Being Low-Income and Uninsured in Missouri: Coverage Challenges during Year One of ACA Implementation

How does coverage affect financial security?

Although all low-income adults face financial insecurity, having health insurance eases the concern about medical expenses. Those enrolled in MO HealthNet demonstrate the “peace-of-mind” value of health insurance. Although over half of those enrolled in MO HealthNet are financially insecure in general, only about a third are not confident that they can afford major medical costs. In contrast, low-income uninsured adults live with worry about medical costs in addition to their general financial instability.

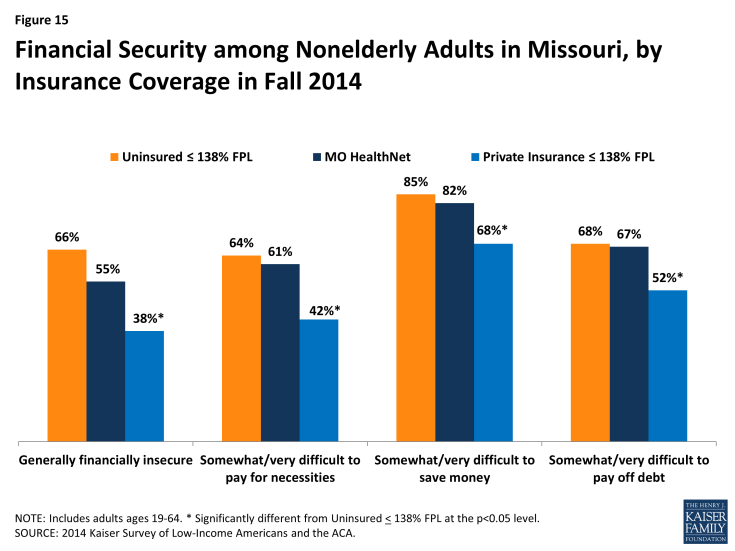

Medical bills lead to an array of financial problems for the low-income uninsured that those with MO HealthNet or private insurance do not encounter as frequently. Despite being less likely to use services, over half (53%) of the low-income uninsured report a problem paying their medical bills. The low-income uninsured were also more likely than low-income adults with either MO HealthNet or private coverage to report serious consequences from medical bills, such as using up their savings, having difficulty paying for necessities, borrowing money, or being sent to collection (Figure 13).

Figure 13: Problems Paying Medical Bills among Nonelderly Adults in Missouri, by Insurance Coverage in Fall 2014

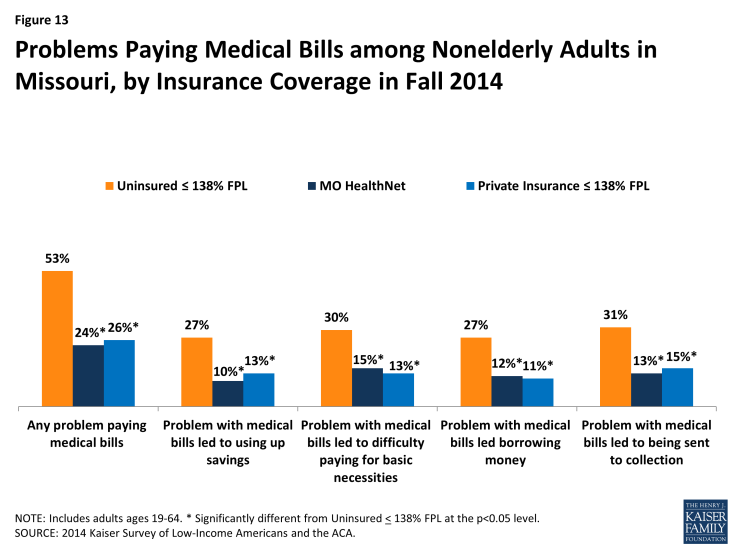

In addition to being more likely to report experiencing financial strain due to medical bills, the low-income uninsured are more likely than others to report living with worry about their ability to afford medical care in the future. As we found in the 2013 survey, the uninsured are much more likely than those with MO HealthNet or the privately insured to lack confidence that they can afford health care costs for usual circumstances or major illnesses.1 In 2014, over three quarters (78%) of the low-income uninsured are not confident they can afford usual medical costs, and close to nine in ten (86%) are not confident they can afford major medical costs. This is in stark contrast to the low-income privately insured, and especially to those enrolled in MO HealthNet. Although more low-income privately insured are not confident that they can afford major medical costs than the share of low-income privately insured who are not confident they can afford usual medical costs, we do not detect a difference between the share of those enrolled in MO HealthNet that are not confident that they can afford usual medical costs and those that are not confident they can afford major medical costs.

Just as higher rates of postponing care among the low-income uninsured affect these persons’ engagement in work, school, and other activities (discussed above), the worry about medical costs also affects low-income uninsured adults’ job performance, family relationships, or ability to sleep at a higher rate (36%) compared to the mid-income uninsured (17%), those enrolled in MO HealthNet (18%), and the low-income privately insured (13%) (Figure 14 and Additional Table A3).

Figure 14: Financial Insecurity Over Medical Costs among Nonelderly Adults in Missouri, by Insurance Coverage in Fall 2014

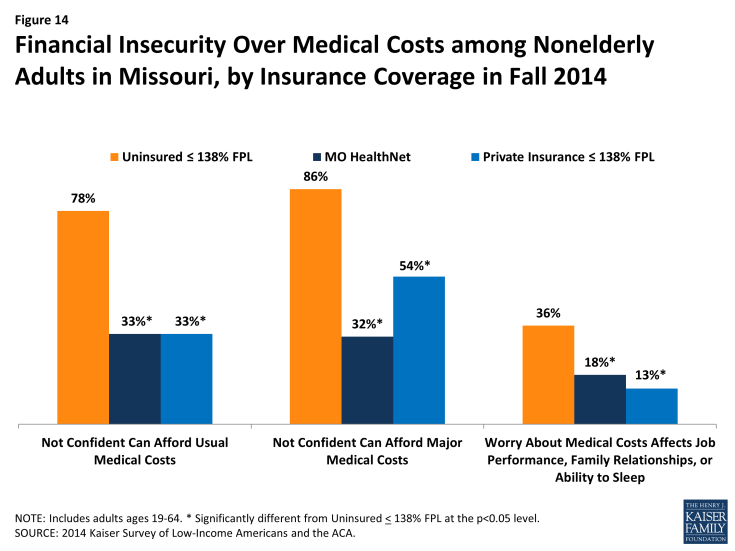

These differences in problems and worry from medical cost exist even though there are few differences in overall financial stability between the low-income uninsured adults and those enrolled in MO HealthNet. Like low-income uninsured adults, over half of adults with MO HealthNet are generally financially insecure (Figure 15). They also report similar rates of financial difficulty in paying for necessities, saving money, or paying off debt. In contrast, even though low-income adults with private insurance are similarly low-income, they are more financially secure, perhaps reflecting stability due to ties to full-time employment or connections to other resources or support.