Estimates of Eligibility for ACA Coverage among the Uninsured by Race and Ethnicity

The Affordable Care Act (ACA) extends health insurance coverage to people who lack access to an affordable coverage option. Under the ACA, as of 2014, Medicaid coverage is extended to low-income adults in states that have opted to expand eligibility, and tax credits are available for middle-income people who purchase coverage through a health insurance Marketplace. Millions of people have enrolled in these new coverage options, but millions of others are still uninsured. Some remain ineligible for coverage, and others may be unaware of the availability of new coverage options or still find coverage unaffordable even with financial assistance.

A recent Kaiser Family Foundation analysis provided national and state-by-state estimates of eligibility for ACA coverage options among those who remained uninsured, which showed that nearly half of the nonelderly uninsured are eligible for assistance in 2015.1 This analysis builds off of that work to provide national estimates of eligibility for ACA coverage options by race/ethnicity, including Whites, Blacks, and Hispanics. Analysis by additional groups was not possible due to sample size limitations. The analysis is based on Kaiser Family Foundation analysis of the 2015 Current Population Survey, combined with other data sources. We estimate coverage and eligibility as of early 2015, which is prior to the end of the 2015 Marketplace open enrollment period. An overview of the methodology underlying the analysis can be found in the Methods box at the end of the brief, and more detail is available in the Technical Appendices available here.

Background

The ACA fills historical gaps in Medicaid eligibility by extending Medicaid to nearly all nonelderly adults with incomes at or below 138% of the federal poverty level (FPL) ($27,724 for a family of three in 20152). With the June 2012 Supreme Court ruling, the Medicaid expansion essentially became optional for states, and as of September 2015, 30 states and DC had expanded Medicaid eligibility under the ACA. Under rules in place before the ACA, all states already extended public coverage to poor and low-income children, with a median income eligibility level of 255% of poverty in 2015.3 The ACA also established Health Insurance Marketplaces where individuals can purchase insurance and allows for federal tax credits for such coverage for people with incomes from 100% to 400% FPL ($19,790 to $79,160 for a family of three in 2015).4,5 Tax credits are generally only available to people who are not eligible for other coverage.

Because the ACA envisioned low-income people receiving coverage through Medicaid, people with incomes below poverty are not eligible for Marketplace subsidies. Thus, in the 20 states not implementing the Medicaid expansion, some adults fall into a “coverage gap” of earning too much to qualify for Medicaid but not enough to qualify for premium tax credits. In addition, undocumented immigrants are ineligible for Medicaid coverage and barred from purchasing coverage through a Marketplace. In most cases, lawfully present immigrants are subject to a five-year waiting period before they may enroll in Medicaid, though they can purchase coverage through a Marketplace and may receive tax credits for such coverage.

Eligibility for Assistance under the ACA by Race and Ethnicity

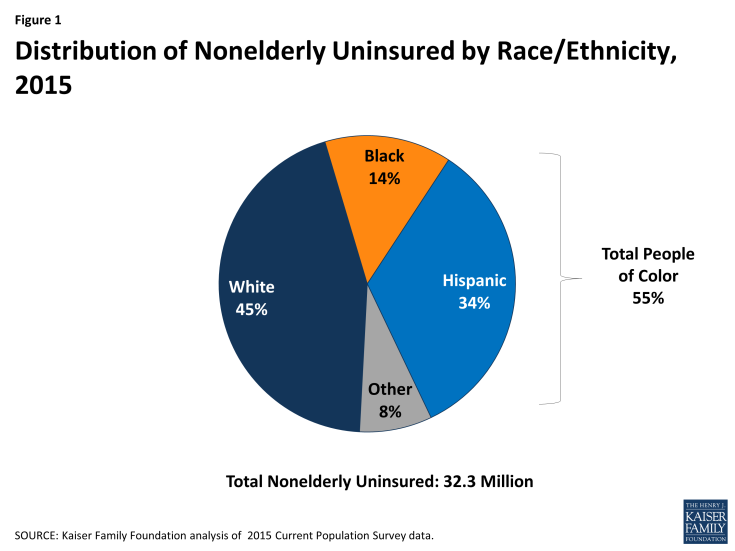

More than half (55%) of the total 32.3 million nonelderly uninsured are people of color. This includes 34% who identify as Hispanic, 14% who identify as Black, and 8% who identify as another group or mixed race (Figure 1).

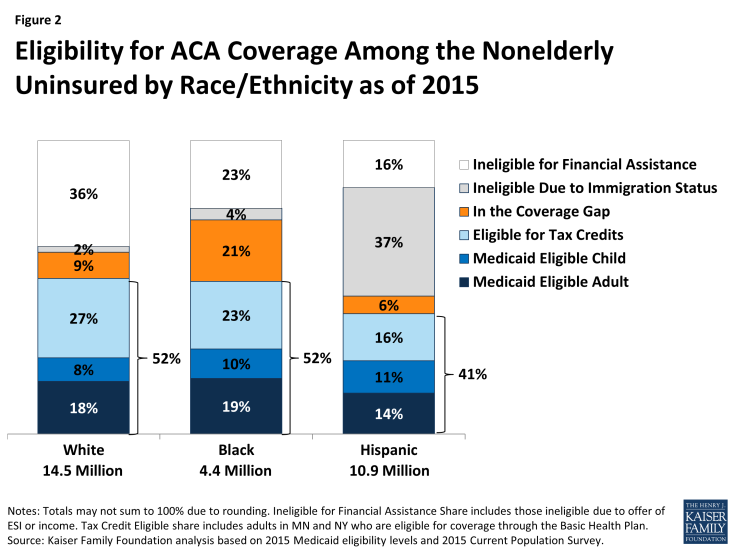

Just over half (52%) of uninsured Whites and Blacks qualify for assistance under the ACA (Figure 2). Over a quarter of uninsured Whites (26%) are Medicaid eligible children and adults, and 29% of uninsured Blacks are Medicaid eligible adults and children. Those who are Medicaid eligible include people who were previously eligible as well as those newly eligible under the ACA. Roughly a quarter of both uninsured Whites and Blacks qualify for premium tax credits to purchase coverage through the Marketplace.6 However, uninsured Blacks are more than twice as likely as uninsured Whites (21% vs. 9%) to fall into the coverage gap. This reflects the fact that a large share of uninsured Blacks resides in the southern region of the country where most states have not adopted the Medicaid expansion. Small shares of both uninsured Whites and Blacks are ineligible based on immigration status. Over a third of uninsured Whites (36%) and nearly a quarter of uninsured Blacks (23%) are ineligible for financial assistance either because they have an offer of ESI or an income above the limit for premium tax credits but could purchase unsubsidized Marketplace coverage.

A smaller share of uninsured Hispanics (41%) qualifies for assistance compared to uninsured Whites (52%). Much of this difference is because a larger share of uninsured Hispanics (37%) is ineligible due to immigration status compared to Whites (2%). Moreover, a small share of uninsured Hispanics falls into the coverage gap since several key states that have large numbers of uninsured Hispanics have adopted the expansion, including California, New York, and Arizona.

Eligibility for Assistance Under the ACA by Race and Ethnicity and State Medicaid Expansion Status

Patterns of eligibility for each racial/ethnic group also vary depending on whether a state has expanded Medicaid to low-income adults.

Uninsured Whites are more likely to be eligible for assistance in expansions states compared to non-expansion states (62% vs. 43%) since there is no coverage gap in the expansion states (Figure 3). Without the coverage gap, 40% of uninsured Whites are eligible for Medicaid in expansion states. In the non-expansion states only 11% are eligible for Medicaid, while 19% fall in the coverage gap. In the non-expansion states, eligibility for tax credits partially offsets the gap since individuals with incomes between 100-138% can receive tax credits in these states. As such, a larger share of uninsured Whites is eligible for tax credits in non-expansion states compared to expansion states (32% vs. 22%).

Figure 3: Eligibility for ACA Coverage Among White Nonelderly Uninsured as of 2015 by State Medicaid Expansion Status

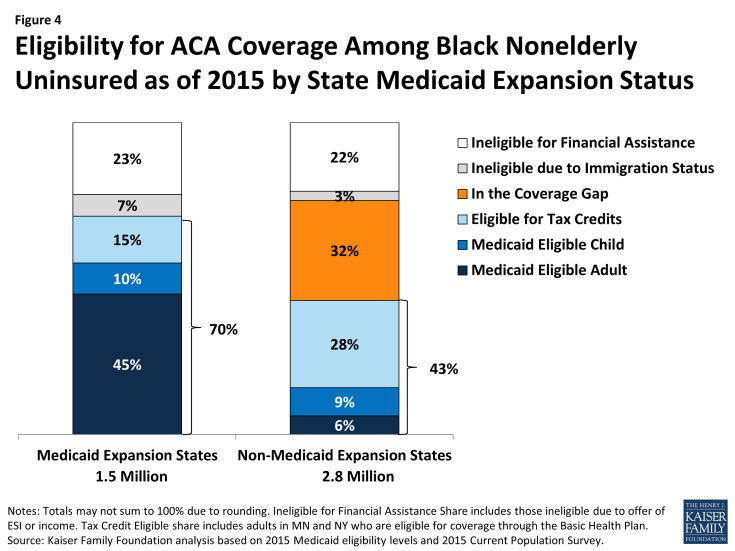

Medicaid expansion decisions have a large impact on eligibility for coverage among uninsured Blacks. In expansion states, seven in ten (70%) of uninsured Blacks are eligible for coverage, including over half (55%) who are eligible for Medicaid. In contrast, in non-expansion states only 15% of uninsured Blacks are eligible for Medicaid while nearly a third (32%) fall into the coverage gap. As such, in the expansion states, less than half (43%) of uninsured Blacks are eligible for assistance.

Figure 4: Eligibility for ACA Coverage Among Black Nonelderly Uninsured as of 2015 by State Medicaid Expansion Status

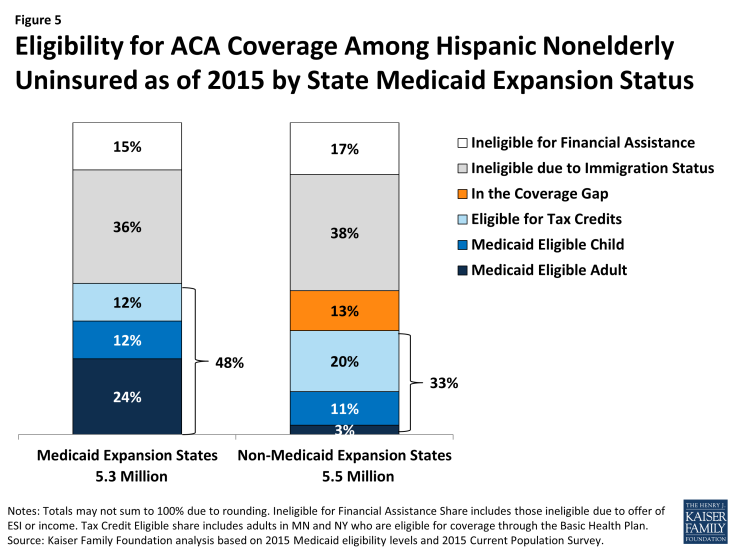

Most uninsured Hispanics remain ineligible for assistance in both expansion and non-expansion states. A larger share of uninsured Hispanics is eligible for assistance in expansion states compared to non-expansion states (48% vs. 33%). However, this difference is not as large as the differences observed for uninsured Blacks and Whites since a smaller share fall into the coverage gap in the non-expansion states and significantly larger shares remain ineligible due to immigration status in both expansion and non-expansion states.

Figure 5: Eligibility for ACA Coverage Among Hispanic Nonelderly Uninsured as of 2015 by State Medicaid Expansion Status

Discussion

Though millions of people have gained coverage under the ACA, many remain uninsured. The ACA provides new coverage options across the income spectrum for low and moderate-income people, and overall nearly half of the uninsured population appears to be eligible for Medicaid or subsidized Marketplace coverage. For these individuals, outreach and education about coverage and financial assistance may be important to continuing coverage gains that were seen in the first two years of full ACA implementation. However, there are distinctions in eligibility patterns by race and ethnicity.

The data show that the Medicaid expansion is an important coverage pathway for uninsured Blacks in states that have adopted the expansion, as over half of uninsured Blacks in these states are Medicaid eligible. However, Blacks are disproportionately impacted by the coverage gap resulting from state decisions not to expand Medicaid. Overall, uninsured Blacks are more than twice as likely as uninsured Whites to fall into the gap (21% vs. 9%), and nearly a third (32%) of uninsured Blacks in non-expansion states fall into the gap.

The data also show that a larger share of Hispanics remains outside the reach of the ACA compared to other groups. Overall, more than one-third of uninsured Hispanics remain ineligible for coverage options due to immigration status. In the absence of coverage options, many of these individuals will likely remain uninsured.

Across racial and ethnic groups, a remaining share of individuals also remains ineligible for assistance because they have access to employer coverage that may be considered affordable or have incomes too high to qualify for Medicaid or Marketplace subsidies. Increased penalties under the ACA’s so-called “individual mandate” in 2016 may encourage some of them to obtain coverage.

As the beginning of open enrollment for 2016 Marketplace coverage approaches, there are still substantial opportunities to increase coverage by reaching those who are eligible for help under the ACA. Understanding how eligibility for coverage options varies by race and ethnicity may help inform outreach and education efforts and provide increased understanding of the scope of remaining coverage gains that can be achieved. These differences also have important implications for efforts to promote greater health equity moving forward.

| Methods |

| This analysis uses data from the 2015 Current Population Survey (CPS) Annual Social and Economic Supplement (ASEC). The CPS ASEC provides socioeconomic and demographic information for the United Sates population and specific subpopulations. Importantly, the CPS ASEC provides detailed data on families and households, which we use to determine income for ACA eligibility purposes.

The CPS asks respondents about coverage at the time of the interview (for the 2015 CPS, February, March, or April 2015) as well as throughout the preceding calendar year. People who report any type of coverage throughout the preceding calendar year are counted as “insured.” Thus, the calendar year measure of the uninsured population captures people who lacked coverage for the entirety of 2014 (and thus were uninsured at the start of 2015). We use this measure of insurance coverage, rather than the measure of coverage at the time of interview, because the latter lacks detail about coverage type that is used in our model. Based on other survey data, as well as administrative data on ACA enrollment, it is likely that a small number of people included in this analysis gained coverage in 2015. Medicaid and Marketplaces have different rules about household composition and income for eligibility. For this analysis, we calculate household membership and income for both Medicaid and Marketplace premium tax credits for each person individually, using the rules for each program. For more detail on how we construct Medicaid and Marketplace households and count income, see the detailed technical Appendix A available here. Undocumented immigrants are ineligible for Medicaid and Marketplace coverage. Since CPS data do not directly indicate whether an immigrant is lawfully present, we draw on the methods underlying the 2013 analysis by the State Health Access Data Assistance Center (SHADAC) and the recommendations made by Van Hook et. al.7,8 This approach uses the Survey of Income and Program Participation (SIPP) to develop a model that predicts immigration status; it then applies the model to CPS, controlling to state-level estimates of total undocumented population from Department of Homeland Security. For more detail on the immigration imputation used in this analysis, see the technical Appendix B available here. Individuals in tax-filing units with access to an affordable offer of Employer-Sponsored Insurance are still potentially MAGI-eligible for Medicaid coverage, but they are ineligible for advance premium tax credits in the Health Insurance Exchanges. Since CPS data do not directly indicate whether workers have access to ESI, we draw on the methods comparable to our imputation of authorization status and use SIPP to develop a model that predicts offer of ESI, then apply the model to CPS. For more detail on the offer imputation used in this analysis, see the technical Appendix C available here. As of January 2014, Medicaid financial eligibility for most nonelderly adults is based on modified adjusted gross income (MAGI). To determine whether each individual is eligible for Medicaid, we use each state’s reported eligibility levels as of January 1, 2015, updated to reflect state implementation of the Medicaid expansion as of September 2015 and 2015 Federal Poverty Levels.9 Some nonelderly adults with incomes above MAGI levels may be eligible for Medicaid through other pathways; however, we only assess eligibility through the MAGI pathway.10 An individual’s income is likely to fluctuate throughout the year, impacting his or her eligibility for Medicaid. Our estimates are based on annual income and thus represent a snapshot of the number of people in the coverage gap at a given point in time. Over the course of the year, a larger number of people are likely to move and out of the coverage gap as their income fluctuates. |

Endnotes

Garfield, R., et al. October 2015. New Estimates of Eligibility for ACA Coverage among the Uninsured. (Washington, DC: Kaiser Family Foundation.) Available at: https://www.kff.org/uninsured/issue-brief/new-estimates-of-eligibility-for-aca-coverage-among-the-uninsured/.

U.S. Department of Health and Human Services, Office of The Assistant Secretary for Planning and Evaluation, 2015 Poverty Guidelines. Available at: http://aspe.hhs.gov/2015-poverty-guidelines.

Kaiser Family Foundation State Health Facts Online. Medicaid/CHIP Upper Income Eligibility Limits for Children, 2000-2015. Available at: https://www.kff.org/medicaid/state-indicator/medicaidchip-upper-income-eligibility-limits-for-children-2000-2015/.

U.S. Department of Health and Human Services, Office of The Assistant Secretary for Planning and Evaluation, 2014 Poverty Guidelines. Available at: http://aspe.hhs.gov/2014-poverty-guidelines

Tax credit eligibility in 2015 is based on 2014 poverty guidelines. In addition to the premium tax credits, the federal government also makes available cost-sharing subsidies to reduce what people with incomes between 100% and 250% of poverty have to pay out-of-pocket to access health services. The cost-sharing subsidies are also available on a sliding scale based on income.

Includes individuals in Minnesota and New York who are eligible for coverage through the Basic Health Plan.

State Health Access Data Assistance Center. 2013. “State Estimates of the Low-income Uninsured Not Eligible for the ACA Medicaid Expansion.” Issue Brief #35. Minneapolis, MN: University of Minnesota. Available at: http://www.rwjf.org/content/dam/farm/reports/issue_briefs/2013/rwjf404825

Van Hook, J., Bachmeier, J., Coffman, D., and Harel, O. 2015. “Can We Spin Straw into Gold? An Evaluation of Immigrant Legal Status Imputation Approaches” Demography. 52(1):329-54.

Based on state-reported eligibility levels as of January 1, 2015. Eligibility levels are updated to reflect state implementation of the Medicaid expansion as of September 2015 and 2015 Federal Poverty Levels, but may not reflect other eligibility policy changes since January 2015. The Kaiser Family Foundation State Health Facts. Data Source: Kaiser Commission on Medicaid and the Uninsured with the Georgetown University Center for Children and Families: Modern Era Medicaid: Findings from a 50-State Survey of Eligibility, Enrollment, Renewal, and Cost-Sharing Policies in Medicaid and CHIP as of January 2015, Kaiser Family Foundation, January 20, 2015.

Non-MAGI pathways for nonelderly adults include disability-related pathways, such as SSI beneficiary; Qualified Severely Impaired Individuals; Working Disabled; and Medically Needy. We are unable to assess disability status in the CPS sufficiently to model eligibility under these pathways. However, previous research indicates high current participation rates among individuals with disabilities (largely due to the automatic link between SSI and Medicaid in most states, see Kenney GM, V Lynch, J Haley, and M Huntress. “Variation in Medicaid Eligibility and Participation among Adults: Implications for the Affordable Care Act.” Inquiry. 49:231-53 (Fall 2012)), indicating that there may be a small number of eligible uninsured individuals in this group. Further, many of these pathways (with the exception of SSI, which automatically links an individual to Medicaid in most states) are optional for states, and eligibility in states not implementing the ACA expansion is limited. For example, the median income eligibility level for coverage through the Medically Needy pathway is 15% of poverty in states that are not expanding Medicaid, and most states not expanding Medicaid do not provide coverage above SSI levels for individuals with disabilities. (See: O’Mally-Watts, M and K Young. The Medicaid Medically Needy Program: Spending and Enrollment Update. (Washington, DC: Kaiser Family Foundation), December 2012. Available at: http://www.kff.org/medicaid/issue-brief/the-medicaid-medically-needy-program-spending-and/. And Kaiser Commission on Medicaid and the Uninsured, “Medicaid Financial Eligibility: Primary Pathways for the Elderly and People with Disabilities,” February 2010. Available at: http://www.kff.org/medicaid/issue-brief/medicaid-financial-eligibility-primary-pathways-for-the-elderly-and-people-with-disabilities/.