2015 Employer Health Benefits Survey

Section Nine: Prescription Drug Benefits

- As in prior years, nearly all (more than 99%) covered workers in employer-sponsored plans have a prescription drug benefit.

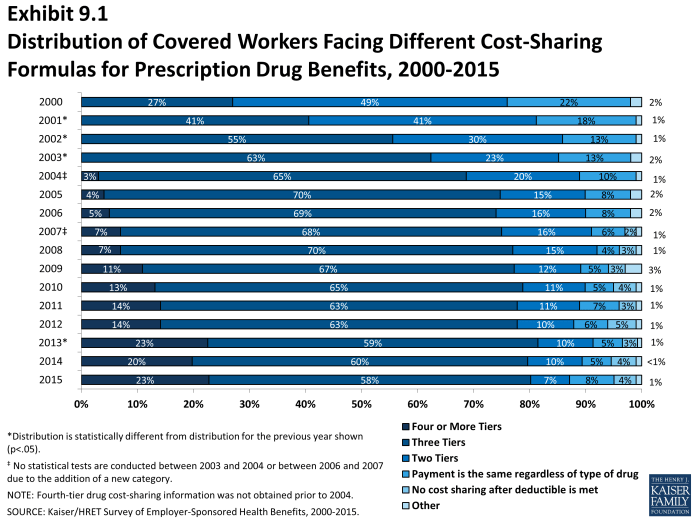

- An overwhelming majority of covered workers (88%) have a tiered cost-sharing formula for prescription drugs in 2015 (Exhibit 9.1). Cost-sharing tiers generally refer to a health plan placing a drug on a formulary or preferred drug list, which classifies drugs as generic, preferred, or non-preferred. Over the past few years, an increasing number of plans have created four or more tiers of drug cost sharing, which may be used for lifestyle drugs or expensive biologics. Employers often place various drugs in generic, preferred, or non-preferred tiers to encourage enrollees to select cheaper alternatives or to pass on to enrollees the higher costs of more expensive drugs. Sometimes employers will require high initial cost sharing for higher tier drugs but then include a coinsurance maximum to limit an enrollee’s total liability.

- Eighty-one percent of covered workers are enrolled in plans with three, four, or more tiers of cost sharing for prescription drugs, similar to 80% of covered workers in 2014 (Exhibit 9.1).

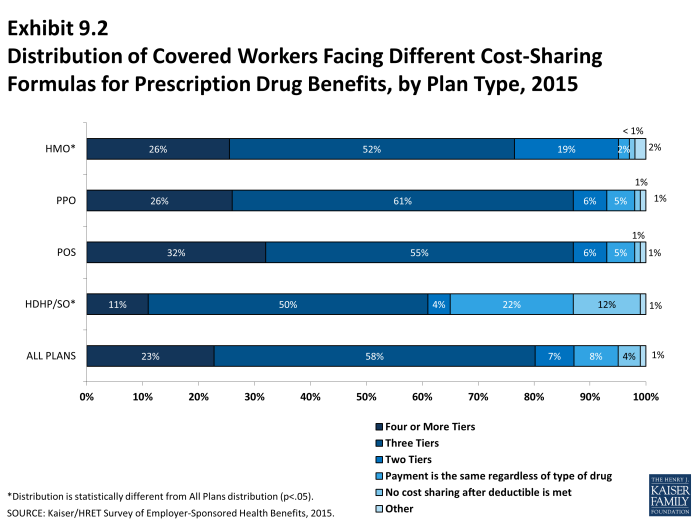

- HDHP/SOs have a different cost-sharing pattern for prescription drugs than other plan types. Twenty-two percent of workers enrolled in HDHP/SOs are in a plan whose payment is the same regardless of drug type, compared to only 8% for all plans. Twelve percent are in a plan that pays 100% of prescription costs once the plan deductible is met, compared to 4% for all plans (Exhibit 9.2).

Three or More Tiers

- Twenty-three percent of covered workers are in a plan that has four or more tiers of cost sharing for prescription drugs (Exhibit 9.1).

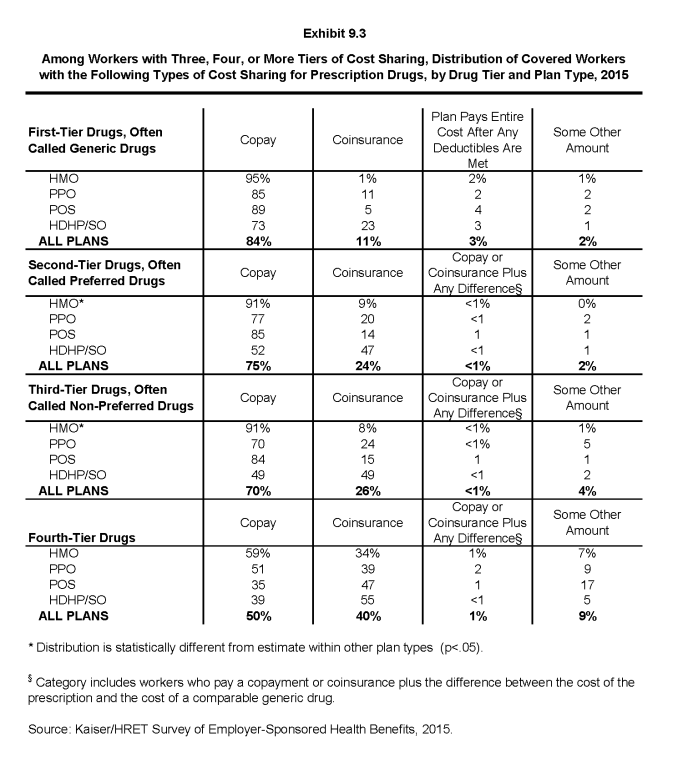

- Among workers covered by plans with three or more tiers of cost sharing for prescription drugs, copayments are far more common than coinsurance in the first three tiers. For covered workers in plans with three or more cost-sharing tiers, 50% face a copayment for fourth-tier drugs and 40% face coinsurance (Exhibit 9.3).

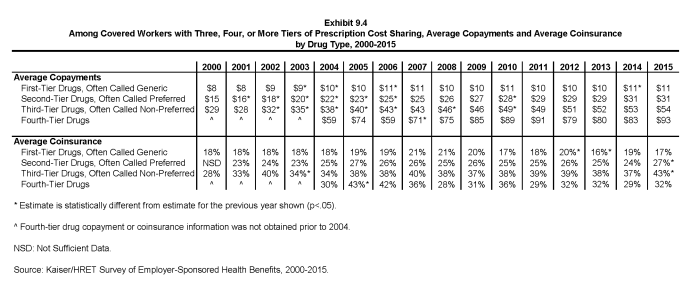

- For covered workers in plans with three, four, or more tiers of cost sharing for prescription drugs, the average copayments for first-tier drugs ($11), second-tier drugs ($31), third-tier drugs ($54), and fourth-tier drugs ($93) are comparable to the amounts reported in 2014 ($11, $31, $53, and $83, respectively) (Exhibit 9.4).

- For covered workers in plans with three, four, or more tiers of cost sharing for prescription drugs, coinsurance averages 17% for first-tier drugs, 27% for second-tier drugs, 43% for third-tier drugs, and 32% for fourth-tier drugs. Coinsurance averages for second and third tier drugs are significantly higher than last year (27% vs. 24%) (43% vs. 37%) (Exhibit 9.4).

Single and Two Tiers

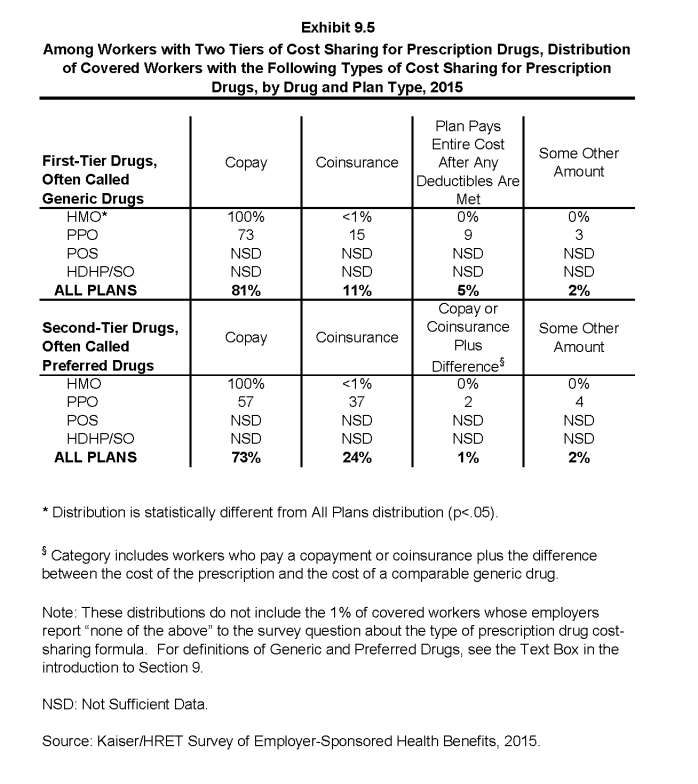

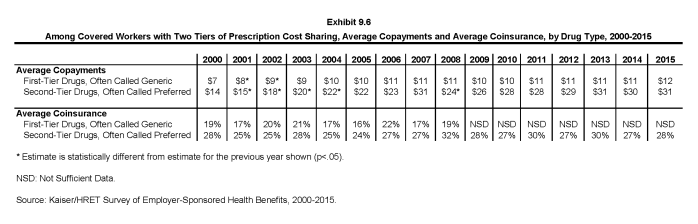

- Seven percent of covered workers are in a plan that has two tiers for prescription drug cost sharing (Exhibit 9.1). Similar to workers in plans with more cost-sharing tiers, copayments are more common than coinsurance for workers in plans with two tiers (Exhibit 9.5). The average copayment for the first tier is $12, and the average copayment for the second tier is $31. The average coinsurance rate for the second tier is 28% (Exhibit 9.6).

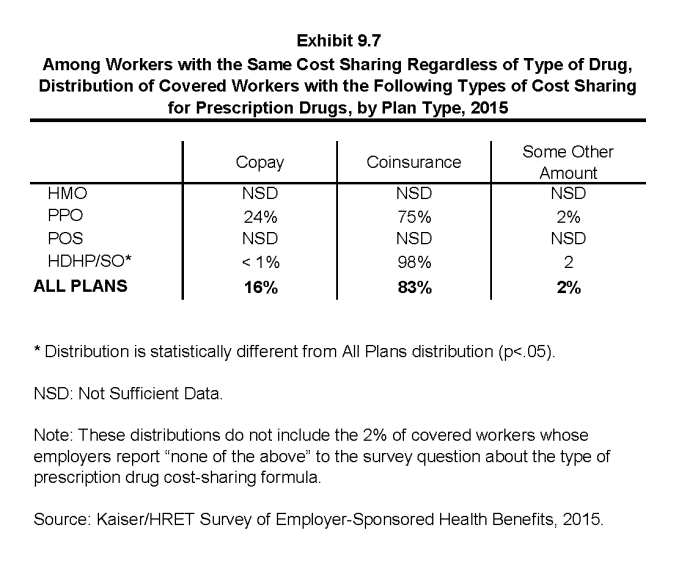

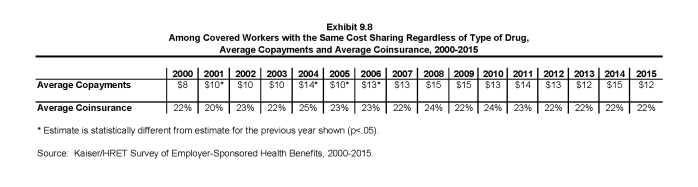

- Eight percent of covered workers are covered by plans in which cost sharing is the same regardless of the type of drug chosen (Exhibit 9.1). Among these covered workers, 16% have copayments and 83% have coinsurance (Exhibit 9.7). The average copayment is $12 and the average coinsurance is 22% (Exhibit 9.8).

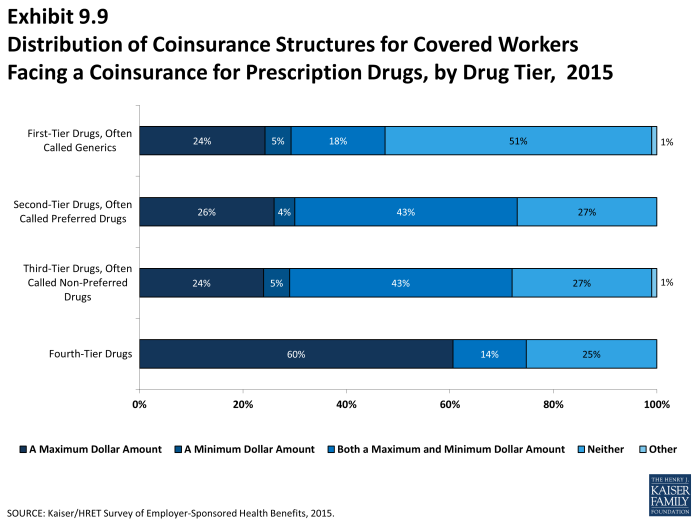

- Coinsurance rates for prescription drugs often have maximum or minimum dollar amounts associated with the coinsurance rate. Depending on the plan design, coinsurance maximums may significantly limit an enrollee’s out of pocket spending on high cost drugs. For generic or first tier drugs, 24% of workers with a coinsurance rate have only a maximum dollar amount attached to the coinsurance rate, 5% have only a minimum dollar amount, 18% have both, and 51% have neither. Coinsurance maximums are more common on higher tiers; 74% of covered workers with a fourth tier coinsurance have a maximum compared to 42% of first tier plans (Exhibit 9.9).

Deductibles

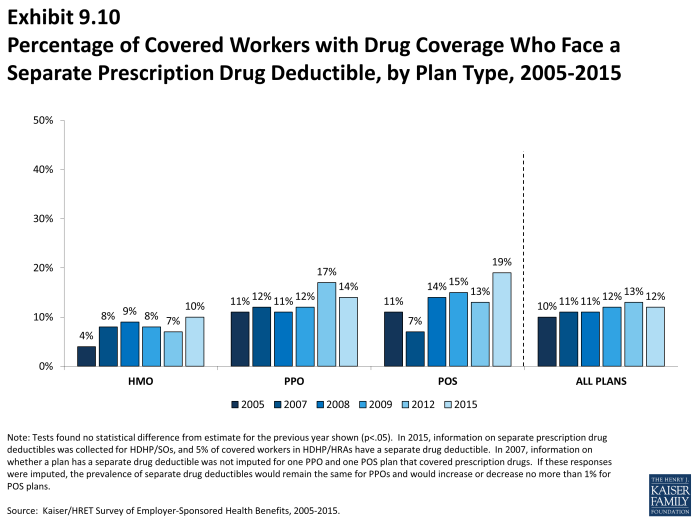

- In addition to a copayment or coinsurance, some covered workers with drug coverage are also required to pay a separate prescription drug deductible (12%) (Exhibit 9.10). Separate annual deductibles are an amount an employee must pay out of pocket before the plan covers most drugs. These deductibles are separate from any general annual deductible and may apply to a select number of tiers.

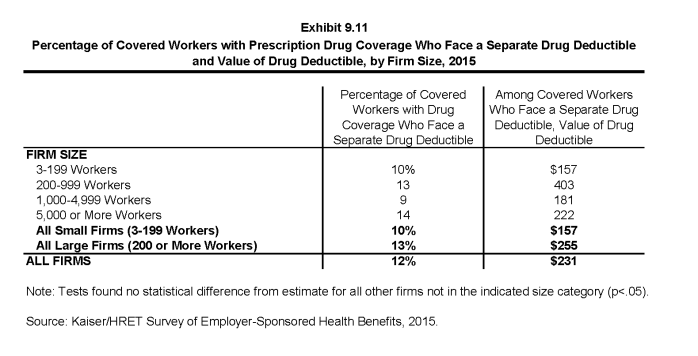

- The average annual deductible among workers who face a separate general annual deductible is $231 (Exhibit 9.11). Five percent of covered workers are enrolled in a plan with an annual deductible for prescription drug coverage of $500 or more.

Specialty drugs

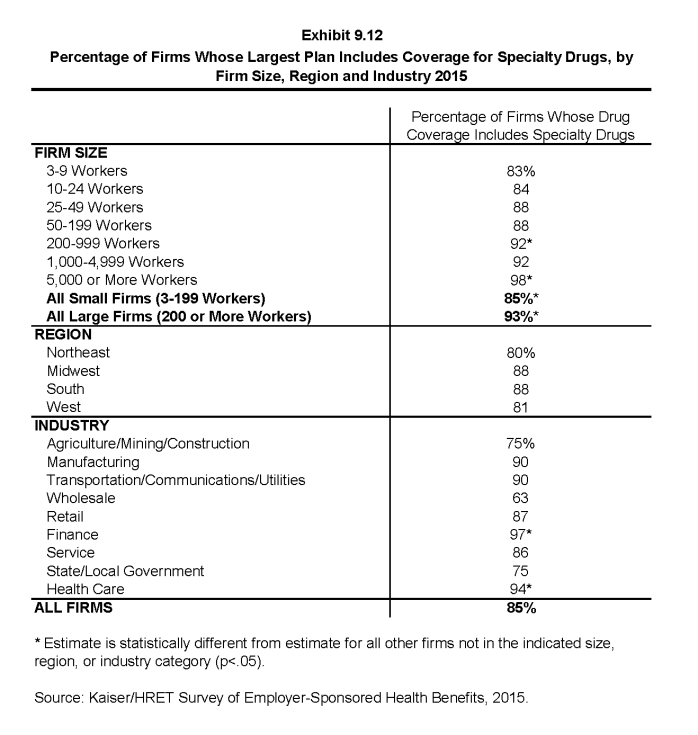

- Specialty drugs such as biologics may be used to treat chronic conditions and often require special handling and administration. Many plans place specialty drugs on the fourth or higher tier of the formulary. Eighty-five percent of firms’ largest plan includes coverage for specialty drugs (Exhibit 9.12). Most covered workers with drug coverage are enrolled in a plan that covers specialty drugs such as biologics (94%).

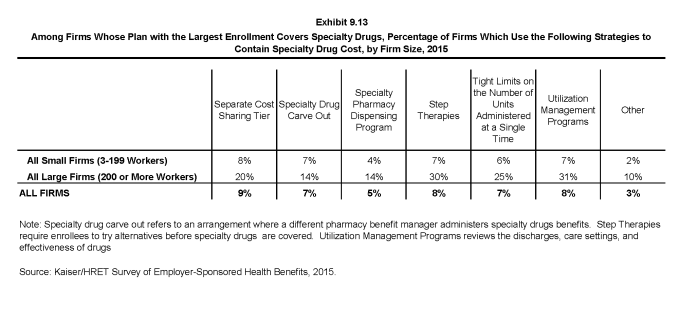

- Specialty drugs are typically high cost; firms use a variety of strategies to contain these costs. Nine percent of firms whose plan with the largest enrollment covers specialty drugs use a separate cost sharing tier for specialty drugs. Eight percent use a step-therapy approach where enrollees must try alternatives before specialty drugs are covered, and 7% use tight limits on the number of units administered at a single time (Exhibit 9.13).

Generic drugs: Drugs product that are no longer covered by patent protection and thus may be produced and/or distributed by multiple drug companies.

Preferred drugs: Drugs included on a formulary or preferred drug list; for example, a brand-name drug without a generic substitute.

Non-preferred drugs: Drugs not included on a formulary or preferred drug list; for example, a brand-name drug with a generic substitute.

Fourth-tier drugs: New types of cost-sharing arrangements that typically build additional layers of higher copayments or coinsurance for specifically identified types of drugs, such as lifestyle drugs or biologics.