2016 Survey of Health Insurance Marketplace Assister Programs and Brokers

Section 3: Help Between Open Enrollment Periods

Returning Assister Programs helped at least 830,000 consumers with special enrollment periods in the past year. Again this year we asked returning Assister Programs about help they provided consumers outside of Open Enrollment periods. Most Programs were available throughout the year to help consumers who became eligible for special enrollment periods (SEP) or who needed to report other mid-year income or family changes to the Marketplace in order to update their application for subsidies.

Large caseload Programs helped more people with SEPs and reporting other mid-year changes compared to small caseload Programs (Table 6). Nationwide, we estimate Assister Programs helped at least 830,000 consumer apply for SEPs in 2015, which is a 30% increase over the amount of SEP assistance reported for 2014. This change may be due to the fact that the first Open Enrollment extended through April of 2014, leaving fewer remaining months that year for SEP to arise.

| Table 6. Help with Special Enrollment Periods and Mid-Year Changes During 2015 | |||

| All Returning Programs | Large Caseload Programs | Small Caseload Programs | |

| Number of People Helped with Special Enrollment Periods | |||

| Up to 50 people | 46% | 15% | 69%* |

| 51-100 people | 12% | 15% | 6%* |

| 101-500 people | 12% | 26% | 1%* |

| More than 500 people | 8% | 25% | – * |

| Don’t know/No answer | 22% | 18% | 23% |

| Number of People Helped to Report Mid-Year Changes | |||

| Up to 50 people | 53% | 28% | 77%* |

| 51-100 people | 9% | 14% | 2%* |

| 101-500 people | 10% | 24% | – * |

| More than 500 people | 3% | 13% | – * |

| Don’t know/No answer | 24% | 20% | 21% |

| *Significantly different from Large caseload Programs at the 95% confidence level NOTE: Columns may not sum to 100% due to rounding. |

|||

Assister Programs also helped consumers report mid-year changes in their subsidy eligibility, though fewer people came in for this type of help. Large caseload Programs, again, provided more of this type of help (Table 46). Nationwide, we estimate Assister Programs helped at least 349,000 consumers report mid-year changes to the Marketplace in 2015.

Assister Programs provided post-enrollment help to at least 745,000 consumers between the second and third Open Enrollment periods. This year, nearly all returning Assister Programs also offered to help consumers with post-enrollment problems, though they are not required to do so. Large caseload Programs provided most of this assistance (Table 7).

| Table 7. Help with Post-Enrollment Problems | |||

| All Assister Programs | Large Caseload Programs | Small Caseload Programs | |

| Number of People Helped with Post-Enrollment Problems | |||

| Up to 50 people | 44% | 11% | 80%* |

| 51-100 people | 13% | 12% | 7% |

| 101-500 people | 17% | 27% | ±* |

| More than 500 people | 10% | 34% | -* |

| Don’t know/No answer | 17% | 15% | 13% |

| ± Less than 1 percent; *Significantly different from Large caseload Programs at the 95% confidence level NOTE: Columns may not sum to 100% due to rounding. |

|||

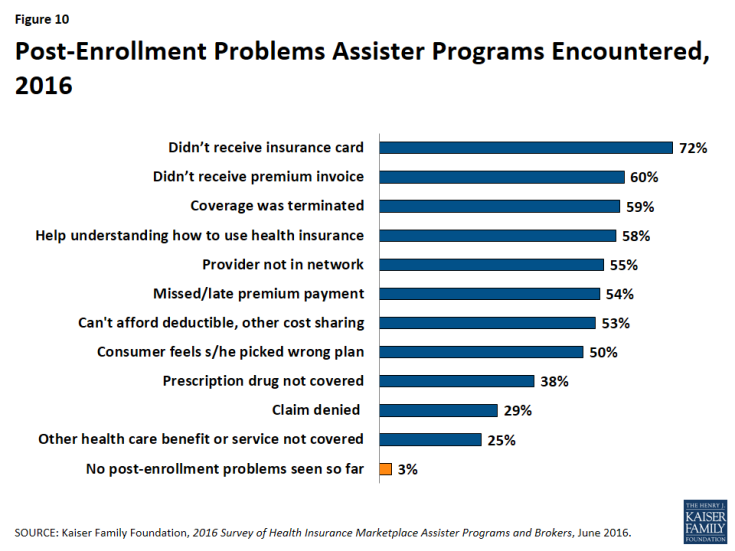

Consumers sought help with premium payment and invoicing problems, claims denials, and when their health providers were not in-network. Consumers also returned for help because they did not understand how to use their health coverage (Figure 10). Like last year, most Assister Programs (70%) said they could help consumers successfully resolve post-enrollment problems most of the time; 25% said they succeeded just some of the time and 5% said not very often.

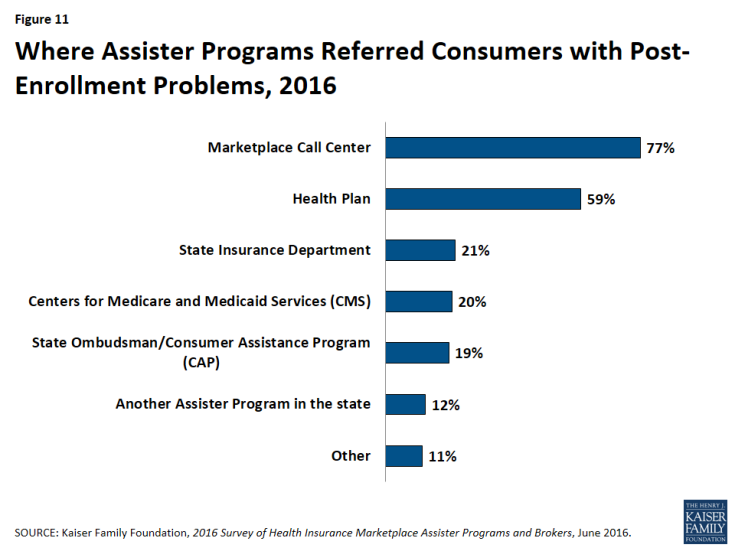

The ACA requires Navigators to refer consumers with post-enrollment problems to state Consumer Assistance Programs, or CAPs. However, federal funding for CAPs has not continued, and while many remain operational, Marketplace Assisters mostly refer consumers with post-enrollment problems elsewhere. When asked where they refer consumers with post-enrollment problems they cannot resolve, only 19% of Assister Programs mentioned CAPs. Instead, like last year, Assisters mostly referred consumers to the Marketplace Call Center (77%) or back to their health plan (59%) (Figure 11).