2018 Employer Health Benefits Survey

Published:

Section 6: Worker and Employer Contributions for Premiums

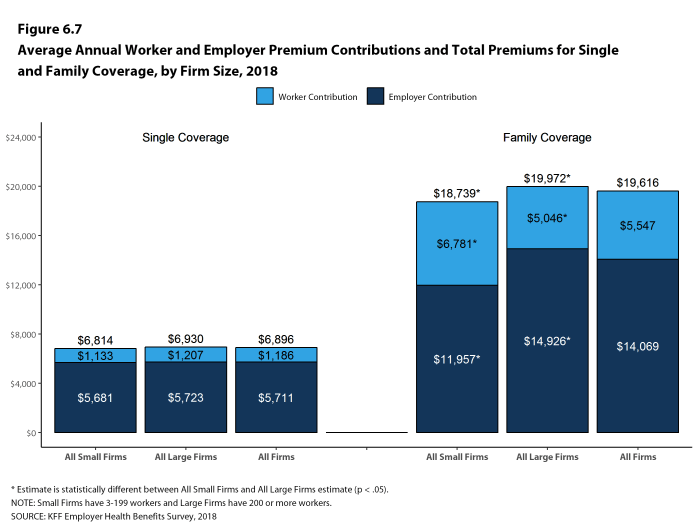

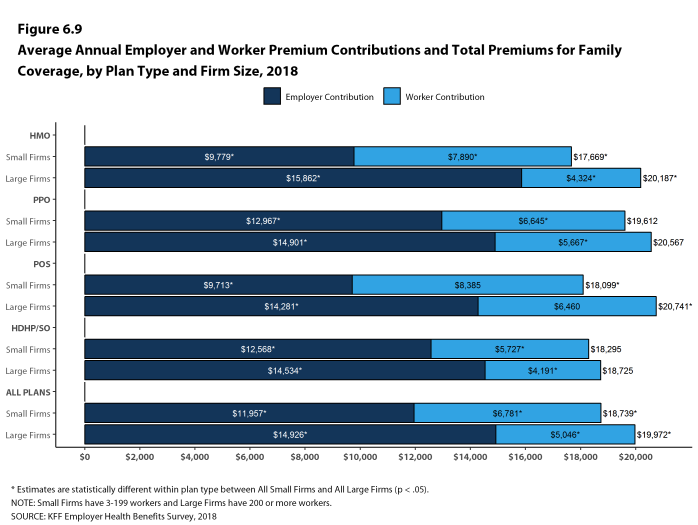

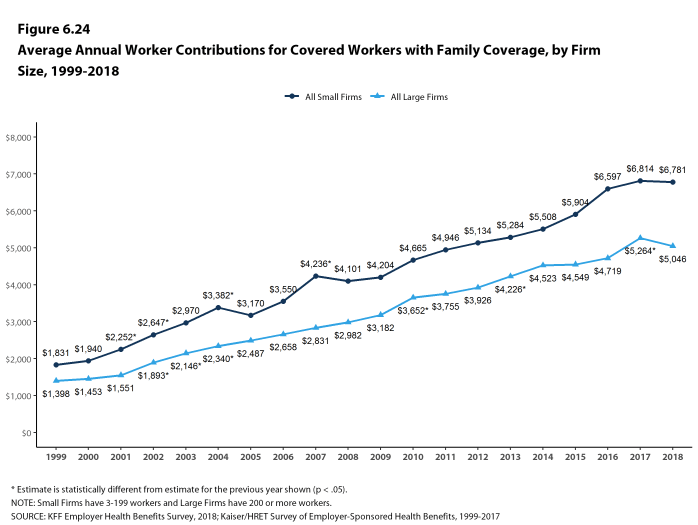

In 2018, premium contributions by covered workers average 18% for single coverage and 29% for family coverage.18 The average monthly worker contributions are $99 for single coverage ($1,186 annually) and $462 for family coverage ($5,547 annually). Covered workers in small firms (3-199 workers) make a higher average contribution for family coverage ($6,781 vs. $5,046) than covered workers in large firms (200 or more workers).

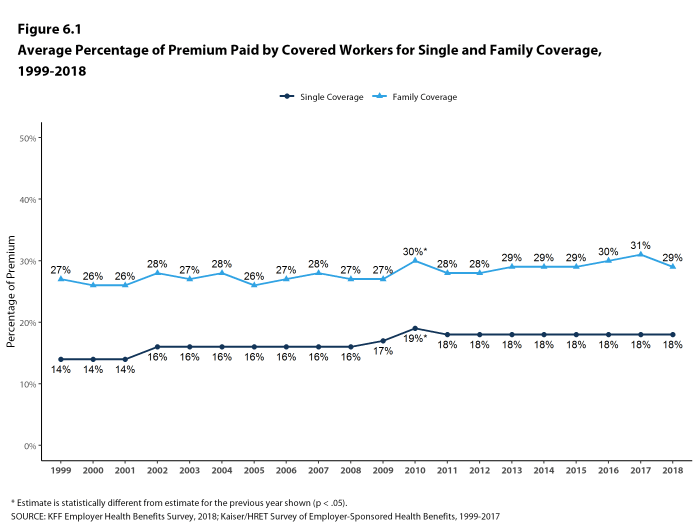

- In 2018, covered workers on average contribute 18% of the premium for single coverage and 29% of the premium for family coverage [Figure 6.1].19 The average percentage contributed for single coverage has remained stable in recent years. While estimates of the average contribution percentage for family coverage have shown small changes in recent years, the differences after 2012 are not statistically significant.

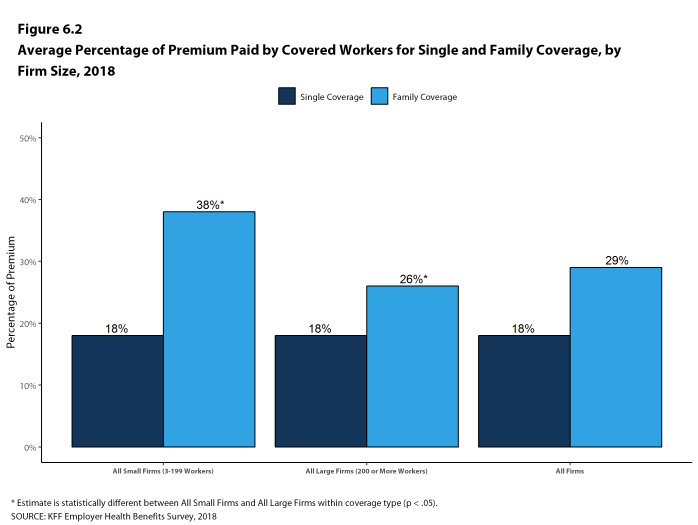

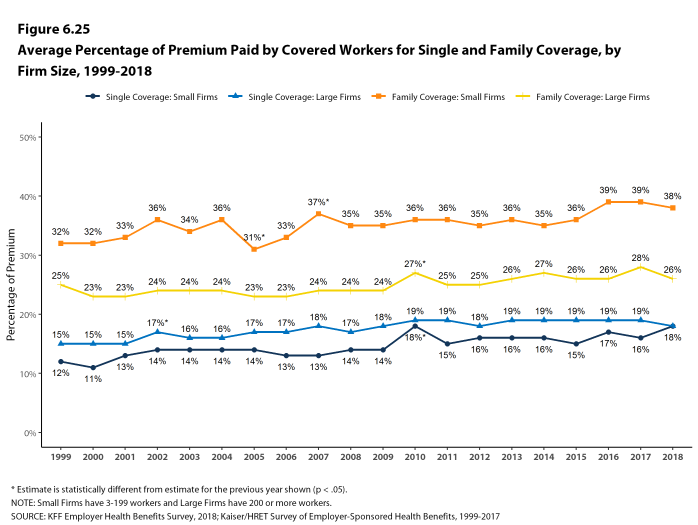

- Covered workers in small firms on average contribute a higher percentage of the premium for family coverage (38% vs. 26%) than covered workers in large firms [Figure 6.2].

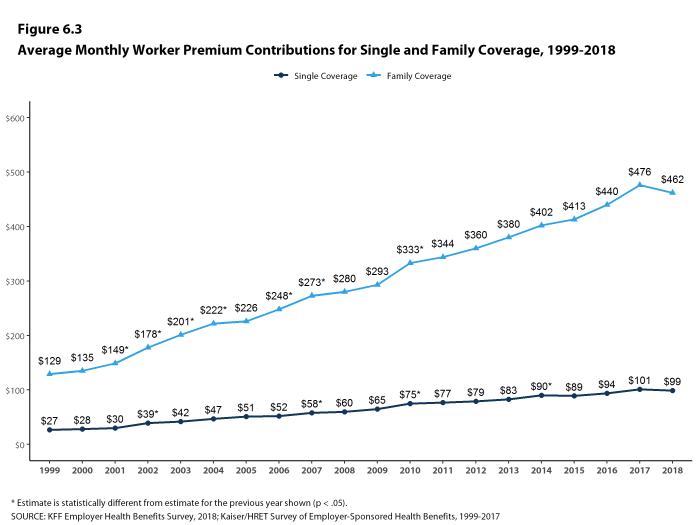

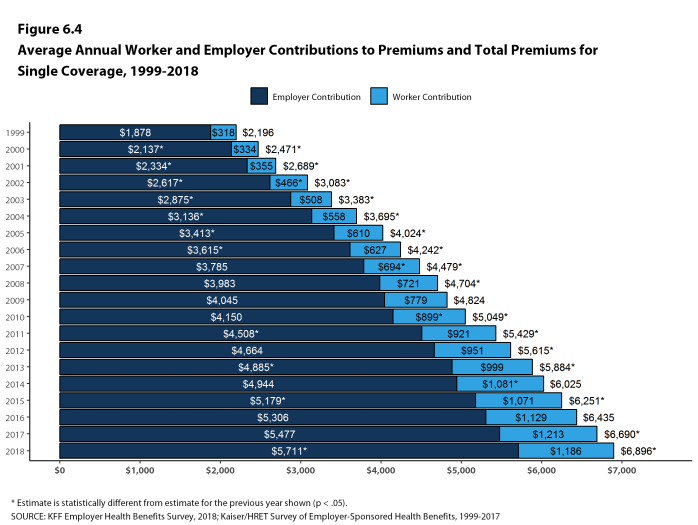

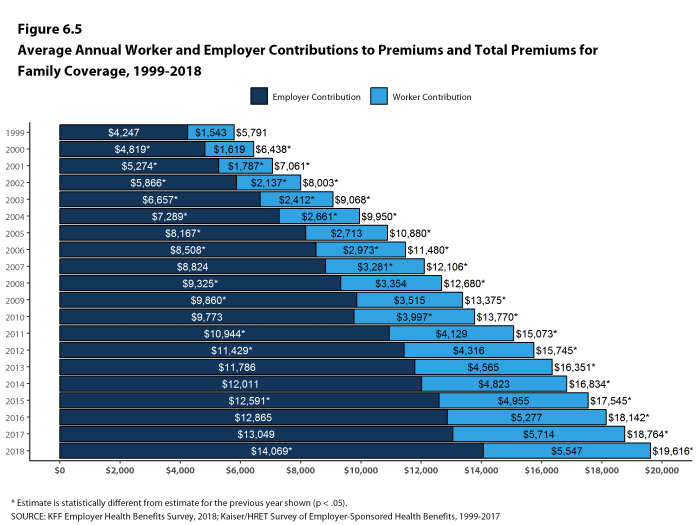

- Workers with single coverage make an average contribution of $99 per month ($1,186 annually), and workers with family coverage make an average contribution of $462 per month ($5,547 annually) toward their health insurance premiums [Figures 6.3, 6.4, and 6.5].

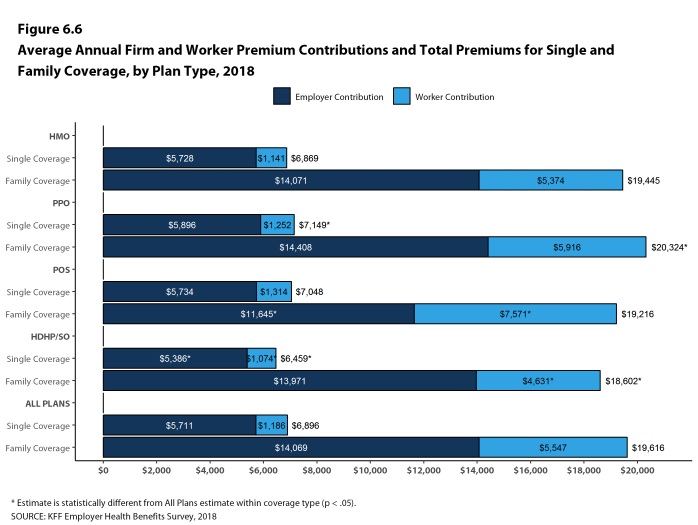

- The average worker contributions in HDHP/SOs are lower than the overall average worker contribution for single coverage ($1,074 vs. $1,186) and family coverage ($4,631 vs. $5,547). The average worker contributions in PPOs are higher than the overall average worker contribution for family coverage ($5,916 vs. $5,547) [Figure 6.6].

- Worker contributions also differ by firm size. Workers in small firms on average contribute significantly more annually for family coverage than workers in large firms ($6,781 vs. $5,046) [Figure 6.7].

Figure 6.1: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, 1999-2018

Figure 6.2: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 2018

Figure 6.4: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Single Coverage, 1999-2018

Figure 6.5: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Family Coverage, 1999-2018

Figure 6.6: Average Annual Firm and Worker Premium Contributions and Total Premiums for Single and Family Coverage, by Plan Type, 2018

Figure 6.7: Average Annual Worker and Employer Premium Contributions and Total Premiums for Single and Family Coverage, by Firm Size, 2018

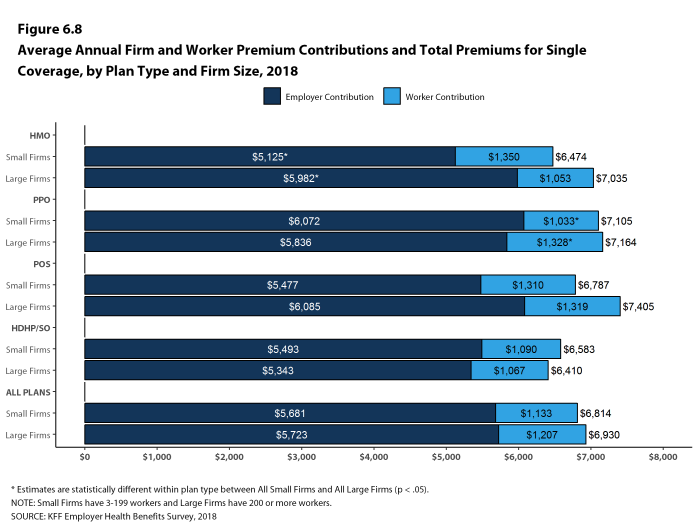

Figure 6.8: Average Annual Firm and Worker Premium Contributions and Total Premiums for Single Coverage, by Plan Type and Firm Size, 2018

Figure 6.9: Average Annual Employer and Worker Premium Contributions and Total Premiums for Family Coverage, by Plan Type and Firm Size, 2018

DISTRIBUTIONS OF WORKER CONTRIBUTIONS TO THE PREMIUM

- About four-fifths of covered workers are in a plan where the employer contributes at least half of the premium for both single and family coverage.

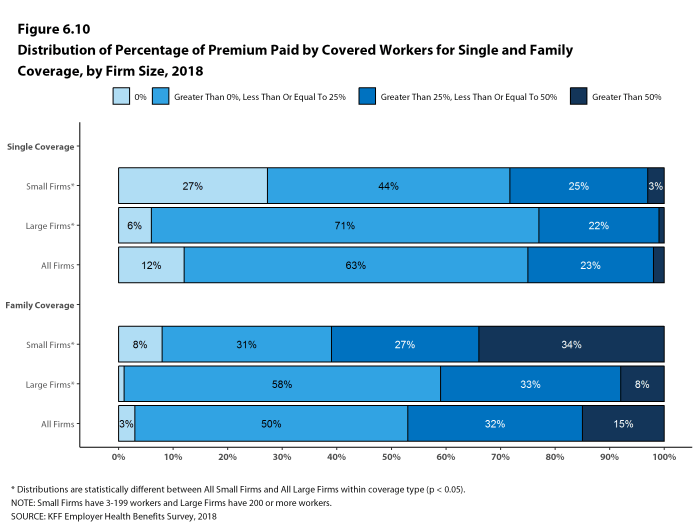

- Twelve percent of covered workers are in a plan where the employer pays the entire premium for single coverage; 3% of covered workers are in a plan where the employer pays the entire premium for family coverage [Figure 6.10].

- Covered workers in small firms are much more likely than covered workers in large firms to be in a plan where the employer pays 100% of the premium.

- Twenty-seven percent of covered workers in small firms have an employer that pays the full premium for single coverage, compared to 6% of covered workers in large firms [Figure 6.10].

- For family coverage, 8% of covered workers in small firms have an employer that pays the full premium, compared to 1% of covered workers in large firms [Figure 6.10].

- Fifteen percent of covered workers are in a plan with a worker contribution of more than 50% of the premium for family coverage [Figure 6.10].

- Thirty-four percent of covered workers in small firms work in a firm where the worker contribution for family coverage is more than 50% of the premium, compared to 8% of covered workers in large firms [Figure 6.10].

- Small shares of covered workers in small firms (3%) and large firms (1%) must pay more than 50% of the premium for single coverage [Figure 6.10].

- There is substantial variation among workers in small firms and workers in large firms in the dollar amounts they contribute for single and family coverage.

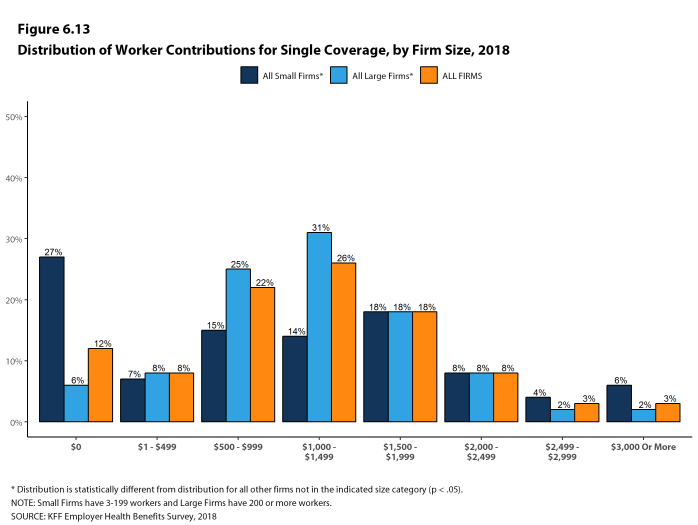

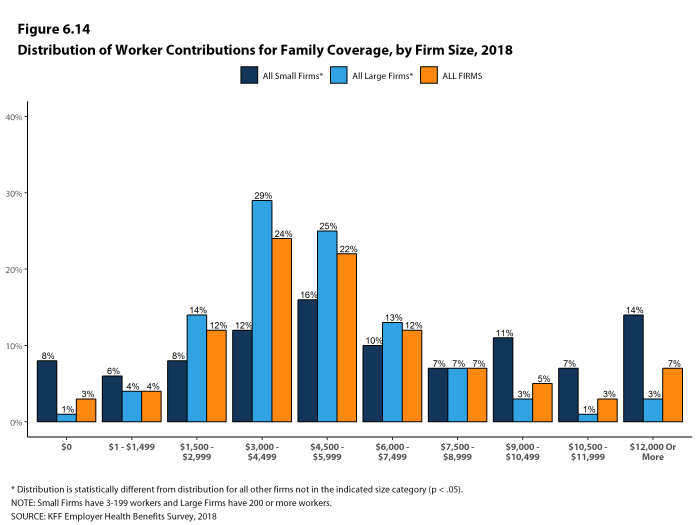

- Among covered workers in small firms, 35% make a contribution for single coverage of less than $500, while 19% contribute $2,000 or more. For family coverage, 14% make a contribution of less than $1,500 for family coverage, while 21% contribute $10,500 or more [Figures 6.13 and 6.14].

- Among covered workers in large firms, 13% make a contribution for single coverage of less than $500, while 12% contribute $2,000 or more. For family coverage, 5% make a contribution of less than $1,500 for family coverage, while 4% contribute $10,500 or more [Figures 6.13 and 6.14].

Figure 6.10: Distribution of Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 2018

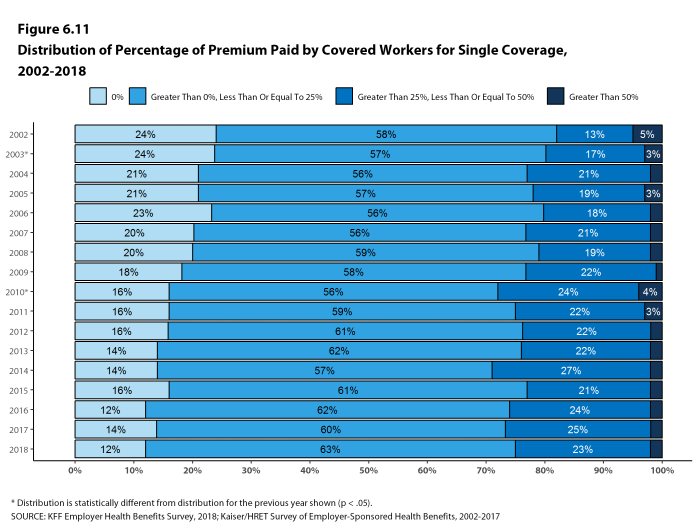

Figure 6.11: Distribution of Percentage of Premium Paid by Covered Workers for Single Coverage, 2002-2018

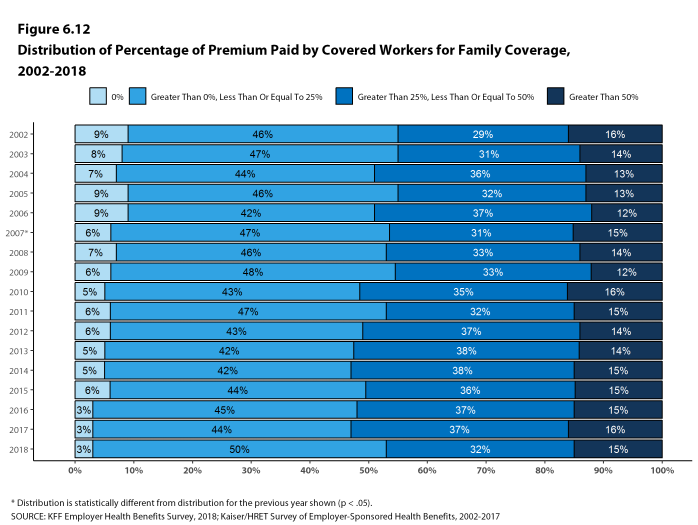

Figure 6.12: Distribution of Percentage of Premium Paid by Covered Workers for Family Coverage, 2002-2018

DIFFERENCES BY FIRM CHARACTERISTICS

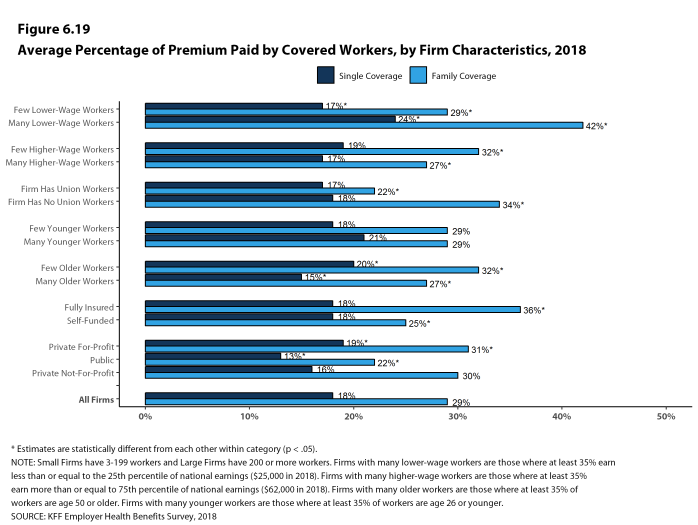

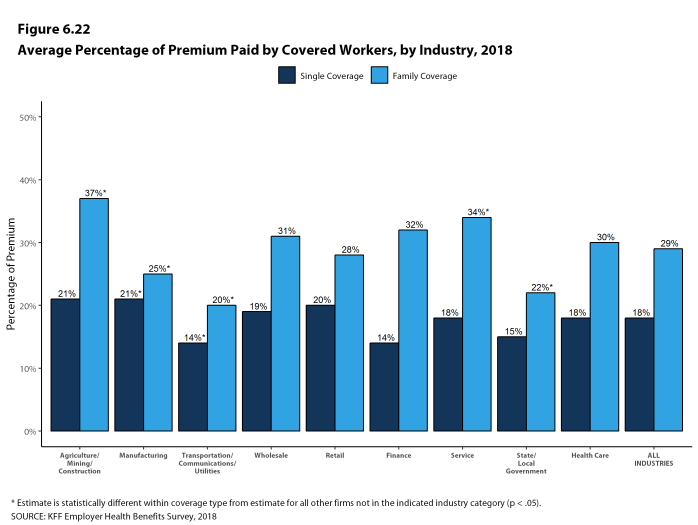

- The percentage of the premium paid by covered workers also varies by firm characteristics.

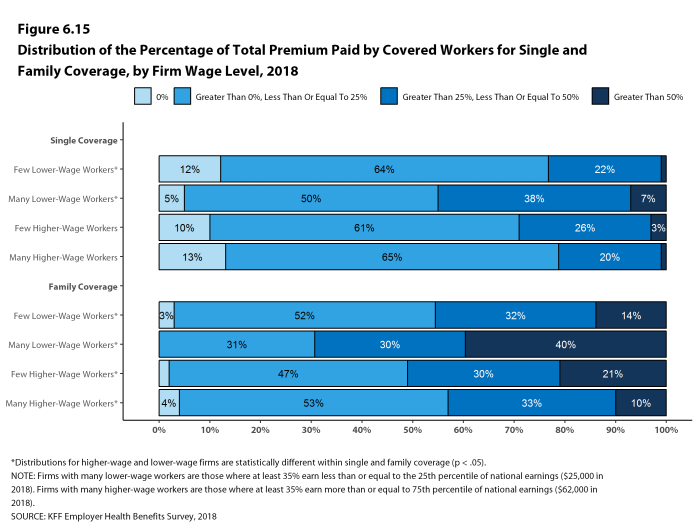

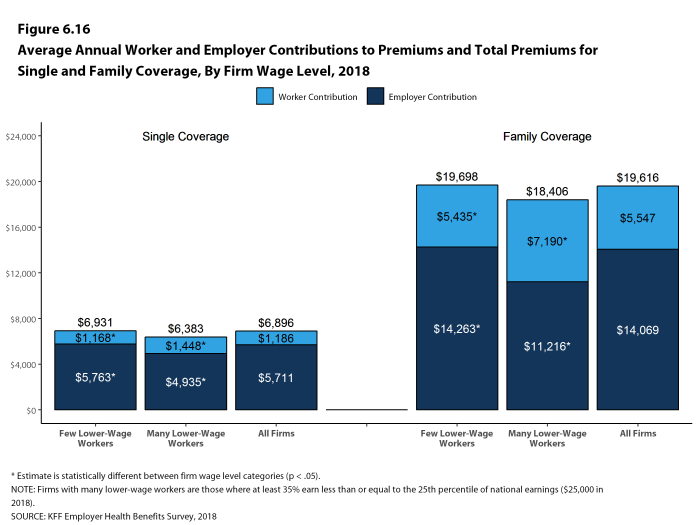

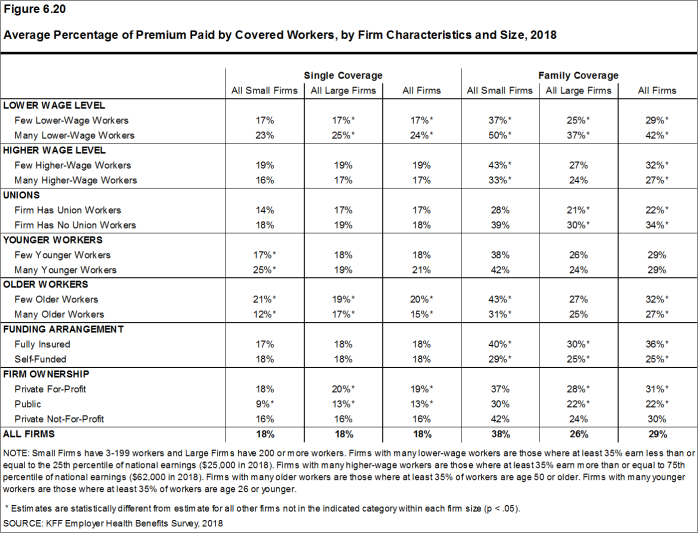

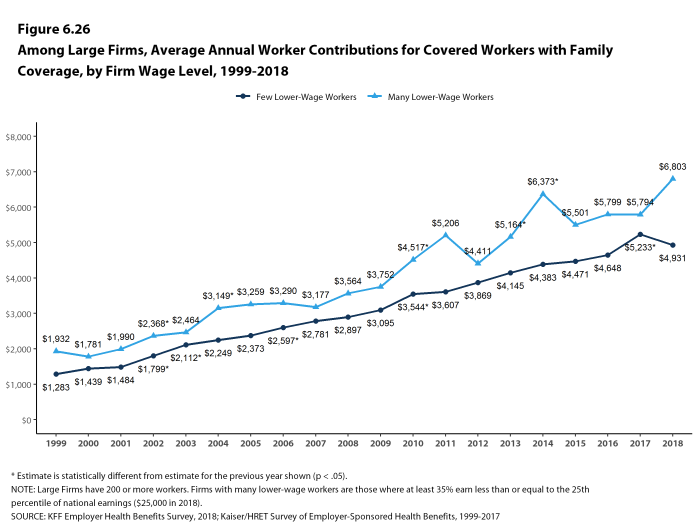

- Covered workers in firms with a relatively large share of lower-wage workers (where at least 35% of workers earn $25,000 a year or less) on average have higher contribution rates for single coverage (24% vs. 17%) and family coverage (42% vs. 29%) than those in firms with a smaller share of lower-wage workers [Figures 6.19 and 6.20].

- Covered workers in firms with a relatively large share of higher-wage workers (where at least 35% earn $62,000 or more annually) on average have lower contribution rates for family coverage than those in firms with a smaller share of higher-wage workers (27% vs. 32%) [Figures 6.19 and 6.20].

- Covered workers in firms that have at least some union workers on average have lower contribution rates for family coverage than those in firms without any union workers (22% vs. 34%) [Figure 6.20].

- Covered workers in firms that are partially or completely self-funded on average have lower contribution rates for family coverage than workers in firms that are fully-insured (25% vs. 36%) [Figure 6.20].20

- Covered workers in private for-profit firms on average have higher contribution rates for both single coverage (19%) and family coverage (31%) than workers in other types of firms. Covered workers in public organizations have lower contribution rates for both single coverage (13%) and family coverage (22%) than workers in other types of firms [Figures 6.19 and 6.20].

Figure 6.15: Distribution of the Percentage of Total Premium Paid by Covered Workers for Single and Family Coverage, by Firm Wage Level, 2018

Figure 6.16: Average Annual Worker and Employer Contributions to Premiums and Total Premiums for Single and Family Coverage, by Firm Wage Level, 2018

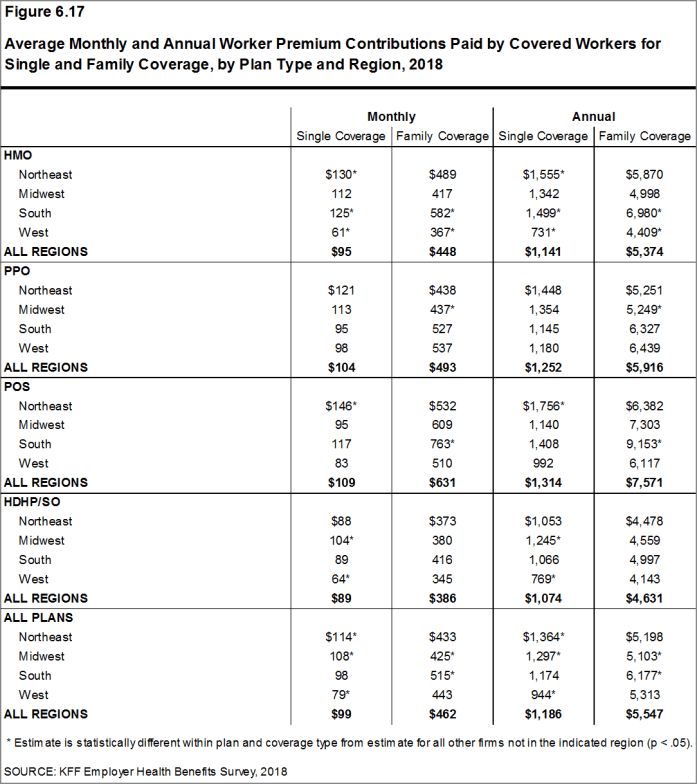

Figure 6.17: Average Monthly and Annual Worker Premium Contributions Paid by Covered Workers for Single and Family Coverage, by Plan Type and Region, 2018

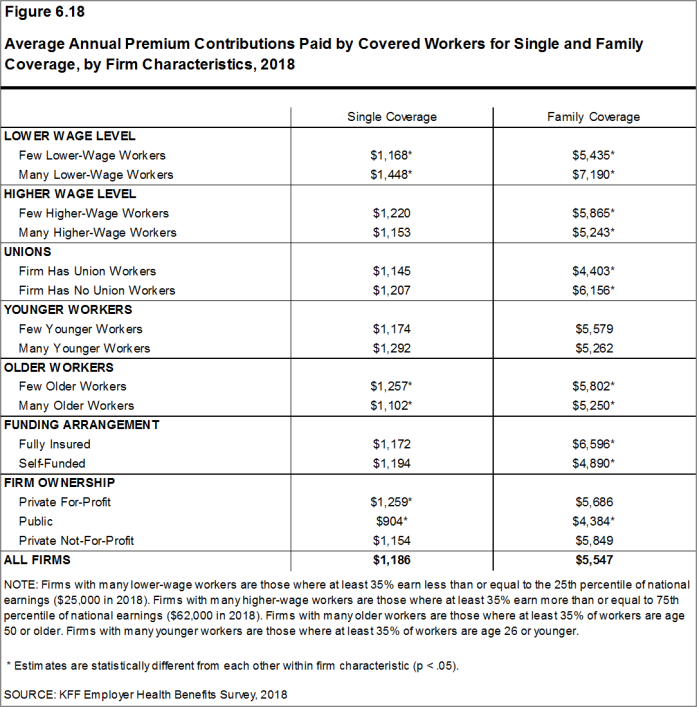

Figure 6.18: Average Annual Premium Contributions Paid by Covered Workers for Single and Family Coverage, by Firm Characteristics, 2018

Figure 6.20: Average Percentage of Premium Paid by Covered Workers, by Firm Characteristics and Size, 2018

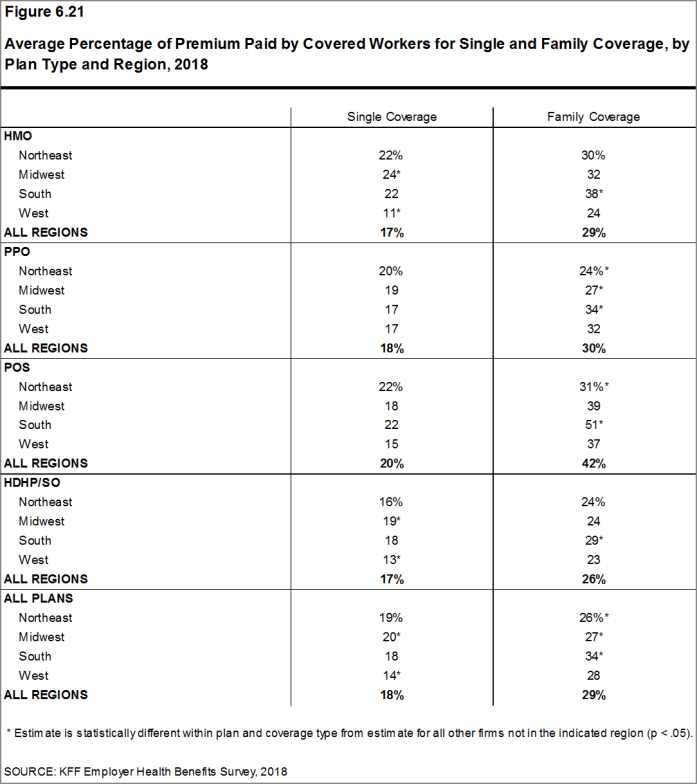

Figure 6.21: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Plan Type and Region, 2018

CHANGES OVER TIME

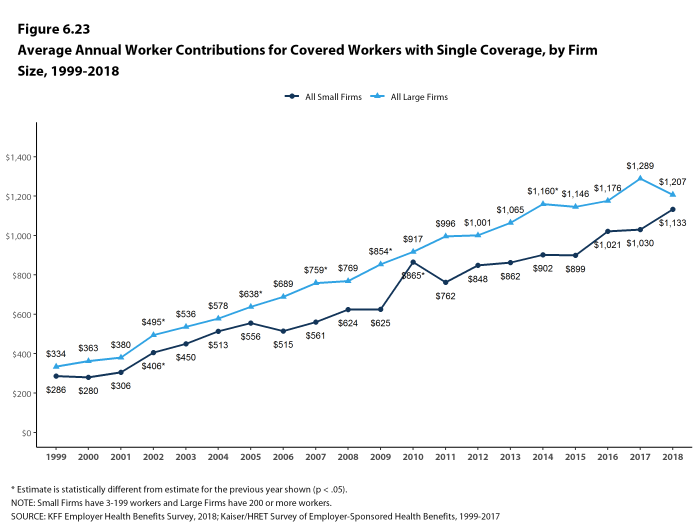

- The average worker contributions for single and family coverage have increased 65% and 65%, respectively, over the past 10 years, and 19% and 21%, respectively, over the past five years.

- Over the past ten years, the average worker contribution for family coverage has increased faster than the average employer contribution for family coverage (65% vs. 51%).

- The average worker contributions for single and family coverage in both small and large firms are similar to last year [Figures 6.23 and 6.24].

Figure 6.23: Average Annual Worker Contributions for Covered Workers With Single Coverage, by Firm Size, 1999-2018

Figure 6.24: Average Annual Worker Contributions for Covered Workers With Family Coverage, by Firm Size, 1999-2018

Figure 6.25: Average Percentage of Premium Paid by Covered Workers for Single and Family Coverage, by Firm Size, 1999-2018

- Estimates for premiums, worker contributions to premiums, and employer contributions to premiums presented in Section 6 do not include contributions made by the employer to Health Savings Accounts (HSAs) or Health Reimbursement Arrangements (HRAs). See Section 8 for estimates of employer contributions to HSAs and HRAs.↩

- The average percentage contribution is calculated as a weighted average of all a firm’s plan types and may not necessarily equal the average worker contribution divided by the average premium.↩

- For definitions of self-funded and fully-insured plans, see the introduction to Section 10.↩

Sections

- Section 1: Cost of Health Insurance

- Section 2: Health Benefits Offer Rates

- Section 3: Employee Coverage, Eligibility, and Participation

- Section 4: Types of Plans Offered

- Section 5: Market Shares of Health Plans

- Section 6: Worker and Employer Contributions for Premiums

- Section 7: Employee Cost Sharing

- Section 8: High-Deductible Health Plans with Savings Option

- Section 9: Prescription Drug Benefits

- Section 10: Plan Funding

- Section 11: Retiree Health Benefits

- Section 12: Health and Wellness Programs

- Section 13: Grandfathered Health Plans

- Section 14: Employer Practices and Health Plan Networks