Funding for Health Care Providers During the Pandemic: An Update

Since the start of the coronavirus pandemic, Congress, states, and both the Trump and Biden Administrations have adopted a number of policies to ease financial pressure on hospitals and other health care providers. The infusion of funds was intended to help alleviate the fiscal impact of revenue loss due to delays in non-urgent care, coupled with new costs associated with COVID-19. With the recent increase in Omicron-related cases, hospitalizations and deaths, this brief describes the main sources of federal funds for health care providers and how those funds have been allocated. It also describes federal spending for COVID-19 testing, including at-home testing, using the most recent data available (as of September 2021).

| Federal Funding for Hospitals and Other Health Care Providers During the Pandemic: Key Sources of Federal Support |

The federal government has used a variety of strategies to provide enhanced financial support for hospitals and other health care providers to compensate for revenue loss and higher costs associated with the pandemic:

|

The Impact of the Pandemic on Health Care Spending and Providers

The capacity of hospitals and other health care providers to withstand the pressures of the pandemic depends on a variety of factors, including their financial health prior to the pandemic, the impact of the pandemic on revenue and expenses, and how much assistance they received from the federal government. In this section we briefly describe the impact of the pandemic and federal actions to support different types of providers. In the next section, we provide more detail on the various policies enacted by Congress and the Executive Branch over the last two years.

HOSPITAL AND PHYSICIAN SERVICES

Hospital admissions and use of other health care services dropped dramatically during the Spring of 2020, leading to a sharp decline in revenue for hospitals, outpatient centers and physicians. According to the Medicare Payment Advisory Commission (MedPAC), federal coronavirus relief funds and cost reductions allowed some but not all hospitals to remain profitable during the first three quarters of 2020. Further, MedPAC’s preliminary data shows that in 2021, among the six largest hospital systems, operating profits exceeded pre-pandemic levels. However, even though hospital revenues have largely rebounded, total health care spending was still below expected levels through the second quarter of 2021 (based on pre-pandemic spending), according to an analysis from KFF and EPIC Health Research Network

The impact on physicians has varied, according to the MedPAC. Between June and early December of 2020, the volume of total primary care visits (including telehealth) and elective services (e.g., colonoscopies and total knee replacement) were close to or just below the 2019 levels. Based on MedPAC’s analysis, the rapid growth in allowed charges for telehealth services partially offset decline in in-person office visits in early 2020.

SKILLED NURSING FACILITIES

Nursing homes, including skilled nursing facilities, also received federal funds to mitigate the financial effects of the pandemic, although the long-term effects of the pandemic on these facilities remains unclear. According to MedPAC, new federal assistance made available to skilled nursing facilities helped to offset much of their financial losses and costs incurred due to COVID-19, with total margins increasing in 2020 based on preliminary data. However, skilled nursing facility volume remains below pre-pandemic levels and therefore the longer-term effects of lower utilization for some facilities remains uncertain. Additionally, with staffing declining by approximately 10% between February and December 2020, staffing issues and costs could pose a fiscal challenge for skilled nursing facilities into the future.

SAFETY-NET PROVIDERS

Safety-net providers, including those with a high share of Medicaid and uninsured patients, have been at risk of financial strain during the pandemic, according to a MACPAC report. Contributing factors include low operating margins and the pandemic’s disproportionate impact on populations primarily covered by Medicaid, including people of color and those who use long-term services and supports. Providers that tend to serve Medicaid, but not Medicare, patients, such as pediatricians, home and community-based services providers, and behavioral health practitioners, were less likely to have received federal Provider Relief Funds.

Sources of Federal Support for Hospitals and Other Health Care Providers During the Pandemic

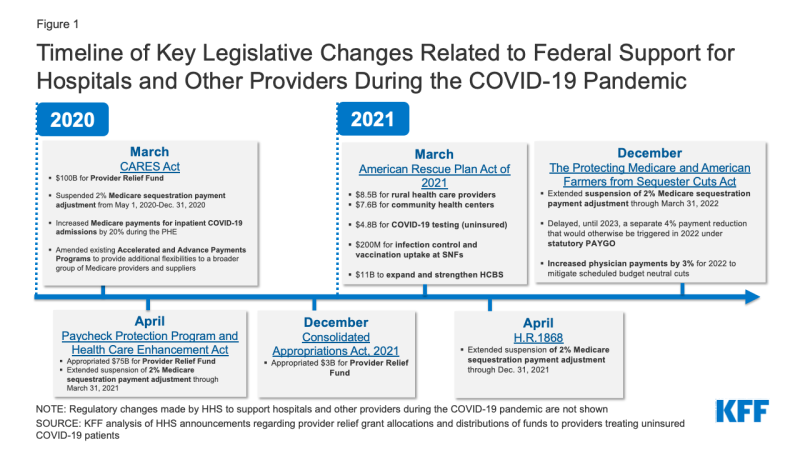

Approaching two years into the pandemic, policymakers have provided substantial support for hospitals and other health care providers to compensate for lost revenue and higher expenses associated with the COVID-19 pandemic. The legislative actions are described in the timeline below (Figure 1).

Figure 1: Timeline of Key Legislative Changes Related to Federal Support for Hospitals and Other Providers During the COVID-19 Pandemic

Payments from the Provider Relief Fund and Paycheck Protection Program loans to support hospitals and other health care providers during the pandemic contributed to a substantial increase in federal health care spending in 2020 – a 36% increase in spending in 2020 compared to 6% in 2019, according to National Health Expenditure data. Federal support during the pandemic appears to have stalled the pace of hospital closures, with fewer hospital closures in fiscal years 2020 (25 closures) and 2021 (10 closures) compared to 2019 (46 closures). In particular, many rural hospitals were struggling before and during the pandemic, with 18 rural hospitals closing in 2019 and 19 closing in 2020, while there were just 2 rural hospital closures reported in 2021. According to a Medicaid and CHIP Payment and Access Commission (MACPAC) report, critical access hospitals and other rural hospitals appear to have received more Provider Relief Funds as a share of their operating expenses than other types of hospitals, although it is not clear if the assistance they have received will be sufficient to prevent additional closures that would further impact access. The various funding and other policy actions taken to support providers include:

- Provider Relief Fund: The Provider Relief Fund was initially established under the CARES Act in response to concerns about the impact of the COVID-19 on hospitals and other health care providers across the country. Congress subsequently authorized additional amounts for the Provider Relief Fund in The Paycheck Protection Program and Health Care Enhancement Act and the Consolidated Appropriations Act, 2021 (Figure 1). Of the $178 billion in total amounts authorized for the Fund, HHS allocated $170.9 billion (including $8 billion to support vaccine and therapeutic development and procurement activities (previously known as Operation Warp Speed), leaving $7.1 billion unallocated as of December 2021, according to the Government Accountability Office (GAO) (Figure 2). As of December 2021, $143.5 billion has been disbursed.Initially, the funds were distributed to virtually all Medicare-enrolled health care providers in grants that amounted to at least 2% of their 2018 (or most recent complete tax year) annual total patient revenue to cover lost revenue and unreimbursed costs associated with the pandemic. This approach allowed HHS to disburse funds quickly, but also favored providers with a larger share of revenue from private insurance since private insurers tend to reimburse at higher rates than Medicare and Medicaid. The initial distribution also excluded Medicaid and CHIP providers who were not enrolled in Medicare (38% of all Medicaid/CHIP providers); these providers were unable to apply for federal Provider Relief Funds until June 2020. A MACPAC review of Provider Relief Fund applications submitted as of November 26, 2020 (after the phase three general distribution application deadline closed), found that about 18% of Medicaid and CHIP providers who are not enrolled in Medicare received federal Provider Relief Funds, compared to virtually all Medicare providers, and about 54% of all providers potentially eligible for relief funds. Certain providers—including skilled nursing facilities, safety net hospitals, and hospitals that treated a large number of COVID-19 patients early in the pandemic—were among those that later qualified for additional grants.The Phase 4 distribution of $17 billion announced in September 2021 is based on the change in providers’ operating revenues and expenditures for the period between July 1, 2020 and March 31, 2021. According to HHS, the objective is to reimburse smaller providers for their lost revenues and COVID-19 expenditures at a higher rate than larger providers, because according to HHS, smaller providers are more likely to operate on narrow margins and serve higher-need communities. The Phase 4 distribution also includes bonus payments to providers that billed state Medicaid programs, state CHIPs, and/or Medicare between January 1, 2019 to December 31, 2020. To ensure an equitable distribution, bonus payments will be based on Medicare payment rates, which are generally higher. These bonus payments will account for approximately 25% of Phase 4 funds.

Of the $17 billion in Phase 4 Provider Relief Funds, HHS has distributed $11 billion, including $9 billion distributed in December 2021 and $2 billion distributed in January 2022. The average payment of the $9 billion distributed in December 2021 ranged from $58,000 for small providers to $1.7 million for large providers. Data on targeted distributions of Phase 4 payments by type of provider are not yet available. According to HHS statements published in an October 2021 GAO report, the remaining unallocated Provider Relief Funds are reserved for future contingencies and emerging needs.

- Additional Funds for Rural Health, Community Health Centers and Other Providers: The American Rescue Plan (ARP) included $8.5 billion for rural health care providers to help cover lost revenue and costs associated with COVID-19 (Figure 1). In November 2021, HHS began distributing $7.5 billion of the $8.5 billion in ARP rural payments to providers. According to HHS, payments to providers varied widely, ranging from $500 to approximately $43 million. Providers or suppliers are eligible for ARP rural payments if they bill Medicare, Medicaid, and/or CHIP, and operate in or serve patients in a rural area. Therefore, eligible providers do not have to be located in a rural area to get an ARP payment. In other words, large health systems in urban centers who serve rural patients are also eligible. Other eligible providers include rural health clinics, critical access hospitals, in-home health, hospice, or long-term care providers. Similar to bonus payments under Phase 4 Provider Relief Funds, ARP rural payments are generally based on Medicare rates to allow an equitable distribution of funds. HHS has not announced the timing for the distribution of the remaining $1 billion of the $8.5 billion appropriated for rural health care providers.The ARP also included $7.6 billion for community health centers, more than $6 billion of which was awarded by HHS in April 2021. The ARP also included $200 million to support infection control and vaccination uptake at skilled nursing facilities.The ARP also included a 10 percentage point increase in the federal matching rate (FMAP) for state spending on Medicaid HCBS from April 1, 2021 through March 31, 2022, an estimated $11 billion nationally, to support home and community based services (HCBS) programs and strengthen the direct care workforce. States may use the enhanced funds for a variety of purposes, including supporting direct care workers, expanding HCBS eligibility and/or services, and improving IT systems. However, a KFF survey of state Medicaid HCBS programs found that 2/3 of responding states (25 out of 38) reported a permanent HCBS provider closure during the pandemic, with most of these states experiencing permanent closure of more than one HCBS provider type.

- Temporary suspension of Medicare automatic payment reductions (sequestration): Congress has provided additional financial protection for hospitals and other health care providers by continuing to waive the automatic 2% reduction in Medicare payments that would be required under budget rules, known as sequestration. COVID-19 relief legislation originally suspended the sequestration payment adjustment of 2% from May 1, 2020 through December 31, 2021.1 On December 10, 2021, the Protecting Medicare and American Farmers from Sequester Cuts Act, S.610, was enacted into law, which continues to exempt Medicare from sequestration until March 31, 2022 (Figure 1). For the next three months (April 1, 2022 to June 30, 2022), the reduction will be phased in at 1% before resuming to 2% thereafter. However, for fiscal year 2030, payment reductions will be increased to 2.25% during the first 6 months and 3% for the next 6 months of that fiscal year, offsetting the federal budgetary effects of the recent sequestration suspensionsThis recently-enacted law (S. 610) will also delay, until 2023, a separate Medicare sequestration of 4% which would otherwise be triggered in 2022 under statutory Pay-As-You-Go (PAYGO). Specifically, any budgetary effects recorded for the fiscal year 2022 “PAYGO scorecards” will be delayed and added to the amounts for the fiscal year 2023 scorecard. Additionally, S.610 provides a 3% increase in Medicare Physician Fee Schedule (PFS) payments for 2022 in order to mitigate scheduled budget neutral cuts resulting from a 3.75% increase in PFS payments in 2021. These legislative changes provide relief for hospitals and other health care providers serving Medicare patients across-the-board, rather than take a more targeted approach to relieve financially troubled hospitals and other health care providers that were significantly impacted by COVID-19.

- Paycheck Protection Program (PPP) and Other Loans: Many health care providers were eligible for some of the loan programs included in the Coronavirus Aid, Relief, and Economic Security (CARES) Act, including the PPP. Under the PPP for small businesses, loans are forgiven if employers do not lay off workers and meet other criteria. By August of 2020, health care providers received nearly $68 billion of the $525 billion in PPP loans that were distributed in 2020. In 2021, health care providers received another $29 billion of the $278 billion in PPP loans that were distributed that year. The CARES Act also appropriated $454 billion for loans to larger businesses—including hospitals. According to recent preliminary estimates by MedPAC, health care providers have received approximately $100 billion in total PPP loans.

- Medicare Accelerated and Advance Payment Programs: Health care providers that participate in traditional Medicare were eligible for loans through the Medicare Accelerated and Advance Payment Programs, which helps providers facing cash flow disruptions during an emergency. About 80% of the $100 billion in loans went to hospitals. Repayment for the loans was originally set to begin in August of 2020, but Congress delayed the start date for repayments until one year after providers received the loans, which CMS says began as early as March 30, 2021 for those providers and suppliers that received loans on March 30, 2020. Once repayment begins, a portion of the new Medicare claims are reduced to repay the loans (25% during the first 11 months of repayment and 50% during the next six months). CMS is no longer accepting applications for accelerated or advanced payments as they relate to the COVID-19 Public Health Emergency.

- Increase in Medicare COVID-19 inpatient reimbursement: Medicare has increased all inpatient reimbursement for COVID-19 patients by 20% during the public health emergency (PHE), which has been renewed through April 14, 2022. Additionally, under the New COVID-19 Treatments Add-on Payment (NCTAP) policy, eligible providers in the inpatient setting receive additional payments for certain COVID-19 treatments, such as remdesivir or convalescent plasma. In order to incentivize inpatient hospitals to continue providing new COVID-19 treatments beyond the end of the PHE, CMS recently extended the NCTAP for certain eligible technologies through the end of the fiscal year in which the PHE ends. Beneficiaries receiving inpatient care for treatment of COVID-19 are subject to cost sharing (deductible and copayments for extended stays).

- Reimbursement for COVID-19 vaccination administration: Medicare increased its reimbursement for COVID-19 vaccine administration from $17 for an initial dose in a series and $28 for the final dose in a series to approximately $40 per dose. This also applies to booster doses approved by the FDA under the emergency use authorizations. As of June 2021, Medicare also pays an additional $35 per dose for administering the COVID-19 vaccine in the home for certain Medicare patients. Most states have policies in place to increase Medicaid payments for COVID-19 vaccine administration to 100% of the Medicare rate. Medicare and Medicaid beneficiaries are not subject to any cost sharing for the COVID-19 vaccine and administration. For the uninsured and underinsured, a portion of the Provider Relief Funds are being used to reimburse providers for administering COVID-19 vaccines to uninsured or underinsured individuals.

- Medicaid options to support providers: The coronavirus pandemic resulted in financial strain for health care providers who tend to care for a disproportionate share of Medicaid patients. As of July 1, 2021, 41 states increased provider payment rates for a range of provider types via Disaster-Relief State Plan Amendments (SPAs) or other administrative authority, 40 states did so for HCBS waivers specifically using Appendix K, and two states received approval for Section 1115 waivers that increased payment rates for HCBS. States were also able to use retainer payments for certain HCBS providers as well as directed payments through managed care. In a survey of state Medicaid programs, more than two-thirds of responding states (33 of 47) indicated that one or more payment changes made in FY 2021 or FY 2022 were related in whole or in part to COVID-19. Across provider types, the vast majority of COVID-19-related payment changes were rate increases. COVID-19-related payment changes were most commonly associated with nursing facilities (27 states) and HCBS providers (26 states). Additionally, states reported a variety of other FFS payment changes in FY 2021 or planned for FY 2022 in response to COVID-19 including: increasing COVID-19 vaccine reimbursement rates to 100% of the Medicare rate and allowing a broader range of providers to be reimbursed for vaccine administration such as pharmacists, home health agencies, ambulance providers, renal dialysis clinics, and outpatient behavioral health clinics; making retainer payments to HCBS providers and bed hold payments to institutional providers; and making supplemental or add-on payments to certain providers, especially nursing facilities, for COVID-19 patients.

- Other support for safety net providers, underserved populations and testing: There has been additional funding allocated to health centers ($9.6B), reimbursements for testing for the uninsured ($2B) and telehealth support for safety net providers ($300M). In addition, $61.4B has been allocated for broader testing activities, beyond what is described in this brief, including for community-based testing programs and the Indian Health Services. That allocation includes funding from several pieces of legislation, including $4.8 billion from ARP announced by HHS in May 2021. It is unclear if this allocation includes funding for at-home tests being distributed through the United States Postal Service or now eligible for reimbursement by private health insurance. It is not yet clear how the federal government is paying for at-home tests being distributed through USPS and the fiscal impact of providing this coverage.

The Long-Term Impact of the Pandemic Across Providers and Communities Remains Uncertain

When hospitals and other health care providers experienced steep drops in revenue early in the pandemic, Congress stepped in with an infusion of funds to bolster the finances of these providers. Collectively, the infusion of funds and other forms of support have generally maintained or improved providers’ financial performance in 2020. However, not all providers had equal access to these funds, including providers serving a disproportionate share of Medicaid patients, who were less likely to have received federal Provider Relief Funds or more likely to wait longer to receive these Funds. With emerging virus variants, including the Omicron variant which has caused rapid increases in COVID-19 infections and hospitalizations, the financial impact of the pandemic across providers and communities still remains unclear. More recently, hospitals have been pressing Congress for additional funds, in light of rising hospital admissions attributable to the Omicron variant. At this time, Congress’ intent on making any statutory changes in response to these concerns is not clear.

Endnotes

The CARES Act, H.R.748, originally suspended the sequestration payment adjustment of 2% from May 1, 2020 through December 31, 2020, followed by the Consolidated Appropriations Act, 2021, H.R.133, that extended the suspension period to March 31, 2021, and then H.R. 1868 delayed the reinstatement until December 31, 2021. On December 10, 2021, the Protecting Medicare and American Farmers from Sequester Cuts Act, S.610, was enacted into law, continuing to exempt Medicare from sequestration until March 31, 2022.