Limitations of the Program for Uninsured COVID-19 Patients Raise Concerns

Karyn Schwartz and Jennifer Tolbert

Published:

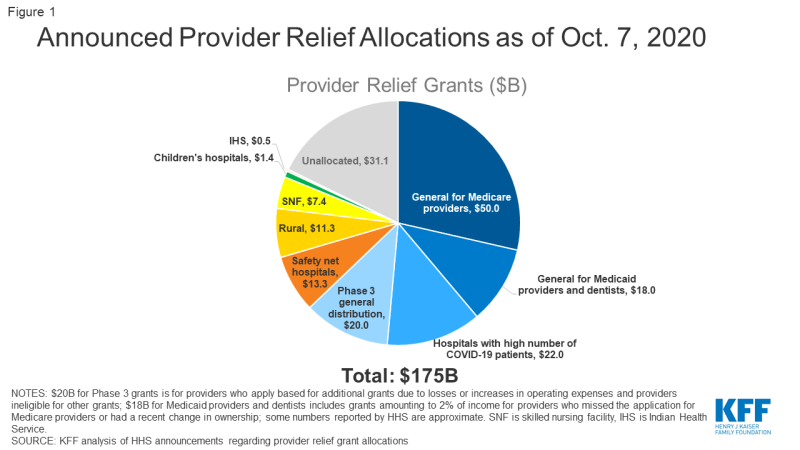

The Trump administration’s coronavirus treatment reimbursement program for uninsured COVID-19 patients was announced in early April and has now been in place for about five months. This program uses money from the Coronavirus Aid, Relief, and Economic Security (CARES) Act’s $175 billion Provider Relief Fund to reimburse providers for treating uninsured patients with COVID-19. So far, the Department of Health and Human Services (HHS) program has paid out limited reimbursement for uninsured patients and is not designed to provide the same comprehensive access and protection from high medical bills for COVID-19 treatment as traditional insurance.

One important factor limiting the reach of the HHS uninsured reimbursement program is guidance from the department that makes eligibility for reimbursement contingent upon a primary diagnosis of COVID-19. In some cases, patients with COVID-19 who are being treated for symptoms brought on by the virus may not have a primary diagnosis of COVID-19. Hospital groups have noted that this is particularly a problem for patients with sepsis caused by COVID-19. In those cases, coding protocols dictate that patients are coded with sepsis as their primary diagnosis and not COVID-19.

Additionally, providers are not required to participate in this program, and patients do not have easy visibility into which providers participate. Providers that have participated in the past are not required to continue to do so, and if providers choose to not participate, they may bill uninsured patients directly. When uninsured patients pay for their own care, their bills are often calculated using the undiscounted “list prices” for care, which are typically much higher than the Medicare rates providers are paid through this HHS program.

Another important limitation of the policy is that this program does not guarantee reimbursement for providers—instead reimbursement is contingent on available funding. HHS has now announced provider grant allocations that total $143.9 billion, including $20 billion in grants announced on October 1. This leaves $31.1 billion remaining in the fund (Figure 1). HHS has not indicated how much money—if any—is being set aside to cover the costs of treating uninsured COVID-19 patients and how it will weigh the needs of that program with the ongoing needs of providers.

KFF has estimated that hospital costs alone for these patients could ultimately be between $13.9 billion to $41.8 billion, depending on how many people become infected and are admitted to a hospital. HHS’s program will reimburse for both hospital costs along with many other services including office visits (including telehealth), non-emergency transportation, and for post-acute care. Providers accepting reimbursement are paid at Medicare rates and are prohibited from billing patients.

HHS has made data publicly available on the amount it has paid out to providers who have requested reimbursement for treating uninsured COVID-19 patients. The most recent data available includes reimbursements to providers as of September 30, 2020 and shows a modest total of $881 million in payments, though more provider reimbursements are likely waiting to be processed. That data lists about 8,000 providers who have received reimbursement for care for uninsured patients (providers with the same name in the same state were only counted once).

As discussed above, part of the reason for the relatively low total amount that has been reimbursed through this fund is likely due to the program being limited to patients with a primary diagnosis of COVID-19. Additionally, it is also unclear how many uninsured COVID-19 patients are being billed for their care because their providers are unaware of this program or have chosen to not participate. While large hospitals are likely participating in the program, smaller providers may not be aware of this source of funding or they may face administrative barriers to submitting claims and getting reimbursed.

The reimbursement program is, by design, different from policy approaches that would instead promote access to affordable health coverage, which would provide broader protections for people who are uninsured or at risk of becoming uninsured. Policy options that enable people to afford and enroll in comprehensive health insurance would help them access care for all their health care needs, including possible COVID-19 testing and treatment, although these policies would likely increase government spending. Such policies range from subsidizing COBRA so that people can afford to maintain employer sponsored coverage after a layoff, increasing Medicaid coverage, and creating a new open enrollment period for marketplace coverage and potentially increasing subsidies to make that coverage more affordable.

The number of new cases of COVID-19 is increasing again in many states, and nearly 30,000 people are hospitalized with the virus, many in states with larger numbers of uninsured residents, including Florida, Georgia, and Texas. Additionally, the U.S. economy has now lost about 11 million jobs since the start of the pandemic. While many workers originally had remained on furlough with continuing employer-sponsored health insurance, some employers are now starting to formally lay-off workers and likely discontinuing their health insurance. Given these trends, there may be increased spending in the Trump administration’s program to reimburse for treatment for uninsured COVID-19 patients, along with new pressure to explore options for increasing access to coverage for a growing number of uninsured people during this pandemic and economic crisis.