The independent source for health policy research, polling, and news.

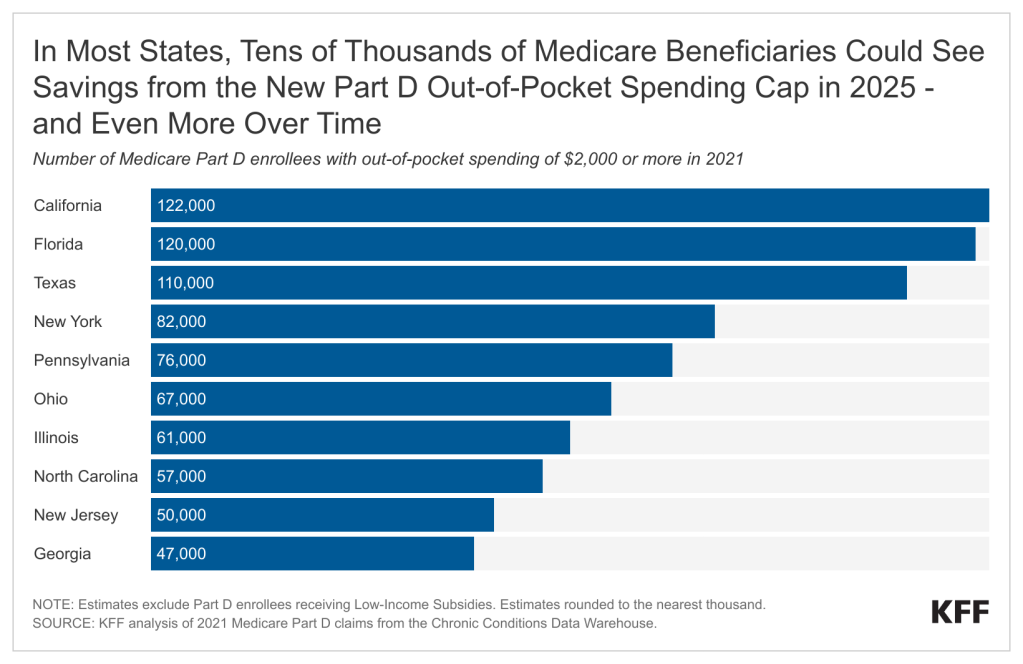

New $2,000 Medicare Part D Cap Could Reduce Out-of-Pocket Drug Costs for Over One Million Beneficiaries Beginning Next Year, Including Tens of Thousands of Beneficiaries in Most States

Millions More Will Reach the Spending Threshold and Benefit From the Cap Over Time

A KFF analysis shows that a new out-of-pocket spending cap in Medicare Part D could translate into savings for well over 1 million beneficiaries when it takes effect next year, including more than 100,000 people each in California, Florida and Texas, based on analyses of drug spending in 2021.

The $2,000 cap, part of the Inflation Reduction Act of 2022, will lead to thousands of dollars in savings for Medicare patients who take high-cost drugs for cancer, rheumatoid arthritis, and other serious conditions. This new limit follows the elimination this year of a longstanding requirement that Part D enrollees pay 5% of their drug costs out-of-pocket after their drug expenditures reach a certain threshold.

Based on KFF’s review of Part D drug claims data, if the cap been in place in 2021, 1.5 million Medicare beneficiaries would have benefited because their out-of-pocket costs for prescription drugs exceeded $2,000. Of the total 1.5 million, about 200,000 Medicare beneficiaries spent $5,000 or more for their prescriptions that year, while another 300,000 expended between $3,000 and $5,000. The rest spent between $2,000 and $3,000.

Moreover, the number of people who will see savings from the cap will rise over a longer period of time. A total of 5 million Part D enrollees had out-of-pocket drug costs of $2,000 or more in at least one year during the 10-year period ending in 2021, for instance.

In most states, tens of thousands of Medicare beneficiaries could save money from the new cap next year. In six states — New York, Pennsylvania, Ohio, Illinois, North Carolina, and New Jersey — between 50,000 and 82,000 beneficiaries spent more than $2,000 out-of-pocket for prescription drugs in 2021. The numbers were higher in California, Florida, and Texas, where more than 100,000 Part D enrollees exceeded the threshold that year.