Similar but Not the Same: How Medicare Per Capita Spending Compares for Younger and Older Beneficiaries

Medicare is most commonly known as a health insurance program for people ages 65 and older, but, since 1973, the program has also provided coverage to millions of people with permanent disabilities who are younger than age 65.1 People under age 65 qualify for Medicare after they receive Social Security Disability Insurance (SSDI) payments for 24 months. Younger adults with end-stage renal disease (ESRD) and amyotrophic lateral sclerosis (ALS) are eligible for Medicare as soon as they begin receiving SSDI benefits. Over time, the share of Medicare beneficiaries under age 65 has more than doubled, from 7% (1.7 million people) in 19732 to 16% (9.1 million) this year.3

Medicare beneficiaries under age 65 with disabilities differ from beneficiaries age 65 and older in several ways.4 In 2012, nearly two-thirds of all younger Medicare beneficiaries (65%) had a cognitive or mental impairment, compared to 29% of seniors. Nearly 6 in 10 (59%) reported their health status as fair or poor and almost the same share (58%) reported having one or more limitations in their activities of daily living, compared to 20% and 34% of seniors, respectively. In 2014, half of all Medicare beneficiaries under age 65 lived on income less than $17,050, one third less than median income of $26,150 among beneficiaries age 65 and older.5

Differences in health status between younger and older Medicare beneficiaries suggest that Medicare spending could also differ for these two groups. In 2014, Medicare beneficiaries under age 65 accounted for 18% of the 38.5 million beneficiaries in traditional Medicare (excluding Medicare Advantage enrollees), and a somewhat higher share (23%) of total traditional Medicare spending that year.6 Per capita spending also could vary for these two groups, both overall and by type of service. This data note compares average per capita Medicare spending and service use for beneficiaries under age 65 to spending among those over age 65.7 The analysis is based on data from a 5% sample of Medicare claims for services covered under Parts A, B, and D for traditional Medicare beneficiaries from the Chronic Conditions Data Warehouse (CCW) of the Centers for Medicare & Medicaid Services (CMS) from 2000 to 2014. The analysis excludes beneficiaries enrolled in Medicare Advantage because comparable data on Medicare spending by service are not available for these enrollees.8,9

Findings

Average Medicare per capita spending on Part A and Part B services is only modestly higher for beneficiaries under age 65 than those over 65. Average total spending is higher for beneficiaries under age 65, mainly due to Part D prescription drug spending.

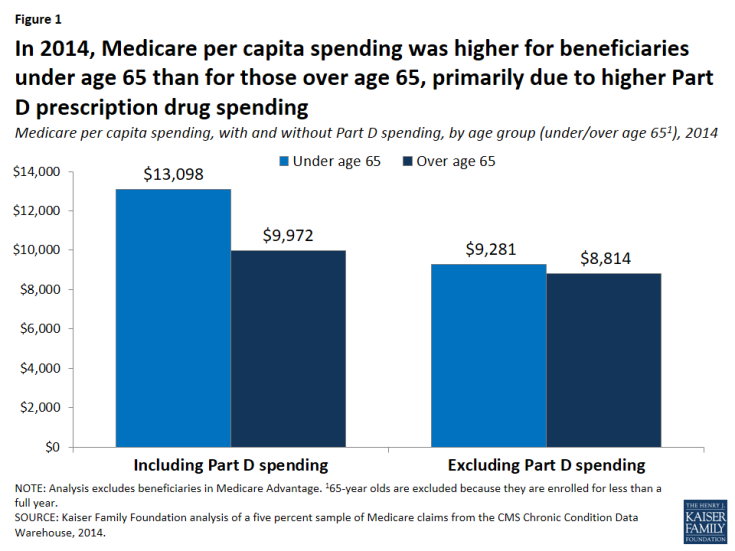

- Medicare per capita spending for beneficiaries younger than age 65 averaged $13,098 in 2014, nearly one third more than average per capita Medicare spending for beneficiaries over age 65 ($9,972) (Figure 1). Excluding Part D drug spending, the difference narrows considerably, to $9,281 for beneficiaries under age 65 and $8,814 for those over age 65, on average.

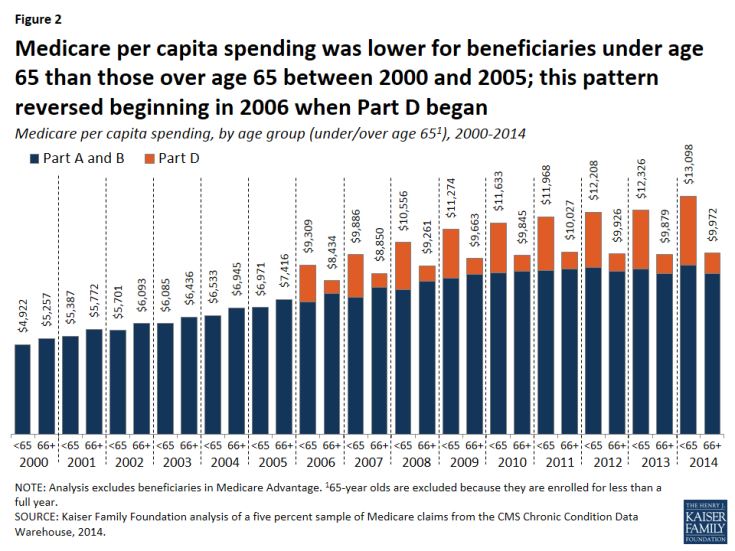

- Since 2000, per capita spending for Medicare-covered services under Part A and Part B has been similar for beneficiaries under and over age 65. Beginning in 2006, with the start of the Medicare Part D prescription drug benefit, average total per capita Medicare spending for those under age 65 surpassed that of beneficiaries over age 65, due to higher Part D spending among younger beneficiaries. (Figure 2)

The pattern of spending by type of service is different for beneficiaries under age 65 with disabilities than for those over age 65. On average, beneficiaries under age 65 have higher per capita spending for drugs covered under Part D and for inpatient and outpatient services, but lower spending on post-acute and hospice care than beneficiaries over age 65.

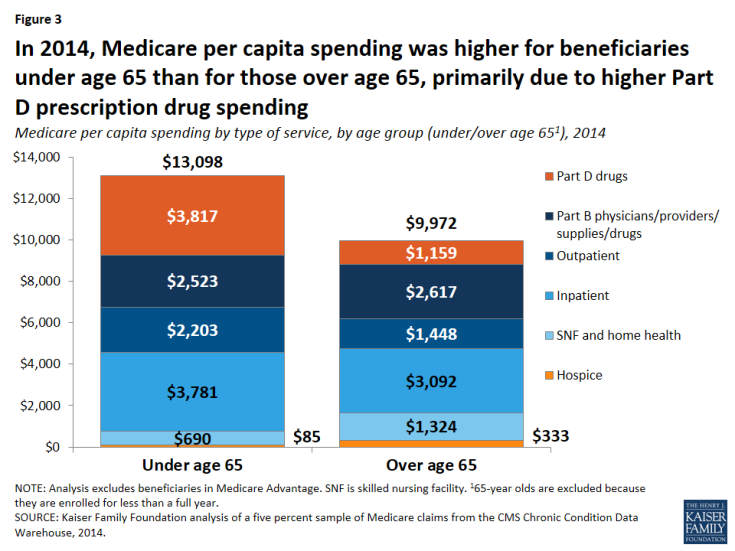

- In 2014, average Medicare per capita spending on outpatient Part D prescription drugs was more than three times larger for beneficiaries under age 65 ($3,817) than for those over age 65 ($1,159).10 Part B drug spending, however, was somewhat lower among those under age 65 ($287) than those over age 65 ($360). (Figure 3; Table 1) The pattern of much higher Part D drug spending but somewhat lower Part B drug spending by beneficiaries under age 65 compared to those over age 65 could be because a considerable share of total Part B drug spending is for drugs used to treat cancer and its side effects,11 which may be more likely to be used by older beneficiaries.12

- Medicare per capita spending on hospital inpatient and outpatient services was higher among beneficiaries under age 65 ($3,781 and $2,203, respectively) than among older beneficiaries ($3,092 and $1,448) in 2014.

- Conversely, average Medicare per capita spending for post-acute care (skilled nursing facility and home health services) was half as much for younger beneficiaries with disabilities than for those over age 65 in 2014 ($690 versus $1,324). Although a similar share of both groups of beneficiaries used inpatient services in 2014, smaller shares of beneficiaries under age 65 used post-acute care services than those over age 65.13

- Similarly, average Medicare per capita spending on hospice care was considerably lower for beneficiaries under age 65 than those over age 65 ($85 versus $333). This is partly because the death rate is lower among beneficiaries under age 65 than among those over age 65,14 and because roughly half as many younger Medicare beneficiaries who died in 2014 used hospice services than older beneficiaries who died that year.15

Part D prescription drug spending accounts for a much larger share of total spending for beneficiaries under age 65 than older beneficiaries, while post-acute care spending accounts for a larger share of spending among beneficiaries over age 65.

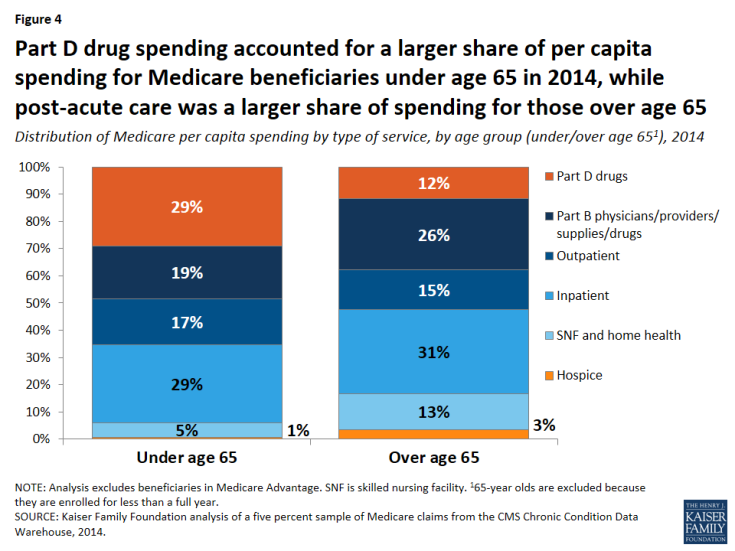

- Part D drug spending accounted for 29% of per capita spending among beneficiaries younger than age 65 in 2014, but just 12% of per capita spending for beneficiaries over age 65. (Figure 4; Table 1)

- Post-acute care services (skilled nursing facility and home health services) comprised a much smaller share of total per capita spending for beneficiaries under age 65 than those over age 65 (5% versus 13%).

- Inpatient and outpatient services accounted for similar shares of per capita spending in 2014 for both beneficiaries under age 65 (29% and 17%, respectively) and those over age 65 (31% and 15%, respectively).

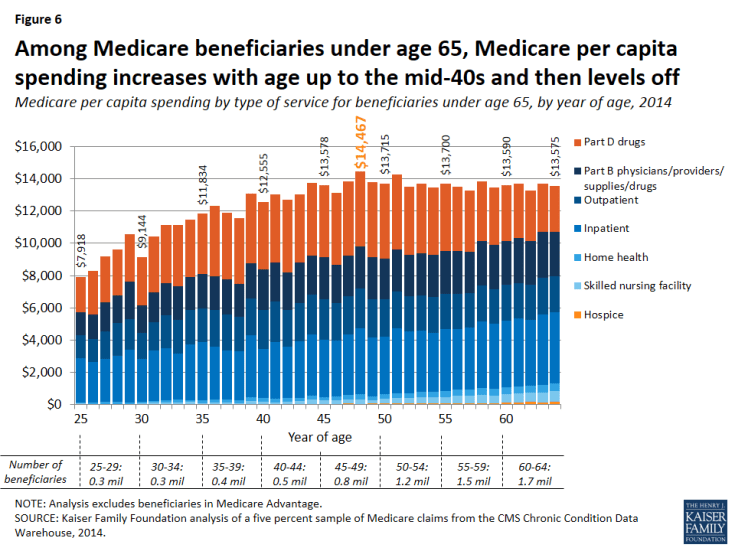

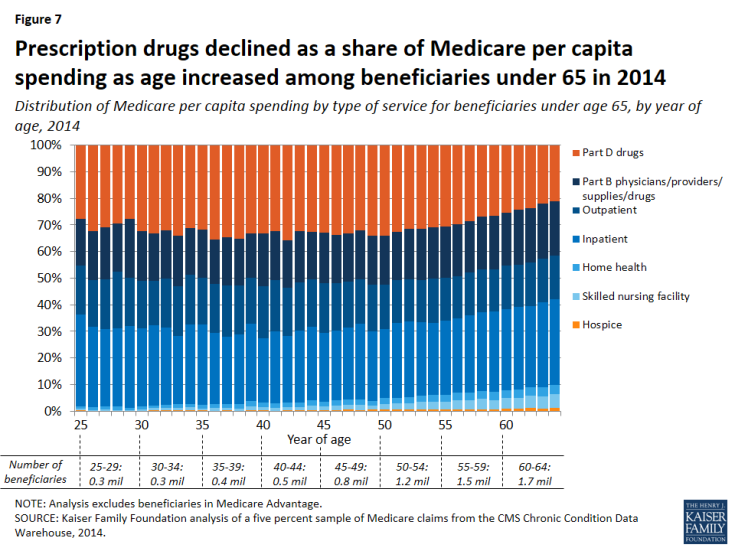

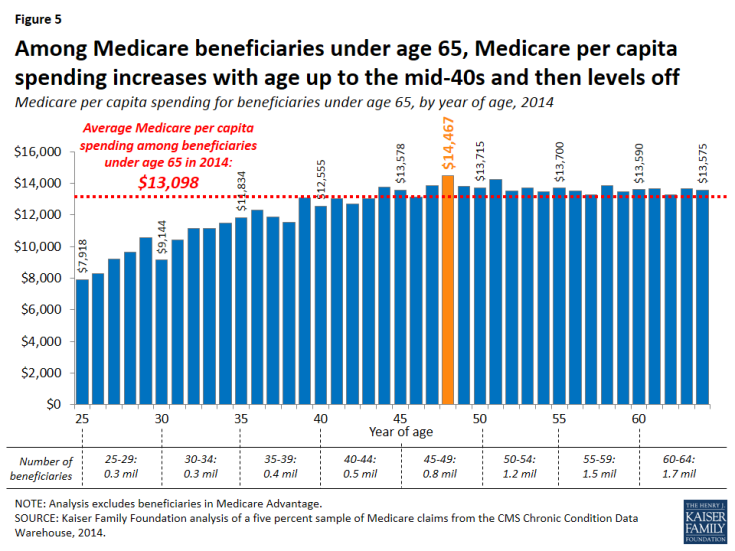

Among beneficiaries under age 65, Medicare per capita spending increases with age until beneficiaries reach their 40s and then generally levels off.

- In 2014, average per capita Medicare spending increased from $7,918 for 25 year-olds to $11,834 for 35 year-olds to $13,578 for 45 year-olds, leveling off at around that amount for beneficiaries between the ages of 45 and 64. (Figure 5; Table 1)

- Both in dollar amounts and as a share of total spending, Medicare per capita spending for inpatient, outpatient, and physician services is similar at different ages among beneficiaries younger than age 65, while per capita Part D prescription drug spending increases modestly but then declines as beneficiaries age. (Figures 6 and 7)

- Average per capita spending on skilled nursing facility, home health, and hospice services increases by year of age among beneficiaries under age 65, but these services account for a very small share of total Medicare spending for younger beneficiaries—ranging from less than 1% to 5% of total per capita spending for skilled nursing facility services, 1% to 3% for home health services, and around 1% for hospice services for beneficiaries as they age from 25 years old to 64 years old.

Figure 5: Among Medicare beneficiaries under age 65, Medicare per capita spending increases with age up to the mid-40s and then levels off

Among beneficiaries over age 65, Medicare per capita spending is nearly two times higher for those who initially qualified for Medicare before age 65 due to disability or ESRD.

Among beneficiaries over age 65, average Medicare per capita spending is considerably higher for those who originally qualified for Medicare before they turned 65 due to having a permanent disability, ESRD, or ALS, than for older beneficiaries who qualified for Medicare based on age alone. In 2014, 2.6 million traditional Medicare beneficiaries over age 65 (9% of all traditional Medicare beneficiaries over age 65) initially qualified for Medicare due to receiving disability insurance benefits, having ESRD, or both prior to turning age 6516; these beneficiaries had average spending of $17,193, nearly twice the level of average spending among the 26.7 million traditional Medicare beneficiaries over age 65 who first became entitled to Medicare when they turned 65 ($9,278) (Figure 8).

Figure 8: In 2014, Medicare per capita spending was nearly twice as much for beneficiaries over age 65 originally entitled to Medicare due to disability or ESRD as for those entitled when they turned 65

Discussion

Comparing Medicare per capita spending by beneficiaries under age 65 with disabilities and spending by those over age 65 shows a large difference between the two populations, primarily due to substantially higher Part D prescription drug spending for beneficiaries under age 65. Other spending differences by type of service—such as lower spending on post-acute care services and higher spending on inpatient and outpatient services among beneficiaries under age 65 compared to those over age 65—reflect variation in medical needs and treatment among beneficiaries at different years of age.

Contrary to what might be expected based on health status differences between Medicare beneficiaries under age 65 with disabilities and older beneficiaries, average Medicare per capita spending on services covered under Part A and Part B was only moderately higher among those under age 65 than over age 65 in 2014, and was in fact somewhat lower among younger beneficiaries between 2000 and 2011. Total per capita spending began to diverge more widely beginning in 2006 when the Part D prescription drug benefit took effect, with much higher average Part D spending among beneficiaries under age 65. These findings suggest that curtailing rising drug costs would have the effect of reducing the Medicare spending gap between beneficiaries under and over age 65.

While this analysis shows that younger beneficiaries with disabilities have similar spending patterns as older beneficiaries for Medicare-covered hospital and physician services combined, we are unable to examine spending for certain services not covered by Medicare that may be needed and used more often by younger beneficiaries with disabilities, in particular long-term services and supports and dental care. For these services, state Medicaid programs may be playing a much greater role for Medicare beneficiaries with disabilities than older beneficiaries. Addressing gaps in Medicare-covered benefits could help to address unmet needs for long-term services and supports and dental services that both younger and older beneficiaries may face—especially those who are not dually eligible for Medicare and Medicaid—but would also add to Medicare’s bottom line.

Juliette Cubanski and Tricia Neuman are with the Kaiser Family Foundation.

Anthony Damico is an independent consultant.