Contraception 2.0: Findings of a National Study of Online Contraception Platforms

Overview

Customers access telecontraception platforms through web browsers or through phone apps. Clients create an account and fill out a health questionnaire that is meant to screen for birth control contraindications, such as a history of strokes, a recent pregnancy, high blood pressure and smoking status. Customers must also report a recent blood pressure reading. Depending on the state, a healthcare provider reviews these questionnaires once submitted or has a video consultation with the customer to determine whether the client is a good candidate for contraception. Research has found that telecontraception platforms generally screen adequately for these contraindications.

All telecontraception platforms offer oral contraceptives and many also offer the contraceptive patch and contraceptive ring. Platforms offer a variety of brands and generic equivalents, and most offer a $10 to $15 per month oral contraception option. Clients pick their preferred contraceptive method and depending on the company, can use private insurance or Medicaid to cover the prescription or pay out of pocket. Most companies also charge an additional consultation fee that covers the medical consultation and other services and is often not billed to insurance and must be covered out-of-pocket by the client. This can range from a $15 consultation fee to a $99 yearly membership that typically covers the medical evaluation and customer support for the duration of the prescription. Clients can obtain a new prescription for contraception or have an existing prescription mailed directly to their home or a local pharmacy for pickup.

Operations

Telecontraception Services

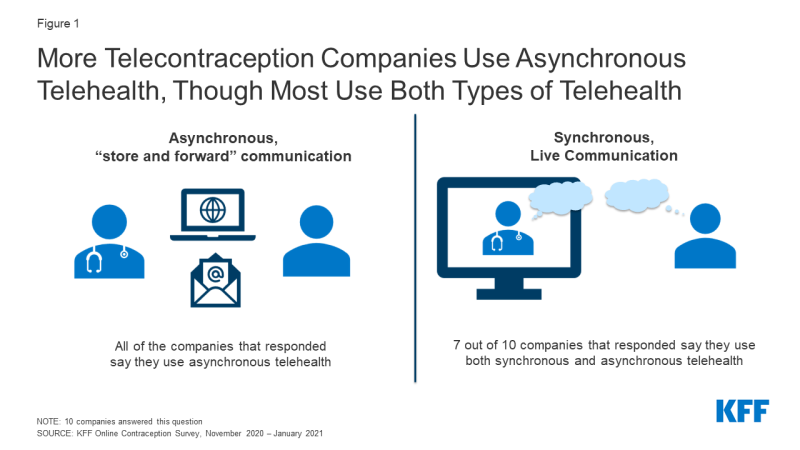

Telecontraception is marketed as a convenient way for people to quickly access a prescription for birth control without leaving their home. All the companies that responded said they provide asynchronous (e.g., store-and-forward) telehealth (n = 10), which involves a patient sending their information through a questionnaire or form that can be viewed by a medical provider at a later time. Seven of these companies also provide synchronous (e.g., live video-conferencing) telehealth services that involves real-time interaction between the patient and medical provider (Figure 1).

Figure 1: More Telecontraception Companies Use Asynchronous Telehealth, Though Most Use Both Types of Telehealth

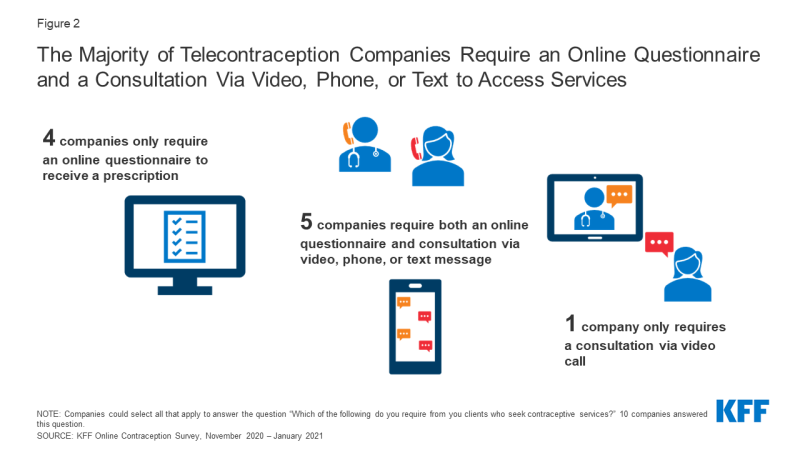

Four companies only require an online questionnaire to receive a prescription, one company requires a consultation via video call, and five companies require both an online questionnaire and consultation via video call, phone call, or text message (Figure 2). One of the companies that only requires an online questionnaire specified that they require a photo government ID and one company said they only require consultation with video in states when required, otherwise, they use an online questionnaire.

Figure 2: The Majority of Telecontraception Companies Require an Online Questionnaire and a Consultation Via Video, Phone, or Text to Access Services

Staffing

PROVIDER TYPE AND PAYMENT

The number of providers working for telecontraception companies varied widely by company with a range of 10-154 providers working with each company. Of the eight companies that responded to this question, on average, online contraception companies were more likely to have medical doctors (MDs) on staff compared to other medical professionals, followed by nurse practitioners (NPs) (Figure 3).

A range of provider types work at telecontraception companies. Three companies employ only MDs as clinical staff. Three other companies have a much larger share of NPs compared to MDs (95%, 85%, and 80% NPs compared to 1%, 15%, and 10% MDs). One company is split evenly between MDs and Doctors of Osteopathic Medicine (DOs) (50% and 50%). There is another company that had a wide variety of providers, including 50% MDs, 30% NPs, 10% physician assistants (PAs), and 10% Doctors of Pharmacy (PharmDs). This is the only company that responded they were currently employing PharmDs and three companies employ PAs.

There was considerable variation in the arrangements that the companies used to pay their providers. Of the nine companies that responded about how their providers were paid, two companies said all of their providers were salaried employees, three companies said they had salaried providers and providers paid hourly, two companies said their providers were only paid hourly, and two companies said providers were paid per visit. One of these companies specified that their salaried employees were paid by the independent professional medical corporation with which the providers are affiliated.

TRAINING

The number of hours of training providers receive about prescribing birth control varied considerably ranging from one to fifteen hours. The company that responded one hour said training is one hour initially, followed by one hour per year. One company did not provide the number of hours of training their providers receive about prescribing birth control, but said every provider receives minimum required training, including ongoing training.

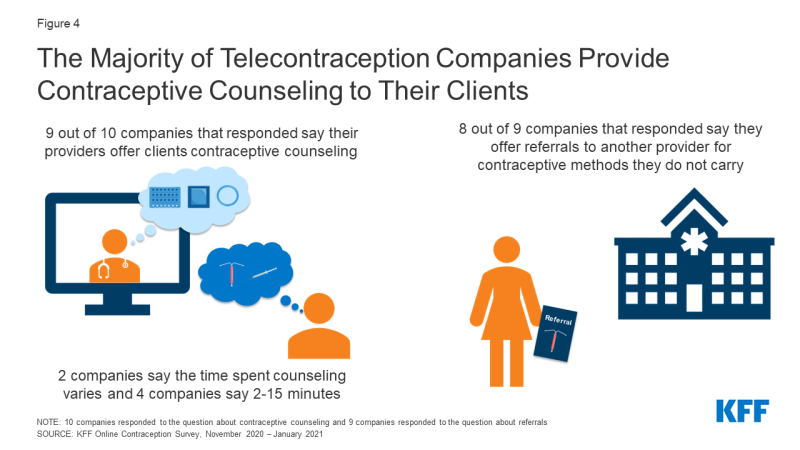

CONTRACEPTIVE COUNSELING aND ReFERRALS

Nine of the ten companies that responded said their providers offer clients contraceptive counseling (Figure 4). Contraceptive counseling includes working with the client interactively to select the most appropriate contraceptive method for them. We asked, on average, how much time per visit providers usually spend doing contraceptive counseling. Two companies did not provide specific time ranges, only saying that it varies and the four companies that provided an amount of time said contraceptive counseling ranged from 2–15 minutes.

Figure 4: The Majority of Telecontraception Companies Provide Contraceptive Counseling to Their Clients

Of the nine companies that responded about referrals, eight companies said they offer referrals to another provider for clients seeking a contraceptive method that their company does not provide, or when a client is not eligible for hormonal methods based on their medical history. However, only one of the companies that responded to the questionnaire is affiliated with a brick-and-mortar health system or provider network to which they can refer clients. With additional follow-up, another company said they refer their patients to all the same places a typical primary care office would refer their patients to and help patients navigate the best place for them (e.g., in-network, geographical proximity, patient reviews). One company said they can direct clients to federally qualified health centers or other community-based organizations. One company said they did not offer referrals at all.

NEW PRESCRIPTIONS VS. ReFILLS

We asked what share of their new contraceptive clients were seeking a refill for their existing contraceptive method or were seeking a prescription for a new contraceptive method or different brand or formulation. Five companies responded and three companies said the majority of their clients were seeking a prescription for a new contraceptive method or different brand or formulation (percentage of clients: 100%, 70%, 70%) and two companies said their new contraceptive clients were split between those seeking a new prescription and those seeking a refill for their existing contraceptive method.

DISTRIBUTION

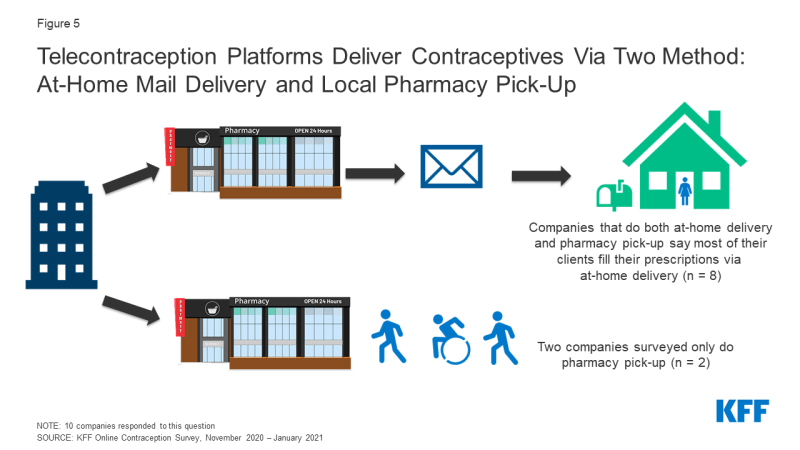

Telecontraception platforms offer two forms of delivery for contraceptives: at-home delivery via mail service and/or pick-up at a local pharmacy. From our tracker, most companies offer both at-home delivery and local pharmacy pick-up, and very few offer just one option. In our survey, the majority of companies said most clients fill their prescriptions via at-home delivery (n = 8), which makes these platforms convenient options, especially during a pandemic (Figure 5). Companies said it usually takes two to seven days for prescriptions to arrive at the client’s home and all the companies that do at-home delivery said they use the United States Postal Service for delivery, except for one company that uses DHL.

Figure 5: Telecontraception Platforms Deliver Contraceptives Via Two Method: At-Home Mail Delivery and Local Pharmacy Pick-Up

Two companies said that most of their clients fill their prescriptions via local pharmacy pick-up and that prescriptions are available for same-day pick-ups, making this a fast option if a client needs their contraception as soon as possible. Most telecontraception companies’ pharmacy pick-ups are available on the same day of the client consultation (n = 8). Two companies that mostly do at-home delivery said pharmacy pick-ups are not available for same day pick-up.

There is sizable variation in how these platforms work with pharmacies, both mail order and brick and mortar pharmacies. In order to deliver contraception to their clients’ homes, some companies use an in-house pharmacy, but the majority partner with outside pharmacies (Figure 6). At least one of the companies partnered with up to six pharmacies. The two companies that said most of their clients pick-up their contraceptives at local pharmacies partnered with larger pharmacy networks. One of the vendors reported partnering with 90,000 pharmacies and the other explained that they partner with one pharmacy delivery company, but are networked into most every major pharmacy in the U.S.

The majority of telecontraception companies distribute three months of oral contraceptives at a time (n = 8). However, there was variation. One company said, on average, they usually distribute one month of oral contraceptives at a time and another company said on average they usually distribute twelve months of oral contraceptives at a time. Some companies have providers that write prescriptions for a year of oral contraceptives, but they are only dispensed for one to three months at a time due to state and insurance limitations. Currently, only 19 states require that insurers cover a 12-month supply of oral contraceptives and that requirement is limited to fully insured self-regulated plans, not self-funded employer plans.

Clients Served

Since these telecontraception companies have been in business for differing periods of time (most of the companies started up between 2011 and 2019) and not all companies deliver and/or prescribe in all states, the number of contraceptive clients served by these companies varies widely; two companies were comparatively smaller, serving less than 10,000 contraceptive clients, while three companies reported serving 300,000+ clients (Figure 7).

Among all these companies’ clientele, contraceptive service customers account for 10%–100% of their total clientele. All the companies that responded said their contraceptive clients were 100% female. This could be because no prescription contraceptive methods are geared towards men and condoms are available for purchase at low cost over-the-counter. While there are companies that sell condoms online like Lola, the companies that we focused on for this study offered hormonal contraceptives. On average, the largest share of these companies’ clients are between the ages of 18 and 24, but the 25- to 30-year-old age group also accounts for one third of the market. (Figure 8).

Many of the companies are looking to diversify and expand their markets. When asked if there was a population their company would like to serve that they do not currently serve, responses included: Spanish speakers, rural populations, LGBTQIA+ populations, and clients with Medicaid and insurance.

Availability Across State Lines

Many of these companies can be accessed in a number of U.S. states, and of the 13 companies in our study, five companies can prescribe contraception in all 50 states. Seven companies can function as a mail-order pharmacy and deliver contraception in all 50 states for those individuals that already have a prescription from their provider.

State telehealth laws and provider licensing across state lines were the top reasons that companies cited as to why they were not able to prescribe contraception to their clients in all 50 states. Two of the companies said that it was an administrative challenge for staff to bring on new states. One company said they were limited by the fact that their pharmacy partners don’t distribute in all 50 states (Figure 9).

For the six companies who said they could not deliver contraception by mail in all 50 states there was not a predominant reason. Two companies cited restrictive state telehealth laws. One of these companies also said they were limited by the fact that their pharmacy partners do not distribute in all 50 states and it is an administrative challenge for staff to bring on new states. One company said they do not have providers licensed in all 50 states and another responded that delivering contraception in all 50 states is in their product roadmap for future launch.

Marketing

Most telecontraception companies rely on a range of approaches to advertise and market their products and services. Some use organic searches from search engines like Google or Bing where people can search for their products (n = 11), paid searches or search engine marketing like Google ads (n = 9), or paid social media like Facebook, Twitter, and Instagram ads (n = 8) (Figure 10). One company said their consumers found out about their company through TV, podcasts, and influencers.

Services and Supplies

While all of the companies we surveyed provided contraception, many provided additional services to their clients, like urinary tract infection (UTI) treatment, STI diagnosis and treatment services, skin care and hair loss treatments, and other primary care services (Figure 11). Mental health services, and erectile dysfunction treatments were offered by four of the platforms and some also offer vitamins, COVID-19 tests and PrEP.

Oral contraceptives make up the largest share of their contraceptive service product lines by far, ranging from 70-93% with a mean of 87% across companies (Figure 12). A much smaller share of their contraceptive lines is for emergency contraceptive pills, the contraceptive ring and patch. A small fraction of their contraceptive lines includes Depo Sub-Q injections and female condoms.

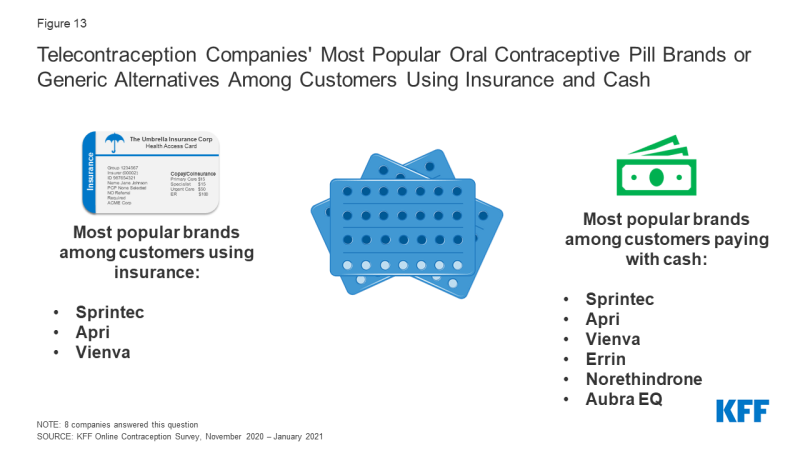

The most popular contraceptive pill brand or generic alternative among customers using insurance and customers paying with cash was the combination pill Sprintec, which is a generic equivalent to Ortho-Cyclen. Apri and Vienva, combination generic pill equivalents to Desogen and Alesse respectively, were also popular among customers using insurance and cash. For customers using cash, companies also responded that Errin, a progestin-only generic equivalent to Ortho Micronor, and norethindrone, as well as Aubra EQ, a combination pill generic equivalent to Alesse were also popular (Figure 13).

Figure 13: Telecontraception Companies’ Most Popular Oral Contraceptive Pill Brands or Generic Alternatives Among Customers Using Insurance and Cash

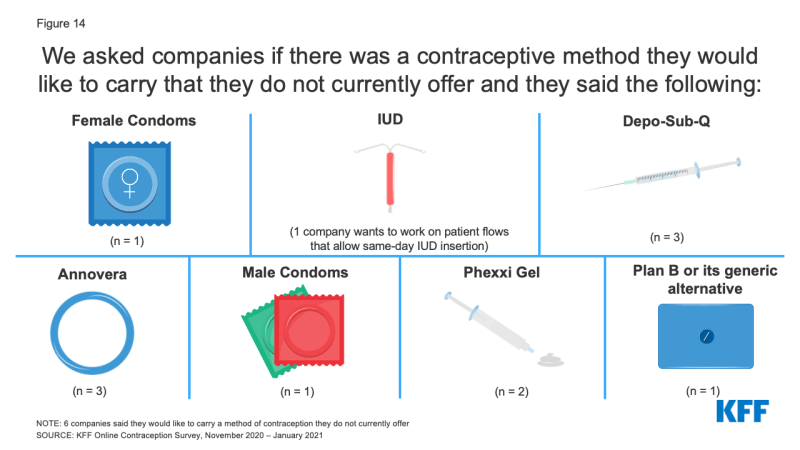

We asked companies if there was a method of contraception they would like to carry that they do not currently offer and the reason why they did not currently carry it (Figure 14). Three companies said they would like to carry Depo-Sub-Q and one company responded that they currently do not carry it because the average co-pay and the self-pay cost are too high. Another company cited the same reasons for not carrying female condoms, and another wanted to carry male condoms, but said they are not reimbursed enough. One company said they would like to expand their contraceptive offerings to include Annovera, the 1-year vaginal ring, and Plan B or its generic alternative for emergency contraception and two companies would like to carry Phexxi gel, a non-hormonal prescription vaginal gel. Since our study was conducted, one of these companies now carries Phexxi gel. While these companies are primarily focused on short acting hormonal contraceptive methods, one company said they would like to work on patient flows that allow obtaining an IUD for single appointment insertion to streamline IUD adoption.

Figure 14: We asked companies if there was a contraceptive method they would like to carry that they do not currently offer and they said the following:

Payments for Services and Supplies

Since 2012, the Affordable Care Act (ACA) has required most private insurance plans to cover all FDA approved contraceptive methods and services without cost-sharing, although religious employers and employers with religious and moral objections to contraception are exempt from the coverage requirement. Additionally, the ACA also created a new Medicaid eligibility pathway for adults that also requires contraceptive coverage without cost-sharing. While these requirements do not apply to Medicaid pathways available prior to the ACA, KFF research has found that most states cover a broad range of contraceptive methods across all Medicaid pathways available in the state. Not all telecontraception platforms accept both private insurance and Medicaid, but the majority accept at least one form of insurance, and many serve clients willing to pay out-of-pocket for their contraception.

PRIVATE INSURANCE

We asked companies if they accepted private insurance and about the barriers they have encountered while working with private plans, and for those that do not accept private insurance, what were the obstacles that were preventing them from accepting it. Of the ten companies that responded to this question, eight accept private insurance and two companies do not (Figure 15). One company that does not accept private insurance cited multiple obstacles including that they had previously tried to work with private insurance, but experienced barriers; low reimbursement; excessive administrative burdens; the complexity of developing relationships with private insurance companies; and clients’ willingness to pay out-of-pocket. The other company that does not currently accept private insurance said they began with a self-pay model, but they are currently working on expanding to accept Medicaid and private insurance.

Among the companies that accept private insurance, three report that private insurance companies are unwilling to cover contraceptive mail order deliveries beyond the first few months, likely due to pharmacy contract limitations and competition by the private insurance companies’ internal mail orders. One company explained that Pharmacy Benefit Managers (PBM) place limits on refills from the telecontraception company and require patients to use their insurance company’s PBM’s mail order program. One company also said private insurance companies do not always cover a one-year supply of contraception when they prescribe one year of contraception, even when state law requires insurers in that state to cover a 12-month supply. One company cited prior authorization requirements and two cited copays as barriers they have experienced in trying to work with private plans. Another company also said that refills requested prematurely by clients result in coverage denials that mean patients must wait longer than they would like before getting their next refill. This same company said they are considered out of network (and therefore clients can be charged copayments) and the contraceptives they provide may not be on a private insurance company’s formulary also resulting in charges and lack of coverage.

MEDICAID

Fewer companies accept Medicaid, the state-federal health program for low-income people (6 of 10 that responded to this question). Of the four companies that do not accept Medicaid, half said they have tried to work with Medicaid but have experienced barriers. One of these companies also said that Medicaid’s telehealth policies are too restrictive. Two companies said that accepting Medicaid was too administratively burdensome and another two said the complexity of developing relationships with state Medicaid managed care organizations was a barrier to accepting Medicaid.

A major challenge to working with Medicaid that was cited by companies that currently accept Medicaid was the variation of Medicaid requirements across states, with each state Medicaid program having its own unique regulations and processes to enroll. One company said that in California, they have to contract with each county and the counties require them to be physically located within them, which makes their business model as a mail order company difficult. Another company similarly cited contracting challenges for mail order dispensing. One company also said that Medicaid requirements that the provider be located in a health facility to bill Medicaid also presented a challenge. This same company noted that low reimbursement rates for visits and oral contraceptive pills, restrictions on the number of packs that can be dispensed at one time to a patient, and requirement for a real-time (synchronous) video visit even in states that otherwise permit asynchronous care pose barriers to working with Medicaid.

Eight companies provided the distribution of payment methods that their current contraceptive clients use. One company’s contraceptive clients are 100% paying with cash – this company does not accept private insurance or Medicaid. Two other companies said the majority of their clients pay with cash. Three companies said half of their contraceptive clients use insurance and half use cash to pay for their contraception. Only two companies said the majority of their clients pay with insurance (Figure 16).

Of the nine companies that responded, four companies said they have relationships with manufacturers that offer their company a rebate, discount, or incentive for a particular contraceptive. Three out of the four companies said this allows them to offer these contraceptives at a lower price.

Change in Client Volume Since COVID

The COVID-19 pandemic has expanded interest and use of telecontraception companies, and many noted a sizable bump in business this past year. All of the companies that responded said their client volume has increased since the start of the COVID-19 pandemic. The majority of companies said their client volume had increased over 50% since the start of the COVID-19 pandemic (n = 6) when they responded in the winter of 2019 (Figure 17). One company had seen client volume increase between 25-50% and two companies had experienced client volume increases between 10-24%. Eight of the companies said they have seen the greatest relative increase in demand for oral contraceptives and one company had not seen an increase in demand for any particular method, but their client volume had increased over 50%.

Looking Forward

The rise of telecontraception platforms has created a new way for women of reproductive age to access contraceptives easily and quickly without having to visit a doctor’s office or leave their homes. This access has been particularly important during the COVID-19 pandemic as telehealth options have expanded. While many of the companies accept some form of insurance, barriers in working with insurance are cited frequently and people can end up paying out-of-pocket when they are entitled to no cost contraceptive services and supplies through their private insurance through the Affordable Care Act’s Contraceptive Coverage requirements. However, many women may be willing to pay out-of-pocket for the ease of a quick consultation and having their contraception sent straight to their home, without having to ever step foot in a clinic or schedule a telehealth appointment. These platforms are also available in all 50 states and could be affordable options for uninsured individuals that do not want or are unable to visit a Title X funded clinic or federally qualified health center to receive their contraceptive care.

While telecontraception may be a valuable option for some individuals, there is still an important role for bricks and mortar clinics that can provide the full range of contraceptive methods without cost-sharing to their patients and connect their patients to other primary care services. It will also be important that individuals who want to use telecontraception have access to quality contraceptive counseling, referrals if desired, and other primary care that may not be offered by all of these platforms. These companies may serve a small share of reproductive aged women right now but could become an important source of contraceptive care in the future, particularly for those individuals who may have difficulty accessing in-person care or prefer not to access care through a clinic. While telecontraception can provide a new pathway to contraception for many women, it does not necessarily ensure that people have access to the contraceptive method of their choice and that the financial and other structural barriers to that care are addressed.

We would like to acknowledge all of the telecontraception companies that participated in this study and provided this valuable information.