Community Health Centers: Growing Importance in a Changing Health Care System

Introduction

Community health centers play an increasingly important role in the US health care system. Launched in 1965 as a small experiment in bringing comprehensive primary care to rural and urban medically underserved communities, health centers have grown steadily over five decades following studies showing their effectiveness, not only in creating access to health care but in improving health on a community-wide basis.1 Today’s health centers offer a wide range of services spanning a full spectrum of care for conditions that can be successfully managed in community settings. Services found at health centers range from basic preventive medical and dental care to advanced treatment for serious and chronic physical and mental health conditions.

This issue brief provides a 2016 snapshot of health center patients and operations, including the services they furnish, their staffing, and their financial characteristics. It also examines changes in access to care and utilization of services by health center patients following the implementation of the coverage expansions through the Affordable Care Act (ACA) in 2014.

Findings

National Profile of Health Centers

Health centers serve a large and diverse patient population. In 2016, federally-funded community health centers served 25.9 million children and adults—more than one in twelve people—in over 10,400 urban and rural locations. An additional 58 community health centers supported with state and local funding cared for more than 738,000 patients.2

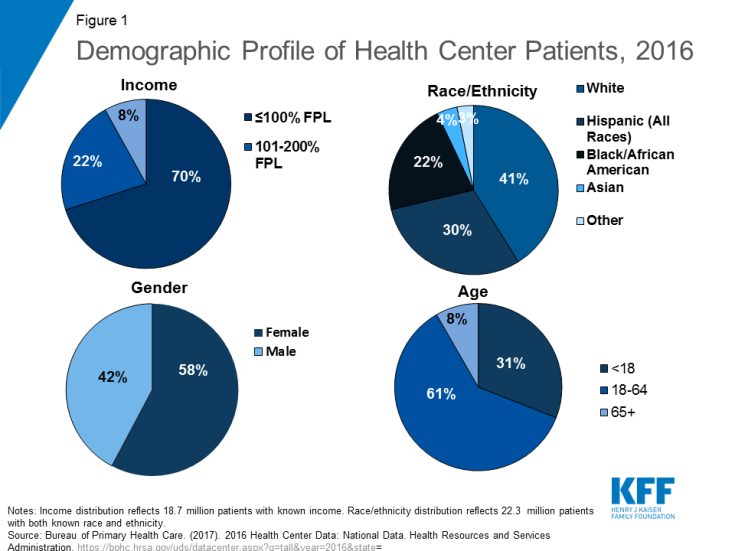

The demographic profile of health center patients reflects how health centers, authorized under Section 330 of the Public Health Service Act, serve communities in need. By law, health centers must operate in or serve communities considered medically underserved because of elevated poverty and health risks and a shortage of primary health care providers. In 2016, over nine in ten (92%) health center patients had income at or below 200% of the federal poverty level, including 70% who had incomes at or below 100% of the federal poverty level or $20,780 for a family of three in mainland U.S. in 20183 (Figure 1). Because racial and ethnic minority Americans are more likely to live in medically underserved areas, they represent a greater share of health center patients. In 2016, nearly six in ten health center patients were from racial or ethnic minority groups, while only 41% of patients were non-Hispanic White. Hispanics comprised 30% of all patients, Black/African American patients represented 22%, and 7% were other races, including Asians and American Indian and Alaska Natives. The majority of health center patients were female and working-age adults; however, 31% of health center patients were children under 18, reflecting the important role health centers play in providing access to care for poor children and their families.

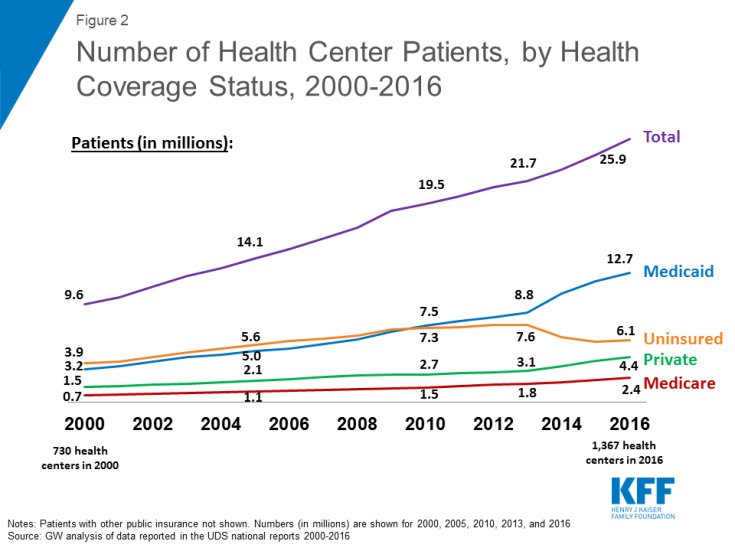

Growth in the number of health centers over time has led to a substantial increase in the number of patients who receive care at health centers. Since 2000, the number of health centers has increased from 730 to 1,367 in 2016. At the same time, the number of patients served surged from 9.6 million in 2000 to 25.9 million in 2016 (Figure 2). While the number of patients has grown steadily since 2000, the pace of growth for patients with health coverage, especially those with Medicaid, increased following the implementation of the ACA in 2014. In contrast, the number of uninsured patients nearly doubled from 2000 to 2010 and then fell in the wake of implementation of the ACA.

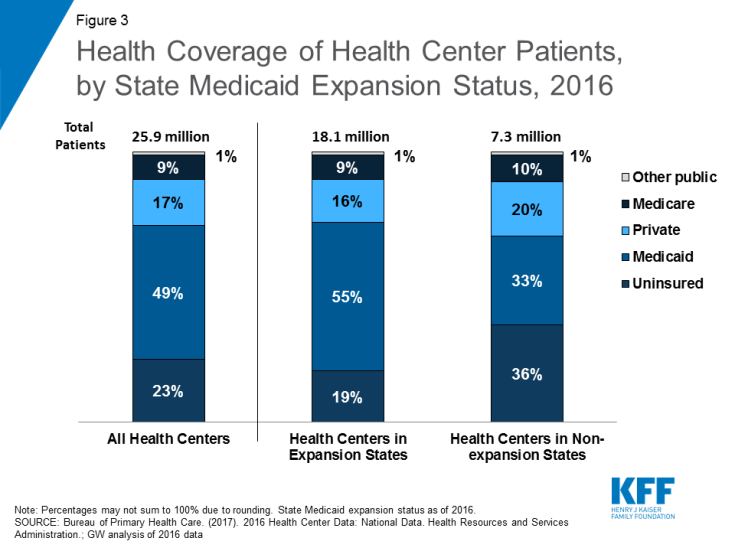

Nearly half of health center patients overall are covered by Medicaid. Medicaid is the most important source of health coverage for health center patients. In 2016, 49% of patients were covered by Medicaid (Figure 3). Another 17% had private insurance, including coverage through the Marketplaces, while 9% had Medicare. Despite increases in coverage from the ACA, 23% of health center patients were uninsured in 2016.

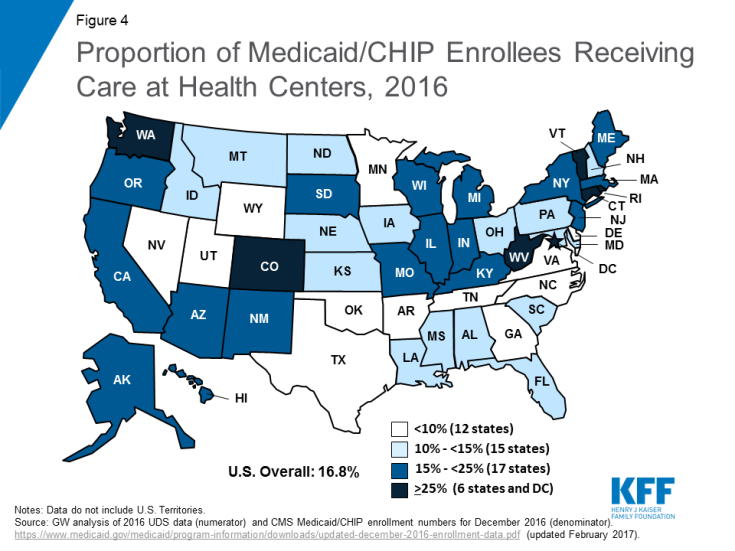

Furthermore, health centers represent a key source of health care for Medicaid patients. In 23 states and the District of Columbia, health centers serve at least 15% of the population with Medicaid or Children’s Health Insurance Program (CHIP) coverage, and in six states and the District of Columbia, more than one in four people with Medicaid use health centers (Figure 4). Nationally, one in six Medicaid enrollees receives care through a health center.4

Coverage of health center patients differs in Medicaid expansion and non-expansion states. State Medicaid expansion decisions affect the coverage of health center patients. In states that expanded Medicaid, over eight in ten patients have health coverage, and over half are covered by Medicaid. In contrast, less than two-thirds of health center patients in non-expansion states have health coverage, and only one-third has Medicaid coverage (Figure 3). A slightly higher share of patients in non-expansion states has private coverage (20% vs. 16%). However, because marketplace subsidies are not available to individuals with income below 100% FPL, which leaves millions of poor adults in the Medicaid coverage gap, health center patients in non-expansion states are more likely to be uninsured than those in expansion states. In 2016, over one in three health center patients in non-expansion states was uninsured compared to less than one in five in expansion states.

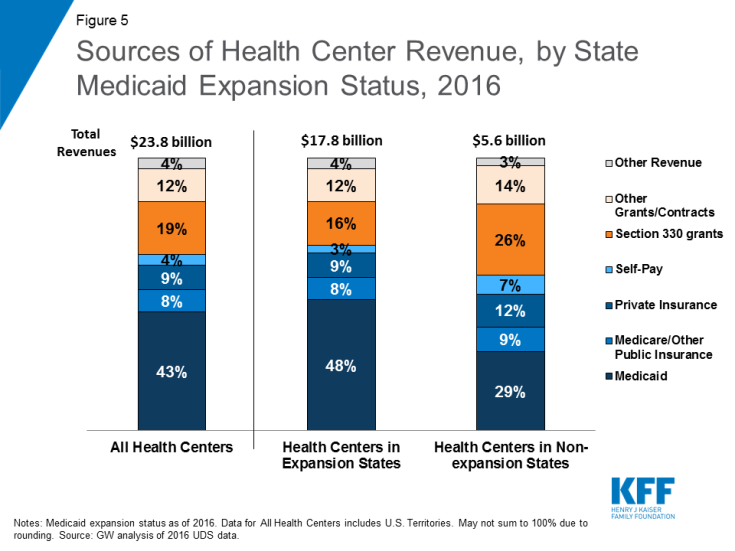

Medicaid and Federal 330 grants account for the majority of health center revenues. Health centers depend on a number of revenue sources, but revenue from Medicaid and federal Section 330 grant funds dominate. Medicaid represents the single largest source of funding, accounting for 43% of total health center revenues in 2016 (Figure 5). Federal Section 330 grants, funded through a combination of annual appropriations and the Community Health Center Fund,5 represent the next largest source of revenue at 19%. These federal grants make it possible for health centers to reach uninsured populations and to offer services for which there is no source of insurance coverage, such as adult dental care, covered under Medicaid on a comprehensive basis in only 15 states in 2016.6 Grant funding also supports health centers’ obligation to discount their charges in accordance with patients’ ability to pay (a legal requirement of the health center program). Critical not only for uninsured patients, but also for those enrolled in private insurance plans that have large deductibles and other out-of-pocket costs, these discounts ensure access to affordable care for health center patients.

Health centers in Medicaid expansion states have higher revenue and greater operational capacity than those in non-expansion states. In 2016, average revenues for health centers in Medicaid expansion states were over 60% higher than for health centers in non-expansion states ($20.1 million vs. $12.4 million). The primary sources of those revenues also differ. Medicaid is a more important source of funding in expansion states, accounting for 48% of health center revenue compared to 29% of revenues in non-expansion states. By contrast, health centers in non-expansion states are more reliant on Section 330 grant funding to support their operations. These grant funds represent over a quarter of total revenues in non-expansion states compared to 16% in expansion states.

The higher revenue available to health centers in Medicaid expansion states translates into significantly higher average number of patients served, increased number of delivery sites, larger staffs, and a broader range of services provided (Table 1). In 2016, health centers in expansion states served 20,471 patients compared to 16,143 patients at health centers in non-expansion states and provided 49% more clinic visits (86,045 vs. 57,913). In addition, they employed 170 full-time equivalent (FTE) staff compared to 118 FTE staff at health centers in non-expansion states. Health centers in expansion states were also more likely to provide substance use disorder and/or mental health services and vision care services than health centers in non-expansion states.

| Table 1: Health Center Profile, by State Medicaid Expansion Status in 2016 | ||

| Health Center Profile | Medicaid Expansion States | Non-expansion States |

| Health Center Characteristics (averages) | ||

| Total Revenues* | $20.1 million | $12.4 million |

| Number of delivery sites* | 8 | 7 |

| Patients* | 20,471 | 16,143 |

| Patient visits* | 86,045 | 57,931 |

| Total staff (FTE)* | 170 | 118 |

| Share of Health Centers Offering the Following Services | ||

| Substance use disorder and/or mental health services* | 91% | 79% |

| Dental services | 81% | 79% |

| Vision care services* | 27% | 18% |

| SOURCE: GW analysis of 2016 UDS data. * Difference between Medicaid expansion and non-expansion states is significant at p<.05. |

||

Health centers provide a range of services to meet patient needs. In 2016, health centers reported 104 million patient visits. Of these visits, over two-thirds (68%) were medical care visits, and 14% were dental care visits (Table 2). Mental health and substance use disorder services accounted for nearly 10% of all patient visits that year, while assistance in enabling access to other necessary care accounted for 6% of all visits. Over the years, the mix of health center services also has changed, reflecting both the evolution of the health center program and changing patient needs. In 2010, 76% of health centers offered dental care; by 2016, the share had grown to 80%. The proportion of health centers offering mental health services grew from 73% to 87% over this time period, while the proportion offering substance use disorder services increased to one in four (28%) by 2016, up from 20% in 2010 (Figure 6). The share of health centers providing addiction services is likely higher as the 28% reported here only include those health centers with staff dedicated to treating substance use disorders; it does not include health centers that do not have dedicated staff, but where primary care physicians are providing medication-assisted treatment or other addiction treatment services.

Figure 6: Percentage of Health Centers Providing Dental and Behavioral Health Services, 2010 and 2016

Health centers are major employers in their communities. In 2016, health centers employed 207,656 FTE staff. These staff included 12,419 physicians, 60,035 nurse practitioners, physician assistants, nurses, and other medical services personnel, 16,142 dental professionals, 20,497 staff furnishing enabling services, and 10,355 staff providing mental health and substance use disorder services, including treatment for opioid addiction.7 In addition, health insurance enrollment assistance always has been a basic requirement for all health centers; in 2016, health centers employed 4,535 eligibility assistance workers.8 Since 2013, health center eligibility workers have assisted more than 12 million community residents with insurance enrollment.9

The National Health Service Corps (NHSC), which provides scholarship and loan repayment assistance to support training of primary health care medical and dental professionals, represents a key source of health center staffing. There are currently 8,153 FTE providers employed by the NHSC10 and community health centers account for about half of NHSC sites.11 According to HRSA estimates, NHSC assignees account for 19% of clinical staff working at health centers.12

| Table 2: Patient Visits by Type of Service, 2010-2016 | ||

| Patient Visits | 2010 | 2016 |

| Total visits | 77 million | 104 million |

| Medical care | 73% | 68% |

| Dental care | 12% | 14% |

| Mental health services | 6% | 8% |

| Substance use disorder services | 1% | 1% |

| Vision/other professional services | 2% | 3% |

| Enabling services | 6% | 6% |

| SOURCE: GW analysis of 2010 and 2016 UDS data. | ||

Access to Care for Health Center Patients

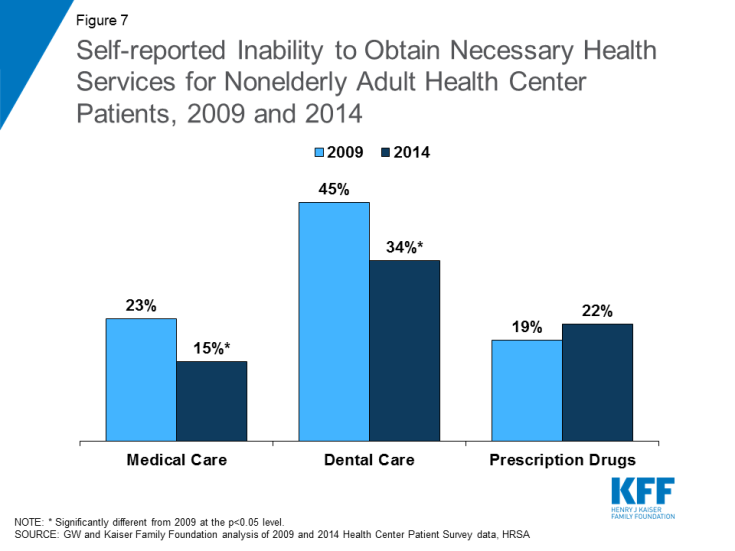

Following implementation of the ACA, fewer health center patients reported they could not get the care they needed. Leading up to the implementation of the ACA’s coverage expansions in 2014, many experts expressed concern over whether primary care providers, especially safety net providers, had the capacity to ensure access to care for the millions of people who would gain coverage through the expansion of Medicaid and the Marketplaces. They feared that while low-income adults might gain coverage, they would face long wait times or other barriers to getting needed care. Recently released data from the Health Center Patient Survey from 2014 indicates that health center patients experienced fewer barriers to accessing needed care following the coverage expansions in 2014 compared to 2009. Specifically, between 2009 and 2014, the proportion of nonelderly adult health center patients reporting an inability to obtain medical and dental care declined significantly, from 23% to 15% for medical care and 45% to 34% for dental care (Figure 7). The share reporting they could not access needed prescription drugs increased slightly; however, this change was not significant.

Figure 7: Self-reported Inability to Obtain Necessary Health Services for Nonelderly Adult Health Center Patients, 2009 and 2014

Examining these trends by patient health insurance status reveals that the share of uninsured patients reporting an inability to get medical services dropped by nearly half from 37% in 2009 to 20% in 2014 (Appendix Table 1). This significant improvement in the ability of uninsured patients to access medical care may be the result of efforts by health centers to expand their capacity with funding made available by the ACA. This finding also underscores the importance of federal grant funding in supporting health centers’ commitment to serving uninsured patients. While Medicaid patients did not experience the same degree of improvement in their ability to access medical services, they were less likely than uninsured patients to report inability to access care (14% vs. 20% in 2014). However, Medicaid patients experienced significant improvements in access to dental care.

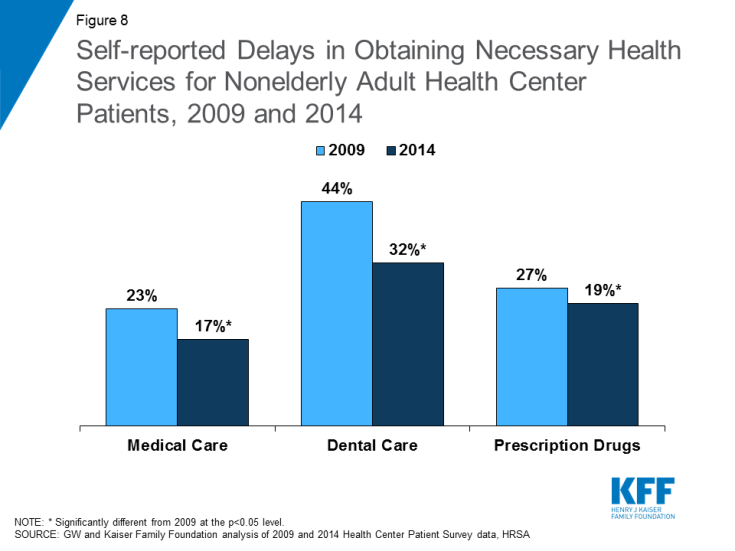

The share of patients reporting delays in getting needed health care services also declined, but some health center patients continue to face challenges in getting the care they need. Increases in insurance coverage through the ACA also did not result in longer wait times for health services, as some policymakers feared. From 2009-2014, the proportion of health center patients reporting delays in obtaining needed medical and dental care and prescription drugs also declined (Figure 8). However, despite improvements in coverage, in the first year of full implementation of health reform some health center patients continued to face challenges getting needed care in a timely manner, possibly because of a surge in people seeking care as insurance reforms rapidly took effect. These challenges were particularly prominent in the case of dental care, with roughly a third of patients reporting an inability to obtain care and a third reporting delays in obtaining care. Additionally, over one in five health center patients reported not being able to get needed prescription drugs in 2014. This barrier may result from restrictive drug formularies, particularly for Marketplace plans, but also for Medicaid in some states.

Figure 8: Self-reported Delays in Obtaining Necessary Health Services for Nonelderly Adult Health Center Patients, 2009 and 2014

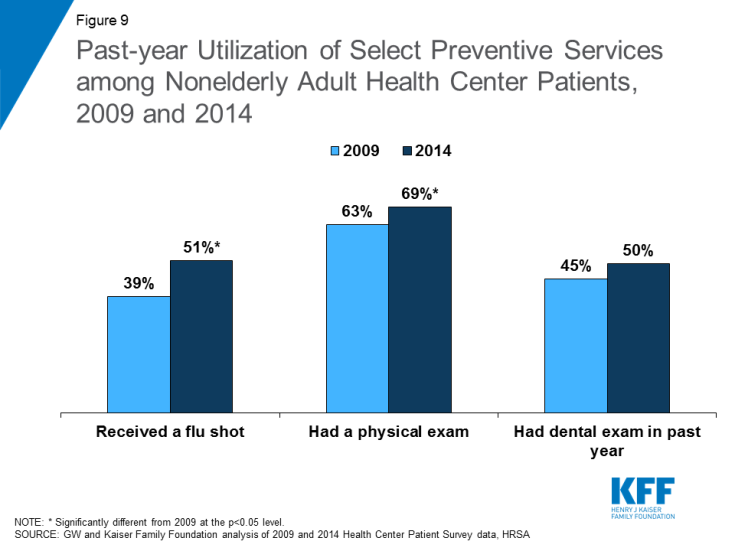

Utilization of preventive services increased among health center patients from 2009 to 2014. Health center patients in 2014 were more likely than those in 2009 to report having received a flu shot and having had a physical exam during the previous year (Figure 9). Uninsured patients were also significantly more likely to have had a physical exam and a dental exam in 2014 than in 2009 (Appendix Table 2). These changes are likely a reflection of increases in insurance coverage, which not only facilitates access to many necessary services but also increases health centers’ capacity to provide both physical and dental health care to all patients, regardless of their insurance status.

Figure 9: Past-year Utilization of Select Preventive Services among Nonelderly Adult Health Center Patients, 2009 and 2014

Emerging Opportunities and Challenges

In a rapidly changing health care environment, important opportunities and challenges for health centers continue to emerge. Health centers reach 26 million people, but more than 90 million live in medically underserved communities.13 As the principal program for anchoring primary health care in underserved communities, continued growth in the health center program will broaden access to care in these communities, particularly given the strong evidence of the role of primary health care in a high performing health system. However, growth depends on steady, reliable revenue in order to hire staff, to expand the range of services offered, and to add hours and locations. Given the communities in which health centers operate, Medicaid and federal section 330 grants represent the two most important sources of revenue.

The recent delay in extending the Community Health Center Fund (CHCF), which provides 70% of all grant funding on which health centers rely in order to support the cost of uncovered services and populations, underscores the impact funding uncertainty can have on the ability of health centers to serve their patients. The CHCF expired on September 30, 2017 and was not renewed until February 9, 2018. Preliminary data from a 2018 survey of community health centers revealed that health centers had begun taking a number of actions in response to the funding delay, and many more were considering actions.14 Nearly two-thirds reported they had or would institute a hiring freeze and 57% said they would lay off staff. Six in ten reported they were canceling or delaying capital projects and other investments and nearly four in ten said they were considering eliminating or reducing dental health and mental health services. With the CHCF reauthorized for two years, it is likely that many health centers will halt or reverse these decisions; however, their responses highlight the challenge funding uncertainty poses to the ability of health centers to sustain their operations.

Looking ahead, the resolution of the funding cliff is important, but it is also relatively short-term. Preventing future cliffs that have a disruptive effect on essential health center operations will help sustain the program over time and better ensure stability within the primary care system, a crucial dimension of access and quality. One approach under discussion would extend the period of funding for health centers and the National Health Service Corps similar to the 10-year funding approach now established for CHIP. This strategy could enable health centers to make long-term operational decisions without concern over whether funding would be available from one year to the next.

State decisions on the ACA Medicaid expansion have also had a significant effect on the capacity of health centers to serve low-income communities. Health centers in states that expanded Medicaid have more sites, serve more patients, and are more likely to provide behavioral health and vision services than health centers in non-expansion states. The service delivery implications of 18 states opting not to expand Medicaid continue to limit health center capacity.

Finally, increasing access to care remains a key focus for health centers. Findings from the Health Center Patient Survey indicate that access to needed care for health center patients improved overall in the immediate period following implementation of the ACA. Increases in insurance coverage among health center patients, along with enhanced investment in the health center program, contributed to improvements in the ability of patients to get the care they need and in reduced delays in obtaining needed care. Access to preventive services, including annual physicals and flu shots, also improved. However, some patients continue to face barriers to care, particularly uninsured patients. Maintaining recent coverage gains through the Medicaid expansion and the Marketplaces and continued stable funding for health centers are important to ensuring patients in medically underserved and rural communities can access the care they need.

Additional funding support for this brief was provided to the George Washington University by the RCHN Community Health Foundation.

| Methods

The data sources that informed this analysis include the federal Uniform Data System (UDS) as well as the Health Center Patient Survey. The UDS collects detailed data from health centers annually, including patient demographics, services provided, clinical processes and outcomes, patients’ use of services, costs, and revenues. The data presented in this brief were collected in 2016, the most recent year for which data are available. Analyses by Medicaid expansion status were based upon states’ status by the end of 2016, when 19 states15 had not yet adopted the Medicaid expansion. Analyses by Medicaid expansion do not include data on health centers in US territories. The Health Center Patient Survey (HCPS) provides patient-level data on a number of measures, including sociodemographic characteristics, health conditions, health behaviors, access to and utilization of health care services, and satisfaction with health care services. HCPS data are collected every five years using in-person, one-on-one interviews and provide a nationally representative overview of patients who receive care at health centers. The data presented in this brief were drawn from 2009 and 2014, the first year of available data following implementation of the ACA coverage expansions. The analysis is restricted to nonelderly adults (age 18-64), the subset of patients most affected by the Medicaid expansion. In both years of the HCPS, all participants were asked whether they or their doctor believed they needed various types of health services, including medical care, dental care, and prescription medication. They were also asked whether they were unable to obtain or delayed in obtaining these services. This treatment could have been delivered by the health center or by another health care provider. Participants were also asked about past-year health services utilization for a number of measures, including flu shots, physical exams, and dental exams. |