What to Know About Medicare Part D Premiums

The Inflation Reduction Act of 2022 includes several provisions to lower prescription drug costs for people with Medicare and reduce drug spending by the federal government, including several changes to the Part D benefit. These changes, including a new $2,000 cap on out-of-pocket drug spending, will help to lower out-of-pocket costs for Part D enrollees but could also make it harder for some Part D plan sponsors to offer low-priced coverage, particularly sponsors of stand-alone prescription drug plans (PDPs).

In anticipation of potential premium increases by Part D sponsors to cover higher costs associated with a more generous Part D drug benefit, the Inflation Reduction Act included a provision designed to help limit annual premium increases. Specifically, the law caps growth in the base beneficiary premium to no more than 6% above the prior year’s amount, though it is important to note that the base premium is not the same as the individual plan-level premiums charged by Part D sponsors and paid by Part D enrollees. In addition, the Centers for Medicare & Medicaid Services (CMS) made changes to the Part D payment methodology for 2025 to better reflect expected increases in plan liability for the redesigned Part D benefit, with the goal of enhancing market stability. CMS has also announced a new voluntary demonstration to provide additional premium stabilization and enhanced protection against the risk of losses to stand-alone PDPs (see details below).

These FAQs provide context for understanding Medicare Part D premiums in 2025 and changes in recent years. While the impact of the Part D benefit redesign changes on the 2025 Part D market is unknown at this time, premiums for individual Part D plans are likely to continue to vary and annual plan-level premium increases may be higher or lower than 6% for 2025, as they were for 2024. The fall open enrollment period will present all Part D enrollees with the opportunity to evaluate their coverage and determine whether there are lower-cost plan options that meet their needs.

Key Takeaways

- Changes to the Part D benefit in the Inflation Reduction Act will mean lower out-of-pocket costs for Part D enrollees but higher costs for Part D plans overall, leading to concerns about possible premium increases.

- CMS is taking steps to mitigate potential premium increases through a new demonstration program for stand-alone drug plans, as well as payment changes designed to bring greater stability to the Part D market in 2025.

- The Inflation Reduction Act includes a provision to cap growth in the base beneficiary premium to 6%. For 2025, the base premium is $36.78, an increase of $2.08 or 6% over the 2024 base premium. Although this 6% cap doesn’t apply to the individual premiums that plans charge, it does help to limit premium increases.

- Actual Part D plan premiums for 2025 are not yet known and will be announced in September, but premiums are expected to vary, with lower monthly premiums for Medicare Advantage drug plans than stand-alone drug plans, on average, as in 2024. The annual open enrollment period, which runs from October 15 to December 7, presents an opportunity for Part D enrollees to compare plans and shop for lower-priced coverage that meets their needs.

How is the Part D benefit changing for 2025?

The Inflation Reduction Act includes a number of changes to the Medicare Part D drug benefit, including a new $2,000 cap on out-of-pocket drug spending in 2025 for enrollees in Medicare Part D plans. It also requires Part D plans and drug manufacturers to pay a greater share of costs for Part D enrollees with drug costs in the catastrophic coverage phase (above the $2,000 spending cap) and reduces Medicare’s reinsurance liability. The law also eliminates the coverage gap phase as of 2025, where enrollees are currently responsible for paying 25% of their drug costs, drug manufacturers provide a 70% price discount on brand-name drugs, and plans pay 5% of costs.

As of 2025, once enrollees have met their deductible (if their plan includes one), they will enter the initial coverage phase, where they will face cost sharing of 25% under the standard benefit (as in 2024), manufacturers will provide a 10% price discount, and Part D plans will pay 65% (Figure 1). Once enrollees reach the out-of-pocket spending cap and enter the catastrophic coverage phase, plans will be required to pay 60% of drug costs, up from 20% in 2024, and drug manufacturers will be required to provide a 20% price discount on brand-name drugs. Medicare’s share of total costs in the catastrophic phase will decrease from 80% to 20% for brand-name drugs and from 80% to 40% for generic drugs.

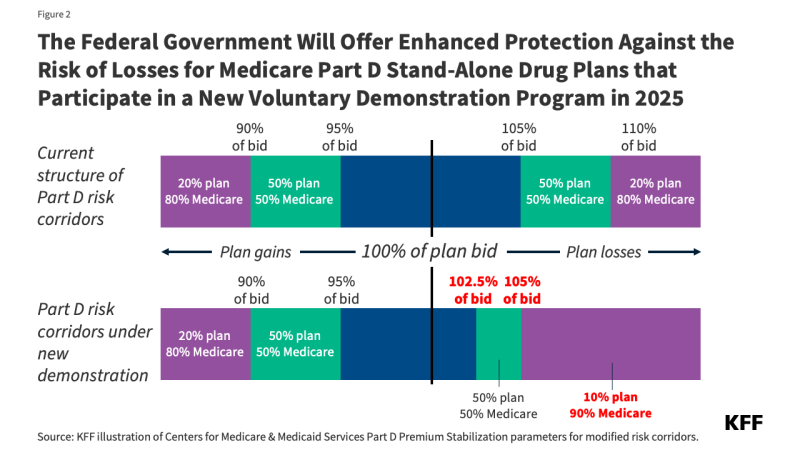

Although Part D plans will be taking on additional liability for high drug costs in 2025, Medicare will continue to limit their liability for higher-than-expected drug costs through risk corridors, a risk sharing mechanism that has been in place since the Part D program started in 2006. In addition, CMS is launching a new voluntary demonstration to provide enhanced risk-corridor protection against overall losses for participating stand-alone PDPs to help stabilize the market (see details below).

What is known about Part D premiums for 2025?

CMS announced the Part D base beneficiary premium for 2025 on July 29, 2024 (this announcement typically occurs at the end of July each year). For 2025, the base beneficiary premium is $36.78, an increase of $2.08, or 6%, over the 2024 base premium of $34.70. A provision in the Inflation Reduction Act capped annual growth in the base beneficiary premium to 6% over the prior year’s amount (see details below).

The base premium is calculated as a share of average plan bids for basic Part D benefits submitted by both stand-alone PDPs and Medicare Advantage drug plans (MA-PDs). All Part D plans submit a bid for basic benefits, while plans that offer enhanced benefits, such as a lower Part D deductible, also report the portion of their bid that is for basic versus enhanced benefits. (In 2024, most Part D enrollees were in enhanced plans: 72% of all Part D enrollees, including 79% of MA-PD enrollees and 62% of PDP enrollees). Each year, CMS averages standardized bids submitted by PDPs and MA-PDs to cover basic Part D benefits and calculates the National Average Monthly Bid Amount, or NAMBA. The calculation of the base beneficiary premium is based on the national average bid adjusted for individual reinsurance subsidies. Because the base premium is an average across both types of plans and reflects the cost of basic benefits only, this amount does not equal what a Part D enrollee will pay for coverage in any given Part D plan.

Actual premiums for Part D plans available in 2025 will be released in September, as they are every year, just prior to the October 1 start date of marketing for the coming plan year and the open enrollment period that runs from October 15 to December 7.

How will the new CMS demonstration help to stabilize the Part D market for 2025?

CMS has announced new premium stabilization measures for stand-alone PDPs as part of a voluntary Section 402 demonstration program that will be in effect for 2025 and two additional years (though the exact parameters may vary beyond 2025). Because CMS observed more variation in plan bids for 2025 among PDPs than MA-PDs, the new Part D Premium Stabilization Demonstration is targeted exclusively to PDPs. CMS’s rationale for this demonstration is to stabilize the PDP market in the initial transition years of the Inflation Reduction Act’s Part D benefit improvements, and to test whether the premium changes and revised risk corridors “increase the efficiency and economy” of services as the law’s Part D benefit changes are fully implemented. Similar Section 402 demonstrations were conducted under the George W. Bush Administration in the early years of Part D as the program was being rolled out.

The Part D Premium Stabilization Demonstration has three components for PDPs that choose to participate:

- Lowers the base beneficiary premium by $15 (or less if a $15 reduction would result in a plan premium of less than $0).

- Limits total Part D premium increases to $35 between 2024 and 2025 (applied after taking into account the $15 reduction in the base beneficiary premium).

- Narrows the upper thresholds of the risk corridors to reduce the range of spending where PDPs bear full risk for actual costs higher than their bids and increases the government’s risk sharing for a portion of plan losses from 80% to 90% (Figure 2).

What is the Inflation Reduction Act’s Part D premium stabilization provision and what impact has it had to date?

Beginning in 2024, the premium stabilization provision of the Inflation Reduction Act caps annual growth in the Part D base beneficiary premium at 6%. For 2024, the first year the premium stabilization provision was in effect, the Part D base beneficiary premium was $34.70, a 6% increase over the 2023 amount of $32.74 (Figure 3). Without the premium stabilization provision, the 2024 base beneficiary premium would have been $39.35, an increase of 20%, reflecting a higher average monthly bid amount for basic Part D coverage in 2024 ($68.28) than in 2023 ($34.71).

For 2025, the Part D base beneficiary premium is $36.78, capped at a 6% increase over the 2024 amount. Without premium stabilization, the 2025 base premium would have been $55.98, 42% higher than the 2024 unadjusted base premium (61% higher than the base premium with the 6% cap in 2024). Between 2024 and 2025, the average monthly bid amount for basic benefits increased from $64.28 to $179.45. (See below for examples of how the 6% cap on the base premium helps to limit growth in premiums paid by enrollees for two hypothetical plans.)

What other changes has CMS adopted to help to limit Part D premium increases for 2025?

In addition to the premium stabilization measures described above, CMS has also made changes to its plan payment methodologies for the 2025 plan year. While technical in nature, these changes are designed to enhance market stability through an improved payment methodology that accounts for the substantial changes to the Part D benefit for 2025.

- Updates to the Part D risk adjustment model: The Part D risk adjustment model predicts plan liability for prescription drugs. The model is used to determine the amount of “direct subsidy” prospective payments that Part D plans receive from the federal government, which are adjusted for the health status of a plan’s enrollees. Enrollees with higher risk scores (which vary above and below an average of 1.0) translate to higher expected plan costs and higher subsidy payments. For 2025, CMS took steps to improve the predictive ability of the Part D risk adjustment model, including by recalibrating the model based on more current diagnosis and spending data than used in previous years.

- Using different normalization factors for MA-PDs and PDPs: For individual Part D enrollees, risk scores are calculated based on individual demographic and disease factors, and then adjustments are applied, including a “normalization factor.” New for 2025, CMS is applying different normalization factors for MA-PDs and PDPs, which will have the effect of increasing PDP risk scores relative to what they would have been otherwise. Historically, due to differences in coding and utilization patterns across both types of plans, the Part D risk adjustment model has underpredicted costs for PDP plans and overpredicted costs for MA-PD plans, which has had the effect of increasing standardized plan bids (and premiums) for PDPs relative to MA-PDs. Using separate normalization factors is expected to increase PDP risk scores, which would lead to higher direct subsidy payments, which could mitigate potential premium increases to help stabilize the PDP market. Because MA-PD sponsors can use rebate dollars from Medicare payments to lower or eliminate their Part D premiums, most MA-PD enrollees pay no premium for their Part D drug coverage (see details below).

What factors contributed to the increase in plan bids for basic benefits since 2023?

For 2025, the new $2,000 out-of-pocket spending cap and the increase in Part D plan liability for drug costs incurred by enrollees above the cap, combined with the reduction in Medicare reinsurance, as explained above, are factors in the higher national average monthly plan bid. CMS has emphasized that while the NAMBA increased substantially for 2025, this will be accompanied by substantially higher upfront payments from the government to plans in the form of direct subsidies for basic benefits covered by the plan – a shift from previous years when reinsurance payments accounted for a much larger share of Part D spending than direct subsidy payments. CMS estimates that the average direct subsidy payment will be $142.67, or 80% of the national average bid amount of $179.45.

For 2024, part of the explanation for the higher national average bid for basic benefits was the elimination of Part D enrollees’ 5% coinsurance requirement for drug costs in the catastrophic coverage phase and the increase in plans’ share of these costs from 15% to 20%. Another factor was a revision to the definition of Part D’s “negotiated price” that took effect in 2024 (not to be confused with the new drug price negotiation program established by the Inflation Reduction Act). The definition of negotiated price has been in place since the start of Part D, and it matters because this is the price upon which beneficiary cost sharing is based at the point of sale, which is particularly relevant when enrollees face a coinsurance requirement. Under the change, plans are now required to pass along all price concessions they receive from pharmacies, which help to lower the plan’s total costs, to enrollees at the point of sale. Enrollees will benefit from this change in the form of lower out-of-pocket drug costs, but plans were expected to face higher costs and lower revenues.

What do Part D premiums look like in 2024?

While the impact of the Part D benefit redesign changes on the 2025 Part D market is currently unknown, premiums for individual Part D plans are likely to continue to vary in 2025, as they do in 2024 – ranging from $0 to $100 per month or more. This is in part why Part D enrollees are encouraged to shop for plans during the annual open enrollment period in the fall.

For 2024, the average monthly premium for Part D coverage is $25, including premiums for both Medicare Advantage drug plans (MA-PDs) and PDPs. The average monthly premium for drug coverage in MA-PDs ($9) is substantially lower than in PDPs ($43). In 2024, 57% of all Part D enrollees are in MA-PDs in 2024 and 43% are in stand-alone prescription drug plans (PDPs).

The lower MA-PD average premium is heavily weighted by the predominance of zero-premium plans in the MA-PD market, because, as noted above, MA-PD sponsors can use rebate dollars from Medicare payments to lower or eliminate their Part D premiums. For 2024, all Medicare beneficiaries had access to zero-premium MA-PD plans – 27 on average – whereas only 1 PDP was available for zero premium for non-LIS enrollees in only 14 out of 34 PDP regions.

Even with changes to the Part D benefit between 2023 and 2024 that increased plan liability, the average monthly premium for Part D coverage across both plan types combined was the same in both years ($25) (Figure 4). The average MA-PD premium decreased by $1 (from $10 to $9), while the average PDP premium increased by $3 (from $40 to $43).

The $43 average PDP premium is based on enrollment in March 2024 after the end of open enrollment. This amount is lower than the estimated $48 premium for 2024, which was calculated in the fall of 2023 before open enrollment for 2024 and did not account for plan switching by current enrollees or plan choices by new enrollees during the open enrollment period. The fact that the actual average PDP premium for 2024 is lower than the estimated premium indicates that some PDP enrollees opted for lower-premium plans during open enrollment.

What share of Part D enrollees pay no premium for drug coverage?

Overall, nearly half of the 30.1 million Part D enrollees who are not receiving Part D low-income subsidies (LIS), or 14.3 million enrollees, pay no premium for their drug coverage in 2024 (Figure 5). The share of Part D enrollees paying no premium is heavily weighted by MA-PD enrollees. In 2024, three-quarters of MA-PD enrollees without LIS pay no premium for their drug coverage compared to 13% of PDP enrollees.

How does the Inflation Reduction Act premium stabilization provision help to limit growth in Part D premiums?

The premium for an individual plan is calculated as the base premium plus the difference between the plan’s bid and the national average bid (the NAMBA). Examples with two hypothetical plans illustrate how the 6% cap on growth in the base premium limits premium growth for an individual plan (Table 1).

For both plans, the 6% premium stabilization cap mitigates the increase in plan premiums between 2023 and 2024. For Plan A, with the 6% cap in effect, the premium increased by 10%, but without the 6% stabilization cap, the premium would have increased by 31%. Similarly, for Plan B, the 6% cap limits premium growth to 19%, compared to a 32% increase without the cap.

This work was supported in part by Arnold Ventures. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.