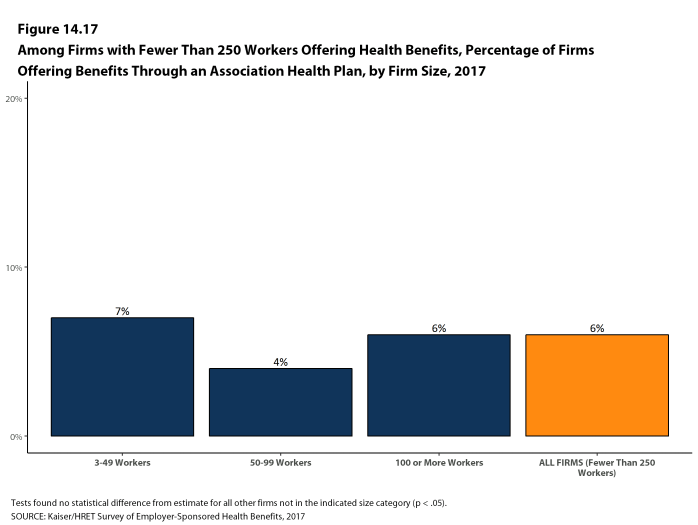

- An association health plan is an organization of employers that coordinates coverage in order to reduce costs or improve benefits. Six percent of offering firms with fewer than 250 workers offer health benefits through a trade or professional association health plan [Figure 14.17].

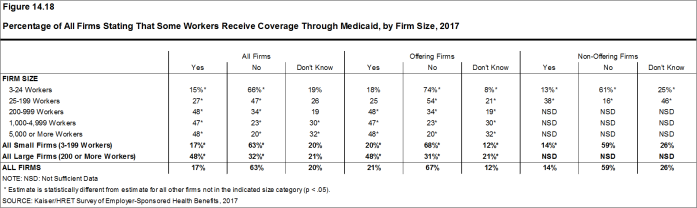

- A substantial share of firms that offer health benefits report having workers who receive coverage from Medicaid. Medicaid is a federally and state-funded program that provides health coverage for people who are poor, aged or disabled. Twenty percent of small firms and 48% of large firms report that they have workers covered by Medicaid. We note that, as expected, there is a significant share of firms, particularly larger firms, that do not know the answer to this question [Figure 14.18].

Figure 14.17: Among Firms With Fewer Than 250 Workers Offering Health Benefits, Percentage of Firms Offering Benefits Through an Association Health Plan, by Firm Size, 2017