2017 Employer Health Benefits Survey

Section 12: Health and Wellness Programs

Firms continue to show considerable interest in programs that help workers identify health issues and manage chronic conditions. Many employers believe that improving the health of their workers and their family members can improve morale, productivity and reduce health care costs. In addition to wellness programs, many large firms use disease management programs to help workers manage chronic conditions.

In addition to offering wellness programs, a majority of large firms now offer health screening programs, including health risk assessments, which are questionnaires asking workers about lifestyle, stress or physical health, and biometric screening, which we define as in-person health examinations conducted by a medical professional. Firms and insurers may use the health information collected during screenings to target wellness offerings or other health services to workers with certain conditions or behaviors that pose a risk to their health. Some firms have incentive programs that reward or penalize workers for different activities, including participating in wellness programs or completing health screenings.

Only firms offering health benefits were asked about their wellness and health promotion programs. Information about incentives is reported only for large firms (200 or more workers) because many small firm (3-199 workers) respondents do not know this information about their programs. This year’s survey includes new questions about how a firm evaluates its wellness programs and about penalties for workers who use tobacco.

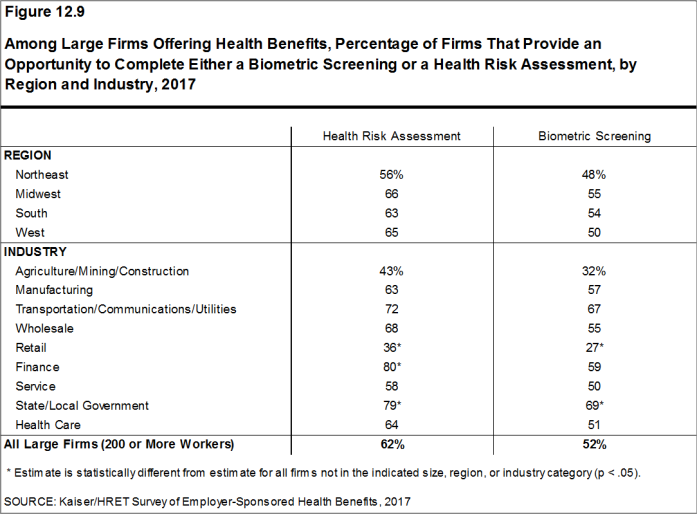

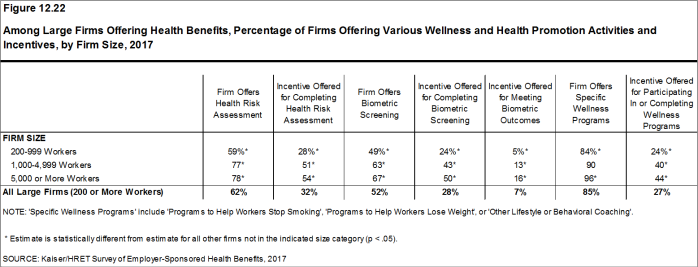

Among large firms offering health benefits in 2017, 62% offer workers the opportunity to complete a health risk assessment, 52% offer workers the opportunity to complete a biometric screening, and 85% offer workers wellness programs such as programs to help them stop smoking or lose weight, or programs that offer lifestyle and behavioral coaching. Substantial shares of these large firms provide incentives for workers to participate in or to complete the programs.

HEALTH RISK ASSESSMENTS

Some firms provide workers the opportunity to complete a health risk assessment to identify potential health issues. Health risk assessments generally include questions about medical history, health status, and lifestyle. At small firms, health risk assessments are typically administered by an insurer.

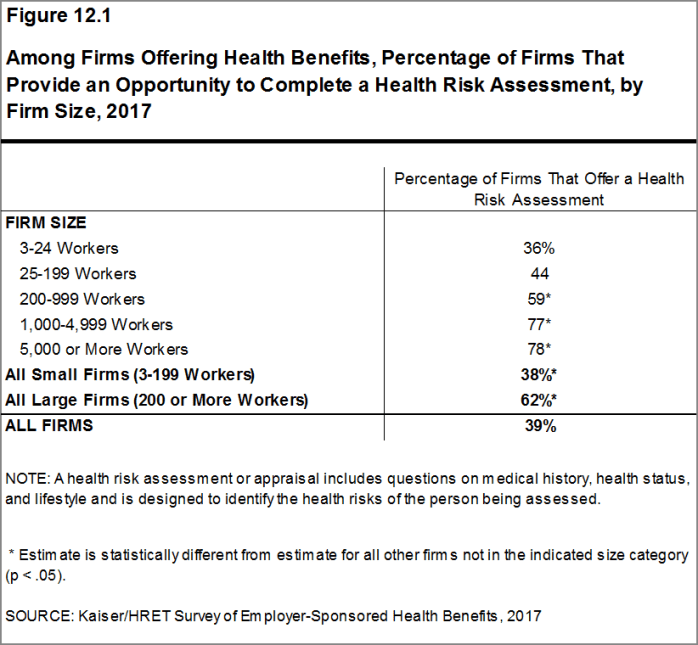

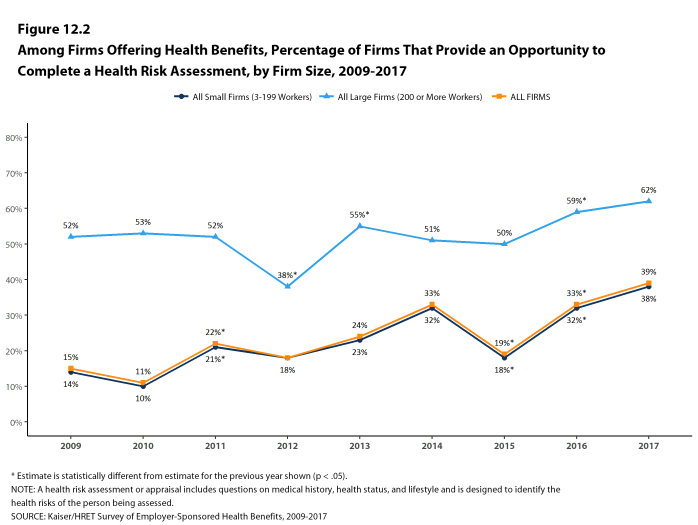

- Among firms offering health benefits, 38% of small firms and 62% of large firms provide workers the opportunity to complete a health risk assessment [Figure 12.1]. These percentages are similar to the corresponding percentages for 2016 (32% for small firms and 59% for large firms) [Figure 12.2].

- Seventy-eight percent of firms offering health benefits with 5,000 or more workers provide workers the opportunity to complete a health risk assessment, similar to the percentage for 2016 (74%) [Figure 12.1].

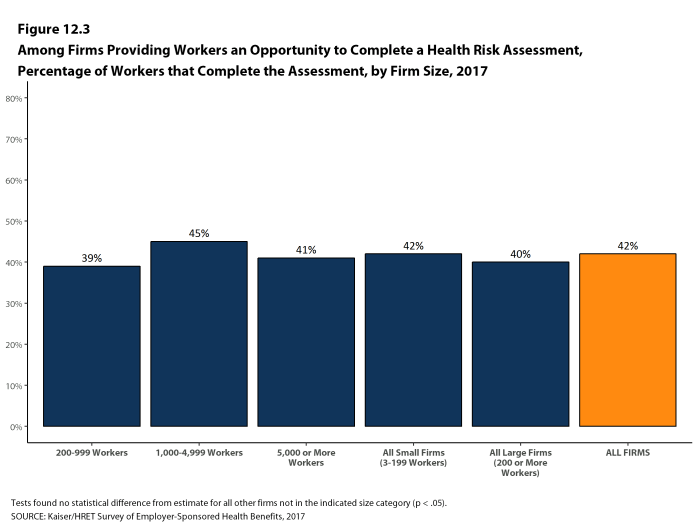

- In firms providing workers the opportunity to complete a health risk assessment, 42% of covered workers complete an assessment, similar to the percentage in 2016 [Figure 12.3].

- There is considerable variation across firms in the percentage of workers who complete the assessment. Nineteen percent of large firms providing workers the opportunity to complete a health risk assessment report that more than 75% of their workers complete the assessment, while 45% report no more than 25% of workers complete the assessment.

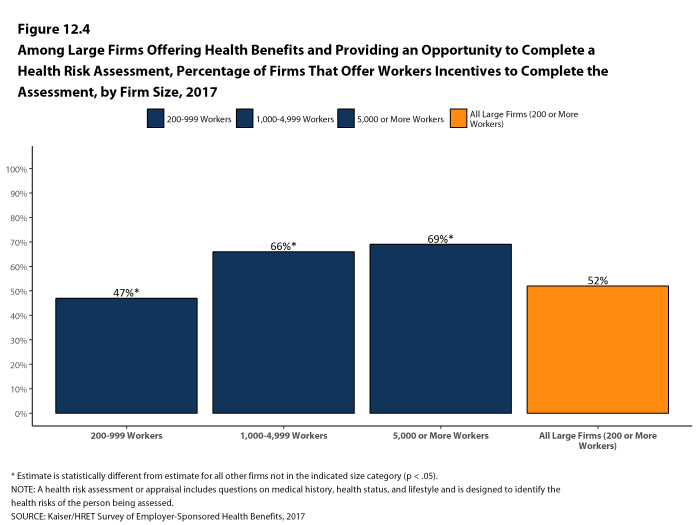

- Some firms offer incentives to encourage workers to complete a health risk assessment.

- Among large firms that offer a health risk assessment, 52% offer workers an incentive to complete the assessment [Figure 12.4].

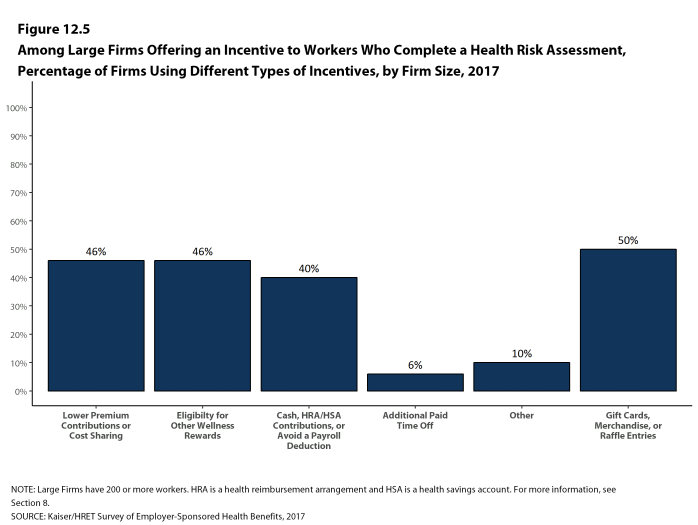

- Among large firms offering incentives for workers to complete a health risk assessment, 46% lower premium contributions or reduce cost sharing and 40% offer cash, HSA or HRA contributions, or allow the worker to avoid a payroll deduction [Figure 12.5]. In some firms, workers must complete the assessment to be eligible for other rewards under the firm’s wellness programs. Some firms offer workers more than one type of incentive.

Figure 12.1: Among Firms Offering Health Benefits, Percentage of Firms That Provide an Opportunity to Complete a Health Risk Assessment, by Firm Size, 2017

Figure 12.2: Among Firms Offering Health Benefits, Percentage of Firms That Provide an Opportunity to Complete a Health Risk Assessment, by Firm Size, 2009-2017

Figure 12.3: Among Firms Providing Workers an Opportunity to Complete a Health Risk Assessment, Percentage of Workers That Complete the Assessment, by Firm Size, 2017

Figure 12.4: Among Large Firms Offering Health Benefits and Providing an Opportunity to Complete a Health Risk Assessment, Percentage of Firms That Offer Workers Incentives to Complete the Assessment, by Firm Size, 2017

BIOMETRIC SCREENING

Biometric screening is a health examination that measures a person’s risk factors (such as cholesterol, blood pressure, and body mass index (BMI)) for certain medical issues. A biometric outcome involves assessing whether an enrollee meets specified health targets related to certain risk factors, such as meeting a target BMI or cholesterol level. As defined by this survey, goals related to smoking are not included in the biometric screening questions.

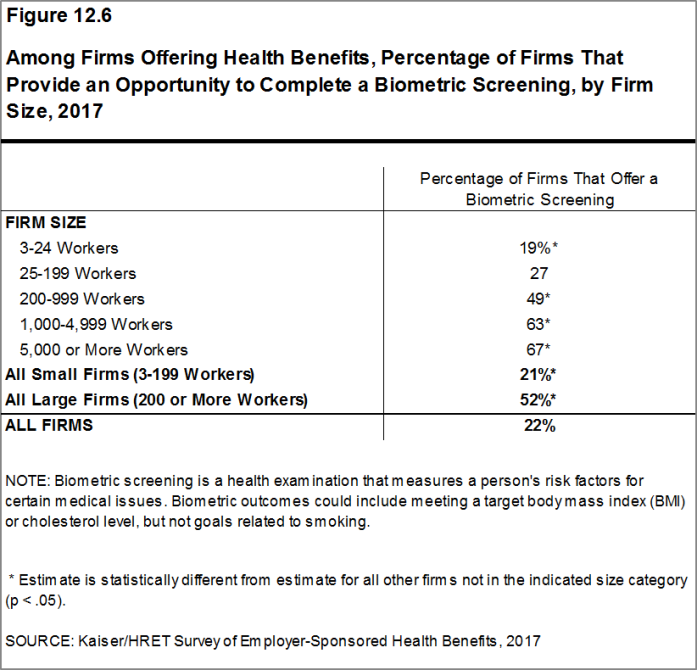

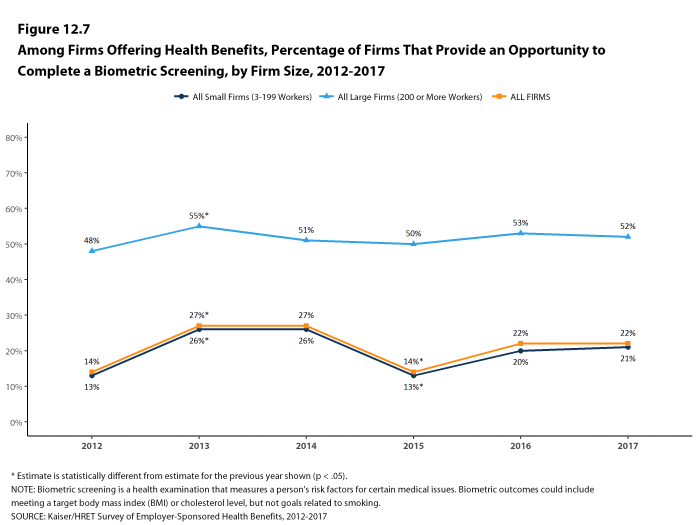

- Among firms offering health benefits, 21% of small firms and 52% of large firms provide workers the opportunity to complete a biometric screening [Figure 12.6]. These percentages are similar to 2016 (20% and 53%) [Figure 12.7].

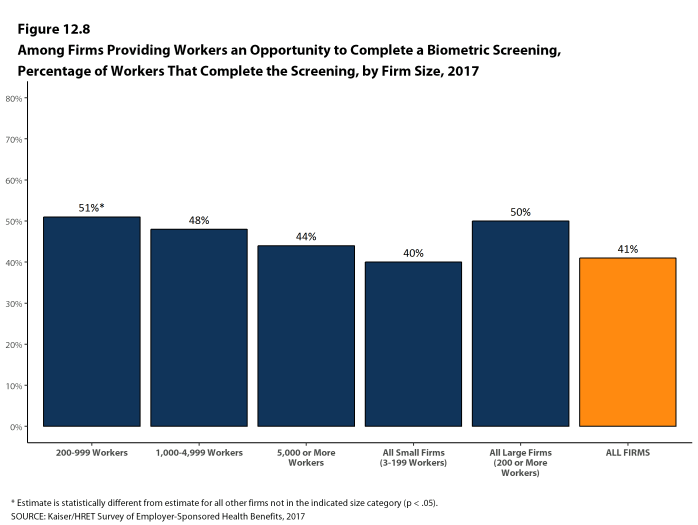

- In firms providing workers the opportunity to complete a biometric screening, 41% of covered workers complete a screening [Figure 12.8].

- There is considerable variation across firms in the percentage of workers who complete a biometric screening. Twenty-two percent of large firms providing workers the opportunity to complete a biometric screening report that more than 75% of their workers complete the screening, while 26% report no more than 25% of workers complete the screening.

- Firms that provide workers the opportunity to complete a biometric screening may include additional incentives for those workers who do so.

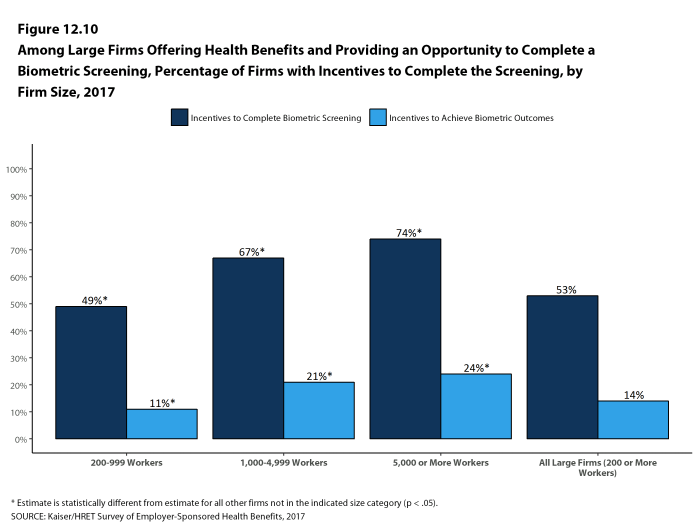

- Among large firms with biometric screening programs, 53% offer workers an incentive to complete the screening [Figure 12.10]. The likelihood of a firm with a biometric screening program offering an incentive to complete a biometric screening increases with firm size [Figure 12.10]. Some firms report offering more than one type of incentive.

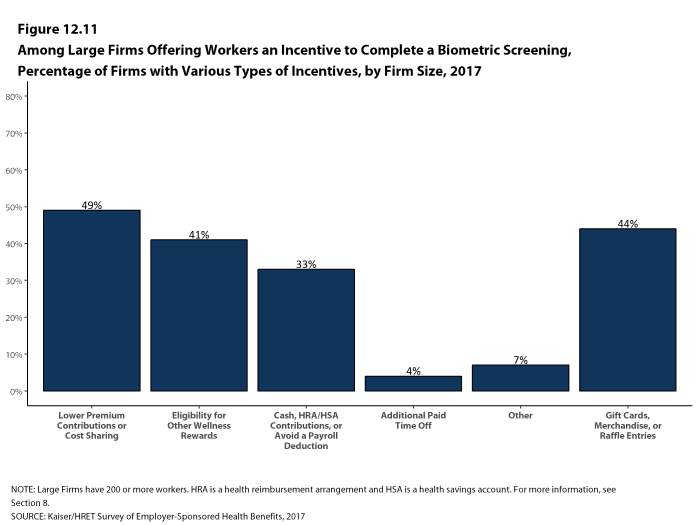

- Among large firms with an incentive for workers to complete a biometric screening, 49% lower premium contributions or reduce cost sharing and 33% offer cash, HRA or HSA contributions, or allow the worker to avoid a payroll deduction. As with incentives for health risk assessments, workers in some firms must complete the biometric screening to be eligible for other rewards under the firm’s wellness programs [Figure 12.11].

- In addition to incentives for completing a biometric screening, some firms offer workers incentives to meet biometric outcomes. Among large firms with biometric screening programs, 14% reward or penalize workers based on achieving specified biometric outcomes (such as meeting a target BMI) [Figure 12.10].

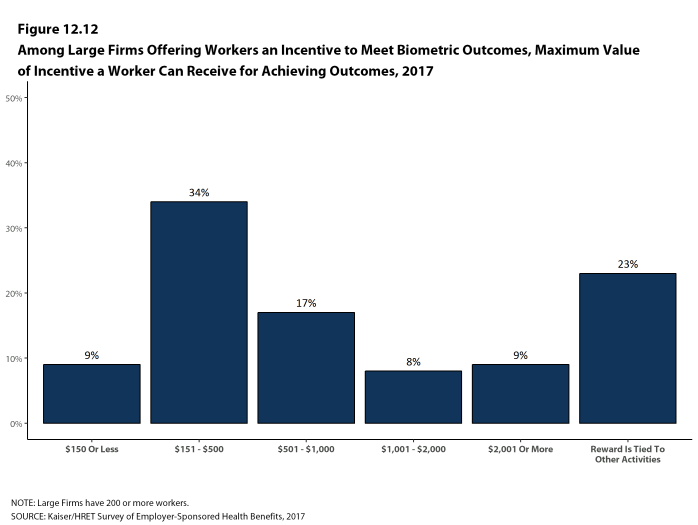

- The size of the incentives firms offer for meeting biometric outcomes varies considerably. Among large firms offering a reward or penalty for meeting biometric outcomes, the maximum reward is valued at $150 or less for 9% of firms and more than $1,000 for 17% of firms [Figure 12.12]. Twenty-three percent of these firms combine the reward with incentives for other activities.

Figure 12.6: Among Firms Offering Health Benefits, Percentage of Firms That Provide an Opportunity to Complete a Biometric Screening, by Firm Size, 2017

Figure 12.7: Among Firms Offering Health Benefits, Percentage of Firms That Provide an Opportunity to Complete a Biometric Screening, by Firm Size, 2012-2017

Figure 12.8: Among Firms Providing Workers an Opportunity to Complete a Biometric Screening, Percentage of Workers That Complete the Screening, by Firm Size, 2017

Figure 12.9: Among Large Firms Offering Health Benefits, Percentage of Firms That Provide an Opportunity to Complete Either a Biometric Screening or a Health Risk Assessment, by Region and Industry, 2017

Figure 12.10: Among Large Firms Offering Health Benefits and Providing an Opportunity to Complete a Biometric Screening, Percentage of Firms With Incentives to Complete the Screening, by Firm Size, 2017

Figure 12.11: Among Large Firms Offering Workers an Incentive to Complete a Biometric Screening, Percentage of Firms With Various Types of Incentives, by Firm Size, 2017

ADMINISTRATION OF HEALTH SCREENING PROGRAMS

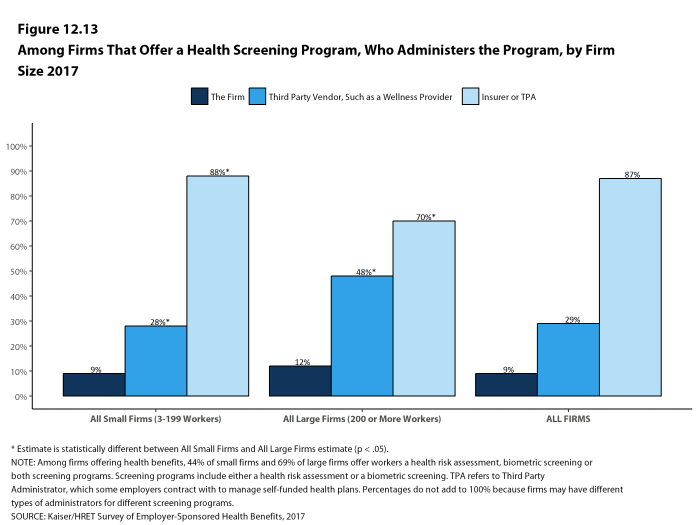

Among firms offering health benefits, 44% of small firms and 69% of large firms offer workers a health risk assessment, biometric screening or both screening programs. The scope and administration of screening programs vary considerably across firms, and some firms use different administrators for different programs.

- Among firms that offer a health screening program, an insurer or third-party administrator administers some health screening programs at 87% of firms, third party vendors, such as wellness providers, administer some screening programs at 29% of firms, and the firm itself administers some health screening programs at 9% of firms [Figure 12.13].

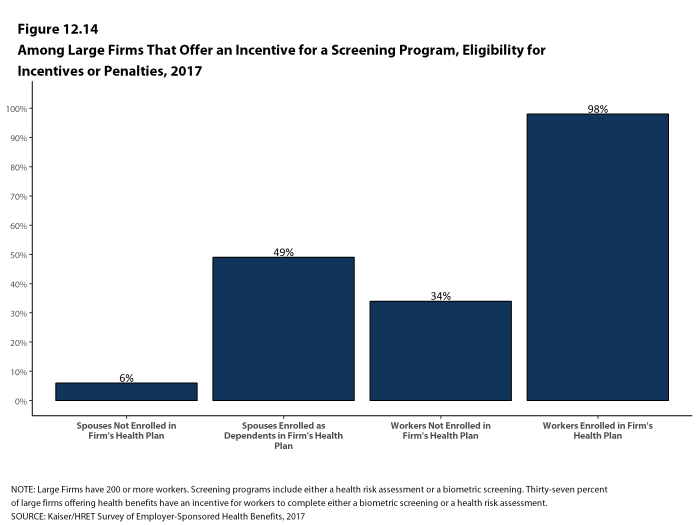

- Thirty-seven percent of large firms offering health benefits have an incentive for workers to complete biometric screening or a health risk assessment. Among large firms with an incentive for either health screening program, 34% have incentives for workers not enrolled in the health plan and 49% have incentives for spouses enrolled as dependents in the plan [Figure 12.14].

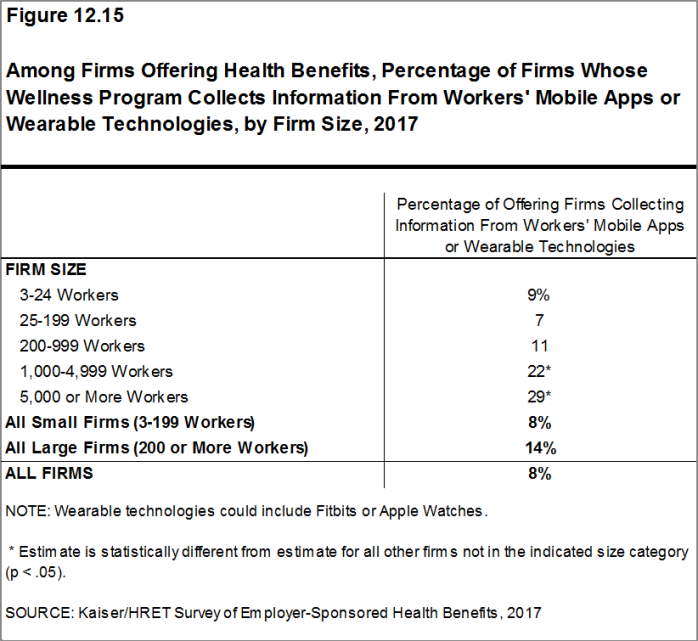

- Among firms offering health benefits, 8% of small firms and 14% of large firms collect information from workers’ wearable devices, such as a Fitbit or Apple Watch, as part of their wellness or health promotion program [Figure 12.15].

Figure 12.13: Among Firms That Offer a Health Screening Program, Who Administers the Program, by Firm Size 2017

Figure 12.14: Among Large Firms That Offer an Incentive for a Screening Program, Eligibility for Incentives or Penalties, 2017

WELLNESS AND HEALTH PROMOTION PROGRAMS

Many firms and health plans offer programs to help workers engage in healthy lifestyles and reduce health risks. Wellness and health promotion programs may include exercise programs, health education classes, and stress-management counseling. These programs may be offered directly by the firm, an insurer, or a third-party contractor.

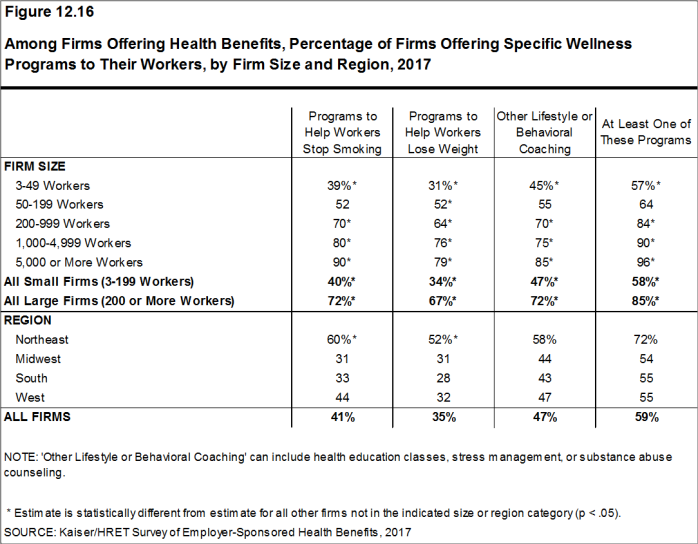

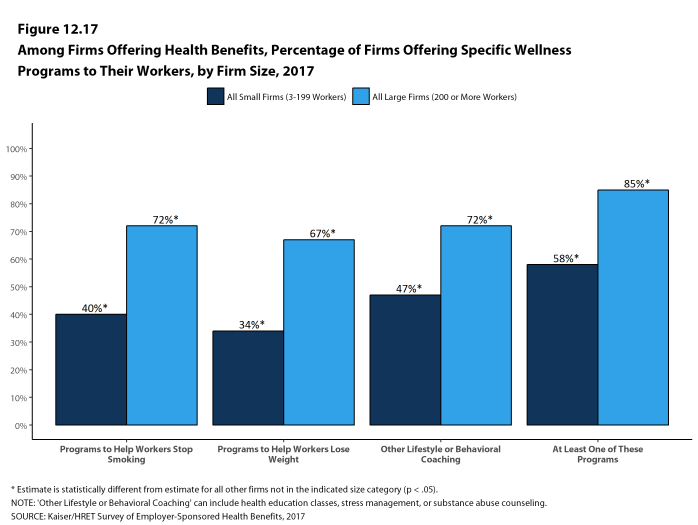

- Among firms offering health benefits, 40% of small firms and 72% of large firms offer programs to help workers stop smoking, 34% of small firms and 67% of large firms offer programs to help workers lose weight, and 47% of small firms and 72% of large firms offer some other lifestyle or behavioral coaching program. Fifty-eight percent of small firms and 85% of large firms offering health benefits offer at least one of these three programs [Figures 12.16 and 12.17].

- To encourage participation in wellness programs, firms may offer incentives to workers who participate in or complete wellness programs.

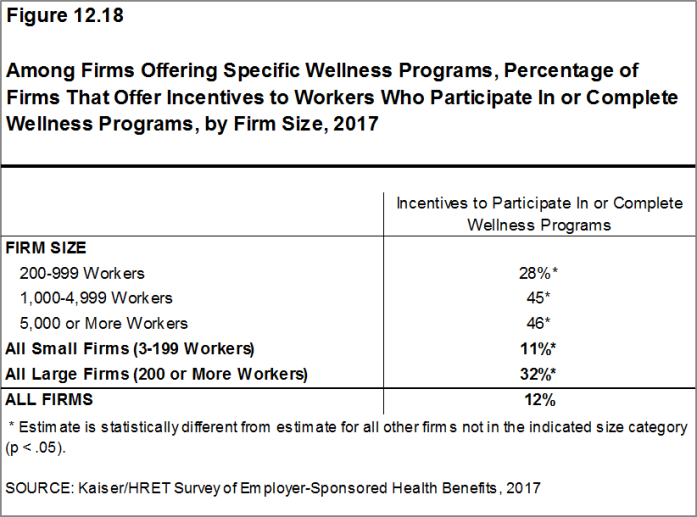

- Thirty-two percent of large firms offering one of these wellness or health promotion programs offer an incentive to encourage workers to participate in or complete the programs [Figure 12.18]. Forty-six percent of firms with more than 5,000 workers offering one of these wellness or health promotion programs offer an incentive to participate in or complete the programs.

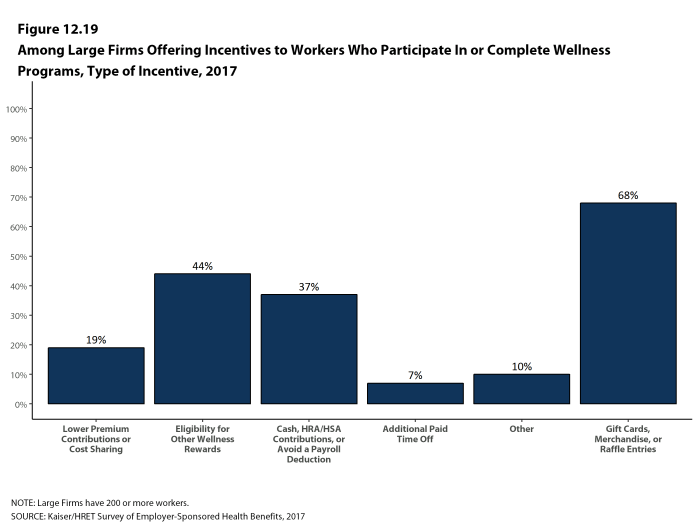

- Among large firms offering incentives to workers to participate in or complete wellness or health promotion programs, 19% lower premium contributions or reduce cost sharing and 37% offer cash , HSA or HRA contributions, or allow the worker to avoid a payroll deduction [Figure 12.19].

- Firms with incentives for health risk assessments, biometric screening, or wellness or health promotion programs were asked to report the maximum reward or penalty a worker could earn for all of the firm’s health promotion activities combined. Some firms do not offer incentives for individual activities, but offer rewards to workers who complete a variety of activities. Among large firms offering incentives for any of these programs, the maximum value for all wellness-related incentives is $150 or less in 25% of firms and more than $1,000 in 19% of firms [Figure 12.20].

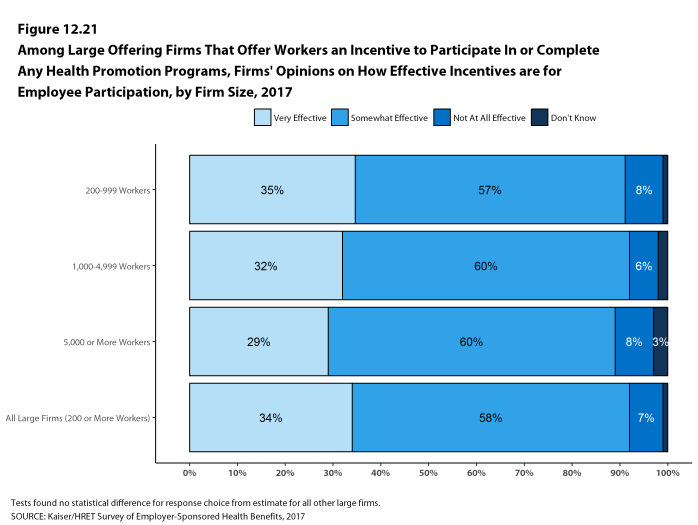

- Firms with incentives for health risk assessments, biometric screening, or wellness or health promotion programs were also asked how effective they believed incentives were for encouraging participation. Thirty-four percent of large firms offering incentives for any one of these programs said the incentives are “very effective” at encouraging workers to participate and 58% said the incentives are “somewhat effective”, while 7% said the incentives are “not at all effective” [Figure 12.21].

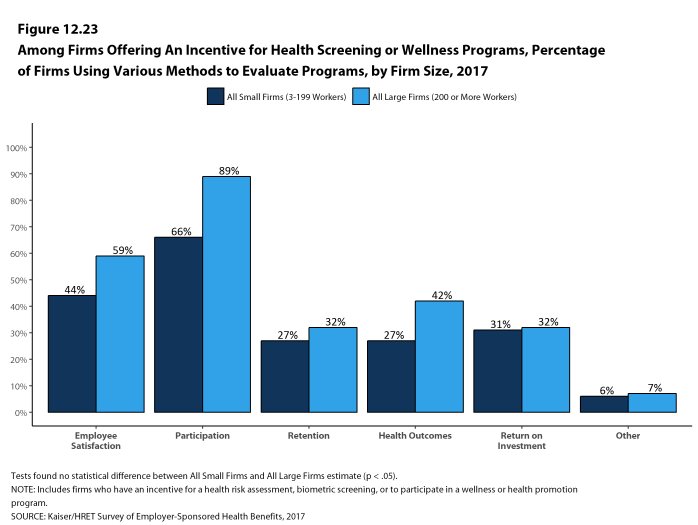

- Firms offering a health screening program or a wellness program use a variety of metrics to evaluate their health promotion programs, including participation, employee satisfaction, and return on investment [Figure 12.23].

Figure 12.16: Among Firms Offering Health Benefits, Percentage of Firms Offering Specific Wellness Programs to Their Workers, by Firm Size and Region, 2017

Figure 12.17: Among Firms Offering Health Benefits, Percentage of Firms Offering Specific Wellness Programs to Their Workers, by Firm Size, 2017

Figure 12.18: Among Firms Offering Specific Wellness Programs, Percentage of Firms That Offer Incentives to Workers Who Participate In or Complete Wellness Programs, by Firm Size, 2017

Figure 12.19: Among Large Firms Offering Incentives to Workers Who Participate In or Complete Wellness Programs, Type of Incentive, 2017

Figure 12.20: Among Large Firms That Offer Workers an Incentive to Participate In or Complete Any Health Promotion Programs, Maximum Annual Value of the Incentive for All Programs Combined, 2017

Figure 12.21: Among Large Offering Firms That Offer Workers an Incentive to Participate In or Complete Any Health Promotion Programs, Firms’ Opinions On How Effective Incentives Are for Employee Participation, by Firm Size, 2017

Figure 12.22: Among Large Firms Offering Health Benefits, Percentage of Firms Offering Various Wellness and Health Promotion Activities and Incentives, by Firm Size, 2017

DISEASE MANAGEMENT

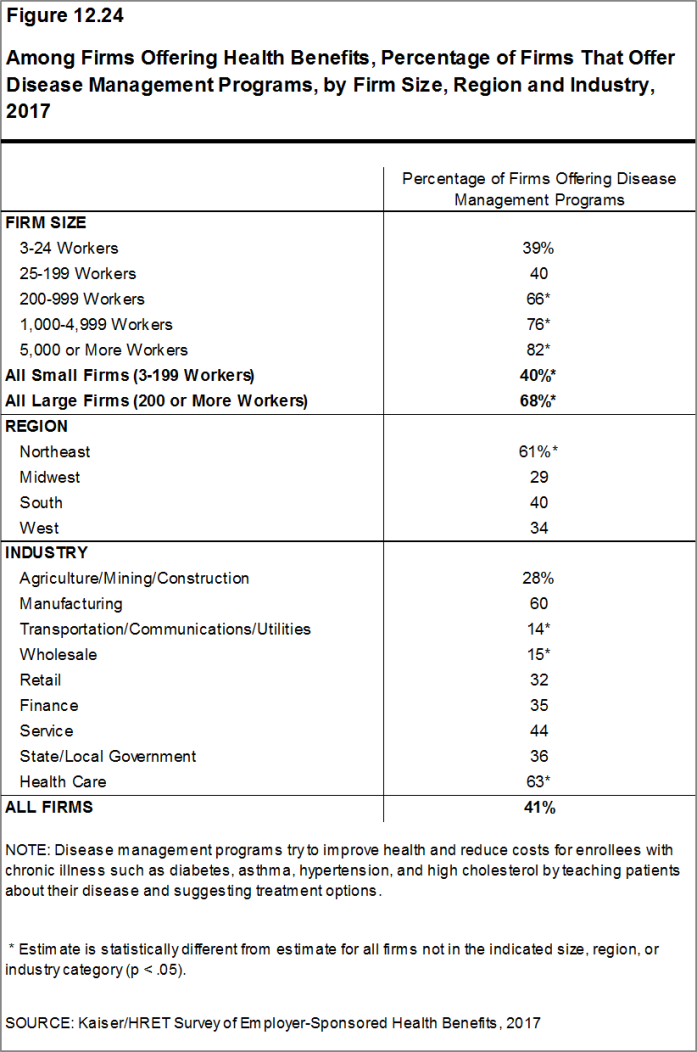

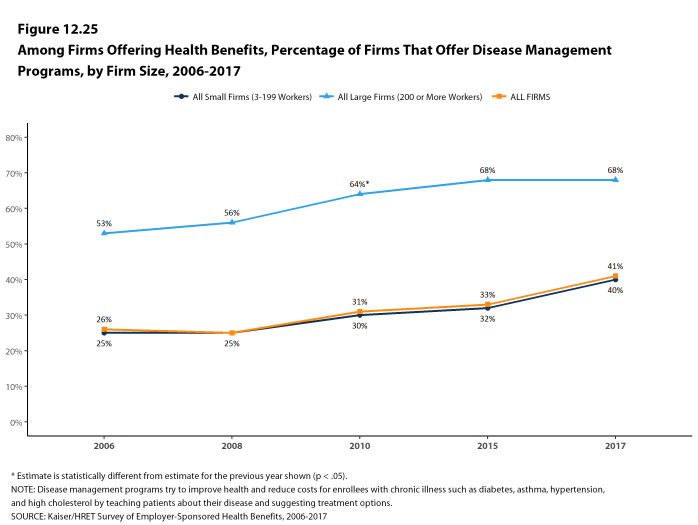

Disease management programs aim to improve health and reduce costs for enrollees with chronic illnesses by educating them about their disease and suggesting treatment options. These programs can help enrollees with conditions such as diabetes, asthma, hypertension, and high cholesterol.

- Forty-one percent of firms that offer health benefits offer disease management programs. Large firms are more likely than small firms to offer disease management programs (68% vs. 40%) [Figure 12.24].

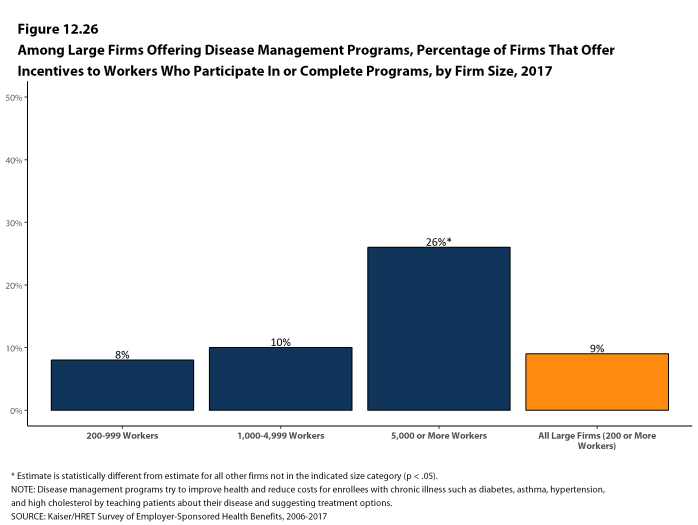

- Nine percent of large firms that offer disease management programs offer incentives for workers to participate in or complete the programs. This percentage is highest among firms with 5,000 or more workers (26%) [Figure 12.26].

Figure 12.24: Among Firms Offering Health Benefits, Percentage of Firms That Offer Disease Management Programs, by Firm Size, Region and Industry, 2017

Figure 12.25: Among Firms Offering Health Benefits, Percentage of Firms That Offer Disease Management Programs, by Firm Size, 2006-2017

PENALTIES FOR TOBACCO USE

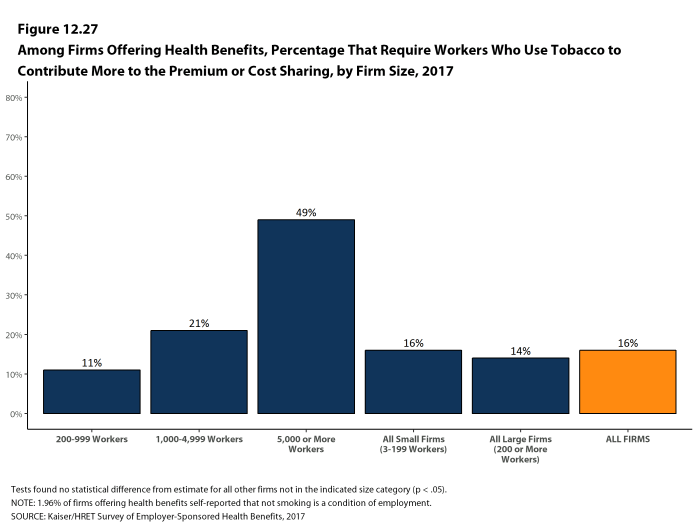

- Among firms offering health benefits, 16% of small firms and 14% of large firms, including 49% of firms with 5,000 or more workers, require higher premium contributions or cost sharing from workers who use tobacco [Figure 12.27]. Some firms noted that not smoking is a condition of employment.

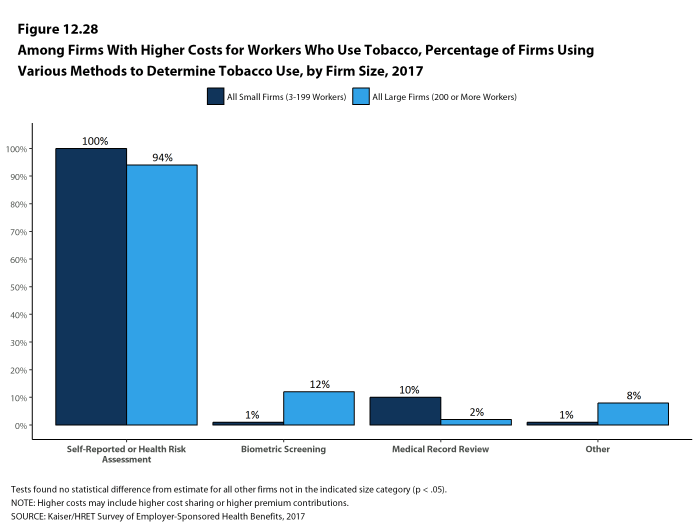

- Among firms with higher costs for workers who use tobacco, virtually all firms rely on self-reporting, including through a health risk assessment, to determine whether a worker uses tobacco [Figure 12.28].

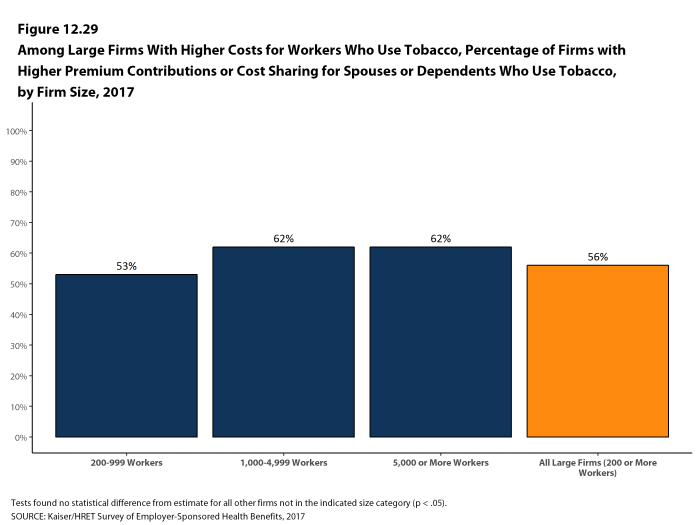

- Among large firms with higher costs for workers who use tobacco, 56% indicate that dependents also have higher premium contributions or cost sharing if they use tobacco [Figure 12.29].

Figure 12.27: Among Firms Offering Health Benefits, Percentage That Require Workers Who Use Tobacco to Contribute More to the Premium or Cost Sharing, by Firm Size, 2017

Figure 12.28: Among Firms With Higher Costs for Workers Who Use Tobacco, Percentage of Firms Using Various Methods to Determine Tobacco Use, by Firm Size, 2017