2016 Employer Health Benefits Survey

Section Two: Health Benefits Offer Rates

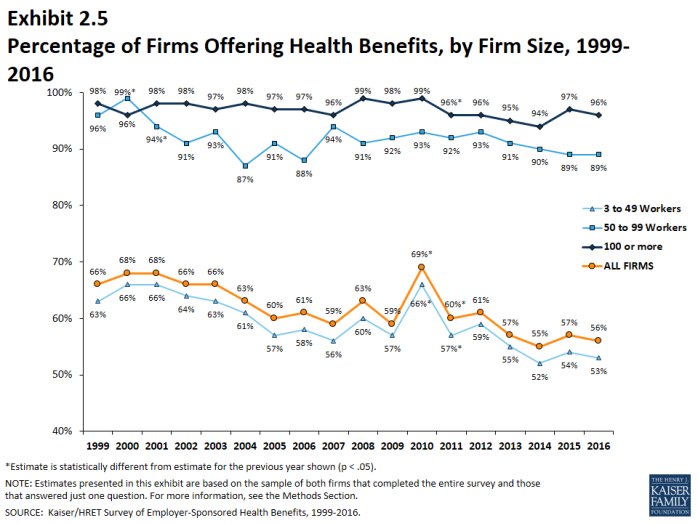

While nearly all large firms (200 or more workers) offer health benefits to at least some employees, small firms (3-199 workers) are significantly less likely to do so. The percentage of all firms offering health benefits in 2016 (56%) is similar to the percentages of firms offering health benefits in 2006 (61%) and 2011 (60%). The percentages of smaller firms (10 to 49 workers) offering coverage, however, has fallen since 2011 and years before. This trend precedes the ACA coverage expansions and is consistent with longer-term trends reported elsewhere.

Firms not offering health benefits continue to cite cost as the most important reason they do not do so. Almost all firms that offer coverage offer to dependents such as children and the spouses of eligible employees.

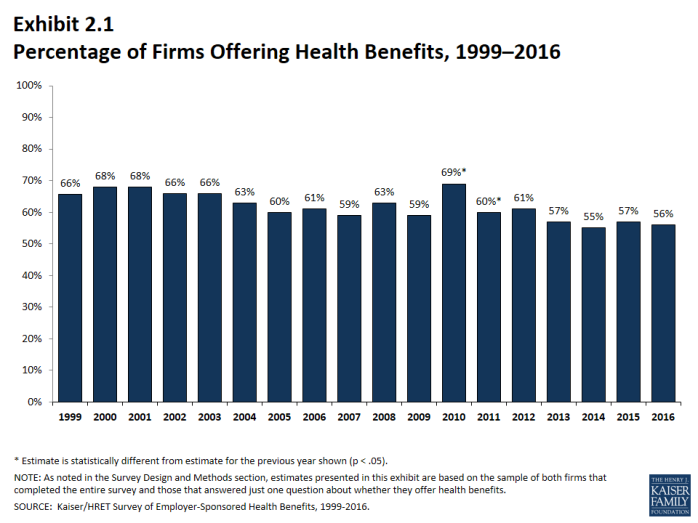

- In 2016, 56% of firms offer health benefits, similar to the 57% who reported doing so in 2015 (Exhibit 2.1).

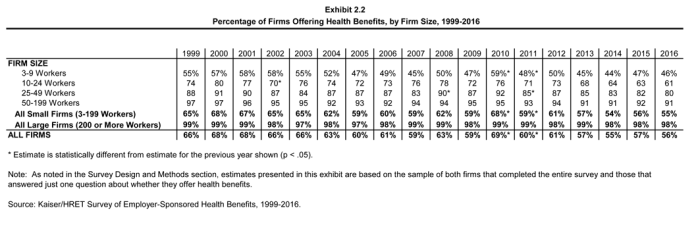

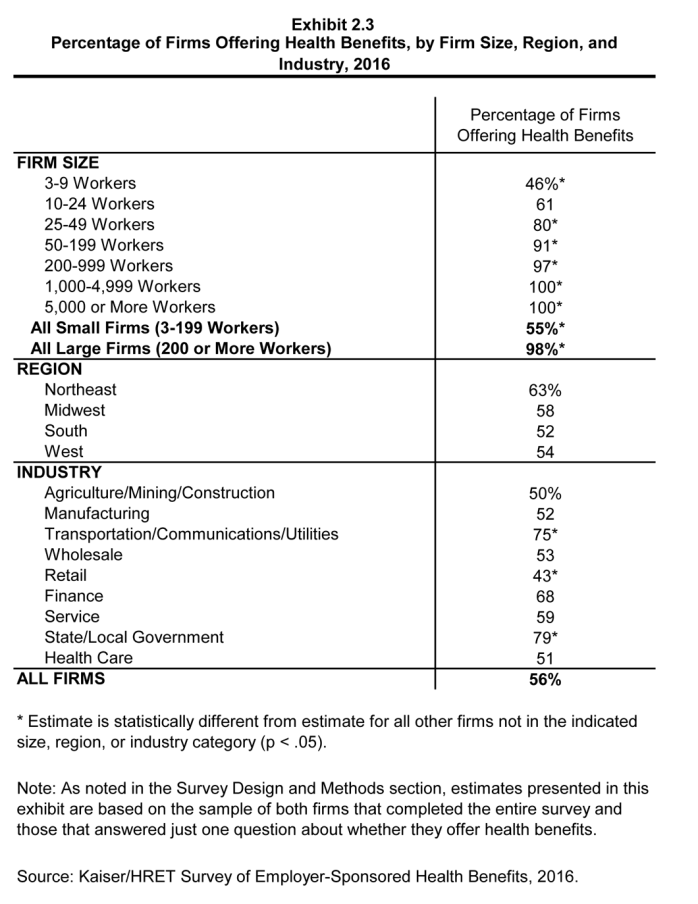

- Ninety-eight percent of large firms offer health benefits to at least some of their workers (Exhibit 2.3). In contrast, only 55% of small firms offer health benefits in 2016. The percentage of both small and large firms offering health benefits to at least some of their workers is similar to last year (Exhibit 2.2).

- Since most firms in the country are small, variation in the overall offer rate is driven largely by changes in the percentages of the smallest firms (3-9 workers) offering health benefits. For more information on the distribution of firms in the country, see the Survey Design and Methods Section and Exhibit M1.1

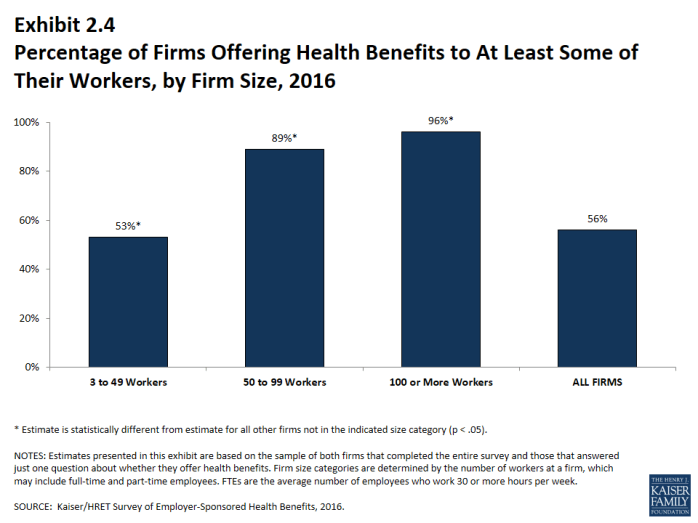

- Ninety-six percent of firms with 100 or more workers offer health benefits to at least some of their employees in 2016. Eighty-nine percent of firms with 50 to 99 workers offer benefits to at least some workers (Exhibit 2.4).

- The percentages of smaller firms (10 to 49 workers) offering coverage has fallen since 2011 and years before.

- The overall percentage of firms offering coverage in 2016 is similar to the percentage offering coverage in 2011 (60%) and 2006 (61%).

- Offer rates vary across different types of firms.

- Small firms are less likely to offer health insurance: 46% of firms with 3 to 9 workers offer coverage, compared 80% of firms with 25 to 49 workers, and 91% of firms with 50 to 199 employees (Exhibit 2.3).

- Offer rates throughout different firm size categories in 2016 remain similar to those reported in 2015 (Exhibit 2.2).

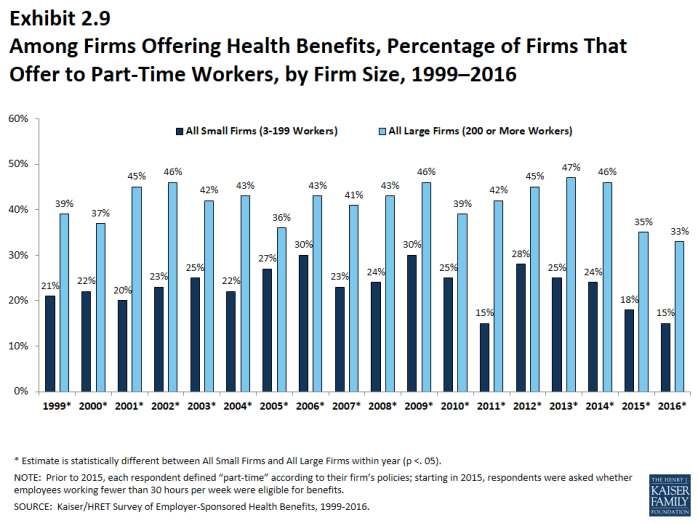

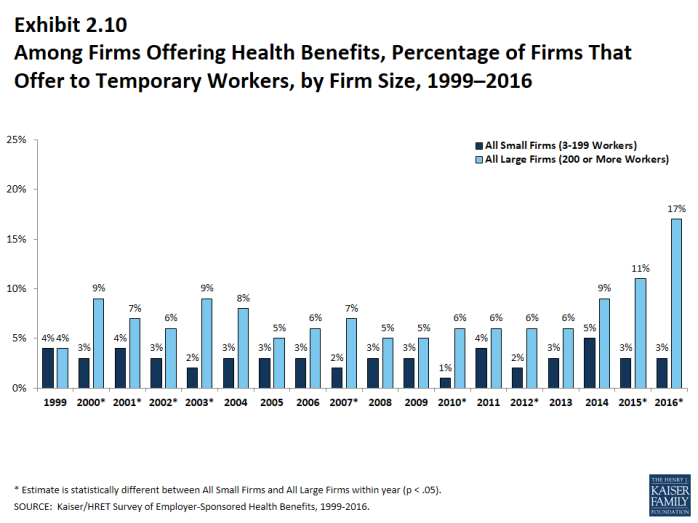

Part-Time and Temporary Workers

- Among firms offering health benefits, relatively few offer benefits to their part-time and temporary workers.

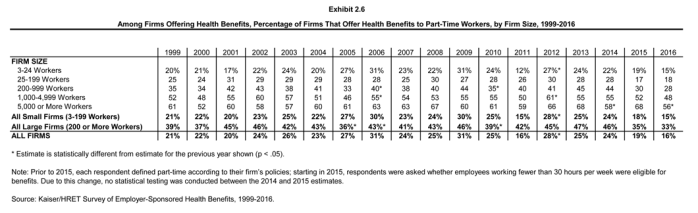

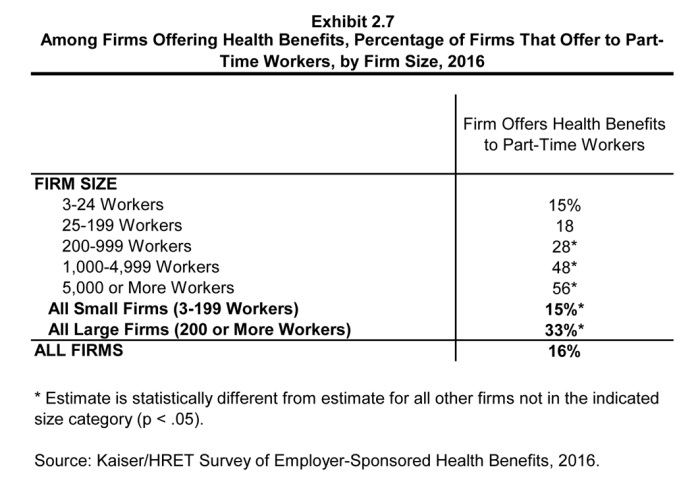

- The Affordable Care Act (ACA) defines part-time workers as those who on average work fewer than 30 hours per week. The employer shared responsibility provision of the ACA requires that large firms offer full-time employees a minimum standard of coverage or be assessed a penalty.2 Beginning in 2015, we modified the survey to explicitly ask employers whether they offered benefits to employees working fewer than 30 hours. Our previous question did not include a definition of “part-time”. For this reason, historical data on part-time offer rates are shown, but we did not test whether the differences between 2014 and 2015 were significant. Many employers may work with multiple definitions of part-time; one for their compliance with legal requirements and another for internal policies and programs.

- In 2016, 16% of all firms that offer health benefits offer them to part-time workers (Exhibit 2.7). Large firms are more likely to offer health benefits to part-time employees than small firms (33% vs. 15%) (Exhibit 2.9).

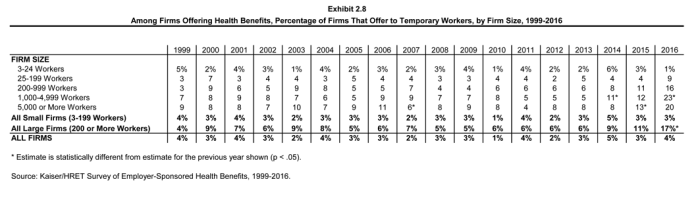

- A small percentage (4%) of firms offering health benefits offer them to temporary workers (Exhibit 2.8). More large firms offering health benefits elect to offer temporary workers coverage than small firms (17% vs. 3%) (Exhibit 2.10). The percentage of large firms offering health benefits to temporary workers is higher than the 11% reported in 2015.

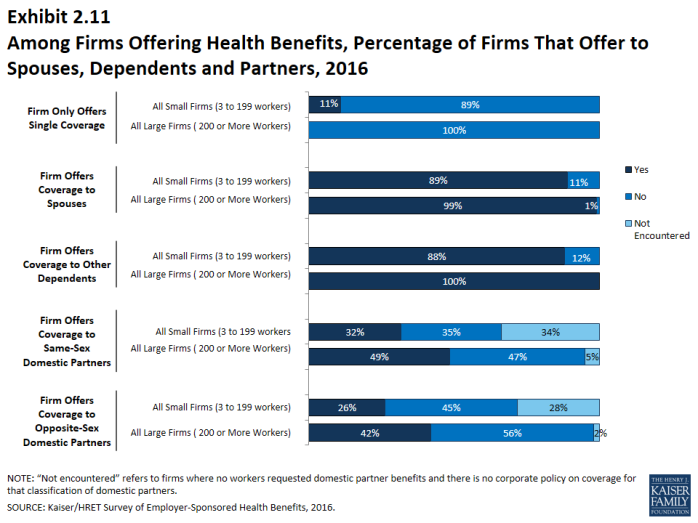

Spouses, Dependents and Domestic Partner Benefits

- The majority of firms offering health benefits offer to spouses and dependents, such as children. In 2016, 89% of small firms and 99% of large firms offering health benefits offer coverage to spouses (Exhibit 2.11). Fewer small firms offer coverage to spouses in 2016 than did in 2015 (98%). Eighty-eight percent of small firms and 100% of large firms offering health benefits cover other dependents, such as children, similar to last year. Eleven percent of small firms offering health benefits offer only single coverage to employees, higher than the 2% of small firms last year.

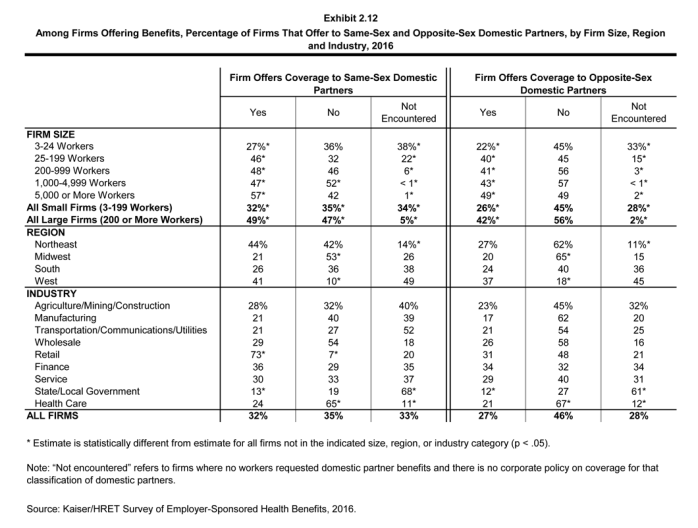

- Employers were also asked whether same-sex or opposite-sex domestic partners were allowed to enroll in the firm’s coverage. While definitions may vary, employers often define domestic partners as an unmarried couple who has lived together for a specified period of time. Firms may define domestic partners separately from any legal requirements a state may have, and also, employers may have a different policy in different parts of the country.

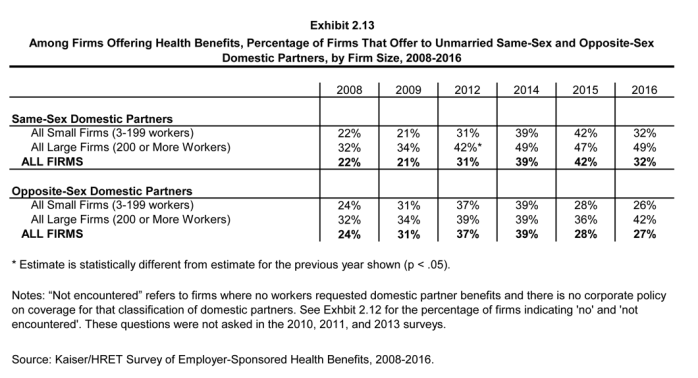

- In 2016, 27% of firms offering health benefits offer coverage to opposite-sex domestic partners, similar to the 28% who did so in 2015. Thirty-two percent of firms offering health benefits offer coverage to same-sex domestic partners, similar to the 42% who did so last year (Exhibit 2.13).

- When we ask employers if they offer health benefits to opposite or same-sex domestic partners, many firms report that they have not encountered this issue. At many small firms, the firm may not have formal human resource policies on domestic partners simply because none of the firm’s employees have asked to cover a domestic partner. Regarding health benefits for opposite-sex domestic partners, 28% of firms report in 2016 that they have not encountered this request or that the question was not applicable (Exhibit 2.12). The vast majority of firms in the United States are small businesses; 61% of firms have between 3 and 9 employees and 98% have between 3 and 199 employees (Exhibit M.1). Therefore, statistics about the percentage of firms that offer domestic partner benefits are largely determined by small businesses. More small firms (28%) compared to large firms (2%) indicate that they have not encountered this request or that the question was not applicable (Exhibit 2.12). Regarding health benefits for same-sex domestic partners, 33% of firms report that they have not encountered the request or that the question was not applicable. More small firms (34%) than large firms (5%) report that they have not encountered the issue of offering benefits to same-sex domestic partners (Exhibit 2.12).

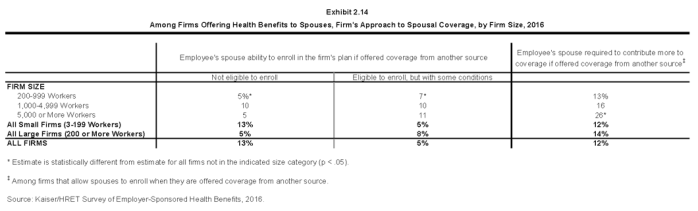

- Virtually all firms offering family coverage offer coverage to spouses. Among firms offering health benefits to spouses, 13% do not allow an employee’s spouse to enroll in the firm’s plan if that spouse is offered coverage from another source, and an additional 5% allow the spouse to enroll subject to conditions (Exhibit 2.14). Among firms offering health benefits to spouses, 12% require an employee’s spouse to contribute more to the coverage if that spouse is offered coverage from another source. Very large firms (5,000 or more workers) are more likely than smaller firms to require higher spousal contributions when the spouse is offered coverage elsewhere (26% vs. 12%).

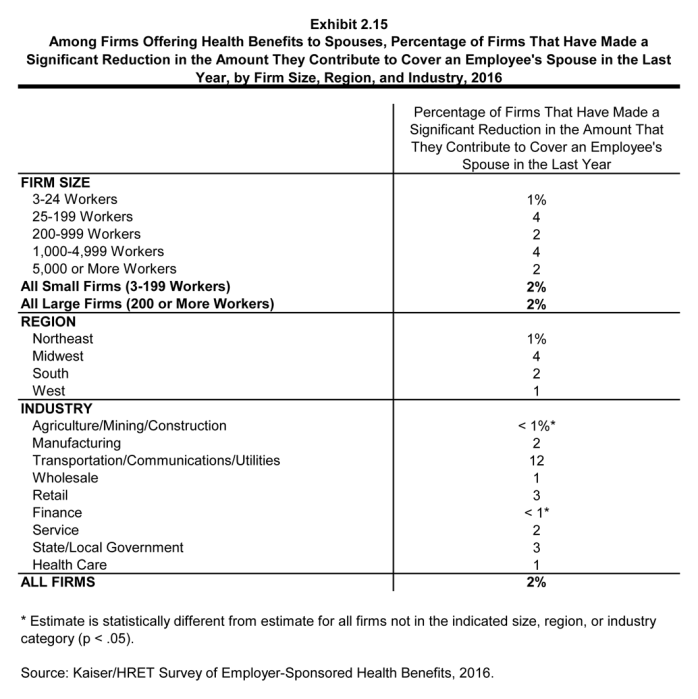

- Among firms offering health benefits to spouses, 2% have made a significant reduction in the amount they contribute to cover an employee’s spouse in the last year, with no difference between small and large firms (Exhibit 2.15).

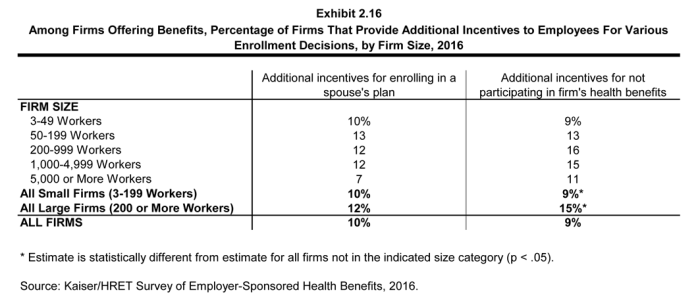

- Among all firms that offer health benefits, 10% report providing additional compensation or benefits to employees if they enroll in a spouse’s plan, and 9% provide additional compensation or benefits to employees if they do not participate in the firm’s health benefits (Exhibit 2.16).

Firms Not Offering Health Benefits

- The survey asks firms that do not offer health benefits if they have offered insurance or shopped for insurance in the recent past, and about their most important reasons for not offering coverage. Because such a small percentage of large firms report not offering health benefits, we present responses for small non-offering firms only.

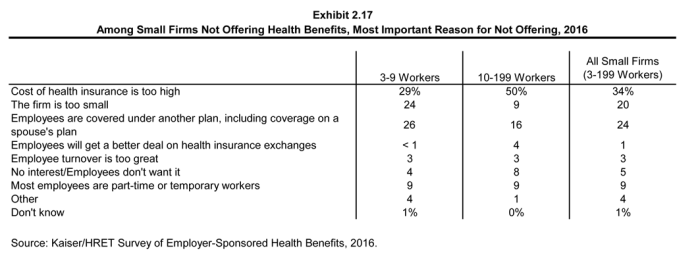

- The cost of health insurance remains the primary reason cited by firms for not offering health benefits. Among small firms not offering health benefits, 34% cite high cost as “the most important reason” for not doing so, followed by “employees are generally covered under another plan” (24%) (Exhibit 2.17). Relatively few small employers indicate that they do not offer because they believe that employees will get a better deal on the health insurance exchanges (1%).

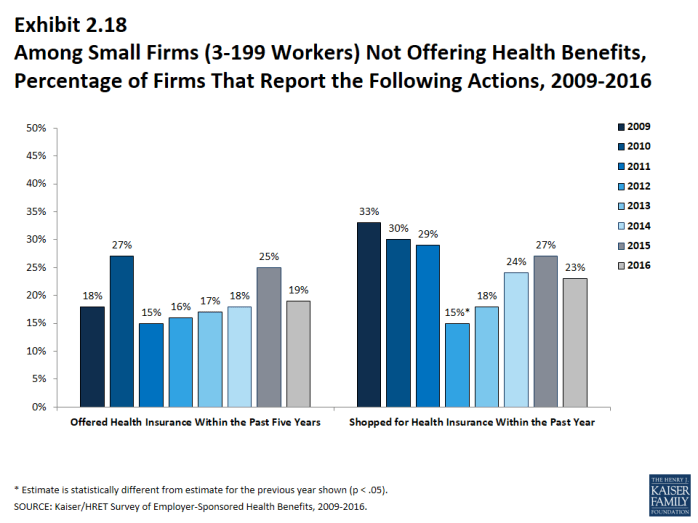

- Many non-offering small firms have either offered health insurance in the past five years, or shopped for health insurance in the past year. Nineteen percent of non-offering small firms have offered health benefits in the past five years, while 23% have shopped for coverage in the past year (Exhibit 2.18). The 19% of non-offering small firms that have offered coverage in the past five years is similar to the 25% reported last year.

- Thirty percent of non-offering small firms report that they stopped offering coverage within the last year, similar to the percentage (38%) last year.

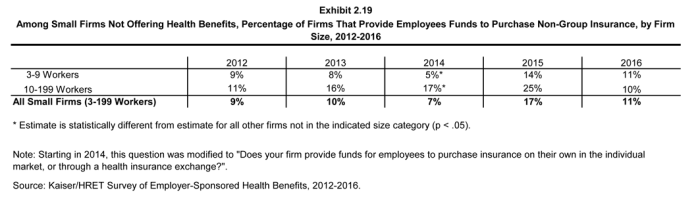

- Among non-offering small firms, 11% report that they provide funds to their employees to purchase health insurance on their own in the individual market or through a health insurance exchange (Exhibit 2.19). The IRS has issued guidance limiting the circumstances in which employers can contribute to an employee’s non-group plan going forward.3

SHOP Exchanges

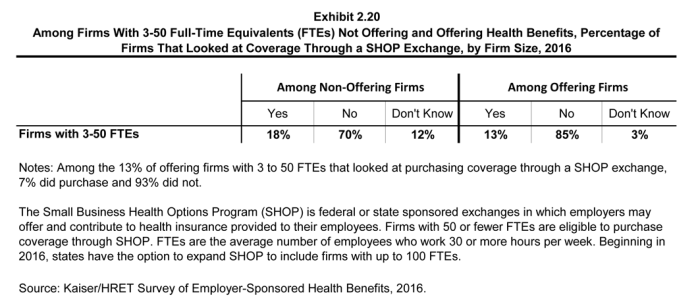

The Small Business Health Options Program (SHOP) is federal or state sponsored exchanges in which employers may offer and contribute to health insurance provided to their employees. Firms with 50 or fewer full-time equivalent workers (FTEs) are eligible to participate in a SHOP exchange. Beginning in 2016, states have the option to expand SHOP to include firms with up to 100 FTEs. Some employers are eligible for tax credits when purchasing coverage on the exchanges.

- Eighteen percent of firms with 3 to 50 FTEs who do not offer health benefits said they looked at coverage on a SHOP exchange (Exhibit 2.20).

- Thirteen percent of firms with 3 to 50 FTEs who offer health benefits said they looked at coverage on a SHOP exchange (Exhibit 2.20).

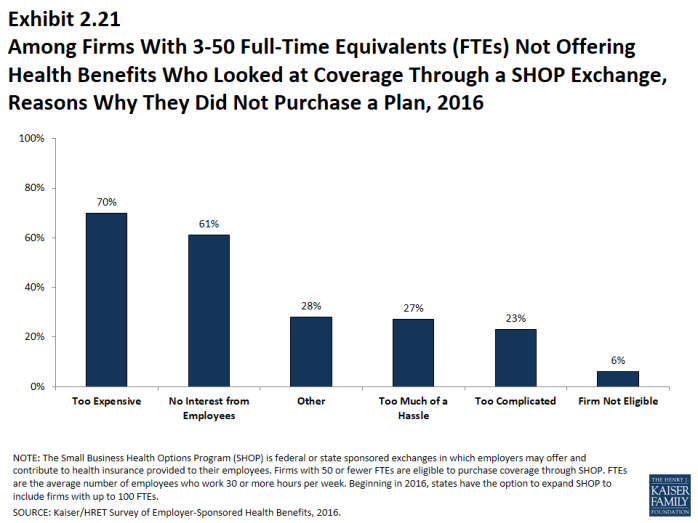

- Among non-offering firms with 50 or fewer FTEs that looked at coverage but chose not to purchase on a SHOP exchange, 70% reported they did not do so because the plans were too expensive (Exhibit 2.21).

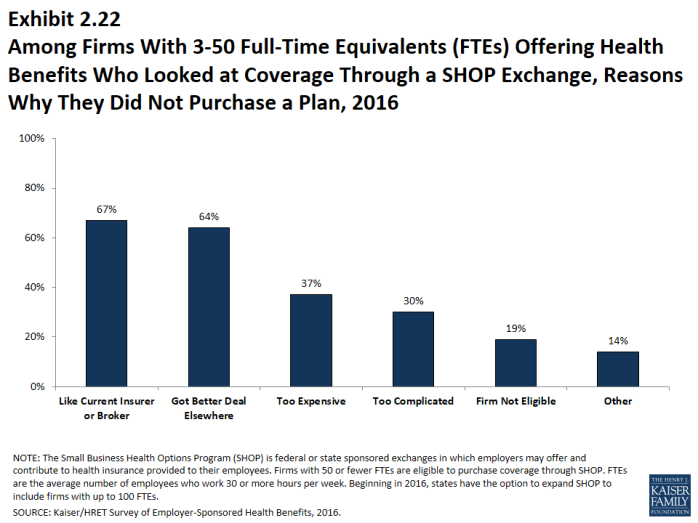

- Among offering firms with 50 or fewer FTEs that looked at coverage but chose not to purchase on a SHOP exchange, their reasons included that they like their current insurer or broker (67%) and that they got a better deal elsewhere (64%) (Exhibit 2.22).